Whom do you trust? The typical measure of the social trust concept is through responses to survey questions such as this one: “Do you think most people can be trusted?” Unfortunately, data from many sources are documenting a decline in social trust in the US, as measured by such questions. 2019 Pew Research survey data show that 79 percent of US adults believe that “Americans have ‘far too little’ or ‘too little’ confidence in each other,” while 70 percent believe that “Americans’ low trust in each other makes it harder to solve the country’s problems.”1Lee Rainie, Scott Keeter, and Andrew Perrin, “Trust and Distrust in America,” Pew Research Center, July 22, 2019, 29, https://www.pewresearch.org/politics/2019/07/22/trust-and-distrust-in-america/. The role of social trust and social capital in developing economic and political institutions is becoming a prevalent topic among social science researchers. Social trust and social capital are similar concepts that attempt to measure the health and connectivity of a society’s social fabric. Social trust is closely related to cultural heritage, and has been found to be associated with the development of constitutions, with economic growth, with happiness, and with economic freedom. Because social trust is associated with so many beneficial outcomes, it is important to find the cause of the erosion of social trust among the US population. It is not just social trust, which is a trust for one another, that is eroding.

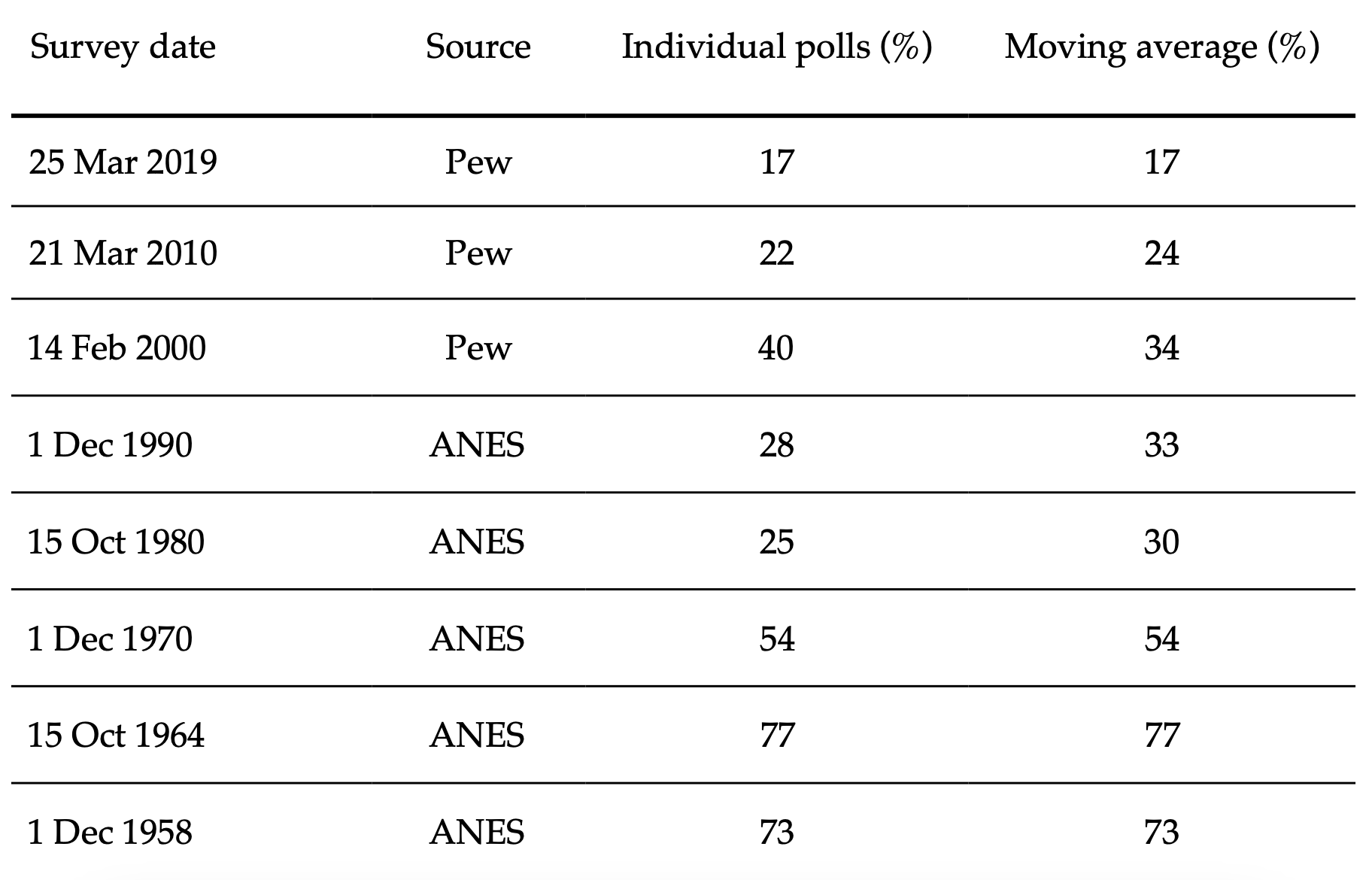

Table 1. Trust and the US Government

Sources: Pew = Pew Research Center; ANES = American National Election Studies.

Note: The poll results provided here are the percentages of people who reported that they trust the government in Washington “always” or “most of the time.”

According to a recent Pew Research Center poll, only 17 percent of Americans “trust the government in Washington to do what is right ‘just about always’ or ‘most of the time.’” This is a historic low: in 1958 this number was at at 73 percent.2Pew Research Center, “Public Trust in Government: 1958-2019.” Pew Research Center, April 171 2019, https://www.pewresearch.org/politics/2019/04/11/public-trust-in-government-1958-2019/ Table 1 shows the change in trust in the federal government over the past seven decades. In addition, Americans think that other Americans’ trust in Washington, DC, has declined—75 percent of poll respondents believe that trust in the federal government has been shrinking, and 41 percent believe that Americans lack of trust in the federal government is a major problem.3Rainie, Keeter, and Perrin, “Trust and Distrust in America.”

Similarly, Gallup polls have surveyed individuals regarding trust in the three branches of the US government, and all three are accorded historically low levels of trust. In 2019 the percentages of people who have a “great deal” of trust in the current executive, judicial, and legislative branches are 24, 16, and 4 percent, respectively.4Gallup, “Trust in Government,” In Depth: Topics A to Z, accessed May 9, 2020, https://news.gallup.com/poll/5392/trust-government.aspx.In addition, Gallup finds that trust in the American people to make good judgments under the democratic system is also down.5Gallup, “Confidence in Institutions,” In Depth: Topics A to Z, accessed May 9, 2020, https://news.gallup.com/poll/1597/confidence-institutions.aspx. In 1974, 83 percent of people thought that the American people had either a great deal or a fair amount of confidence in making democratic decisions; however, in 2018 only 58 percent thought they had a great deal or fair amount of confidence. If trust in the federal government and its citizens is at a low and people do not think others trust the government, then what effect does this have on our economic system and, more importantly, on the regulatory environment that is supposed to protect individuals from a variety of potential harms?

Meanwhile, numerous studies examine the various effects of regulation on an economic system. Regulation consists of rules, mandatory prescriptions that must be followed, and prohibitions stipulating what must not be done. Regulation acts as a constraint on the behavior of the regulated. The academic literature argues theoretically and empirically that regulation can introduce inefficiencies and drag to an economic system,6Simeon Djankov et al., “The Regulation of Entry,” Quarterly Journal of Economics 117, no. 1 (2002): 1–37; William A. Niskanen, “The Peculiar Economics of Bureaucracy,” American Economic Review 58, no. 2 (1968): 293–305. affecting economic growth,7Simeon Djankov, Caralee McLiesh, and Rita Maria Ramalho, “Regulation and Growth,” Economics Letters 92, no. 3 (2006): 395–401. entrepreneurship,8Silvia Ardagna and Annamaria Lusardi, “Explaining International Differences in Entrepreneurship: The Role of Individual Characteristics and Regulatory Constraints” (NBER Working Paper No. 14012, National Bureau of Economic Research, Cambridge, MA, 2008); Peter T. Calcagno and Russell S. Sobel, “Regulatory Costs on Entrepreneurship and Establishment Employment Size,” Small Business Economics 42, no. 3 (2014): 541–59; Nathan Goldschlag and Alex Tabarrok, “Is Regulation to Blame for the Decline in American Entrepreneurship?,” Economic Policy 33, no. 93 (2018): 5–44; Leora Klapper, Luc Laeven, and Raghuram Rajan, “Entry Regulation as a Barrier to Entrepreneurship,” Journal of Financial Economics 82, no. 3 (2006): 591–629; André van Stel, David J. Storey, and A. Roy Thurik, “The Effect of Business Regulations on Nascent and Young Business Entrepreneurship,” Small Business Economics 28, no. 2–3 (2007): 171–86. workers,9Daron Acemoglu and Joshua D. Angrist, “Consequences of Employment Protection? The Case of the Americans with Disabilities Act,” Journal of Political Economy 109, no. 5 (2001): 915–57. and firms.10Bruce Yandle, “Bootleggers and Baptists—the Education of a Regulatory Economist,” Regulation 7, no. 3 (1983): 12–16. While government regulations can be necessary to promote the safety or well-being of its citizens, overwhelming regulatory burdens can be costly to firms that must comply and to customers that pay higher prices.11Dustin Chambers, Courtney A. Collins, and Alan Krause, “How Do Federal Regulations Affect Consumer Prices? An Analysis of the Regressive Effects of Regulation,” Public Choice 180, no. 1–2 (2019): 57–90; Morris M. Kleiner, “Occupational Licensing,” Journal of Economic Perspectives 14, no. 4 (2000): 189–202. Excessive regulation can raise the possibility of regulatory capture, whereby industries gain control of the agencies tasked with regulating them,12George J. Stigler, “The Theory of Economic Regulation,” Bell Journal of Economics and Management Science 2, no. 1 (1971): 3–21. or rent-seeking behavior, whereby firms seek preferential treatment in exchange for political favors.13Gordon Tullock, “Efficient Rent Seeking,” in Efficient Rent-Seeking, ed. Alan A. Lockard and Gordon Tullock (Boston: Springer, 2001). Each of these pitfalls reflects a tendency for regulation to protect firms from their competition instead of protecting citizens.

One might argue that an economic system with high trust and simple but effective rules might not require as much regulation. After all, if you trust fellow citizens to do the right thing, then you don’t need regulation to constrain their behavior. Indeed, researchers have found that those with low social trust demand more regulation while those with high social trust prefer less.14Hans Pitlik and Ludek Kouba, “Does Social Distrust Always Lead to a Stronger Support for Government Intervention?,” Public Choice 163, no. 3–4 (2015): 355–77. However, those with low social trust are also likely not to trust the state regulating agencies, whereas those with high social trust are likely to trust the regulating agencies.

Attitudes toward regulation and intervention are found to be conditional on institutional trust: an individual with high social trust is more likely to support regulation when confidence in regulating agencies is high and confidence in companies (the entities needing regulation) is low. This creates a possibility that social trust and regulation could display a positive correlation. Social trust itself is not developed in a vacuum, but is rather derived from the cumulating of social development through experiences. This development requires a feedback mechanism whereby praiseworthy behavior is rewarded and blameworthy behavior is punished.15Vernon L. Smith and Bart J. Wilson, Humanomics: Moral Sentiments and the Wealth of Nations for the Twenty-First Century (Cambridge: Cambridge University Press, 2019). Regulation circumvents the feedback mechanism in which individuals develop their sociality, leaving one with lower social trust as a result.16Thomas A. Rietz et al., “Trust, Reciprocity, and Rules,” Economic Inquiry 56, no. 3 (2018): 1526–42.

With trust at historic lows and regulation at historic highs, we want to examine the relationship that may exist between them. This chapter’s objective is to pull together the literature on regulation and social trust, along with data from the US, to examine what role social trust plays in the determination and development of regulation.

There is little literature that examines the relationship between social trust and regulation. The literature that does exist only examines cross-country data. For instance, economists Philippe Aghion, Yann Algan, Pierre Cahuc, and Andrei Shleifer argue that there is a negative relationship between trust and regulation. They argue that the causation should go both ways, with increased distrust causing increased regulation and increased regulation further degrading trust.17Philippe Aghion et al., “Regulation and Distrust,” Quarterly Journal of Economics 125, no. 3 (2010): 1015–49. However, they are unable to implement an empirical test of bidirectional causation and rely purely on correlation across countries in one time period. Paolo Pinotti, a researcher with the Bank of Italy, uses individual data across multiple countries from a single year.18Paolo Pinotti, “Trust, Honesty and Regulations” (MPRA Paper 7740, Munich Personal RePEc Archive, 2008). He looks at the relationship between social trust and individual preferences about regulation and finds evidence that low social trust is correlated with an increased preference for regulation. He puts forward a theoretical framework that suggests trust may causally influence preferences for regulation and the level of regulation itself, yet this causal link cannot be established by his study.

We intend to add to this research by focusing on one country—the United States—and using time-series data as opposed to a cross section of countries. Using social trust data from the General Social Survey and regulation data from RegData, we examine the relationship between social trust and regulation from 1972 to 2017. This long period of data allows us to see whether the same results that are present in the cross-country analysis are present over time, and in a single developed country. While our data do not allow for a full-scale determination of causation as opposed to correlation, we are able to take advantage of the long time horizon of our data to test for what is known as “Granger causality.” Granger causality has been likened to predictive causality. It requires that the cause (increased regulation) occur before the effect (decreased social trust). Essentially, past movements in a cause variable can be tested for subsequent movements in an effect variable. One of the useful aspects of this concept and statistical technique is that it allows for and tests for bidirectional causality.

The rest of the chapter develops as follows: The next section explores the literature on regulation, social trust, and the overlap between them. The third section presents the data and model used to examine social trust and regulation. The fourth section presents the results of our empirical analysis. The fifth section summarizes the results in the context of recommendations for policy reform, and the final section offers a conclusion.

Literature and Background

Regulation

To begin examining the impact of social trust on regulation, we bring together two broad areas of research in the economics literature. The first area examines the impact of regulation on economic activity. The literature on regulation presents empirical evidence that higher levels of regulation are negatively correlated with business activity, entrepreneurship, and economic growth.19See Ardagna and Lusardi, “Explaining International Differences in Entrepreneurship”; Klapper, Laeven, and Rajan, “Entry Regulation as a Barrier to Entrepreneurship”; van Stel, Storey, and Thurik, “Effect of Business Regulations.” Several studies suggest that the agencies that set and impose regulations seek to gain job security, power, and prestige by providing greater amounts of regulations.20Niskanen, “Peculiar Economics of Bureaucracy”; Barry Weingast, Kenneth Shepsle, and Christopher Johnsen, “The political economy of benefits and costs: A neoclassical approach to distributive politics,” Journal of Political Economy, 89, no. 4, (1981): 642–664; Robert B. Ekelund and Robert D. Tollison, “The Interest-Group Theory of Government,” in The Elgar Companion to Public Choice, ed. William F. Shughart II and Laura Razzolini (Cheltenham, UK: Edward Elgar, 2001). These agencies pass new regulations to benefit the special interest groups that dominate the political landscape. Firms might hire lobbyists to represent them within an industry to rent-seek for regulations that will lessen competition, or interest groups might promote “public interest” concerns about issues such as the environment or land use policy. In some cases, both forces might be in play, as in situations that follow economist Bruce Yandle’s “bootleggers and Baptists” theory of special-interest-group activity.21Yandle, “Bootleggers and Baptists.” Researchers have found that countries with high costs of entry into the market due to a high regulatory burden also have a weaker perception of marketplace competition and lower-quality private and public goods.22Djankov et al., “Regulation of Entry.” The quality of private goods is measured by a country’s compliance with international quality standards. The quality of public goods in a country is measured by the level of water pollution, the number of deaths from accidental poisoning, and the number of deaths from intestinal infection.

Research suggests that higher levels of government intervention reduce entrepreneurial activity at the cross-country level.23Christian Bjørnskov and Nicolai J. Foss, “Do Economic Freedom and Entrepreneurship Impact Total Factor Productivity?” (SMG Working Paper No. 8/2010, Center for Strategic Management and Globalization, Copenhagen Business School, September 2010); Kristina Nyström, “The Institutions of Economic Freedom and Entrepreneurship: Evidence from Panel Data,” Public Choice 136, no. 3–4 (2008): 269–82. Specifically, regulatory scholars Andrew Hale, David Borys, and Mark Adams contend that regulation has become so burdensome and complex, owing to its overly vague and difficult-to-interpret language and the large investments in time and resources required to discover and interpret it, that it actually reduces safety—contrary to the good intentions of the regulators.24Andrew Hale, David Borys, and Mark Adams, “Regulatory Overload: A Behavioral Analysis of Regulatory Compliance” (Working Paper No. 11-74, Mercatus Center at George Mason University, Arlington, VA, 2011). The authors support their argument with a review of relevant literature on safety regulation. Using economist William Baumol’s theory of productive and unproductive entrepreneurship, several researchers argue that regulation will not lessen entrepreneurship, but will rather redirect it into unproductive channels.25Russ Sobel, “Testing Baumol: Institutional quality and the productivity of entrepreneurship,” Journal of Business Venturing, 23, (2008): 641–655; van Stel, Storey, and Thurik, “Effect of Business Regulations.” For Baumol’s theory, see William Baumol, “Entrepreneurship: Productive, unproductive and destructive.” Journal of Political Economy, 98(5), (1990) 893–921. One study uses data from the US to explore the possibility that trends of increasing regulation, measured by RegData, can lead to a trend of declining entrepreneurial activity. The authors find little evidence to suggest that regulation affects entrepreneurial activity in the US economy.26Goldschlag and Tabarrok, “Is Regulation to Blame?”

At the state level, research shows that states with higher levels of economic freedom and with less regulation tend to spur on more entrepreneurial ventures.27Noel D. Campbell, Tammy M. Rogers, and Kirk C. Heriot, “The Economic Freedom Index as a Determinant of Firm Births and Firm Deaths,” Southwest Business and Economics Journal 16 (2007): 37–50. Regulations can also affect the size and scope of firms. One study suggests that regulation can operate as a fixed cost to firms and deter the growth of small firms.28Calcagno and Sobel, “Regulatory Costs on Entrepreneurship.” Firms will also purposely remain small in an attempt to avoid or be exempt from regulation.29Feng Gao, Joanna Shuang Wu, and Jerold Zimmerman, “Unintended Consequences of Granting Small Firms Exemptions from Securities Regulation: Evidence from the Sarbanes‐Oxley Act,” Journal of Accounting Research 47, no. 2 (2009): 459–506; Daron Acemoglu and Joshua D. Angrist. “Consequences of Employment Protection? The Case of The Americans With Disabilities Act,” Journal of Political Economy, 109 (2001): 915-957. Specifically, regulations like Sarbanes-Oxley seem to encourage firms to remain just small enough to maintain exemption from regulation as small businesses.30Gao, Wu, and Zimmerman, “Unintended Consequences of Granting Small Firms Exemptions.” Economists Daron Acemoglu and Joshua Angrist argue that the Americans with Disabilities Act actually reduced the employment of people who are disabled.31Acemoglu and Angrist, “Consequences of Employment Protection?” The act requires employer accommodations for disabled workers and makes workplace discrimination based on disability illegal. Its advocates intended to make the workplace more open and inclusive to those with disabilities by providing legal protections, yet the evidence paints a different picture of the workplace that now exists. The required accommodations make hiring someone with a disability very costly—in some cases, more costly than the expected cost of litigation owing to noncompliance.

The Nobel Prize winning economist, Joseph Stiglitz argues that market failures such as externalities are one motivation for regulation. He notes that environmental regulations have given us cleaner air and water and that we could not fathom a world without food safety regulations.32Joseph E. Stiglitz, “Government Failure vs. Market Failure: Principles of Regulation,” in Government and Markets: Toward a New Theory of Regulation, ed. Edward J. Balleisen and David A. Moss (Cambridge: Cambridge University Press, 2009). Financial regulation is an area of debate over the net costs or benefits of regulation. Stiglitz argues that the problem with financial markets is not that they are regulated, but that financial regulation tends to be very specific.33Stiglitz, “Government Failure vs. Market Failure.” The high level of specificity makes it possible for financial entrepreneurs to leverage the specificity and circumvent regulatory restriction. The highly dynamic nature of financial markets presents a unique set of challenges for regulators. Lynn Stout, Professor of Law, argues that financial speculation creates real welfare losses and that there are regulatory solutions that could reduce these welfare losses.34Lynn A. Stout, “Are Stock Markets Costly Casinos? Disagreement, Market Failure, and Securities Regulation,” Virginia Law Review 81, no. 3 (April 1995): 611–712.

The issue, according to Stiglitz, is that markets do not operate as our models of perfect competition predict they should and that issues such as asymmetric information create a real need for regulation in the market. The question is not whether we need regulation: “The debate is only whether we have gone too far, and whether we could have gotten the desired results at lower costs.”35Stiglitz, “Government Failure vs. Market Failure,” 13. In addition, there is the issue of market irrationality, which—behavioral economics argues that individuals will make less-than-optimal decision and that behavioral economics might provide insights into creating regulation that can improve an individual’s well-being. Economist Cass Sunstein argues that paying attention to choice architecture in designing regulation could change how regulation is imposed and improve the regulatory environment.36Cass R. Sunstein, “Nudges.gov: Behavioral Economics and Regulation,” in The Oxford Handbook of Behavioral Economics and the Law, ed. Eyal Zamir and Doron Teichman (Oxford: Oxford University Press, 2014). Richard Thaler and Sunstein similarly argue, in their book Nudge, that designing regulations so as to make the most beneficial option the easiest choice—that is, giving people a nudge—is a way to create regulatory benefits to improve on market irrationality. Thus, by employing lessons learned from behavioral economics, nudges could allow for better and more efficient types of regulation.37Richard H. Thaler and Cass R. Sunstein, Nudge: Improving Decisions about Health, Wealth, and Happiness (New Haven: Penguin, 2009).

According to Economists Patrick McLaughlin, Nita Ghei, and Michael Wilt, overall regulatory restrictions in the US have increased by almost 20 percent since 1997. It is estimated that if regulations had remained at the same level they were in 1980, the US GDP would have grown by an additional $4 trillion as of 2012. Thus the inefficiencies and burdens associated with regulations can slow economic growth, increase the prices of goods to consumers, distort labor markets, and increase inequality.38Patrick A. McLaughlin, Nita Ghei, and Michael Wilt, “Regulatory Accumulation and Its Costs: An Overview” (Policy Brief, Mercatus Center at George Mason University, Arlington, VA, November 2018), https://www.mercatus.org/publications/regulation/regulatory-accumulation-and-its-costs-0.

Social Trust

Political Scientist Robert Putnam defines social capital as ‘‘features of social organization, such as trust, norms, and networks, that can improve the efficiency of society by facilitating coordinated actions.’’39Robert D. Putnam, Making Democracy Work: Civic Traditions in Modern Italy, with Robert Leonardi and Raffaella Y. Nanetti (Princeton, NJ: Princeton University Press, 1993), 167. Social trust, which is considered to be a component of social capital, has been found to be a determining factor in the development of several political and economic institutions. Similarly to regulation, social trust has been found to affect economic growth. One study found that countries with high social trust grow faster than countries with low social trust.40Stephen Knack and Philip Keefer, “Does Social Capital Have an Economic PayOff? A Cross-Country Investigation,” Quarterly Journal of Economics 112, no. 4 (1997): 1251–88.Another researcher argues that social trust can influence growth through other factors such as governance and education.41Christian Bjørnskov, “How Does Social Trust Affect Economic Growth?,” Southern Economic Journal 78, no. 4 (2012): 1346–68. Using an econometric technique known as three-stage least squares regression, which controls for many confounding factors, Christian Bjørnskov, economist, finds that social trust causes economic growth through the intermediary channels of increased education and improved governance.42Bjørnskov, “How Does Social Trust Affect Economic Growth?” Social trust causes increased schooling and increases an index for the “rule of law” (improved governance). Each of these has an effect on economic growth. However, political scientist Peter Nannestad argues that high social trust in Scandinavian countries has also led to the development of a large welfare state, which is likely to reduce growth.43Peter Nannestad, “What Have We Learned about Generalized Trust, If Anything?,” Annual Review of Political Science 11 (June 2008): 413–36.

A study by economists Ryan Murphy, Meg Tuszynski, and Jeremy Jackson (one of the authors of this chapter) brings together these disparate literatures on trust (social capital), economic freedom, growth, entrepreneurship, and well-being. Using data on the US, its authors find weak evidence of a positive effect of trust on economic freedom in the US. Conversely, they also find weak evidence of a negative effect of economic freedom on trust.44Ryan Murphy, Meg Tuszynski, and Jeremy Jackson, “Some Dynamics of Socioeconomic Relationships: Well-Being, Social Capital, Economic Freedom, Economic Growth, and Entrepreneurship,” American Journal of Entrepreneurship 13, (June 2020):4-44. Neither effect was large, which tends to agree with the results of previous studies that also explore the effect of economic freedom on social capital in the US.45Jeremy Jackson, Art Carden, and Ryan A. Compton, “Economic Freedom and Social Capital,” Applied Economics 47, no. 54 (2015): 5853–67; Jeremy J. Jackson, “Economic Freedom and Social Capital: Pooled Mean Group Evidence,” Applied Economics Letters 24, no. 6 (2017): 370–73.

These studies stand in contrast to a 2006 study that finds a positive causal relationship between economic freedom and trust using international data from the Economic Freedom of the World report and the World Values Survey.46Niclas Berggren and Henrik Jordahl, “Free to Trust: Economic Freedom and Social Capital,” Kyklos 59, no. 2 (2006): 141–69. While social capital and social trust remain separate concepts, social trust is a key element of social capital and is often touted as the component of social capital that is most economically relevant.47Christian Bjørnskov, “The Multiple Facets of Social Capital,” European Journal of Political Economy 22, no. 1 (2006): 22–40. This chapter is not focused on the concept of economic freedom, yet economic freedom and regulation are certainly linked concepts. A society with high levels of economic freedom will tend to have lower levels of regulation.

Social capital and social trust can be described as binding, when tightly knit communities are bound together in solidarity, and bridging which refers to the connectedness of disparate communities and groups to one another. Social trust provides a community with what it needs to overcome problems of collective action and may reduce the need for regulations to restrict the behavior of those who don’t comply with the community standards of conduct and behavior. Likewise, a highly regulated community may be one in which social trust isn’t needed. You don’t need to trust others if you can instead trust the state to enforce compliance with community standards of conduct and behavior. At a more extreme level, high levels of regulation may even destroy social trust by eliminating the feedback loop required for the development of sociality. Or perhaps trust develops because regulation creates compliance that then allows individuals to trust one another. The direction of the effect between social trust and regulation can go either way—it could be positive or negative. Before we review the literature on trust and regulation, we discuss relationship between government and trust more broadly.

Trust and Government Level, Size, and Scope

Beyond cross-country studies, there are studies that examine political trust at the local and state levels in the United States. One 2005 study attempts to determine political trust at the local level. The authors find that the more diverse cities are with regard to ideology, income inequality, and education level, the lower political trust is.48Wendy M. Rahn and Thomas J. Rudolph, “A Tale of Political Trust in American Cities,” Public Opinion Quarterly 69, no. 4 (2005): 530–60. Other researchers, looking at the state level, argue that political trust in state and local government is consistently high in the United States—and much higher than trust in the federal government. They argue that economic conditions such as unemployment and fiscal condition explain why there is more trust at the state level.49Aaron C. Weinschenk and David J. Helpap, “Political Trust in the American States,” State and Local Government Review 47, no. 1 (2015): 26–34.

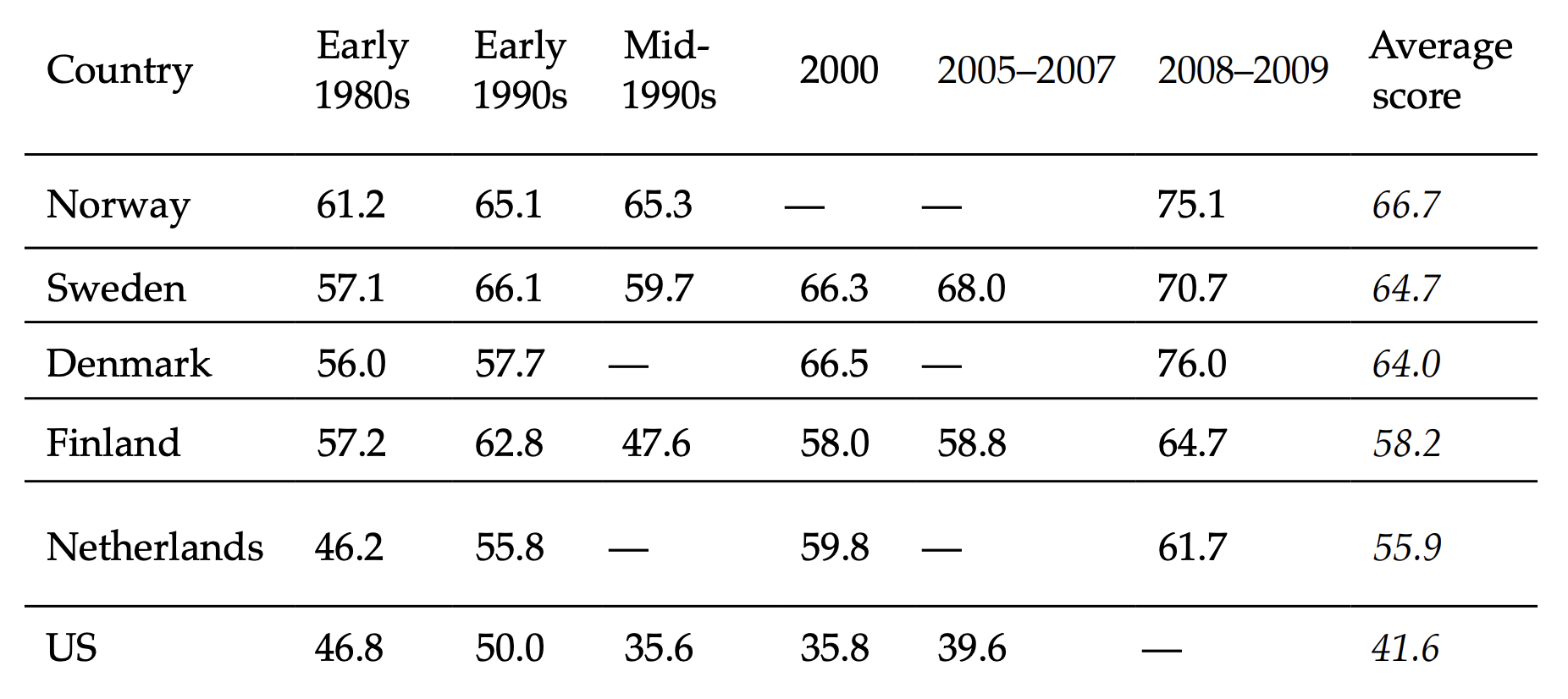

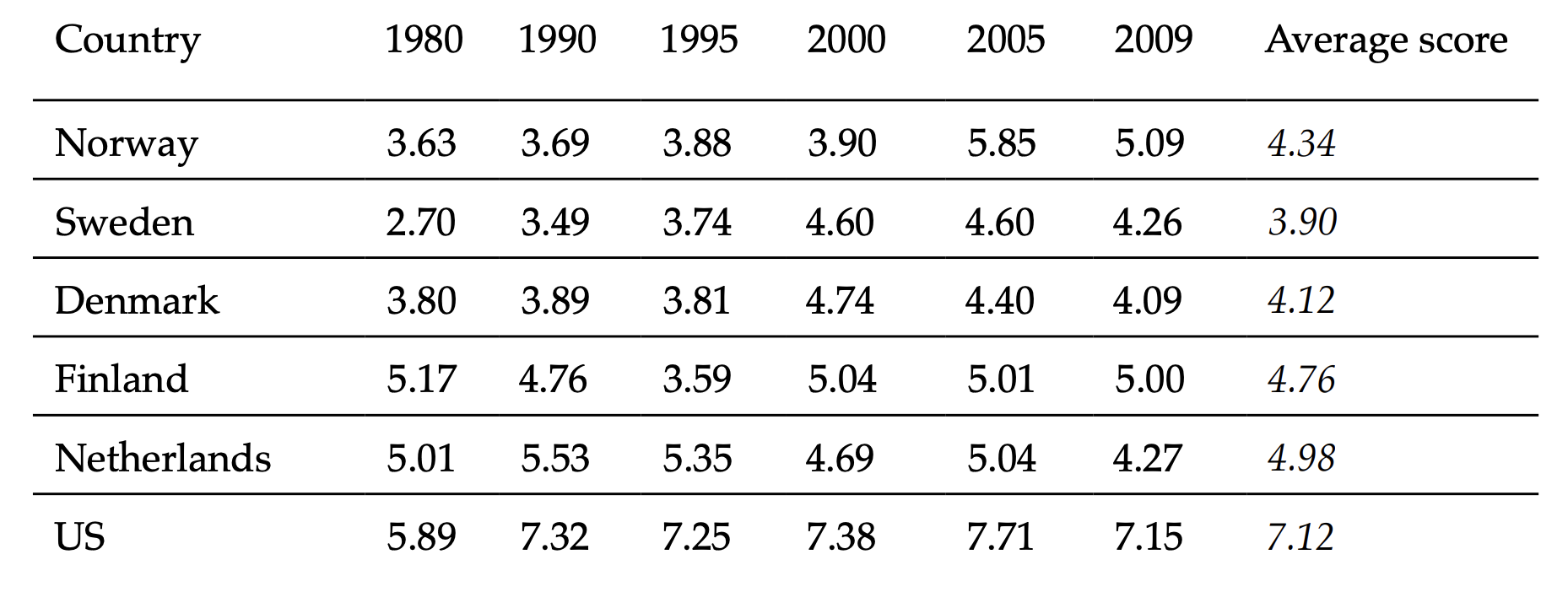

Large government is often associated with slow growth and economic inefficiency, but these issues are separate from the economic consequences of regulation. Many of the Scandinavian countries are associated with a large welfare system, but they are also known for their high levels of social trust.50Nannestad, “What Have We Learned?” However, these countries are not necessarily heavily regulated. Table 2 shows that, among the countries of Norway, Sweden, Denmark, Finland, and the Netherlands, social trust has been increasing across the waves of the World Values Survey, beginning in the 1980s. At the same time, social trust in the US has been decreasing. Table 3 indicates the size of government (as measured by the Economic Freedom of the World index) for these same countries. The Economic Freedom of the World index measures economic freedom on a scale of 0–10, with higher values indicating greater economic freedom. Evaluating economic freedom over the same period as the World Value Survey, in these countries has improved slightly, but on average they score between 4 and 5. The US has an average size-of-government score of approximately 7 over this period. Thus, the US has a smaller government than all of these countries, but less social trust.

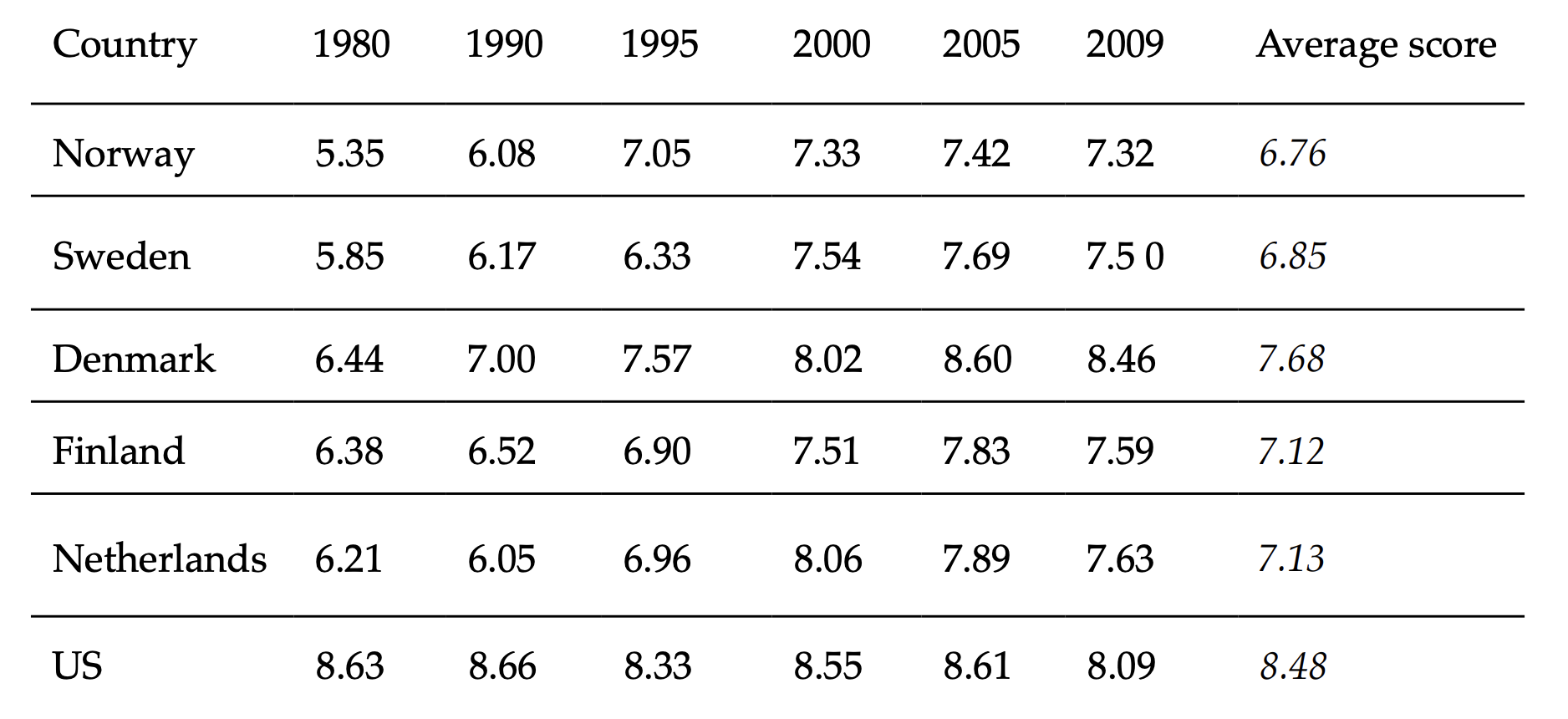

However, these are not overly regulated countries. Table 4 demonstrates that the Economic Freedom of the World index for all of these countries has been improving with regard to regulation, increasing their index scores by between 1 and 2 points. For instance, Norway went from 5.35 in 1980 to 7.32 in 2009. The US has experienced only slight decreases in economic freedom. Thus, Norway, Sweden, Denmark, Finland, and the Netherlands score relatively well on this measure of regulation, and this evidence suggests that regulation in these countries has been decreasing while their social trust has been increasing. Several researchers have argued that social trust must precede the large welfare state to keep the other parts of the government, such as regulation, in check.51Andreas Bergh and Christian Bjørnskov, “Historical Trust Levels Predict the Current Size of the Welfare State,” Kyklos 64, no. 1 (2011): 1–19; Christian Bjørnskov and Gert Tinggaard Svendsen, “Does Social Trust Determine the Size of the Welfare State? Evidence Using Historical Identification,” Public Choice 157, no. 1–2 (2013): 269–86. The high social trust is what allows the large welfare state to function effectively. Similarly, others suggest that the quality of governance is what is necessary to maintain a stable welfare state.52Bo Rothstein, Marcus Samanni, and Jan Teorell, “Explaining the Welfare State: Power Resources vs. the Quality of Government,” European Political Science Review 4, no. 1 (2012): 1–28. The US has not seen much change in the economic freedom measure of regulation—there is a slight decrease over this time period, while trust levels have declined. This suggests that regulation and trust are inversely related, but the level of trust is a separate issue from the overall size of government. We now review the literature on the relationship between regulation and trust more explicitly.

Table 2. Social Trust Scores

Source: Average scores from the World Values Survey, http://www.worldvaluessurvey.org/wvs.jsp.

Table 3. Government Size Scores

Source: Economic Freedom of the World report Fraser Institute, https://www.fraserinstitute.org/economic-freedom/dataset.

Table 4. Regulation Scores

Source: Economic Freedom of the World report Fraser Institute, https://www.fraserinstitute.org/economic-freedom/dataset.

Regulation and Trust

Some researchers claim that trust is an important aspect of having a society flourish and that when trust and ethical behavior are low, citizens will demand regulation.53Art Carden, Steven Castello, and Benjamin Priday, “Religious Freedom and Private Enterprise,” Journal of Private Enterprise 35, (2020): 47-59. Regulation can bring with it economic and political inefficiencies and costs as well as further damaging social trust, as noted above. Therefore, low trust and demands for regulation can form a vicious cycle in which social trust spirals downward. For instance, there seems to be evidence that social trust affects contracts. Two 1997 studies found that contracts will be longer and more verbose where there are low levels of social trust.54Knack and Keefer, “Does Social Capital Have an Economic Pay-Off?”; Rafael La Porta, Florencio Lopez-de-Silanes, Andrei Shleifer, and Robert Vishny. “Trust in Large Organizations,” American Economic Review, 87(2) (1997): 333–38. The authors of one article claim that in places that lack formal institutions to enforce contracts and secure property rights social capital can aid in facilitating economic activity.55Knack and Keefer, “Does Social Capital Have an Economic Pay-Off?” Therefore, where institutions that formally enforce contracts and secure property rights are not present and where trust is low the return on investment for regulations is high. A later study applies this argument to national constitutions and finds that countries with high social trust have shorter constitutions.56Christian Bjørnskov and Stefan Voigt, “Constitutional Verbosity and Social Trust,” Public Choice 161, no. 1–2 (2014): 91–112. Another study finds similar relationship between social trust and constitutions for US states.57David Ahnen and Peter T. Calcagno, “Constitutions and Social Trust: An Analysis of the US States,” Journal of Private Enterprise 34, no. 3 (2019): 11–33.

There are a few studies that bring together the areas of regulation and social trust. Aghion, Algan, Cahuc, and Shleifer, using a cross-country study, argue that there is a negative relationship between trust and regulation. They argue that individuals in low-trust countries will demand more regulation from their government even when citizens perceive that the government is corrupt. Developing a model of civic-mindedness, the authors claim that communities that are civic-minded will have low regulation and corruption.58Aghion et al., “Regulation and Distrust.” They argue that distrust is a source of disorder, and this relationship leads individuals to demand more regulation. Using the World Values Survey, they examine both countries in the Organization for Economic Co-operation and Development and former Soviet countries to demonstrate that regulation and corruption flow from distrust.59Aghion et al., “Regulation and Distrust.”

Similarly, Pinotti—also using cross-country data—shows that low levels of trust increase the levels of regulation. In particular, Pinotti claims that studies of regulation and corruption have omitted the important variable of trust.60Pinotti, “Trust, Honesty and Regulations.” Furthermore, he argues that accounting for trust reduces the effects of regulation on entry into markets. He suggests that it is the low levels of trust that are at the source of the problem, as opposed to the regulations themselves.61Paolo Pinotti, “Trust, Regulation and Market Failures,” Review of Economics and Statistics 94, no. 3 (2012): 650–58.

Economists Hans Pitlik and Ludek Kouba claim that the influence of social trust on attitudes about government intervention is conditional on the perception of the reliability, honesty, and incorruptibility of state actors and major companies.62Pitlik and Kouba, “Does Social Distrust Always Lead to a Stronger Support for Government Intervention?” Public Choice 163, (2015): 355-377.Pitlik and Kouba’s results support the idea that the impact of social trust on attitudes about government intervention is conditional on individual confidence in state actors relative to private companies.

There is a well-established literature that examines trust in laboratory experiments based on game theory. In Humanomics, economists Vernon Smith and Bart Wilson review that literature and extend it to include insights from Adam Smith’s The Theory of Moral Sentiments.63Smith and Wilson, Humanomics. They modify the traditional trust game by giving players the option to punish those who display blameworthy behavior (want of beneficence) and subsequently the option to reward behavior that is praiseworthy (beneficent action). Laboratory experiments of these modified trust games support Adam Smith’s description of how morality, sociality, and trust are developed through the feedback loops of social interaction that reward that which is praiseworthy and punish that which is blameworthy. When this feedback loop is bypassed by state regulation, the opportunity for society to develop the social norms required for generating social trust is missing. This is the mechanism by which regulation can erode social trust.

Using trust experiments, economists Thomas Rietz, Eric Schniter, Roman Sheremeta, and Timothy Shields find that if a system based on trust is functioning well, it is best not to interfere with it by imposing minimum standards of behavior. However, if a trust-based system is not performing well in the absence of rules, it might be improved with the addition of rules, but only when the rules are very restrictive. In the researchers’ experimental environment, trust and reciprocity are damaged by the imposition of rules (which we interpret as regulations), further damaging the welfare aspects of the game.64Rietz et al., “Trust, Reciprocity, and Rules.” Regulation damages the individuals’ ability to learn about and influence norms of trust and reciprocity.

We are building on the work that brings together the literature on regulation and trust by looking at social trust in the US over time. The General Social Survey provides us with data for the US from 1972 to 2017. We add to the literature by examining the relationship between regulation and social trust in a single country over time. Previous studies have used data from many countries at one point in time. Such studies are subject to error because many cultural factors, which vary from country to country, are hard to control for. A lack of multiple time periods also eliminates the ability to observe a cause and effect over time. By focusing on one country over time, we overcome these difficulties to the extent that cultural factors are constant over time.

As noted above, we know that regulation has been increasing in the US, which lets us ask two questions: Do increases in regulation have a degrading effect on social trust? Does lower social trust lead to an increase in regulation as a response? Our time-series data allow us to further test the direction of causality between regulation and trust . We are also able to test whether a negative relationship between regulation and trust exists over time.

Data and Methodology

Data

Our data come from two major sources. The General Social Survey (GSS) provides trust data at the US level for the years 1972–2018. The survey asks individuals questions on a variety of topics that range from social media, workplace conflict, and religion all the way to national security issues. A variety of questions address an individual’s confidence or trust in government, business, the press, the judiciary, and individuals. The survey also includes a question regarding general social trust. The GSS has long been one of the main sources for social trust data in the US and has been used in numerous frequently cited research studies.65Robert D. Putnam, Bowling Alone: The Collapse and Revival of American Community (New York: Simon & Schuster, 2000); Eric M. Uslaner and Mitchell Brown, “In-equality, Trust, and Civic Engagement,” American Politics Research 33, no. 6 (2005): 868–94. The general trust question in the GSS asks, “Generally speaking, would you say that most people can be trusted or that you can’t be too careful in dealing with people?” Our variable Trust is the proportion of respondents in a given year who choose the response “most people can be trusted.” The GSS data contain annual data for 1972–1993, although with some gaps, and biennial data beginning in 1994. To measure overall confidence and trust levels in a given year, we compute the simple average of all responses that year. In years where there are no GSS data available, we impute the value as the average of the years before and after. Where two consecutive data points are missing, we impute the data points with a simple linear projection. This gives us an annual time series of trust data from 1972 to 2017.66In total, 19 values for trust are imputed.

Because Pitlik and Kouba find that the effect of social trust on the demand for regulation is mitigated by institutional confidence,67Pitlik and Kouba, “Does Social Distrust Always Lead to a Stronger Support?” we also consider a GSS question regarding confidence in institutions. Here is the question: “I am going to name some institutions in this country. As far as the people running these institutions are concerned, would you say you have a great deal of confidence, only some confidence, or hardly any confidence at all in them?” The responses are coded on a scale of 1 to 3, with higher values indicating greater confidence. We construct variables using responses about confidence in the following institutions: Congress (ConLegislature), press (ConPress), medicine (ConMedicine), finance (ConFinance), and business (ConBusiness). Our variables for institutional confidence are the proportion of respondents that report having “a great deal of confidence.” (The confidence variables were added to the GSS in 1973.)

The data on regulation come from RegData, a database published by the Mercatus Center at George Mason University. RegData includes two primary metrics: restrictions and industry relevance. We focus on restrictions, which is a proxy for the number of regulatory restrictions contained in the regulatory text (Restrictions). Restrictions are measured by counting select words and phrases, such as shall or must, that are typically used in legal language to create binding obligations or prohibitions. RegData also offers a secondary measure of restrictions—the total word count of the regulatory text—as an alternative measure of the volume of regulation over time (Words). We use both of these measures to account for regulation in the US over time. RegData provides us with annual data on restrictions and words from 1970 to 2017, which match well with our GSS data. Thus, combining the two data sets, we have a time series that goes from 1973 to 2017.

The relationship between social trust (or social capital) and economic growth is well established in the literature.68Knack and Keefer, “Does Social Capital Have an Economic Pay-Off?” Income inequality as measured by the Gini coefficient has also been shown to be causally related to social trust.69Guglielmo Barone and Sauro Mocetti, “Inequality and Trust: New Evidence from Panel Data,” Economic Inquiry 54, no. 2 (2016): 794–809; Eric M. Uslaner, “Trust, Democracy and Governance: Can Government Policies Influence Generalized Trust?,” in Generating Social Capital: Civil Society and Institutions in Comparative Perspective, ed. Marc Hooghe and Dietlind Stolle (New York: Palgrave Macmillan, 2003). Unemployment is also related to general macroeconomic conditions, to economic growth, and to regulation.70Francesco Daveri and Guido Tabellini, “Unemployment, Growth and Taxation in Industrial Countries,” Economic Policy 15, no. 30 (2000): 48–104; Horst Feldmann, “The Unemployment Effects of Labor Regulation around the World,” Journal of Comparative Economics 37, no. 1 (2009): 76–90. While our main focus is the relationship between social trust and regulation, it is important to include control variables in our analysis to mitigate the potential that omitted variable bias could lead to false conclusions about Granger causality. For this reason, in addition to the variables of interest—social trust and regulation—we include three control variables: the US GDP growth rate (Growth), income inequality measured by the Gini coefficient (Gini), and the US unemployment rate (Unemployment). While it is possible to conceive of other potentially relevant control variables, the relatively short length of the data set (44 years of observations) and the lag structure of the model make adding a large number controls problematic.71Vector autoregression is well known, as a methodology, to suffer from parameter overproliferation. Too many estimated parameters relative to the number of observations weakens the statistical power available. Also, many potential control variables end up moving together over time, causing further statistical problems of collinearity.

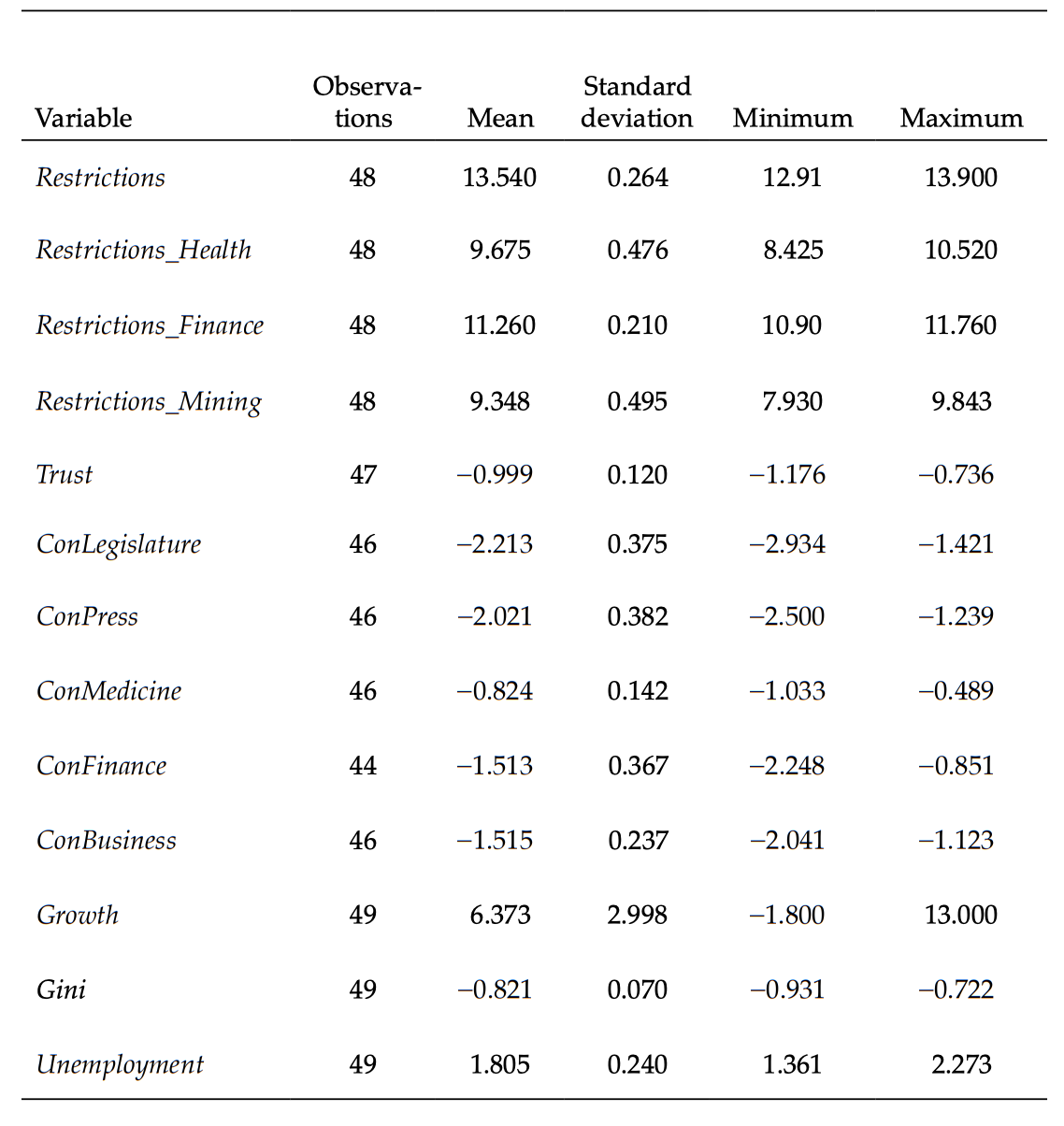

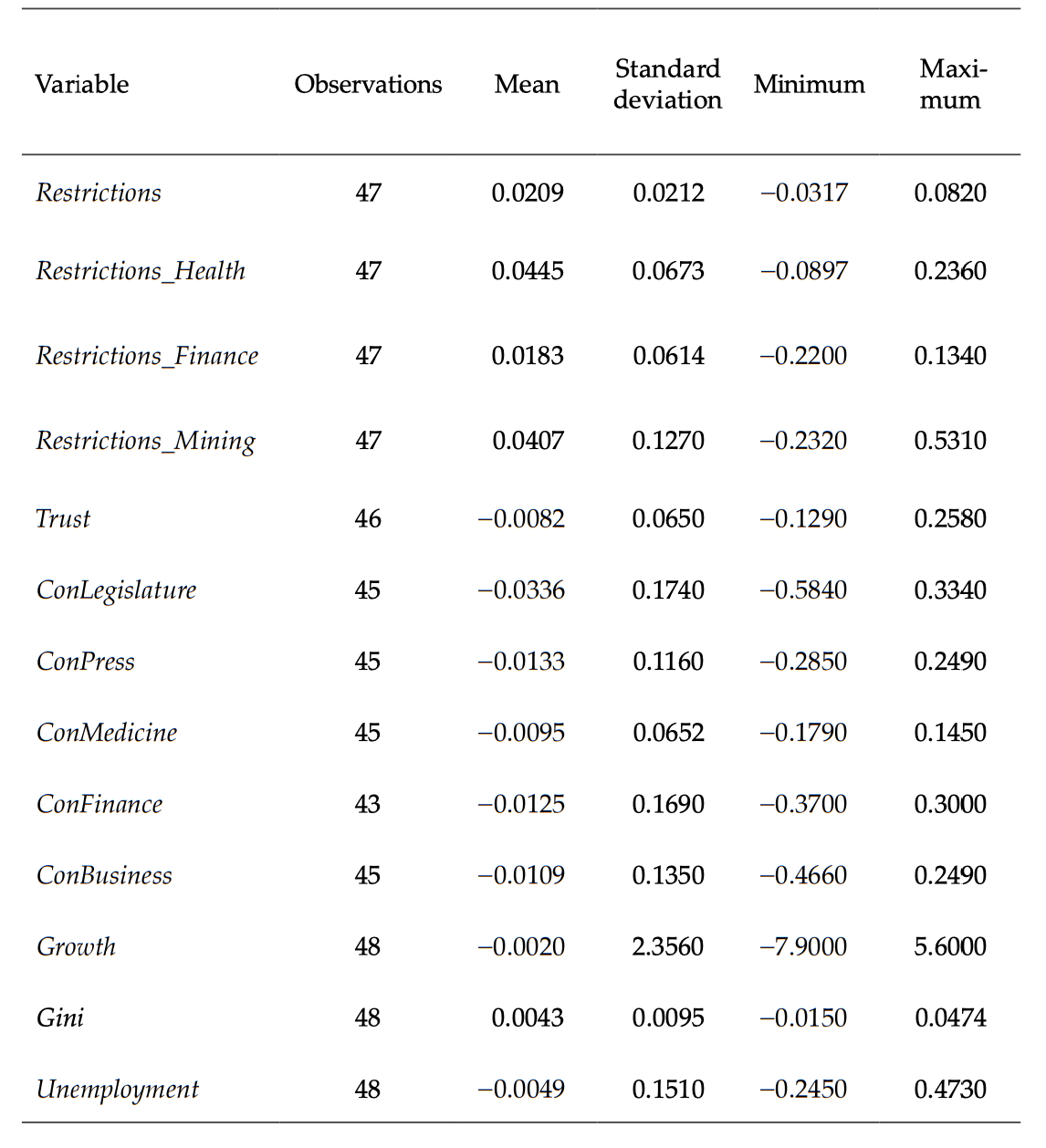

Summary statistics for all data are given in table 5, where the data have first been transformed by the natural logarithm.

Table 5. Summary Statistics

Methodology

Since our data are a time series and we want to determine whether trust affects regulation and regulation affects trust, our main empirical method is a regression technique known as vector autoregressive (VAR). All variables enter into the VAR model after we have first taken the log and then the first difference (which is calculated by subtracting the value at time t from the value at time t − 1).72This first differencing a technical requirement need to apply the VAR methodology to our data. This method treats each of the key variables, Trust and Restrictions, as endogenous variables that depend on lagged values of itself and each of the other variables. This model allows us to conduct what are known as tests of Granger causality. Granger causality refers to the ability of past values of one variable to predict the current values of another. This method corresponds to an empirical test of cause (a change in a current value of one variable) producing an effect (a change in the future value of another variable). We will conduct Granger causality tests to answer two questions: Does regulation “Granger cause” trust and, conversely, does trust “Granger cause” regulation?73It is important to note that Granger causality is a very specific type of causality. It should not be confused with a more general concept of causality that might be gleaned from an experimental research design. The VAR methodology also allows one to track the dynamic effects of a one-time change in one variable on another variable with what is known as an impulse response function. We compute impulse response functions that allow us to examine the dynamic effects of a change in trust on regulation and the dynamic effects of a change in regulation on trust.

A more detailed description of the methodology can be found in this chapter’s appendix.

Results

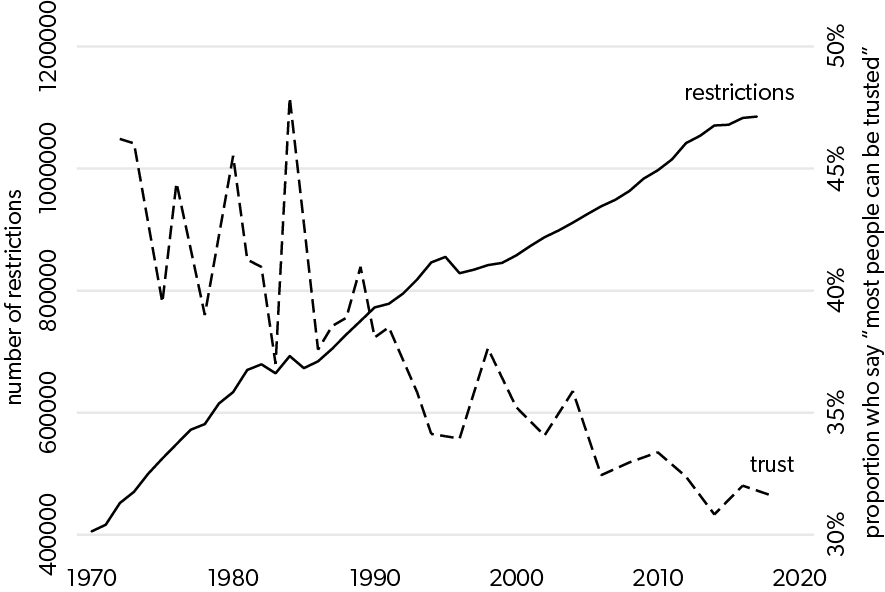

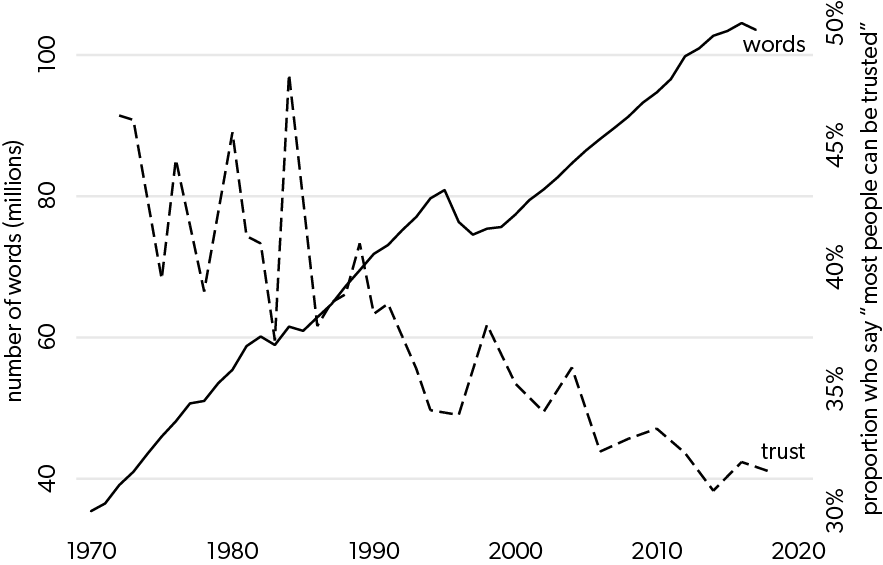

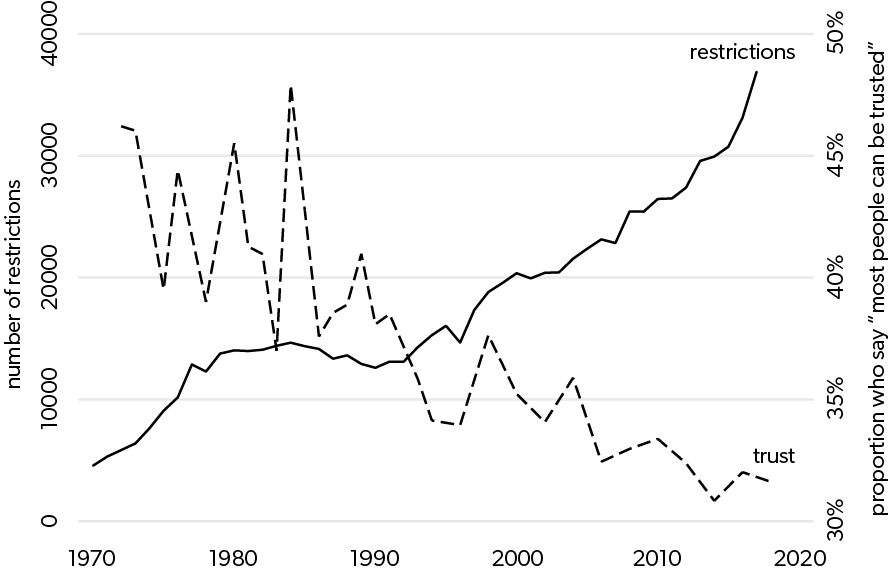

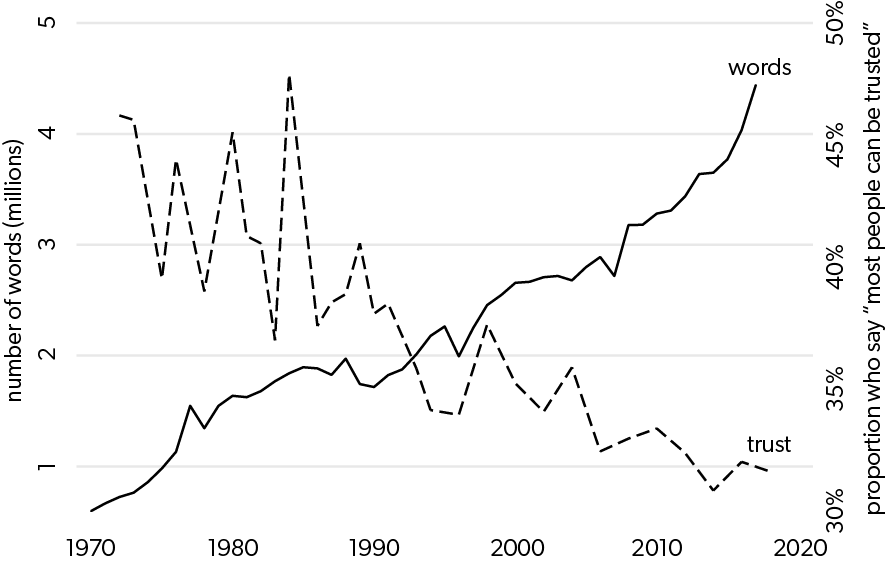

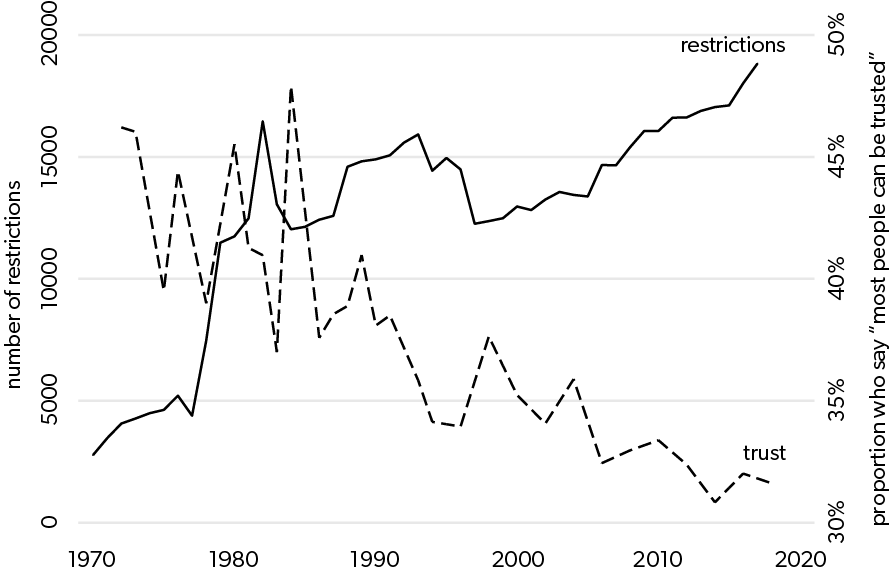

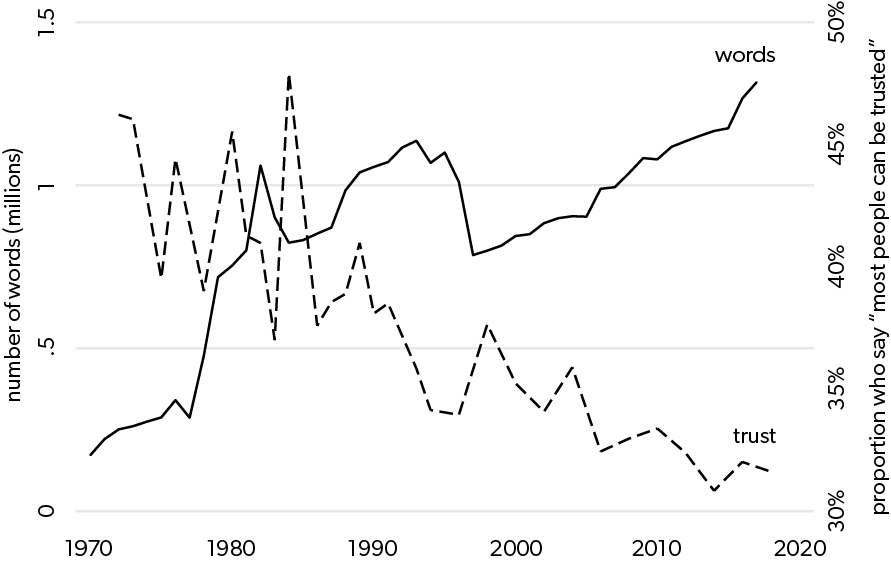

To begin our examination of the relationship between regulation and trust, we examine the raw data. We plot the annual mean of Trust and the annual number of Restrictions (figure 1). Figure 1 shows Trust (the proportion of people who responded “most people can be trusted”) at just over 45% in 1972 and declining over the period of observation to just over 30% in 2018. Restrictions in 1970 was at 40,000 and by 2017 was at just over 1 million. Thus, the annual trends of the raw data suggest a strong negative relationship between the two variables. In figure 2 we plot Trust and Words: the same strong negative relationship is also present using the volume measure of regulation.

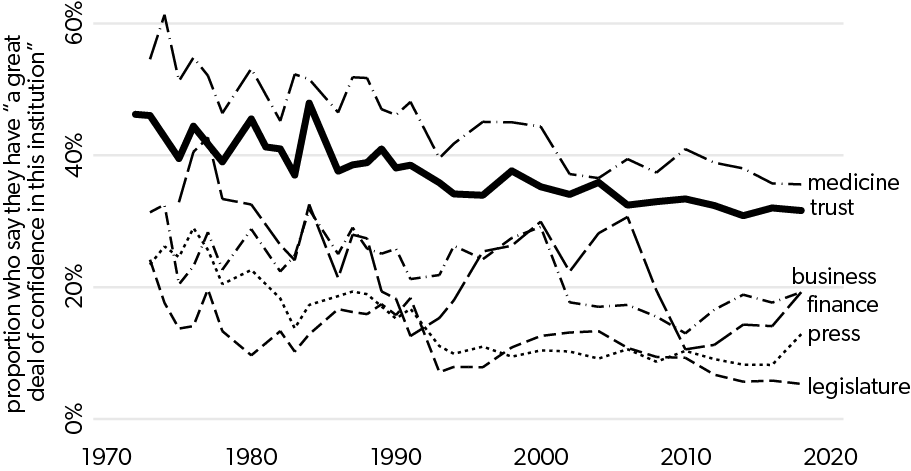

To examine this relationship further, we can similarly plot out social trust and confidence in our various institutions. Figure 3 shows the trends in Trust, ConPress, ConMedicine, ConLegislature, ConBusiness, and ConFinance. A few observations can be made as we compare the respondents’ confidence in these various institutions. Confidence in all of these institutions, like social trust, is declining over the period in question. Respondents have the most confidence in medicine and the least confidence in Congress. Confidence in financial institutions shows the most volatility, with declines in confidence corresponding with economic downturns.

Figure 1. Social Trust and Regulatory Restrictions

Sources: General Social Survey (data set), NORC at the University of Chicago, 2018 data (release 2), March 2019; Patrick A. McLaughlin and Oliver Sherouse, RegData US 3.1 Annual (data set), QuantGov, Mercatus Center at George Mason University, Arlington, VA, 2018.

Figure 2. Social Trust and Volume of Regulatory Text

Sources: General Social Survey (data set), NORC at the University of Chicago, 2018 data (release 2), March 2019; Patrick A. McLaughlin and Oliver Sherouse, RegData US 3.1 Annual (data set), QuantGov, Mercatus Center at George Mason University, Arling- ton, VA, 2018.

Figure 3. Social Trust and Confidence in Various Institutions

Source: General Social Survey (data set), NORC at the University of Chicago, 2018 data (release 2), March 2019.

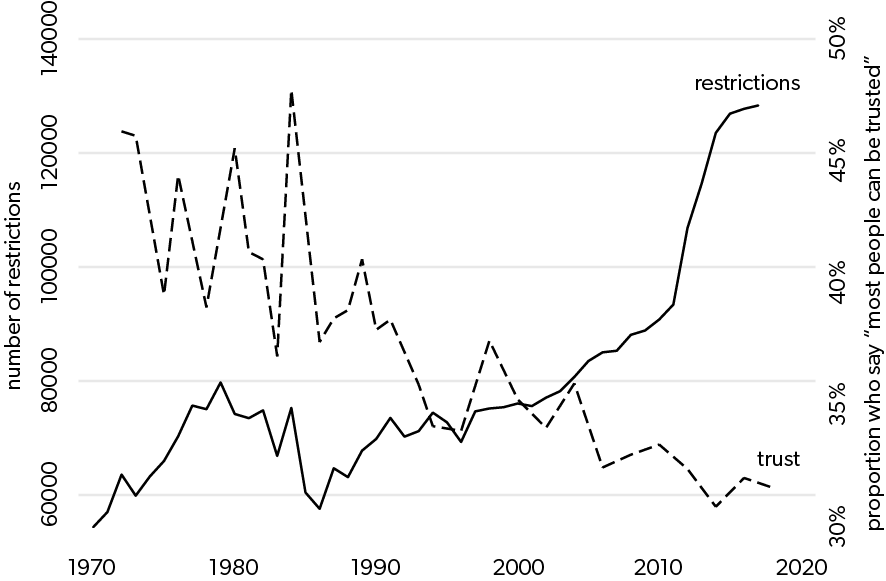

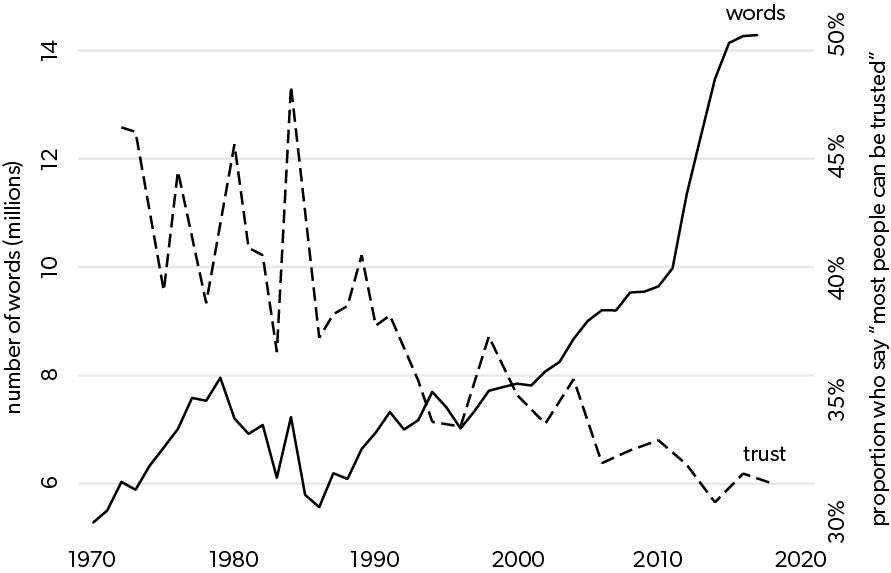

Figures 1 and 2 suggest that Restrictions and Words appear to be increasing at a steady and smooth rate, but if we examine various industries, we see that there is variation in regulation. We identify three industries to examine closer: healthcare, finance, and mining. RegData provides data broken down by the codes used in the North American Industry Classification System, so we focus on the two-digit codes for our three chosen industries. In the figures that follow, we plot Trust against Restrictions and Words limited to these specific industries.

We identify these industries as ones that are heavily regulated. Finance and healthcare/medicine are industries that have confidence measures in the GSS, noted in figure 3, but both are service industries. Mining is an industry that is heavily regulated because of the potentially dangerous conditions associated with working in mining, but there is no corresponding GSS data available for confidence in mining and it is not an industry that most individuals would pay close attention to. For this reason, we include it to determine whether the relationship between general social trust and regulation in mining is different from the relationships between general social trust and regulation in the other two industries.

Figures 4 and 5 show Trust plotted alongside Restrictions_Health and Words_Health, respectively. Figure 4 shows that Restrictions_Health was increasing during the early 1970s, then appears to plateau from the late 1970s through the early 1990s before beginning to increase again. The negative relationship between social trust and regulatory restrictions is still obvious. Figure 5 shows a similar pattern, with some spikes and dips in Words_Health over the time frame.

We repeat this exercise with the finance industry (figures 6 and 7) and the mining industry (figures 8 and 9). We will limit our discussion here to Restrictions_Finance and Restrictions_Mining. Figure 6 depicts Restrictions_Finance increasing during the 1970s, declining during the early to mid 1980s, increasing again aside from a couple of dips just before 2000, and then increasing steadily after 2000—with a sharp increase following the Great Recession. However, Restrictions_Mining is perhaps the most interesting variable relative to Trust, and shows the greatest amount of change. The restrictions on mining increased dramatically in the mid to late 1970s, and then declined somewhat during the mid 1980s. Restrictions on mining increased again around 1990 before falling around 2000. Since then, they have steadily increased. Again, the negative relationship between social trust and regulatory restrictions is present in these industries, although it is less pronounced in mining.

Figure 4. Social Trust and Regulatory Restrictions Related to the Healthcare Industry

Sources: General Social Survey (data set), NORC at the University of Chicago, 2018 data (release 2), March 2019; Patrick A. McLaughlin and Oliver Sherouse, RegData US 3.1 Annual (data set), QuantGov, Mercatus Center at George Mason University, Arlington, VA, 2018.

Figure 5. Social Trust and Volume of Regulatory Text Related to the Healthcare Industry

Sources: General Social Survey (data set), NORC at the University of Chicago, 2018 data (release 2), March 2019; Patrick A. McLaughlin and Oliver Sherouse, RegData US 3.1 Annual (data set), QuantGov, Mercatus Center at George Mason University, Arlington, VA, 2018.

Figure 6. Social Trust and Regulatory Restrictions Related to the Finance Industry

Sources: General Social Survey (data set), NORC at the University of Chicago, 2018 data (release 2), March 2019; Patrick A. McLaughlin and Oliver Sherouse, RegData US 3.1 Annual (data set), QuantGov, Mercatus Center at George Mason University, Arlington, VA, 2018.

Figure 7. Social Trust and Volume of Regulatory Text Related to the Finance Industry

Sources: General Social Survey (data set), NORC at the University of Chicago, 2018 data (release 2), March 2019; Patrick A. McLaughlin and Oliver Sherouse, RegData US 3.1 Annual (data set), QuantGov, Mercatus Center at George Mason University, Arlington, VA, 2018.

Figure 8. Social Trust and Regulatory Restrictions Related to the Mining Industry

Sources: General Social Survey (data set), NORC at the University of Chicago, 2018 data (release 2), March 2019; Patrick A. McLaughlin and Oliver Sherouse, RegData US 3.1 Annual (data set), QuantGov, Mercatus Center at George Mason University, Arlington, VA, 2018.

Figure 9. Social Trust and Volume of Regulatory Text Related to the Mining Industry

Sources: General Social Survey (data set), NORC at the University of Chicago, 2018 data (release 2), March 2019; Patrick A. McLaughlin and Oliver Sherouse, RegData US 3.1 Annual (data set), QuantGov, Mercatus Center at George Mason University, Arlington, VA, 2018.

Aghion, Algan, Cahuc, and Shleifer argue that causality runs from higher levels distrust leading to demanding regulation.74Aghion et al., “Regulation and Distrust. However, their analysis is a cross-country study. Given our time series of data, we can examine a Granger causality between Trust and regulation (as measured by Restrictions) to determine whether Trust Granger causes Restrictions, whether Restrictions Granger causes Trust, or whether Granger causality runs in both directions.

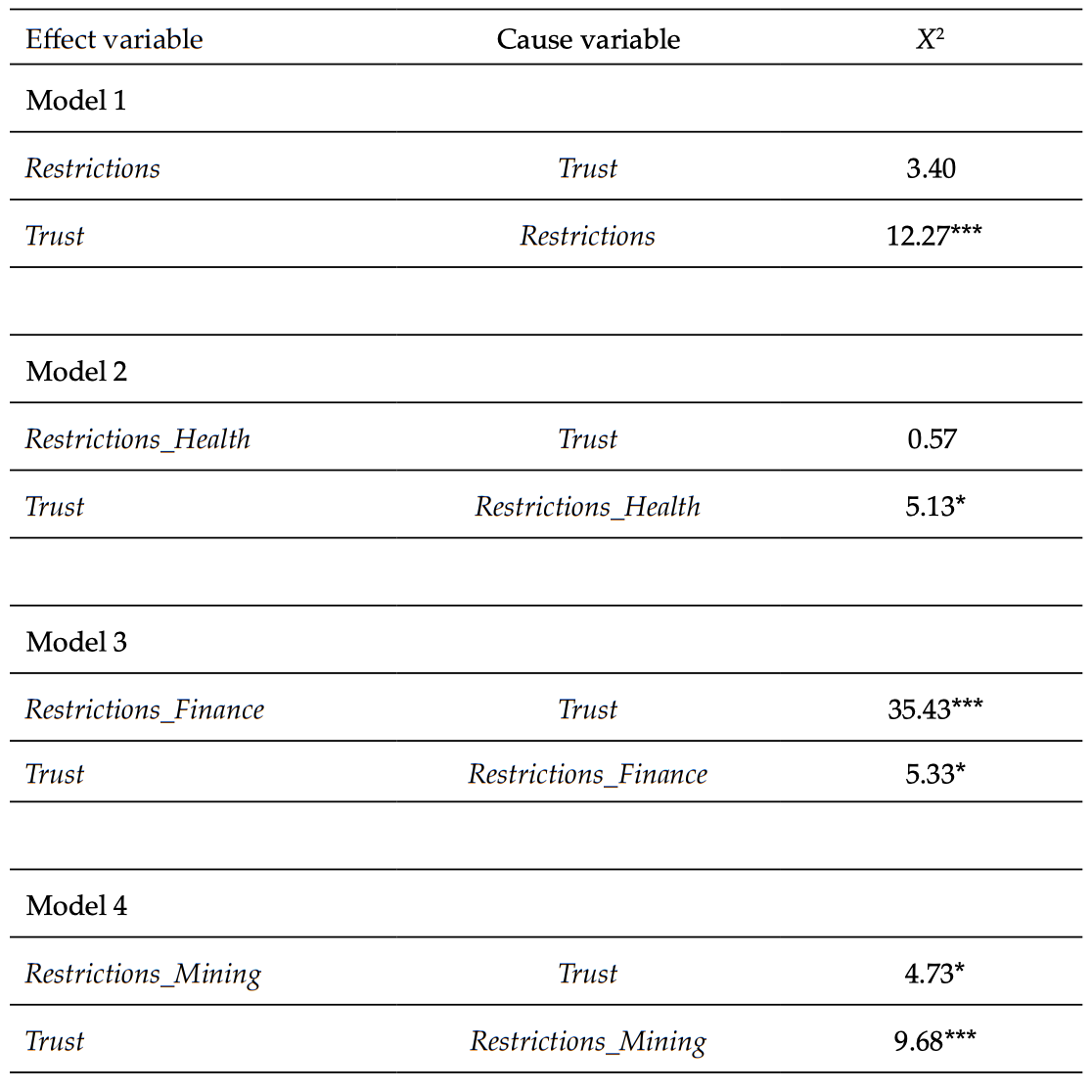

A Wald test is used to determine Granger causality from the VAR output. (See the appendix for details concerning the VAR model, output, and Wald tests.) Our results indicate that changes in Trust do not Granger cause later changes in Restrictions.75All the variables in the model are first differenced. The summary statistics for the difference variables are presented in table A1 in the appendix. That is, changes in Trust do not have the ability to predict future changes in Restrictions. However, the converse is confirmed. Changes in Restrictions do Granger cause changes in Trust. Current changes in regulation as measured by Restrictions can be used to forecast future changes in Trust. This relationship of Restrictions Granger causing Trust holds across the three industries we examine as well. Additionally, Trust Granger causes Restrictions_Finance and Restrictions_Mining—thus, when it comes to the finance and mining industries, Granger causality runs in both directions.

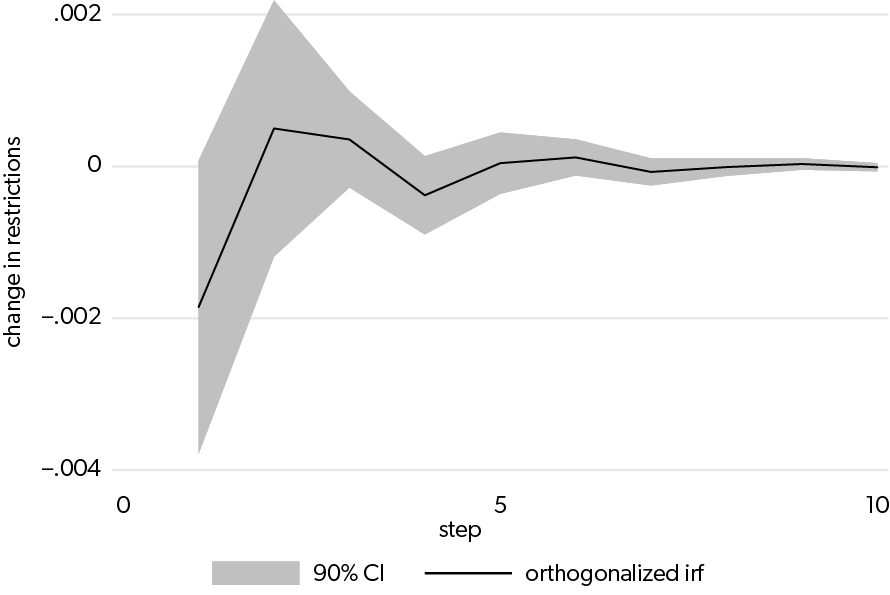

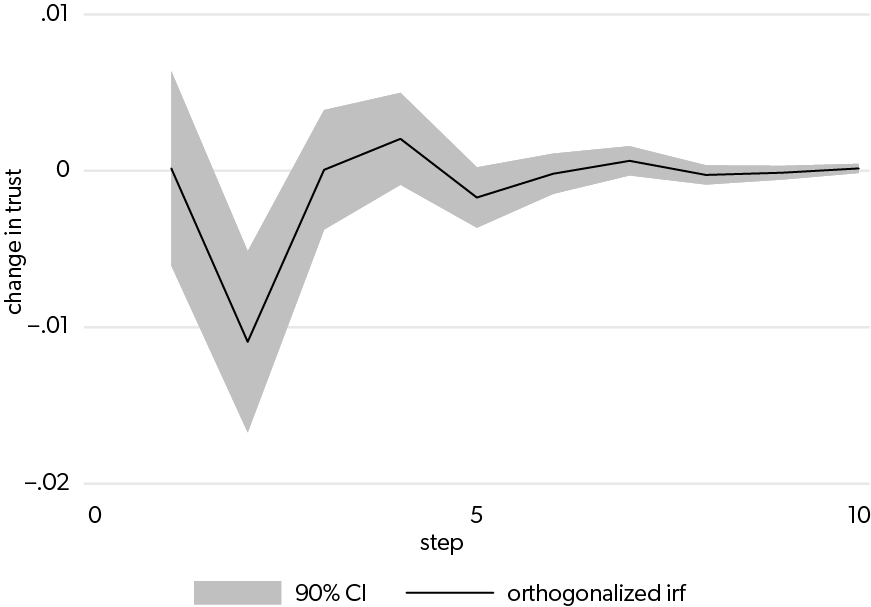

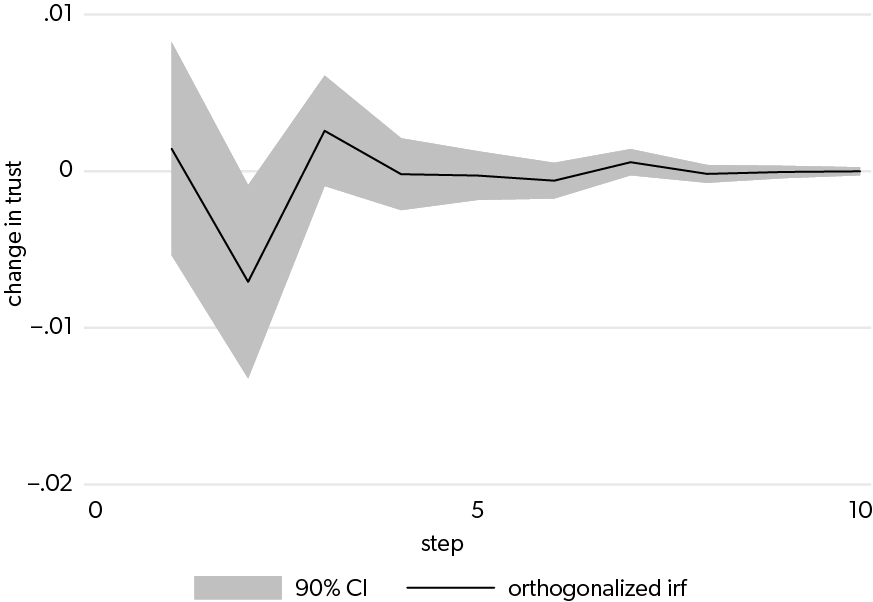

Finally, to further assess the relationship between trust and regulation, we employ an impulse response function (IRF). An IRF estimates the dynamic effect of a one-time change (shock) in one variable as it interacts with other variables, leading them to all change over time. The IRFs that we compute and graph presumes that a one-time shock to a variable happens at time zero and then maps the dynamic impact on another variable over the following 10 time periods. Again, we test this relationship in both directions. Figure 10 illustrates the effect of a one standard deviation increase (shock) in Trust on the number of regulatory restrictions. The estimated effect is the solid line, while the shaded area around the line represents the 90 percent confidence interval around the estimated effect.

In the period following the shock to trust, there is a small negative effect on restrictions. However, the confidence interval contains zero, which demonstrates that the size of the effect is statistically insignificant. The initial small negative effect quickly goes to zero after the first period. Similarly, the dynamic effect on Trust of a one standard deviation increase (shock) in Restrictions is computed in an IRF and displayed in figure 11. Trust has no immediate response to the initial shock in Restrictions. However, in time period 2, there is a significant decrease in Trust by just over 1 percent, which is about half a standard deviation in Trust. In the third period and following after the shock in Restrictions, there are no further changes to Trust. This demonstrates that a one standard deviation increase in Restrictions will tend to correlate with a half a standard deviation decrease in Trust two periods later. These results provide further evidence for the negative relation- ship between social trust and regulation.

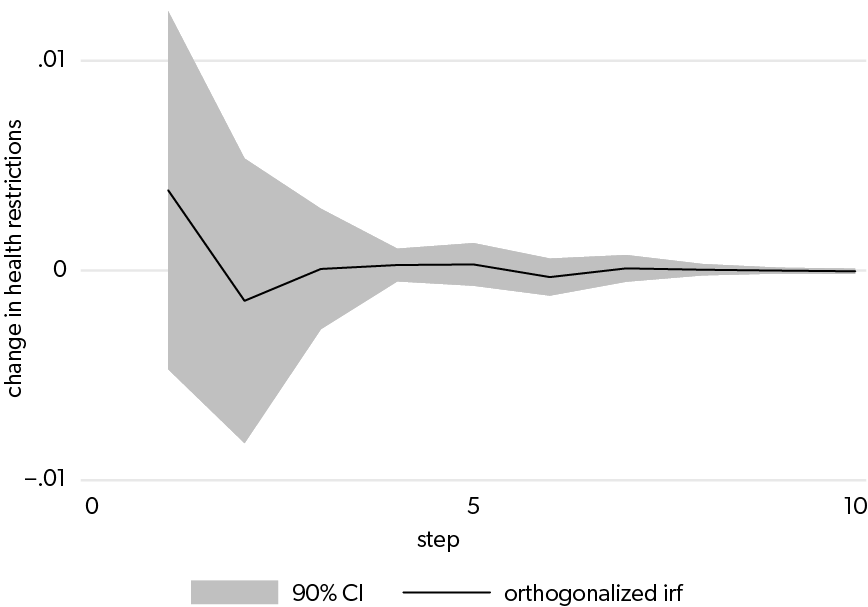

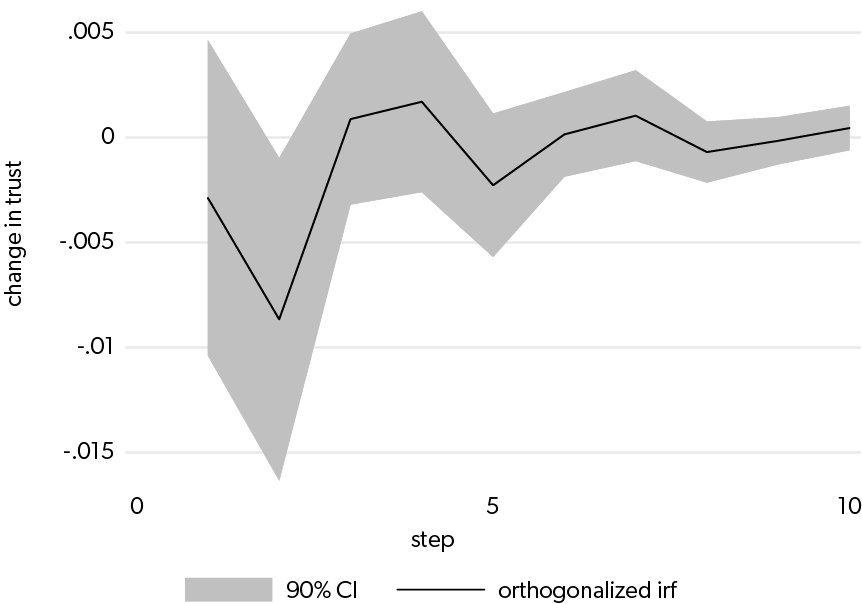

The dynamics of the relationship between changes in social trust and changes in regulation differ by industry. To examine this more fully, we also compute IRFs for Trust and regulation in each of the industries previously examined: healthcare, finance, and mining. These IRFs are presented in figures 12 through 17. The IRF showing the dynamics between a one standard deviation increase in healthcare restrictions and its impact on social trust is found in figure 12. This graph shows the familiar pattern we saw for overall restrictions in figure 11: Initially, there is no impact on social trust, but two periods after an increase in healthcare regulations, there is a significant decrease in social trust. Figure 13 demonstrates that a one standard deviation increase in social trust has no dynamic impact on healthcare restrictions. Figures 14 and 15 graph the corresponding IRFs for the finance industry. A one standard deviation increase in finance regulations leads to an immediate (although statistically insignificant) decrease in social trust, followed by another (this time statistically significant) decrease in social trust two years later.

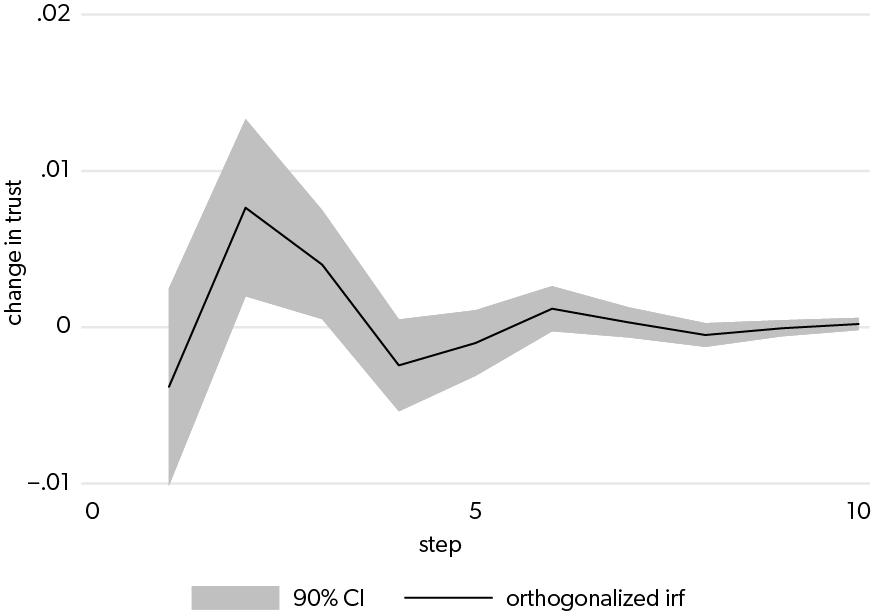

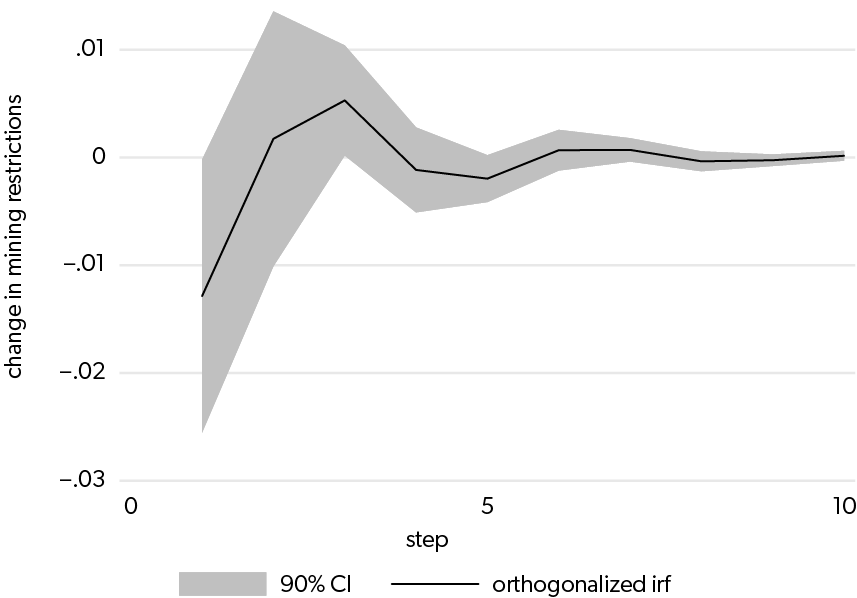

Interestingly, a one standard deviation increase in social trust also leads to a decline in finance regulation one year later. Thus, there is evidence of a vicious cycle in the finance industry, as increased regulation leads to decreased social trust and decreased social trust leads to increased regulation. The mining industry presents an entirely different set of relationships. Figures 16 and 17 graph the corresponding IRFs for the mining industry. As shown in figure 16, a one standard deviation increase in mining restrictions actually leads to subsequent increases in social trust in years 2 and 3 following the increase. This is the opposite of the effect we saw for regulation overall and in the healthcare and finance industries.

Figure 17 demonstrates that a one standard deviation increase in social trust leads to a decrease in mining restrictions the following year—a decrease that disappears in subsequent years.

Figure 10. Impulse Response Function: Trust to Restrictions

Figure 11. Impulse Response Function: Restrictions to Trust

Figure 12. Impulse Response Function: Restrictions_Health to Trust

Figure 13. Impulse Response Function: Trust to Restrictions_Health

Figure 14. Impulse Response Function: Restrictions_Finance to Trust

Figure 15. Impulse Response Function: Trust to Restrictions_Finance

Figure 16. Impulse Response Function: Restrictions_Mining to Trust

Figure 17. Impulse Response Function: Trust to Restrictions_Mining

Policy Reform

Social trust has been found to be correlated with economic growth76Knack and Keefer, “Does Social Capital Have an Economic Pay-Off?” and subjective well-being,77Eric Uslaner, The Moral Foundations of Trust (Cambridge: Cambridge University Press, 2002); John F. Helliwell, “How’s Life? Combining Individual and National Variables to Explain Subjective Well-Being,” Economic Modelling 20, no. 2 (2003): 331–60; John F. Helliwell, “Well‐Being, Social Capital and Public Policy: What’s New?,” Economic Journal 116, no. 510 (2006): C34–C45. making its promotion an ideal objective for policy. While there are often specific benefits that accrue from specific and targeted pieces of regulation, there are also benefits to be had from general and broad deregulation efforts and reforms that reduce the complexity and burden of regulation. Regulation can get in the way of the necessary social feedback loops that create social trust as social interactions reward that which is praiseworthy and punish that which is blameworthy. Our findings demonstrate that, in addition to traditional benefits, general deregulation may also bring an increase in social trust.

While we do not find evidence that increases in social trust would lead to decreases in overall regulation, thus revealing a virtuous cycle of deregulation, we do reveal such a virtuous cycle of deregulation in the finance industry. A general reduction of the regulatory burden in the finance industry can lead to increases in social trust. These increases in social trust then lead to further general reductions of regulation in the finance industry—thus perpetuating a cycle that will see further increases in social trust.

These results bring to the fore two main policy recommendations. First, policymakers should look for ways to reduce the overall regulatory burden on the economy. Doing so would promote economic efficiency, economic growth, and social trust. Second, policymakers should look for ways to reduce the regulatory burden on the finance industry specifically. Such reductions may bring additional benefits owing to the virtuous cycle. A reduced regulatory burden in the finance industry will lead to increased social trust, which will further propagate itself from further reductions in the financial regulatory burden.

Conclusion

We set out to empirically examine the question of causality between regulation and social trust. Our analysis adds to the existing literature by providing a new time-series data set of regulation and trust in the US. Other studies have all been cross-sectional and cross-country. Our findings are consistent with those of previous researchers, who have found that there is a negative relationship between social trust and regulation.78Aghion et al., “Regulation and Distrust”; Pinotti, “Trust, Regulation and Market Failures.” However, Granger causality tests provide strong evidence that regulation Granger causes trust. There is less compelling evidence that trust Granger causes regulation.

This relationship is tested with a data set encompassing all the regulations in the US as well as a select set of industry regulations, and the results continue to hold. These results suggest that a vicious cycle does not exist between the degradation of social trust and growth in regulation that have been observed in the US since the 1970s. Because social trust doesn’t Granger cause regulation, it is possible to implement policies that can support social trust without the negative consequences generated from regulation. Furthermore, policies that reduce the regulatory burden have the added benefit of leading to increased social trust along with increased efficiency and economic growth. This is especially beneficial because social trust is known to be associated with so many other desirable outcomes.

Appendix: Methodology in Detail

To conduct our tests of Granger causality, we first determine whether the variables contain a unit root and, if so, whether stationarity can be achieved by first-differencing the data. We confirm that the first differences of all data are stationary, so all VAR regressions are performed using first differences of the data. This allows us to use a simple VAR econometric specification on which we can conduct Wald tests for Granger causality. In all VAR regressions, the data are first logged and then first-differenced. The summary statistics of the data in log first differences appear in table A1.

Each VAR model we estimate is a system of two linear regression equations, as expressed in equations A1 and A2, where subscript t indexes time, Trust is the first difference of the log level of trust, Restrictions is the first difference of the log level of the number of restrictions (from RegData), and X is a vector of log first differences of control variables.79Each variable in the regression equations represents a log difference. These differences are calculated following a similar pattern. For example, is the log level of trust at time t minus the log level of trust at time t − 1.Letting i index each equation, the error term is and the parameters to be estimated are (1) the constants for each equation,

; (2) the coefficients for lagged differences of endogenous variables,

; and (3) the vector of coefficients for lagged differences of exogenous variables,

.

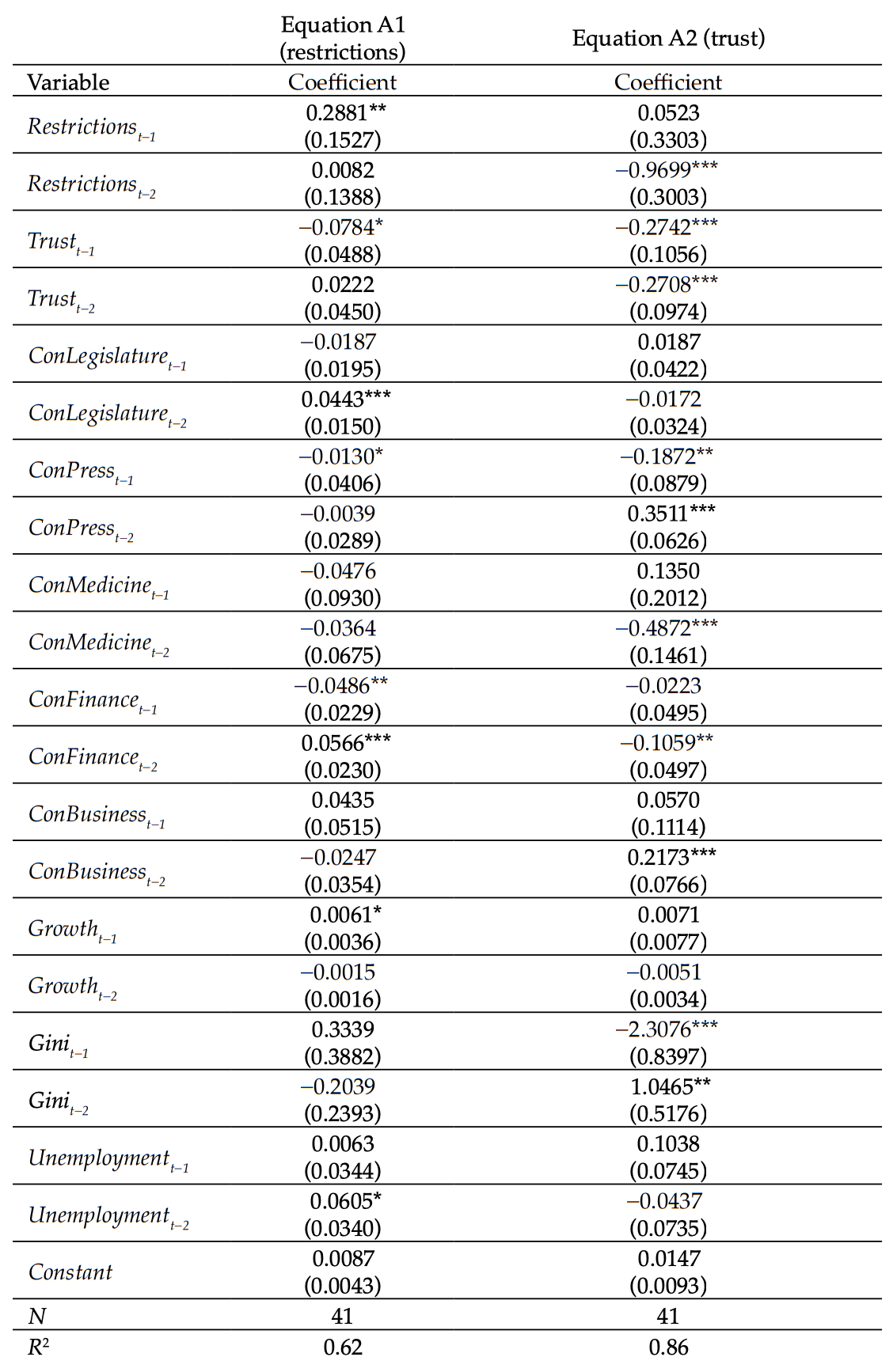

(1)

(2)

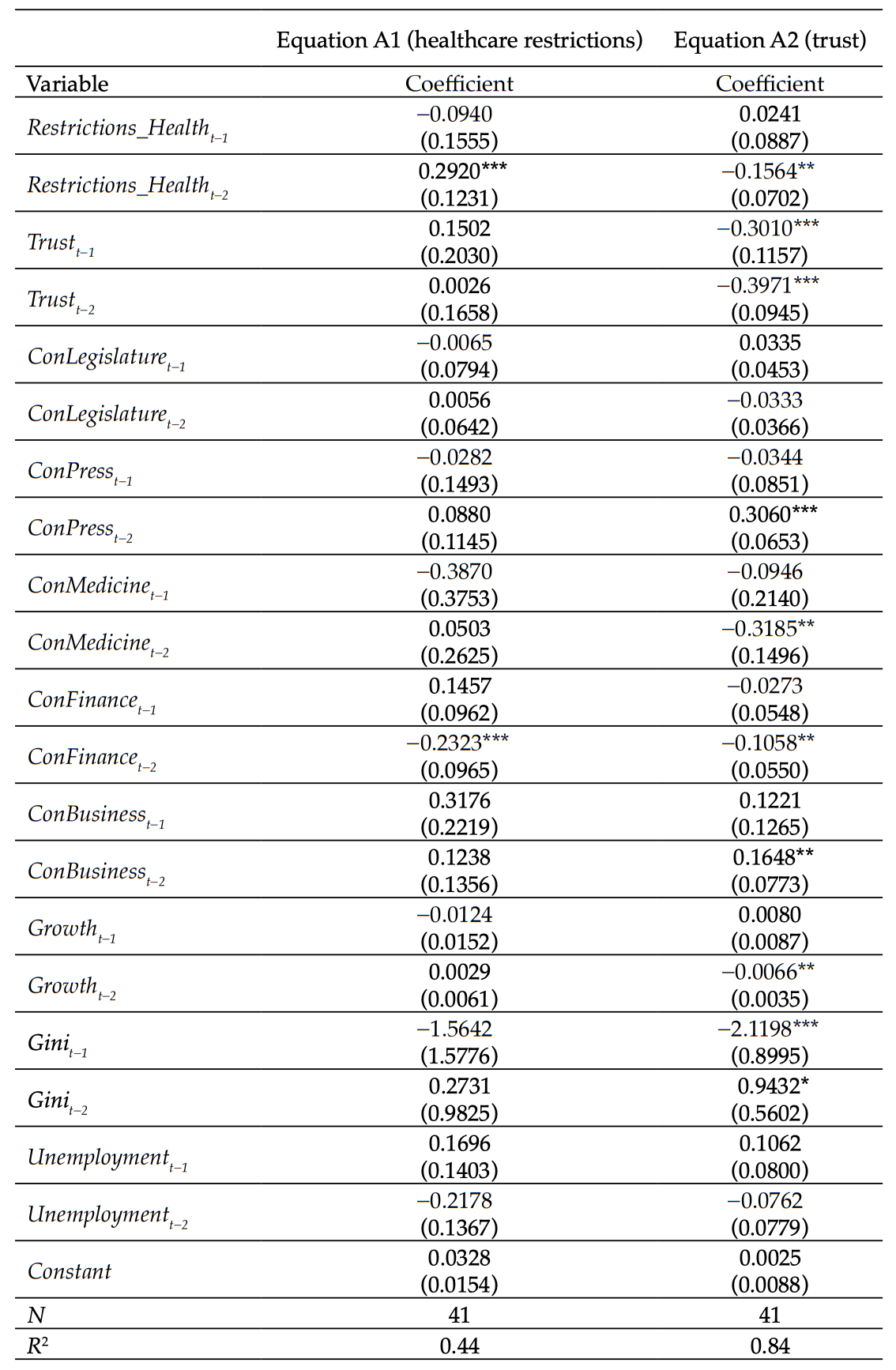

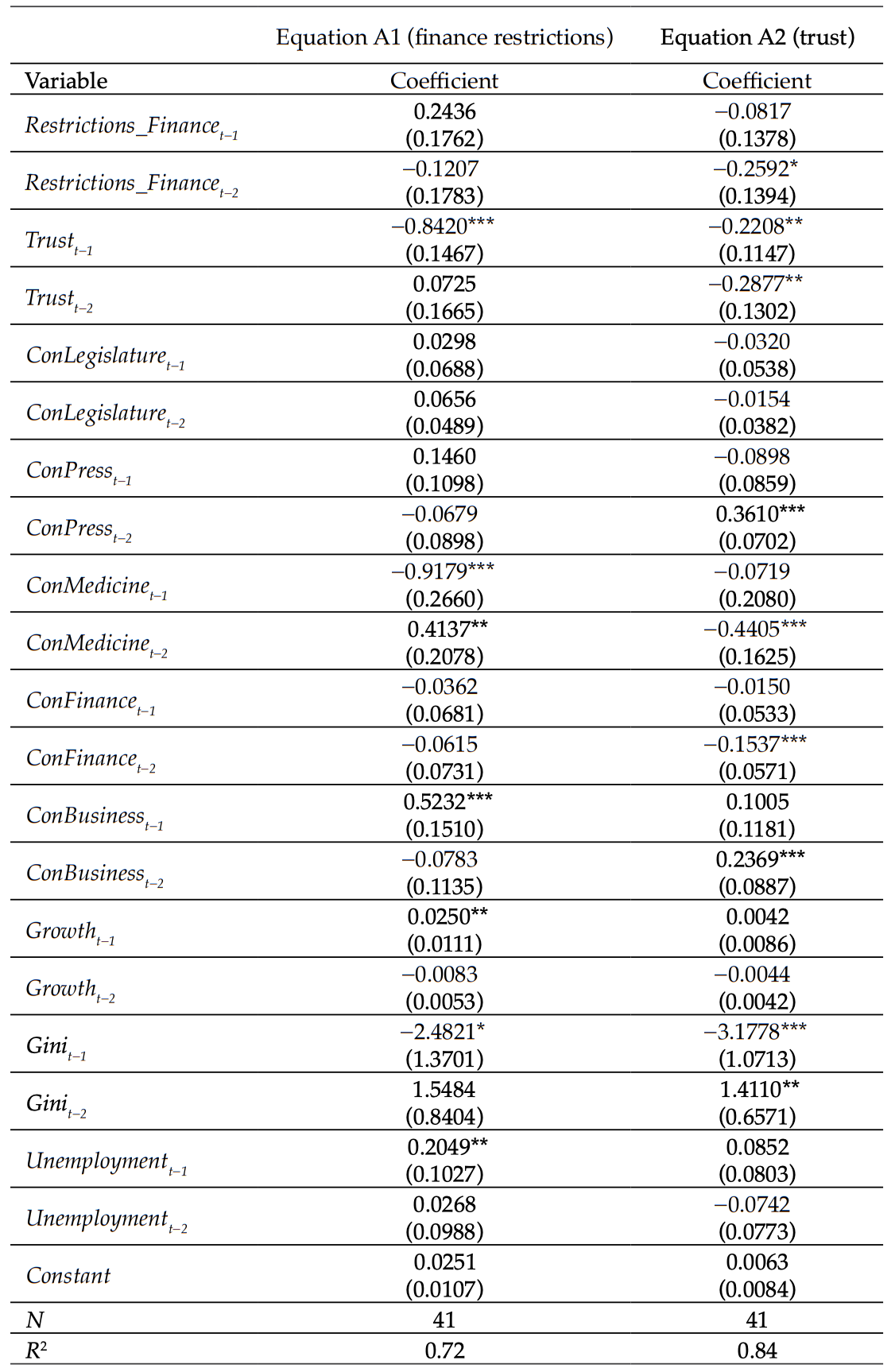

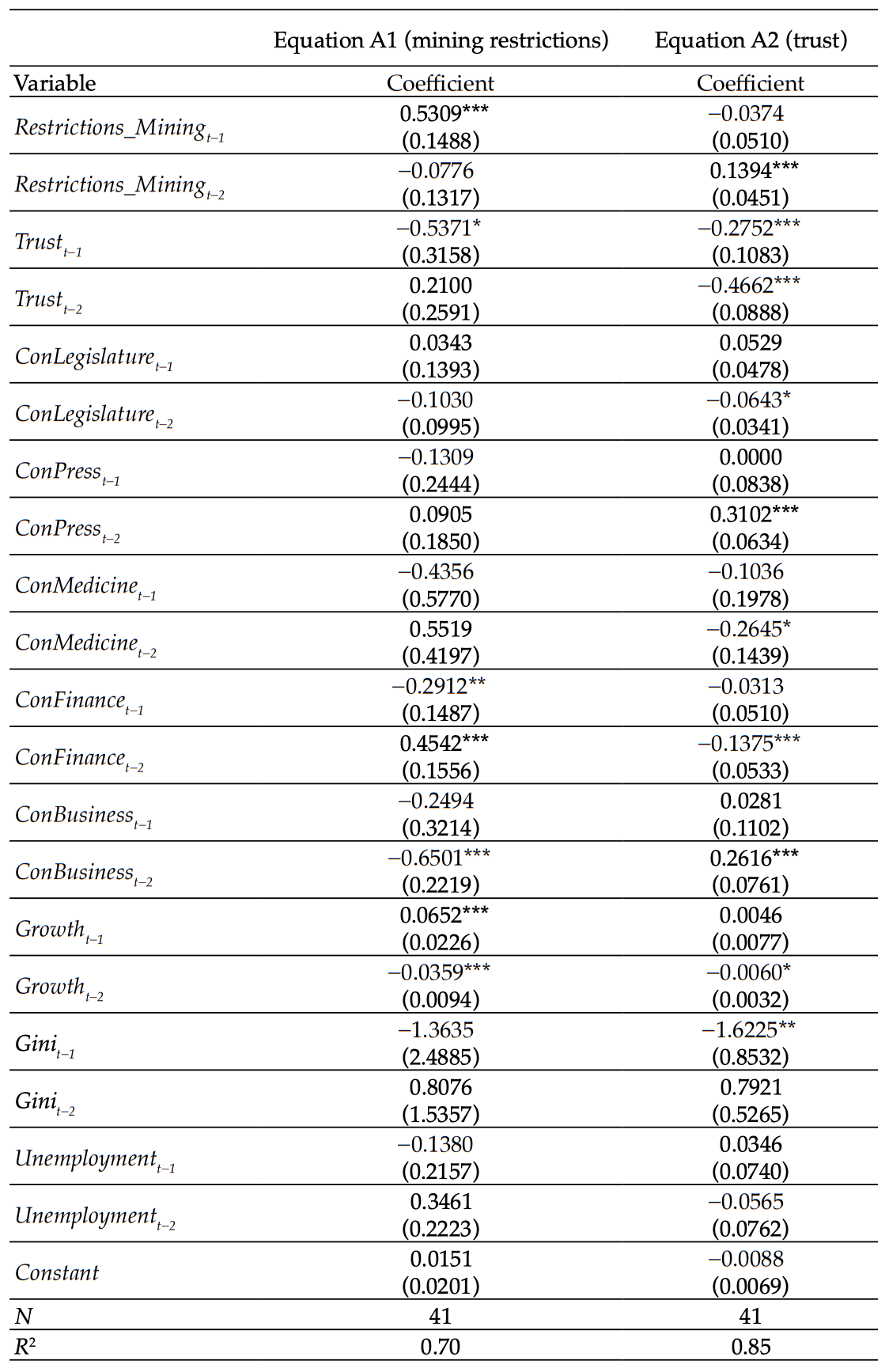

VAR model 1 is a simple two-way VAR specification between the log first differences of Restrictions and Trust. Diagnostic tests indicate that a VAR model of lag order 2 is most appropriate. The VAR model includes the confidence measures of our institutions and our controls for economic conditions. This model generates an R2 of .62 on Restrictions and .86 on Trust, indicating that the model is better able to predict Trust than Restrictions. The VAR coefficients for model 1 can be seen in table A2. We continue in this same vein with our restrictions in the specific industries of healthcare, finance, and mining in VAR models 2, 3, and 4, respectively. These results can be found in tables A3, A4, and A5, respectively. Table A6 displays the Wald test statistics for all Granger causality tests.

Table A1. Summary Statistics in Log Differences

Table A2. Vector Autoregression Model 1: Regulatory Restrictions and Social Trust

Note: Standard errors are in parentheses.

* p < .1; ** p < .05; *** p < .01.

Table A3. Vector Augoregression Model 2: Healthcare Industry Regulatory Restrictions and Social Trust

Note: Standard errors are in parentheses.

* p < .1; ** p < .05; *** p < .01.

Table A4. Vector Autoregression Model 3: Finance Industry Regulatory Restrictions and Social Trust

Note: Standard errors are in parentheses.

* p < .1; ** p < .05; *** p < .01.

Table A5. Vector Autoregression Model 4: Mining Industry Regulatory Restrictions and Social Trust

Note: Standard errors are in parentheses.

* p < .1; ** p < .05; *** p < .01.

Table A6. Granger Causality Wald Tests

Note: * p < .1; ** p < .05; *** p < .01.

References

Acemoglu, Daron and Joshua D. Angrist. “Consequences of Employment Protection? The Case of the Americans with Disabilities Act.” Journal of Political Economy 109, no. 5 (2001): 915–57.

Aghion, Phillippe et al. “Regulation and Distrust.” Quarterly Journal of Economics 125, no. 3 (2010): 1015–49.

Ahnen, David and Peter T. Calcagno. “Constitutions and Social Trust: An Analysis of the US States.” Journal of Private Enterprise 34, no. 3 (2019): 11–33.

Ardagna, Silvia and Annamaria Lusardi. “Explaining International Differences in Entrepreneurship: The Role of Individual Characteristics and Regulatory Constraints” (NBER Working Paper No. 14012. National Bureau of Economic Research. Cambridge, MA, 2008).

Barone, Guglielmo and Sauro Mocetti. “Inequality and Trust: New Evidence from Panel Data.” Economic Inquiry 54, no. 2 (2016): 794–809.

Baumol, William. “Entrepreneurship: Productive, unproductive and destructive.” Journal of Political Economy. 98(5), (1990) 893–921.

Berggren, Niclas and Henrik Jordahl. “Free to Trust: Economic Freedom and Social Capital.” Kyklos 59, no. 2 (2006): 141–69.

Bergh, Andreas and Christian Bjørnskov. “Historical Trust Levels Predict the Current Size of the Welfare State.” Kyklos 64, no. 1 (2011): 1–19.

Bjørnskov, Christian and Gert Tinggaard Svendsen. “Does Social Trust Determine the Size of the Welfare State? Evidence Using Historical Identification.” Public Choice 157, no. 1–2 (2013): 269–86.

Bjørnskov, Christian and Nicolai J. Foss. “Do Economic Freedom and Entrepreneurship Impact Total Factor Productivity?” (SMG Working Paper No. 8/2010. Center for Strategic Management and Globalization. Copenhagen Business School. September 2010).

Bjørnskov, Christian and Stefan Voigt. “Constitutional Verbosity and Social Trust.” Public Choice 161, no. 1–2 (2014): 91–112.

Bjørnskov, Christian. “How Does Social Trust Affect Economic Growth?” Southern Economic Journal 78, no. 4 (2012): 1346–68.

Bjørnskov, Christian. “The Multiple Facets of Social Capital.” European Journal of Political Economy 22, no. 1 (2006): 22–40.

Calcagno, Peter T. and Russell S. Sobel. “Regulatory Costs on Entrepreneurship and Establishment Employment Size.” Small Business Economics 42, no. 3 (2014): 541–59.

Campbell, Noel D., Tammy M. Rogers, and Kirk C. Heriot. “The Economic Freedom Index as a Determinant of Firm Births and Firm Deaths.” Southwest Business and Economics Journal 16 (2007): 37–50.

Carden, Art, Steven Castello, and Benjamin Priday. “Religious Freedom and Private Enterprise.” Journal of Private Enterprise 35. (2020): 47-59.

Chambers, Dustin, Courtney A. Collins, and Alan Krause. “How Do Federal Regulations Affect Consumer Prices? An Analysis of the Regressive Effects of Regulation.” Public Choice 180, no. 1–2 (2019): 57–90.

Daveri, Francesco and Guido Tabellini. “Unemployment, Growth and Taxation in Industrial Countries.” Economic Policy 15, no. 30 (2000): 48–104.

Djankov, Simeon et al. “The Regulation of Entry.” Quarterly Journal of Economics 117, no. 1 (2002): 1–37.

Djankov, Simeon, Caralee McLiesh, and Rita Maria Ramalho. “Regulation and Growth.” Economics Letters 92, no. 3 (2006): 395–401.

Ekelund, Robert B. and Robert D. Tollison. “The Interest-Group Theory of Government.” The Elgar Companion to Public Choice. ed. William F. Shughart II and Laura Razzolini (Cheltenham, UK: Edward Elgar, 2001).

Feldmann, Horst. “The Unemployment Effects of Labor Regulation around the World,” Journal of Comparative Economics 37, no. 1 (2009): 76–90.

Gallup. “Confidence in Institutions.” In Depth: Topics A to Z. Accessed May 9, 2020. https://news.gallup.com/poll/1597/confidence-institutions.aspx.

Gallup. “Trust in Government.” In Depth: Topics A to Z. Accessed May 9, 2020. https://news.gallup.com/poll/5392/trust-government.aspx.

Gao, Feng, Joanna Shuang Wu, and Jerold Zimmerman. “Unintended Consequences of Granting Small Firms Exemptions from Securities Regulation: Evidence from the Sarbanes‐Oxley Act.” Journal of Accounting Research 47, no. 2 (2009): 459–506.

Goldschlag, Nathan and Alex Tabarrok. “Is Regulation to Blame for the Decline in American Entrepreneurship?” Economic Policy 33, no. 93 (2018): 5–44.

Hale, Andrew, David Borys, and Mark Adams. “Regulatory Overload: A Behavioral Analysis of Regulatory Compliance” (Working Paper No. 11-74, Mercatus Center at George Mason University, Arlington, VA, 2011).

Helliwell, John F. “How’s Life? Combining Individual and National Variables to Explain Subjective Well-Being.” Economic Modelling 20, no. 2 (2003): 331–60.

Helliwell, John F. “Well‐Being, Social Capital and Public Policy: What’s New?” Economic Journal 116, no. 510 (2006): C34–C45.

Jackson, Jeremy J. “Economic Freedom and Social Capital: Pooled Mean Group Evidence.” Applied Economics Letters 24, no. 6 (2017): 370–73.

Jackson, Jeremy, Art Carden, and Ryan A. Compton. “Economic Freedom and Social Capital.” Applied Economics 47, no. 54 (2015): 5853–67.

Klapper, Leora, Luc Laeven, and Raghuram Rajan. “Entry Regulation as a Barrier to Entrepreneurship.” Journal of Financial Economics 82, no. 3 (2006): 591–629.

Kleiner, Morris M. “Occupational Licensing.” Journal of Economic Perspectives 14, no. 4 (2000): 189–202.

Knack, Stephen and Philip Keefer. “Does Social Capital Have an Economic PayOff? A Cross-Country Investigation.” Quarterly Journal of Economics 112, no. 4 (1997): 125 1–88.

la Porta, Rafael, Florencio Lopez-de-Silanes, Andrei Shleifer, and Robert Vishny. “Trust in Large Organizations.” American Economic Review. 87(2) (1997): 333–38.

McLaughlin, Patrick A., Nita Ghei, and Michael Wilt. “Regulatory Accumulation and Its Costs: An Overview” (Policy Brief, Mercatus Center at George Mason University, Arlington, VA, November 2018). https://www.mercatus.org/publications/regulation/regulatory-accumulation-and-its-costs-0.

Murphy, Ryan, Meg Tuszynski, and Jeremy Jackson. “Some Dynamics of Socioeconomic Relationships: Well-Being, Social Capital, Economic Freedom, Economic Growth, and Entrepreneurship.” American Journal of Entrepreneurship 13. (June 2020):4-44.

Nannestad, Peter. “What Have We Learned about Generalized Trust, If Anything?” Annual Review of Political Science 11 (June 2008): 413–36.

Niskanen, William A. “The Peculiar Economics of Bureaucracy.” American Economic Review 58, no. 2 (1968): 293–305.

Nyström, Kristina. “The Institutions of Economic Freedom and Entrepreneurship: Evidence from Panel Data.” Public Choice 136, no. 3–4 (2008): 269–82.

Pew Research Center. “Public Trust in Government: 1958-2019.” Pew Research Center. April 171 2019. https://www.pewresearch.org/politics/2019/04/11/public-trust-in-government-1958-2019/.

Pinotti, Paolo. “Trust, Honesty and Regulations” (MPRA Paper 7740, Munich Personal RePEc Archive, 2008).

Pinotti, Paolo. “Trust, Regulation and Market Failures.” Review of Economics and Statistics 94, no. 3 (2012): 650–58.

Pitlik, Hans and Ludek Kouba. “Does Social Distrust Always Lead to a Stronger Support for Government Intervention?” Public Choice 163, no. 3–4 (2015): 355–77.

Putnam, Robert D. Bowling Alone: The Collapse and Revival of American Community (New York: Simon & Schuster, 2000).

Putnam, Robert D. Making Democracy Work: Civic Traditions in Modern Italy. With Robert Leonardi and Raffaella Y. Nanetti (Princeton, NJ: Princeton University Press, 1993). 167.

Rahn, Wendy M. and Thomas J. Rudolph. “A Tale of Political Trust in American Cities.” Public Opinion Quarterly 69, no. 4 (2005): 530–60.

Rainie, Lee, Scott Keeter, and Andrew Perrin. “Trust and Distrust in America.” Pew Research Center. July 22, 2019. 29. https://www.pewresearch.org/politics/2019/07/22/trust-and-distrust-in-america/.

Rietz, Thomas A. et al. “Trust, Reciprocity, and Rules.” Economic Inquiry 56, no. 3 (2018): 1526–42.

Rothstein, Bo, Marcus Samanni, and Jan Teorell. “Explaining the Welfare State: Power Resources vs. the Quality of Government.” European Political Science Review 4, no. 1 (2012): 1–28.

Smith, Vernon L. and Bart J. Wilson. Humanomics: Moral Sentiments and the Wealth of Nations for the Twenty-First Century (Cambridge: Cambridge University Press. 2019).

Sobel, Russ. “Testing Baumol: Institutional quality and the productivity of entrepreneurship.” Journal of Business Venturing. 23. (2008): 641–655.

Stigler, George J. “The Theory of Economic Regulation.” Bell Journal of Economics and Management Science 2, no. 1 (1971): 3–21.

Stiglitz, Joseph. “Government Failure vs. Market Failure: Principles of Regulation.” in Government and Markets: Toward a New Theory of Regulation. ed. Edward J. Balleisen and David A. Moss (Cambridge: Cambridge University Press. 2009).

Stout, Lynn A. “Are Stock Markets Costly Casinos? Disagreement, Market Failure, and Securities Regulation.” Virginia Law Review 81, no. 3 (April 1995): 611–712.

Sunstein, Cass R. “Nudges.gov: Behavioral Economics and Regulation.” The Oxford Handbook of Behavioral Economics and the Law. ed. Eyal Zamir and Doron Teichman (Oxford: Oxford University Press, 2014).

Thaler, Richard H. and Cass R. Sunstein. Nudge: Improving Decisions about Health, Wealth, and Happiness (New Haven: Penguin, 2009).

Tullock, Gordon. “Efficient Rent Seeking.” Efficient Rent-Seeking. ed. Alan A. Lockard and Gordon Tullock (Boston: Springer, 2001).

Uslaner, Eric M. “Trust, Democracy and Governance: Can Government Policies Influence Generalized Trust?” in Generating Social Capital: Civil Society and Institutions in Comparative Perspective. ed. Marc Hooghe and Dietlind Stolle (New York: Palgrave Macmillan. 2003).

Uslaner, Eric M. and Mitchell Brown. “Inequality, Trust, and Civic Engagement.” American Politics Research 33, no. 6 (2005): 868–94.

Uslaner, Eric M. The Moral Foundations of Trust (Cambridge: Cambridge University Press. 2002).

van Stel, André, David J. Storey, and A. Roy Thurik. “The Effect of Business Regulations on Nascent and Young Business Entrepreneurship.” Small Business Economics 28. no. 2–3 (2007): 171–86.

Weingast, Barry, Kenneth Shepsle, and Christopher Johnsen. “The political economy of benefits and costs: A neoclassical approach to distributive politics.” Journal of Political Economy. 89, no. 4, (1981): 642–664.

Weinschenk, Aaron C. and David J. Helpap. “Political Trust in the American States.” State and Local Government Review 47, no. 1 (2015): 26–34.

Yandle, Bruce. “Bootleggers and Baptists—the Education of a Regulatory Economist.” Regulation 7. no. 3 (1983): 12–16.

Table of Contents

- Regulation and Entrepreneurship: Theory, Impacts, and Implications

- Regulation and the Perpetuation of Poverty in the US and Senegal

- Social Trust and Regulation: A Time-Series Analysis of the United States

- Regulation and the Shadow Economy

- An Introduction to the Effect of Regulation on Employment and Wages

- Occupational Licensing: A Barrier to Opportunity and Prosperity

- Gender, Race, and Earnings: The Divergent Effect of Occupational Licensing on the Distribution of Earnings and on Access to the Economy

- How Can Certificate-of-Need Laws Be Reformed to Improve Access to Healthcare?

- Land Use Regulation and Housing Affordability

- Building Energy Codes: A Case Study in Regulation and Cost-Benefit Analysis

- The Tradeoffs between Energy Efficiency, Consumer Preferences, and Economic Growth

- Cooperation or Conflict: Two Approaches to Conservation

- Retail Electric Competition and Natural Monopoly: The Shocking Truth

- Governance for Networks: Regulation by Networks in Electric Power Markets in Texas

- Net Neutrality: Internet Regulation and the Plans to Bring It Back

- Unintended Consequences of Regulating Private School Choice Programs: A Review of the Evidence