Given the well-known health harms of smoking, tobacco is regulated and taxed nearly everywhere in the world. With the introduction of electronic nicotine delivery systems (ENDS), commonly known as e-cigarettes, new questions have arisen about the risks to health from their use and whether they should be regulated as strictly as tobacco. In some quarters, the possibility that e-cigarettes and vaping could deliver an attractive, smoking-like sensory experience while avoiding the health harms that accompany combusting and inhaling tobacco has been greeted with enthusiasm, since the new products could help some smokers transition to a less risky product. In other quarters, and in much of the American public health community, e-cigarettes were greeted with skepticism and hostility, since they could potentially renormalize smoking, set back the great gains in tobacco control of the past several decades, and hook a new generation of young people on nicotine and smoking. This chapter covers the regulatory history of tobacco and e-cigarettes, summarizes upcoming regulatory actions and challenges, discusses the key issues involved in the regulation of these activities, and includes suggestions for better regulation.

Readers will benefit from an understanding of some vaping technology and terminology. All e-cigarettes work by means of a battery-operated heater that vaporizes a solution containing nicotine and flavoring (known as an eliquid), which is then inhaled by the user. Sometimes grouped with e-cigarettes are heat-not-burn products that heat ground tobacco without combustion. There are many types of e-cigarettes and vaping systems, from cartridge-based “closed” systems, in which the consumer buys a disposable, unmodifiable eliquid cartridge, to tank-based “open” systems, in which the vaper buys vials of eliquid for refill and can customize what is vaped. All of these will be referred to as “e-cigarettes” in this chapter, and their consumption will be called “vaping,” unless a distinction among products is required. The exception is that discussions of the scientific literature on the health effects of e-cigarettes exclude heat-not-burn products, which are typically not included in the studies. Finally, note that using e-cigarettes is not “smoking”—nothing is combusted and there is no smoke.

History of Tobacco Regulation in the United States

From 1900 to 1963, per capita consumption of cigarettes grew rapidly, from a low figure in 1900 until in the latter year the daily average was more than half a pack per adult.1Institute of Medicine, Ending the Tobacco Problem: A Blueprint for the Nation, ed. Richard J. Bonnie, Kathleen Stratton, and Robert B. Wallace (Washington, DC: National Academies Press, 2007). The watershed moment in the history of smoking in the United States was the publication of the Surgeon General’s report in 1964, which stated that “cigarette smoking is a health hazard of sufficient importance in the United States to warrant appropriate remedial action.”2US Department of Health, Education, and Welfare, Smoking and Health: Report of the Advisory Committee to the Surgeon General of the Public Health Service (Washington, DC: US Government Printing Office, 1964), 32. After that year, consumption began its long decline, falling to 0.13 packs sold a day per adult in 2018.3Euromonitor International, Tobacco in the United States, Country Report, January 2019, Passport.

Of course, the average smoker consumes more than that. In 2018, adult smokers reported smoking a bit more than half a pack a day, while retail sales of cigarettes averaged a bit less than one pack per day per adult smoker.4The smoking intensity figure of 11.5 cigarettes per day (with a 95% confidence interval for the mean of [11.2, 11.8]) is calculated by the author from the 2018 Tobacco Use Supplement to the Current Population Survey. The retail sales figures are from Euromonitor International, Tobacco in the United States. The discrepancy between self-reported smoking behavior and sales per adult smoker is due to the well-known fact that survey respondents tend to underreport smoking and to the fact that many underage smokers consume some of the sales. That same year, there were about 34 million adult cigarette smokers in the US and 49 million adult users of any tobacco product, including e-cigarettes.5MeLisa R. Creamer et al., “Tobacco Product Use and Cessation Indicators among Adults—United States, 2018,” Morbidity and Mortality Weekly Report 68, no. 45 (2019): 1013–19. These figures imply that the prevalence of cigarette smoking has fallen to 13.7 percent among US adults, while the prevalence of any form of tobacco consumption is 19.7 percent. Adult cigarette smoking prevalence has declined about two-thirds from its peak in the 1960s.

The sale and use of tobacco in the US has been regulated in various ways for decades, although much of the regulatory action has come relatively recently compared to the long history of smoking. The first federal action regarding the tobacco industry and the health effects of its products was the requirement that cigarette manufacturers add the notice that smoking “may be hazardous to your health” on packs. The health warning, which came into effect in 1966, was the first of its kind in the world.6Heikki Hiilamo, Eric Crosbie, and Stanton A. Glantz, “The Evolution of Health Warning Labels on Cigarette Packs: The Role of Precedents, and Tobacco Industry Strategies to Block Diffusion,” Tobacco Control 23, no. 1 (2014): e2.

Despite the landmark surgeon general’s report in 1964, until the 1980s tobacco was specifically exempted from legislation (e.g., the Toxic Substances Control Act) and regulation (e.g., by the Consumer Product Safety Commission) that otherwise would have curtailed the industry or the freedom to smoke.7Institute of Medicine, Ending the Tobacco Problem. Starting in 1985, a set of four rotating health warnings with stronger wording were required on cigarette packaging.8Hiilamo, Crosbie, and Glantz, “Evolution of Health Warning Labels.” The FDA sought to add graphical health warnings in 2011, but legal action by the tobacco industry has delayed the requirement for almost a decade.9See Tobacco Products; Required Warnings for Cigarette Packages and Advertisements, 84 Fed. Reg. 42754 (August 16, 2019), and the discussion below.

The first federally mandated restrictions on where one could smoke came in the late 1980s, with bans on smoking on certain domestic airline flights.10Pub. L. No. 100-202 (1987) banned smoking on domestic airline flights scheduled for two hours or less, while Pub. L. No. 101-164 (1989) did the same for flights scheduled for six hours or less. The so-called Synar Amendment of 1992 required all states to adopt and enforce restrictions on the sales and distribution of tobacco to minors; federal enforcement of the restrictions (through the withholding of certain federal payments to the states) went into effect in 1996.11States were required to have (and enforce through random inspections) laws “prohibiting any manufacturer, retailer or distributor of tobacco products from selling or distributing such products to any individual under the age of 18.” In the event of noncompliance, a state would lose eligibility for a Substance Abuse Prevention and Treatment Block Grant. See Tobacco Regulation for Substance Abuse Prevention and Treatment Block Grants, 61 Fed. Reg. 1492 (January 19, 1996). While as recently as the 1980s some states had no restrictions on sales to minors, however defined, by 1995 all states and the District of Columbia prohibited the sale and distribution of tobacco products to those under 18 years of age.12See Dorie E. Apollonio and Stanton A. Glantz, “Minimum Ages of Legal Access for Tobacco in the United States from 1863 to 2015,” American Journal of Public Health 106, no. 7 (2016): 1200–207; and D. M. Shelton et al., “State Laws on Tobacco Control—United States, 1995,” Morbidity and Mortality Weekly Report Surveillance Summaries 44, no. 6 (1995): 1–28.

In 1998, the three major tobacco manufacturers signed the Master Settlement Agreement (MSA) with 46 states. In exchange for immunity from legal claims by these states for costs incurred for smoking-related illnesses and deaths, the three major tobacco manufacturers agreed to pay the states an estimated $206 billion, finance a $1.5 billion anti-smoking campaign, and cease various forms of advertising, product placement, and event sponsorship, as well as any form of marketing aimed at youth. While the settling states say that “the central purpose of the MSA is to reduce smoking, especially in American youth,”13The statement is from the National Association of Attorneys General Center for Tobacco and Public Health, the organization set up by the attorneys general of the settling states to handle matters pertaining to the MSA. See “NAAG Center for Tobacco and Public Health,” National Association of Attorneys General, accessed July 2, 2020, https://www.naag.org/naag/about_naag/naag-center-for-tobacco-and-public-health.php. it appears that the states spend little of the money collected from the MSA and tobacco taxes on tobacco prevention and cessation programs—well under 3 percent of it in 2020.14“A State-by-State Look at the 1998 Tobacco Settlement 21 Years Later,” Campaign for Tobacco-Free Kids, last modified January 16, 2020, https://www.tobaccofreekids.org/what-we-do/us/statereport.

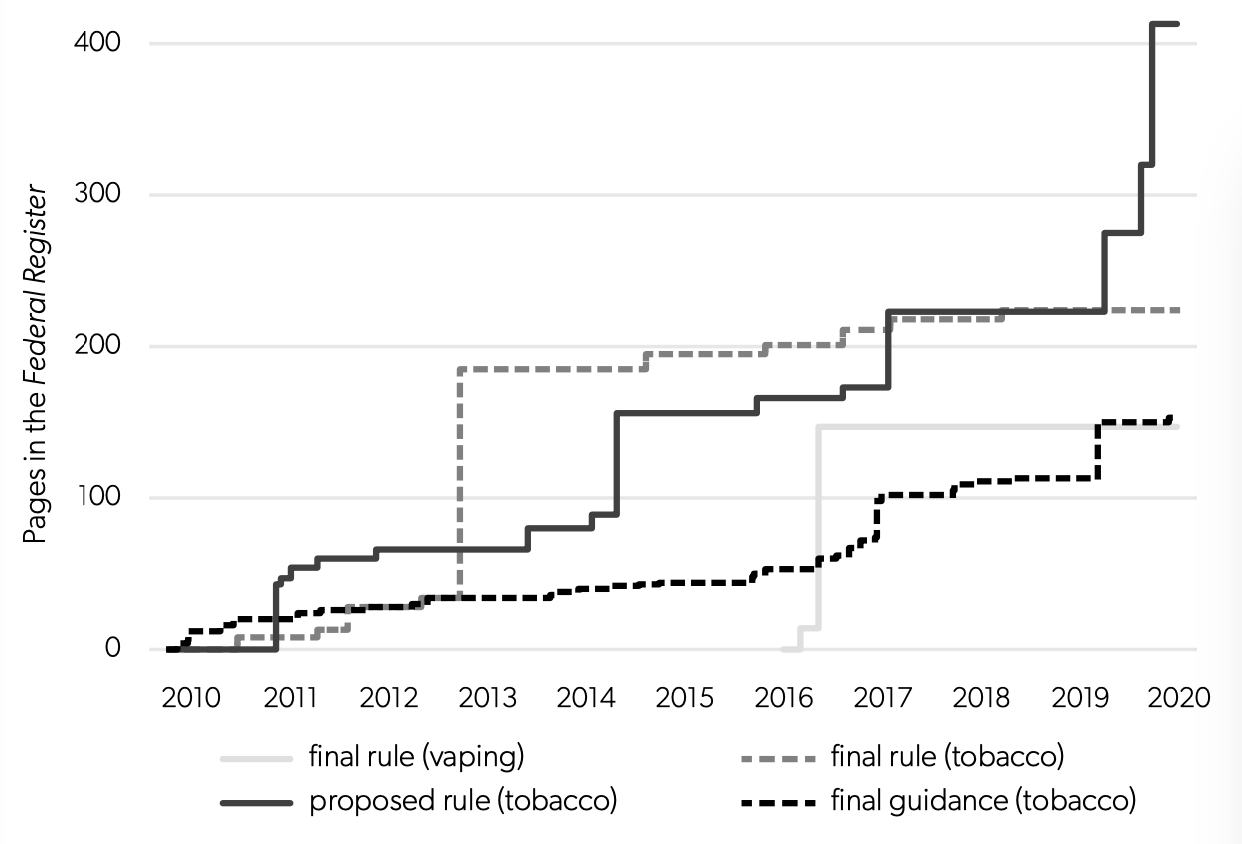

The entering wedge for direct federal regulation of tobacco as a consumer product came in the form of Family Smoking Prevention and Tobacco Control Act of 2009, which granted the FDA authority to regulate tobacco products. The FDA’s first action under the act was to issue a rule in 2010 prohibiting the sale of cigarettes and smokeless tobacco to any person under age 18. (Such sales were already illegal in all states.)15See Regulations Restricting the Sale and Distribution of Cigarettes and Smokeless Tobacco to Protect Children and Adolescents, 75 Fed. Reg. 13225 (March 19, 2010). The rule was a revised version of a 1996 FDA rule that was ultimately voided by the Supreme Court, which ruled in 2000 that the FDA lacked the authority to regulate tobacco as a drug. FDA v. Brown & Williamson Tobacco Corp. (98-1152), 529 U.S. 120 (2000), 153 F.3d 155, affirmed. Since that time, there has been a steady flow of proposed and final rules and “guidance” from the FDA regarding tobacco regulation. Figure 1 shows the growth of federal regulation regarding tobacco over time, as measured by the cumulative number of pages of rules in the Federal Register. By 2015, there were over 200 pages of binding regulations, and by the beginning of 2020 there were 224 pages of rules, more than 150 pages of guidance regarding those rules, and well over 400 accumulated pages of proposed rules. The pages of proposed rules nearly doubled in 2019 with recent actions by the FDA (about which more will be said below).

In the first of two recent federal regulatory actions, the age threshold for retail sales of tobacco products after December 2019 was raised from 18 to 21 years.16The new regulation (which took effect immediately when President Trump signed the bill on December 20, 2019) amends the Federal Food, Drug, and Cosmetics Act at 21 U.S.C. 387f(d) to include the higher minimum age of retail sale for any tobacco product, including ecigarettes (because of the FDA deeming action described in the next section). Before that time, well fewer than half the states had an age restriction that high. In its most recent action, the FDA issued rules requiring graphical warnings on cigarette packages.17Tobacco Products; Required Warnings for Cigarette Packages and Advertisements, 84 Fed. Reg. 42754 (August 16, 2019). These new color graphics depicting the negative health consequences of smoking will occupy the entire top half of the area of the front and rear faces of cigarette packages.18For the final rule, see Tobacco Products; Required Warnings for Cigarette Packages and Advertisements, 85 Fed. Reg. 15638 (March 18, 2020). Some research indicates that such large graphical warnings are more likely to be noticed by smokers or more likely to lead them to consider cessation or smoking less.19See David Hammond et al., “Text and Graphic Warnings on Cigarette Packages: Findings from the International Tobacco Control Four Country Study,” American Journal of Preventive Medicine 32, no. 3 (2007): 202–9; Seth M. Noar et al., “Pictorial Cigarette Pack Warnings: A Meta-analysis of Experimental Studies,” Tobacco Control 25, no. 3 (2016): 341–54. However, apparently no study has shown that graphical warnings lead to an increase in actual cessation (versus stated intentions to quit).

In addition to tobacco regulations, the federal government has levied excise taxes on cigarettes continuously since the time of the Civil War.20The Tax Burden on Tobacco: Historical Compilation (Arlington, VA: Orzechowski and Walker, 2014). The tax remained at 8 cents a pack from 1951 until 1983, when it was doubled. In the early 1990s the tax was raised to 24 cents, and in the early 2000s it was raised by stages to 39 cents. In 2009, the largest increase yet resulted in a per-pack federal tax of $1.01, where it remains in 2020.

Figure 1. Growth of Federal Regulation from the FDA Regarding Tobacco and E-cigarettes

Source: Author’s calculations from FDA data, https://www.fda.gov/media/88873/download.

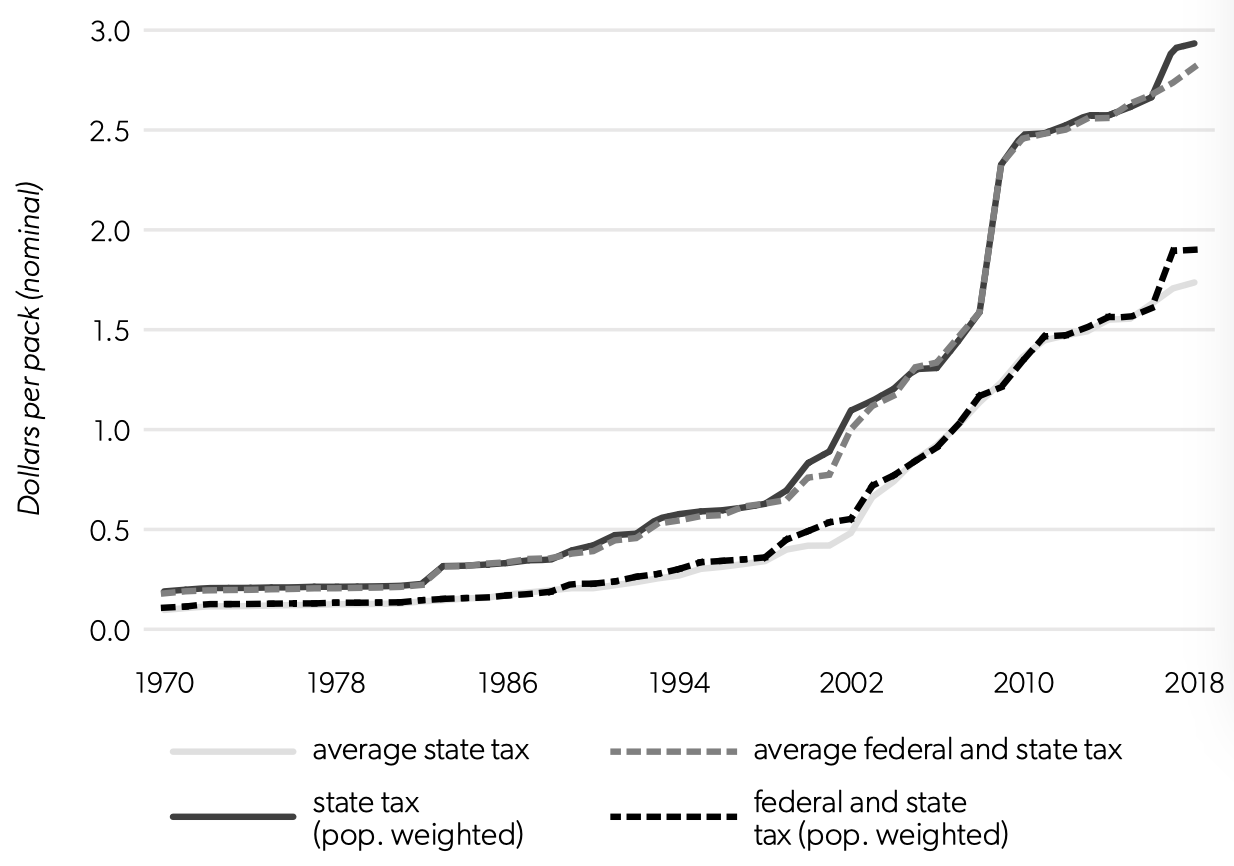

State taxes on tobacco vary widely, although most states have increased their cigarette taxes in the past two decades. From 1970 to 2018, the average state excise tax (not weighted for population or consumption) increased from 9.6 cents per pack to $1.74—an annualized nominal growth rate of 7.5 percent and an inflation-adjusted growth rate of 3.6 percent (see figure 2). State taxes grew exceptionally quickly after 2000, with an inflation-adjusted growth rate of the average tax of 5.5 percent per year. Adding the federal tax on top of the state taxes shows that the combined nominal rates rose by an average of 5.7 percent per year between 1970 and 2018 and have risen by 6.9 percent per year since 2000. These large increases in the taxes over time resulted in almost 40 percent of the retail sales prices of cigarettes going to excise taxes in 2018—or, to put it another way, an effective 65 percent tax rate on a pack.

Figure 2 also shows the population-weighted averages of the taxes; these reflect the excise taxes facing the average person in the nation. For the most part these are similar to the simple averages, with the exception of a divergence in 2017 owing to California enacting a large tax increase. Overall, these levels of taxation make cigarettes one of the most highly taxed products in the nation. By comparison, state alcohol taxes averaged only three to five cents per drink in 2015.21See Timothy S. Naimi et al., “Erosion of State Alcohol Excise Taxes in the United States,” Journal of Studies on Alcohol and Drugs 79, no. 1 (2018): 43–48.

History of E-cigarette Regulation in the United States

The market for e-cigarette products in the United States began to take off around 2006. In 2008, the e-cigarette market had only $28 million in revenue from an estimated 190,000 vapers, but by 2017 it was a $4.6 billion market with an estimated 8.4 million vapers.22Euromonitor International, Tobacco in the United States. Those figures represent a revenue growth rate of over 50 percent per year. Given the recent emergence of e-cigarettes as a significant product, it is unsurprising that the regulatory history of vaping is short. In 2016, the FDA “deemed” e-cigarettes (or, more properly speaking, ENDS) to be tobacco products.23Ned Sharpless, “How FDA is Regulating E-Cigarettes,” September 10, 2019, https://www.fda.gov/news-events/fda-voices/how-fda-regulating-e-cigarettes.

Figure 2. Growth of State and Federal Excise Taxation on Cigarettes

Source: Data from the Centers for Disease Control and Prevention, “Tax Burden on Tobacco, 1970-2018,” August 13, 2020, https://chronicdata.cdc.gov/Policy/The-Tax-Burden-on-Tobacco-1970-2018/7nwe-3aj9.

While the FDA has the legal authority to deem new or existing products to be tobacco products, and thus subject to its regulatory authority, it is worth noting that ENDS do not contain tobacco. While nicotine is the addictive substance found in tobacco, it is the other constituents in tobacco that, when combusted and inhaled, cause the main health problems associated with smoking. In particular, to quote a report from the National Academies of Sciences, Engineering, and Medicine, “There is no evidence to indicate that nicotine is a carcinogen.”24National Academies of Sciences, Engineering, and Medicine, Public Health Consequences of Ecigarettes (Washington, DC: National Academies Press, 2018). Thinking of e-cigarettes as tobacco products thus greatly confuses the issue, a point to which I will return below.

After deeming e-cigarettes to be tobacco products, the FDA aimed its entire set of tobacco-related regulations at vaping products as well. Manufacturers of existing products had to register with the FDA and submit lists of products, their ingredients, and evidence about their health effects.25See the review of the regulatory status of ecigarettes provided by the Ned Sharpless, the acting commissioner of the FDA. Ned Sharpless, “How FDA Is Regulating Ecigarettes,” Food and Drug Administration, September 10, 2019, https://www.fda.gov/news-events/fda-voices-perspectives-fda-leadership-and-experts/how-fda-regulating-e-cigarettes. Manufacturers are now required to place on product packaging a warning that they contain nicotine and that nicotine is an addictive chemical. Products introduced between 2007 and August 2016 could continue to be sold while their applications for regulatory approval were considered by the FDA.26After a court decision, the deadline for filing the applications with the FDA was initially set at May 12, 2020, but this was later extended by 120 days because of impacts from COVID-19 in April. The court ordered that products with timely applications could remain on the market for one year pending FDA review. New e-cigarette products are not allowed to be introduced after August 2016 without premarket approval. Since the FDA has not ruled on any e-cigarette application yet, in part because continuing legal action made uncertain the deadline for submission of applications, anti-vaping advocates can still truthfully claim that there are no FDA-approved e-cigarettes on the market.27The one partial exception is Philip Morris International’s heat-not-burn product IQOS, which heats tobacco (unlike conventional ENDS, which vaporize an eliquid) without combustion so that the vapor can be inhaled. Heat-not-burn products are often considered a different category from ecigarettes by users, researchers, and manufacturers. In January 2020, the FDA also effectively prohibited sales of flavored cartridge-based e-cigarettes (other than tobacco-, mint-, and menthol-flavored e-cigarettes).28See Food and Drug Administration, Enforcement Priorities for Electronic Nicotine Delivery Systems (ENDS) and Other Deemed Products on the Market without Premarket Authorization: Guidance for Industry, January 2020, https://www.fda.gov/media/133880/download. However, flavored eliquids for open-system tank vaping (typically available at vape shops) remain allowed.29More properly speaking, they are technically still illegal (as with all ENDS apart from IQOS), but are not candidates for FDA enforcement at the present time.

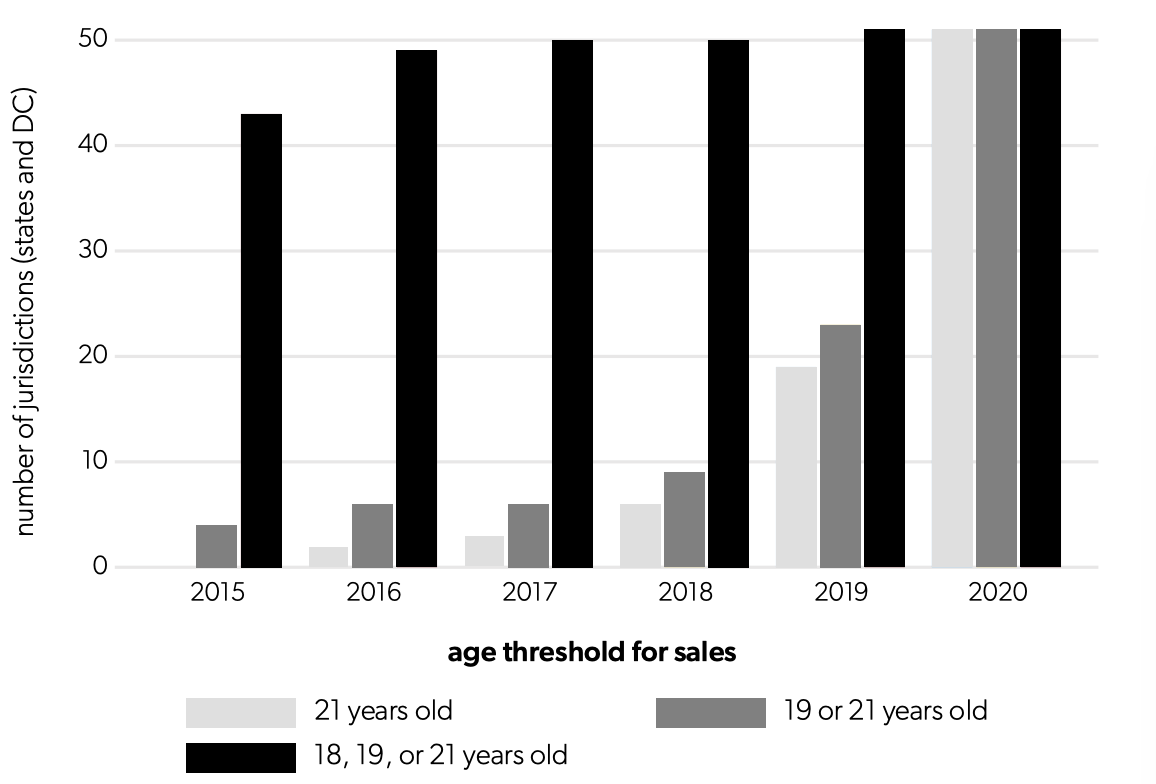

With e-cigarettes added to the regulatory purview of the FDA, age restrictions on sales to youth under age 18 and the prohibition of sales from vending machines came into force in 2016.30However, as discussed in note 11 above, rather than functioning as an outright restriction, the federal age limit is instead enforced through financial consequences for states that do not so restrict sales. As figure 3 shows, nearly all states followed the FDA’s prompting. Michigan, however, did not restrict sales of ecigarettes to minors until April 2019. See Malachi Barrett, “Michigan Senate Approves Ban on Ecigarette Sales to Minors,” MLive, April 23, 2019. Most states had already banned sales to youth before the federal action (see figure 3), and over time many states raised their age restrictions on sales to 19 or 21 years. Near the end of 2019, as mentioned above, the federal age limit was raised to 21 for all tobacco products, including e-cigarettes.

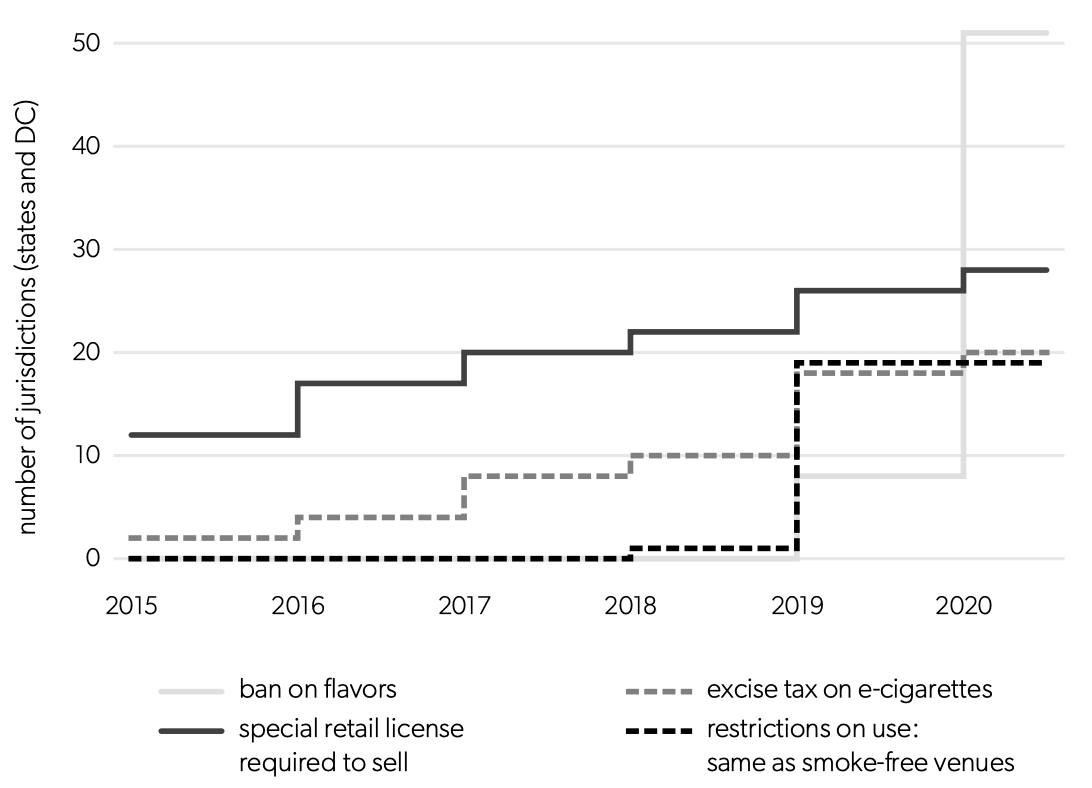

States have also been free to impose other regulation on the sales and usage of e-cigarettes. The increasing number of other regulations among the states is depicted in figure 4. Some states require retailers to obtain special licenses to sell e-cigarettes, typically with the goal of limiting youth access to vaping products; some place the same restrictions on vapers regarding using the devices in public as on smokers (thus applying “smoke-free” rules to a smoke-free product). Finally, a minority of states levy excise taxes on e-cigarettes (in contrast to ubiquitous state taxes on cigarettes).

Upcoming Potential Regulatory Changes

The FDA is currently undertaking several rulemaking processes on tobacco regulation. One regulatory proceeding is considering whether menthol flavoring in cigarettes will be banned (other flavors are already illegal).31For the advance notice of proposed rulemaking, see 83 Fed. Reg. 12294 (March 21, 2018). The due date for comments from interested parties was extended to July; see 83 Fed. Reg. 26618 (June 8, 2018). Perhaps the most ambitious regulatory action contemplated by the FDA is to lower the nicotine content in cigarettes to minimally addictive or nonaddictive levels.32For the advance notice of proposed rulemaking, see 83 Fed. Reg. 11818 (March 16, 2018). While the FDA does not have the authority to ban cigarettes outright, such action would effectively kill the legal market for the product as it exists today. Public comments on the latter two proceedings were due in the summer of 2018, but the FDA has not issued final rules for either (or announced that it is abandoning the effort) as of the start of 2020.

As discussed earlier, apart from a single heat-not-burn product, the FDA has not issued rulings on any of the submissions for regulatory product approval for e-cigarette products. Thus, the industry faces a large degree of uncertainty going forward regarding the amount of effort required for successful submissions. The fact that the one approved product, IQOS by Philip Morris International, purportedly required billions of dollars for regulatory compliance on the part of the manufacturer and experienced two years of regulatory delay until approval does not bode well for any maker of e-cigarettes, apart from the largest tobacco manufacturers.33For the rough cost estimate, see Jennifer Maloney, “FDA Clears Philip Morris International Heat-Not-Burn IQOS Device for Sale in U.S.,” Wall Street Journal, April 30, 2019.

The main upcoming regulatory action by the FDA—eagerly awaited by industry and the public health community—is not new regulation per se, but rather a definitive ruling on any of the regulatory approvals sought for e-cigarette products (discussed above). It remains to be seen whether any such products will be allowed to claim that they are safer than cigarettes or that they aid in cessation of smoking. It is also unclear whether any cartridge-based ENDS flavored with something other than mint or menthol will be approved; despite the current sales ban, the FDA has not ruled out granting regulatory approval for such products. As mentioned above, the only ruling to date has been on a heat-not-burn product, which differs in many ways from traditional vaping products.

Figure 3. Growth of State Regulation Regarding E-cigarette Sales to Youth

Sources: Tobacco Control Legal Consortium, U.S. E-cigarette regulation: a 50-state review, 2020. Available from https://publichealthlawcenter.org/resources/us-e-cigarette-regulations-50-state-review.

Figure 4. Growth of State Regulations Regarding E-cigarette Sales and Usage

Sources: Public Health Law Center, “E-Cigarette Tax : States with Laws Taxing E-Cigarettes,” 2020; Public Health Law Center, Retail Licensure on E-Cigarettes: States with Laws Requiring Licenses for Retail Sales of E-Cigarettes, 2020; Public Health Law Center, “U.S. E-Cigarette Regulation: A 50-State Review.”

Issues Involved with Taxing and Regulating Tobacco

This section covers the various rationales offered for regulating tobacco and some of the unintended consequences of doing so. The three main rationales for excise taxes and regulations on tobacco fall into two categories. The main economic rationale has traditionally been to tax tobacco to align the private and social costs of smoking. The main actual rationale appears to be paternalism. In recent years, a hybrid rationale has emerged in which theories from behavioral economics are used to justify paternalistic taxation and regulation. These rationales are all discussed here.

The economic rationale for regulation: externalities.

The traditional economic rationale for tobacco taxation is that it serves to correct consumers’ faulty incentives (i.e., it is taxation to correct for externalities, à la economist Arthur C. Pigou). In other words, the main economic rationale for tobacco taxation depends on the presence of negative externalities.

An externality in this context is an effect of consumption that creates adverse consequences for persons other than the decision maker. So-called Pigovian taxes are set to correct for the externalities, so that consumers consider the costs and benefits of their actions from the social rather than merely the personal perspective. The two externalities discussed for consumption of tobacco are the burdens imposed on taxpayers (fiscal externalities) and the burdens imposed on nonsmokers (health externalities).34The discussion here follows Kenneth Warner et al., “Criteria for Determining an Optimal Cigarette Tax: The Economist’s Perspective,” Tobacco Control 4, no. 4 (1995): 380–86. When smokers degrade their likely future health by their consumption of tobacco, they create future expected costs for publicly funded health programs such as Medicare. However, whether it is proper to treat such “fiscal externalities” identically to other externalities in the social calculus is debated.35The argument presented here is from Edgar K. Browning, “The Myth of Fiscal Externalities,” Public Finance Review 27, no. 1 (January 1999): 3–18. Externalities require attention and possibly correction because they create inefficiencies, not because they transfer benefits from one party to another in the economy. The inefficiencies associated with fiscal externalities, however, are due to the inefficiencies inherent in subsidized healthcare, not to smoking per se. That is, the inefficiency (if any) arises because of the policy (Medicare), not the individual’s action (smoking).

The remaining difficulties with an argument based on fiscal externalities, for those wishing to justify high tax rates on cigarettes, are twofold. First, the cost of a pack is borne today (by the buyer), but any external costs for society to fund healthcare are far in the future. The present expected discounted value of those future healthcare costs is small, and thus so would be the corrective taxes. (Note, however, that if healthcare cost increases continue to outpace general inflation, this first rebuttal loses some force.) Second, since smokers on average die younger than nonsmokers, they reduce the drain on the public purse for social security payments and have fewer years of eligibility for (costly) Medicare.36See Jane G. Gravell and Dennis Zimmerman, Cigarette Taxes to Fund Health Care Reform: An Economic Analysis (Washington, DC: Library of Congress, 1994); and Willard G. Manning et al., “The Taxes of Sin: Do Smokers and Drinkers Pay Their Way?” JAMA 261, no. 11 (1989): 1604–9.

Thus it is unsurprising that studies taking these considerations into account while computing the optimal tax to account for fiscal externalities alone generally find that current excise tax levels are too high compared to the net externalities.37It is also important to note that studies (such as those cited in note 35) were reaching such conclusions well before the recent rounds of increases in tobacco taxes. See figure 2. Even using an astronomically high figure for the health cost to society of smoking a single pack ($35), the optimal tax to correct for negative externalities would be only 40 cents per pack (compared to the actual excise tax, which averaged around $2.80 in 2018).38For the average tax rate, see figure 2; for the study, see Jonathan Gruber and Botond Köszegi, A Modern Economic View of Tobacco Taxation (Paris: International Union against Tuberculosis and Lung Disease, 2008). This estimate of the net negative externality does not include any harmful effects of secondhand smoke. The weight of the literature instead finds similarly small externalities, but some notable exceptions actually find social savings from smoking (although these tend to be in countries with higher public expenditures on health than the United States).39Sijbren Cnossen, “Tobacco Taxation in the European Union,” FinanzArchiv/Public Finance Analysis 62, no. 2 (2006): 305–22.

However, fiscal externalities are not the only costs imposed on society by smokers. The other negative externality created by smoking is the burden imposed on nonsmokers, primarily through secondhand smoke. Such burdens include the annoyance of being exposed to others’ smoke and any adverse health effects. Health-related externalities based on second-hand smoke gained prominence in arguments for taxation and tobacco control in the US in the 1990s, after the earlier studies concluding that tobacco taxes were too high. Given that “everyone knows” how harmful secondhand smoke is, many people would be surprised to learn how weak the scientific evidence used to justify the indoor smoke-free laws of the 1990s actually was.40See W. Kip Viscusi, “The New Cigarette Paternalism,” Regulation 25, no. 4 (2002): 58–64; and Gary L. Huber, Robert E. Brockie, and Vijay K. Majhajan, “Smoke and Mirrors: The EPA’s Flawed Study of Environmental Tobacco Smoke and Lung Cancer,” Regulation 16, no. 3 (1993): 44–54. A landmark study in 1993 from the Environmental Protection Agency purported to show the adverse health effects of secondhand smoke and was influential in the passage of many local and state smoke-free ordinances. However, the report was savaged by a federal court.41A US district court found that the “EPA’s study selection is disturbing” and that the agency had cherry-picked the data, excluding almost half the available evidence—the half that did not support its preferred conclusion. See Flue-Cured Tobacco Co-op. v. U.S.E.P.A., 4 F. Supp. 2d 435 (M.D.N.C. 1998). While this court decision was later overturned for the reason that the EPA’s study was not a reviewable action under the Administrative Procedure Act, the findings regarding the scientific weakness of the report were left unrebutted. See Flue-Cured Tobacco Cooperative Stabilization Co. et al. v. Environmental Protection Agency et al., 313 F.3d 852 (4th Cir. 2002). The study, which stated that it reviewed the best available scientific evidence at the time, was thrown out by the court in part because it “did not demonstrate a statistically significant association between [secondhand tobacco smoke] and lung cancer,” which was its main claim. The point of rehearsing the story behind the first smoke-free ordinances is not to suggest that secondhand smoke does not have adverse health effects; that link is better established today. Rather, it is to note that, as is likely the case with the debate about e-cigarettes today (as will be covered below), the call to regulate smoking was sustained by political and social factors beyond those supported directly by the scientific knowledge at the time.42For a fascinating sociological perspective on why the anti-smoking crusade began to succeed when it did after “centuries of failure,” see Randall Collins, “Tobacco Ritual and Anti-ritual: Substance Ingestion as a History of Social Boundaries,” in Interaction Ritual Chains (Princeton, NJ: Princeton University Press, 2004). Collins points out the importance of nonscientific factors such as the “enjoying the moral prestige of a popular progressive movement” [p. 344].

Today, it is estimated that there are about 41,000 deaths per year in the United States attributable to secondhand smoke.43See The Health Consequences of Smoking—50 Years of Progress: A Report of the Surgeon General (Atlanta: US Department of Health and Human Services, 2014). Note that such estimates are typically reported without confidence intervals, but—given the uncertainty in the relative risks underlying the calculations—the confidence intervals would be wide. That figure represents about 1.5 percent of all deaths.44See Melanie Heron, “Deaths: Leading Causes for 2014,” National Vital Statistics Reports 65, no. 5 (2016): 1–95. The negative effects of maternal and passive smoking on infant and child health are considered some of the most important negative externalities.45See G. Banderali et al., “Short and Long Term Health Effects of Parental Tobacco Smoking during Pregnancy and Lactation: A Descriptive Review,” Journal of Translational Medicine 13 (2015); Kerry Anne McGeary et al., “Impact of Comprehensive Smoking Bans on the Health of Infants and Children,” American Journal of Health Economics 6, no. 1 (2020): 1–38. Various studies have associated smoking during pregnancy with reduced fetal growth, low birth weight, and, later in life, obesity, cardiovascular disease, and respiratory ailments. However, it remains the case that some of the links are weaker than people often assume. For example, one meta-analysis covering 76 studies on environmental tobacco smoke exposure found that there was no statistically significant association between environmental tobacco smoke in the home and premature births, low birthweight, spontaneous abortions, or lower Apgar scores at birth.46See Giselle Salmasi et al., “Environmental Tobacco Smoke Exposure and Perinatal Outcomes: A Systematic Review and Meta‐analyses,” Acta Obstetricia et Gynecologica Scandinavica 89, no. 4 (2010): 423–41. Note that the results regarding low birthweight are equivocal: while there is no statistically significant association between environmental tobacco exposure and low birthweight, when the latter is defined as a binary variable for birthweight less than 2.5 kilograms, there is a statistically significant association with lower birthweight when defined as a continuous variable. Such equivocal results hint at (perhaps substantial) nonlinearity or threshold effects in the relationship between environmental tobacco exposure and birthweight. Regardless, comparison with the results of other studies shows that the negative impact on birthweight of drinking one additional cup of coffee a day is more certain than the impact of a father smoking preterm (where certainty is ascertained by statistical significance and the width of confidence intervals). For the impact of a father smoking, see Ting-Jung Ko et al., “Parental Smoking during Pregnancy and Its Association with Low Birth Weight, Small for Gestational Age, and Preterm Birth Offspring: A Birth Cohort Study,” Pediatrics and Neonatology 55, no.1 (2014): 20–27. For the impact of drinking coffee, see Jongeun Rhee et al., “Maternal Caffeine Consumption during Pregnancy and Risk of Low Birth Weight: A Dose-Response Meta-analysis of Observational Studies,” PLOS ONE 10, no. 7 (2015): 1–18. On the other hand, the same meta-analysis found a positive association of secondhand smoke with congenital malformations.47The difficulty with measuring how detrimental maternal and passive smoking may be to neonatal and child health is exacerbated by the high likelihood that unobserved factors are correlated with these causes and the health outcomes. Most of the public health studies in the meta-analysis cited use cross-sectional data and cannot control for such confounding factors. A better-designed study demonstrates that the impact of maternal smoking on infant health and the infant healthcare cost savings associated with ceasing smoking during pregnancy are typically overestimated by an order of magnitude. See Douglas Almond, Kenneth Y. Chay, and David S. Lee, “The Costs of Low Birth Weight” Quarterly Journal of Economics 120, no. 3 (2005): 1031–83. Furthermore, many studies find that anti-smoking regulations are associated with better infant and child health.48See, for example, the many studies cited in Timor Faber et al., “Effect of Tobacco Control Policies on Perinatal and Child Health: A Systematic Review and Meta-Analysis” The Lancet Public Health 2, no. 9 (2017): e420–37 and Timor Faber et al., “Smoke-Free Legislation and Child Health” npj Primary Care Respiratory Medicine 26, art. no. 16067 (2016): 1–8. As discussed in the previous note, most such studies suffer potential bias from confounding factors. One recent study using methodology to reduce the impact of omitted variable bias (and, interestingly, one cited by a referee as bolstering the link between smoking and the health of infants and children) showed that after controlling for unobserved confounding factors at the county level, there was no association (at the standard 5% significance level) between comprehensive smoking bans and birthweight or the prevalence of low birthweight (see the bottom of panel b of table 3 of McGeary et al., “Impact of Comprehensive Smoking Bans.”) or the prevalence of hay fever, any respiratory allergies, asthma, ear infections, or being in “excellent or very good” general health. Out of nine child health outcomes studied, the only two displaying significant association with a ban were emergency room visits and being in “fair or poor” general health.

Before leaving the subject of negative externalities, it is important to note that a tax is a blunt instrument for reducing environmental tobacco smoke exposure. The price elasticity of market demand for cigarettes is estimated to be around 0.4, implying that a 10 percent increase in the price of cigarettes reduces total consumption in the market by only 4 percent. Other, more direct interventions can have much larger impacts. For example, consider concerns about the health of unborn children in a smoking household. One behavioral intervention that involved advising about health risks, introducing strategies within the home to eliminate exposure to smoke, and cognitive behavioral therapy for depression or intimate partner violence when necessary reduced the odds of secondhand smoke exposure by one-half.49Ayman El-Mohandes et al., “An Intervention to Reduce Environmental Tobacco Smoke Exposure Improves Pregnancy Outcomes,” Pediatrics 125, no. 4 (2010): 721–28. From the viewpoint of political economy, it is important to recognize that policymakers may prefer tobacco taxes to behavioral intervention programs because the former raise revenue for the state while the latter require public expenditure.

The behavioral rationale for regulation: “internalities.”

Since taxes on tobacco may already be adequate or too high from the usual point of view of taxing to correct for externalities, tobacco control advocates in recent years have turned to justifications based on behavioral economics. The nontechnical version of these arguments proceeds along the following lines: “Youth are not rationally forward-thinking consumers, and most smokers begin smoking in their youth.” The former assertion, coupled with the latter empirical observation, and supplemented with survey evidence showing that most smokers say that they wish they had not started smoking,50For example, roughly 90% of US smokers agreed with the following statement: “If you had to do it over again, you would not have started smoking.” Geoffrey T. Fong et al., “The Near-Universal Experience of Regret among Smokers in Four Countries: Findings from the International Tobacco Control Policy Evaluation Survey,” Nicotine & Tobacco Research 6, no. 3 (2004): 341–51. have led many advocates to call for higher tobacco taxes despite the absence of the usual economic rationales.

Arguments against this rationale include the observation that (as discussed earlier) taxes are blunt instruments to prevent smoking, especially since many youth do not pay for their cigarettes and, in particular, for their first cigarettes.51More than 60% of child smokers in one study said that they were given their first cigarettes. See Janet G. Baugh et al., “Development Trends of First Cigarette Smoking Experience of Children: The Bogalusa Heart Study,” American Journal of Public Health 72, no. 10 (1982): 1161–64. The greatest weight of a cigarette tax falls on adults, not youth. Furthermore, sales of tobacco to youth are already illegal; if the “infinite tax” tacitly imposed by a ban does not prevent youth from starting to smoke, then why would a finite tax do so—especially since both forms of tax can be evaded, as discussed below? The evidence is inconclusive regarding the impact of cigarette prices on youth smoking. At least some studies find that higher prices lower the propensity of youth to smoke,52Hana Ross and Frank J. Chaloupka, “The Effect of Cigarette Prices on Youth Smoking,” Health Economics 12, no. 3 (2003): 217–30; Dean R. Lillard, Eamon Molloy, and Andrew Sfekas, “Smoking Initiation and the Iron Law of Demand,” Journal of Health Economics 32, no. 1 (2013): 114–27. although other research indicates that the actual primary driver affecting youth’s smoking behavior is anti-smoking sentiment or regulations in the state rather than prices per se.53Philip DeCicca et al., “Youth Smoking, Cigarette Prices, and Anti‐smoking Sentiment,” Health Economics 17, no. 6 (2007): 733–49; Jeffrey Wasserman et al., “The Effects of Excise Taxes and Regulations on Cigarette Smoking,” Journal of Health Economics 10, no. 1 (1991): 43–64.

Extending the behavioral economic rationale for tobacco taxes to adults requires a theory involving so-called internalities—irrational behavior due to limited self-control or foresight. Such theories, when applied to tobacco consumption, assume that there is a “behavioral wedge” between the price of the good and the value to the consumer of the last unit consumed.54In the theories discussed here, the value to the consumer of the last unit consumed is measured as the money-metric marginal utility from consumption. See Emmanuel Farhi and Xavier Gabaix, “Optimal Taxation with Behavioral Agents,” American Economic Review 110, no. 1 (2020): 298–336. Whereas a rational consumer (roughly speaking) spends money on a commodity to the point where it is just worth it, in terms of satisfaction gained for the price paid, the behavioral wedge implies that the individual “overconsumes” the good, even as evaluated by the person’s own (eventual) preferences. Such individuals will look back on past decisions and wish that they had not consumed so much of the good. This may happen, for example, if youth, when they first try smoking, underestimate the likelihood that they will get addicted and become lifelong smokers (with all the resulting pecuniary and health costs). The implication is that, theoretically, increasing the price of a good by increasing an excise tax may actually increase some people’s welfare. Thus, a tax may help “nudge” a consumer toward an outcome that is better for that person, in the estimation of that person. One study adopting this approach arrived at the conclusion that an “optimal” tax to correct for internalities might be as high as $15 per pack—far higher than any tax in the nation.55Gruber and Köszegi, Modern Economic View of Tobacco Taxation. Such conclusions regarding optimal taxes make the behavioral approach a convenient rationale for parties advocating for higher tobacco taxes.

The paternalistic rationale for regulation.

As is clear from the discussion of the behavioral rationale for tobacco regulation, many policy analysts and policymakers approach the subject of tobacco regulation with a heavy dose of paternalism. They view smokers as faulty decision makers who need to be saved from their own poor choices. Some authors are quite explicit about this. For example, in one behavioral economic study performed for a lung cancer group, the authors explain, “we will focus on failures of individual self-control which lead to excessive smoking relative to desired levels. In such a case, tobacco taxation can provide a corrective force to combat failures of self-control.”56Gruber and Köszegi, Modern Economic View of Tobacco Taxation, p. 2. In this approach, the power of the state to tax provides a corrective force to nudge (or shove) irrational, tricked, or self-deluded smokers toward cessation.

Paternalism is a comfortable position for many policymakers to adopt, since—given smoking’s negative correlation with income and education—relatively few of them smoke today. As Kip Viscusi, a University Distinguished Professor at Vanderbilt University, has pointed out, since policymakers have chosen not to smoke, it is therefore easy for them to assume that smokers are mistaken, irrational, or in need of policy nudges toward cessation.57Viscusi, “New Cigarette Paternalism.” Of course, the fact that a behavior is hard to quit does not necessarily prove that the choice to begin was irrational (as most coffee drinkers would attest).58For a discussion of assumptions under which a rational individual would choose to become addicted, see Gary S. Becker and Kevin M. Murphy, “A Theory of Rational Addiction,” Journal of Political Economy 96, no. 4 (1988): 675–700. Furthermore, assumed faulty choices based on mistaken perceptions of the health effects of smoking appear to be unlikely, since, if anything, the American public overestimates the risks of smoking today.59Viscusi shows that at a time when medical science indicated that the risk of lung cancer for an average smoker was 6%–13%, the public thought it was 47%. Similar overestimation of risk is also present for premature mortality and life-years lost. Viscusi, “New Cigarette Paternalism.” (The evidence about whether youth in particular hold correct perceptions of the risks involved in smoking is inconclusive, however.)60The evidence in one study shows that among 14-to-22-year-olds, 70% of smokers and 79% of nonsmokers overestimated the risks of lung cancer. The same researchers found that only 34% of smokers and 41% of nonsmokers overestimated the total mortality risk of smoking, which the researchers take to be around 50%. Daniel Romer and Patrick Jamieson, “Do Adolescents Appreciate the Risks of Smoking? Evidence from a National Survey,” Journal of Adolescent Health 29, no. 1 (2001): 12–21. However, at the time of that study, the public was being told by the surgeon general’s report on smoking and the National Cancer Institute that the mortality risk was 18 percent to 36 percent. See Viscusi, “New Cigarette Paternalism.” It appears unlikely that any average smoker or nonsmoker would be looking at the technical academic or clinical literature indicating higher risk. Thus, the large majority of both smokers and nonsmokers were overestimating the risks compared to what they were being told by the most prominent sources of information. One would expect that as the higher estimates of mortality risk diffused into the public-facing messaging in the tobacco control community, people’s perceptions of risk would rise in response, if the degree of overestimation were to remain similar. However, apparently no more recent studies on risk perception have been performed.

Evidence for intertemporal irrationality and time inconsistency in decision-making (by which economists mean that the future self will regret decisions made by the present self) comes mainly from lab experiments. These are typically performed on college students at elite universities—hardly a representative demographic. There is also a small empirical literature that claims to find time inconsistency in real-world economic decisions (other than decisions about smoking).61For example, one strand of literature finds time inconsistency in labor market and welfare program participation decisions. See Hanming Fang and Dan Silverman, “Time‐Inconsistency and Welfare Program Participation: Evidence from the NLSY,” International Economic Review 50, no. 4 (2009): 1043–77. Such apparent irrationality follows from individuals in the data not making the choices that the economic theorists think that they should after estimating impressively technical yet still restrictive models of consumers’ choices. It remains to be seen whether these findings will hold up when more realistic models of economic behavior based on less restrictive assumptions are investigated.

While the arguments for paternalistic action by the state thus assume that smokers “need help helping themselves,” arguments for less paternalism can be based on normative and positive grounds.62See Russell S. Sobel and Joshua C. Hall, “In Loco Parentis: A Paternalism Ranking of the States,” in For Your Own Good: Taxes, Paternalism, and Fiscal Discrimination in the Twenty-First Century, ed. Adam J. Hoffer and Todd Nesbit (Arlington, VA: Mercatus Center at George Mason University, 2018). Normative ideas include the idea that the proper role of government is to protect the liberty of the citizens regarding—among other concerns—economic decisions, and the idea that (absent compelling reasons to the contrary) individuals should be free to make choices without government interference. Conversely, even granting the premise of limited cognition and the desire to optimize the behavior of individuals who cannot do so themselves, bounded rationality can raise the costs of government decision-making relative to private decision-making.63The argument follows from the observations that consumers have stronger incentives to correct their behavior than do government decision makers and that consumers have stronger incentives to make good choices when choosing what to buy than when choosing how to vote. See Edward L. Glaeser, “Paternalism and Psychology,” Regulation 29, no. 2 (2006). Positive arguments against paternalistic tobacco taxes are based on the unintended consequences that such taxes can have. For example, evidence from the 1990s indicates that higher prices caused smokers to switch to cigarettes that were higher in tar and nicotine, and therefore more harmful and addictive.64See M. C. Farrelly et al., “The Effects of Higher Cigarette Prices on Tar and Nicotine Consumption in a Cohort of Adult Smokers,” Health Economics 13, no. 1 (2004): 49–58. Despite the oft-heard slogan that “there is no such thing as a safer cigarette,” the epidemiological evidence indicates that low-tar cigarettes reduce the risk of lung cancer and total mortality for smokers. See G. C. Kabat, “Fifty Years’ Experience of Reduced-Tar Cigarettes: What Do We Know about Their Health Effects?,” Inhalation Toxicology 15, no. 11 (2003): 1059–102. Other unintended consequences are covered in the next subsection.65For more complete critiques of paternalism and taxation, see Adam J. Hoffer and Todd Nesbit, eds., For Your Own Good: Taxes, Paternalism, and Fiscal Discrimination in the Twenty-First Century (Arlington, VA: Mercatus Center at George Mason University, 2018); Adam J. Hoffer, William F. Shughart II, and Michael D. Thomas, “Sin Taxes and Sindustry: Revenue, Paternalism, and Political Interest,” Independent Review 19, no. 1 (2014): 47–64.

Unintended consequences of taxes and regulations.

An effective approach to policy must focus less on what policymakers hope will happen and more on what is likely to happen. This takes us into the realm of unintended consequences.

A standard desideratum for taxation is equity, based on the ability-to-pay principle. This principle leads to the system of progressive income taxation in the United States, for example. Excise taxes on cigarettes are regressive, however: poorer individuals spend a greater share of their income on consumption, and therefore an excise tax takes a greater share of a poor person’s income than it does of a wealthy person’s income. Furthermore, cigarette smoking is more prevalent among lower-income groups in the United States. These facts compound to make tobacco taxes doubly regressive.66See Matthew C. Farrelly et al., “Response by Adults to Increases in Cigarette Prices by Sociodemographic Characteristics,” Southern Economic Journal 68, no. 1 (2001): 156–65; Don Fullerton and Diane L. Rogers, Who Bears the Lifetime Tax Burden? (Washington, DC: Brookings Institution Press, 1993); Andrew B. Lyon and Robert M. Schwab, “Consumption Taxes in a Life-Cycle Framework: Are Sin Taxes Regressive?,” Review of Economics and Statistics 77, no. 3 (1995): 389–406; and Dahlia K. Remler, “Poor Smokers, Poor Quitters, and Cigarette Tax Regressivity,” American Journal of Public Health 94, no. 2 (2004): 225–29. While tobacco taxes may constitute only a small part of the total financial burden facing most smokers, in some cases the tax burden could be onerous. Consider, as an extreme example, a full-time minimum-wage worker in Chicago, where combined federal, state, county, and local tobacco taxes during the second half of 2019 were $8.17 per pack.67See “Increases and Changes to Consumer Taxes in Chicago for 2020,” Civic Federation, January 10, 2020, https://www.civicfed.org/civic-federation/blog/increases-and-changes-consumer-taxes-chicago-2020. The minimum wage in Chicago at the time was $12 per hour. During that period, the taxes alone on a pack-a-day smoking habit would have taken up 12 percent of the individual’s gross wages.68See Matthew C. Farrelly, James M. Nonnemaker, and Kimberly A. Watson, “The Consequences of High Cigarette Excise Taxes for Low-Income Smokers,” PLOS ONE 7, no. 9 (2012): e43838. The authors conclude after an empirical examination that high cigarette taxes “can impose a significant financial burden on low-income smokers.” See also James E. Prieger et al., The Impact of Ecigarette Regulation on the Illicit Trade in Tobacco Products in the European Union (Geneva, Switzerland: BOTEC Analysis, 2019), which discusses at length the issue of “specific impoverishment” caused by tobacco taxes.

If higher taxes encouraged many low-income individuals to quit smoking, then one could argue that the regressive impact of tobacco taxes would be blunted or removed entirely. The evidence for the predicate is weak, however. There is evidence that higher prices are associated with a lower number of smokers, even among the low-income population, but evidence for a link between prices and cessation is less clear (in part because cessation is harder to study than smoking prevalence). One study found that there is no correlation between successful cessation among smokers below the poverty line and cigarette prices in their state of residence, either in bivariate analysis or after controlling for other factors.69 Maya Vijayaraghavan et al., “The Effectiveness of Cigarette Price and Smoke-Free Homes on Low-Income Smokers in the United States,” American Journal of Public Health 103, no. 12 (2013): 2276–83. Furthermore, while some evidence shows that higher prices are associated with lower smoking prevalence among low-income individuals, this evidence does not by itself imply that taxes cause cessation, since it could just as well mean that fewer low-income individuals ever started smoking.

The indirect evidence for higher taxes leading to cessation is stronger: several studies show that tax increases lead to a lower smoking prevalence among older adults.71Philip DeCicca and Logan McLeod, “Cigarette Taxes and Older Adult Smoking: Evidence from Recent Large Tax Increases,” Journal of Health Economics 27, no. 4 (2008): 918–29. Given that few people begin smoking once out of their twenties, a lower prevalence of smoking among older smokers than younger smokers is indicative of cessation.72Even here, the evidence is mixed, because when the estimated smoking responses to tax increases are used to simulate trends in the prevalence of smoking in the US, the models greatly underpredict actual smoking rates. Philip DeCicca et al., “The Economics of Smoking Prevention,” in Oxford Research Encyclopedia of Economics and Finance (Oxford: Oxford University Press, 2018). That is, if tax increases discouraged adult smoking so much, then there would not be so many actual smokers still. Thus, DeCicca et al. conclude that “the true [price] elasticity lies between zero and −0.1, which is considerably smaller than the corresponding consensus estimate.” Regardless, another study found that, cigarette tax increases remain regressive even accounting for the different sensitivity among income groups of smoking to prices.73Gregory J. Colman and Dahlia K. Remler, “Vertical Equity Consequences of Very High Cigarette Tax Increases: If the Poor Are the Ones Smoking, How Could Cigarette Tax Increases Be Progressive?,” Journal of Policy Analysis and Management 27, no. 2 (2008): 376–400. This study also explains how under extreme behavioral models (as discussed earlier) cigarette taxes can be progressive, but nevertheless concludes that “taxes and other hindrances on smoking benefit higher-income more than lower-income smokers who are planning to quit.” Colman and Remler, “Vertical Equity Consequences,” 396.

Proponents of higher tobacco taxes often respond to the regressivity argument by contending that revenue from the taxes should be directed toward cessation programs intended to help low-income smokers quit or toward relieving these smokers’ financial burdens.74See, for example, Vijayaraghavan et al., “Effectiveness of Cigarette Price and Smoke-Free Homes.” Funding cessation programs may be an admirable intention, but—as mentioned earlier—less than 3 percent of current tobacco tax and MSA payments are spent on cessation.75See “State-by-State Look,” Campaign for Tobacco-Free Kids. While this fact may appear to be at odds with the common recent practice of earmarking tax increases for cessation programs or other public health initiatives, the fungibility of state tax revenue implies that earmarking a dollar does not mean that an additional dollar will be spent on the targeted cause. See George R. Crowley and Adam J. Hoffer, “Earmarking Tax Revenues: Leviathan’s Secret Weapon?,” in Hoffer and Nesbit, For Your Own Good. Taxing to relieve a household’s financial burden is an odd argument, since no scheme taxing a subset of the poor could result in net financial gains for those taxed. A final open question regarding the equity of taxes is whether the health benefits of reduced smoking accrue disproportionately to lower-income individuals and families. If so, the direct regressivity of the taxes would be attenuated (or even reversed) by the offsetting health benefits.

Illicit trade in response to tobacco taxes is also a concern. As stated in a leading economics textbook on public finance, “markets do not take taxes lying down.”76See Jonathan Gruber, Public Finance and Public Policy (New York: Worth Publishers, 2005), 547. Furthermore, to borrow a statement attributed to John Maynard Keynes, “the avoidance of taxes is the only pursuit that still carries any reward.” A large body of research indicates that increasing tobacco taxes can have the unintended consequence of stimulating illicit trade in tobacco products (ITTP).77See Roger Bate, Cody Kallen, and Aparna Mathur, “The Perverse Effect of Sin Taxes: The Rise of Illicit White Cigarettes,” Applied Economics 52, no. 8 (2020): 789–805; James E. Prieger and Jonathan Kulick, “Cigarette Taxes and Illicit Trade in Europe,” Economic Inquiry 56, no. 3 (2018): 1706–23; James E. Prieger and Jonathan Kulick, “Tax Evasion and Illicit Cigarettes in California: Part IV—Smokers’ Behavioral and Market Responses to a Tax Increase,” BOTEC Analysis, January 24, 2019, https://ssrn.com/abstract=3322095; Philip DeCicca, Donald Kenkel, and Feng Liu, “Excise Tax Avoidance: The Case of State Cigarette Taxes,” Journal of Health Economics 32, no. 6 (2013): 1130–41; Michael LaFaive, “Prohibition by Price: Cigarette Taxes and Unintended Consequences,” in Hoffer and Nesbit, For Your Own Good; and the numerous empirical studies cited in these studies. In the United States, most ITTP takes the form of legitimately manufactured cigarettes that are transported between states to be sold illicitly, avoiding state and local excise taxes at the point of retail sale. ITTP also involves counterfeit cigarettes, untaxed sales from Native American reservations, illicit whites (cigarettes legal in the country of manufacture but intended for illegal sales in other markets), and gray market reimported goods.78See James E. Prieger, Jonathan Kulick, and Mark A. R. Kleiman, “Unintended Consequences of Cigarette Prohibition, Regulation, and Taxation,” International Journal of Law, Crime and Justice 46 (2016): 69–85. ITTP is big business. The National Academy of Sciences found in 2017 that illicit sales compose between 8.5 percent and 21 percent of the total market for cigarettes in the United States. This range represents between 1.24 and 2.91 “billion packs of cigarettes annually and between $2.95 billion and $6.92 billion in lost gross state and local tax revenues.”79National Research Council and Institute of Medicine, Understanding the U.S. Illicit Tobacco Market: Characteristics, Policy Context, and Lessons from International Experiences, ed. Peter Reuter and Malay Majmundar (Washington, DC: National Academies Press, 2015), 4. Worldwide, the avoided taxes from ITTP are estimated to be in the tens of billions of dollars per year, putting ITTP in the same financial class as the global traffic in illicit drugs.80See discussion of this comparison in Prieger et al., Impact of Ecigarette Regulation.

The economic explanation for ITTP is simple: licit and illicit cigarettes are substitutes, and when the tax-inclusive price of the licit good rises, some users will switch to the illicit substitute. The degree to which tax increases and tax differentials among states and localities cause substitution toward ITTP depends on many factors, including the rule of law, enforcement at customs borders and at points of sale, the ease of access to illicit sources, the price differential between licit and illicit cigarettes, and the moral sentiments of the smoker.81For empirical evidence on the final point, see Prieger and Kulick, “Tax Evasion and Illicit Cigarettes in California: Part IV.”

While the basic fact that an increase in taxes leads to more ITTP, holding other factors constant, is generally accepted by most economists, there is much disagreement over the policy implications. If tax rates across states were unified, then presumably raising a unified rate would not stimulate as much ITTP as raising an already high local tax (such as in Chicago or New York City), given the large role that interstate tax arbitrage currently plays in ITTP.82Rajiv Goel and James W. Saunoris, “Cigarette Smuggling: Using the Shadow Economy or Creating Its Own?,” Journal of Economics and Finance 43 (2019): 582–93. Some in the public health community downplay any suggestion that taxes are linked to ITTP, dismissing the argument through guilt by association, since the tobacco industry makes this claim.83See Julia Smith, Sheryl Thompson, and Kelley Lee, “Death and Taxes: The Framing of the Causes and Policy Responses to the Illicit Tobacco Trade in Canadian Newspapers,” Cogent Social Sciences 3, no. 1 (2017). Others argue either that the effects are small or that other measures can be taken to combat illicit trade.84See Luk Joossens and Martin Raw, “From Cigarette Smuggling to Illicit Tobacco Trade,” Tobacco Control 21, no. 2 (2012): 230–34. Careful empirical investigation has shown, however, that raising taxes can lead to sizeable increases in ITTP.85See in particular Prieger and Kulick, “Cigarette Taxes and Illicit Trade in Europe.” Notwithstanding, the evidence is clear that in most cases ITTP may erode but does not reverse revenue gains from increased taxes. Similarly, taxes do decrease consumption of tobacco products, even though ITTP may attenuate the amount by which they do so.86A group of economists with diverse perspectives on tobacco taxation and ITTP state that “little disagreement exists that an increase in the tax rate would generate significant increases in revenue, or that it would decrease consumption.” Warner et al., “Criteria for Determining an Optimal Cigarette Tax.”

Before leaving the subject of ITTP, it is important to note that it creates harms to health additional to those of smoking genuine, fully taxed cigarettes. Counterfeit cigarettes have been shown to contain pesticides, human and animal waste, heavy metals, and other harmful substances.87See Lee Moran, “Fake Cigarettes Containing Human Feces, Rat Droppings Flood British Market: Report,” New York Daily News, November 11, 2014; W. Edryd Stephens, Angus Calder, and Jason Newton, “Source and Health Implications of High Toxic Metal Concentrations in Illicit Tobacco Products,” Environmental Science and Technology 39, no. 2 (2005): 479–88; and Oliver Bennett, “How Counterfeit Cigarettes Containing Pesticides and Arsenic Make It to Our Streets,” Independent, August 7, 2018. Furthermore, law enforcement directed at ITTP can create other harms, including those from incarceration and violence, given the well-known link between enforcement action against illicit drug markets and violence.88See Prieger, Kulick, and Kleiman, “Unintended Consequences of Cigarette Prohibition”; James E. Prieger and Jonathan Kulick, “Violence in Illicit Markets: Unintended Consequences and the Search for Paradoxical Effects of Enforcement,” B.E. Journal of Economic Analysis and Policy 15, no. 3 (2015): 1263–95; and James Prieger and Jonathan Kulick, “Unintended Consequences of Enforcement in Illicit Markets,” Economics Letters 125, no. 2 (2014): 295–97.

Issues Involved with Taxing and Regulating E-cigarettes

This section reviews the most prominent issues regarding the regulation of ENDS and potential unintended consequences.

The main issues surrounding vaping concern its safety, its relationship to smoking (including whether it is a promising avenue for harm reduction), and unintended consequences of regulation and taxation. Harm reduction refers to policies and approaches aimed at reducing the harms from an addictive substance, but not the use of the substance per se.89See Alison Ritter and Jacqui Cameron, “A Review of the Efficacy and Effectiveness of Harm Reduction Strategies for Alcohol, Tobacco and Illicit Drugs,” Drug and Alcohol Review 25, no. 6 (2006): 611–24. The viewpoint of harm reduction is widely accepted in the public health community for alcohol and illicit drugs, but it is controversial in the tobacco control community, mainly because of guilt by association with Big Tobacco, which “has been seen by some to lead the harm reduction push (through the development of new nicotine delivery devices).”90Ritter and Cameron, “Review of the Efficacy and Effectiveness,” 613. Thus, in traditional tobacco control abstinence is taken as the goal, rather than finding safer ways to consume nicotine. The rejection of harm reduction as a guiding philosophy is sometimes justified with reference to the precautionary principle, which posits that lack of scientific certainty should not delay action to regulate or ban new products such as e-cigarettes.91See the discussion of harm reduction versus the precautionary principle in Lawrence W. Green, Jonathan E. Fielding, and Ross C. Brownson, “The Debate about Electronic Cigarettes: Harm Minimization or the Precautionary Principle,” Annual Review of Public Health 39 (2018): 189–91. Notwithstanding, the discussion to follow examines the issue through the lens of harm reduction and whether e-cigarettes could be part of such an approach.

Is vaping safer than smoking?

What many consider to be the most important question is the easiest to answer: Is vaping safer than smoking? Because e-cigarettes do not involve combustion, and because the combustion of the organic material in a cigarette creates nearly all the health hazards, it would be surprising indeed if e-cigarettes were found to be as risky for health as smoking. This simple expectation has been greatly muddied in the public mind by certain public health advocates who hold a priori goals of abstinence for both smoking and vaping. Thus, a review of the state of current knowledge on this topic may be useful.

To begin with, from the standpoint of harm reduction, the question is not whether e-cigarettes pose no health risks at all (except perhaps for the subject of initiation by youth, a subject to which I will return below). In the context of the public health disaster caused by smoking, the proper first question must be whether e-cigarettes are safer than cigarettes, and to what degree. After considering the state of the evidence, the official health ministry of England declared that vaping is at least 95 percent less harmful to health than smoking.92See A. McNeill et al., Ecigarettes: An Evidence Update (London: Public Health England, 2015). The purpose of Public Health England’s statement in 2015 was not to present a precise risk multiple, but instead to effectively encourage smokers who have been unable to quit by other methods to switch to vaping instead of smoking.93“Based on current knowledge, stating that vaping is at least 95% less harmful than smoking remains a good way to communicate the large difference in relative risk unambiguously so that more smokers are encouraged to make the switch from smoking to vaping.” McNeill et al., Ecigarettes: An Evidence Update. Given the clarity of the statement, the obvious implication that switching should be encouraged, and the resistance of some in the American public health community to that message, it is unsurprising that Public Health England has been attacked for its statement. See, for example, Thomas Eissenberg et al., “Invalidity of an Oft-Cited Estimate of the Relative Harms of Electronic Cigarettes,” American Journal of Public Health 110, no. 2 (2020): 161–62. A good discussion of the issues involved and a rebuttal may be found in Clive Bates, “Vaping Is Still at Least 95% Lower Risk than Smoking—Debunking a Feeble and Empty Critique,” The Counterfactual (blog), January 17, 2020.

Eliquids and vapor contain substances known to be harmful to human health when inhaled, including irritants, carcinogens, and particulates.94Tianrong Cheng, “Chemical Evaluation of Electronic Cigarettes,” Tobacco Control 23, no. S2 (2014): 11–17. Then again, much of modern life exposes individuals to harmful substances. Thus the question is what the short- and long-term health effects from such exposure are, and how they compare with those from smoking.

One difficulty in discussing the health effects of vaping is the great multiplicity of products: there is no “standard” vapor, concentration of chemicals in eliquids, or intensity of inhalation. Notwithstanding, one study found that along the spectrum of products tested, the preponderance of products produced vapor with cancer potencies of less than 1 percent of those of tobacco smoke.95William E. Stephens, “Comparing the Cancer Potencies of Emissions from Vapourised Nicotine Products Including Ecigarettes with Those of Tobacco Smoke,” Tobacco Control 27, no. 1 (2018): 10–17. Fewer harmful substances in the vapor means that fewer end up in the body. Another study concluded that switching completely from cigarettes to e-cigarettes “substantially reduced levels of measured carcinogens and toxins” in the body.96See Lion Shahab et al., “Nicotine, Carcinogen, and Toxin Exposure in Long-Term Ecigarette and Nicotine Replacement Therapy Users: A Cross-Sectional Study,” Annals of Internal Medicine 166, no. 6 (2017): 390–400. Overall, the National Academy of Sciences report on e-cigarettes found that “there is conclusive evidence that completely substituting e-cigarettes for combustible tobacco cigarettes reduces users’ exposure to numerous toxicants and carcinogens present in combustible tobacco cigarettes.”97See National Academies of Science, Engineering, and Medicine, Public Health Consequences of Ecigarettes.

Perhaps the strongest case against vaping on the grounds of deleterious health effects would be based on respiratory disease, since exposure to particulates and flavorings in e-cigarette vapor could potentially impair the function of the lungs. Several studies find that vaping can cause acute respiratory symptoms such as coughing and wheezing, particularly among adolescents. Some of these studies do not control for concurrent or past smoking; controlling for these confounding factors removes the positive associations between vaping and respiratory symptoms in some studies.98For example, one study found that the odds of wheezing in adolescents are affected by ecigarette use only when past cigarette use is not controlled for. See Rob McConnell et al., “Electronic Cigarette Use and Respiratory Symptoms in Adolescents,” American Journal of Respiratory and Critical Care Medicine 195, no. 8 (2017): 1043–49. Conversely, the association between vaping and the odds of having symptoms of bronchitis was reduced in magnitude but not removed when past cigarette use was controlled for. Even here, however, the recent National Academy of Sciences report concluded that “there is no available evidence whether or not e-cigarettes cause respiratory diseases in humans.”99See National Academies of Science, Engineering, and Medicine, Public Health Consequences of Ecigarettes. Conversely, the same report found “limited evidence” for improvement in symptoms from asthma and chronic obstructive pulmonary disease when smokers who suffered from those ailments switched completely to vaping. Summarizing evidence concerning a variety of potential ill health effects, the report found that there is “substantial evidence that completely switching from regular use of combustible tobacco cigarettes to e-cigarettes results in reduced short-term adverse health outcomes in several organ systems,” including the respiratory system.

To conclude, while there is great uncertainty about the long-term effects of vaping, the answer to whether using e-cigarettes is better for health than smoking is almost surely yes. Viewed as part of a continuum of nicotine delivery methods arranged in terms of health risk, e-cigarettes appear to be much closer to nicotine replacement therapies than to smoking. However, the strongest arguments for the potential for e-cigarettes to reduce health harms to users can be made for users who switch completely away from smoking. There is no available evidence about whether long-term e-cigarette use among users who continue to smoke, called dual users, changes morbidity or mortality compared to smokers who do not vape.100See National Academies of Science, Engineering, and Medicine, Public Health Consequences of Ecigarettes.

Do e-cigarettes aid in cessation?

Is vaping a useful aid to help smokers quit smoking, or does it just prolong the habit by allowing smokers another way to consume nicotine when they are temporarily unable to smoke? It appears likely that e-cigarettes would be a more appealing cessation aid than nicotine replacement therapies (NRTs) such as patches, gum, or lozenges, given the sensory and behavioral similarity of vaping to smoking. The scientific literature on e-cigarettes and cessation is still in its early stages; given the novelty of vaping, no long-term studies on e-cigarettes and cessation have been performed. However, the initial literature is mainly encouraging.

A review of existing studies conducted in 2015 found that, overall, use of e-cigarettes was positively associated with both cessation of smoking and reduction in the intensity of smoking (for those who did not quit).101See Muhammad Aziz Rahman et al., “Ecigarettes and Smoking Cessation: Evidence from a Systematic Review and Meta-analysis,” PLOS ONE 10, no. 3 (2015). A more recent review of studies on cessation came to a similar conclusion, but only after excluding numerous published studies that did not meet standard levels of quality for scientific research in medicine or public health.102See Andrea C. Villanti et al., “How Do We Determine the Impact of E‐cigarettes on Cigarette Smoking Cessation or Reduction? Review and Recommendations for Answering the Research Question with Scientific Rigor,” Addiction 113, no. 3 (2018): 391–404. The observation that this review found that most studies on vaping and cessation (all but four out of 91) failed to constitute reliable scientific evidence is important, because public health researchers who oppose vaping sometimes claim that “the weight of the evidence” shows that ecigarette use does not aid cessation. The latter meta-analysis found that rates of smoking cessation with e-cigarettes were generally similar to rates of cessation with NRT, while the former found e-cigarettes to be twice as effective as NRT.103The cessation rate, defined as the 12-month quit rate, was found to be about 10% with NRTs and 20% with ecigarettes. See Rahman et al., “Ecigarettes and Smoking Cessation.” Some research conducted after these reviews also suggests that e-cigarettes can play a role in cessation.104Some recent studies finding that ecigarettes may aid cessation use quasi-experimental designs. See Dhaval Dave et al., “Does Ecigarette Advertising Encourage Adult Smokers to Quit?,” Journal of Health Economics 68 (2019): 102227; Henry Saffer et al., “Ecigarettes and Adult Smoking: Evidence from Minnesota” (NBER Working Paper No. 26589, National Bureau of Economic Research, Cambridge, MA, December 2019). Other studies employ randomized controlled trials. See Peter Hajek et al., “A Randomized Trial of Ecigarettes versus Nicotine-Replacement Therapy,” New England Journal of Medicine 380 (2019): 629–37. The authors find that ecigarettes were more effective for smoking cessation than nicotine-replacement therapy.

Are kids getting addicted to e-cigarettes?

There have been many dire, headline-grabbing reports issued in recent years referring to the “vaping epidemic” among youth. For example, in 2019 many variations on the headline “Teen Vaping Surges to More Than One in Four Students” appeared.105See, for example, Angelica LaVito, “CDC Says Teen Vaping Surges to More than 1 in 4 High School Students,” CNBC, September 12, 2019. However, the much-publicized “27 percent” statistic pertains to the proportion of high school students who have used an e-cigarette once or more during the past 30 days. There is clearly a lot of casual use among high schoolers, since the prevalence of substantial use of e-cigarettes among high school students (defined as use on 20 or more days out of the past 30) is less than 10 percent.106Karen A. Cullen et al., “Ecigarette Use among Youth in the United States, 2019,” JAMA 322, no. 21 (2019): 2095–103. This figure is derived by multiplying the any-use prevalence of 27.5% by the proportion of current users using 20 days or more out of the past 30 (34.2%).