Does regulation kill jobs or create them? Push wages up or push them down? In fact it can have any of these effects, depending on how it is written and where it is applied. In this chapter, I first use economic theory to distinguish among certain common types of regulation and explain their varying effects on wages and employment. I then summarize the empirical literature from economics and adjacent fields that attempts to determine whether the effects predicted by simple economic theory hold true in the real world, measure how large these effects are in practice, and quantify the net effect of all US regulations on wages and employment.

In short, the literature finds that the directional predictions of simple economic theory generally hold true, but that the estimated size of these effects varies widely. Several attempts to quantify the “cumulative” cost of US regulation have produced estimates in the neighborhood of $2 trillion per year, but in fact these studies only estimate the cost of about a quarter of all federal regulations.

What Is Regulation?

A typical regulation states a set of actions that certain types of individuals or firms must or must not take. Take, for example, chapter 2, section 1420.3, from Title 16 of the Code of Federal Regulations—“requirements for four-wheel ATVs”—which begins,

Each ATV shall comply with all applicable provisions of the American National Standard for Four-Wheel All-Terrain Vehicles (ANSI/SVIA 1–2017), ANSI-approved on June 8, 2017. The Director of the Federal Register approves this incorporation by reference in accordance with 5 U.S.C. 552(a) and 1 CFR part 51. You may obtain a copy from Specialty Vehicle Institute of America. . . .

In short, the regulation is adding design requirements to a manufacturing process, presumably with the goal of enhancing consumer safety.

In some cases regulations do not constitute binding constraints that actually affect producers, either because they are not enforced or because producers would have done things that way without being told to. But in the typical case regulations do matter, and do change the decisions made by economic actors.

Different types of regulations have different effects, and the scope, scale, and variety of regulation can be bewildering even to experienced researchers and to those in regulated industries. To keep things simple, rather than attempting to discuss every possible type of regulation, in this chapter I focus on a few major types of regulation that have clear ties to labor markets. These include common general regulations (cost-increasing regulations, bans, and entry barriers) that can have spillover effects on labor markets, as well as labor-specific regulations that target labor markets directly (minimum wages, mandated benefits, and employment regulations).

What Does Basic Economic Theory Predict about How Different Types of Regulation Affect Wages and Employment?

Cost-Increasing Regulations

A typical cost-increasing regulation, such as the ATV rule described above, directs producers to change their products in costly ways, often for the purpose of benefiting a third party such as consumers or the environment. In basic economic terms, an increase in the cost of production is a leftward shift in the supply curve, which leads to higher prices, reduced production, and lower revenue for producers. In the case of consumer-safety regulation, these effects may be partly offset by an increase in demand, to the extent that consumers see the regulated product as higher quality. But apart from unusual cases in which producers were making a systematic error and producing goods below the profit-maximizing quality, the effect of cost-increasing regulation on a market remains the same: higher prices, reduced production, lower revenue.

What does this mean for wages and employment? In general, as revenue falls, the marginal revenue product of workers falls, and therefore so do wages and employment. However, certain workers in occupations related to regulatory compliance may become more valuable and see their wages and employment rise, as long as the regulation is not so onerous that it shuts down the industry entirely.

Bans

Sometimes regulations do simply shut down an industry, either intentionally or as an unintended consequence of cost increases.1See, for example, Ban of Hazardous Lawn Darts, 16 C.F.R. pt. 1306 (2016). In such cases the effect on wages and employment is clearly negative:2That is, it is negative unless the effect on consumer safety is so profound as to itself constitute a major boon to That is unlikely for the ban on lawn darts, but plausible for its near neighbor in the Code of Federal Regulations, Ban of Lead-Containing Paint and Certain Consumer Products Bearing Lead-Containing Paint, 16 C.F.R. pt. 1303 (2016). See, for example, Rick Nevin, “The Answer Is Lead Poisoning” (working paper, December 19, 2012), https://9zc.d79.myftpupload.com/wp-content/uploads/2020/09/Nevin-2012-The-Answer-is-Lead-Poisoning.pdf. all workers in the industry lose their jobs, though most will become reemployed as they move to other, next-best jobs.

Entry Barriers

To the extent that regulatory compliance is a fixed cost, larger firms will be better able to bear it. Larger firms may even lobby for cost-increasing regulations in the hopes of raising rivals’ costs more than their own and thereby gaining a relative competitive advantage.3Steven C. Salop, David T. Scheffman, and Warren Schwartz, “A Bidding Analysis of Special Interest Regulation: Raising Rivals’ Costs in a Rent Seeking Society” (Working Paper No. 114, Federal Trade Commission, Washington, DC, September 1984). But while a typical regulation applies to all firms, at least on paper, entry barriers are an important exception. Regulatory entry barriers explicitly apply only to new firms—incumbents may be exempted through grandfathering or may have already paid the fixed cost of entry. Examples of entry barriers include the need to obtain a business license and the need to gain the approval of a state board before starting a business.

The obvious effect of such entry barriers is to reduce entry—that is, to reduce the number of new firms in the affected industry or region. What is less obvious is how this affects wages and employment. Do entry barriers work like the typical regulation—shifting supply leftward, reducing the marginal revenue product of most workers, and so reducing employment and wages? Perhaps. But while entry barriers raise costs for new firms, they do not raise costs for existing firms, which instead become more profitable because the reduced competition allows them to charge higher prices. Incumbent firms gain more “monopsony” market power over workers, which they can use to push down wages and employment, but they also gain more “monopoly” market power over consumers. A textbook monopoly raises prices and cuts back production. Reduced production generally leads to lower employment, and this monopoly employment effect is in the same direction as the monopsony employment effect, so we can be confident that entry barriers lead to lower employment.

But entry barriers’ effect on wages is ambiguous. The monopsony effect pushes wages down, but the monopoly effect can push them up, though the monopoly effect is itself ambiguous. Monopolies may lead to lower wages because the lower production drops the demand for labor, or to higher wages because of “rent sharing,” in which the more-profitable monopoly leads to workers with a higher marginal revenue product and employers better able to pay high wages (think of 1960s-era Detroit automakers).

This latter effect is especially pronounced in the case of occupational licensing, where the entry barrier targets workers directly rather than targeting the products they make or the firms that employ them (see chapter six in this volume for a more in-depth discussion of occupational licensing). If a certain type of workers, say cosmetologists, must go through a costly licensing process before they are able to legally work in their field, this situation functions as a reduction in the supply of cosmetologists, reducing their numbers but increasing their wages.

Occupational licensing is not merely an entry barrier but also a form of regulation that targets workers specifically. Given our subject (employment and wages), occupational licensing and other types of labor-specific regulations deserve a closer look.

Labor-Specific Regulations

While most regulations affect workers only unintentionally, a large minority of regulations do target labor. Among the 41 titles of the Code of Federal Regulations are Title 20, “Employees’ Benefits,” and Title 29, “Labor”; many other titles also include regulations targeting labor. According to 2019 data from Quantgov,4“Agency Regulatory Restrictions over Time,” QuantGov, accessed September 24, 2020, https://www.quantgov.org/agency-restrictions. the Department of Labor was the sixth-largest regulatory agency out of 130 federal regulatory agencies.5The Department of Labor is the sixth largest agency as measured by total regulatory restrictions in the Code of Federal Regulations. The five agencies with the most restrictions are, in order, the Environmental Protection Agency, the Department of the Treasury, the Department of Agriculture, the Department of Transportation, and the Department of Homeland Security. Labor-specific regulations generally affect wages and employment through one of three mechanisms: they target wages directly, they target employee benefits or working conditions, or they target employment or the demand for workers directly. Each of these mechanisms affects wages and employment differently and so merits separate analysis. But economic logic ties wages, benefits, and employment together. Employers aim to offer a compensation package (including cash wages and nonwage benefits) that is generous enough to attract the employees they want but not so generous that it exceeds the revenue the employees add through their work. When regulations attempt to improve workers’ wages, benefits, or job security, they can sometimes improve workers’ bargaining power and make workers better off at the expense of employer profits and consumer prices. But profit-maximizing employers are always looking for ways around these regulations, leading to trade-offs across wages, benefits, and employment.

Minimum wages.

Minimum wages increase wages for some workers but lead employers to reduce job benefits in an attempt to bring total compensation back down to the desired, profit-maximizing level. Curtailed benefits could include benefits directly funded by employers, such as health insurance and retirement matching, but also other perquisites of the job, such as flexible hours. Minimum-wage jobs may not have many such benefits to cut, however. Therefore, minimum wages will be partly paid for through lower profits—but if the profitability of a worker falls below zero, the job may simply be cut.

Mandated benefits.

A similar logic applies to regulations that mandate employee benefits such as health insurance or workers’ compensation. Employers attempt to reduce the total compensation package to its profit-maximizing level by cutting wages or other benefits. To the extent that they are unable to do so, or to the extent that employees value the mandated benefit below its cost of provision, employment will fall.6Lawrence Summers, “Some Simple Economics of Mandated Benefits,” in “Papers and Proceedings of the Hundred and First Annual Meeting of the American Economic Association,” special issue, American Economic Review 79, no. 2 (1989): 177–83.

Employment regulation.

Employment-targeting regulations take two common forms. One tries to make the jobs of existing employees more secure through protections against arbitrary firing.7For example, in the United States the Worker Adjustment and Retraining Notification Act requires firms with 100 or more employees to give at least 60 days notice before mass layoffs (affecting 50 or more employees), and some states have stricter laws of their own; see “Plant Closings and Layoffs,” US Department of Labor, accessed April 28, 2020, https://www.dol.gov/general/topic/termination/plant-closings. This functions as an employee benefit—employers can offer slightly lower wages or other benefits and still attract employees—with the twist that it makes employers more cautious about hiring in the first place. The other type of employment regulation aims to increase the total number of employees rather than to make individual employees more secure in their jobs. These regulations may be motivated by a desire to “create jobs” (think of the mandatory full-service gas stations in Oregon and New Jersey), or by the belief that the additional workers will improve product quality or consumer safety (think of the requirement that a copilot be present on flights). In general, this type of regulation increases the demand for workers and so increases both employment and wages, unless the costs imposed by the regulation are so great as to shut down production.

Summary of Predictions

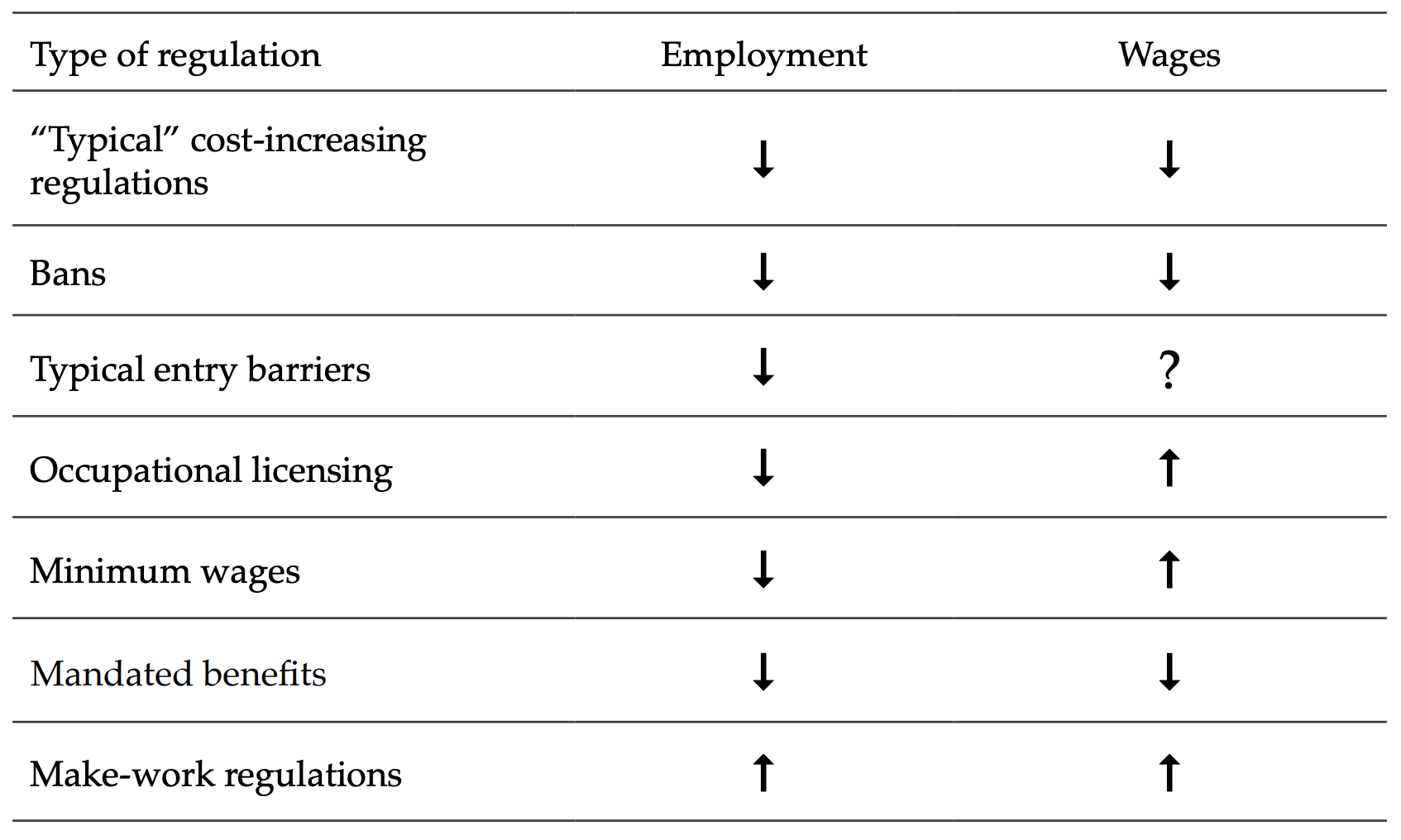

Table 1 summarizes the predictions made above. For the sake of simplicity, I only include the effect on employment and wages in the typical case, ignoring the other effects of regulation (on employee benefits, prices, profits, etc.) and ignoring the contrary effects on small sub- groups (such as compliance workers benefiting while most workers are harmed) or unusual cases (such as make-work regulations being so costly they shut down the industry).8Some effects may also change over time. Using a more complex theoretical model with monopolistic competition and bargaining, Olivier Blanchard (former Chief Economist of the International Monetary Fund) and economist Francesco Giavazzi argue that a typical regulation leads to higher wages and employment in the short run by protecting incumbents before lowering employment and wages in the long run by discouraging new firms from entering. Olivier Blanchard and Francesco Giavazzi, “Macroeconomic Effects of Regulation and Deregulation in Goods and Labor Markets,” Quarterly Journal of Economics 118, no. 3 (2003): 879–907.

Table 1. Effect of Various Regulations on Employment and Wages (Basic Theory)

In short, regulations almost always harm employment on net, while their effects on wages are more mixed. But in order to fully evaluate the costs and benefits of a regulation, we need to know more than just how it affects employment and wages.

Remember: Bad Jobs Exist

We have now examined the simple economics explaining how various regulations affect employment and wages. A noneconomist may assume I intend to argue that the regulations that kill jobs and cut wages are bad, while the regulations that create jobs and raise wages are good. But neither of these inferences is necessarily true. To draw conclusions about the overall costs and benefits of regulation, we need to look a bit deeper.

Bad jobs exist. When regulation kills a bad job, most people are made better off. When regulation creates a bad job, most people are made worse off. By “bad jobs,” I don’t simply mean menial or low-paying jobs, but rather jobs that destroy more value than they create. Most jobs involving manual labor or low pay are not bad in this sense; for instance, sanitation and food preparation generally create great value. Instead, one archetypal bad job might be manager in a lead paint factory. The job may have paid well and carried some status, and lead paint was a product that many people were willing to pay for. But it also contributed to a mass poisoning that made the world a dumber and more violent place,9Nevin, “Answer Is Lead Poisoning.” and these costs almost certainly outweigh the benefits of lead-paint-factory jobs and longer-lasting paint. The regulation banning lead paint certainly reduced employment in the short run, and this should be counted as a cost of regulation, but a job-killing regulation may nevertheless be worthwhile if it brings sufficient benefits to others. Conversely, a job-creating regulation is not necessarily a good one.

Besides the manager of a lead paint factory, another archetypal “bad job” may be that of the bureaucrat who must approve beneficial activities. Suppose an activity is generally beneficial and carries no special risk to consumers or the environment, yet a regulation requires it to receive bureaucratic approval before proceeding.10Think, perhaps, of selling flowers, which requires a license in Louisiana: Shoshana Weissmann and C. Jarrett Dieterle, “Louisiana Is the Only State That Requires Occupational Licenses for Florists. It’s Absurd,” USA Today, March 28, 2018. The regulation may create bureaucratic jobs, and the recipients of those jobs will appreciate the salary, but the regulation that created their jobs can only delay or deny benefits to others. Everyone would be better off if the regulation were repealed, even if the bureaucrat received the same salary for doing nothing.11A similar logic holds to a lesser degree for “make-work” jobs (in the purest form, think of digging a hole and filling it in again). While these jobs do not actually harm others, they are simply an unnecessarily costly way of transferring money. If the goal is to make workers better off, forget about the make-work and write them a check. See also Travis Wiseman’s chapter on unproductive entrepreneurship (chapter 4 in this volume).

While the labor-market effects of regulations are important, they are far from the only cost or benefit of regulations, and do not themselves constitute sufficient grounds for accepting or rejecting a regulation. There’s a reason why this study of labor-market effects is only one chapter in a larger work on regulation.

What Has Empirical Research Found Regarding Regulation, Wages, and Employment?

Now we’ve seen what basic economic theory has to say about which types of regulations push employment and wages up or down. In this section, we turn to the empirical literature on specific regulations to see whether this theory holds in the real world, and to measure just how big the effects of regulation are.

Entry Barriers

The most generic and universal form of entry barrier is the process that every new business must go through to legally form. The World Bank’s Ease of Doing Business index has measured the intensity of this barrier in almost every country since 2003.12“Doing Business: Measuring Business Regulations,” World Bank, accessed April 28, 2020, https://www.doingbusiness.org/en/doingbusiness. According to the 2019 report, in New Zealand starting a new business requires only a single step that takes less than a day, while in other countries such as Haiti and Venezuela, starting a new business requires at least a dozen steps that may take several months to complete, and costs several times the average annual income.13Doing Business 2019: Training for Reform, 16th ed. (Washington, DC: World Bank, 2019). The scholars who created the initial version of this index confirmed that higher entry barriers lead to less product market competition and a higher share of employment in the unofficial economy.14Simeon Djankov et , “The Regulation of Entry,” Quarterly Journal of Economics 117, no. 1 (2002): 1–37. This reduction in (legal) employment matches what economic theory predicts (as discussed above), as well as the findings of other empirical work—specifically, that new firms create a disproportionate share of new jobs.15Ryan Decker et al., “The Role of Entrepreneurship in US Job Creation and Economic Dynamism,” Journal of Economic Perspectives 28, no. 3 (2014): 3–24. But the large literature using the Ease of Doing Business index has generally not studied the effect of business entry restrictions on wages.

The literature on occupational licensing has reached a near-consensus that occupational licensing reduces employment while increasing wages for workers in the licensed profession. From economists Milton Friedman and Simon Kuznets in their classic study of professional licensing to the authors of more recent work, researchers consistently find slower employment growth and higher wages in licensed professions.16Milton Friedman and Simon Kuznets, Income from Independent Professional Practice (New York: National Bureau of Economic Research, 1954); Morris Kleiner and Alan Krueger, “Analyzing the Extent and Influence of Occupational Licensing on the Labor Market,” Journal of Labor Economics 31, no. 2 (2013): S173–S202.

Labor-Specific Regulations

Minimum wages.

There are at least as many articles on the minimum wage as there are labor economists; a search on EconLit reveals 3,140 written since 1945. To sum up an immense and varied literature too quickly: economic theory works, but the employment effects are smaller and slower than you might think after looking at a typical textbook supply and demand graph. A substantial minority of papers find that a minimum wage is not associated with any significant dis-employment. Specifically, a minimum wage increase is more likely to slow the hiring of new workers than it is to cause layoffs of existing workers.17Jonathan Meer and Jeremy West, “Effects of the Minimum Wage on Employment Dynamics,” Journal of Human Resources 2 (2016): 500–22. For an excel- lent summary of the state of minimum wage research, see Jeffrey Clemens and Michael Strain, “Estimating the Employment Effects of Recent Minimum Wage Changes: Early Evidence, an Interpretative Framework, and a Pre-commitment to Future Analysis” (NBER Working Paper No. 23084, National Bureau of Economic Research, Cambridge, MA, 2017). For a meta-analysis of recent work, see Paul Wolfson and Dale Belman, “15 Years of Research on US Employment and the Minimum Wage,” Labour 33 (2019): 488–506.

Mandated benefits.

Benefit regulations include mandates that employers cover health insurance18Jonathan T. Kolstad and Amanda E. Kowalski, “Mandate-Based Health Reform and the Labor Market: Evidence from the Massachusetts Reform,” Journal of Health Economics 47 (2016): 81–106; Conor Lennon, “Are the Costs of Employer-Provided Health Insurance Passed On to Workers at the Individual Level?” (working paper, August 5, 2019), http://www.conorjlennon.com/uploads/3/9/6/0/39604893/lennon_ehb_revision_sept_2020.pdf. and mandates that employer health insurance cover specific treatments.19Jonathan Gruber, “The Incidence of Mandated Maternity Benefits,” American Economic Review 84, no. 3 (1994): 622–41; Joanna N. Lahey, “The Efficiency of a Group-Specific Mandated Benefit Revisited: The Effect of Infertility Mandates,” Journal of Policy Analysis and Management 31, no. 1 (2012): 63–92; James Bailey, “Who Pays the High Health Costs of Older Workers? Evidence from Prostate Cancer Screening Mandates,” Applied Economics 46, no. 32 (2014): 3931–41. Studies consistently find that many benefit regulations reduce wages. As economic theory predicts, though, the effect of benefit mandates on employment is more mixed.20Summers, “Some Simple Economics.” In some cases benefit mandates seem not to harm employment at all.21Gruber, “Incidence of Mandated Maternity Benefits.” This could be due to firms finding regulatory loopholes,22For one example where health insurance benefit mandates had little effect on employment because firms were able to use a self-insurance loophole (though self-insuring added its own costs), see James Bailey and Douglas Webber, “Health Insurance Benefit Mandates and Firm Size Distribution,” Journal Risk and Insurance 85 (2018): 577–95. or to the logic of the model by Lawrence Summers (former Harvard president and US Secretary of the Treasury), where the cost of the benefit is fully passed back to employees in the form of lower wages (so employers have no incentive to reduce hiring) while employees fully value the benefit (so all continue working, since they perceive their total compensation to be the same).

In other cases, though, benefit mandates do seem to have affected employment. Some regulations attempt to benefit a specific group (such as maternity benefits, which target younger women), and these can lead to lower employment for that group without necessarily lowering overall employment. In a 2014 study I found this to be true for older men in the case of prostate cancer screening,23Bailey, “Who Pays the High Health Costs of Older Workers?” but the most extreme example is likely the Americans with Disabilities Act. The act intended to protect and promote employment by adding antidiscrimination protections for disabled workers and requiring employers to offer “reasonable accommodations” for disabilities. But despite the explicit antidiscrimination parts of the law, employers reacted strongly; economists Thomas DeLeire, Daron Acemoglu, and Joshua Angrist estimate that the act reduced the employment of disabled workers by at least 10 percent.24Thomas DeLeire, “The Wage and Employment Effects of the Americans with Disabilities Act,” Journal of Human Resources 35 (Fall 2000): 693–715; Daron Acemoglu and Joshua D. Angrist, “Consequences of Employment Protection? The Case of the Americans with Disabilities Act,” Journal of Political Economy 109, no. 5 (2001): 915–57.

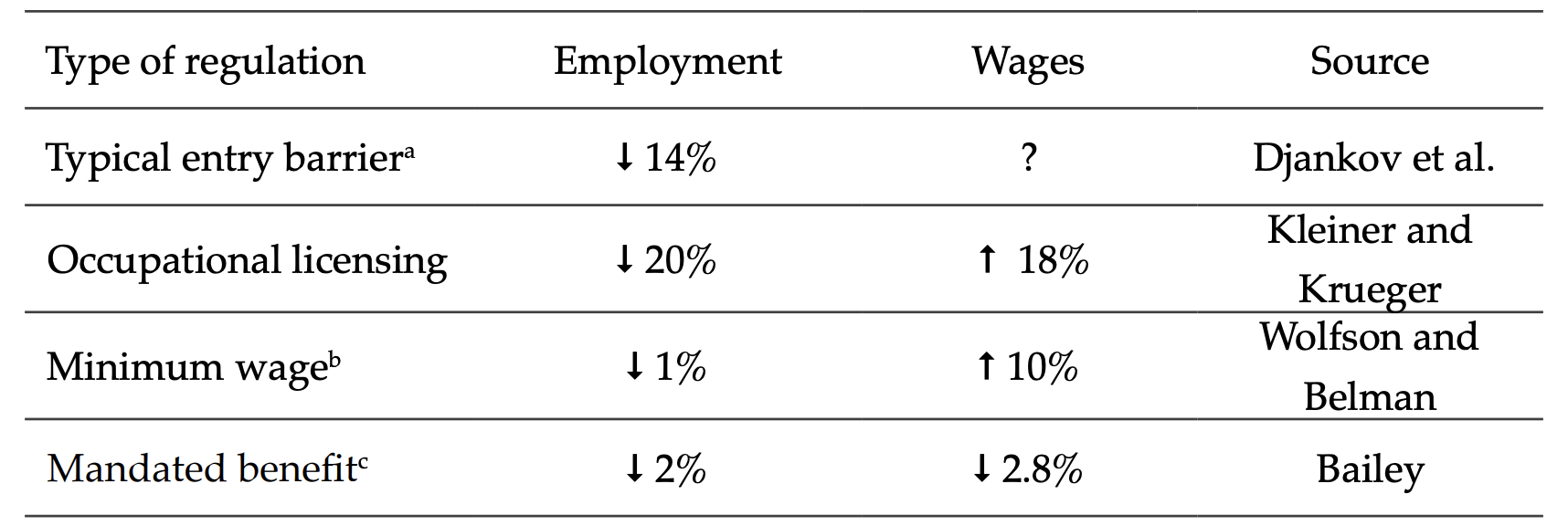

Summarizing empirical work on specific regulations.

Table 2 summarizes the empirical estimates for certain types of regulations. These generally accord with the theoretical predictions summarized in table 1 about how different types of regulation affect employment, and the empirical research gives us an idea of how strong these effects are. Before we start celebrating the excellent predictive track record of economic theory, however, I must advise some caution about the state of the empirical evidence. It is challenging to find empirical work estimating the effect of some types of regulation on wages or employment, which is why these types of regulation are not included in the table, and why there is only a question mark for the effect of entry barriers on wages (the paper cited does not attempt to measure the effect on wages, only on employment). Other types of regulation have the opposite problem: there are many estimates available but they don’t all agree, either because of disagreements over the proper estimation methodology (as for the minimum wage) or because even within a category of regulation there can be a variety of effects (as for various mandated benefits). Still, economic theory is looking good overall: Where empirical work exists it generally confirms the direction predictions of economic theory, and at worst it finds no effect rather than an effect in the opposite direction of the prediction.

Table 2. Estimated Effect of Certain Regulations on Employment and Wages

a To be precise, Djankov et al. find that employment shifts to the unofficial economy, but do not test whether it falls overall.

b The minimum wage estimate is from a meta-analysis that summarizes 37 other studies, many of which estimated dis-employment effects larger or smaller than the pooled 1% estimate.

c The effect size is particularly likely to vary with the specific benefit; Lahey finds that employment falls with no effect on wages, while Gruber finds that wages fall with no effect on employment.

Sources: Simeon Djankov et al., “The Regulation of Entry,” Quarterly Journal of Economics 117, no. 1 (2002): 1–37; Morris Kleiner and Alan Krueger, “Analyzing the Extent and Influence of Occupational Licensing on the Labor Market,” Journal of Labor Economics 31, no. 2 (2013): S173–S202; Paul Wolfson and Dale Belman, “15 Years of Research on US Employment and the Minimum Wage,” Labour 33 (2019): 488–506, https://doi.org/10.1111/labr.12162; James Bailey, “Who Pays the High Health Costs of Older Workers? Evidence from Prostate Cancer Screening Mandates,” Applied Economics 46, no. 32 (2014): 3931–41.

Aggregate effect of labor-specific regulations.

The research on how specific labor regulations affect wages and employment is generally excellent—researchers have used the latest empirical methods to carefully identify the effect of the regulations they study. This excellent research is made possible by the nature of the regulations being studied, which tend to target only some groups or to be enacted in only some states, leaving other groups or states to serve as controls. But not every specific regulation can be studied this way, and it is particularly difficult to determine the effect of aggregate regulation with as much certainty. Do mandated benefits and other labor-market regulations merely change who gets hired, or do they really reduce overall employment?

Here the evidence is more suggestive than definitive, but there is a lot of it. Europe generally has more labor-market regulation than the United States, together with higher unemployment.25R. Shackleton, “The Economics of Employment Regulation,” Economic Affairs 25.3 (2005). Moreover, the labor force participation rate of prime-age men in the US has fallen from a peak of 94.7 percent in 1967 to 86.4 percent in 2019.26“Employment Rate: Aged 25–54: Males for the United States,” FRED, Federal Reserve Bank of St. Louis, accessed September 24, 2020, https://fred.stlouisfed.org/series/LREM25MAUSA156S. In other words, the proportion of men aged 25–54 who have no job and are not trying to get one has more than doubled. The causes of this change remain poorly understood and much debated,27Didem Tuzemen, “Why Are Prime-Age Men Vanishing from the Labor Force?,” KC Fed Economic Review (Federal Reserve Bank of Kansas City), February 21, 2018. but it has occurred along- side a huge expansion of federal regulation (as measured by number of words and restrictions in the Code of Federal Regulations);28McLaughlin and Sherouse, RegData US 3.1 Annual (data set). of occupational licensing;29Kleiner and Krueger, “Analyzing the Extent and Influence of Occupational Licensing.” and of health insurance benefit mandates (which increased more than fortyfold since the 1960s30Susan Laudicina, Joan Gardner, and Kim Holland, “State Legislative Healthcare and Insurance Issues” (Technical Report, Blue Cross Blue Shield Association, 2011).).

If all this regulation has increased the cost of hiring faster than the value employers see in new employees, we would expect employment to fall. The growth in US nonemployment has been concentrated at lower skill levels,31Tuzemen, “Why Are Prime-Age Men Vanishing from the Labor Force?” which may be because employer demand has grown more at higher skill levels (the “job polarization” discussed by economist Didem Tuzemen and many others noting a growing wage and employment gap by skill and education level). Alternatively, it could be because regulatory costs bind more at lower levels—an employer can simply cut wages for high-wage workers if regulation makes them more costly to employ, but for a worker who is already at the mini- mum wage and with minimal benefits, the employer’s only choice is between cutting employment or accepting the loss in profits. This is one reason why regulation often has “regressive effects”—that is, it hits lower-income workers harder.32Diana Thomas, “Regressive Effects of Regulation” Mercatus Center Working Paper No. 12-35, November 2012; James Bailey, Diana Thomas, and Joseph Anderson, “Regressive Effects of Regulation on Wages,” Public Choice 180 (2019): 91–103; Dustin Chambers, Patrick A. McLaughlin, and Laura Stanley, “Barriers to Prosperity: The Harmful Impact of Entry Regulations on Income Inequality,” Public Choice 180 (2019): 165–90.

The Overall Effect of Regulation

We’ve now considered the evidence on many specific types of regulation. But what does all this add up to? If a country or state engaged in a wholesale, across-the-board program of regulation or deregulation, how would this program affect labor markets? Perhaps surprisingly, only a handful of researchers have attempted to answer this question; as economists Mark Crain and Nicole Crain put it, “For the most part, the volume of regulations and their complexity have discouraged attempts by government agencies and private researchers to generate a comprehensive estimate of regulatory costs.”33W. Mark Crain and Nicole V. Crain, “The Cost of Federal Regulation to the U.S. Economy, Manufacturing and Small Business” (report, National Association of Manufacturers, September 10, 2014).

The basic approach of most studies has been to compare the state of the labor market across more- and less-regulated countries, states, or industries. Some analyses are cross-sectional, making these com- parisons at a single point in time; the challenge here is that states and countries differ in many ways besides their level of regulation, and controlling for all of these differences is difficult. Other time-series or panel analyses focus on changes in regulation over time, so that a state or country can be compared to itself before the regulatory change as well as to other polities.

An article in the Journal of Economic Growth measures total regulation in the US over time by counting the number of pages in the Code of Federal Regulations.34John W. Dawson and John J. Seater, “Federal Regulation and Aggregate Economic Growth,” Journal of Economic Growth 12, no. 2 (2013): 137–77. While its primary focus is on total output and total factor productivity, the results also imply that increased regulation in the postwar era led to slower wage and employment growth.

The advent of RegData has for the first time allowed researchers to easily quantify how the level of federal regulation varies by industry in the US.35McLaughlin and Sherouse, RegData US 3.1 Annual (data set). In a 2017 study with Diana Thomas, I find that doubling the level of regulation in an industry leads to a 6.3 percent decline in new hires,36James Bailey and Diana Thomas, “Regulating Away Competition: The Effect of Regulation on Entrepreneurship and Employment,” Journal of Regulatory Economics 52 (2017): 237–54. and a 2018 article finds a similar result using a similar approach.37Dustin Chambers, Patrick A. McLaughlin, and Tyler Richards, “Regulation, Entrepreneurship, and Firm Size” (Mercatus Working Paper, Mercatus Center at George Mason University, Arlington, VA, 2018). Entrepreneurship scholars David Lucas and Christopher Boudreaux also find reduced net job creation in more-regulated industries, but find that this effect is moderated by state economic freedom.38David S. Lucas and Christopher Boudreaux, “Federal Regulation, Job Creation, and the Moderating Effect of State Economic Freedom: Evidence from the United States” (working paper, July 19, 2018), http://home.fau.edu/cboudreaux/web/Regional%20Studies%20Article%207.20.18%20.pdf. Indices that measure economic freedom generally include some measures of regulation and researchers have evaluated their effects on a variety of outcomes, including labor market outcomes. See, for example, Stephan F. Gohmann, Bradley K. Hobbs, and Myra McCrickard, “Economic Freedom and Service Industry Growth in the United States,” Entrepreneurship Theory and Practice 32, no. 5 (2008): 855–74. I generally do not discuss such work in this chapter because these indices include many nonregulatory measures along with the regulatory measures. Also using RegData to compare industries, economists Bentley Coffey, Patrick McLaughlin, and Pietro Peretto estimate that in 2012, the economy was 25 percent smaller than it would have been in the absence of regulatory growth since 1980,39Bentley Coffey, Patrick A. McLaughlin, and Pietro Peretto, “The Cumulative Cost of Regulations” (Mercatus Working Paper, Mercatus Center at George Mason University, Arlington, VA, 2016). This figure was also endorsed by an October 2, 2017, report of the Council of Economic Advisers, “The Growth Potential of Deregulation.” which translates to $13,000 less in per capita income. (The authors do not provide estimates for how much of this is due to declines in labor income as opposed to other income sources.)

While RegData’s original goal was to quantify federal regulation in the United States,40McLaughlin and Sherouse, RegData US 3.1 Annual (data set). its creators are in the process of expanding it to cover other countries and the regulatory codes of US states. Using a preliminary measure of US state regulatory codes, policy analyst Mark Febrizio finds very large dis-employment effects: “a 10 percentage point increase in [regulatory] restrictions is associated with a 11 to 13 per- centage point decrease in employment growth.”41Mark Febrizio, “Analyzing the Economic Effects of State-Level Regulation” (working paper, July 18, 2018), https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3220171.

Crain and Crain use a cross-country measure of regulation from the World Economic Forum’s Global Competitiveness Report 2006–2013 to create an Economic Regulation Index. They find that GDP per capita falls by 8.1 percent for each one-point increase in the Economic Regulation Index; because the US has 26 percent more regulation than the “benchmark” lowest-regulation countries of the Organisation for Economic Co-operation and Development, they translate this to mean that US GDP would increase by $1.4 trillion (about 8 percent) if US regulation were cut to benchmark levels. After adding the costs of some other types of regulation not captured by the first index, they conclude that the annual cost of regulation in the US is about $2 trillion, which translates to about $10,000 per worker. Like the authors of several of the studies using RegData, they find that this cost is disproportionately borne by small firms.42Crain and Crain, “Cost of Federal Regulation.”

Wayne Crews states, “regulatory costs are unknowable in an elemental sense, and estimates of them are not observable or calculable—much as the economic calculations necessary to enable central economic planning are impossible.”43Clyde Wayne Crews Jr., “Ten Thousand Commandments: An Annual Snapshot of the Federal Regulatory State,” 2019 ed. (report, Competitive Enterprise Institute, Washington, DC, 2019). Still, Crews does his best to calculate the incalculable, and estimates that regulation causes a $1.9 trillion hit to US GDP, though he cautions that this is more of a lower bound: “This figure is based on a nonscientific, disclaimer-laden, fusion amalgam of GDP losses, and compliance costs derived from available official data and other sources. Even so, this assessment is more representative and inclusive than official estimates and more ‘conservative’ in that bur- dens conceivably are considerably more.”44Crews, “Ten Thousand Commandments.” As with other GDP-based estimates, it is not clear how much of this reduction to income occurs because of lower wages or employment and how much because of other factors.

The Council of Economic Advisers (CEA) attempts to quantify the aggregate economic effects of the net deregulatory stance of the Trump administration. The CEA’s main estimation strategy is to sum up the impact estimates of previous government reports on major recent (de)regulatory actions. The council concludes that if this regulatory approach is continued, it will raise US GDP by up to 2.2 percent over a decade, raising real income by $3,100 per household. Much of this effect occurs through the channel of lower consumer prices rather than higher nominal wages or employment. Unlike some researchers, the CEA has also attempted to quantify the nonpecuniary benefits of repealed regulation, and concludes that they amounted to $600 per year, so that the total net benefit of deregulation is $2,500 per household.45“The Economic Effects of Federal Deregulation since January 2017: An Interim Report” (report, Council of Economic Advisers, June 2019).

In sum, research on the overall effect of regulation has produced a variety of estimates. This is partly because it has employed a variety of estimation strategies and data sets and partly because it has estimated the effect of regulation on different outcomes (GDP, productivity, new hires, etc.). Perhaps most importantly, different researchers considered different counterfactuals. Despite titles and abstracts that sometimes imply otherwise, none of these researchers has actually attempted to sum up the overall cost of all regulation—and they have been wise not to, as we have no real examples to study of a country cutting all or even most regulation.46Idaho did sunset its entire regulatory code in 2019, but plans to reinstate much of it in 2020. See James Broughel, “Idaho Repeals Its Regulatory Code,” The Bridge (Mercatus Center at George Mason University), May 9, 2019; J. Kennerly Davis, “Man Bites Dog—Idaho Repeals Its Regulatory Code,” Federalist Society blog, July 18, 2019. Instead, their estimates are based on counterfactuals such as cutting regulation to the level the US had in 1980, or to the level of the current lowest-regulation countries in the Organisation for Economic Co-operation and Development (each roughly a 25 percent cut); or they measure the effects of smaller actual deregulations such as the net reduction in federal regulation since 2017.

While it would be nice to know the net effect of all US regulation on GDP, employment, and wages, from a practical standpoint it is more important to know the likely effect of changes to regulation at the margin, because a greater-than-25-percent cut to regulation seems unlikely.47British Columbia did reduce regulation by 43 percent in the years after 2000, as measured in Laura Jones, “Cutting Red Tape in Canada: A Regulatory Reform Model for the United States?” (Mercatus Research, Mercatus Center at George Mason University, Arlington, VA, 2015). This marginal effect will depend above all on which regulations are actually passed or repealed: this chapter has shown that different types of regulations have very different effects, this mix of regulations will vary with the political times, and for any given administration the best strategy is likely to involve measuring the effects of the specific regulations it has passed and repealed, as the CEA has done.48“The Economic Effects of Federal Deregulation since January 2017: An Interim Report.”

References

Acemoglu, Daron and Joshua D. Angrist. “Consequences of Employment Protection? The Case of the Americans with Disabilities Act.” Journal of Political Economy 109, no. 5 (2001): 915–57.

“Agency Regulatory Restrictions over Time.” QuantGov. Accessed September 24, 2020. https://www.quantgov.org/agency-restrictions.

Bailey, James and Diana Thomas. “Regulating Away Competition: The Effect of Regulation on Entrepreneurship and Employment.” Journal of Regulatory Economics 52 (2017): 237–54.

Bailey, James and Douglas Webber. “Health Insurance Benefit Mandates and Firm Size Distribution.” Journal Risk and Insurance 85 (2018): 577–95.

Bailey, James, Diana Thomas, and Joseph Anderson. “Regressive Effects of Regulation on Wages.” Public Choice 180 (2019): 91–103.

Bailey, James. “Who Pays the High Health Costs of Older Workers? Evidence from Prostate Cancer Screening Mandates.” Applied Economics 46, no. 32 (2014): 3931–41.

Blanchard, Olivier and Francesco Giavazzi. “Macroeconomic Effects of Regulation and Deregulation in Goods and Labor Markets.” Quarterly Journal of Economics 118, no. 3 (2003): 879–907.

Broughel, James. “Idaho Repeals Its Regulatory Code.” The Bridge (Mercatus Center at George Mason University). May 9, 2019.

Chambers, Dustin, Patrick A. McLaughlin, and Laura Stanley. “Barriers to Prosperity: The Harmful Impact of Entry Regulations on Income Inequality.” Public Choice 180 (2019): 165–90.

Chambers, Dustin, Patrick A. McLaughlin, and Tyler Richards. “Regulation, Entrepreneurship, and Firm Size.” (Mercatus Working Paper. Mercatus Center at George Mason University. Arlington, VA, 2018).

Clemens, Jeffrey and Michael Strain. “Estimating the Employment Effects of Recent Minimum Wage Changes: Early Evidence, an Interpretative Framework, and a Pre-commitment to Future Analysis.” (NBER Working Paper No. 23084. National Bureau of Economic Research. Cambridge, MA. 2017).

Coffey, Bentley, Patrick A. McLaughlin, and Pietro Peretto. “The Cumulative Cost of Regulations.” (Mercatus Working Paper. Mercatus Center at George Mason University. Arlington, VA. 2016).

Crain, W. Mark and Nicole V. Crain. “The Cost of Federal Regulation to the U.S. Economy, Manufacturing and Small Business.” (Report. National Association of Manufacturers. September 10, 2014).

Crews, Clyde Wayne Jr., “Ten Thousand Commandments: An Annual Snapshot of the Federal Regulatory State.” 2019 ed. (Report. Competitive Enterprise Institute. Washington, DC. 2019).

Davis, J. Kennerly. “Man Bites Dog—Idaho Repeals Its Regulatory Code.” Federalist Society blog. July 18, 2019.

Dawson, John W. and John J. Seater. “Federal Regulation and Aggregate Economic Growth.” Journal of Economic Growth 12, no. 2 (2013): 137–77.

Decker, Ryan et al. “The Role of Entrepreneurship in US Job Creation and Economic Dynamism.” Journal of Economic Perspectives 28, no. 3 (2014): 3–24.

DeLeire, Thomas. “The Wage and Employment Effects of the Americans with Disabilities Act.” Journal of Human Resources 35 (Fall 2000): 693–715.

Djankov, Simeon et al. “The Regulation of Entry.” Quarterly Journal of Economics 117, no. 1 (2002): 1–37.

Doing Business 2019: Training for Reform. 16th ed. (Washington, DC: World Bank. 2019).

“Doing Business: Measuring Business Regulations.” World Bank. Accessed April 28, 2020. https://www.doingbusiness.org/en/doingbusiness.

“Employment Rate: Aged 25–54: Males for the United States.” FRED. Federal Reserve Bank of St. Louis. Accessed September 24, 2020. https://fred.stlouisfed.org/series/LREM25MAUSA156S.

Febrizio, Mark. “Analyzing the Economic Effects of State-Level Regulation.” (working paper, July 18, 2018). https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3220171.

Friedman, Milton and Simon Kuznets. Income from Independent Professional Practice (New York: National Bureau of Economic Research. 1954).

Gohmann, Stephan F., Bradley K. Hobbs, and Myra McCrickard. “Economic Freedom and Service Industry Growth in the United States.” Entrepreneurship Theory and Practice 32, no. 5 (2008): 855–74.

Gruber, Jonathan. “The Incidence of Mandated Maternity Benefits.” American Economic Review 84, no. 3 (1994): 622–41.

Jones, Laura. “Cutting Red Tape in Canada: A Regulatory Reform Model for the United States?” (Mercatus Research. Mercatus Center at George Mason University. Arlington, VA. 2015).

Kleiner, Morris and Alan Krueger. “Analyzing the Extent and Influence of Occupational Licensing on the Labor Market.” Journal of Labor Economics 31, no. 2 (2013): S173–S202.

Kolstad, Jonathan T. and Amanda E. Kowalski. “Mandate-Based Health Reform and the Labor Market: Evidence from the Massachusetts Reform.” Journal of Health Economics 47 (2016): 81–106.

Lahey, Joanna N. “The Efficiency of a Group-Specific Mandated Benefit Revisited: The Effect of Infertility Mandates.” Journal of Policy Analysis and Management 31, no. 1 (2012): 63–92.

Laudicina, Susan, Joan Gardner, and Kim Holland. “State Legislative Healthcare and Insurance Issues” (Technical Report. Blue Cross Blue Shield Association. 2011).

Lennon, Conor. “Are the Costs of Employer-Provided Health Insurance Passed On to Workers at the Individual Level?” (Working paper. August 5, 2019). http://www.conorjlennon.com/uploads/3/9/6/0/39604893/lennon_ehb_revision_sept2020.pdf.

Lucas, David S. and Christopher Boudreaux. “Federal Regulation, Job Creation, and the Moderating Effect of State Economic Freedom: Evidence from the United States” (Working paper. July 19, 2018). http://home.fau.edu/cboudreaux/web/Regional%20Studies%20Article%207.20.18%20.pdf.

McLaughlin and Sherouse, RegData US 3.1 Annual (data set).

Meer, Jonathan and Jeremy West. “Effects of the Minimum Wage on Employment Dynamics.” Journal of Human Resources 51.2 (2016): 500–22.

Nevin, Rick. “The Answer Is Lead Poisoning” (Working paper. December 19, 2012). https://9zc.d79.myftpupload.com/wp-content/uploads/2020/09/Nevin-2012-The-Answer-is-Lead-Poisoning.pdf.

“Plant Closings and Layoffs.” US Department of Labor. Accessed April 28, 2020. https://www.dol.gov/general/topic/termination/plantclosings.

Salop, Steven C., David T. Scheffman, and Warren Schwartz. “A Bidding Analysis of Special Interest Regulation: Raising Rivals’ Costs in a Rent Seeking Society” (Working Paper No. 114. Federal Trade Commission. Washington, DC. September 1984).

Shackleton, J. R. “The Economics of Employment Regulation.” Economic Affairs 25.3 (2005).

Summers, Lawrence. “Some Simple Economics of Mandated Benefits.” in “Papers and Proceedings of the Hundred and First Annual Meeting of the American Economic Association.” Special issue. American Economic Review 79, no. 2 (1989): 177–83.

“The Economic Effects of Federal Deregulation since January 2017: An Interim Report” (Report. Council of Economic Advisers. June 2019).

Thomas, Diana. “Regressive Effects of Regulation.” Mercatus Center Working Paper No. 12-35, November 2012.

Tuzemen, Didem. “Why Are Prime-Age Men Vanishing from the Labor Force?” KC Fed Economic Review (Federal Reserve Bank of Kansas City). February 21, 2018.

Weissmann, Shoshana and C. Jarrett Dieterle. “Louisiana Is the Only State That Requires Occupational Licenses for Florists. It’s Absurd.” USA Today. March 28, 2018.

Wolfson, Paul and Dale Belman. “15 Years of Research on US Employment and the Minimum Wage.” Labour 33 (2019): 488–506.

Table of Contents

- Regulation and Entrepreneurship: Theory, Impacts, and Implications

- Regulation and the Perpetuation of Poverty in the US and Senegal

- Social Trust and Regulation: A Time-Series Analysis of the United States

- Regulation and the Shadow Economy

- An Introduction to the Effect of Regulation on Employment and Wages

- Occupational Licensing: A Barrier to Opportunity and Prosperity

- Gender, Race, and Earnings: The Divergent Effect of Occupational Licensing on the Distribution of Earnings and on Access to the Economy

- How Can Certificate-of-Need Laws Be Reformed to Improve Access to Healthcare?

- Land Use Regulation and Housing Affordability

- Building Energy Codes: A Case Study in Regulation and Cost-Benefit Analysis

- The Tradeoffs between Energy Efficiency, Consumer Preferences, and Economic Growth

- Cooperation or Conflict: Two Approaches to Conservation

- Retail Electric Competition and Natural Monopoly: The Shocking Truth

- Governance for Networks: Regulation by Networks in Electric Power Markets in Texas

- Net Neutrality: Internet Regulation and the Plans to Bring It Back

- Unintended Consequences of Regulating Private School Choice Programs: A Review of the Evidence

- “Blue Laws” and Other Cases of Bootlegger/Baptist Influence in Beer Regulation

- Smoke or Vapor? Regulation of Tobacco and Vaping

- Moving Forward: A Guide for Regulatory Policy