During the past four decades, competition has come to several industries previously thought to be natural monopolies, including previously unlikely candidates such as telephone service and cable TV. Economic studies generally show that, contrary to what natural monopoly theory would predict, competition has produced cost reductions, price reductions, and other consumer benefits.1For a sample of the relevant literature, see Robert W. Crandall, After the Breakup: U.S. Telecommunications in a More Competitive Era (Washington, DC: Brookings Institution, 1991); Robert W. Crandall and Jerry Hausman, “Competition in U.S. Telecommunications Services: Effects of the 1996 Legislation,” in Deregulation of Network Industries: What’s Next?, ed. Sam Peltzman and Clifford Winston (Washington, DC: AEI-Brookings Joint Center for Regulatory Studies, 1991); Robert W. Crandall and Jerry Ellig, Economic Deregulation and Customer Choice: Lessons for the Electric Industry (Fairfax, VA: Center for Market Processes, 1997); Thomas W. Hazlett, “Cable Television,” in Handbook of Telecommunications Economics: Technology Evolution and the Internet, ed. Sumit Majumdar et al. (Amsterdam: Elsevier Science, 2006); Thomas W. Hazlett, The Political Spectrum (New Haven, CT: Yale University Press, 2017). Indeed, competition in these industries has become explicit national policy.

In contrast, regulated monopoly remains the dominant paradigm for electricity retailing in the United States. Only in 13 states and the District of Columbia can most consumers choose their electricity supplier. These jurisdictions account for about one-third of the nation’s power production and consumption.2Philip R. O’Connor, “Restructuring Recharged: The Superior Performance of Competitive Electricity Markets 2008–2016” (white paper, Retail Energy Supply Association, Hummelstown, PA, April 2017), 12. Even in these states, electric distribution wires remain regulated monopolies. Direct competition between electric utilities that each own overlapping networks of distribution wires is quite rare. Retail competition—whether or not accompanied by competition in distribution—remains a controversial concept.

This chapter seeks to advance the policy discussion on electric competition by comparing the results of monopoly and competition in retail electricity sales. It reviews empirical research on two different models for achieving retail competition: competition between electricity retailers to serve customers who have access to a wires network that is a regulated monopoly, and duopolistic competition between electric utilities with overlapping wires networks. Under both models, competition is associated with substantial price reductions, substantial cost reductions, and some degree of innovative product differentiation.

Policymakers’ interest in retail electric competition tends to increase when new technologies push the cost of power from new plants below the average cost of power from old plants.3Severin Borenstein and James Bushnell, “The U.S. Electric Industry after 20 Years of Restructuring” (NBER Working Paper No. 21113, National Bureau of Economic Research, Cambridge, MA, April 2015). In recent years the US has seen significant reductions in the cost of gas-fired generation (largely because of fracking) and the cost of renewable sources.4Regarding fracking, see Catherine Hausman and Ryan Kellogg, “Welfare and Distributional Implications of Shale Gas,” Brookings Papers on Economic Activity, March 2015, 71–125. Regarding renewable energy, see Michael Giberson and L. Lynne Kiesling, “Governance for Networks: Regulation by Networks in Electric Power Markets in Texas,” chapter 14 in this volume. If history repeats itself, the availability of new, lower-cost power sources will lead to renewed interest in retail competition. Indeed, retail electric competition was the subject of a ballot initiative in Nevada in 2018; Virginia legislators introduced a bipartisan retail competition bill in January 2020; and retail competition has been proposed in South Carolina’s ongoing debate over privatization of Santee Cooper, the state-owned electric utility.5Kelsey Misbrener, “Energy Choice Coalition Supports New Virginia Energy Reform Act,” Solar Power World, January 9, 2020; “Nevada Question 3, Changes to Energy Market and Prohibit State-Sanctioned Electric-Generation Monopolies Amendment (2018),” Ballotpedia, accessed May 12, 2020, https://ballotpedia.org/Nevada_Question_3,_Changes_to_Energy_Market_and_Prohibit_State-Sanctioned_Electric-Generation_Monopolies_Amendment_(2018); Oran P. Smith and Michael T. Maloney, “Energizing Enterprise: How Energy Market Reforms in the Wake of the V.C. Summer Debacle Can Transform South Carolina’s Economy” (Report, Palmetto Promise Institute, November 2018); Jerry Ellig, “Selling Santee Cooper: Competition Should Be Part of the Plan,” Post and Courier (Charleston, SC), April 14, 2019. A review of the economic evidence on retail electric competition is thus clearly timely.

The Theory

The electric industry consists of four conceptually distinct functions that operated as monopolies in most of the United States for most of the 20th century: (1) power generation, (2) high-voltage transmission wires, (3) lower-voltage distribution wires, and (4) retail sales to customers.6The first two paragraphs in this section are based largely on Giberson and Kiesling, “Markets as Network Governance.” Readers are referred to that chapter for a more extensive discussion. Power generation was believed to be a natural monopoly because of economies of scale: it was less expensive for one firm to operate a few large power plants than for many firms to operate smaller power plants. Similarly, the wires businesses are still usually assumed to be natural monopolies on the grounds that having one set of wires is less expensive than having duplicate sets of wires. The retail sales function was typically bundled with the monopoly local distribution function, as there seemed to be little reason to have competing retailers when power generation and wires were both monopolies. In addition, all four functions were frequently operated together by vertically integrated monopolies because of economies of scope—primarily efficiencies stemming from the need for minute-by-minute coordination of power generation with power use.

Technological changes altered these relationships beginning in the 1980s. Economies of scale became a questionable argument for monopoly in generation as smaller cogenerators and gas-fired power plants became competitive with larger, utility-owned power plants. Economies of scope became a questionable argument for vertical integration as computers and communication technology reduced coordination costs, enabling competition first in bulk (wholesale) power markets and then in retail sales. Wires are still almost always regulated by federal and state governments as monopolies, although there are some examples of competing local distribution companies with competing wires (discussed below).

The mere existence of retail competition does not necessarily refute the claim that retail competition sacrifices economies of scale or scope. As a matter of economic theory, an industry can be a natural monopoly and nevertheless be vulnerable to inefficient competition. Protection from competition is required to ensure economic efficiency if the natural monopoly is “unsustainable,” which means a peculiar set of cost and demand conditions leads to the presence of competitors in the market even though one firm can serve the entire market at the lowest cost.7William J. Baumol, John C. Panzar, and Robert D. Willig, Contestable Markets and the Theory of Industry Structure (New York: Harcourt Brace Jovanovich, 1982), 192–208. Thus, it is possible in theory that competition in electricity retailing could lead to higher prices or other less-favorable contract terms than customers would receive from a regulated monopoly.

On the other hand, if retail electricity sales do not involve large economies of scale or scope, then retail competition (as opposed to regulated monopoly) could potentially improve economic welfare in at least three ways: (1) by providing more efficient pricing, (2) by bringing price reductions driven by cost reductions, and (3) by product differentiation. Efficient pricing of a homogeneous commodity promotes the allocative efficiency described in textbook models of competition. But since real-world competition is a rivalrous process of experimentation and discovery, competition can also generate productive efficiency—reductions in cost, improvements in productivity, and increased innovation that lead to price reductions and product differentiation.8F. A. Hayek, New Studies in Philosophy, Politics, Economics, and the History of Ideas (London: Routledge & Kegan Paul, 1978), chapter 12, “Competition as a Discovery Procedure.” On the distinction between allocative and productive efficiency, see W. Kip Viscusi, Joseph E. Harrington Jr., and John M. Vernon, Economics of Regulation and Antirust, 4th ed. (Cambridge, MA: MIT Press, 2005), 79–95.

More Efficient Pricing

Traditional public utility regulation tends to set prices equal to average costs, and it may also permit the utility to earn some monopoly profits. Prices that reflect marginal costs promote economic efficiency and enhance overall welfare.9Borenstein and Bushnell, “U.S. Electric Industry,” 10. Competition should be expected to eliminate monopoly profits and generate electricity prices that more closely reflect marginal costs—primarily the price of natural gas—instead of the utility’s average costs.10Jay Zarnikau and Doug Whitworth, “Has Electricity Utility Restructuring Led to Lower Electricity Prices for Residential Consumers in Texas?,” Energy Policy 34, no. 15 (2006): 2199–200. True marginal cost retail prices would vary minute by minute as wholesale prices change, and few customers currently see such prices, even where retail competition exists.11L. Lynne Kiesling, “Incumbent Vertical Market Power, Experimentation, and Institutional Design in the Deregulating Electricity Industry,” Independent Review 19, no. 2 (Fall 2014): 239–64. Kiesling describes experimental programs that show that consumers value and respond to real-time price signals when they have access to technology (smart meters) that enables them to preprogram their responses. However, one would expect prices in a competitive retail market to reflect marginal costs at least somewhat more closely than do prices set under rate-of-return regulation.

Of course, price increases due to spikes in marginal costs rarely seem like a benefit from the customer’s perspective. When marginal costs in competitive markets jump, average-cost pricing under monopoly regulation can look like a better deal for the consumer, even if it does misallocate resources. Nevertheless, competition could improve overall welfare by driving prices closer to marginal costs, even if competitive retail prices (based on marginal cost) sometimes exceed regulated monopoly prices (based on average cost).

Price Reductions

Inefficiencies created by public utility regulation are well known in the economics literature. On the one hand, rate-of-return regulation can increase the regulated firm’s costs by promoting an inefficient substitution of capital for labor.12Harvey Averch and Leland L. Johnson, “Behavior of the Firm under Regulatory Constraint,” American Economic Review 52 (December 1962): 1052–69. On the other hand, utility regulation may diminish the firm’s incentive to invest if the regulator cannot credibly commit that it will not expropriate the value of the firm’s investments after these investments are made.13Graeme Guthrie, “Regulating Infrastructure: The Impact on Risk and Investment,” Journal of Economic Literature 44, no. 4 (December 2006): 925–72. Utility regulation can reduce a firm’s incentive to cut costs or innovate more generally, because the firm’s rates are periodically adjusted to eliminate the profits from innovation.14M. E. Beesley and Stephen C. Littlechild, “The Regulation of Privatized Monopolies in the United Kingdom,” Rand Journal of Economics 20, no. 3 (1989): 454–72; Mark W. Frank, “An Empirical Analysis of Electricity Regulation on Technical Change in Texas,” Review of Industrial Organization 22 (2003): 313–31; Israel Kirzner, Discovery and the Capitalist Process (Chicago: University of Chicago Press, 1985), chapter 6: “The Perils of Regulation: A Market Process Approach.” In addition, protection from competition can also diminish a utility’s incentive to control costs or innovate because it does not have to fear losing business to competitors; economists call this type of efficiency “X-efficiency.”15Harvey Leibenstein, “Allocative Efficiency versus ‘X-efficiency,’” American Economic Review 56 (1966): 392–413; Rodney Stevenson, “X-inefficiency and Interfirm Rivalry: Evidence from the Electric Utility Industry,” Land Economics 58, no. 1 (1982): 52–66. If these inefficiencies are sufficiently large, the introduction of competition can reduce costs, improve productivity, and increase service innovation.

Product Differentiation

If customers value differentiated electricity products, then competition creates the opportunity for diverse electricity providers to provide additional features, services, or quality attributes. Competition is the process that allows different retailers to offer additional features or services in order to discover which ones have enough value to customers to justify their costs.

MIT economics professor Paul Joskow notes several ways retailers might add value, such as by providing less expensive metering, billing, or customer service; by procuring power at lower cost; by installing more sophisticated metering and control technology; by offering products that let customers hedge risks; by supplying green power; and by offering products, applications, and services “behind the meter.” He also argues that many value-added functions retailers fulfill in other industries—such as providing more convenient locations, offering more convenient delivery options, maintaining inventories, offering complementary products, providing point-of-sale service, providing post-sale service or returns, providing information about the product, and negotiating quantity discounts with manufacturers—are not very relevant in electricity. He recommends that retailers be allowed to compete but doubts that differentiated services will be attractive to many smaller customers.16Paul L. Joskow, “Why Do We Need Electricity Retailers? Or Can You Get It Cheaper Wholesale?” (working paper, Harvard Electricity Policy Group, 2000).

Stephen Littlechild, a University of Cambrdge professor who headed the United Kingdom’s electricity regulatory agency from 1989-98, expresses a more sanguine view of the potential for product differentiation, noting that experiences in the Untied Kingdom and elsewhere suggest that consumers value fixed-price contracts, smoothed payment plans, and the bundling of electricity and gas.17Stephen C. Littlechild, “Wholesale Spot Price Pass-Through,” Journal of Regulatory Economics 23, no. 1 (2003): 71. Choice experiments provide additional insight about the potential for product differentiation in electricity retailing. A study published in The Energy Journal in 2019 finds that noticeable percentages of small and medium-sized commercial and industrial customers express a positive willingness to pay more for service from a company they are familiar with, service from a company with a local office, electricity generated from renewable sources, a choice of payment options, customized billing, a website that provides usage information, a real person answering customer service calls instead of a voice response system, a package that bundles electricity with other products such as other fuels or warranties, or service from a company that earmarks funds for local economic development or local charities. Signup bonuses are generally viewed negatively. The majority of customers regard variable rates and one-, two-, or three-year contracts negatively, but a sizeable minority value these kinds of arrangements.18Andrew A. Goett, Kathleen Hudson, and Kenneth E. Train, “Customers’ Choice among Retail Energy Suppliers: The Willingness-to-Pay for Service Attributes,” Energy Journal 21, no. 4 (2000): 1–28.

Whether competition in retail electricity supply enhances or diminishes economic welfare is ultimately an empirical question. Studies of formerly monopolized or cartelized network industries that were restructured to introduce competition typically find that competition leads to more efficient pricing, and that it also generates innovative cost reductions, productivity gains, and nonprice competition.19Crandall, After the Breakup; Crandall and Ellig, Economic Deregulation; Crandall and Hausman, “Competition in U.S. Telecommunications”; Hazlett, Political Spectrum; Jerry Ellig, “Railroad Deregulation and Consumer Welfare,” Journal of Regulatory Economics 21, no. 2 (2002): 143–67; Clifford Winston, “U.S. Industry Adjustment to Economic Deregulation,” Journal of Economic Perspectives 12 (1998): 89–110; Clifford Winston, “Economic Deregulation: Days of Reckoning for Microeconomists,” Journal of Economic Literature 31 (1993): 1263–89. Thus, there is ample reason to consider whether retail electric competition has produced some of the same kinds of benefits.

Retail Competition with Monopoly Distribution: General Trends

Retail electric competition became a subject of significant debate in Washington, DC, and in state capitals during the 1990s. All states that implemented some form of retail competition continued to treat the wires used for long-distance transmission and local distribution as regulated monopolies. Power generation and marketing to retail customers were opened to competition.

There are, however, significant differences across state electricity restructuring plans. California enacted a sweeping restructuring law in 1996, then reversed course after wholesale prices spiked in 2000 and 2001. Michigan restructured but then capped the size of competitive sales at 10 percent of the market in 2009.20Michael Giberson and Arthur R. Wardle, “The Consequences of Retail Electric Choice in the United States: An Assessment of Empirical Studies” (working paper, Center for Growth and Opportunity, September 2019 draft), 6. Texas enacted the most extensive plan in 1999, allowing approximately 8 million customers in the region covered by the Electric Reliability Council of Texas to choose their electricity suppliers. Unlike the other states with retail competition, Texas utilities do not offer a regulated default service for customers who decline to switch providers; such service has served as a barrier to entry in other states that have sought to implement retail competition.21Kiesling, “Incumbent Vertical Market Power.”

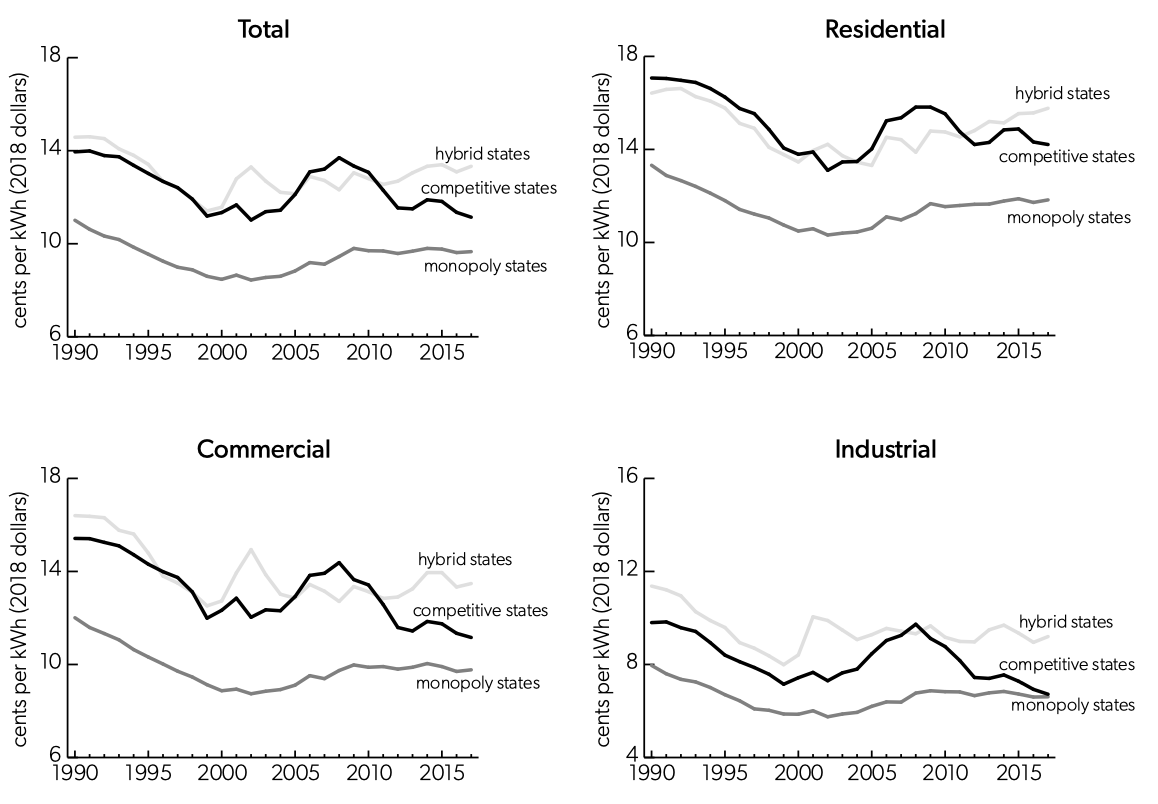

States can be divided roughly into three groups according to the extent of retail electric competition. Figure 1 shows weighted average electricity price trends for each group of states (in inflation-adjusted 2018 dollars). These data show the delivered price of electricity to customers (in other words, the total cost including wires charges). Therefore, the comparisons capture any effects of retail competition on economies of scale or scope that might ultimately affect the price paid by the customer. The cost of producing the electric power is generally less than half of the total cost of the delivered price.

Figure 1. Electricity Price Trends (Delivered Price of Electricity)

Note: “Competitive” states are Connecticut, Delaware, Illinois, Massachusetts, Maine, Maryland, New Hampshire, New Jersey, New York, Ohio, Pennsylvania, Rhode Island, and Texas; this category also includes Washington, DC. “Hybrid” states are Arizona, California, Michigan, Montana, Nevada, and Oregon. The rest of the states are “monopoly” states. (Alaska and Hawaii are excluded.)

Source: Author’s calculations using data from the US Energy Information Administration, “Electricity” (database), accessed November 13, 2019, https://www.eia.gov/electricity/data.php.

Thirteen states and the District of Columbia currently allow most customers to choose their power suppliers;22O’Connor, “Restructuring Recharged,” 13. these states are labeled “competitive” in figure 1. Arizona, California, Michigan, Montana, Nevada, and Oregon allow competition for a limited portion of the total load; these are the “hybrid” sates. The remaining states are the “monopoly” states. (Alaska and Hawaii are excluded because they have very high electricity prices owing to their unique geographic circumstances.) In a study conducted for the Retail Energy Supply Association, former Illinois Commerce Commission Chairman Philip O’Connor contended that the electric utilities’ costs in the hybrid states are largely driven by regulation, since a minority of the market is open to competition.23O’Connor, “Restructuring Recharged,” 12. His price comparisons include the hybrid states with the monopoly states. But, as figure 1 reveals, price levels and the pattern of price changes differ visibly in the hybrid and the competitive states, so in this chapter prices for these two groups are shown separately.

Figure 1 shows that electricity prices were falling in all three kinds of states during the 1990s. This occurred largely because of the lower marginal cost of new generation, primarily fueled by natural gas. The pattern was similar across all states, since the regulated monopoly model prevailed everywhere during that time. However, the states that eventually became the competitive and the hybrid states had substantially higher electricity prices than the states where retail sales remained a monopoly; indeed, the relatively high prices may have motivated the interest in competition and may be part of the reason the competitive states experienced price reductions.

During the transitional period to competition (roughly 1998–2008 for most states), the competitive and hybrid states implemented restructuring plans that opened retail markets to competition. Figure 1 shows that prices in these states became more volatile than prices in the monopoly states. Most of the empirical evidence suggests that retail competition aligned retail prices more closely with fluctuating marginal costs—usually the price of natural gas.24Giberson and Wardle, “Consequences of Retail Electric Choice,” 12. The primary exception comes from a study of Connecticut, which found that retail prices tracked the utilities’ regulated rate for “standard offer service” more closely than they tracked wholesale electricity prices.25Giberson and Wardle, 20–21.

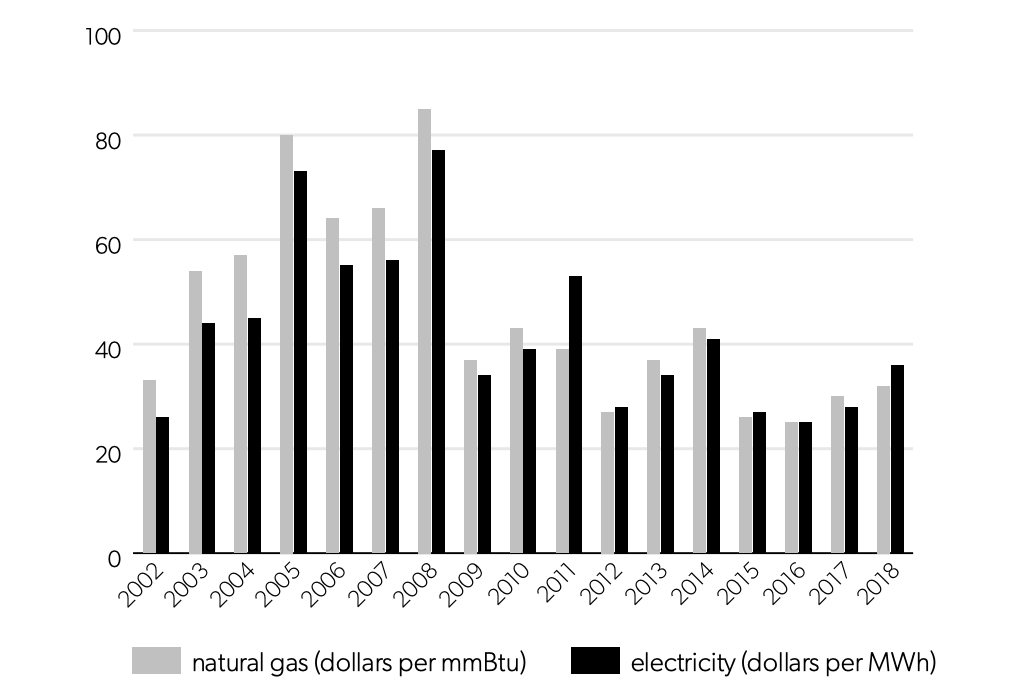

In California, prices spiked owing to supply shortages and manipulation of the wholesale power market in 2001 and 2002. These California price spikes largely account for figure 1’s spikes in the weighted average price of electricity in the hybrid states for those years. The competitive states experienced price increases later, between 2002 and 2008. These increases largely reflect the fact that the price of natural gas more than doubled during this period, from $3.32 per million British thermal units (mmBtu) in 2002 to $8.50 per mmBtu in 2008.262018 State of the Market Report for the ERCOT Electricity Markets (Fairfax, VA: Potomac Economics, June 2019), 5.

In a survey of published academic literature on electricity restructuring, Northeastern University economist John Kwoka concluded that academic studies of the early years of electricity restructuring could not adequately separate the effects of fuel price changes, excess generation capacity, mandatory rate reductions, price caps, stranded cost recovery mechanisms, and other transitional issues to determine what, if any, price effects could be attributed to restructuring.27John Kwoka, “Restructuring the US Electric Power Sector: A Review of Recent Studies,” Review of Industrial Organization 32, no. 3–4 (2008): 165–96. Most competitive states retained rate caps until at least 2007, which tended to blunt customers’ incentive to shop for better electricity prices.28Giberson and Wardle, “Consequences of Retail Electric Choice,” 13–14.

By 2008, however, nonutilities owned a substantial amount of generation and served a substantial number of customers in the competitive states, and transitional issues had largely been resolved. Eight years later, nonutility competitors served almost three-quarters of the load that was eligible to switch in the 13 competitive states and DC, including 49 percent of residential customers.29O’Connor, “Restructuring Recharged,” 13–16. As figure 1 shows, after 2008 the price trend in competitive states diverges significantly from the trend in the hybrid and the monopoly states. Prices in competitive states declined steeply after 2008, whereas prices in hybrid and monopoly states generally increased. Residential, commercial, and industrial customers all received price reductions in the competitive states. Table 1 shows the percent change in prices between 2008 and 2017 in all three types of states.

This comparison suggests that retail competition, when fully implemented, may have generated significant price reductions. But raw price data are only suggestive. Prices in many competitive electricity markets are lower than prior regulated prices, but that information alone does not tell us how much of the price difference is due to competition. Prices in competitive markets tend to be higher than prices in monopoly markets, but it would be erroneous to conclude that competition increases prices. Prices in the competitive states were higher than prices in the monopoly states before the former introduced competition. Numerous other factors that could affect prices in the two sets of markets may not be the same.

Table 1. Weighted Average Electricity Percent Changes in Price, 2008-2017

Source: Author’s calculations using data from the US Energy Information Administration, “Electricity” (database), accessed May 12, 2020, https://www.eia.gov/electricity/data.php.

An accurate assessment of the effects of competition requires a comparison of prices paid in competitive markets to a relevant counterfactual estimate of what the prices would have been in the absence of competition.30L. Lynne Kiesling, “Retail Restructuring and Market Design in Texas,” in Electricity Restructuring: The Texas Story, ed. L. Lynne Kiesling and Andrew N. Kleit (Washington, DC: AEI Press, 2009), 171–72. Two types of scholarly studies attempt to identify a relevant counterfactual by controlling for other factors that could increase electricity prices. Some compare price trends in competitive and monopoly states after controlling for other factors that influence prices. Others focus on the pattern of prices over time in a single state.

The studies comparing monopoly and competitive states generally find that competition is associated with at least small price reductions for residential customers. Some of these studies find no change in commercial or industrial rates, but one study finds that commercial and industrial rates fell too.31Giberson and Wardle, “Consequences of Retail Electric Choice,” 15–17.

Single-state studies have been conducted on Illinois, Ohio, and Texas. The Illinois study found that Illinois avoided price increases that affected neighboring states between 1997 and 2007, and the authors argue that this result can be attributed to competition in Illinois. A study of Ohio found that restructuring is associated with increased prices in parts of the state where utilities did not divest their generation assets to independent companies, but competition is associated with price reductions in the service territory of Duke Energy, which did divest its generation assets.32Giberson and Wardle, “Consequences of Retail Electric Choice,” 14–19. (Multiple studies of Texas will be discussed in the following section.)

One study assesses the extent of product differentiation in competitive versus noncompetitive states. Competitive states have more customers selecting green power and dynamic pricing.33Mathew J. Morey and Laurence D. Kirsch, “Retail Choice in Electricity: What Have We Learned in 20 Years?” (report, Christensen Associates Energy Consulting LLC for Electric Markets Research Foundation, February 11, 2016).

The available scholarly evidence suggests that well-designed and fully implemented retail competition programs more closely align prices with marginal costs, can reduce prices below the level where they would be in the absence of competition, and might promote some product differentiation. But attaining these results depends crucially on whether the competition program is well designed and fully implemented. For this reason, it is instructive to take a closer look at the two states commonly regarded as retail competition’s most significant success and most spectacular failure. The most notable success occurred in the state of Texas, where approximately 8 million residential, commercial, and industrial customers have the right to choose their power supplier.34“About ERCOT,” Electric Reliability Council of Texas website, accessed May 12, 2020, http://www.ercot.com/about. The most spectacular failure occurred in California, where skyrocketing electricity prices bankrupted one of the largest utilities in the state and led to the recall of Governor Gray Davis and the election of Governor Arnold Schwarzenegger in 2003.

The Texas Success

Texas is widely recognized for achieving the most extensive retail electric competition in the United States.35Borenstein and Bushnell, “U.S. Electric Industry,” 9. Texas introduced electric competition in the portion of the state covered by the Electric Reliability Council of Texas (ERCOT). The transmission grid in the ERCOT region is completely under the jurisdiction of the state; hence, the state of Texas has jurisdiction to regulate wholesale transactions as well as retail transactions within ERCOT.36For more detailed descriptions of ERCOT, see Giberson and Kiesling, “Markets as Network Governance”; David Spence and Darren Bush, “Why Does ERCOT Have Only One Regulator?,” in Electricity Restructuring: The Texas Story, ed. L. Lynne Kiesling and Andrew N. Kleit (Washington, DC: AEI Press, 2009).

The Texas Restructuring Plan

Texas enacted its electricity restructuring bill in 1999. Senate Bill 7 allowed the approximately 60 electric co-ops and 50 municipal utilities within ERCOT to opt in to competition;37Jay Zarnikau, “A Review of Efforts to Restructure Texas’ Electricity Market,” Energy Policy 33 (2005): 15. most of them declined to do so. Indeed, in 2018 Lubbock Power & Light became the first municipal utility to opt in to competition. The switch will occur once the construction of transmission interconnections with ERCOT is completed in 2021.38“The ERCOT Solution,” Lubbock Power & Light, accessed May 12, 2020, http://lpandl.com/ercot/.

Vertically integrated utilities were separated into a transmission and distribution utility, a power generation company, and a retail electricity provider. No generator was allowed to own generation capacity exceeding 20 percent of the load in its service territory.39Kiesling, “Incumbent Vertical Market Power,” 156–57.

Retail competition began in 2002. For five years, each utility’s marketing affiliate was required to offer residential and small commercial customers in its service territory a regulated “price to beat” that was set 6 percent below 1999 rates. After three years or after the utility lost 40 percent of its customers to competitors, the utility’s marketing affiliate was permitted to offer service at rates below the price to beat.40Pat Wood III and Gürcan Gülen, “Laying the Groundwork for Power Competition in Texas,” in Electricity Restructuring: The Texas Story, ed. L. Lynne Kiesling and Andrew N. Kleit (Washington, DC: AEI Press, 2009), 30.

The price to beat could be adjusted twice yearly for changes in fuel costs.41Kiesling, “Retail Restructuring,” 166. This provision was critical because natural gas accounts for approximately half of the electric power consumed in Texas,42Public Utility Commission of Texas, “Scope of Competition in Electric Markets in Texas” (Report to the 85th Legislature, Austin, TX, January 2017), 15. and gas-fired plants are the marginal source of power about 85 percent of the time.43Zarnikau and Whitworth, “Has Electric Utility Restructuring Led to Lower Electricity Prices?,” 2193. If the regulated default price were not flexible, competitors would be reluctant to enter the market, because they would have to compete against an artificially low regulated price when the cost of gas is high. An inflexible regulated retail price also could have led to financial stress or even bankruptcy for the incumbent utilities as wholesale prices fluctuated.44Wood and Gülen, “Laying the Groundwork,” 30; Zarnikau, “Review of Efforts,” 20.

Substantial new generation entered the market in the years before competition. Between 1995 and 2000, 5,700 megawatts of new power plant capacity were built. Most of these plants were built by nonutility generators. The Texas wholesale power market is based largely on confidential, bilateral contracts rather than on a centralized spot market. ERCOT does operate an auction market for balancing energy and for ancillary services such as reserves.45Zarnikau, “Review of Efforts,” 30.

Price Trends

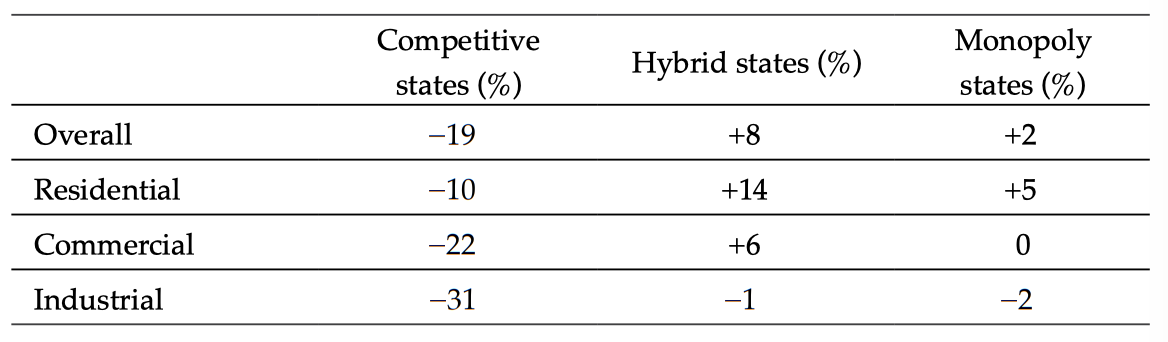

Figure 2 compares inflation-adjusted electricity price trends in Texas and in the monopoly states between 1990 and 2017. Texas residential and commercial customers paid higher prices than their counterparts in monopoly states during the decade when competition was being debated (1990–1999). Prices became more volatile during the transition years, 2000–2007. Texas prices peaked in 2008, then declined so sharply that the average price in Texas was below the price in monopoly states after 2012.

Figure 2. Price Trends in Texas vs. Monopoly States (Delivered Price of Electricity)

Source: Author’s calculations using data from the US Energy Information Administration, “Electricity” (database), accessed November 13, 2019, https://www.eia.gov/electricity/data.php.

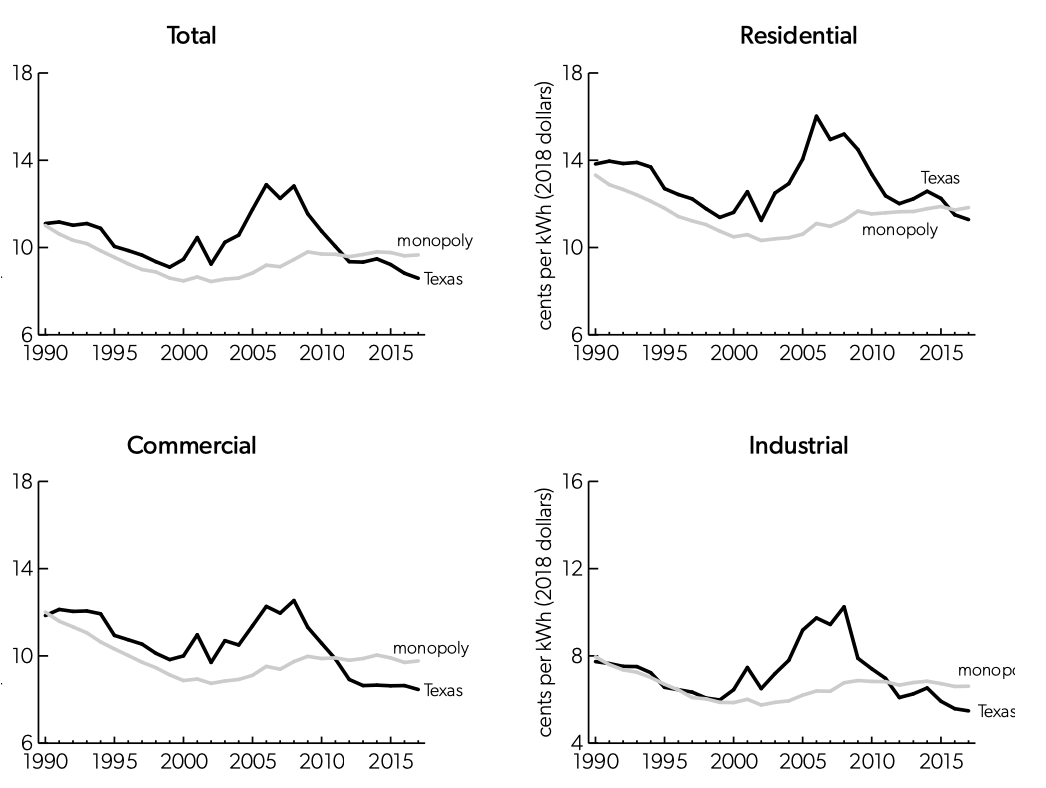

Figure 3. Texas Electricity Rates in 2018 vs. Last Regulated Rate

Source: Public Utility Commission of Texas, “Scope of Competition in Electric Markets in Texas” (Report to the 86th Legislature, Austin, TX, January 2019), 3.

Every two years, the Public Utility Commission of Texas produces a report for the Texas legislature on competition in the electric industry. Figure 3 shows that in 2018, the average price for residential power plans in all five ERCOT distribution regions was between 10 and 24 percent below the last regulated price. The least expensive 12-month fixed price plan offered even larger savings.

Efficient Pricing

The available evidence suggests that under competition, the price of electricity is more closely linked to the price of natural gas. Figure 4 shows that wholesale electricity prices in ERCOT’s real-time balancing market have tracked natural gas prices in most years since 2001. Gas prices dropped substantially after 2008, largely because of fracking technology.46Hausman and Kellogg, “Welfare and Distributional Implications.”

Figure 4. Average Real-Time Energy Prices and Natural Gas Prices in the Electric Reliability Council of Texas Region

Source: 2018 State of the Market Report for the ERCOT Electricity Markets (Fairfax, VA: Potomac Economics, June 2019), 5.

Competition and the fuel cost adjustments in the regulated price to beat conveyed these changes in the marginal cost of power to customers. Raw data show that Texas retail electricity prices have generally tracked wholesale prices since 2002.47Figure 4 in Giberson and Kiesling, “Markets as Network Governance.” The advent of retail electric competition in 2002 was followed by a run-up in the price of natural gas in 2003 and 2004, which led to increases in wholesale prices, the regulated price to beat, and the offers from competitive retail electricity providers.48Linhong Kang and Jay Zarnikau, “Did the Expiration of Retail Price Caps Affect Prices in the Restructured Texas Electricity Market?,” Energy Policy 37, no. 5 (2009): 1713–14. As a result, a study published in Energy Policy in 2006 concluded that residential consumers in Texas markets open to competition paid more for electricity than consumers in Texas’s monopoly markets in 2002–2004.49Zarnikau and Whitworth, “Has Electric Utility Restructuring Led to Lower Electricity Prices?,” 2200. Because the price to beat was more directly linked to natural gas prices than were traditional regulated prices, the price to beat increased faster than prices in regulated monopoly markets between January 2002 and December 2004. Residential consumers who switched providers paid lower rates than the price to beat, but only 18 percent had done so by September 2004.50Public Utility Commission of Texas, “Scope of Competition in Electric Markets in Texas” (Report to the 79th Legislature, Austin, TX, January 2005), 60.

In some cases, the price to beat allowed the utility to over-recover its costs; for example, one utility was permitted a 23.4 percent increase in the price to beat because gas prices increased 23.4 percent, even though gas-fired plants accounted for only 42 percent of the company’s power supply.51Robert W. Michaels, “Competition in Texas Electric Markets: What Texas Did Right & What’s Left to Do” (report, Texas Public Policy Foundation, Austin, TX, March 2007), 9. This occurred because the Public Utility Commission of Texas recognized that the marginal cost of gas-fired generation sets the price in a competitive market.52Kiesling, “Retail Restructuring,” 158–59.

An econometric study using more recent data finds that retail prices more closely reflect marginal costs in the state’s competitive markets than in the monopoly markets. The econometric analysis covers the years 2002–2016 and examines pricing trends for customers using 1,000 kilowatt-hours (kWh) of power per month. The authors analyzed factors that affect prices in the five competitive regions of ERCOT and eight noncompetitive markets: the territories served by two investor-owned utilities, three co-ops, and three municipal utilities. In all five competitive regions, retail residential prices are positively correlated with the wholesale price of power and utility wages. In other words, retail prices vary with marginal costs, as one would expect in a competitive market. Retail prices are positively correlated with wholesale electricity prices in only three of the noncompetitive markets and positively correlated with wages in only one of the noncompetitive markets.53Peter R. Hartley, Kenneth B. Medlock III, and Olivera Jankovska, “Electricity Reform and Retail Pricing in Texas,” Energy Economics 80 (2019): 1–11.

The study also examines the efficiency of pricing for commercial customers. Analysis using a sample of commercial rates gathered directly from customers shows that between 2005 and late 2009, commercial rates in competitive markets were above commercial rates in noncompetitive markets. Between late 2009 and 2016, commercial rates in competitive markets fell below commercial rates in noncompetitive markets by an ever-widening amount. The authors conclude that commercial rates more closely track wholesale prices in the competitive markets, and commercial customers in noncompetitive markets are likely cross-subsidizing other customers.54Hartley, Medlock, and Jankovska, “Electricity Reform,” 10.

Price Reductions

Several empirical studies have attempted to identify the price effect of retail competition in Texas after controlling for other factors that could influence prices. One early study found that competition likely reduced prices for larger customers but not for residential customers.55Zarnikau and Whitworth, “Has Electric Utility Restructuring Led to Lower Electricity Prices?”

Competition appears to have placed a significant constraint on prices only after the regulated price to beat was eliminated in 2007. A 2009 study found that the disappearance of the price to beat is associated with a drop in residential electricity prices of about 2.3–2.4 cents per kWh, or roughly 19–20 percent. There are several reasons why elimination of a price cap could be associated with lower prices. Natural gas prices peaked above 11 cents per mmBtu in 2005 and dropped below 6 cents per mmBtu in 2006, but the price to beat did not drop as quickly as the price of natural gas and was likely above the competitive level. Once it was eliminated, retail electricity providers competed against each other instead of competing against the artificially high price to beat. Alternatively, the existence of the cap may have reduced the profitability of entry and increased uncertainty for competitive providers, thus discouraging entry and constraining competition until the price to beat was eliminated.56Kang and Zarnikau, “Did the Expiration Affect Prices?”

A 2019 study found evidence that competition has spurred retail cost reductions. A time trend variable in the econometric analysis reveals that the spread between retail and wholesale prices in competitive regions declined after the regulated price to beat expired in January 2007. The regression results indicate that the spread between retail and wholesale prices in competitive regions fell by between 0.6 cents and 2.0 cents per kWh between 2007 and 2016. By comparison, this spread increased over time in three of the noncompetitive regions and was unchanged in four others.57Hartley, Medlock, and Jankovska, “Electricity Reform,” 9. Thus, the existence of competition is associated with a noticeable reduction in retailers’ nonenergy costs over time.

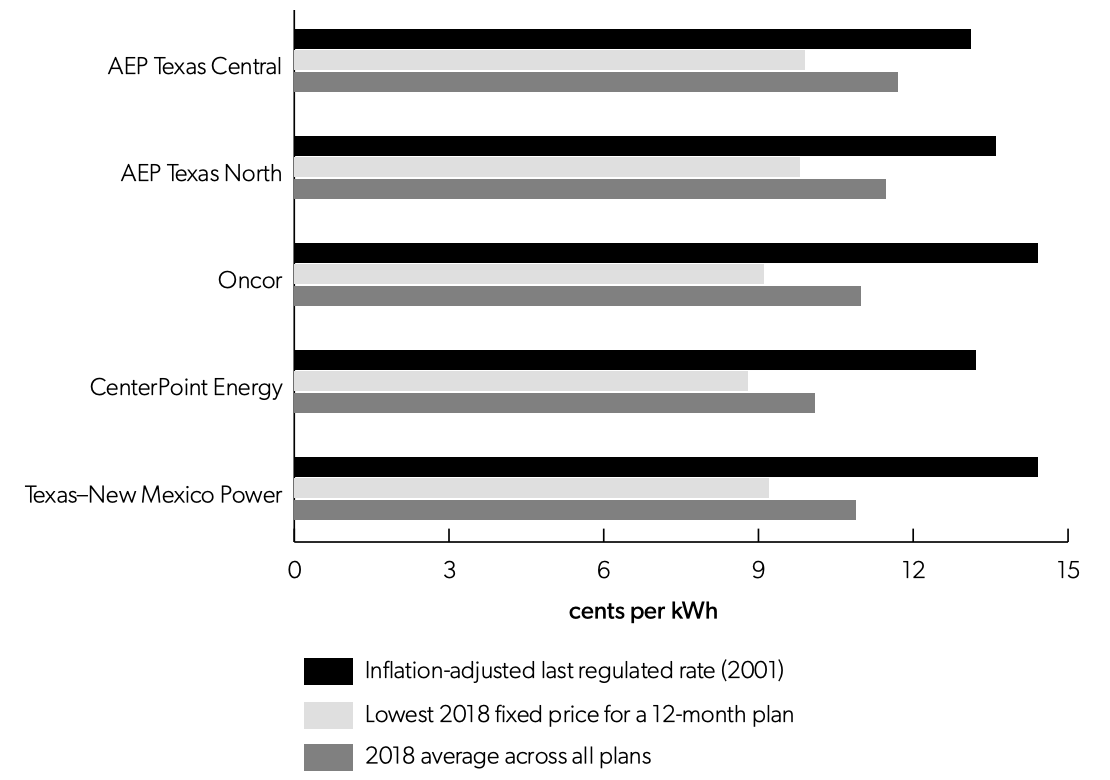

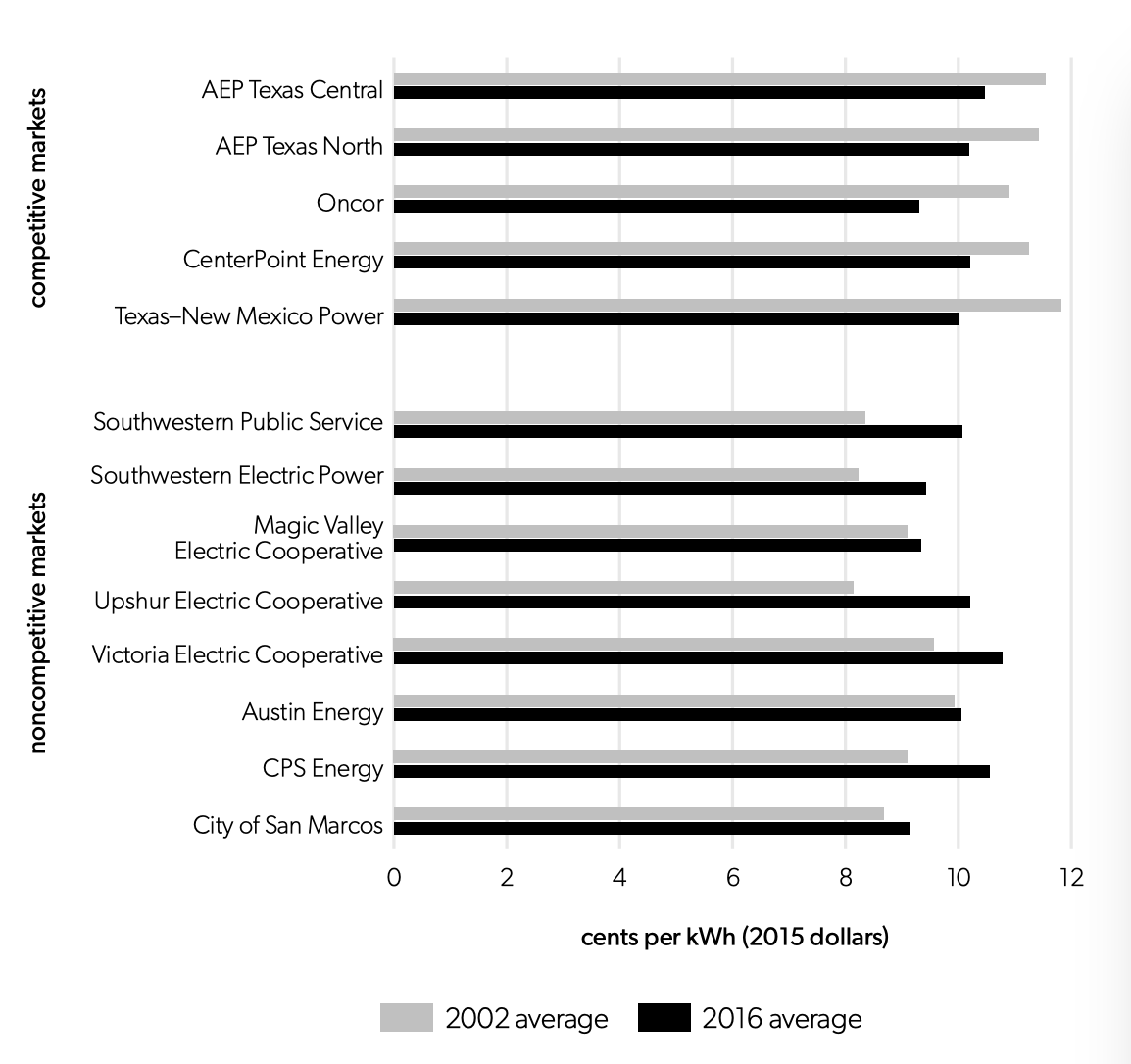

The raw data in figure 5 provide a visualization of the econometric results. At the advent of competition in 2002, retail prices in the five competitive markets were higher than retail prices in the eight noncompetitive markets. By 2016, inflation-adjusted retail prices had fallen in the competitive markets by between 1.04 cents and 1.82 cents per kWh. During that same time period, retail prices rose in the noncompetitive markets by between 0.23 cents and 2.07 cents per kWh. Between 2002 and 2016, wholesale prices fell by between 0.55 cents and 1.10 cents per kWh, depending on the wholesale region. Thus, retail prices in competitive markets fell by more than the wholesale price, at the same time that retail prices were rising in the noncompetitive markets.

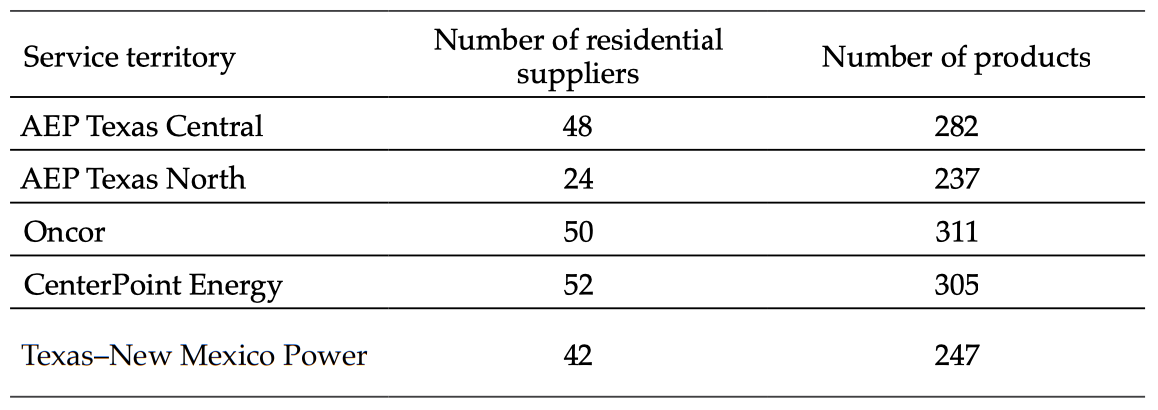

Product Differentiation

The ability to choose among differentiated products can be a source of value to customers in addition to competition’s effect on prices. Although retail electricity providers in Texas did not initially offer a lot of differentiated products,58Kiesling, “Retail Restructuring,” 163; Zarnikau, “Review of Efforts,” 24. product differentiation has expanded as the market has matured. As table 2 shows, in the competitive regions, residential customers could choose from between 24 and 51 different suppliers offering hundreds of different products in 2018. Product offerings include 100 percent renewable energy, time-of-use pricing, free electricity on weekends, prepaid plans, and price guarantees lasting from 1 to 60 months.59Public Utility Commission of Texas, “Scope of Competition in Electric Markets in Texas” (Report to the 86th Legislature, Austin, TX, January 2019), 3. By 2018, 94 percent of residential customers, 94 percent of small nonresidential customers, and 98 percent of large nonresidential customers had affirmatively chosen an electricity supplier at least once.60Electric Reliability Council of Texas, “Supplemental Information: Retail Electric Market, September 2017–September 2018,” PowerPoint file, accessed May 12, 2020, http://ercot.com/content/wcm/key_documents_lists/89277/Observed_Selection_of_Electric_Providers_September_2018.ppt.pptx.

Figure 5. Average Electricity Rates in 2002 and 2016 (Adjusted for Inflation), 1,000 kWh

Source: Table 1 in Peter R. Hartley, Kenneth B. Medlock III, and Olivera Jankovska, “Electricity Reform and Retail Pricing in Texas,” Energy Economics 80 (2019): 7.

Table 2. Number of Retail Suppliers and Products in Texas, 2018

Source: Public Utility Commission of Texas, “Scope of Competition in Electric Markets in Texas” (Report to the 86th Legislature, Austin, TX, January 2019), 2.

The California Debacle

California enacted its restructuring law in 1996. California did not fare nearly as well as Texas during its brief experiment with retail electric competition.

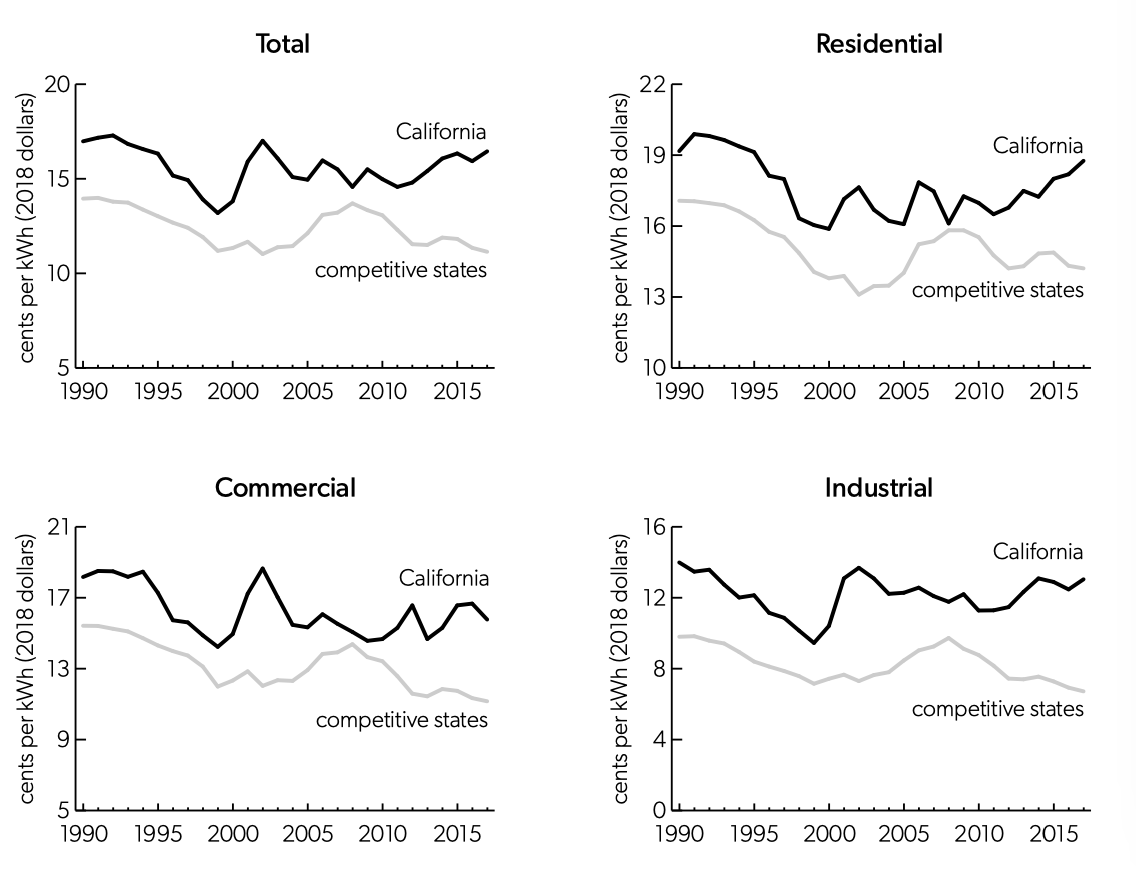

Figure 6 shows that California’s electricity prices have always been substantially higher than the prices in the states where retail competition currently exists. Prices fell steadily until 1998 or 1999, then rose modestly for a year or two. Prices spiked in 2001 and 2002, especially for commercial and industrial customers. California prices began to rise after 2008 for residential customers and after 2010 for commercial and industrial customers. Prices in states with retail competition began a steady decline after 2008.

Figure 6. Price Trends in California vs. Competitive States (Delivered Price of Electricity)

Source: Author’s calculations using data from the US Energy Information Administration, “Electricity” (database), accessed November 13, 2019, https://www.eia.gov/electricity/data.php.

The atypical behavior of prices in California stems directly from unique features of the California market design. Customers were guaranteed price reductions, even if they did not shop around. They received the option to purchase power at a rate equal to 90 percent of the regulated rate in 1996.61Frank A. Wolak, “Diagnosing the California Electricity Crisis,” Electricity Journal 16, no. 7 (2003): 16. Unlike Texas, with its adjustable price-to-beat mechanism, California provided for little retail price flexibility to accommodate fluctuations in the marginal cost of producing electricity. The retail price of electricity (not including transmission and distribution charges) was capped at about 6 cents per kWh.62Severin Borenstein, “The Trouble with Electricity Markets: Understanding California’s Restructuring Disaster,” Journal of Economic Perspectives 16, no. 1 (2002): 193. These provisions discouraged new competitors from serving the residential market, so most residential customers continued to buy electricity from the incumbent utilities at a fixed price.

The three investor-owned California utilities—Pacific Gas and Electric, Southern California Edison, and San Diego Gas & Electric—were required to purchase all power in a state-mandated, day-ahead wholesale spot market. They retained no right to buy power under long-term contracts from generation facilities that they divested. The combination of inflexible retail prices and fluctuating wholesale prices left the utilities exposed to substantial financial risk, which they did not hedge.63Wolak, “Diagnosing the California Electricity Crisis,” 17–18. The wholesale market commenced operation on April 1, 1998.64Borenstein, “Trouble with Electricity Markets,” 195.

Generators selling in the wholesale market learned that higher bids would not lead to a significant reduction in the quantity sold. The capped retail prices did not signal to consumers when power became more scarce. Since utilities were obligated to satisfy consumer demand at the fixed retail price, they had to procure sufficient power regardless of the wholesale price. The absence of demand response allowed generators to exercise market power by withholding supply and bidding high prices.

Unique features of California’s electricity supply situation also made it easier for generators to exercise market power in 2000 and 2001. Just 672 megawatts of new power plants were built during 1995–2000 in the run-up to competition. California is heavily dependent on power imports from neighboring states, and hydroelectric power accounted for 20–25 percent of California’s total supply. Owing to a dryer-than-normal year, hydroelectric imports in 2000 were 47 percent below their level in 1999.65Wolak, “Diagnosing the California Electricity Crisis,” 20–21. Because there was less supply available on the market, individual generators had greater ability to influence prices by withholding supply.

Price spikes and shortages were the inevitable result. California experienced rolling blackouts in January, March, and May 2001.66Wolak, 29. One major utility, Pacific Gas and Electric, declared bankruptcy in March 2001. Other California utilities were allowed to increase their rates to prevent additional bankruptcies.

The state sought to prevent further wholesale price spikes by signing $45 billion worth of long-term contracts to purchase electricity in 2001:67Wolak, 30. “By mid-summer 2001, spot electricity prices were back to pre-crisis levels, and the state was committed to over $40 billion worth of long-term electricity contracts at prices that are likely more than 50 percent above the expected future spot prices.”68Borenstein, “Trouble with Electricity Markets,” 209. Retail competition was also repealed.

Clearly, the failure of retail competition in California has nothing to do with any inherent tendency in electricity markets toward natural monopoly. Rather, California chose an inherently unstable combination of mandatory retail rate reductions, inflexible retail prices, and a requirement that utilities buy most of their power in a volatile day-ahead spot market that was highly vulnerable to manipulation.

Retail Competition with Competing Wires: The Electric Avenue Less Traveled

Not all network industries use shared access to monopoly infrastructure. Railroad transportation, cable television, wireless, broadband, satellite communications, and even wireline telephone involve significant competition between firms that build their own infrastructure.69Crandall and Ellig, Economic Deregulation; Hazlett, Political Spectrum; Ellig, “Railroad Deregulation.” Even in electricity, some duopolistic competition has existed in the United States between local distribution companies that own their own wires. These duopolies engage in both retailing and distribution, and sometimes also in transmission and generation. Empirical research finds that costs and prices are both substantially lower where competition exists; this result suggests that the salutary effects of competition outweigh any lost economies of scale.

In 1966, 49 US cities had direct competition between an investor-owned electric utility and a municipal electric utility; by 1981, that number had declined to 27.70Walter J. Primeaux Jr., Direct Electric Utility Competition (New York: Praeger, 1986), 19, 188. Not surprisingly, economists have studied these duopoly electric markets to see how competition affects prices and service. Empirical research focuses on the municipal utilities because the data for these utilities are available for the individual cities where competition exists. The municipal utilities’ prices are set by local officials, and they are not subject to rate-of-return regulation.71Walter J. Primeaux Jr., “Estimate of the Price Effect of Competition: The Case of Electricity,” Resources and Energy 7 (1985): 327–30.

The first extensive econometric studies were conducted by University of Illinois economist Walter Primeaux and summarized in his 1986 book, Direct Electric Utility Competition. There are two reasons that competition could lead to lower prices: competition could force firms to set prices closer to costs, and competitive firms may have lower costs owing to X-efficiency. Primeaux employed a sample that matched municipal utilities that faced competition with municipal utilities in similar cities with similar sources of electricity supply that did not face competition. He found that the marginal price of moving from the 750 kWh rate block to the 1,000 kWh rate block was 19 percent lower in cities with competition. Average revenue per KWh, a proxy for the average electricity rate, is 33 percent lower where competition exists.72Primeaux, “Estimate of the Price Effect of Competition,” 336-37. The marginal price result is statistically significant at the 5 percent level, and the average revenue result is significant at the 10 percent level.

Primeaux also found that competition is associated with a reduction in average costs of 11 percent at the mean value of average cost.73Walter J. Primeaux Jr., “An Assessment of X-efficiency Gained through Competition,” Review of Economics and Statistics 59, no. 1 (1977): 105–8; Walter J. Primeaux Jr., “A Re-examination of the Monopoly Market Structure for Electric Utilities,” in Promoting Competition in Regulated Markets, ed. Almarin Phillips (Washington, DC: Brookings Institution, 1974), 175–200. The overall effect of competition on costs varies with the size of the firm, because competition sacrifices some economies of scale. The increased costs due to lost economies of scale exceed the decreased costs due to X-efficiency at annual sales above 222 million kWh. At the time of Primeaux’s study, 92 percent of publicly owned systems and 60 percent of investor-owned systems had annual sales below 100 million kWh.74Primeaux, “Re-examination of the Monopoly Market Structure,” 195–96. There was no difference in capacity utilization in monopoly and duopoly markets.75Primeaux, Direct Electric Utility Competition, 66–68.

The size of the cost reduction suggests that lower costs account for a significant portion, but not all, of the price reduction associated with competition. It appears that competitive rivalry also pushes prices closer to costs. Duopoly firms changed their prices more frequently than monopoly firms, which implies a greater degree of rivalry.76Walter J. Primeaux Jr. and Mark Bomball, “A Re-examination of the Kinky Oligopoly Demand Curve,” Journal of Political Economy 82 (1974): 851–62.

If natural monopoly exists anywhere in electricity, it is likely in transmission and distribution.77Kiesling, “Incumbent Vertical Market Power.” Using data from 1961–1976, Primeaux and a coauthor estimated a cost function for transmission and distribution that controls for whether a utility faces direct competition. They find that the average cost curve for transmission and distribution is likely U-shaped, which suggests that larger, monopolized transmission and distribution utilities have exhausted the economies of scale.78Randy A. Nelson and Walter J. Primeaux Jr., “The Effects of Competition on Transmission and Distribution Costs in the Municipal Electric Industry,” Land Economics 64, no. 4 (1988): 338–46. Their analysis focused on the combined cost of transmission and distribution; it did not test whether there are economies of scope from combining transmission and distribution.

Case studies have revealed several examples of product differentiation in duopoly markets. Utilities serving multiple cities addressed customer complaints more quickly in cities where they faced competition. Competing utilities installed standby facilities so they could offer more reliable service, cut down trees for customers, provided free poles for television antennae, and furnished contractors with outside wiring for free.79Primeaux, Direct Electric Utility Competition, 123, 134–39. Other inducements offered by competitors in some cities included free temporary service for new construction, free labor for inside wiring, appliance sales, and appliance service.80Primeaux, Direct Electric Utility Competition, 208. Companies rarely charged for connection or disconnection, and the deposits they required from new customers were low.81Nelson and Primeaux, “Effects of Competition on Transmission and Distribution Costs,” 304.

In a 1996 study, John Kwoka identified 22 cities with multiple electric utilities where at least some customers were permitted to switch providers as of 1989. In 12 of these cities, current customers could switch; in the others, only new residents or new industrial customers could choose their electric company. Kwoka’s regression results suggest that companies that face competition may have higher fixed costs (although the correlation is not statistically significant). Companies facing competition have lower variable costs, and this relationship is statistically significant. The net effect is that electric utilities that face competition have costs that are 16 percent lower than those of utilities that do not face competition.82John Kwoka, Power Structure: Ownership, Integration, and Competition in the U.S. Electric Industry (Boston: Kluwer Academic, 1996), 62–65. Direct wire-on-wire competition is also associated with an 8.1 percent reduction in price, in addition to the effect on costs. Thus, direct competition is associated with a 24 percent reduction in electricity prices.83Kwoka, Power Structure, 91–92.

It is interesting to compare the size of the price reductions associated with direct infrastructure competition with that of the price reductions associated with retail choice and open access to the wires. Direct infrastructure competition preserves economies of scope and subjects a larger portion of the industry to competition, but it also involves duplicative facilities. Retail choice with open access to the wires could sacrifice economies of scope, and it leaves the wires monopolized, but it avoids the cost of duplicating the wires.

Kwoka’s and Primeaux’s results suggest that direct infrastructure competition is associated with price reductions of 24–33 percent. The raw data in table 1 show that after 2008, when competition was fully implemented, average prices in competitive states declined by 19 percent while prices in monopoly states were rising. In Texas, residential electricity prices fell by about 19–20 percent after the price to beat was phased out.84Kang and Zarnikau, “Did the Expiration Affect Prices?” The Public Utility Commission of Texas reports that average electricity prices in competitive regions of the state in 2018 were 10–23 percent below both the last regulated price and the national average.85Public Utility Commission of Texas, “Scope of Competition” (2019), 3. These results suggest that retail competition between companies with their own distribution wires delivers price reductions at least as large as those produced by customer choice with monopoly wires. Indeed, the price reductions from infrastructure competition may be even larger. Such comparisons are, of course, only suggestive, since they involve studies conducted with different data sets at different times that control for different factors that influence prices.

Policy Reform

Scholarly research on retail competition suggests that competition can produce a more efficient retail price structure, reduce retail price levels, and promote the introduction of value-added services. The research also shows, however, that retail reform can be a quite complex undertaking. Results have varied greatly depending on how the rules and institutions governing the retail market are established.

The most common type of reform leaves transmission and distribution wires as regulated monopolies and implements competition in the retailing function. In general, policymakers who seek to introduce or expand this type of retail electric competition would do well to follow the Texas model, as described above and in chapter 15 of this volume. A key feature that allowed retail competition to flourish in Texas, even for residential customers, was the elimination of a standby regulated service offering from the incumbent electric utilities. The “price to beat” mechanism was temporary and adjusted to reflect changes in the marginal cost of generation. Competition intensified greatly, and consumers reaped greater benefits, after the price to beat expired.

California also offers two important lessons for electricity market reform. First, it is clear that requiring a utility to offer a regulated standby rate creates a substantial barrier to entry on the retail level—especially if the regulated rate gives customers who do not shop a guaranteed price cut. Second, requiring utilities to buy all their power in a spot market prone to manipulation is a recipe for disaster. Policymakers seem to have heeded the second lesson, because no state has tried to replicate California’s mandatory spot market requirement. However, it is not clear whether the first lesson has been learned; other than Texas, even the states with retail competition still require the incumbent utility to offer consumers standby service at a regulated rate. This may explain why none of the other competitive states has seen as much competition for retail customers as Texas has.

Studies of duopolistic retail competition between vertically integrated utilities suggest that this form of competition can also be viable. However, the number of jurisdictions with duopolistic utility competition has fallen over time, and it is not clear why. Nevertheless, the empirical research suggests that there is no economic justification for granting exclusive monopoly territories to electric distribution companies. States should abolish monopoly electric franchises and allow competition to emerge if and where it is practicable.

Conclusions

The available scholarly evidence clearly refutes the idea that monopoly is the most efficient market structure for retail electricity sales. Many of the studies summarized in this chapter find that electricity prices in states that allow widespread retail choice tend to be lower than they would have been under monopoly, once the lengthy transition period concludes. Under competition, prices more closely reflect marginal costs, and costs themselves appear to have fallen. Moreover, at least in the state with the most developed retail market—Texas—there is evidence of product differentiation that may create additional value for consumers. Contrary to natural monopoly theory, no studies find that retail competition, per se, increased prices, although several studies find that flaws in market design have led to higher prices. Aside from California, whose experience was covered in depth above, the most common design flaw involves failure to sufficiently “quarantine” the remaining utility monopoly so it cannot distort the retail market.86Kiesling, “Incumbent Vertical Market Power.”

Studies of duopolistic competition between utilities that engage in both retailing and distribution produce results qualitatively similar to those of the studies of states that implemented retail competition while treating the wires as regulated monopolies. Econometric studies find that under duopoly, electric utilities have lower costs and charge lower prices than under monopoly—prices that seem to reflect both the cost difference and the effects of competitive rivalry. Case studies reveal numerous ways in which duopoly firms compete through product differentiation.

Regardless of which form retail competition takes, there is no economic justification for monopolizing electricity retailing.

References

2018 State of the Market Report for the ERCOT Electricity Markets (Fairfax, VA: Potomac Economics. June 2019). 5.

“About ERCOT.” Electric Reliability Council of Texas website. Accessed May 12, 2020. http://www.ercot.com/about.

Averch, Harvey and Leland L. Johnson. “Behavior of the Firm under Regulatory Constraint.” American Economic Review 52 (December 1962): 1052–69.

Baumol, William J., John C. Panzar, and Robert D. Willig. Contestable Markets and the Theory of Industry Structure (New York: Harcourt Brace Jovanovich. 1982). 192–208.

Beesley, M. E. and Stephen C. Littlechild. “The Regulation of Privatized Monopolies in the United Kingdom.” Rand Journal of Economics 20. No. 3 (1989): 454–72.

Borenstein, Severin and James Bushnell. “The U.S. Electric Industry after 20 Years of Restructuring” (NBER Working Paper No. 21113. National Bureau of Economic Research. Cambridge, MA. April 2015).

Borenstein, Severin. “The Trouble with Electricity Markets: Understanding California’s Restructuring Disaster.” Journal of Economic Perspectives 16. No. 1 (2002): 193.

Crandall, Robert W. After the Breakup: U.S. Telecommunications in a More Competitive Era (Washington, DC: Brookings Institution. 1991).

Crandall, Robert W. and Jerry Ellig. Economic Deregulation and Customer Choice: Lessons for the Electric Industry (Fairfax, VA: Center for Market Processes.1997).

Crandall, Robert W. and Jerry Hausman. “Competition in U.S. Telecommunications Services: Effects of the 1996 Legislation.” Deregulation of Network Industries: What’s Next? Ed. Sam Peltzman and Clifford Winston (Washington, DC: AEI-Brookings Joint Center for Regulatory Studies. 1991).

Electric Reliability Council of Texas. “Supplemental Information: Retail Electric Market. September 2017–September 2018.” PowerPoint file. Accessed May 12, 2020. http://ercot.com/content/wcm/key_documents_lists/89277/Observed_Selection_of_Electric_Providers_September_2018.ppt.pptx.

Ellig, Jerry. “Railroad Deregulation and Consumer Welfare.” Journal of Regulatory Economics 21. No. 2 (2002): 143–67.

Ellig, Jerry. “Selling Santee Cooper: Competition Should Be Part of the Plan.” Post and Courier (Charleston, SC). April 14, 2019.

Frank, Mark W. “An Empirical Analysis of Electricity Regulation on Technical Change in Texas.” Review of Industrial Organization 22 (2003): 313–31.

Giberson, Michael and Arthur R. Wardle. “The Consequences of Retail Electric Choice in the United States: An Assessment of Empirical Studies” (Working paper. Center for Growth and Opportunity. September 2019 draft). 6.

Giberson, Michael and L. Lynne Kiesling. “Governance for Networks: Regulation by Networks in Electric Power Markets in Texas.”

Goett, Andrew A., Kathleen Hudson, and Kenneth E. Train. “Customers’ Choice among Retail Energy Suppliers: The Willingness-to-Pay for Service Attributes.” Energy Journal 21. No. 4 (2000): 1–28.

Guthrie, Graeme. “Regulating Infrastructure: The Impact on Risk and Investment.” Journal of Economic Literature 44. No. 4 (December 2006): 925–72.

Hartley, Peter R., Kenneth B. Medlock III, and Olivera Jankovska. “Electricity Reform and Retail Pricing in Texas.” Energy Economics 80 (2019): 1–11.

Hausman, Catherine and Ryan Kellogg. “Welfare and Distributional Implications of Shale Gas.” Brookings Papers on Economic Activity. March 2015. 71–125.

Hayek, F. A. New Studies in Philosophy, Politics, Economics, and the History of Ideas (London: Routledge & Kegan Paul. 1978). Chapter 12. “Competition as a Discovery Procedure.”

Hazlett, Thomas W. “Cable Television.” Handbook of Telecommunications Economics: Technology Evolution and the Internet. Ed. Sumit Majumdar et al. (Amsterdam: Elsevier Science, 2006).

Hazlett, Thomas W. The Political Spectrum (New Haven, CT: Yale University Press. 2017).

Joskow, Paul L. “Why Do We Need Electricity Retailers? Or Can You Get It Cheaper Wholesale?” (Working paper. Harvard Electricity Policy Group. 2000).

Kang, Linhong and Jay Zarnikau. “Did the Expiration of Retail Price Caps Affect Prices in the Restructured Texas Electricity Market?” Energy Policy 37. No. 5 (2009): 1713–14.

Kiesling, L. Lynne. “Incumbent Vertical Market Power, Experimentation, and Institutional Design in the Deregulating Electricity Industry.” Independent Review 19. No. 2 (Fall 2014): 239–64.

Kiesling, L. Lynne. “Retail Restructuring and Market Design in Texas.” Electricity Restructuring: The Texas Story. Ed. L. Lynne Kiesling and Andrew N. Kleit (Washington, DC: AEI Press. 2009). 171–72.

Kirzner, Israel. Discovery and the Capitalist Process (Chicago: University of Chicago Press. 1985). Chapter 6: “The Perils of Regulation: A Market Process Approach.”

Kwoka, John. “Restructuring the US Electric Power Sector: A Review of Recent Studies.” Review of Industrial Organization 32. No. 3–4 (2008): 165–96.

Kwoka, John. Power Structure: Ownership, Integration, and Competition in the U.S. Electric Industry (Boston: Kluwer Academic. 1996). 62–65.

Leibenstein, Harvey. “Allocative Efficiency versus ‘X-efficiency.’” American Economic Review 56 (1966): 392–413.

Littlechild, Stephen C. “Wholesale Spot Price Pass-Through.” Journal of Regulatory Economics 23. No. 1 (2003): 71.

Michaels, Robert W. “Competition in Texas Electric Markets: What Texas Did Right & What’s Left to Do” (Report. Texas Public Policy Foundation. Austin, TX. March 2007). 9.

Misbrener, Kelsey. “Energy Choice Coalition Supports New Virginia Energy Reform Act.” Solar Power World. January 9, 2020.

Morey, Matthew J. and Laurence D. Kirsch. “Retail Choice in Electricity: What Have We Learned in 20 Years?” (Report. Christensen Associates Energy Consulting LLC for Electric Markets Research Foundation. February 11, 2016).

Nelson, Randy A. and Walter J. Primeaux Jr. “The Effects of Competition on Transmission and Distribution Costs in the Municipal Electric Industry.” Land Economics 64. No. 4 (1988): 338–46.

“Nevada Question 3, Changes to Energy Market and Prohibit State-Sanctioned Electric-Generation Monopolies Amendment (2018).” Ballotpedia. Accessed May 12, 2020. https://ballotpedia.org/Nevada_Question_3,_Changes_to_Energy_Market_and_Prohibit_State-Sanctioned_Electric-Generation_Monopolies_Amendment_(2018).

O’Connor, Philip R. “Restructuring Recharged: The Superior Performance of Competitive Electricity Markets 2008–2016” (White paper. Retail Energy Supply Association. Hummelstown, PA. April 2017). 12.

Primeaux, Walter J. Jr. “A Re-examination of the Monopoly Market Structure for Electric Utilities.” Promoting Competition in Regulated Markets. Ed. Almarin Phillips (Washington, DC: Brookings Institution. 1974). 175–200.

Primeaux, Walter J. Jr. “An Assessment of X-efficiency Gained through Competition.” Review of Economics and Statistics 59. No. 1 (1977): 105–8.

Primeaux, Walter J. Jr. “Estimate of the Price Effect of Competition: The Case of Electricity.” Resources and Energy 7 (1985): 327–30.

Primeaux, Walter J. Jr. and Mark Bomball. “A Re-examination of the Kinky Oligopoly Demand Curve.” Journal of Political Economy 82 (1974): 851–62.

Primeaux, Walter J. Jr. Direct Electric Utility Competition (New York: Praeger. 1986). 19, 188.

Public Utility Commission of Texas. “Scope of Competition in Electric Markets in Texas” (Report to the 85th Legislature. Austin, TX. January 2017). 15.

Public Utility Commission of Texas. “Scope of Competition in Electric Markets in Texas” (Report to the 79th Legislature. Austin, TX. January 2005). 60.

Public Utility Commission of Texas. “Scope of Competition in Electric Markets in Texas” (Report to the 86th Legislature. Austin, TX. January 2019). 3.

Smith, Oran P. and Michael T. Maloney. “Energizing Enterprise: How Energy Market Reforms in the Wake of the V.C. Summer Debacle Can Transform South Carolina’s Economy” (Report. Palmetto Promise Institute. November 2018).

Spence, David and Darren Bush. “Why Does ERCOT Have Only One Regulator?” Electricity Restructuring: The Texas Story. Ed. L. Lynne Kiesling and Andrew N. Kleit (Washington, DC: AEI Press. 2009).

Stevenson, Rodney. “X-inefficiency and Interfirm Rivalry: Evidence from the Electric Utility Industry.” Land Economics 58. No. 1 (1982): 52–66.

“The ERCOT Solution.” Lubbock Power & Light. Accessed May 12, 2020. http://lpandl.com/ercot/.

Viscusi, W. Kip, Joseph E. Harrington Jr., and John M. Vernon. Economics of Regulation and Antirust. 4th ed. (Cambridge, MA: MIT Press. 2005). 79–95.

Winston, Clifford. “Economic Deregulation: Days of Reckoning for Microeconomists.” Journal of Economic Literature 31 (1993): 1263–89.

Winston, Clifford. “U.S. Industry Adjustment to Economic Deregulation.” Journal of Economic Perspectives 12 (1998): 89–110.

Wolak, Frank A. “Diagnosing the California Electricity Crisis.” Electricity Journal 16. No. 7 (2003): 16.

Wood, Pat III and Gürcan Gülen. “Laying the Groundwork for Power Competition in Texas.” Electricity Restructuring: The Texas Story. Ed. L. Lynne Kiesling and Andrew N. Kleit (Washington, DC: AEI Press. 2009). 30.

Zarnikau, Jay and Doug Whitworth. “Has Electricity Utility Restructuring Led to Lower Electricity Prices for Residential Consumers in Texas?” Energy Policy 34. No. 15 (2006): 2199–200.

Zarnikau, Jay. “A Review of Efforts to Restructure Texas’ Electricity Market.” Energy Policy 33 (2005): 15.

Table of Contents

- Regulation and Entrepreneurship: Theory, Impacts, and Implications

- Regulation and the Perpetuation of Poverty in the US and Senegal

- Social Trust and Regulation: A Time-Series Analysis of the United States

- Regulation and the Shadow Economy

- An Introduction to the Effect of Regulation on Employment and Wages

- Occupational Licensing: A Barrier to Opportunity and Prosperity

- Gender, Race, and Earnings: The Divergent Effect of Occupational Licensing on the Distribution of Earnings and on Access to the Economy

- How Can Certificate-of-Need Laws Be Reformed to Improve Access to Healthcare?

- Land Use Regulation and Housing Affordability

- Building Energy Codes: A Case Study in Regulation and Cost-Benefit Analysis

- The Tradeoffs between Energy Efficiency, Consumer Preferences, and Economic Growth

- Cooperation or Conflict: Two Approaches to Conservation

- Retail Electric Competition and Natural Monopoly: The Shocking Truth

- Governance for Networks: Regulation by Networks in Electric Power Markets in Texas

- Net Neutrality: Internet Regulation and the Plans to Bring It Back

- Unintended Consequences of Regulating Private School Choice Programs: A Review of the Evidence

- “Blue Laws” and Other Cases of Bootlegger/Baptist Influence in Beer Regulation

- Smoke or Vapor? Regulation of Tobacco and Vaping

- Moving Forward: A Guide for Regulatory Policy