Most electricity consumers, whether households or small businesses, have few (if any) choices when it comes to their electricity supplier. The electric power business works a little differently in Texas, where most consumers can choose from among dozens of suppliers and face as many as two hundred different plans.

Reforms in Texas and several other states over the past 30 years were intended to promote the growth of competition in the electric power industry. The political debate was framed as a choice between regulation and deregulation. Should government regulators oversee the industry or should oversight somehow be “left to the market”?

Astute industry observers, noting the voluminous regulations required to support the emergence of competition, see the deregulation label as misplaced. Restructuring is the preferred term of art. How and why is the reformed structure to work? The question draws attention to what in economics are called governance institutions.

Market exchange requires a background of social practices to define and enforce property rights. For a marketplace to emerge and endure, it further requires methods for resolving disputes. Governance institutions for market exchange are the collection of social practices concerning property rights and dispute resolution that enable durable market exchanges. Governance institutions have been studied in circumstances ranging from medieval trading coalitions to piracy to prison yards to diamond trading to the provision of municipal services. We add to this literature with a case study examining governance institutions arising in wholesale electric power markets.

Governance is often considered to come in two types: public or private. According to this classification, within a particular sphere either government authority dominates or voluntary private interaction dominates. Work on common-pool resource institutions has added a third category of analysis, in which governance is provided primarily by social custom. Most, perhaps all, market settings are hybrids, in which some governance issues are resolved within one institutional setting and others are addressed elsewhere.

In electric power markets government authority has long been the dominant governance institution, but reforms undertaken over the past 30 years have shifted governance purposefully in the direction of market institutions. Much industry analysis remains framed as regulation versus deregulation, which is to say it assumes that governance is either public or it is private. In addition, the development of governance institutions for wholesale power markets remains an ongoing process as rules are introduced or revised to adapt to changing conditions. The goals for this case study are two: First, we will illustrate the value of the governance literature for understanding the organization of wholesale power markets. Second, we will use the case of electric power markets to examine and develop the understanding of governance institutions in the explicitly hybrid circumstances of wholesale power markets integrated with power system operations. Wholesale power trading is both enabled and constrained by the networked physical infrastructure connecting producers and consumers. We therefore draw on and mix three kinds of materials for our study: the literature on governance institutions, the literature on networks, and the recent history and economics of electric power markets.

The term governance has broad application in social analysis, with similarly broad variation in the scope of the term and the use to which it is applied. University of California, Berkeley political scientist Mark Bevir explores this variation in an essay in the Encyclopedia of Governance.1Mark Bevir, “Governance,” in Encyclopedia of Governance, ed. Mark Bevir (Thousand Oaks, CA: Sage, 2007). Within Bevir’s typology, our approach fits most clearly within “rational choice theory,” albeit without commitments to perfectly consistent preferences or completeness of information (commitments typical in formal modeling). In other words, we take our focus on governance to be about goal-oriented behavior by agents working within an environment of formal and informal rules, which they rely on to plan activity and coordinate with other agents.

Often it becomes easier to see how governance institutions work in everyday cases if one first considers the institutions that arise in relatively unusual environments.2While not focused on governance issues per se, LSE Fellow and author Richard Davies’s recent book suggests a similar perspective—that our understanding of the everyday present can be deepened by examining extreme cases. Richard Davies, Extreme Economies: What Life at the World’s Margins Can Teach Us about Our Own Future (New York: Farrar, Straus, and Giroux, 2019). In the 11th century, a time when few people traveled far from home, the overseas trading networks employed by Maghribi traders provides one example of an unusual case.3Avner Greif, “Reputation and Coalitions in Medieval Trade: Evidence on the Maghribi Traders,” Journal of Economic History 49, no. 4 (1989): 857–82. George Mason University economist Peter Leeson’s work on pirate governance studies cooperation (among pirates, if not their victims) in a seafaring environment.4Peter T. Leeson, “An-arrgh-chy: The Law and Economics of Pirate Organization,” Journal of Political Economy 115, no. 6 (2007): 1049–94; Peter T. Leeson, The Invisible Hook: The Hidden Economics of Pirates (Princeton, NJ: Princeton University Press, 2009). Brown University political scientist David Skarbek’s work on prison gangs presents another environment quite unlike the everyday world most buyers and sellers inhabit.5David Skarbek, “Governance and Prison Gangs,” American Political Science Review 105, no. 4 (2011): 702–16; David Skarbek, The Social Order of the Underworld: How Prison Gangs Govern the American Penal System (Oxford: Oxford University Press, 2014). We offer the electric power industry as another relatively extreme environment within which to explore governance. Our exploration draws on the analysis of common-pool resources produced by Indiana University political scientist and Nobel prizewinner Elinor Ostrom and her colleagues,6Elinor Ostrom, Governing the Commons: The Evolution of Institutions for Collective Action (Cambridge: Cambridge University Press, 1990). the analysis of network governance offered by University of Illinois law professor Amitai Aviram,7Amitai Aviram, “Regulation by Networks,” BYU Law Review, 2003, 1179-1238. and historical and institutional detail about the development of electric power markets.

The electric power trading environment is relatively extreme owing to the somewhat unforgiving nature of service delivery over an electric power grid. At the moment of the power transaction, the range of potential buyers and sellers is fixed by the network of physical electrical infrastructure connecting consumers and producers. The service must be produced the moment it is consumed. Successful delivery of electric power service involves meeting demanding technical requirements. Within the electric grid, individual power transactions may be complementary to some other uses of the grid while they create or shift patterns of congestion and thus compete against others. Overall maintaining grid stability can require electric generation to sacrifice the sale of electricity to provide grid support services, often without direct payment.8Federal Energy Regulatory Commission, Payment for Reactive Power, Commission Staff Report AD14-7, April 22, 2014. The physical demands of managing the production, delivery, and consumption of electric power create a distinctive, and in this respect extreme, economic environment. These physical constraints also affect the institutional framework or governance structure in which exchange occurs.9As an implication of these claims, we would predict that a rise of decentralized, relatively inexpensive battery storage capability would precipitate dramatic changes to governance systems surrounding electric power.

We investigate the topic of governance in networks with a focus on electric power markets in Texas. Texas is the only US state with a market design fully integrating competitive wholesale and competitive retail transactions.10For background on the electric industry in Texas and its regulatory reforms over the past two decades, see L. Lynne Kiesling and Andrew N. Kleit, eds., Electricity Restructuring: The Texas Story (Washington, DC: AEI Press, 2009). In the United States, electricity has traditionally been sold predominantly by privately owned companies granted monopoly territory protection by the state and constrained by state regulation of rates and other terms of service. These privately-owned electric utilities tend to be vertically integrated across a range of activities including electric power generation, long-distance transmission service, local distribution service, and retailing power to captive consumers. The fundamental governance systems within the traditional system are state and federal utility regulations, constrained somewhat by capital markets and manager-shareholder relations, as well as the broader environment of property and contract law.

The Texas approach retains significant portions of the traditional governance framework but limits the monopoly portions of the regulated electric utility to the transmission and distribution systems and shifts electric generation and retailing functions to predominantly market governance. Much of the governance of the wholesale power market occurs through the Electric Reliability Council of Texas (ERCOT), an independent system operator (ISO) that runs the wholesale power market and oversees operations of the transmission grid.

Briefly, in Texas electric power retailers buy power from electric generation and offer to sell it to end-use customers in competitive retail markets.11While several other states participate in ISO-style wholesale markets integrated with transmission-grid operations and some of these states also allow some degree of retail electric competition, the Texas approach is frequently regarded as the most complete integration of competition in wholesale and retail markets. The rest of this chapter will explore key features of governance institutions in general and how those governance institutions are shaped by a networked environments. This survey of the governance literature is employed to show how market-based governance institutions replace traditional rate-based regulation of vertically-integrated electric utilities and identify some advantages of making such replacement.

Governance and Networks

Effective governance institutions reflect the opportunities for gains from exchange and the related risks of opportunistic behavior.12Following Aviram, we rely on the definition of opportunism provided by Robert Cooter: “an act in which someone destroys part of the cooperative surplus to secure a larger share of it.” Robert D. Cooter, “The Theory of Market Modernization of Law,” International Review of Law and Economics 16, no. 2 (1996): 150; cited in Aviram, “Regulation by Networks,” 1184. A one-off trade for an inexpensive, immediately consumed product differs from the purchase of a durable consumer appliance. It also differs from an employment contract. Whether trade is within a social circle or between groups, whether potential failures are easy or difficult to recover from, whether parties have high-quality alternatives to the trade—all these features of transactions and the trading environment affect which rules are well-suited to govern behavior and to help people accomplish their various goals.13Ostrom, Governing the Commons.

Economic analysis, including analysis of the electric power system, has commonly focused on only two governance systems—government regulation and market competition—as if they represented the full range of options. Discussions of reforms to the electric power industry over the past three decades exemplify this simple analysis when the discussions are framed as being about deregulation, as if all regulation of potential opportunism is government-imposed regulation and the only alternative is the “free market.”14More sophisticated analysis employs the term restructuring instead, in part simply because government regulation is not removed—the number of regulations may actually increase—while responsibility for certain transactions is shifted away from government regulators and to agents in the market. Yale law professor Robert Ellickson, in Order without Law, identifies five types of governance systems: first-party controllers (self-regulation), second-party controllers (counterparty regulation), and three kinds of third-party controllers—social forces, organizations, and governments.15Robert C. Ellickson, Order without Law: How Neighbors Settle Disputes (Cambridge, MA: Harvard University Press, 1991), 126–32, 241–46; cited in Aviram, “Regulation by Networks,” 1186. Aviram draws on this categorization, explaining networks as one particularly significant form of third-party organizational regulator.16Aviram, “Regulation by Networks.” The work of Elinor Ostrom and others on common-pool resource governance offers a complementary and more extensive examination of these issues.

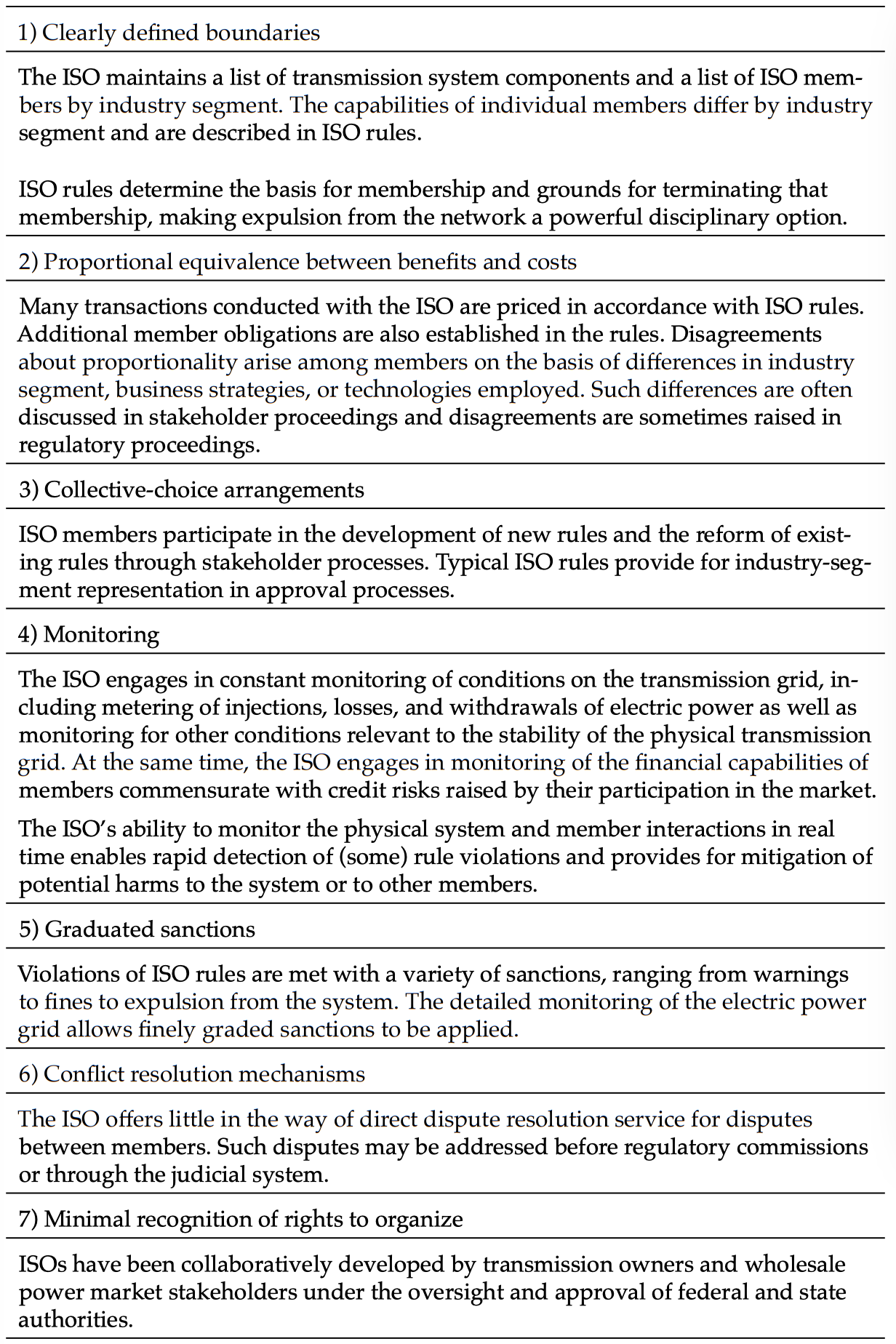

On the basis of her own fieldwork and surveys of many other studies, Ostrom identified eight general principles that characterize durable governance institutions for common-pool resources:17The version of Ostrom’s principles quoted here is from David Sloan Wilson, Elinor Ostrom, and Michael E. Cox, “Generalizing the Core Design Principles for the Efficacy of Groups,” Journal of Economic Behavior and Organization 90 (2013): S21–S32. The eight design principles were originally set out in Ostrom, Governing the Commons.

- “Clearly defined boundaries. The identity of the group and the boundaries of the shared resource are clearly delineated.”

- “Proportional equivalence between benefits and costs. Members of the group must negotiate a system that rewards members for their contributions. High status or other disproportionate benefits must be earned. Unfair inequality poisons collective efforts.”

- “Collective-choice arrangements. Group members must be able to create at least some of their own rules and make their own decisions by consensus. People hate being told what to do but will work hard for group goals that they have agreed upon.”

- “Monitoring. Managing a commons is inherently vulnerable to free-riding and active exploitation. Unless these undermining strategies can be detected at relatively low cost by norm-abiding members of the group, the tragedy of the commons will occur.”

- “Graduated sanctions. Transgressions need not require heavy-handed punishment, at least initially. Often gossip or a gentle reminder is sufficient, but more severe forms of punishment must also be waiting in the wings for use when necessary.”

- “Conflict resolution mechanisms. It must be possible to resolve conflicts quickly and in ways that are perceived as fair by members of the group.”

- “Minimal recognition of rights to organize. Groups must have the authority to conduct their own affairs. Externally imposed rules are unlikely to be adapted to local circumstances and violate principle 3.”

- “For groups that are part of larger social systems, there must be appropriate coordination among relevant groups. Every sphere of activity has an optimal scale. Large scale governance requires finding the optimal scale for each sphere of activity and appropriately coordinating the activities, a concept called polycentric governance.”

Together, the eight principles characterize a system of rules useful in sustaining mutually beneficial cooperation in an environment that might otherwise encourage opportunistic behavior.

Further analysis of the eight principles by environmental scientists Michael Cox, Gwen Arnold, and Sergio Villamayor-Tomás suggested useful refinements to three of the eight principles (1, 2, and 4). For principle 1, “clearly defined boundaries,” Cox, Arnold, and Villamayor-Tomás suggest separating attention to community boundaries from attention to resource boundaries. For principle 2, “proportional equivalence between benefits and costs,” they note that concern for proportional equivalence should be considered both with respect to local conditions and with respect to the individual benefit-cost position of individual community members. Similarly, for principle 4, “monitoring,” they suggest separating the monitoring of resource status from the monitoring of the behavior of group members and nonmembers.18Michael Cox, Gwen Arnold, and Sergio Villamayor-Tomás, “A Review of Design Principles for Community-Based Natural Resource Management,” Ecology and Society 15, no. 4 (2010): 38.

In “Regulation by Networks,” Aviram describes network exchange and explains how the network influences the efficacy of governance institutions available to the network. His analysis is not limited to physical networks such as power grids or natural gas pipelines, but extends to trade associations, commodity exchanges, and other social networks. So long as the network offers significantly positive network effects to its members and has privileged access to the information flow created by transactions, his analysis of network regulation should apply.

All networked environments shape the opportunities for gains from exchange and the potential for opportunism. “Network effects” are benefits that increase as more people are connected. The value of a telecommunication system to a member party increases with the number of other parties the member can communicate with. The larger a trading community becomes, the greater the likelihood that there will be a good fit between the goals of buyers and the goals of sellers. In two-sided markets such as credit card payment systems, the value to consumers increases with the number of sellers accepting the card and the value to sellers increases with the number of consumers using the card.

The presence of strong network effects turns the threat of effective exclusion from the network into a powerful disciplining device. In private, non-networked exchange, the possibility of future gains from trade provides disciplining effects on opportunistic behavior. Opportunistic behavior extracts additional benefits now while sacrificing gains from trade with the same counterparty in the future. However, if the opportunistic agent has sufficiently attractive alternative counterparties, the loss of one will be of small consequence. Information-sharing within a network, however, can result in the loss of all member counterparties, substantially raising the cost of and thereby deterring opportunistic behavior.

Networks can also improve the agents’ ability to secure gains from trade because they reduce the risks arising from counterparties’ failures, whether due to opportunism or accident. Some gains from trade can only be secured through sustained cooperation over time. When one counterparty fails to deliver, networks may be able to replace the nonperforming party and readily mitigate harms that would otherwise result. Reduction of risks enhances the ability to trade.

At the same time, networked systems are exposed to a unique kind of opportunistic behavior for which they cannot be the best regulator: degradation of quality. Aviram offers the example of two interconnected networks, one larger than the other.19Aviram, “Regulation by Networks,” 1210. The interconnection benefits members of each networks by expanding the number of potential counterparties, but the networks’ owners profit most from—and therefore prefer—trades between their own members. In this situation, the larger network faces an incentive to degrade the quality of the interconnection, perhaps by reducing the number of simultaneous transactions that can be supported. The reduction in capacity of the interconnection imposes higher costs on members of the smaller network and thereby increases the relative benefit of switching membership from the smaller to the larger network. The benefits of switching (as opposed to remaining members of the smaller network) increase with each agent that switches, threatening a cascading effect. In the absence of governance structures outside the networks themselves, either the small network will collapse or it will be forced to bear a disproportionate share of the costs of maintaining the interconnection.

The potential case of degradation shows one application of this approach to analysis. Even as a network should be expected to effectively promote certain kinds of transactions, namely those among its members, at the same time it is unlikely to be the most effective regulator of transactions among members of separate networks. If transactions across networks appear to leave potential gains from trade unexploited, this situation suggests that competition among institutions has not yet fully adapted to the environment. Reform consumes resources, so one possibility is that the costs of reform outweigh potential gains. However, improving trade between networks may create winners and losers within separate networks, and losers will have an incentive to frustrate potential reforms.

Markets are networks in both a general and a specific sense. Exchange and transactions are inherently social, requiring parties to be connected. A network of buyers and sellers benefits both sides of the market by increasing the number of potential trading partners, which is a more general phenomenon than demand-side complementarity. More specifically, modern markets are often digital platforms, which means that the market provider is decreasing transaction costs and enabling parties to find each other for mutual benefit.20For a seminal work on multisided platform economics, see Jean-Charles Rochet and Jean Tirole, “Platform Competition in Two-Sided Markets,” Journal of the European Economic Association 1, no. 4 (2003): 990–1029. For a transaction cost economics analysis of digital platforms, see L. Lynne Kiesling, Michael C. Munger, and Alexander Theisen, “From Airbnb to Solar: Toward a Transaction Cost Model of a Retail Electricity Distribution Platform” (working paper, 2019), https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3229960. In such market platforms, the market rules defined by the platform provider and the formal legal context combine to provide an institutional framework that is neither government regulation nor purely private ordering. Digital market platforms that establish rules to mitigate opportunistic behavior are networks capable of regulation in Aviram’s sense.

We can apply Ostrom’s eight principles specifically to the case of ISOs by mixing in Aviram’s work and industry knowledge (see table 1). ISOs offer strong two-sided market effects: the more electric generators connected to the system, the more valuable the system becomes to consumers; the more consumers connected to the system, the more valuable it becomes to electric generators. The ISO can control membership and participation on its network (principle 1), making exclusion a simple and powerful deterrent to opportunistic behavior. Monitoring power flows on the transmission network is central to the ISOs’ function (principle 4), making detection and deterrence of opportunistic behavior an inexpensive feature for an ISO to provide. The ISO market offers easy access to substitute transactions in the case of nonperformance by a counterparty (for example, intentional or accidental failure to supply power as contracted), reducing counterparty risk. The nonperforming party typically settles with the ISO at the market price for deviation from schedules, a type of graduated sanction (principle 5).

Table 1. Principles for Stable Governance Applied to Independent System Operators (ISOs)

Source: The list of principles for stable governance comes from David Sloan Wilson, Elinor Ostrom, and Michael E. Cox, “Generalizing the Core Design Principles for the Efficacy of Groups,” Journal of Economic Behavior and Organization 90 (2013): S21–S32.

However, ISOs have persistently faced difficulty in overcoming barriers to efficient trades with resources or consumers in neighboring ISOs.21For an overview see Rishi Garg, Electric Transmission Seams: A Primer. National Regulatory Research Institute, NBRRI Report No. 15-03 (February 2015). Garg notes the potential for inefficient coordination between ISOs was raised as early as 2000 as the Federal Energy Regulatory Commission was developing rules to govern Regional Transmission Owners. The 2015 report assesses both progress made and continuing challenges in obtaining efficient coordination among neighboring. See also Michael A. Giberson, Improving coordination between regional power markets. Doctoral dissertation, George Mason University (2004). This version of a degradation strategy is, as Aviram suggested, difficult for the network itself to overcome.

In the next section we explore a particular market platform—wholesale power markets operated by ERCOT, the ISO in Texas—as a form of governance institution. Our study is limited to the ERCOT ISO in Texas. While other ISOs in the United States share similar governance structures, we made no effort to examine or compare governance across the seven US ISOs.

Electric Power Markers: The Texas Model and Regulation by Network

The Texas electric power industry works differently enough from what is typical that it is worth explaining what makes it different, why Texas policymakers switched (most of) the state from monopoly to competitive supply, and how the changes affect consumers. Here we introduce the Texas model, give some background, and then discuss how well the Texas system has been working. The Texas approach is recognized among industry specialists as being distinctive—some experts say it is one of the best such markets.22Here are a few expert observations: “The ERCOT market is generally considered to be the most successful of the restructured electricity markets in North America.” Jay Zarnikau, “The Evolution of a Competitive Electricity Market in Texas,” paper presented at 28th USAEE/IAEE North American Conference, New Orleans, LA (December 2008). The ERCOT market is “the most robust restructured retail market in North America and one of the top three in the world.” Young Kim, “Unfinished business: The evolution of US competitive retail electricity markets”, Ch 12 (pp 331-361) in Fereidoon P Sioshansi, Evolution of Global Electricity Markets, Elsevier: Academic Press, 2013. “Texas is the competitive residential electricity market leader for the eighth consecutive year.” Treadway, Nat. “Annual Baseline Assessment of Choice in Canada and the United States (ABACCUS).” Distributed Energy Financial Group LLC (2015). “Texas is widely regarded as the most successful retail electricity market in the US.” Stephen Littlechild, The regulation of retail competition in US residential electricity markets. Technical Report. University of Cambridge, 2018.

Industry History and Structure

Electric power was long seen as an exception to the stereotypical American enthusiasm for free enterprise and rivalry among companies seeking to win loyal customers through low prices and good service. But a wave of deregulation in other industries that had earlier been tightly regulated, with apparent benefits to consumers, led some in the electric power industry to ask “why not here?”

In fact, the electric power industry was once a hotbed of competition. At the beginning of the 20th century, a large city like Chicago would have had 20 or 30 small power companies competing for business. Electric power was slower to come to smaller towns, but by 1920 even a small West Texas town like Lubbock, which had only a few thousand residents at the time, featured two competing electricity suppliers.23Walter J. Primeaux, Direct electric utility competition: The natural monopoly myth. (New York: Praeger Scientific, 1985). But the view was spreading that one company could serve an area more cheaply than two or more, and state-protected monopolies soon dominated the industry.

Monopolies did have several advantages. There were economies of scale and scope that allowed bigger companies to capture technical efficiencies. In addition, the electric power system is composed of several parts that had to be carefully coordinated to maintain service. Before the age of computers and advanced communication technologies, it would have been difficult to maintain the coordination necessary to operate a competitive system. In today’s interconnected world, that old justification for monopoly has fallen away.

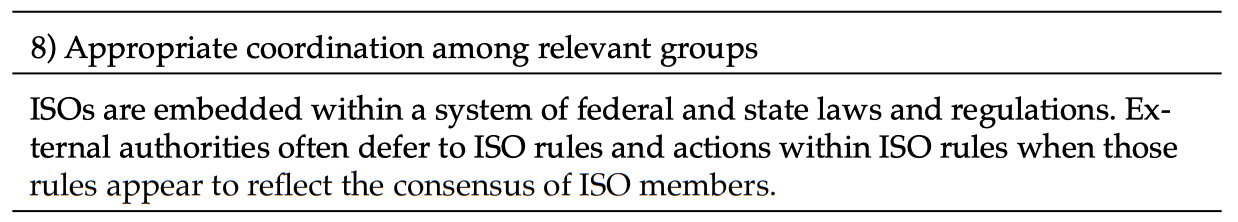

The electric power industry can be divided into three basic parts: the electric power generators, the transmission and distribution “wires,” and the retailing end of the business—see Figure 1. The difficulties involved in carefully coordinating electricity generation with the carrying capacity of the wires to constantly meet the varying demands of end consumers made monopoly seem necessary. Allowing too much power to flow over particular transmission wires can lead to costly failures. A failure to keep production closely matched to consumption could be costly as well. The economies of scale and scope that also supported the monopoly model apply differently to the generation and transmission parts of the industry, and have almost no bearing on the retail side of things.

Early electric companies had just two or three generators, and at the time larger generators could be much more efficient than smaller ones. These economies of scale at the power plant meant that a single company with a few large power plants could operate more cheaply than several smaller companies with smaller power plants. The logic of efficiency drove the industry to larger and larger power plants. The five-megawatt steam turbine installed in Chicago in 1903 was the largest of its time and produced power at half the cost of smaller power plants. But by the 1970s, new power plants were being built that were 100 times larger, and sometimes bigger than that.24Thomas R. Casten. Turning off the Heat: Why America must double energy efficiency to save money and reduce global warming. (New York: Prometheus Books, 1998).

Figure 1. The Traditional Vertically Integrated Utility

Source: U.S. Department of Energy, Office of Electricity Delivery and Energy Reliability, United States Electricity Industry Primer, (Washington, DC. June 2015). Retrieved from www.energy.gov.

Of course, the technology of small power plants improved over the century as well, and by the 1970s a small power plant—when fit to the right situation and the right location—could sometimes be just as cost-effective as a large power plant. The economies-of-scale justification for bigger power plants owned by one large monopoly, once a major force in the industry, faded in importance.

The wires connecting generators and end consumers continue to show significant economies of scale. (Here we use wires as a catch-all term for a range of equipment, including poles, transformers, relays, some very high-tech components, meters, and a lot of actual wires.) High-voltage transmission systems connect distant power supplies to big cities, while lower-voltage distribution systems in cities and towns deliver power to end users. The electric meter, almost always owned by the distribution company, is the “end of the line,” so to speak.

While the generation business upstream of the wires and the retailing business downstream quickly became settings for potential competition in Texas, the wires business itself has remained a monopoly regulated by state and federal regulators. The wires business has been changing, meanwhile: digital meters may be the most obvious change to end consumers, but high-tech digital components are growing in importance as well for the efficient and reliable operation of transmission systems. The increase in customer-owned generation, such as rooftop solar, has also created new challenges for distribution systems. Still, economies of scope remain important to the wires network, so monopoly with regulatory oversight remains the dominant business model.

At the retail end of the industry, where electric power is sold to the end user, simplicity rather than economies of scale drove monopolization. Since a single company owned the power generators and the wires linking that supply to consumers, it seemed natural that a single company would sell the power to consumers. Retail consumers range from large industrial consumers to individual households, with a wide array of businesses in between. As regulated monopoly became the dominant system for selling power, regulated rates tended to come in three basic categories: industrial, commercial, and residential. Sometimes customers within a category would have two or three options, but increased variety made regulation more difficult, so the number of offerings were limited.

The first state regulators of investor-owned electric utilities emerged in 1907, and by the early 1920s a majority of states had adopted state grants of monopoly power to private electric utilities in exchange for oversight over utility rates. Texas was relatively slow to adopt such regulation. Texas left rate regulation of private electric utilities to local governments until the state established the Public Utility Commission in 1975.25William J. Hausman and John L. Neufeld, “How Politics, Economics, and Institutions Shaped Electric Utility Regulation in the United States: 1879–2009,” Business History 53, no. 5 (2011): 723–46; Robert A. Webb, “The 1975 Texas Public Utility Regulatory Act: Revolution or Reaffirmation,” Houston Law Review 13 (1975): 1.

Regulatory Reforms and Wholesale Power Markets

Technological changes in generation in the 1980s contributed to a move toward liberalizing the wholesale (bulk) power portion of the electric industry. New generation technologies such as the combined-cycle gas turbine made generation more economical at smaller scales and reduced the time and cost of turning generators on and off, and these changes made competitive wholesale power markets feasible. Wholesale power markets grew on the foundations of power pools that had been established (in the mid-Atlantic states, as early as the 1930s) to enable vertically integrated monopoly utilities to make bulk power sales to each other in emergency circumstances.

The emergence of non-utility generating resources in the 1980s led to increasing interest on the part of large industrial customers in bypassing utility service and purchasing power directly from independent producers. Congress responded to this interest with the Energy Policy Act of 1992, which required regulated transmission owners to provide third parties with nondiscriminatory access to the transmission grid. Transmission owners were often reluctant to accommodate third-party transactions because typically such deals resulted in the loss of power sales by affiliated local electric power companies. In effect, transmission owners could profit from employing what Aviram describes as a “degradation strategy,”26Aviram, “Regulation by Networks.” and they were often accused of doing so when third-party requests were denied.

The complexity of handling third-party requests and frequent costly regulatory appeals when requests were denied led many to support the development of ISOs, regional power systems integrating transmission system management with a competitive wholesale markets. The new approach enabled both utility and nonutility generators to compete to serve customers at the wholesale level, while managing power flows over the wires in a safe manner. Wholesale competition among power generators provides a part of the foundation needed to offer a choice of suppliers to retail consumers.

In Texas the Electric Reliability Council of Texas expanded to take on these oversight functions in the 1990s.27“About ERCOT,” Electric Reliability Council of Texas website, accessed October 7, 2020, http://www.ercot.com/about. See also David Spence and Darren Bush, “Why Does ERCOT have Only One Regulator?” in Kiesling and Kleit, Electricity Restructuring. ERCOT has its origins in a 1941 organizational effort, the Texas Interconnected System (TIS), to help Texas utilities better coordinate their production for the war. In 1970 TIS reorganized as ERCOT and became the regional electric reliability council covering most of the state.. ERCOT opened its competitive wholesale power market in 1995. In the same year the first commercial wind farm began operation in Texas. ERCOT became an official ISO in 1996—its organizational mission called for it to be an independent third party to operate and coordinate flows in the transmission grid, ensuring open access to the grid and to wholesale power markets for all market participants. ERCOT describes itself as follows:

The Electric Reliability Council of Texas (ERCOT) manages the flow of electric power to more than 25 million Texas customers—representing about 90 percent of the state’s electric load. As the independent system operator for the region, ERCOT schedules power on an electric grid that connects more than 46,500 miles of transmission lines and 650+ generation units. It also performs financial settlement for the competitive wholesale bulk-power market and administers retail switching for 8 million premises in competitive choice areas. ERCOT is a membership-based 501(c)(4) nonprofit corporation, governed by a board of directors and subject to oversight by the Public Utility Commission of Texas and the Texas Legislature. Its members include consumers, cooperatives, generators, power marketers, retail electric providers, investor-owned electric utilities, transmission and distribution providers and municipally owned electric utilities.28“About ERCOT,” Electric Reliability Council of Texas website, accessed October 7, 2020, http://www.ercot.com/about.

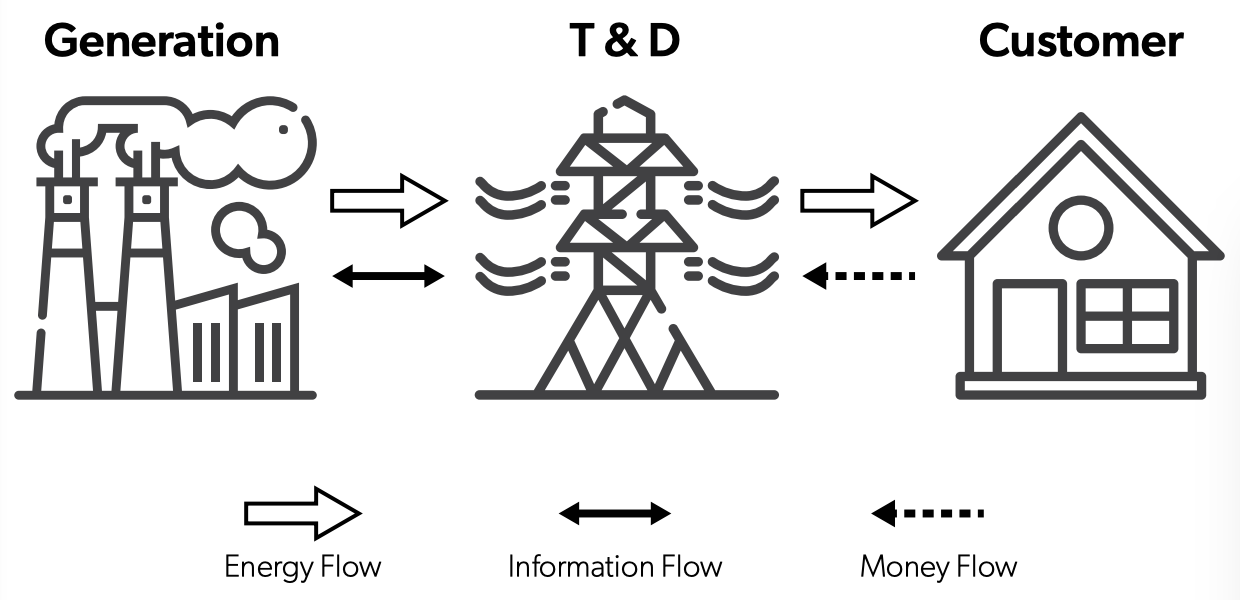

Figure 2 shows ERCOT’s governance structure. ERCOT is overseen by a board of directors composed of market-segment directors, consumer directors, and unaffiliated directors, with market-segment directors allocated across six areas: generators, investor-owned utilities, power marketers, retail energy providers, municipal utilities, and cooperatives.29Amended and Restated Bylaws of Electric Reliability Council of Texas, Inc., July 31, 2020 See “Governance,” Electric Reliability Council of Texas website, ,October 30, 2020 http://www.ercot.com/about/governance. The board is advised by a Technical Advisory Committee (TAC) composed of industry stakeholders, with similar market-sector and consumer membership. The TAC is further supported by four subcommittees and various working groups and task forces. Directors affiliated with market participants are elected by members within the market segment. Unaffiliated directors are selected by affiliated directors. The state’s Office of Public Utility Counsel is assigned to represent residential and small commercial customers on the board and the TAC. The chair of the Public Utility Commission of Texas serves as a nonvoting member of the board.

Figure 2. Governance Structure of the Electric Reliability Council of Texas (ERCOT)

ERCOT’s members represent the various participants (buyers and sellers) in its markets, and they work with ERCOT staff to develop and implement market rules, use data to analyze the performance of those rules, assess penalties for the violation of those rules, and revise those rules through well-communicated procedures if they perceive a potential for improvement.30An example of the rule change process was the decision to change the price formation rules from a zonal design (with the ERCOT territory divided into zones and a single price representing the whole zone) to a nodal design (with a price reflecting congestion costs at each node in the network in the territory). For a thorough discussion of this process, see Eric S. Schubert and Parviz Adib, “Evolution of Wholesale Market Design in ERCOT,” in Kiesling and Kleit, Electricity Restructuring. Any member can propose changes to ERCOT rules. Proposed rule changes are subject to a review-and-comment period, and this process is overseen by the Protocol Revisions Subcommittee of the TAC. The TAC makes recommendations to the board for protocol and other changes, and the board is empowered to adopt or reject proposed changes.

In many respects, therefore, ERCOT is an important central entity for enabling regulation by networks to occur in Texas. The ERCOT market platform is a network of digitally and physically connected parties and interconnected resources. ERCOT participants gain informational advantages by participating in this market network, advantages to which they would not otherwise have access. As an organization, ERCOT focuses on developing market rules that serve this regulatory function:

Balanced market rules are a basic element in Texas competition. Clear, predictable and well-designed rules help foster a stable electricity market. Electric Reliability Council of Texas (ERCOT) market rules are developed by participants from all aspects of the electricity industry. The rules and amendments are reviewed by the Public Utility Commission of Texas to ensure that they satisfy the public interest.31“Market Rules,” Electric Reliability Council of Texas website, accessed October 7, 2020, http://www.ercot.com/mktrules.

Balanced market rules are a basic element in Texas competition. Clear, predictable and well-designed rules help foster a stable electricity market. Electric Reliability Council of Texas (ERCOT) market rules are developed by participants from all aspects of the electricity industry. The rules and amendments are reviewed by the Public Utility Commission of Texas to ensure that they satisfy the public interest.32Aviram, “Regulation by Networks,” 1189.

Trends in Power Generation, Consumption, and Prices

One way to evaluate how well the ERCOT market network is performing this regulatory role is by examining generation, consumption, and prices in ERCOT’s main wholesale power market.33For an earlier evaluation of the competitive performance of ERCOT’s markets, see Steven L. Puller, “Competitive Performance of the ERCOT Wholesale Market,” in Kiesling and Kleit, Electricity Restructuring.

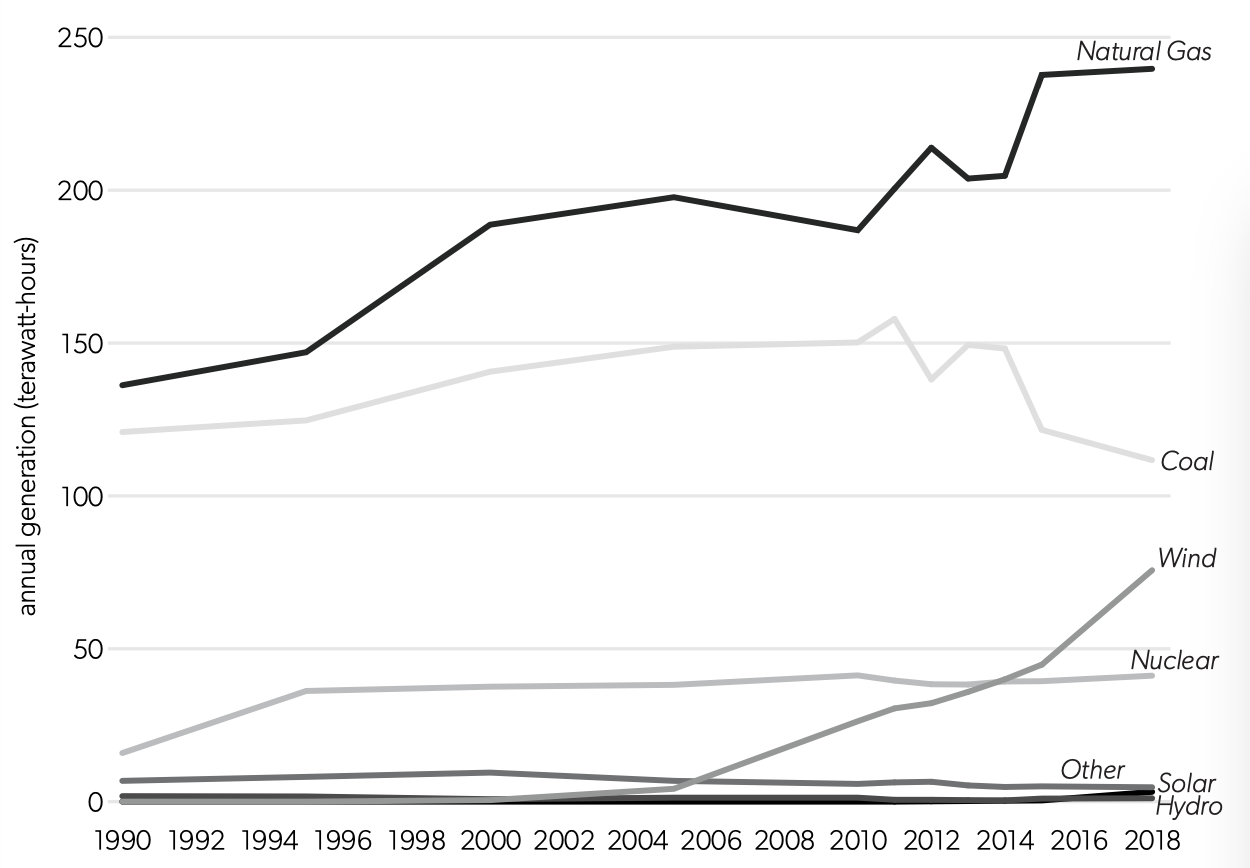

Figure 3 presents the annual power generation by fuel source since 1990. Natural gas generation has shown a consistent upward trajectory, growing from roughly 136 terawatt-hours (TWh) in 1990 to almost 240 TWh in 2010. In contrast, generation from nuclear and nonwind renewables has been relatively flat. Generation from wind increased from 4 TWh in 2005 to more than 75 TWh in 2018—a nearly 1,700 percent increase over this time frame. The production costs of both natural gas and wind generation have fallen, and the ERCOT market has facilitated investment in those increasingly economical resources.

Figure 3. Texas Annual Electricity Generation by Fuel Type

Source: US Energy Information Administration, Electric Power Annual 2018 (Washington, DC: October, 2019).

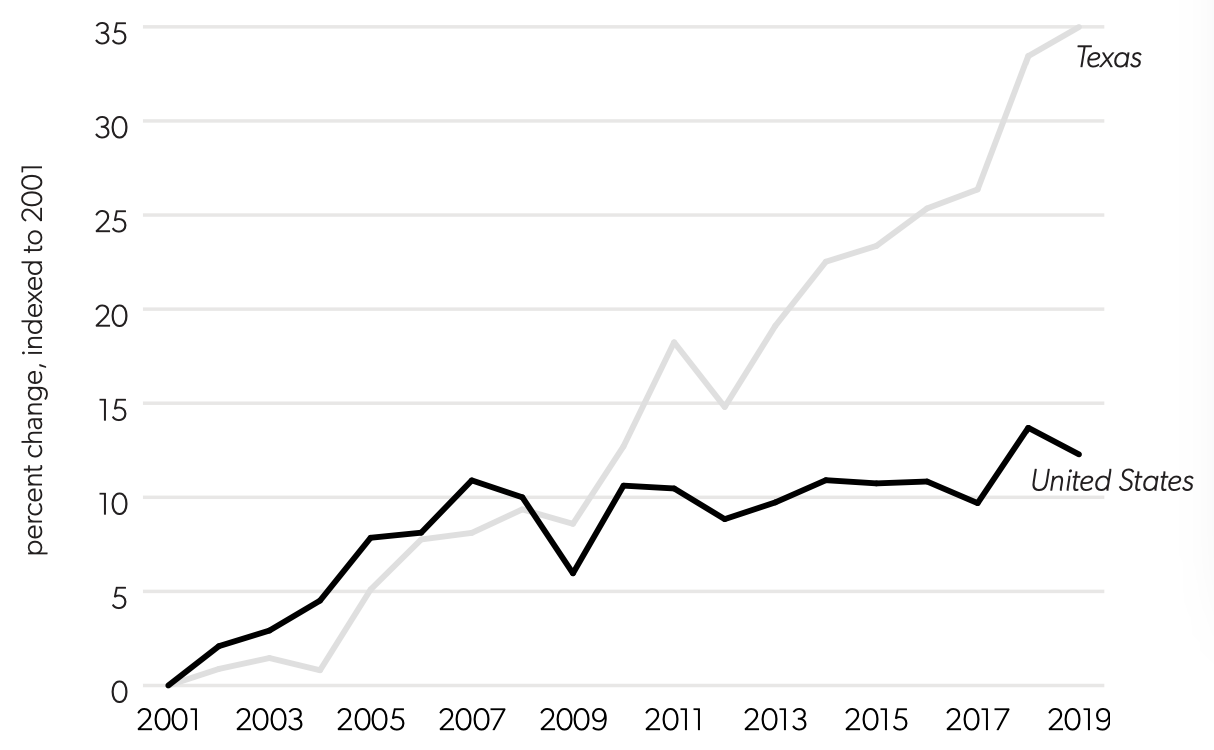

Figure 4. Retail Sales of Electricity, All Sectors, United States and Texas

Source: US Energy Information Administration, Electric Power Annual 2018 (Washington, DC: October, 2019).

Figure 4 indicates that total electricity consumption in Texas has been increasing, a phenomenon that is generally associated with economic growth. In the comparison with national consumption, the divergence after the 2008 recession is striking—consumption in the country as a whole has remained relatively constant while consumption in Texas has grown (and an increasing share of that power is from wind and natural gas, while a decreasing share is from coal).

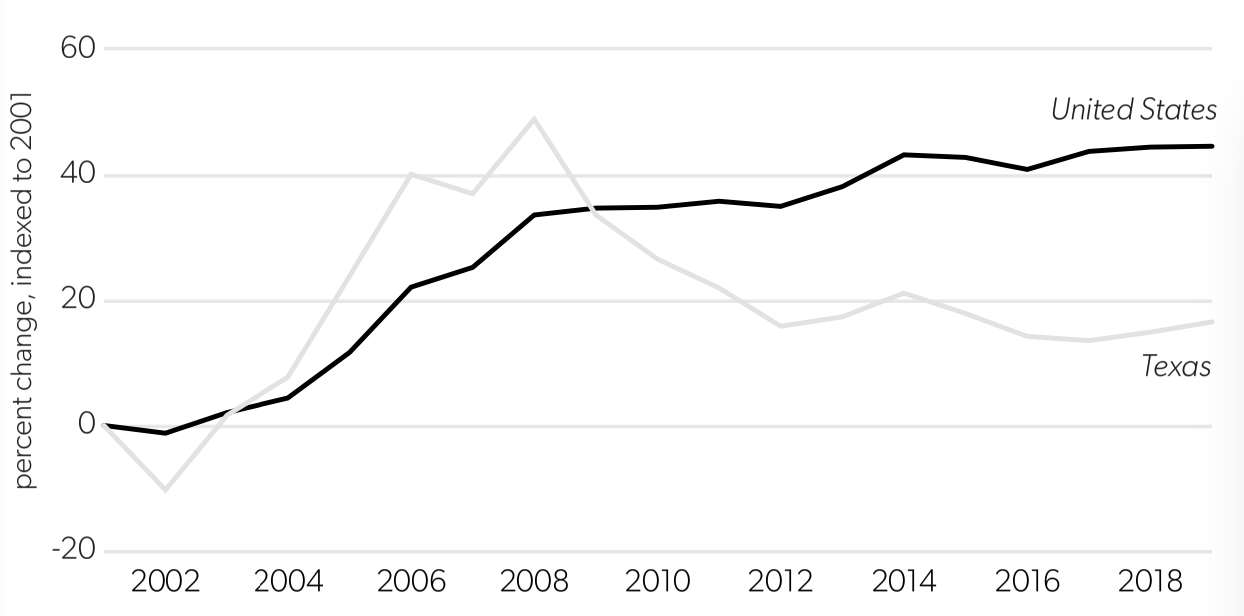

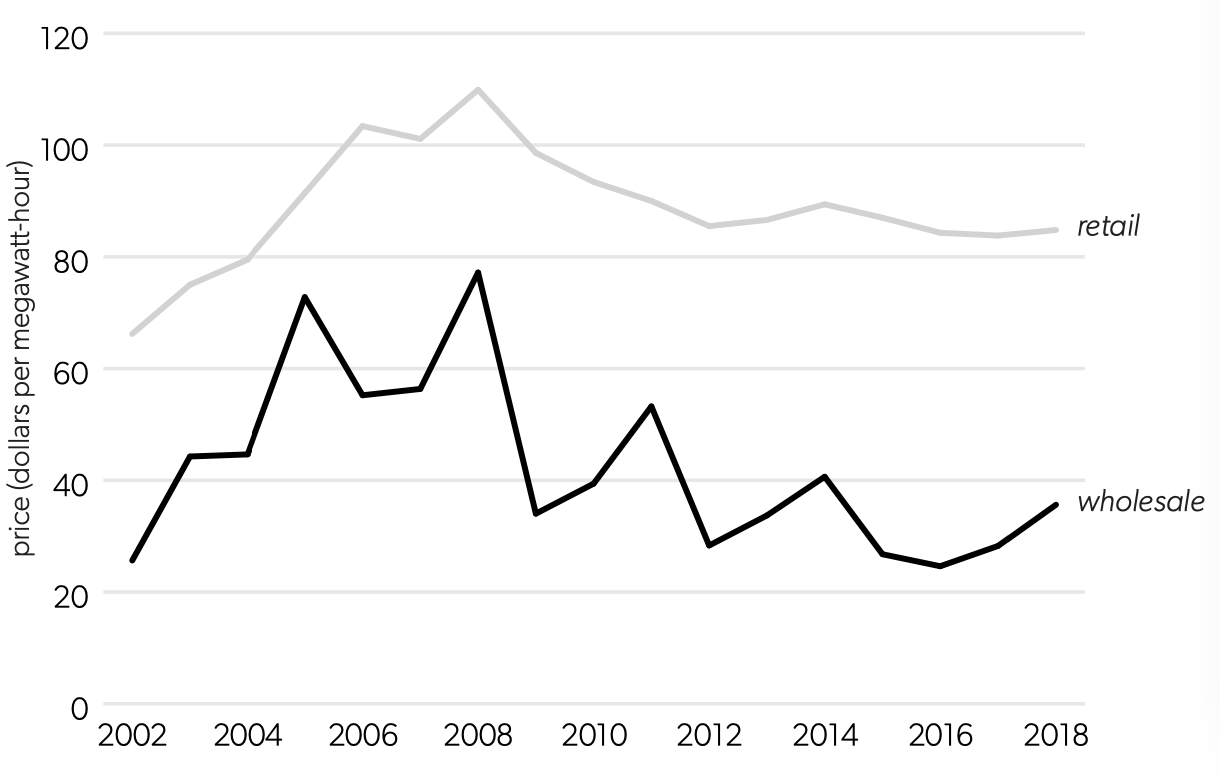

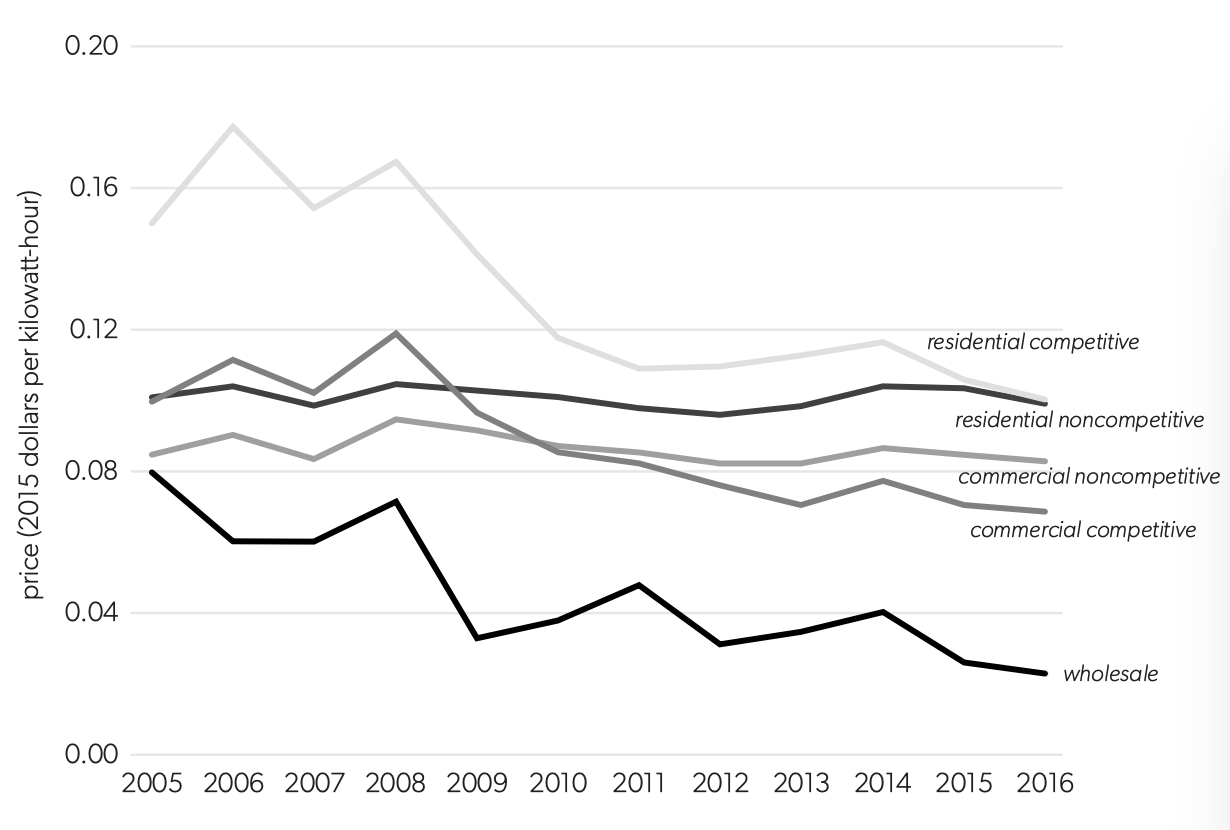

At the same time that electricity consumption in Texas has been increasing, prices in Texas have risen much slower than in the nation as a whole, reflecting competition in both wholesale and retail markets.34These price trends also reflect the high share of natural gas generation in Texas, as well as the growth in the natural gas supply after 2008 from fracking, which reduced prices in both wholesale and retail markets. For an outstanding analysis of the effects of fracking in the natural gas industry, see Catherine Hausman and Ryan Kellogg, “Welfare and Distributional Implications of Shale Gas,” Brookings Papers on Economic Activity, 2015, 71–125. After the Texas retail market opened up to competition in 2002, prices in Texas rose faster than the US average for a few years, but then they dropped below the average for the country in 2009 and have remained lower. Meanwhile, the national average electricity price has slowly crept higher, as figure 5 shows. Since 2009 the average retail price in Texas has been lower than the national average. Figure 6 reinforces this conclusion by comparing wholesale and retail prices over time. While average wholesale prices have been more volatile than average retail prices, both have declined since 2009.

While these production, consumption, and pricing trends don’t provide enough data for causal inferences, they do suggest that the market-based governance structure that prioritizes regulation by networks in ERCOT is associated with welfare-enhancing exchange.

More careful econometric analysis supports this conclusion. A paper by Rice University economists Peter Hartley, Kenneth Medlock, and Olivera Jankovska reports the results of an in-depth analysis of retail and wholesale power prices in Texas since the 2002 opening of retail competition.35Peter Hartley, Kenneth B. Medlock III, and Olivera Jankovska, “Electricity Reform and Retail Pricing in Texas,” Energy Economics 80 (2019): 1–11. Hartley and his colleagues take advantage of the fact that not all electricity consumers in Texas gained access to competitive retail offers. This allows the researchers to, in effect, do a side-by-side comparison of price trends for competitive and noncompetitive areas.

Figure 5. Average Retail Price of Electricity, All Sectors, United States and Texas

Source: US Energy Information Administration Electric Power Annual 2018 (Washington, DC: October, 2019).

Figure 6. Texas Wholesale and Retail Electricity Prices

Sources: Potomac Economics, 2018 State of the Market Report for the ERCOT Electricity Markets, June 2019; US Energy Information Administration, Electric Power Annual 2018 (Washington, DC: October, 2019).

The analysis produced “strong evidence that residential price movements . . . more accurately reflected corresponding movements in wholesale power markets”—suggesting again that fuel and other wholesale cost changes were more rapidly passed through to end consumers with competition. In addition, “the difference between residential and wholesale prices declined on average over the period in the competitive market areas”—meaning that competitive suppliers appear to have lower operating costs than monopoly suppliers. Figure 7 shows Hartley, Medlock, and Jankovska’s comparison of commercial and residential retail prices in competitive and monopoly areas. Comparison to the average wholesale prices (the lowest line) suggests that competitive retail prices better reflected underlying trends in wholesale power prices than did monopoly prices.36Data are available from the Baker Institute for Public Policy’s web page for Hartley, Medlock, and Jankovska, “Electricity Reform and Retail Pricing in Texas,” June 7, 2017, https://www.bakerinstitute.org/research/electricity-reform-and-retail-pricing-texas/. It is also noteworthy that prices for both residential and commercial customers began much higher than rates in monopoly areas, but ended at or below monopoly rates by 2016 (the end of the data set).

Investment in Renewable Energy and Infrastructure

Texas policy has relied primarily on competition within markets to induce investment in wind and solar resources, while investment in the transmission infrastructure to deliver remote wind power to urban consumers required legislative and regulatory action. New investment in electric generation is within the normal range of activities for the ERCOT market, and generally does not produce challenges to the ERCOT governance system. Transmission, on the other hand, was reserved for continued regulation as a monopoly service. In addition, the substantial size of the transmission infrastructure needed to access remote potential wind and solar resource sites could produce significant shifts of costs and benefits for existing ERCOT members. Policy decisions involving significant shifts in costs and benefits are difficult to address within the stakeholder-driven ERCOT governance system.

While wind and solar resources have attractive economic and environmental features, they are intermittent and require some form of backup energy—either a substitute generation source or storage—if they are to be considered resources for reliability or resilience purposes.

Texas’s history of small-scale distributed generation for industrial activity goes back to the early 20th century, with an emphasis on energy-efficient cogeneration, also known as combined heat and power.37Nat Treadway, “Distributed Generation Drives Competitive Energy Services in Texas,” in Kiesling and Kleit, Electricity Restructuring. Little of this distributed generation was renewable—through the 1990s Texas had modest amounts of wind and solar capacity, and what renewable capacity existed in the state was small hydroelectric generation. By the late 1990s, though, wind generation technologies had improved enough that investment in wind capacity increased, particularly in wind-intensive areas in West Texas.

Figure 7. Retail Electricity Prices in Competitive and Monopoly Areas of Texas

Source: Peter Hartley, Kenneth B. Medlock III, and Olivera Jankovska, “Electricity Reform and Retail Pricing in Texas,” Energy Economics 80 (2019): 10.

The original deregulation legislation in Texas, S.B. 7 in 1999, incorporated several provisions to encourage renewable energy development as a way to address air pollution issues in the state’s urban areas while also enabling economic development of the best wind resources of all 50 states.38Dennis Elliott et al., “New Wind Energy Resource Potential Estimates for the United States,” National Renewable Energy Laboratory and AWS Truepower, January 27, 2011, https://www.nrel.gov/docs/fy11osti/50439.pdf. Additionally, maps of potential wind capacity and generation are available at “U.S. Installed and Potential Wind Power Capacity and Generation,” WINDExchange (US Department of Energy), accessed October 7, 2020, https://windexchange.energy.gov/maps-data/321. S.B. 7 included a renewable portfolio standard that was modest by comparison with those of other states, but served as a policy platform for signaling the combined economic and environmental value of investing in wind generation.39S.B. 7, 76th Leg., Reg. Sess. (Texas 1999). S.B. 20 in 2005 augmented the original renewable target,40S.B. 20, 79th Leg., Reg. Sess. (Texas 2005). as energy economist Jay Zarnikau noted in 2011:

SB 7 set an initial goal for renewable energy capacity of 2000MW by 2009. SB 20 in the 2005 legislative session increased Texas’ goal for renewable energy to 5880MW in 2015 and set a “voluntary’’ target of 10,000MW of wind power for 2025. Texas has already met the 2015 goal and is on track to meet the 2025 goal well ahead of schedule.41Jay Zarnikau, “Successful Renewable Energy Development in a Competitive Electricity Market: A Texas Case Study,” Energy Policy 39 (2011): 3909.

Texas also learned from the beneficial economic and environmental effects of federal sulfur dioxide emission permit trading and implemented tradable renewable energy credits as a tool for meeting renewable generation targets. Load-serving entities, which are the retail energy providers in Texas, are required to have a market-share-weighted number of renewable energy credits as their contribution to the state’s renewable energy goals, and they can meet that requirement either by purchasing renewable energy to sell to their customers or by purchasing renewable energy credits in the market.42ERCOT’s description of the renewable energy credit program is available at “Renewable Energy Credit Program,” Electric Reliability Council of Texas website, accessed October 7, 2020, https://www.texasrenewables.com/recprogram.asp.

While West Texas is rich in wind energy potential, the ability to capitalize on wind investments there was constrained by the lack of a transmission network. Increases in wind capacity would create congestion on the existing network, which would lead to price differences in a balkanized wholesale power market. To facilitate wind investments, S.B. 20 in 2005 also included provisions to reduce the regulatory siting and permitting costs for transmission in key areas of wind development. These Competitive Renewable Energy Zones (CREZ) connected wind-rich areas of West and South Texas to the transmission grid, enabling increased sales of wind power to meet demand in urban areas elsewhere in the state. By the time the transmission projects in the five CREZ were completed in 2013, investments in installed wind capacity had increased while transmission congestion fell, and wholesale market prices converged across ERCOT, creating an integrated market capable of capitalizing on Texas’s wind resources.43Xiaodong Du and Ofir Rubin, “Transition and Integration of the ERCOT Market with the Competitive Renewable Energy Zones Project,” Energy Journal 39, no. 4 (October 2018): 235–59. Developers find that development costs are generally lower in Texas than in other states owing to faster permitting and a regulatory environment conducive to investment and innovation.44Zarnikau, “Successful Renewable Energy Development,” 3910, citing Will Ferguson, “Texas Wind Industry’s Rapid Growth Creates New Challenges,” Texas Business Review (February 2010): 1-5.

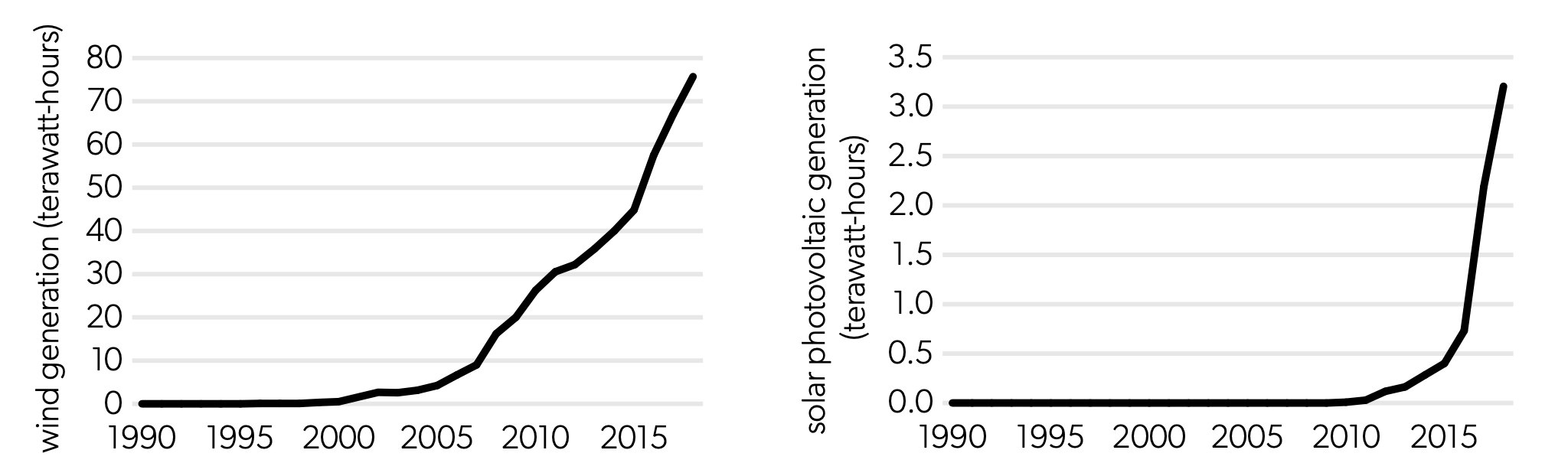

As a consequence of state policies that harness competition and markets to facilitate energy innovation by reducing transaction costs in adoption and deployment, wind and solar investments have grown in Texas since 1990. Figure 8 shows the amount of power generated annually from wind and solar photovoltaic systems from 1990 to 2018. Note the dramatic increase in wind generation as capacity increased and more wind resources were integrated into ERCOT’s markets after the CREZ-enabled investments of 2006–2013. Solar power took a different growth trajectory because of its less attractive cost profile and lower energy efficiency compared to wind through the mid-2010s. Both wind and solar photovoltaic projects have seen larger-than-expected cost reductions as energy efficiency improves, production grows, and a competitive solar installation market drives down installation costs.45Adelina Jashari, Jana Lippelt, and Marie-Theres von Schickfus, “Unexpected Rapid Fall of Wind and Solar Energy Prices: Backgrounds, Effects and Perspectives,” CESifo Forum 19, no. 2 (2018): 65–69. For an analysis of wind turbine cost reductions, see US Department of Energy, 2018 Wind Technologies Market Report, August 2019, available at https://www.osti.gov/servlets/purl/1559881.

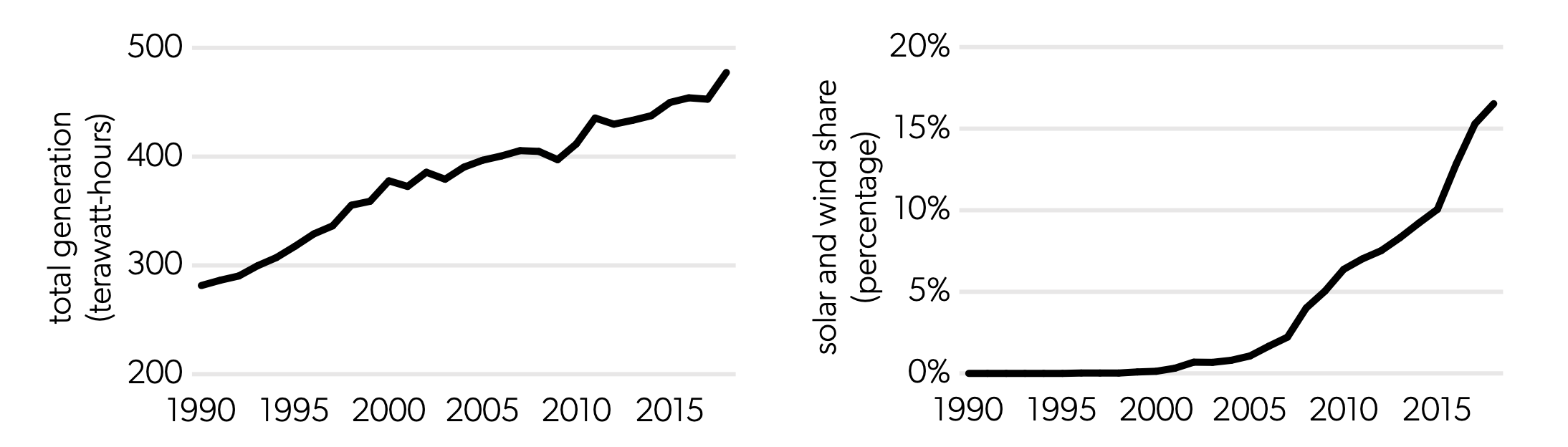

Figure 9 shows that while total electricity generation in Texas has increased slowly, particularly over the past decade, solar and wind’s share of that generation has increased dramatically since 2007 because market policies have been conducive to innovation and investment while the underlying technology costs are falling. The falling cost of both wind and solar technologies make them increasingly economical and better able to help cut pollution and greenhouse gas emissions.

Federal tax policies have also stimulated investment in wind and solar energy, although as the technologies become more economical those subsidies are being phased out. The federal wind production tax credit (PTC) was implemented in 1992 and has been modified and extended several times. The PTC allows a wind developer to claim a tax credit of 2.5 cents (inflation-adjusted) per kilowatt-hour generated. The PTC remains available for projects that began construction before January 1, 2020, and will be discontinued for subsequent wind projects.46Congressional Research Service, The Renewable Electricity Production Tax Credit: In Brief, CRS Report R43453, November 27, 2018. Closed-loop biomass projects and geothermal projects are also eligible for the PTC. Other renewable technologies were also eligible for the PTC, but have been reduced to half credit. See table 1 in Congressional Research Service, Renewable Electricity Production Tax Credit, 2. Solar projects are eligible for a federal investment tax credit of 30 percent of the project’s invested basis. This credit was implemented in 2006; it is currently scheduled to phase out by 2022. Phasing out the wind PTC and solar investment tax credit as wind and solar technologies become commercially attractive will reduce the distortions that the subsidies have introduced into ERCOT markets—particularly their suppression of prices and amplification of periods of negative prices.

Although markets typically have positive prices, sometimes power markets have negative market-clearing prices. Negative prices mean a power supplier will pay someone to take power. They arise in ERCOT for three main reasons: transmission constraints, the construction of new wind capacity in regions with less transmission capacity (leading to a mismatch in time and place between supply and demand), and the production tax credit paid to wind-resource owners.

In markets with large-scale central generation and demand that is stable (but that fluctuates over the day), negative prices may occur because of the cost of ramping down the generator’s production. Turning down a nuclear power plant is expensive, so paying someone to take the power can be cheaper than ramping down generation. Markets enable buyers to benefit from this situation: for example, electricity consumers might be paid for precooling a commercial building, thereby reducing their electricity demand for air conditioning later in the day.

The increasing share of renewables in the generation portfolio introduces a new context for negative prices. In the first decade of the 21st century, as more wind generation came online in West Texas (and storage meanwhile was costly and uneconomical), the West Texas zone of ERCOT saw more periods with negative prices. Wind’s intermittent nature contributed to these negative prices, which occurred because of a combination of insufficient transmission capacity to move the wind power to areas with more demand and insufficient local demand for the power. Thus high-wind periods can also be periods with negative prices.

In a transmission network with no congestion, inexpensive wind in West Texas could power consumption on the Gulf Coast. But when network capacity to deliver that power does not exist, markets balkanize, prices diverge, and plentiful West Texas wind power sells locally at a negative price. (In rare cases, negative prices for electricity briefly covered the entire ERCOT system, which reflects a limited ability to transmit electric power into power grids bordering the ERCOT system.)

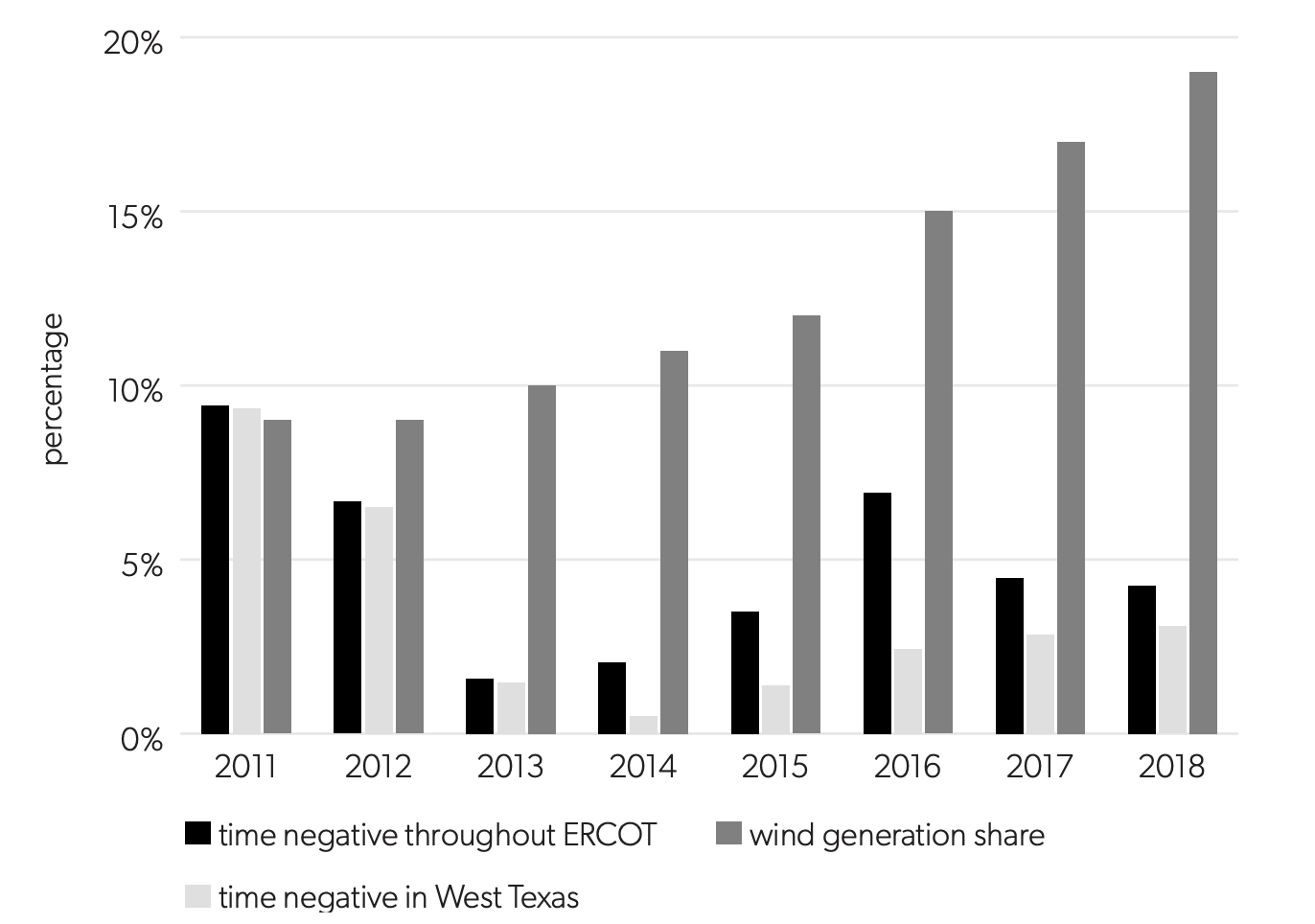

Wind is challenging because it tends to be most available in sparsely populated locations and when demand is relatively low, such as overnight in winter months. Figure 10 shows the percentage of time that ERCOT experienced negative prices overall and in the West Texas zone.

Figure 8. Wind and Solar Photovoltaic Generation in Texas

Source: US Energy Information Administration, Electric Power Annual 2018 (Washington, DC: October 2019).

Figure 9. Total Electricity Generation in Texas vs. Solar and Wind Share

Source: US Energy Information Administration, Electric Power Annual 2018 (Washington, DC: October 2019).

Figure 10. Negative Prices in Texas Compared to Wind Share of Total Generation

Note: ERCOT = Electric Reliability Council of Texas.

Source: Electric Reliability Council of Texas annual reports for 2011–2018.

The increasing incidence of negative prices gave extra impetus to the CREZ transmission investments that went live in 2012 and 2013.47Jess Totten, “Texas Transmission Policy,” in Kiesling and Kleit, Electricity Restructuring, 103. ERCOT and the Public Utility Commission of Texas used negative price data as signals indicating congestion and market balkanization that could be reduced through transmission capacity investment.48Schubert and Adib, “Evolution of Wholesale Market Design in ERCOT.” As figure 10 shows, negative price incidence fell sharply in 2013, indicating the effects of CREZ investments. More recently, ERCOT has experienced more negative prices in West Texas, as wind’s share of generation has grown from 15 to 19 percent.

A third factor contributing to negative prices in ERCOT has been the production tax credit. Wind companies receive the PTC on the basis of actual generation, so they are willing to pay up to the amount of the PTC (roughly $34 per megawatt-hour) to continue generating and not curtail production. The PTC subsidy has introduced a distortion into ERCOT markets by amplifying the phenomenon of negative prices. The elimination of the wind PTC in 2020 should reduce this distortion.

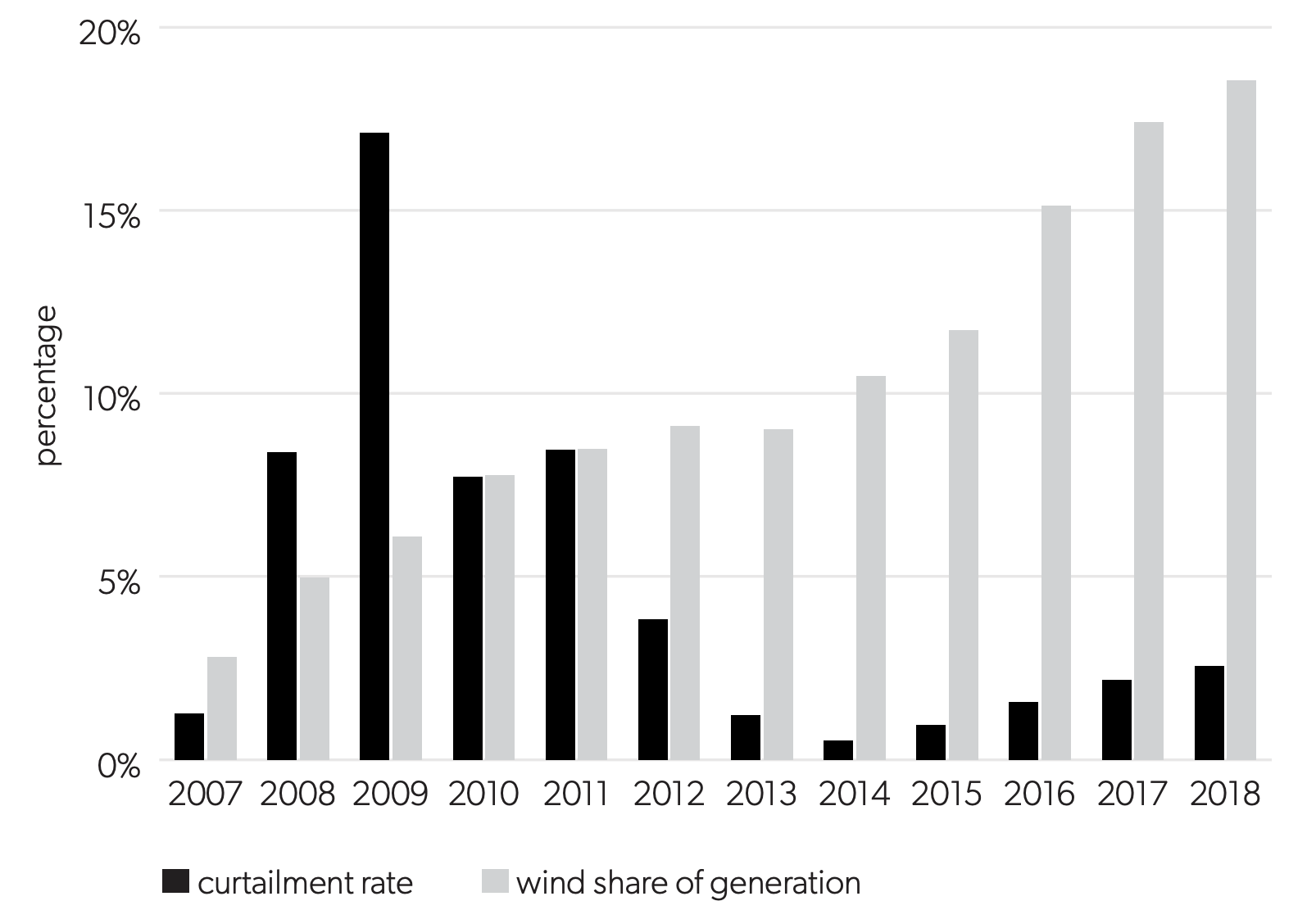

When transmission capacity is insufficient to transport wind energy as it is generated, then the generator may be curtailed, which means that the dispatch controllers in ERCOT tell these generators that they cannot send out their energy. Figure 11 shows the curtailment rate in ERCOT in comparison to the share of generated energy coming from wind resources. Curtailment was particularly high in 2008–2011 (and especially in 2009), and was alleviated starting in 2012 as the CREZ program’s transmission investments increased network capacity. Low curtailment rates along with increasing wind shares since 2013 show the effects of the CREZ program, although curtailment has increased again recently. Reducing transmission constraints and congestion reduced the incidence of negative prices and curtailment and integrated the regional zones in ERCOT into a well-connected market.

Figure 11. Wind Curtailment and Share of Generation in Texas

Source: Figure 42 in US Department of Energy, 2018 Wind Technologies Market Report, August 2019, available at https://www.osti.gov/servlets/purl/1559881.

ERCOT and the Public Utility Commission of Texas view the informative role of the price system as an important aspect of how the competitive market adapts to innovation. Everything has trade-offs, and wind power is no exception. Wind provides clean and increasingly affordable power, but exploiting this requires investments in transmission and backup. Negative prices send both an investment signal and a purchase signal. The CREZ program explicitly used such price signals to coordinate transmission investment, bringing investment to the places where it was likely to be most valuable. The ability of electric generators to participate in markets, often using automation, means that generators that can respond with flexibility can profit from that capability. ERCOT’s market rules and the economic value of having access to ERCOT markets create incentives to invest in such flexible and adaptable resources.

The Role of Network Governance in Texas Electricity

Aviram’s “regulation by network” analysis holds as long as the network offers positive network effects and the network has privileged access to the information flow created by transactions. As described in more detail earlier, positive network effects arise when the addition of members to the network increases the value of the network to other members. Privileged access to information flows results when transactions between members of the network are necessarily observable by the network operator. The electric grid exhibits these characteristics to a high degree, and wholesale power markets are a network institution. While a consumer can self-supply power isolated from connections to others with a sufficient investment in the capability, connection to a grid often offers improved service quality and lower overall system cost. The grid operator closely monitors the supply and consumption of power across the high-voltage grid in order to manage the safe operation of transmission facilities, a process that produces vast quantities of transactional information. The result is that electric power grids are naturally set up to take advantage of “regulation by network” as elaborated in Aviram’s work.

Aviram’s work does not provide a complete discussion of governance institutions, and for that reason we nest it within the broader framework provided by Ostrom’s eight principles. Aviram’s work overlaps with principles 1 and 4. A successful network governance system will also attend to each of the other six principles.

For electric power grids operated as ISOs, the issues raised by principles 7 (“minimal recognition of rights to organize”) and 8 (“appropriate coordination among relevant groups”) are key. For ERCOT, the Public Utility Commission of Texas remains an important overseer. While the commission often defers to stakeholders about the details of ERCOT rules and procedures, the commission’s position provides an independent venue for resolving differences, particularly when differences over proposed rules arise. Disputes can sometimes spill over into the courts or lead to legislative inquiries and other action. For this reason, the relations between ERCOT, the Public Utility Commission, and other outside entities are worthy of further attention in future research. It is in this area, too, that ERCOT is most distinctive from other ISOs, each of which is formally overseen by the Federal Energy Regulatory Commission rather than (primarily) by state legislative and regulatory authorities.

Conclusion: How to Promote Customer Choice and Retail Competiton

Like other parts of the economy, the electric industry is a realm of cooperation, competition, and conflict. Securing opportunities in the electric industry usually requires decades-long commitments in uncertain environments. Long-run forecasts of expected costs and revenues must turn out to be approximately right often enough to give investors confidence to make investments. These opportunities for value creation often depend on governance institutions that are conducive to investment and innovation. In the case of Texas, those institutions are primarily governance by market networks, yielding more investment in increasingly economical and cleaner resources, for the benefit of producers and consumers.

Sometimes uncertainties are simply inherent in the world, from the point of view of potential cooperators—future climate outcomes, for example, are largely unknowable because of complexity and the impossibility of foresight. Other sources of uncertainty are social, such as public policy changes or the creditworthiness of potential counterparties in a proposed venture. Potential opportunistic behavior by counterparties is another source of uncertainty. Governance systems, the social and political rules of the game, can help reduce uncertainty and thereby enable parties to choose longer-run or otherwise riskier ventures when such ventures promise better overall results.

The essential physical network for delivery of electric power enables the industry itself to self-regulate efficiently for a wide range of possible transactions. Aviram’s analysis highlights the specific characteristics of networks for aiding institutional governance, and Ostrom’s much broader governance framework allows us to identify other aspects of the ERCOT system that allow it to be an effective, sustainable governance system. The economic environment within which the ERCOT grid operates and the electric power system itself are constantly changing, and such changes introduce new challenges to be addressed within the governance system. Understanding what aspects of the current ERCOT arrangements help them be effective can ensure that responses to those changes work to sustain rather than undermine ERCOT’s successes.

Our analysis examines governance institutions within competitive electric power markets, a topic too often addressed in terms that assume the black-and-white dichotomy of regulated versus unregulated markets. Elsewhere we have advocated policy reforms to enable retail competition in electric power.49Michael Giberson and Lynne Kiesling, “The Need for Electricity Retail Market Reforms,” Regulation, Fall 2017. Our two key points for effective implementation are as follows:

- Quarantine the monopoly to the wires and lines that form the platform where retail electric companies compete.

- Bring the wholesale and retail electricity markets closer together.

First, unbundle vertically integrated monopolies. Power generation and retailing operations should be completely separated from transmission and distribution operations. Transmission and retailing should be competitive businesses with low barriers to entry and exit. The transmission and delivery business will remain a regulated monopoly utility. The rallying cry here is “quarantine the monopoly!” States that have permitted the monopoly to consume larger parts of the transmission and distribution processes have seen competition and prices suffer because of it.

Second, a competitive retail market also requires access to competitive wholesale power markets. The Texas model of competition in both retail and wholesale electric power is one of the best. We discussed the Texas model in a recent research report titled “Electric Competition in Texas: A Successful Model to Guide the Future.”50Lynne Kiesling and Michael Giberson, Electric Competition in Texas: A Successful Model to Guide the Future, Conservative Texans for Energy Innovation, July 2020, https://www.conservativetexansforenergyinnovation.org/research–/. There are many more details to establishing consumer choice and competitive markets in electric power, of course, but these recommendations provide a foundation.

We can also learn from the states where market performance has been disappointing.51Erik Desrosiers, “Competitive Electricity Retailing: Why Restructuring Must Go On,” Utility Dive, July 11, 2017. As a guide for states seeking to transition from regulation to competition, other reform advocates have suggested five steps for improving competition:

- Unbundle distribution and retailing.

- Phase out default service.

- Allow efficient price signals to emerge.

- Promote access to information.

- Enforce consumer protection.

Each of these steps is important. Unbundling distribution and retailing creates a platform for electric retail companies to compete on. Phasing out the default service provider forces consumers to come into the market and choose a provider. It removes an barrier to competition, because the existing monopoly’s position as the default service provider significantly reduces consumers’ willingness to investigate alternatives.

If policymakers fail to do away with default service providers, then the opportunity for competition to emerge dwindles significantly. It’s important here to promote awareness of the changing regulatory regime as a matter of both consumer protection and market efficiency.

The best recipe for consumer protection is providing clear and trusted information to consumers while aggressively pursuing bad actors who violate consumer-protection laws. Texas’s “Power to Choose” website is an excellent example of an effective consumer education effort as part of the transition to competition.52“Power to Choose” website, Public Utility Commission of Texas, accessed October 7, 2020, http://powertochoose.org. And we should expect third-party rating and education services to arise as well, just as many such services have arisen for comparing credit card offers and other financial services.

Throughout all these steps, policymakers should keep in mind that efficient price signals emerge from well-functioning markets. A key here is preparing for dramatic swings in prices and the rise and fall of many electric retail companies. This is the normal process of market competition that reveals efficient prices. It is often compared to the biological process of evolution. The messy lives and deaths of companies represent the same idea as “survival of the fittest.”

In market systems, the survival test indicates how well companies care for consumers. Attempts by regulators to soften the blows of competition by aiding companies can distort the incentives that companies have to serve consumers. The emergence of negative prices because of the federal production tax credit for wind energy serves as one example. In lieu of giving companies support, if there is an intense demand for such aid because of the turbulence in the electricity market, a better system would provide direct aid to consumers. Consumers can then choose among companies, picking what suits them best.

Texas’s electricity market is an example of the potential for a greater reliance on network governance in place of monopoly regulation. It exemplifies the insights of institutionalists and network thinkers such as Elinor Ostrom. Fundamentally, it reveals that many states rely on a monopoly system despite promising opportunities for a reliance on institutions and networks that emphasize individual choice in a market. As in Texas, there is an opportunity for policymakers to move from a world where there is one choice into a world where consumers can choose from as many as 200 different plans.

References

“About ERCOT.” Electric Reliability Council of Texas website. Accessed October 7, 2020. http://www.ercot.com/about.

Amended and R.stated Bylaws of Electric Reliability Council of Texas, Inc. July 31, 2020.

Aviram, Amitai. “Regulation by Networks.” BYU Law Review. 2003. 1179-1238.

Bevir, Mark. “Governance.” Encyclopedia of Governance. Ed. Mark Bevir (Thousand Oaks, CA: Sage. 2007).

Casten, Thomas R. Turning off the Heat: Why America must double energy efficiency to save money and reduce global warming. (New York: Prometheus Books. 1998).

Congressional Research Service. The Renewable Electricity Production Tax Credit: In Brief. CRS Report R43453. November 27, 2018.

Cooter, Robert D. “The Theory of Market Modernization of Law.” International Review of Law and Economics 16. No. 2 (1996): 150.

Cox, Michael, Gwen Arnold, and Sergio Villamayor-Tomás. “A Review of Design Principles for Community-Based Natural Resource Management.” Ecology and Society 15. No. 4 (2010): 38.

Davies, Richard. Extreme Economies: What Life at the World’s Margins Can Teach Us about Our Own Future (New York: Farrar, Straus, and Giroux, 2019).

Desrosiers, Erik. “Competitive Electricity Retailing: Why Restructuring Must Go On.” Utility Dive. July 11, 2017.

Du, Xiaodong and Ofir Rubin. “Transition and Integration of the ERCOT Market with the Competitive Renewable Energy Zones Project.” Energy Journal 39. No. 4 (October 2018): 235–59.

Ellickson, Robert C. Order without Law: How Neighbors Settle Disputes (Cambridge, MA: Harvard University Press. 1991). 126–32, 241–46.

Elliott, Dennis et al. “New Wind Energy Resource Potential Estimates for the United States.” National Renewable Energy Laboratory and AWS Truepower. January 27, 2011. https://www.nrel.gov/docs/fy11osti/50439.pdf.

Federal Energy Regulatory Commission. Payment for Reactive Power. Commission Staff Report AD14-7. April 22, 2014.

Garg, Rishi. Electric Transmission Seams: A Primer. National Regulatory Research Institute, NBRRI Report No. 15-03 (February 2015).

Giberson, Michael A. Improving coordination between regional power markets. Doctoral dissertation. George Mason University (2004).

Giberson, Michael and Lynne Kiesling. “The Need for Electricity Retail Market Reforms.” Regulation. Fall 2017.

“Governance.” Electric Reliability Council of Texas website. October 30, 2020. http://www.ercot.com/about/governance.

Greif, Avner. “Reputation and Coalitions in Medieval Trade: Evidence on the Maghribi Traders.” Journal of Economic History 49. No. 4 (1989): 857–82.

Hartley, Peter, Kenneth B. Medlock III, and Olivera Jankovska. “Electricity Reform and Retail Pricing in Texas.” Energy Economics 80 (2019): 1–11.

Hausman, Catherine and Ryan Kellogg. “Welfare and Distributional Implications of Shale Gas.” Brookings Papers on Economic Activity. 2015. 71–125.

Hausman, William J. and John L. Neufeld. “How Politics, Economics, and Institutions Shaped Electric Utility Regulation in the United States: 1879–2009.” Business History 53, no. 5 (2011): 723–46.

“Industry’s Rapid Growth Creates New Challenges.” Texas Business Review (February 2010): 1-5.

Jashari, Adelina, Jana Lippelt, and Marie-Theres von Schickfus. “Unexpected Rapid Fall of Wind and Solar Energy Prices: Backgrounds, Effects and Perspectives.” CESifo Forum 19. No. 2 (2018): 65–69.

Kiesling, L. Lynne and Andrew N. Kleit, eds. Electricity Restructuring: The Texas Story (Washington, DC: AEI Press. 2009).

Kiesling, L. Lynne, Michael C. Munger, and Alexander Theisen. “From Airbnb to Solar: Toward a Transaction Cost Model of a Retail Electricity Distribution Platform” (Working paper. 2019). https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3229960.

Kiesling, Lynne and Michael Giberson. Electric Competition in Texas: A Successful Model to Guide the Future. Conservative Texans for Energy Innovation. July 2020. https://www.conservativetexansforenergyinnovation.org/research–/.

Kim, Young. “Unfinished business: The evolution of US competitive retail electricity markets”, Ch 12 (pp 331-361) in Fereidoon P Sioshansi, Evolution of Global Electricity Markets. Elsevier: Academic Press, 2013.

Leeson, Peter T. “An-arrgh-chy: The Law and Economics of Pirate Organization.” Journal of Political Economy 115. No. 6 (2007): 1049–94.

Leeson, Peter T. The Invisible Hook: The Hidden Economics of Pirates (Princeton, NJ: Princeton University Press. 2009).

“Market Rules.” Electric Reliability Council of Texas website. Accessed October 7, 2020. http://www.ercot.com/mktrules.

Ostrom, Elinor. Governing the Commons: The Evolution of Institutions for Collective Action (Cambridge: Cambridge University Press. 1990).

“Power to Choose” website. Public Utility Commission of Texas. Accessed October 7, 2020. http://powertochoose.org.

Primeaux, Walter J. Direct electric utility competition: The natural monopoly myth. (New York: Praeger Scientific. 1985).

Puller, Stephen L. “Competitive Performance of the ERCOT Wholesale Market.” in Kiesling and Kleit. Electricity Restructuring.

“Renewable Energy Credit Program.” Electric Reliability Council of Texas website. Accessed October 7, 2020. https://www.texasrenewables.com/recprogram.asp.