Alcohol is perhaps the most peculiarly regulated commodity in the US economy today.1See Richard E. Wagner, Politics as a Peculiar Business: Insights from a Theory of Entangled Political Economy (Cheltenham, UK: Edward Elgar, 2016). The locus of regulatory control lies mainly at the state level, owing to the Twenty-First Amendment and other legacies of the Prohibition era. This has created a wilderness of different distribution laws that have contributed to the limited variety of American beer for most of the 20th century. An uprising occurred in the late 1970s when the craft beer industry disrupted many of the old ways of bringing beer to the masses. Craft alcohol expert Alistair Williams comments on this shift from the perspective of the demand side of the market, noting that “American tastes in beer are changing. Consumers want increased choice in beer styles, moving away from American light lager which has dominated the market for generations.”2Alistair Williams, “Exploring the Impact of Legislation on the Development of Craft Beer,” Beverages 3, no. 2 (2017): 2. The shift was further propelled by changes in self-distribution laws in the first decade of the 21st century that allowed small craft brewers to meet burgeoning demand from younger drinkers.3Derek Thompson, “Craft Beer Is the Strangest, Happiest Economic Story in America,” The Atlantic, January 8, 2018. While this movement has dramatically changed the market for alcohol, the three-tier system, that is the impetus for much of the regulation of alcohol, is still very much in place, and is widely endorsed at multiple points along the supply chain.4For example, the Brewers Association argues in its list of position statements that “state laws should support an independent distribution tier that is unencumbered by undue influence, ownership or control by the largest brewers and ensures access to market for all brewers.” See “Position Statements,” Brewers Association, accessed March 3, 2020, https://www.brewersassociation.org/government-affairs/position-statements/. See also https://www.nbwa.org/news/what-three-tier-system.

This chapter focuses on state laws that pertain to alcohol regulation, with particular emphasis on the relationship between economic and moral interests that motivate much of the policy discussion. We use Bruce Yandle’s “Bootleggers and Baptists” metaphor5See Bruce Yandle, “Bootleggers and Baptists—the Education of a Regulatory Economist,” Regulation 7, no. 3 (1983): 12–16; Bruce Yandle. “Bootleggers and Baptists in retrospect.” Regulation 22 (1999): 5. to frame these interests and their subsequent influence on the political process. We examine several of the more common types of alcohol regulation, including limits on self-distribution, franchise agreements, and, of course, the blue laws that motivated the metaphor. We also provide a brief case study of two states, Indiana and Kentucky, examining how local interests attempted to use regulations for their own advantage.

Blue Laws and the Origin of Bootleggers and Baptists

Economist Bruce Yandle originally used so-called blue laws, found especially in the southern region of the United States, as the inspiration for his popular Bootleggers-and-Baptists metaphor.6As other authors have before us, we use the “Bootlegger” and “Baptist” labels to refer to the parties concerned in a wide variety of regulatory activity—the term Bootlegger in this sense does not imply illegal action, but rather points to those engaged in political action in pursuit of narrow economic gains. See especially Adam C. Smith and Bruce Yandle, Bootleggers and Baptists: How Economic Forces and Moral Persuasion Interact to Shape Regulatory Politics, (Cato institute Press, 2014), 189. Accordingly, we will denote this group of people as “Bootleggers” with a capital B. References to actual bootleggers engaged in selling illegal booze will be distinguished with a lowercase b. As Yandle explains, “Bootleggers, you will remember, support Sunday closing laws (Blue Laws) that shut down all the local bars and liquor stores. Baptists support the same laws and lobby vigorously for them. Both parties gain, while the regulators are content because the law is easy to administer.”7Yandle, “Bootleggers and Baptists,” 13. While blue laws do indeed spring from religious origins, as shown by their association with the Sabbath, their use in modern times correlates with bootlegger influence as much as Baptist influence. As Michael Lovenheim and Daniel Steefel explain, “A common justification for these laws put forth by policymakers is that they provide a secular benefit to society by curtailing drinking and thereby reducing alcohol-related crimes.”8Michael F. Lovenheim and Daniel P. Steefel, “Do Blue Laws Save Lives? The Effect of Sunday Alcohol Sales Bans on Fatal Vehicle Accidents,” Journal of Policy Analysis and Management 30, no. 4 (2011): 798. Yet the authors found that states that have repealed these laws saw little change in the rate of fatal accidents. Yandle’s theory exposes the “Bootlegger” influence behind what would otherwise seem to be ineffective and outdated legislation.

The Bootleggers and Baptists in Yandle’s theory need not literally be illegal alcohol sellers and churchgoers—though the theory readily lends itself to the alcohol market.9See Jeremy Horpedahl, “Bootleggers, Baptists and Ballots: Coalitions in Arkansas’ Alcohol-Legalization Elections,” Public Choice, 2020, 1–17. Instead, Yandle borrows these terms to make sense of political outcomes that would otherwise seem curious. As we explain below, the Prohibition era was especially rife with abuse of the legal system as actual bootleggers found aggressive means of quenching public thirst. Similarly, the Bootleggers in Yandle’s theory are the economic interests that seek to gain from public spoils. They are an inevitable part of the political process, as demonstrated through the ever-expanding literature on rent-seeking.10See, e.g., Gordon Tullock, “The Welfare Costs of Tariffs, Monopolies, and Theft,” Economic Inquiry 5, no. 3 (1967): 224–32; Robert D. Tollison, “Rent Seeking: A Survey,” Kyklos 35, no. 4 (1982): 575–602; Roger D. Congleton and Arye L. Hillman, eds., Companion to the Political Economy of Rent Seeking (Cheltenham, UK: Edward Elgar, 2015).

On the other hand, the Baptist and Methodist clergymen who seek to curb alcohol use represent an overarching appeal to the public interest. Similarly, the Baptists in Yandle’s theory seek to bring benefits to the public in a way that is recognizable by others. Going back to The Theory of Moral Sentiments by the original Adam Smith (and namesake to one of the authors of this chapter), there is an alertness to sympathy from and for others that motivates our actions and beliefs. In a sense, our propensity to reciprocate trust is as deeply embedded as our propensity to truck and barter. When we find ourselves in sympathy with others, it becomes difficult to disentangle this public-spiritedness from underlying economic interests.11See Adam Smith, The Theory of Moral Sentiments ed. D. D. Raphael and A. L. Macfie (1759; repr., Indianapolis: Liberty Fund, 1982).

Triumph of the Baptists

Prohibition speaks marvelously to this theory in that the intentions of the “drys” who instigated the legislation were intricately linked with other economic and moral interests. Historian Richard Gamble writes,

Not every prohibitionist was motivated by the brand of Christian activism represented by the Christian Century, the Federal Council of Churches, the leaders of mainline or other denominations, or the countless reform associations. The more technocratic prohibitionists emphasized industrial efficiency, safety, and medical science rather than moralism or the Bible. But an appeal to religion pervaded the campaign as a whole. In the case of some Christians, war and Prohibition united them as never before—with such success that Protestant ecumenists considered it yet another sign of the approaching Kingdom of God (whatever that might mean). War and Prohibition divided other Christians; but for the moment, fundamentalists and modernists fought on the same side when it came to Prohibition.12Richard Gamble, “‘Two Kaisers in the Same Grave’: Prohibition at 100,” Law & Liberty, October 1, 2019.

This alliance created a veneer of moral support for what became an unwieldy enforcement process. Daniel Okrent offers,

Consider, for instance, the two constituencies that had the greatest stake in the Eighteenth Amendment and were thus implicit allies. No one had a stronger moral interest in Prohibition than the Baptist and Methodist clergymen who were its tribunes, but no one had a greater financial stake than the criminals who daily sought to undermine it. It’s not easy to prove that the big-time mobsters, on-the-take cops, corrupt judges, speak-easy operators, and all the other economic beneficiaries of the Eighteenth Amendment and the Volstead Act gave their financial support to dry politicians. Researchers are unlikely to discover a canceled check made out to a political campaign and signed “Alphonse Capone.”13Daniel Okrent, Last Call: The Rise and Fall of Prohibition (New York, NY: Simon and Schuster, 2010), 302.

However, the incentives are evident. As Mark Thornton explains, “Not only did spending on alcohol increase, so did spending on substitutes for alcohol. In addition to patent medicines, consumers switched to narcotics, hashish, tobacco, and marijuana.”14Mark Thornton, “Alcohol Prohibition Was a Failure” (Policy Analysis No. 157, Cato Institute, 1991), 4. We’ll discuss these substitution effects further below in reference to modern-day alcohol regulation.

Anti-Saloon League members and bootlegging mobsters were just the actors of that particular era. The more general point of the Bootleggers-and-Baptists framework is that economic interests will appeal to public-interest arguments to use the political process to their advantage.15See Jason F. Shogren, “The Optimal Subsidization of Baptists by Bootleggers,” Public Choice 67, no. 2 (1990): 181–89. Unlike distillers who were the main focus of prohibitionists, breweries had a chance to possibly keep beer legal during Prohibition, but they faced considerable obstacles in gaining public sympathy. First, World War I (1914–1918) made German brewers a prime target for prohibitionists. Anti-German sentiment during the war was used to the advantage of the prohibitionists. For example, the Woman’s Christian Temperance Union used postcards claiming “the Saloon Backer is a Traitor to his Country.”16See for example https://themobmuseum.org/blog/world-war-played-key-role-passage-prohibition/ accessed 10/7/2020. Okrent relates the story of a dry politician saying to a local paper, “We have German enemies across the water. We have German enemies in this country too. And the worst of all our German enemies, the most treacherous, the most menacing, are Pabst, Schlitz, Blatz, and Miller.”17Okrent, Last Call, 100.

Second, treated potable drinking water was becoming the norm. Throughout history, people have boiled water to remove contaminants. In the east, tea was the drink of choice. In the west, beer was the drink of choice. Frederick the Great complained when imported coffee began to replace beer as the drink of choice.18Bert L. Vallee, “Alcohol in the Western World,” Scientific American 278, no. 6 (1998): 80–85. Bert Vallee argues that “western civilization has wine and beer to thank for nourishment and hydration during the past 10,000 years.”19Vallee, “Alcohol in the Western World.” Before the very recent availability of clean, pure water, alcoholic beverages may have been the only safe liquids to drink. Although many large US cities had water piped into homes in the late 1800s, much of the water was pumped from the same river that was receiving untreated sewage. It wasn’t until 1908 that Jersey City became the first city to continuously chlorinate and filter the city’s drinking water.20Victor Kimm, Joseph Cotruvo, and Arden Calvert, Drinking Water: A Half Century of Progress (EPA Alumni Association, 2016). As more cities started chlorinating and filtering their water, the need for beer declined.

Finally, brewers were not well organized. This is partly because the larger breweries were not ready to help out smaller breweries, which generally operated “tied houses” in the city in which they brewed. A tied house is a saloon that only serves a particular brewery’s beer. According to Martin Stack and Myles Gartland, “From 1877 to 1895, the large national shipping breweries such as Anheuser-Busch and Pabst grew much faster than the industry. Yet, from 1895 to 1915, the largest breweries began to see their sales stagnate, and the industry grew at a faster rate, propelled by local and regional firms.”21Martin Stack and Myles Gartland, “The Repeal of Prohibition and the Resurgence of the National Breweries: Productive Efficiency or Path Creation?,” Management Decision 43, no. 3 (2005): 422. Since most bars only served the beer of one brewery, the larger breweries that shipped their beers had few alternatives and mostly sold their products in hotels and restaurants. Stack and Gartland argue that, after Prohibition, new rules were developed that favored larger shippers over local brewers. The larger shippers had a seat at the table when the legislation was being developed, and the local brewers were on the menu. The consequence was the three-tier system of regulation that is prevalent in most states today. In effect, the large national brewers (or “macro-breweries”) became the Bootleggers, albeit legal ones.22One indicator of the larger breweries’ influence was that the day Prohibition ended, August Anheuser Busch Jr. decided to have Clydesdale horses pull a wagon of beer down Pennsylvania Avenue to deliver beer to FDR in the White House. This was the first appearance of these horses for Budweiser. Kat Eschner, “The Budweiser Clydesdales’ First Gig Was the End of Prohibition,” Smithsonian Magazine, March 28, 2017.

Impact of the Twenty-First Amendment

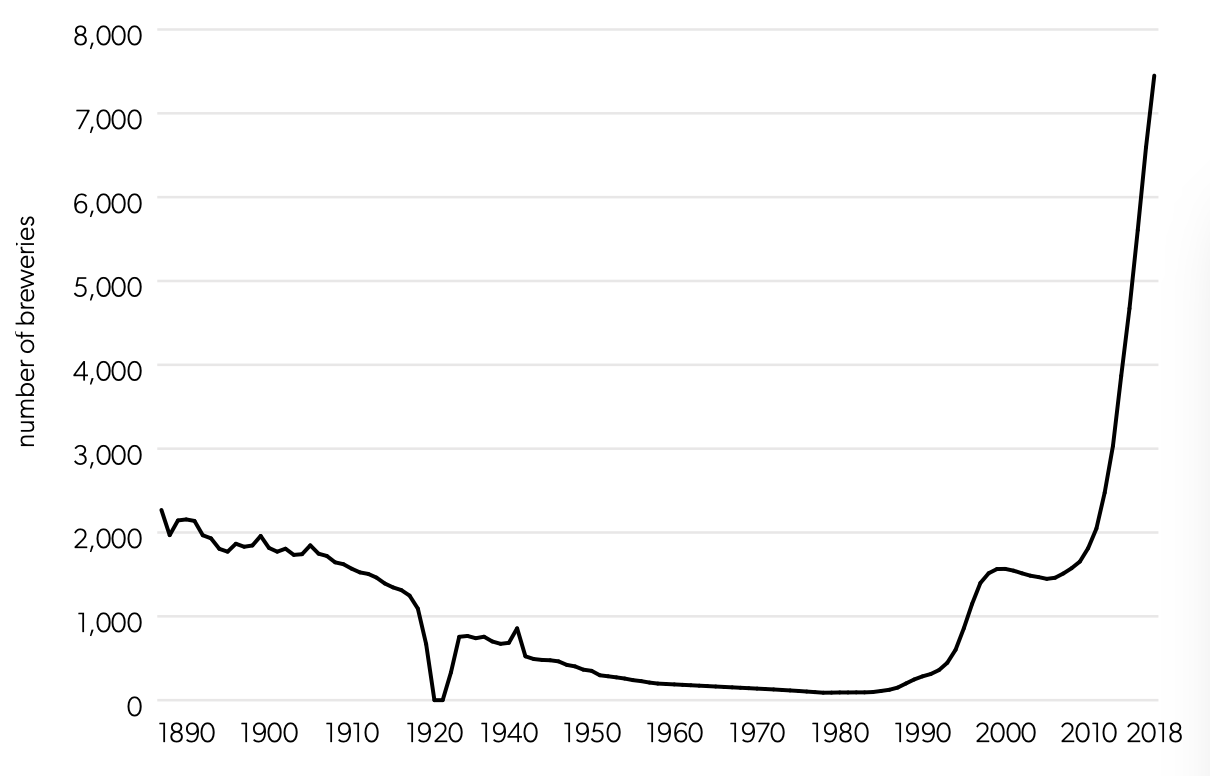

Prohibition, the failed “noble experiment,” ended with the Twenty-First Amendment in 1933, which gave over authority to regulate alcohol to the individual states. From then on, each state was able to determine whether alcohol could be sold and to regulate its manufacture and distribution, tax it, and stipulate when and where people could consume it. As agricultural economist Bradley Rickard and co-authors observe, “the heterogeneity of alcohol availability laws in the United States is striking.”23Bradley J. Rickard, Marco Costanigro, and Teevrat Garg. “Economic and social implications of regulating alcohol availability in grocery stores.” Applied Economic Perspectives and Policy 35, no. 4 (2013): 613-633. Underpinning all of this regulatory apparatus is the three-tier distribution system. Seventeen states directly control the sale of alcohol while the remaining states use a three-tier system.24“Control State Directory and Info,” National Alcohol Beverage Control Association, https://www.nabca.org/control-state-directory-and-info, last accessed 7 October, 2020. But even in control states, the rules differ as to what types of alcohol are controlled. The three-tier system requires alcohol producers (tier 1) to sell to distributors (tier 2), who then sell and deliver the product to retailers such as liquor stores, bars, and restaurants (tier 3). Only at this point is the consumer able to purchase the product. Before the three-tier system, alcohol producers often sold directly to retailers or consumers, and led to the tied houses for breweries discussed above. It’s unclear whether breweries would have consolidated as aggressively as they did had Prohibition not severely disrupted the American alcohol market. Nevertheless, under the three-tier system, the sales of small brewers immediately fell (see figure 1).

Okrent writes, “Of the 1,345 American brewers who had been operating in 1915, a bare 31 were able to turn on their taps within three months of the return of legal beer.” Under the three-tier system, local breweries were no longer able to sell beer in their own saloons: they had to rely on other bars and restaurants to sell their beer. This made it easier for the out-of-town, larger brewers to sell their beer, since they were now in the same market position as the local brewers, though with greater ability to advertise their products. Moreover, economies of scale reduced the costs of mass-produced beer and the larger brewers bought up many of the regional brewers. As a consequence, the number of breweries fell from 756 in 1934 to 89 in 1978.

The Volstead Act was the legislation that detailed the enforcement of the Eighteenth Amendment. The legislation allowed individuals to make wine at home but not beer.25This was a political nod to the Catholic clergy. See Gamble, “Two Kaisers in the Same Grave.” The Twenty-First Amendment repealed Prohibition and gave states the right to regulate alcohol sales and production, but was silent on home-brewing beer. In 1978, President Carter signed a bill which came to be known as the Cranston Act since it has an amendment by senators Alan Cranston, Harrison Schmitt, Dale Bumpers, and Mike Gravel that allowed home-brewing of 100 gallons of beer per adult and up to 200 gallons per household. Soon after, the craft brewing industry started to grow.26The Brewers Association defines craft brewers as those that produce 6 million barrels or fewer, with no controlling interest from non-craft brewers. See “Craft Brewer Definition,” Brewers Association, accessed March 3, 2020, https://www.brewersassociation.org/statistics-and-data/craft-brewer-definition/.

Figure 1 shows the number of breweries in the United States from 1887 until 2018. Prohibition reduced the number of breweries dramatically, and the decline started well before the Eighteenth Amendment took effect, because many states had their own prohibition laws. When the Twenty-First Amendment passed, the few breweries that had survived during Prohibition by producing other products such as malt, ice cream, and other drinks started to scale up and buy out smaller breweries. This led to a decline in the number of breweries. After the Cranston Act in 1978, many homebrewers wanted to open breweries. Since states had the power to determine the production and distribution of alcohol, some states, such as California and Oregon, became early adopters of legal craft breweries, while others, such as Mississippi and Alabama, were late adopters, waiting until 2013 to legalize craft breweries.

A consequence of the Cranston Act was dramatic growth in the number of breweries, from 89 in 1978 to 8,386 in 2019. However, the number of breweries per capita varies dramatically by state and is partly dependent on when a state legalized small breweries, and particularly on whether self-distribution is possible, as we explain below. Some may question the relationship between the Cranston Act of 1978 and the more recent growth in breweries, which generally accelerated in the past 15 years. However, home brewing was the first step. The next step was that states had to pass laws allowing brewpubs to open. Research shows that Washington was the first state to legalize brewpubs, in 1982, followed by California and Oregon in 1983. Half of the states had legalized brewpubs by 1988.27Kenneth G. Elzinga, Carol Horton Tremblay, and Victor J. Tremblay, “Craft Beer in the United States: History, Numbers, and Geography,” Journal of Wine Economics 10, no. 3 (2015): 242–74. Once brewpubs have been legalized, entrepreneurs hoping to open one must find funding and acquire all the appropriate licenses and government certifications.

Figure 1. Number of US Breweries, 1887-2018

Source: “National Beer Sales & Production Data,” Brewers Association, accessed October 7, 2020, https://www.brewersassociation.org/statistics-and-data/national-beer-stats/.

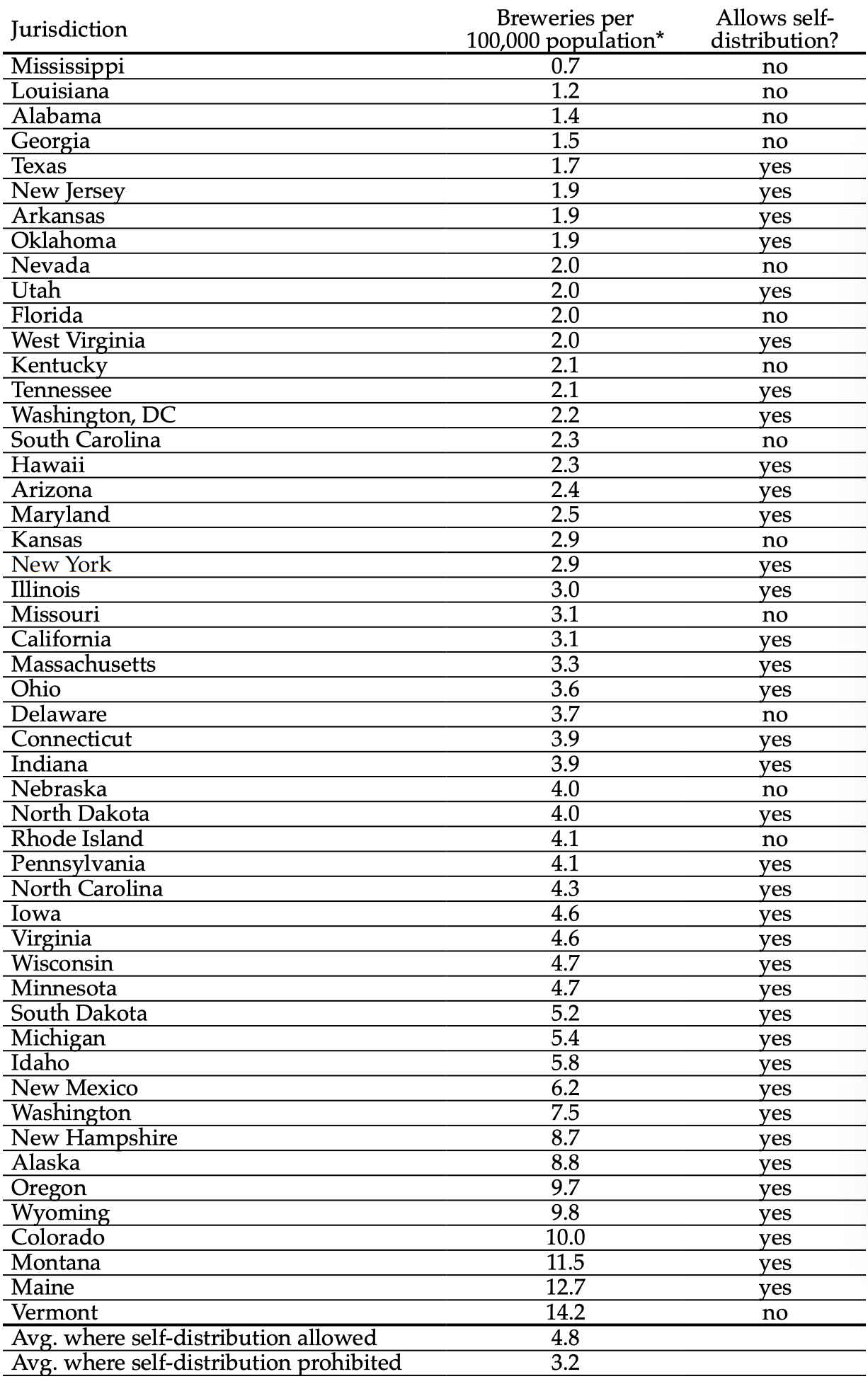

Laws that allow for self-distribution, be it on-site (as in the case of brewpubs) or in local retail outlets, are particularly beneficial to craft brewery growth and are responsible for much of the postmillennial growth in number of breweries.28See Jacob Burgdorf, “Trouble Brewing? Brewer and Wholesaler Laws Restrict Craft Breweries” (Mercatus on Policy, Mercatus Center at George Mason University, Arlington, VA, September 2016). Recall that the three-tier system requires alcohol producers to sell to distributors, which then sell to liquor stores, bars, and other sellers of alcohol. Some states, however, have carved out an exception for smaller breweries that allows them to self-distribute their beer. For example, North Carolina recently raised its distribution cap from 25,000 to 50,000 after a contentious political battle between distributors and craft brewers.29Jennifer Thomas, “Pending NC Legislation Could Signal End to Craft-Beer Battle over Self-Distribution Cap,” Charlotte Business Journal, March 14, 2019. Table 1 shows the number of breweries and breweries per 100,000 population over age 21 as well as self-distribution status in 2019. Notice that the average number of breweries per 100,000 is 3.2 in states that do not allow self-distribution but 4.8 in states that do allow self-distribution. Having 50 percent more breweries per capita results in a greater variety of beer, more competition, and lower prices.30See Stephan F. Gohmann, “Why Are There So Few Breweries in the South?,” Entrepreneurship Theory and Practice 40, no. 5 (2016): 1071–92; Trey Malone and Jayson L. Lusk, “Brewing Up Entrepreneurship: Government Intervention in Beer,” Journal of Entrepreneurship and Public Policy 5, no. 3 (2016): 325–42.

Table 1. Breweries per Capita and Self-Distribution Laws, 2019

* The number of breweries per 100,000 population over age 21.

Source: “State Craft Beer Sales & Production Statistics, 2019,” Brewers Association, accessed October 7, 2020, https://www.brewersassociation.org/statistics/by-state/.

Self-distribution laws ultimately determine the capacity for growth, because they establish when the brewer must work with an outside distributor. Agricultural economist Daniel Toro-Gonzalez and co-authors note that “the variety of products available in the market at a given point in time is not an outcome of the market, but a result of distributors’ decisions.”31Toro-González, Daniel, Jill J. McCluskey, and Ron C. Mittelhammer. “Beer snobs do exist: Estimation of beer demand by type.” Journal of agricultural and resource economics (2014): 174-187. In addition, distributors for the macro-brewers would rather avoid competition for shelf space and taps at restaurants from craft breweries, since such competition will cut into the profits of their high-value clients. As a consequence, these interests have historically pushed for state alcohol laws that make it difficult for craft breweries to self-distribute. But as younger millennials, who favor product differentiation and customization, have reached legal drinking age, they have propelled the growth in the craft sector , putting pressure on distributors to include craft brands in their overall beer portfolio. Toro-Gonzalez and his co-authors explain that while “consumers who purchase [mass-produced] American lagers are highly loyal to this type of beer,”32Ibid., p. 19. craft beer drinkers are equally consistent in avoiding these types of brands.

Moreover, beer sales have been falling in the past 10 years. In 2008 beer captured 50.3 percent of alcohol revenues. Spirits accounted for 33.1 percent of sales, and wine for 16.6 percent. By 2019, these numbers were 45.2 percent for beer, 37.8 percent for spirits, and 17.0 percent for wine.33“Supplier gross revenue of alcoholic beverages in the United States from 2008 to 2019, by beverage type,” Statista, https://www.statista.com/statistics/237868/us-revenue-of-alcoholic-beverages-by-type/ last accessed October 7, 2020. At the same time, the share of beer produced by craft brewers increased from 4.0 percent to 13.2 percent.34See “National Beer Sales & Production Data,” Brewers Association, accessed March 3, 2020, https://www.brewersassociation.org/statistics/national-beer-sales-production-data/. The reduction in sales has fallen hardest on the larger macro-brewers with mass-consumed products. Most macro-breweries have simply acquired craft breweries in order to maintain their market presence.35John Kell, “Anheuser-Busch InBev Buys 9th Craft Brewer,” Fortune, November 3, 2016; James Brumley, “More Craft Beer Can’t Help Big Brewers,” Motley Fool, January 28, 2020. Nevertheless, the macro-brewers continue to resist competition from the craft sector through their relationships with distributors as enforced by the three-tier regulatory process.

In short, the “Bootleggers” in today’s alcohol market are both distributors and macro-brewers. However, these economic interests need “Baptists,” or a genuine moral argument, to keep the current legal structure in place. Fortunately for the Bootleggers, there are groups willing to oblige. Recent research has examined how the number of craft breweries per capita is related to the percentage of the population that is Baptist, to the number of distributors per capita, and to the percentage of state legislators’ campaign contributions coming from macro-breweries.36Gohmann, “Why Are There So Few Breweries in the South?”

The influence of the percentage of the population that is Baptist on the number of breweries is pretty straightforward. In 2006, the Southern Baptist Convention passed the following resolution:

WHEREAS, Years of research confirm biblical warnings that alcohol use leads to physical, mental, and emotional damage (e.g., Proverbs 23:29–35); . . .

RESOLVED, That we urge Southern Baptists to take an active role in supporting legislation that is intended to curb alcohol use in our communities and nation.37Southern Baptist Convention, “On Alcohol Use in America,” accessed Oct. 7 2020, http://media2.sbhla.org.s3.amazonaws.com/annuals/SBC_Annual_2006.pdf.

So, we should expect states with larger percentages of Southern Baptists to have legislators who will keep laws on the books that make it difficult for a brewery to open.

One of us (Gohmann) examined brewery growth from 2004 to 2012. He found that in the South, where literal Baptists make up a large portion of the population, laws that made it easier for breweries to open were indeed slow to change.38Gohmann, “Why Are There So Few Breweries in the South?” In southern states where the percentage of Baptists was larger, the number of breweries per capita was lower. Likewise, in southern states the number of breweries per capita was negatively associated with more beer distributors per capita and a larger percentage of state officers’ campaign contributions coming from big breweries. This relationship did not hold in any other region of the country—likely because other regions lack a sufficient number of Baptists to elect legislators who would keep such distribution control laws in place.39Gohmann, “Why Are There So Few Breweries in the South?”

This relationship seems to be waning, however. In the past five years, the number of craft breweries has almost doubled—from 4,847 in 2015 to 8,386 in 2019.40https://www.brewersassociation.org/statistics-and-data/national-beer-stats/, accessed October 7, 2020. Much of this growth took place in the South.

All Bootleggers-and-Baptists Politics Is Local

In many cases, states have complicated the Bootleggers-and-Baptists situation further by ceding governing authority to local government. Section 2 of the Twenty-First Amendment allows states to determine the rules for alcohol distribution, including whether to be wet or dry. A dry state or county does not allow any alcohol sales. Several states decided to let counties determine their wet/dry status through local-option votes. Currently, 12 states have jurisdictions where alcohol sales are prohibited—that is, dry counties. For example, as in many other southeastern states, North Carolina “set into place the Alcohol Boards of Control (ABC) structure, giving local jurisdictions control over the production, distribution and sale of alcohol across N.C. County ABC Boards are local independent political subdivisions of the State Boards, operating as separate entities, establishing their own policies and procedures.”41Alistair Williams, “Exploring the Impact of Legislation,” 3.

There are several Bootleggers-and-Baptists implications of having wet and dry counties. First, in wet counties that border dry counties, many liquor stores locate right on the county border. These liquor stores are often keen to fight any move in the dry county to become wet. So in this case, the out-of-county liquor stores are the Bootleggers and the local residents in the dry county who wish to remain dry are the Baptists. For example, an article on a statewide vote in Arkansas to legalize the sale of alcohol throughout the state reported that the initiative was strongly opposed by the Arkansas Beverage Retailers Association. “The association says the initiative’s passage would be ‘catastrophic for county line liquor stores’ and would allow large-scale retailers like Walmart and Kroger to dominate the market.”42Jack Holmes, “Will Arkansas’ Prohibition Finally End?,” Daily Beast, updated April 14, 2017. There was no mention in the article of the greater variety of beer and lower prices such competition would bring.

Laws prohibiting alcohol sales in a county might benefit the Bootleggers and assuage the consciences of the Baptists, but these laws have consequences. The three-tier system allows extensive political interference in alcohol markets in a way that significantly increases the cost of regulatory compliance for local brewers. For example, in today’s alcohol market, economists Trey Malone and Dustin Chambers “show that each step of the beer value chain is subject to more than 20,000 regulations, with the majority of the total regulations affecting the brewery level,” which corresponds to tier 3 where consumers buy alcohol. They continue, “In total our estimates suggest that more than 94,000 federal regulations influenced the production and sale of a single bottle of beer in 2012.”43Trey Malone and Dustin Chambers, “Quantifying Federal Regulatory Burdens in the Beer Value Chain,” Agribusiness 33, no. 3 (2017): 2. By way of comparison, 11,000 regulations affect railroads, as of 2012. See Jerry Ellig and Patrick A. McLaughlin, “The Regulatory Determinants of Railroad Safety,” Review of Industrial Organization 49, no. 2 (2016): 371–98. As a consequence, consolidating into larger brands often makes the most sense for brewers wanting to distribute in multiple states.

An additional constraint involves franchising law and pertains to how distributors bargain with brewers. As economist Douglas Whitman explains, “Alcohol wholesalers have regularly sought legislative protection to limit the power of suppliers to terminate their contracts.”44Douglas Glen Whitman, Strange Brew: Alcohol and Government Monopoly (Oakland, CA: Independent Institute, 2003), 7. While franchise agreements routinely contain certain stipulations, their enforcement is typically left to the market process; that is to say, agreements that result in mutual benefit will gain traction over time.45See James C. Cooper et al., “Vertical Antitrust Policy as a Problem of Inference,” International Journal of Industrial Organization 23, no. 7–8 (2005): 639–64. When franchising agreements are enforced not by market process but by government coercion, then their propensity to benefit all parties becomes less credible. Indeed, Francine Lafontaine and Margaret Slade claim that they “have found clear evidence that restrictions on vertical integration that are imposed, often by local authorities, on owners of retail networks are usually detrimental to consumers. Given the weight of the evidence, it behooves government agencies to reconsider the validity of such restrictions.”46Francine Lafontaine and Margaret Slade, “Vertical Integration and Firm Boundaries: The Evidence,” Journal of Economic Literature 45, no. 3 (2007): 680.

Furthermore, many states require alcohol distributors to operate in exclusive territories. This ensures that distributors gain market power because they need not directly compete with one another for local contracts. The use of exclusive territories to properly incentivize contracts is credible when these contracts are entered into voluntarily. For example, Armen Alchian and William Allen explain how Coors used exclusive territories to motivate distributors to properly refrigerate their beer in transit.47Armen A. Alchian and William R. Allen, Universal Economics (Indianapolis: Liberty Fund, 2018), 383–84. As with franchising laws, however, this contracting solution is less credible when it is enacted by legislative decree. Together, these laws create significant entry barriers for new breweries at the local level. Distributors have enormous bargaining power since they are able to (1) control distribution of the product, (2) help structure contracts so that the contracts specifically favor their own interests, and (3) influence state governments directly through their role as part of the larger fiscal apparatus.

The trouble with all this regulatory interference is that it fails to even accomplish its stated goal: namely, to influence the consumption of alcohol by limiting production. Malone and Lusk find that, “at least for the US beer market, consumption habits are not directly correlated with the number of producers. By extension,” they continue, “our results suggest that constructing policies with the intention of influencing consumer behavior by limiting decisions made by the seller is unlikely to accomplish the law’s intended goals.”48Malone and Lusk, “Brewing Up Entrepreneurship,” 337.

For example, regulation can influence alcohol-related traffic fatalities in a way unintended by lawmakers. Economic theory suggests that the implicit price of alcohol will be higher in dry counties. A consumer in a dry county who wishes to purchase alcohol has two options. The first is to purchase it illegally from a literal bootlegger. In this case, the price will be higher than the price in a wet county, since the bootlegger—acting as a middleman—will charge for procuring the alcohol and also for the risk of getting caught. The second option is to drive to a wet county to purchase alcohol. In this case, the consumer has to add the costs of the trip, including time costs, to the purchase price of the alcohol. If the consumer plans on drinking in the wet county, the drinker may have to have a designated driver, find a place to stay to sober up, or take the risk of driving while intoxicated. If the consumer decides to drink in a wet county and then drive home, the potential for a motor vehicle fatality might be higher than it would have been if the consumer had been drinking locally.

Research into fatalities caused by driving under the influence of alcohol has shown mixed results. A study published in 1996 found no association between wet or dry counties and fatalities for 15-to-24-year-olds.49Kelly J. Kelleher et al., “Alcohol Availability and Motor Vehicle Fatalities,” Journal of Adolescent Health 19, no. 5 (1996): 325–30. But data from the National Highway Traffic Safety Administration show that the number of alcohol-related deaths in 2006 was 6.8 per 10,000 people in dry Texas counties, compared to 1.9 per 10,000 in wet Texas counties.50“‘Dry Towns’ in the USA,” American Addiction Centers, accessed March 3, 2020, https://www.alcohol.org/statistics-information/dry-towns/.

Moreover, the same set of substitution effects that encouraged illegal consumption activities during Prohibition is still present today. The availability of alcohol in wet counties also lowers its cost relative to the cost of other illegal substances such as marijuana, heroin, and methamphetamines. Michael Conlin, Stacy Dickert-Conlin, and John Pepper examine the influence of alcohol access in Texas on drug-related crimes and mortality. During the time period of their study, 1978 to 1996, Texas raised the legal drinking age from 18 to 19 and then from 19 to 21. Also, 26 counties changed from dry to wet. This change allowed the researchers to examine the unintended consequences of alcohol prohibition on illicit drug use arrests and deaths. They find that illegal drugs are substitutes for alcohol access. They also find that a jurisdiction changing from dry to wet status in Texas is related to a 14 percent reduction in drug-related mortality.51Michael Conlin, Stacy Dickert-Conlin, and John Pepper, “The Effect of Alcohol Prohibition on Illicit-Drug-Related Crimes,” Journal of Law and Economics 48, no. 1 (2005): 215–34. In a study comparing wet and dry counties in Kentucky, another set of researchers find that the number of meth lab seizures is twice as high in dry counties as in wet ones. If all counties in Kentucky became wet, the number of meth lab seizures would decrease by 35 percent.52Jose Fernandez, Stephan F. Gohmann, and Joshua C. Pinkston, “Breaking Bad in Bourbon Country: Does Alcohol Prohibition Encourage Methamphetamine Production?,” Southern Economic Journal 84, no. 4 (2018): 1001–23.

Comparing the prices of alcohol and marijuana gives similar results. John DiNardo and Thomas Lemieux examine marijuana use by high school seniors when the minimum drinking age is increased. When the drinking age increases, the relative price of now-illegal alcohol rises compared to that of marijuana. The researchers find that alcohol consumption decreases with this increase in the minimum drinking age, but that marijuana use increases.53John DiNardo and Thomas Lemieux, “Alcohol, Marijuana, and American Youth: The Unintended Consequences of Government Regulation,” Journal of Health Economics 20, no. 6 (2001): 991–1010. Raising the minimum legal drinking age makes alcohol a forbidden fruit. Barış Yörük and Ceren Yörük find that, in the United States, the probability of drinking alcohol over the past month increases by 13 percent when people turn 21.54Barış K. Yörük and Ceren Ertan Yörük, “The Impact of Minimum Legal Drinking Age Laws on Alcohol Consumption, Smoking, and Marijuana Use: Evidence from a Regression Discontinuity Design Using Exact Date of Birth,” Journal of Health Economics 30, no. 4 (2011): 740–52. However, other studies find that a higher minimum drinking age reduces alcohol-related traffic fatalities.55Brent D. Mast, Bruce L. Benson, and David W. Rasmussen, “Beer Taxation and Alcohol-Related Traffic Fatalities,” Southern Economic Journal 66, no. 2 (1999): 214–49; Thomas S. Dee, “State Alcohol Policies, Teen Drinking and Traffic Fatalities,” Journal of Public Economics 72, no. 2 (1999): 289–315.

These public health issues could be amplified by an increase in craft breweries. For example, if the surge in craft breweries results in more alcohol-related deaths, then this would justify regulations that discourage the development of microbreweries. However, as stated earlier, Malone and Lusk find that consumption is not related to the number of producers—and, furthermore, beer consumption has been declining since 1981.56Malone and Lusk, “Brewing Up Entrepreneurship”; “Percentage Change in Per Capita Alcohol Consumption, United States, 1977–2016,” National Institute on Alcohol Abuse and Alcoholism, accessed March 3, 2020, https://pubs.niaaa.nih.gov/publications/surveillance110/fig3.htm. A 2018 study examined the propositions distributors appeal to in favor of limiting self-distribution, including the fact that some jobs are created by the three-tier system itself and various public health concerns.57Christopher Koopman and Adam C. Smith. “The Political Economy of Craft Beer in North Carolina (and Beyond).” Political Economy in the Carolinas 1 (2018): 76-98. For evidence that opponents of reform used the argument that changing the system would cost jobs, see Steve Bittenbender, “Would Liquor Access Expansion in Pennsylvania Cost Jobs? Lawmakers, Interested Parties Debate Bills,” Center Square, November 6, 2019. These arguments are intended to appeal to public interest, but—as the researchers explain—each also has questionable empirical bearing on the way alcohol is consumed today. In other words, an alternative take is that distributors are using Baptist arguments to bolster their Bootlegging position.

A recent paper goes even further, documenting spending by interest groups tied to the respective Bootlegger and Baptist positions in the state of Arkansas. Specifically, the author—economist Jeremy Horpedahl—finds that “legalization of alcohol sales at the county level is opposed by religious organizations and by liquor sellers in adjacent counties.”58Jeremy Horpedahl, “Bootleggers, Baptists and Ballots,” 2. In this case, Bootleggers typically supply funding in the form of advertising and legal fees, while Baptists organize opposition groups and provide local outreach. Also, Walmart is a notable proponent of legalization in Arkansas, since it has stores across the state that would be able to distribute beer and wine in newly wet counties. Nevertheless, Horpedahl notes, “even the largest corporation in the world, operating in its own state with a clear economic interest, apparently often is not able to defeat the concentrated interests of county-line liquor stores and passionate preachers.”59Horpedahl, “Bootleggers, Baptists and Ballots,” 15.

A Tale of Two States

As we have discussed so far, in most cases the rules are made at the state or the local level. Two recent cases expose the influence of distribution laws on different groups of competitors. Until recently, Kentucky had a state law that prohibited breweries within the state from distributing their beer. However, no law existed that prohibited a brewery outside the state from owning a distributorship in Kentucky. In the 1970s, Anheuser-Busch bought a distributorship in Louisville. Since craft brewing had not yet started in the state, this purchase was not an issue. However, in 2014 Anheuser-Busch wanted to purchase a distributor in Owensboro, in the western part of the state. The local craft brewers feared that such an acquisition would limit their ability to have their beers distributed in that area. They claimed that the current law favored out-of-state breweries over in-state breweries. The market solution would have been to allow any brewery to distribute within the state, and—as noted above—this would likely have led to increases in the number of breweries and the variety of beer in Kentucky. Instead, by passing H.B. 168 in 2015, the legislature decided that no brewery could own a distributor or distribute its own beer.60H.B. 168, 2015 Leg., Reg. Sess. (Kentucky 2015).

Anheuser-Busch fought this bill, since the company would have to sell one of its distributorships and would lose the opportunity to own a second one. Owning the distributorship would have given Anheuser-Busch much more control over how its beer is marketed in Kentucky. One indicator of the importance of this to Anheuser-Busch is the company’s lobbying expenditures. Many large companies pay lobbyists in each state to represent their interests. In 2014, Anheuser-Busch’s lobbying expenses were $94,064. During the legislative session when H.B. 168 was passed, Anheuser-Busch’s lobbying expenditures increased to $447,342.61The lobbying data are from https://www.followthemoney.org/ last accessed October 7, 2020. The following year, expenditures dropped to $69,998. During the same period, Miller Brewing Company, which was not involved in the distribution debate, had lobbying expenditures each year of $18,812. Another lobbying group, Kentuckians for Entrepreneurship and Growth, appeared in late 2014. It is a coalition of wholesalers, craft brewers, and other groups that pushed for H.B. 168. The group’s lobbying expenditures were $16,058 in 2014, increased to $133,297 during the legislative session, and then fell to zero the following year. These expenditures paid off with the passage of H.B. 168.

Another legal debate happened in Indiana in 2018. The laws in Indiana that regulate selling beer are complicated. If you want cold beer, you can only buy it at a liquor store. Grocery stores (plus pharmacies) and convenience stores (which often accompany gas stations) can sell warm beer. In addition, until 2018 Indiana did not allow any alcohol sales on Sundays. These two rules—the one about cold beer and the one about Sunday sales—led to some perverse incentives for liquor stores, grocery stores, and convenience stores.

Liquor stores had the best deal, since they have the exclusive right to carry cold beer and also did not have to be open on Sunday, unlike most grocery stores and convenience stores. New legislation introduced in 2018 threatened to disrupt these privileges, and led to strange coalitions. The liquor stores did not want either Sunday sales or anybody else selling cold beer. This is an example of the transitional gains trap.62See Gordon Tullock, “The Transitional Gains Trap,” Bell Journal of Economics 6, no. 2 (1975): 671–78. The liquor stores feared that allowing others to sell cold beer would hurt liquor store revenues, since the liquor stores were currently the only option. So the benefit of owning a liquor store, which an entrepreneur may have bought from its previous owner at a price that reflected the additional profits derived from the ability to sell cold beer, would disappear. Thus the liquor store owners wanted to maintain their monopoly. They opposed Sunday sales because this would require them to be open one more day a week with little additional expected weekly sales. They reasoned that consumers would buy all their alcohol on Saturdays for any Sunday consumption, and that any time open on Sunday would require the cost of employing workers.

Grocery stores wanted to be able to sell cold beer and also to sell alcohol on Sundays, since their stores were open for grocery business on Sundays. (Before 2018, the state had made an exception to the Sunday-sales rule for Super Bowl XLVI in 2012, which was hosted in Indianapolis.) Sunday sales might have been the most beneficial rule change for grocery stores, since they are able to stock a large amount of alcohol and would capture sales from many Sunday shoppers.

Convenience stores and gas stations are only allowed to sell warm beer. They wanted to be able to sell cold beer also, since many drivers might pick up a cold six-pack after filling up their gas tank on their way home from work. Sunday sales would also be beneficial, but cold-beer sales would be most beneficial rule change for this group.

The three competitors (liquor stores, grocery stores, and convenience stores) all wanted different rules. Liquor stores wanted the status quo, but grocery chains had the most clout and the most influence on how the legislation would change. If the grocery stores pushed for cold-beer sales, then convenience stores would benefit and be in the grocery stores’ camp, and liquor stores would lose out on their cold-beer monopoly. If the grocery stores pushed for Sunday sales, then liquor stores would lose out, but even though it would cost them and additional day of being open, they could maintain the cold-beer monopoly. Seeing the writing on the wall, the liquor stores teamed up with the grocery stores, and in 2018 Governor Eric Holcomb signed a bill that legalized alcohol sales on Sundays from noon to 8 p.m. Indiana became the 41st state to allow Sunday alcohol sales.

Indiana’s law pitted liquor stores against big-box retailers—grocery stores and pharmacies. Liquor store lobbying expenditures were over $150,000, and they donated more than $750,000 to lawmakers.63Brian Slodysko and Tom Davies, “Governor Signs Historic Indiana Sunday Alcohol Sales Bill,” South Bend Tribune, February 28, 2018. One has to wonder who will be in coalition with the big-box stores the next time legislation comes up about cold-beer sales.

Conclusion

It is hard to gaze on the regulatory landscape of the three-tier system and not see room for improvement. While marginal improvements continue to occur, deeper reform of the three-tier system remains elusive. The coalitions of Bootlegger and Baptist interests manifested in macro-breweries, distributors, and state governments work diligently to keep the existing regulatory apparatus in place. With that said, the 2020 pandemic has brought into intense focus the arcane distribution laws that interfere with brewers’ ability to sell alcohol directly to consumers.64Trey Malone, “Craft Beer Revolution Is in Danger amid Coronavirus Crisis. Here’s What Can Help Save It,” USA Today, April 22, 2020. The pandemic has led to distribution laws across the United States being rescinded temporarily,65Alex Gangitano, “Coronavirus Brings Quick Changes to State Alcohol Laws,” The Hill, April 1, 2020. and some have even been eliminated altogether.66See “Direct Shipment of Alcohol Bill Heading to Governor,” Richmond Register, March 28, 2020. Perhaps now is the perfect time to provide blueprints for reforms that would bring needed change to this hopelessly entangled industry.67https://www.usatoday.com/story/opinion/2020/05/18/coronavirus-forces-changes-outdated-alcohol-regulations-column/5194183002/.

The most crucial change would be increasing limits on self-distribution.68For example, North Carolina recently increased self-distribution to 100,000 barrels. See Brooklynn Cooper, “N.C. Breweries Can Produce Quadruple the Amount of Beer Now. Here’s What They Plan to Do with It,” Charlotte Observer, June 6, 2019. Small brewers in control states, states where the government controls the sales of distilled spirits at the wholesale level, are dependent on distributors to grow and scale their businesses. Preventing craft brewers from distributing their own product stymies the kind of marketing and brand recognition that would otherwise allow each brewer to scale its business as the market allows. The status quo instead sees distributors favoring macro-brewers in a way that makes it difficult for smaller brands to compete. The infamous “100 percent share of mind” campaign in the mid-1990s, in which Budweiser required its distributors to jettison any competing brands, is an excellent example of this.69See Tom Acitelli, The Audacity of Hops: The History of America’s Craft Beer Revolution (Chicago: Chicago Review, 2017), 238. These anticompetitive measures are predictable under the three-tier system, in which distributors wield powerful influence over underlying market share.

Even if distribution is controlled by the state, there should be ample room for competition among distributors by territory. Evidence suggests that when territorial arrangements between wholesalers and retailers are mutually beneficial, these arrangements will come into being naturally without government coercion.70See Whitman, Strange Brew, 27. Enforcing territorial monopolies by government decree, on the other hand, leverages bargaining ability in favor of distributors, which can in turn be used to prevent small brewers from gaining market share in their local area.71Jim Morrill, “Craft Brewers Say This Document Shows the Distribution System Is ‘Rigged,’” Charlotte Observer, May 25, 2017. In addition to these monopoly provisions, there are numerous laws that favor distributors under existing franchise agreements. These include laws that make it tremendously difficult to terminate a relationship with a distributor, even when the brewer is able to demonstrate “good cause” that the contract has not been fulfilled. Typically, beer franchise laws allow the wholesaler a grace period to correct the underlying issues.72See Williams, “Exploring the Impact of Legislation,” 6.

Finally, taxes have been historically tied to alcohol in a way that seeks to accomplish public policy goals that are at times conflicting.73C. Jarrett Dieterle and Kevin Kosar, “GOP Tax Reform Impact on Booze,” January 2018, R Street Institute, https://www.rstreet.org/wp-content/uploads/2018/01/2018-R-Sheet-2-GOP-Tax-Reform-Impact-on-Booze.pdf. If state governments want to raise as much revenue as possible through alcohol consumption, then this should be a stated policy goal, giving rise to a strategy of removing all unnecessary barriers to the alcohol market. On the other hand, if the purpose of taxation is to limit consumption, then policymakers need to find a tax rate that would overwhelm even the most inelastic of beer drinkers. Regardless, greater research in this area is critical to further unpacking these cases of Bootlegger and Baptist influence in alcohol regulation.74For examples of research that explicitly examines and measures these Bootlegger-Baptist relationships, see Gohmann, “Why Are There So Few Breweries in the South?”; Jacob Burgdorf, “Impact of Mandated Exclusive Territories in the US Brewing Industry: Evidence from Scanner Level Data,” International Journal of Industrial Organization 63 (2019): 376–416; and Horpedahl, “Bootleggers, Baptists and Ballots.”

References

Acitelli, Tom. The Audacity of Hops: The History of America’s Craft Beer Revolution (Chicago: Chicago Review. 2017). 238.

Alchian, Armen A. and William R. Allen. Universal Economics (Indianapolis: Liberty Fund. 2018). 383–84.

Bittenbender, Steve. “Would Liquor Access Expansion in Pennsylvania Cost Jobs? Lawmakers, Interested Parties Debate Bills.” Center Square. November 6, 2019.

Brumley, James. “More Craft Beer Can’t Help Big Brewers.” Motley Fool. January 28, 2020.

Burgdorf, Jacob. “Impact of Mandated Exclusive Territories in the US Brewing Industry: Evidence from Scanner Level Data.” International Journal of Industrial Organization 63 (2019): 376–416.

Burgdorf, Jacob. “Trouble Brewing? Brewer and Wholesaler Laws Restrict Craft Breweries” (Mercatus on Policy. Mercatus Center at George Mason University. Arlington, VA. September 2016).

Congleton, Roger D. and Arye L. Hillman. Eds. Companion to the Political Economy of Rent Seeking (Cheltenham, UK: Edward Elgar. 2015).

Conlin, Michael, Stacy Dickert-Conlin, and John Pepper. “The Effect of Alcohol Prohibition on Illicit-Drug-Related Crimes.” Journal of Law and Economics 48. No. 1 (2005): 215–34.

Control State Directory and Info.” National Alcohol Beverage Control Association. https://www.nabca.org/control-state-directory-and-info. Last accessed October 7, 2020.

Cooper, Brooklynn. “N.C. Breweries Can Produce Quadruple the Amount of Beer Now. Here’s What They Plan to Do with It.” Charlotte Observer. June 6, 2019.

Cooper, James C. et al. “Vertical Antitrust Policy as a Problem of Inference.” International Journal of Industrial Organization 23. No. 7–8 (2005): 639–64.

“Craft Brewer Definition.” Brewers Association. Accessed March 3, 2020. https://www.brewersassociation.org/statistics-and-data/craft-brewer-definition/.

Dee, Thomas S. “State Alcohol Policies, Teen Drinking and Traffic Fatalities.” Journal of Public Economics 72. No. 2 (1999): 289–315.

Dieterle, C. Jarrett and Kevin Kosar. “GOP Tax Reform Impact on Booze.” January 2018. R Street Institute. https://www.rstreet.org/wp-content/uploads/2018/01/2018-R-Sheet-2-GOP-Tax-Reform-Impact-on-Booze.pdf.

DiNardo, John and Thomas Lemieux. “Alcohol, Marijuana, and American Youth: The Unintended Consequences of Government Regulation.” Journal of Health Economics 20. No. 6 (2001): 991–1010.

“Direct Shipment of Alcohol Bill Heading to Governor.” Richmond Register. March 28, 2020.

“‘Dry ‘Towns’ in the USA.” American Addiction Centers. Accessed March 3, 2020. https://www.alcohol.org/statistics-information/dry-towns/.

Ellig, Jerry and Patrick A. McLaughlin. “The Regulatory Determinants of Railroad Safety.” Review of Industrial Organization 49. No. 2 (2016): 371–98.

Elzinga, Kenneth G., Carol Horton Tremblay, and Victor J. Tremblay. “Craft Beer in the United States: History, Numbers, and Geography.” Journal of Wine Economics 10. No. 3 (2015): 242–74.

Eschner, Kat. “The Budweiser Clydesdales’ First Gig Was the End of Prohibition.” Smithsonian Magazine. March 28, 2017.

Fernandez, Jose, Stephan F. Gohmann, and Joshua C. Pinkston. “Breaking Bad in Bourbon Country: Does Alcohol Prohibition Encourage Methamphetamine Production?” Southern Economic Journal 84. No. 4 (2018): 1001–23.

Gamble, Richard. “‘Two Kaisers in the Same Grave’: Prohibition at 100.” Law & Liberty. October 1, 2019.

Gangitano, Alex. “Coronavirus Brings Quick Changes to State Alcohol Laws.” The Hill. April 1, 2020.

Gohmann, Stephan F. “Why Are There So Few Breweries in the South?” Entrepreneurship Theory and Practice 40. No. 5 (2016): 1071–92.

H.B. 168. 2015 Leg. Reg. Sess. (Kentucky 2015).

Holmes, Jack. “Will Arkansas’ Prohibition Finally End?” Daily Beast. Updated April 14, 2017.

Horpedahl, Jeremy. “Bootleggers, Baptists and Ballots: Coalitions in Arkansas’ Alcohol-Legalization Elections.” Public Choice. 2020. 1–17.

Kell, John. “Anheuser-Busch InBev Buys 9th Craft Brewer.” Fortune. November 3, 2016.

Kelleher, Kelly J. et al. “Alcohol Availability and Motor Vehicle Fatalities.” Journal of Adolescent Health 19. No. 5 (1996): 325–30.

Kimm, Victor, Joseph Cotruvo, and Arden Calvert. Drinking Water: A Half Century of Progress (EPA Alumni Association. 2016).

Koopman, Christopher and Adam C. Smith. “The Political Economy of Craft Beer in North Carolina (and Beyond).” Political Economy in the Carolinas 1 (2018): 76-98.

Lafontaine, Francine and Margaret Slade. “Vertical Integration and Firm Boundaries: The Evidence.” Journal of Economic Literature 45. No. 3 (2007): 680.

Lovenheim, Michael F. and Daniel P. Steefel. “Do Blue Laws Save Lives? The Effect of Sunday Alcohol Sales Bans on Fatal Vehicle Accidents.” Journal of Policy Analysis and Management 30. No. 4 (2011): 798.

Malone, Trey and Dustin Chambers. “Quantifying Federal Regulatory Burdens in the Beer Value Chain.” Agribusiness 33. No. 3 (2017): 2.

Malone, Trey and Jayson L. Lusk. “Brewing Up Entrepreneurship: Government Intervention in Beer.” Journal of Entrepreneurship and Public Policy 5. No. 3 (2016): 325–42.

Malone, Trey. “Craft Beer Revolution Is in Danger amid Coronavirus Crisis. Here’s What Can Help Save It.” USA Today. April 22, 2020.

Mast, Brent D., Bruce L. Benson, and David W. Rasmussen. “Beer Taxation and Alcohol-Related Traffic Fatalities.” Southern Economic Journal 66. No. 2 (1999): 214–49.

Morrill, Jim. “Craft Brewers Say This Document Shows the Distribution System Is ‘Rigged.’” Charlotte Observer. May 25, 2017.

“National Beer Sales & Production Data.” Brewers Association, accessed March 3, 2020, https://www.brewersassociation.org/statistics/nation-al-beer-sales-production-data/.

Okrent, Daniel. Last Call: The Rise and Fall of Prohibition (New York, NY: Simon and Schuster. 2010). 302.

“Percentage Change in Per Capita Alcohol Consumption, United States, 1977–2016.” National Institute on Alcohol Abuse and Alcoholism. Accessed March 3, 2020. https://pubs.niaaa.nih.gov/publications/surveillance110/fig3.htm.

“Position Statements.” Brewers Association. Accessed March 3, 2020. https://www.brewersassociation.org/government-affairs/position-statements/.

Rickard, Bradley J., Marco Costanigro, and Teevrat Garg. “Economic and social implications of regulating alcohol availability in grocery stores.” Applied Economic Perspectives and Policy 35. No. 4 (2013): 613-633.

Shogren, Jason F. “The Optimal Subsidization of Baptists by Bootleggers.” Public Choice 67. No. 2 (1990): 181–89.

Slodysko, Brian and Tom Davies. “Governor Signs Historic Indiana Sunday Alcohol Sales Bill.” South Bend Tribune. February 28, 2018.

Smith, Adam C. and Bruce Yandle. Bootleggers and Baptists: How Economic Forces and Moral Persuasion Interact to Shape Regulatory Politics. (Cato institute Press. 2014).189.

Smith, Adam. The Theory of Moral Sentiments. Ed. D. D. Raphael and A. L. Macfie (1759. Repr. Indianapolis: Liberty Fund. 1982).

Southern Baptist Convention. “On Alcohol Use in America.” Accessed Oct. 7 2020. http://media2.sbhla.org.s3.amazonaws.com/annuals/SBC_Annual_2006.pdf.

Stack, Martin and Myles Gartland. “The Repeal of Prohibition and the Resurgence of the National Breweries: Productive Efficiency or Path Creation?” Management Decision 43. No. 3 (2005): 422.

“Supplier gross revenue of alcoholic beverages in the United States from 2008 to 2019, by beverage type.” Statista. https://www.statista.com/statistics/237868/us-revenue-of-alcoholic-beverages-by-type/. Last accessed October 7, 2020.

Thomas, Jennifer. “Pending NC Legislation Could Signal End to Craft-Beer Battle over Self-Distribution Cap.” Charlotte Business Journal. March 14, 2019.

Thompson, Derek. “Craft Beer Is the Strangest, Happiest Economic Story in America.” The Atlantic. January 8, 2018.

Thornton, Mark. “Alcohol Prohibition Was a Failure” (Policy Analysis No. 157. Cato Institute. 1991). 4.

Tollison, Robert D. “Rent Seeking: A Survey.” Kyklos 35. No. 4 (1982): 575–602.

Toro-González, Daniel, Jill J. McCluskey, and Ron C. Mittelhammer. “Beer snobs do exist: Estimation of beer demand by type.” Journal of agricultural and resource economics (2014): 174-187.

Tullock, Gordon. “The Transitional Gains Trap.” Bell Journal of Economics 6. No. 2 (1975): 671–78.

Tullock, Gordon. “The Welfare Costs of Tariffs, Monopolies, and Theft.” Economic Inquiry 5. No. 3 (1967): 224–32.

Vallee, Bert L. “Alcohol in the Western World.” Scientific American 278. No. 6 (1998): 80–85.

Wagner, Richard E. Politics as a Peculiar Business: Insights from a Theory of Entangled Political Economy (Cheltenham, UK: Edward Elgar. 2016).

Whitman. Strange Brew: Alcohol and Government Monopoly (Oakland, CA: Independent Institute. 2003). 7.

Williams, Alistair. “Exploring the Impact of Legislation on the Development of Craft Beer.” Beverages 3. No. 2 (2017): 2.

Yandle, Bruce. “Bootleggers and Baptists in retrospect.” Regulation 22 (1999): 5.

Yandle, Bruce. “Bootleggers and Baptists—the Education of a Regulatory Economist.” Regulation 7. No. 3 (1983): 12–16.

Yörük, Barış K. and Ceren Ertan Yörük. “The Impact of Minimum Legal Drinking Age Laws on Alcohol Consumption, Smoking, and Marijuana Use: Evidence from a Regression Discontinuity Design Using Exact Date of Birth.” Journal of Health Economics 30. No. 4 (2011): 740–52.

Table of Contents

- Regulation and Entrepreneurship: Theory, Impacts, and Implications

- Regulation and the Perpetuation of Poverty in the US and Senegal

- Social Trust and Regulation: A Time-Series Analysis of the United States

- Regulation and the Shadow Economy

- An Introduction to the Effect of Regulation on Employment and Wages

- Occupational Licensing: A Barrier to Opportunity and Prosperity

- Gender, Race, and Earnings: The Divergent Effect of Occupational Licensing on the Distribution of Earnings and on Access to the Economy

- How Can Certificate-of-Need Laws Be Reformed to Improve Access to Healthcare?

- Land Use Regulation and Housing Affordability

- Building Energy Codes: A Case Study in Regulation and Cost-Benefit Analysis

- The Tradeoffs between Energy Efficiency, Consumer Preferences, and Economic Growth

- Cooperation or Conflict: Two Approaches to Conservation

- Retail Electric Competition and Natural Monopoly: The Shocking Truth

- Governance for Networks: Regulation by Networks in Electric Power Markets in Texas

- Net Neutrality: Internet Regulation and the Plans to Bring It Back

- Unintended Consequences of Regulating Private School Choice Programs: A Review of the Evidence

- “Blue Laws” and Other Cases of Bootlegger/Baptist Influence in Beer Regulation

- Smoke or Vapor? Regulation of Tobacco and Vaping

- Moving Forward: A Guide for Regulatory Policy