Executive Summary

This paper provides a macroeconomic perspective on the costs and benefits of two very different immigration policy changes—mass deportation and legalization—in comparison to the status quo of allowing illegal immigrants to broadly remain in the country under precarious circumstances. A macroeconomic analysis can capture the economy-wide impact of immigration policies on wages, employment, the government budget, and the stock of productive capital. To provide intuition, the paper begins with a simple analysis before adding layers of complexity that capture how immigration affects the economy. Although the results are sensitive to the assumptions used in the analysis, we find that over a broad range of parameters mass deportation creates worse economic outcomes for US citizens relative to both the status quo and to a policy providing for legalization.

Illegal immigrants are different from natives in many ways. What is not so obvious is which differences matter economically. Simply changing the size of a homogenous labor force would have no impact on economic variables of interest to households. Illegal immigrants have less education than the average native, but we show this difference alone is not sufficient to affect the economy in the long run. The sudden removal of a group of less-educated workers would cause only a temporary, modest wage increase for less-educated workers who remain, though it would cause an asymmetrically large drop in the wages of highly educated workers. However, the benefit to less-educated natives would only be short-lived since the deportation would reduce the benefits workers receive for acquiring new skills. Ultimately, as more natives opt to become less educated, any gains to less-educated workers will be erased.

Other differences between illegal immigrants and legal residents must be incorporated for changes to immigration policy to generate long-run effects. For example, we can consider how undocumented immigrants differ in the taxes they pay, the public services they use, their ability to save or invest here in the United States, or how immigrants often send money to family and friends in their home country. Once those elements are incorporated, this paper shows that native welfare ought to be higher after legalization than after deportation for any reasonable set of parameters.

Whether legalization is preferable to maintaining the current status quo will hinge on three policy levers. Of foremost quantitative importance is the ability or inability of undocumented immigrants to save and invest. If illegal immigrants have the same access to saving and investing opportunities as natives, they would be a boon to the economy because their ineligibility for entitlement programs like Social Security will prompt them to have a higher savings rate than natives. The resulting increase in wages and production would overwhelm any effect from the other two levers.

Realistically though, illegal immigrants cannot save and invest like natives. Under the most severe restrictions on their saving, the welfare ranking of legalization versus maintaining the status quo will depend on how much illegal immigrants consume in government services compared to legal residents and how much they pay in taxes relative to legal residents. If illegal immigrants contribute a sufficiently high amount of tax revenue while consuming few government services, natives will be better off maintaining the status quo. Conversely, if illegal immigrants pay little in taxes or consume more services than natives, native welfare will be higher after deportation or legalization. Ignoring the short-run cost of deportation without further assumptions, natives would be indifferent between legalization and deportation. However, if immigrants send some of their income to their home country to support friends or family, their increased desire to work will tilt the balance in favor of legalization.

When considering immigration, policymakers should bear in mind that immigrants bring value to natives as well as imposing costs on them. It is the net effect of those costs and benefits that should be at the forefront of immigration policy debates, balanced by human rights issues. The focus of this paper is on the costs and benefits of policy for illegal immigrants once they are in this country.

Introduction

While much research has been done to estimate the microeconomic impact of illegal immigration on specific markets in isolation,1 See, for example, the debate between Borjas and Card about the impact of the Mariel boatlift on the labor market in Miami. George J. Borjas, “The Wage Impact of the Marielitos: A Reappraisal,” Industrial and Labor Relations Review 70 (2017): 1077–110; David Card, “The Impact of the Mariel Boatlift on the Miami Labor Market,” Industrial and Labor Relations Review 43 (1990): 245–57. this paper summarizes results from previous studies by Feigenbaum on the macroeconomic effects of illegal immigration on the economy as a whole.2 James A. Feigenbaum, “Transition Dynamics of a Mass Deportation,” 2016. Mimeo; James A. Feigenbaum, “Taxes, Imperfect Capital Markets, and Illegal Immigrants,” 2017. Mimeo. The ongoing debate over the desirability of deportation as a means of addressing illegal immigration serves both as a motivation for the analysis and as a source of contrast from previous studies that mostly assess the impact of an influx, rather than an outflux, of workers.3 Several researchers have looked at the macroeconomic effects of a positive immigration shock. These include Michael Ben-Gad, “The Impact of Immigrant Dynasties on Wage Inequality,” Research in Labor Economics 24 (2005): 77–134; Michael Ben-Gad, “Capital-Skill Complementarity and the Immigration Surplus,” Review of Economic Dynamics 11 (2008): 335–65; Michele Boldrin and Ana Montes, “Modeling an Immigration Shock,” European Economic Review 74 (2015): 190–206; and Serife Genc, “Selective Immigration Policy and Its Impacts on Natives: A General Equilibrium Analysis,” 2015. Mimeo. Their models all have the same basic structure as our model, but they make differing assumptions about the assimilation process, which leads to differing predictions about both the long- and short-term effects of the shock. Those assumptions do not matter for understanding the effects of an unexpected negative shock.

Our analysis focuses exclusively on how different policies regarding illegal immigration affect the welfare of US citizens. No consideration is given to the welfare of the immigrants since this may or may not factor into the preferences of voters. As a preview of our results, there are scenarios in which deportation would be more cost effective than maintaining the status quo—namely, if illegal immigrants consume public services disproportionately.4 Though we will briefly address the short-run costs of implementing a mass deportation—such as the cost of rounding up illegal immigrants and transporting them to other countries—our analysis mostly ignores these one-time costs. As such, one should be aware that the actual costs of a mass deportation would undoubtedly be much higher than what we assume here. However, perhaps counterintuitively, in such a scenario an even cheaper option is to grant amnesty to law-abiding immigrants and legalize all economic immigration. The key variables that determine which of these policies yields the highest welfare for natives are how much illegal immigrants are able to save, how much they consume in public resources, and how much they contribute to tax revenue. Whether illegal immigrants have the same access to saving instruments as legal residents will turn out to be the most important of these variables. However, both experts and laypeople generally agree that illegal immigrants do not have the same access. The other two variables are more difficult to measure and thus there is more controversy about their valuation.

To be precise in our terminology, we denote the ratio of public goods consumption by illegal immigrants relative to that of legal residents 5 Public goods and services will be loosely defined here as any goods or services provided by the government with the exception of Social Security, which we model separately. This would include schools, military, police, and any public spending on health care. and the ratio of how much illegal immigrants pay in taxes relative to legal residents with similar economic characteristics by

Thus, for example, if

, then illegal immigrants pay the same taxes as a native with the same education and productivity profile. If

, then an illegal immigrant will pay less taxes. Likewise if

, an illegal immigrant consumes more goods and services provided by the government, and if

, the immigrant consumes less. We can then simply represent the circumstances in which deportation or legalization will be preferable to the status quo in terms of a graph in these two dimensions

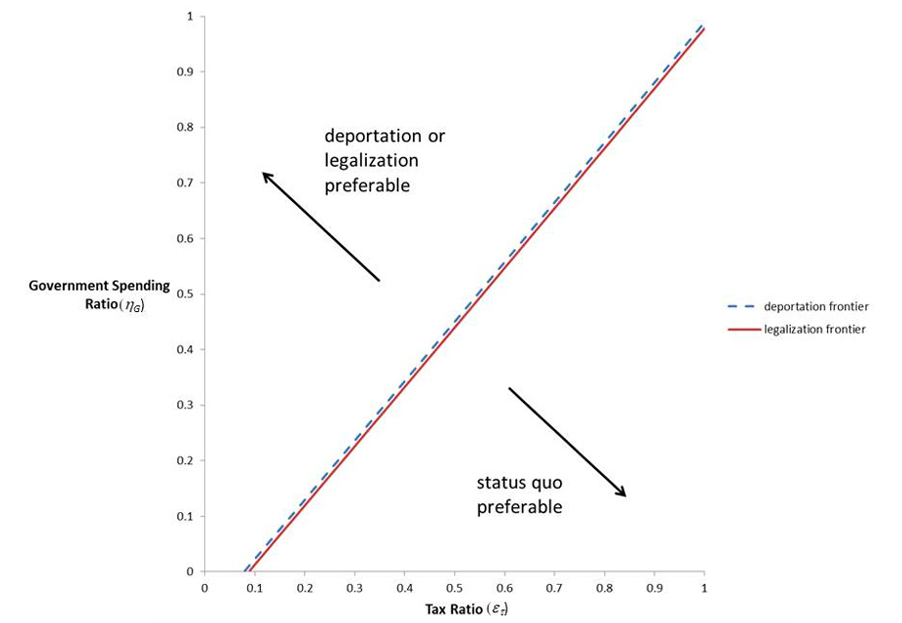

Figure 1 plots an example of the regions of the parameter space for and

where citizens would be better off under deportation, legalization, or maintaining the status quo—the characteristics of which are defined more precisely later. Notice that the two boundary lines both slope upwards, meaning that as illegal immigrants pay more in taxes, they must consume more in public goods and services in order for legal residents to remain indifferent between the policies in question.6There is no frontier where legal residents would be indifferent between deportation and legalization. Starting from a point on either frontier, if we move to the right by improving enforcement of taxes on illegal immigrants without changing anything else, it will then make more sense to let most illegal immigrants remain as they are while paying these higher taxes.7 Presumably some fraction of illegal immigrants will be caught and deported as per current policy while others will take their place. This suggests that another alternative to large-scale deportation or legalization may be to just improve tax enforcement, though delving into the details of implementing such a measure is beyond the scope of this paper.8 One issue that we cannot address here is the mismatch between the jurisdictions collecting taxes from illegal immigrants and the jurisdictions providing services to them. Overall, illegal immigrants might pay more in federal income and payroll taxes than what they receive from the federal government, but that might create a burden to local governments if illegal immigrants pay less in property and sales taxes than what they receive at the state and local level. Again, however, reallocating tax revenues within the government bureaucracy would likely be a more effective solution to this problem than removing the immigrants. Conversely, if we move up from either of these frontiers so illegal immigrants consume more in public goods and services without changing anything else, legal residents would then be better off deporting or legalizing these expensive immigrants than maintaining the status quo.

Regardless of any parameter uncertainty, another notable feature of figure 1 is that the legalization frontier is always below the deportation frontier. In other words, regardless of the amount of taxes paid or public services consumed by illegal immigrants, any welfare gain from legalizing them would be at least as high as the welfare gain from deporting them. Thus, the analysis in this paper suggests that deportation will always trail behind the status quo or legalization. Deportation will never be the best policy option.

2. Immediate Effects of Mass Deportation

One of the main reasons why immigration is such a thorny issue is that models of some complexity are required to answer the most basic questions of how immigration might affect native-born workers. Even the simplest undergraduate macroeconomic model with a population of identical households contains many moving parts. In such a setup, each household acts as a worker, a consumer, and a saver, simultaneously.

Financial markets are assumed to direct the savings of households into the purchase of capital (i.e., the equipment and facilities necessary to produce goods). Wages, interest rates, and per capita consumption are independent of the population in such a rudimentary setting, implying that immigration has no direct effect on economic well-being.9 The size of the economy will matter geopolitically, which may have second-order effects on the household beyond the scope of this paper. For example, a bigger GDP will allow the country to maintain a larger military force, which may improve a household’s feeling of security. Thus, for immigration to matter, a model must be enriched to allow other differences between immigrants and natives.10 To be precise, the models that inform these policy recommendations are general equilibrium models in which all prices are determined through the simultaneous clearing of markets.

The smallest deviation from the above model of identical immigrants and natives was developed in earlier work by Feigenbaum.11 Feigenbaum, “Transition Dynamics.” As a stark thought experiment, the modified framework assumes that legal residents choose their education level while illegal immigrants are all less educated. In this section, the distinction in the ability to invest in education will be the only difference between legal residents and illegal immigrants. Mass deportation is then simulated as a sudden removal of some low-educated households from the economy.12If the deportation is expected, the model would have to take into account the circumstances immigrants would face when they return to their home country in order to predict how they would respond to news of their imminent departure. To be more precise, the model implements a “hard” deportation whereby all illegal immigrants are physically removed from the country.

Note that an unexpected upheaval of this magnitude would undoubtedly cause huge disruption to the economy in the short run. We would, in particular, likely see significant volatility in financial markets while the news is processed. Also, some low-skilled jobs might see wages skyrocket until employers can find cheaper substitutes. These perturbations are outside the scope of this model to investigate. We are only able to consider the effect of the deportation on labor and capital markets after everyone has rationally adjusted to the new regime of fewer illegal immigrants.13 To give some idea of the time scales we are considering, a period in the 2016 model of Feigenbaum should be thought of as 20 years. Feigenbaum, “Transition Dynamics.” However, these transient effects that we are ignoring would typically only benefit a very small fraction of the population for a very short time. Since most of the economy would be hurt even more, accounting for these effects would just reinforce our results.

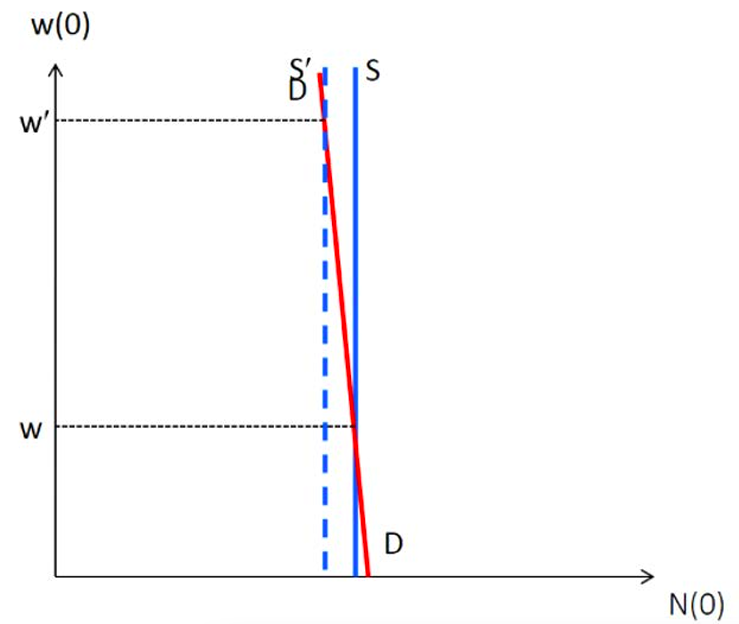

What often comes up in debates about illegal immigration are assertions that increased labor market competition lowers natives’ wages, and that is what we will focus on here. A deportation should raise wages by reducing the supply of less-educated workers.14 Note, however, that if deportees are allowed to take their capital with them, that would partially undo the effect of a smaller labor supply on low-skilled wages. This intuition is captured in figure 2. In the graph, the x-axis measures the number of low-educated workers in the labor force, and the y-axis measures their wage. The line labeled S represents the initial supply of labor. Here we assume that all workers are full- time workers. Since the amount of labor does not vary with the wage, the supply curve S is vertical.15 A deportation would have an even smaller effect on the wage in the more realistic case where the supply curve is upward sloping. The demand curve, labeled D, shows how many workers firms will hire for each wage. This slopes downward since firms hire fewer workers as labor becomes more expensive. Lastly, the wage w is set by market forces equal to the y-coordinate of the point where the demand and supply curves intersect.

Following a deportation, the supply curve shifts leftward to S′ and the wage rises from w to w′, which appears like a sizable increase in figure 2. However, if firms are more responsive to labor costs—that is, if the demand for labor is more elastic, as shown in figure 3—the wage increase in response to a mass deportation is much smaller. More generally, the slope of the demand curve can be represented by a formula that depends on only two parameters, both of which are bounded by observable data. This lends greater support to the smaller wage increase shown in figure 3.

Economists quantify the slope of the demand curve in terms of what is known as its elasticity: the percentage by which low-educated wages will increase (decrease) in response to a 1 percent decrease (increase) in the supply of low-educated labor.16 Note that this is the reciprocal of how one normally defines the elasticity of demand—the percentage by which the quantity of workers that firms want to hire changes in response to a 1 percent change in the wage. For low-educated workers, the elasticity of their wage with respect to their labor supply is: 17The formula is derived in James A. Feigenbaum, “A Nonparametric Formula Relating the Elasticity of a Factor Demand to the Elasticity of Substitution,” Theoretical Economics Letters 9, no. 1 (February 2019): 240–46.

To be precise, because most researchers estimate that illegal immigrants comprise 5 percent of the labor force (4 percent of the population), deporting all of these illegal immigrants should increase low-educated wages by 5 percent. In the formula above, the numerator of is the share of gross domestic product (GDP) that goes to highly educated workers and the owners of capital. An upper bound on the numerator is 1, and a lower bound is the share of output going to just capital, which has been approximately one-third for the United States going back to before World War II.1818 The share of capital is the share of gross income going to capitalists before netting out depreciation. Regarding its value, see Thomas Piketty, Capital in the Twenty-First Century, translated by Arthur Goldhammer (Belknap Press, Cambridge, MA). The denominator of

measures how often firms will replace low-educated workers with alternative resources as the cost of low-educated workers increases. A high elasticity of substitution means it is easy to replace low-educated workers with machines and highly educated workers, while a low elasticity means it is difficult to substitute one for the other. In the latter case, when production requires a combination of low-educated labor and other resources, the inputs are complements.

Given that the numerator is capped at one, generating a large wage response to deportation requires a small-value denominator. That would imply a strong degree of complementarity between less-educated labor and other inputs to production. In such a scenario, less-educated labor would be nearly irreplaceable, which contrasts with the anxiety that many low-educated workers feel about the prospect of automation and outsourcing causing large employment losses and dislocation. If instead the denominator were equal to 1—a common intermediate case—the most that wages could rise for less-educated workers would be 5 percent. Concretely, less-educated native workers with an initial wage of 10 dollars an hour might see a 50-cent per hour increase after a mass deportation.

This back-of-the-envelope calculation lines up with empirical evidence. For example, in 1980, over 100,000 Cubans, mostly without a high school education, made the 100-mile boat trip from Cuba to Florida. Based on what happened to wages and employment for workers with less than a high school education in the Miami job market, Borjas estimates the wage elasticity for these far less educated workers was between 0.5 and 1.5—a range which includes the value of 1 used above.19 While low-educated labor is undoubtedly a substitute for highly educated labor and capital when viewed in the aggregate, if labor is broken down into specific jobs, some jobs are presumably complementary to highly educated labor and capital. For example, janitorial services are not easily performed by machinery. Since the share of GDP going to janitors will be practically zero, if we focus exclusively on janitors the numerator will be 1 and the denominator may be somewhat less than 1, resulting in a wage elasticity for janitors bigger than 1. George J. Borjas, “The Wage Impact of the Marielitos: A Reappraisal,” Industrial and Labor Relations Review 70 (2017): 1077–110. On the other hand, Clemens and Hunt offer reasons why the elasticity is probably much closer to the lower end of Borjas’s estimated range. See Michael A. Clemens and Jennifer Hunt, “The Labor Market Effects of Refugee Waves: Reconciling Conflicting Results” (NBER Working Paper No. 23433, National Bureau of Economic Research, Cambridge, MA, 2017). In 1980, the greater Miami area (Miami-Dade, Broward, and Palm Beach counties) had a population of 3 million.2020 US census data. Assuming this area was a representative sample of the nation as a whole, about 5 percent of the population would have had less than a high school education, so the native population competing with these workers likely numbered on the order of 200,000 workers.2121 This value was calculated using US data on total population (https://fred.stlouisfed.org/series/POPTHM) and employment level with less than a high school diploma and age 25 or older (https://fred.stlouisfed.org/series/LNS12027659) from the Federal Reserve Economic Data (FRED) repository. Thus the Mariel boatlift should have increased the size of the labor force without a high school education by roughly 50 percent, and Borjas reports that some workers saw a 10–30 percent drop in wages.22 Borjas, “Wage Impact.”

The boatlift episode demonstrates that an influx of less-educated workers can have a substantial effect on less-educated natives if these new workers concentrate in a few industries or geographic regions. If instead they are more dispersed across the country, their effect on wages is much smaller on average, even though individual workers may be affected more or less than the average. Assessing the extent to which illegal immigrants congregate in specific labor markets, Keeton and Newton find that immigration has a mixed effect on localized imbalances of supply and demand in regional labor markets.23 Like most researchers, they did not distinguish between legal and illegal immigration, though their data presumably sample more from legal immigrant households. William R. Keeton and Geoffrey B. Newton, “Does Immigration Reduce Imbalances Among Labor Markets or Increase Them? Evidence from Recent Migration Flows,” Kansas City Federal Review 31, no. 4 (2005): 47–78. On the one hand, many immigrants do settle in localities with a high demand for labor, such as farming communities. On the other hand, some cities like San Diego and Miami are immigration magnets because of established social networks created by earlier migrants, which facilitate finding employment and affordable housing. Because illegal immigrants face harsher search frictions than legal immigrants, one would expect them to be drawn more to magnet regions where they can obtain more help overcoming these frictions. In these magnet regions, native workers should experience larger than average disruptions to labor markets as a consequence of immigration. However, any excess labor market distortion attributable to illegal immigration is a consequence of this illegality, not to immigration per se.

Moving from wages to other aspects of the economy, note that goods are produced by combining capital and labor. If a mass deportation causes the labor force to shrink by 5 percent, the economy will not be able to produce as much.24 If deportees are allowed to take their capital with them, output will decrease even more. In other words, gross domestic product—which is the same as aggregate income— must fall. Thus, if total income falls but the income of less-educated workers rises, it must be the case that highly educated workers earn less following a mass deportation. Moreover, because less-educated workers considerably outnumber highly educated workers, the income losses per highly educated worker will be substantial.2525 Busch et al. find econometrically, as one would expect theoretically, the opposite result from the recent wave of refugees that have settled in Germany. Low-skilled workers suffered moderate welfare losses, but these were more than made up for by the gains to the rest of the population. Christopher Busch, Dirk Krueger, Alexander Ludwig, Irina Popova, and Zainab Iftikhar, “Should Germany Have Built a New Wall? Macroeconomic Lessons from the 2015–18 Refugee Wave” 2019. Mimeo.

3. Long-Run Effects of Deportation

The previous section analyzed only the short-run response to a deportation under the assumption that all illegal immigrants are less educated while legal residents get to choose their education level.2626 While most immigrants who enter the country illegally as adults are low-educated, that is not true of many so-called Dreamers who entered the country as children. A mass deportation of highly educated workers will have far more severe effects on the macroeconomy than a mass deportation of low-educated workers and will unambiguously reduce, rather than increase, low-educated wages. For more on this issue, see James A. Feigenbaum and Josh T. Smith, “‘Dreamers’ are Worth the Wall,” Real Clear Politics, February 6, 2018, https://www.realclearpolicy. com/articles/2018/02/06/dreamers_are_worth_the_wall.html In deciding their level of education, natives must balance the cost of further education in terms of time, lost wages, and any disutility from studying, against the future wage premium from higher educational attainment. Following a mass deportation, the reduction of less-educated households increases the ratio of highly educated to less-educated workers remaining in the economy, thereby driving down the wage premium. Over time, subsequent generations of workers would face less of an incentive to attain higher education, which would gradually cause the education population shares to return to their pre-deportation levels and erase any wage gains to less-educated workers from the deportation. Similarly, individual savings rates and all other per capita economic variables would converge to their pre-deportation levels, leaving workers no better off after implementing such a costly mass deportation.27 In equilibrium, households must expect to be just as well off if they choose to become low-educated or highly educated. If one choice is perceived to be better than the other, all households would make the better choice. Thus household welfare will be the same for all households both before the deportation and long afterward. However, the analysis above does not definitively establish that illegal immigrants have no long-run effects on the economy. Rather, it simply demonstrates that differences in average education levels between illegal immigrants and natives are not sufficient to generate any such long-term effects.

Other distinctions between illegal immigrants and legal residents could stem from differences in preferences or additional frictions that illegal immigrants must endure because they are not supposed to be participating in the economy.2828 It is also possible that illegal immigrants might be differently abled than legal residents, which is an issue this paper abstracts from. For now, the analysis focuses on frictions, but preference differences will be of paramount importance when comparing deportation with legalization. Furthermore, to keep matters tractable, the analysis only considers two sources of frictions: (i) differential eligibility for public benefits, use of public goods, and tax treatment; and (ii) differential access to saving instruments.29 Illegal immigrants may face greater job search frictions, which this framework does not address. Illegal immigrants may also have different access to healthcare. Thus, the model used in section II is modified to further differentiate immigrants from native workers according to (i) and (ii).30 For a rigorous treatment of this model, see Feigenbaum, “Illegal Immigrants.”

3.1 Perfect Capital Markets

Let us begin with the simpler case where capital markets are perfect, meaning that households have the same access to all investment vehicles: banks, stock brokers, insurance companies, and so forth. In the context of our model, this means they can all save at a common interest rate.3131 In the model, borrowing is only allowed to finance education. The assumption of perfect capital markets also means that the interest rate on borrowing is the same as that for saving. Reflecting (i), illegal immigrants pay a fraction of the tax rate of their legal counterparts.32 It is also assumed there is a progressive tax system, so highly educated native workers pay a higher income tax rate than less-educated natives. Furthermore, during retirement, legal residents get to enjoy Social Security, whereas illegal immigrants are ineligible. The government uses its tax revenue to pay for Social Security benefits and also for public goods and services like roads, schools, police, and military, denoted collectively by G.33This is the same G that appears in the income-expenditures identity, with some modifications. The analysis assumes that demand for G scales with the population (e.g., 10 times as many schoolchildren necessitates 10 times as many schools).34 This is true even though public goods are usually defined to be nonrivalrous.

However, some households consume more public goods than others. In particular, the parameter captures the ratio of public goods consumption by illegal immigrants relative to that of legal residents. Rather than take a stand on the difficult-to-measure value of

—for example, it could be above 1 if it costs more to teach the children of illegal immigrants for whom English is not their native language, or it could be below 1 because some services are unavailable to illegal immigrants—the analysis instead shows the effect of mass deportation for a range of different parameter values.35 Illegal immigrants are not eligible for the three most expensive benefit programs: Social Security, Medicare, and Medicaid. Social Security is a transfer payment, not a public good or service, and is easily modeled on its own. Since health spending is exogenous in our framework, we

include Medicare and Medicaid under the broad category of public goods and services, although they are counted as transfer payments and do not contribute to G officially in the National Income and Product Accounts.

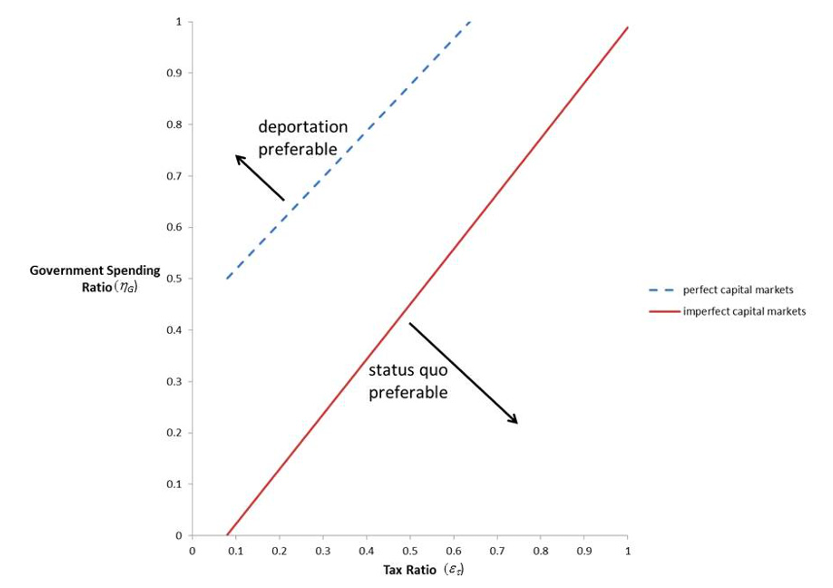

The dashed line in figure 4 shows the frontier in the space of and

where citizens would be indifferent between deporting all illegal immigrants and maintaining the status quo for this case of perfect capital markets.3636 The specific numerical values of the parameters used to generate these frontiers can be found in the technical appendix. Before delving into the intuition behind the trade-offs that form this line, it should be noted that starting at a point on the frontier and moving either right (e.g., by increasing tax enforcement on illegal immigrants) or down (by making public services less available to illegal immigrants) would make natives better off in the long run under the status quo.

If illegal immigrants consume the same amount of public services as legal residents, a policy environment on the indifference frontier would have = 0.55, meaning that as long as the effective tax rate of illegal immigrants is just over half that of natives, deportation would be a net harm to legal residents. To put this number in context, illegal immigrants pay most taxes, such as sales and property taxes, regardless of their legal status. It is true that some illegal immigrants avoid paying income and payroll taxes because their employers are aware that they are illegal and do not withhold these taxes for them.3737 Note that many natives and legal residents who are employed informally also do not have income and payroll taxes withheld from their wages. Taking this into account would raise

However, the Institute of Taxation and Economic Policy estimates that half of illegal immigrants file tax returns, implying that the government should be collecting at least half of what it ought to be getting from illegal immigrants according to statute.38 See ITEP, “Vox: Immigrants Pay Taxes,” media mention, April 13, 2018, https://itep.org/vox-immigrants-pay-taxes/. In 2015, the IRS received 4.4 million tax returns with nonexistent Social Security numbers, which is roughly half of the estimated number of undocumented workers in the United States.

If illegal immigrants consume an even smaller ratio of public goods and services than do legal residents (i.e., if ), then their share of taxes can be even lower for the status quo to be more attractive to natives than undertaking a mass deportation. To understand how illegal immigrants can make less-educated natives better off with their presence even if they only pay a fraction of the total tax burden, it is important to remember that illegal immigrants do not collect Social Security despite contributing to the payroll tax.

Thus, even for values of significantly below 1, illegal immigrants can have a net positive impact on the government budget, thereby allowing the tax rate to be lower and after-tax wages to be higher for natives compared to what would prevail if illegal immigrants were forced to leave.

Perhaps surprisingly, the presence of illegal immigrants would also boost pre-tax wages in this case. While the common intuition described in section II is that illegal immigrants depress the wages of less-educated workers, they actually have the opposite effect under perfect capital markets. This result is largely another consequence of illegal immigrants’ ineligibility for Social Security.3939 Differences in preferences regarding remittances also play a role that is discussed in section IV. In particular, it is well known that Social Security shrinks the size of the economy.40 The effect of Social Security on the size of the capital stock was first documented by Paul A. Samuelson, “Optimum Social Security in a Life- Cycle Growth Model,” International Economic Review 16 (1975): 539-544. Justifications for Social Security today usually involve the need to make up for the inability of many households to prepare for retirement. See, for example, George A. Akerlof, “Behavioral Macroeconomics and Macroeconomic Behavior,” American Economic Review 92 (2002): 411–33. Survey data find that roughly a third of American households have no savings at retirement. Kevin Huang and Frank Caliendo, “Rationalizing Multiple Consumption-Saving Puzzles in a Unified Framework,” Frontiers of Economics in China 6 (2011): 359–88.

By taking income away from the young and giving it directly to the old, Social Security prevents saving that would otherwise contribute to the capital stock and GDP. Thus, making illegal immigrants ineligible for Social Security causes them to save more for their own retirement, which boosts capital and economy-wide wages.

In addition to this savings channel on wages, the presence of illegal immigrants in the labor market spurs more natives to become highly educated, which puts further upward pressure on the wages of less-educated workers.41 Peri confirms empirically that the effect of immigration on low-skilled wages is likely positive. Giovanni Peri, “Did Immigration Contribute to Wage Stagnation of Unskilled Workers?” Research in Economics 72 (2018): 356–65. There is evidence of this educational channel in micro data. Osborne Jackson, “Does Immigration Crowd Natives into or out of Higher Education?” 2014. Mimeo. This effect is magnified by the fact that their ineligibility for Social Security prompts illegal immigrants to work longer hours to make up for lost wealth.

3.2 Capital Markets that Exclude Access by Illegal Immigrants

While the preceding analysis is illustrative, the above results also demonstrate why the assumption of perfect capital markets for illegal immigrants is implausible. Illegal immigrants in this model not only save more than low-educated legal residents, but they also save more than highly educated legal residents, which is clearly counterfactual. We now consider the more plausible opposite extreme as a counterpart, in which legal residents have full access to perfect capital markets but illegal immigrants have zero access to capital markets—that is, illegal immigrants can only save by doing something analogous to hiding money in a mattress. For our purposes, they can save by purchasing durable goods (e.g., automobiles) that will not be used productively and will not earn a positive return.42 They will, in fact, earn a negative return due to depreciation. Under this modified setup, the frontier where citizens are indifferent between deportation and maintaining the status quo in the space of and

shifts down and is denoted by the solid line in figure 4 (and also by the dashed line in figure 1). Intuitively, taking away access to financial markets causes illegal immigrants to mostly live hand-to-mouth rather than save. As a result, they neither contribute to the economy’s capital stock nor work more because there is no way for them to save any surplus income. Thus, in this regime, competition with illegal immigrants does not induce more legal residents to invest in high education.

However, the presence or absence of illegal immigrants does affect interest rates. Since interest rates have a much smaller impact on welfare than wages, we ignored this effect in the preceding discussion, but in this regime it is the primary channel through which a shift in a market supply or demand caused by illegal immigrants matters to legal residents. Analogous to the effect of greater labor market competition on wages, if capital becomes more abundant, interest rates will decline. More precisely, interest rates are a decreasing function of the ratio of capital to low-educated labor. As a first order approximation, we can ignore the effect of interest rates on a household’s saving as well as the contribution of highly educated workers to the capital stock, in which case this ratio will be roughly proportional to the fraction of low-educated workers who save.434 In our baseline calibration, interest rates do not affect a household’s saving rate, though they do affect the household’s lifetime income. Having immigrants in the economy who cannot save will reduce the ratio of capital to low-educated labor and increase interest rates. Thus the presence of illegal immigrants will elevate the interest income earned by legal residents. Deporting illegal immigrants undoes this effect and reduces the benefits that natives gain by saving.44Since the model does not incorporate search frictions, this effect is how the model captures the notion that illegal immigrants are “cheap labor.” They are cheap in the sense that they increase the rate of profit for employers. In a model that more seriously takes into account income and wealth inequality, this effect would dominate the welfare analysis for the wealthiest Americans, giving them a strong incentive to prefer the status quo.

Nevertheless, the effect of illegal immigrants on interest rates has a much smaller effect on negative welfare than the effect of illegal immigrants on taxes. Overall, figure 4 demonstrates that introducing this capital market imperfection increases the region of the parameter space for which mass deportation would be desirable to natives relative to the status quo. In this regime, the optimal policy will be very sensitive to the parameters and

. It is imperative that we have trustworthy estimates before we engage in a costly mass deportation that could harm the legal residents it is intended to help.

4. Deportation versus Legalization

Another policy option for dealing with illegal immigrants besides deporting them would be to legalize them. Before proceeding with the analysis, it is important to distinguish between amnesty and legalization. While little meaningful distinction exists in the short run, the word amnesty implies that penalties for illegal immigration will remain in force in the long run—they would only be waived for the current population of illegal immigrants, as happened under the Immigration Reform and Control Act of 1986 signed by Ronald Reagan.45 A short-term policy of amnesty would be equivalent to a soft deportation in this model if the present generation of illegal immigrants is legalized but no further illegal immigrants are allowed in In the long run, the effects of a one-time amnesty would likely differ little from maintaining the status quo. Thus, the rest of the analysis refers to legalization whereby the penalties from illegal immigration are themselves removed.

As previously discussed, illegal immigration can only have an economic impact if there are meaningful differences between illegal immigrants and legal residents, such as barriers that prevent full participation in the economy. Returning to the result that household-level economic variables (e.g., wages and per capita income and consumption do not depend on population size, the counterintuitive but logical implication is that removing illegal immigrants and legalizing them both lead to the same economic welfare for legal residents. In other words, what matters is the elimination of economic divisions, which can be done either by engaging in a costly mass deportation or by tearing down the barriers and addressing the frictions that create economic distinctions between illegal immigrants and legal citizens in the first place.46 We assume here that the government balances its budget so deportation costs will not generate debt that might continue to affect future generations in the long run.

Before addressing the up-front cost of deportation, it is helpful to distinguish between two kinds of “deportation.” In section II, we considered a so-called hard deportation in which illegal immigrants are physically removed. Alternatively, the United States could implement a “soft” deportation in which we maintain the status quo for the existing cohort of illegal immigrants and shut down all existing avenues by which foreigners enter the country illegally. In this scenario, because of the 14th Amendment, any descendants of illegal immigrants born in the United States would automatically be citizens, but the actual population of illegal immigrants would gradually shrink through attrition. While these two forms of deportation would entail different short-run costs—for example, Immigration and Customs Enforcement (ICE) reports that it spent $11,000 per deportee on removal costs in the 2016–2017 fiscal year,47 See Steven A. Camarota, “Deportation vs. the Cost of Letting Illegal Immigrants Stay,” Center for Immigration Studies, August 3, 2017, https://cis.org/Report/Deportation-vs-Cost-Letting-Illegal-Immigrants-Stay. which would likely increase substantially in a mass deportation—their long-run economic consequences would be the same.48 For example, total costs could aggregate linearly to $660 billion, or 3 percent of GDP, which would dwarf any conceivable change in long-run welfare resulting from either a deportation or legalization. See Feigenbaum, “Illegal Immigrants.” A soft deportation would avoid this upfront cost.49 Presumably a soft deportation would not be costless since it would require a hardening of the border. However, ignoring this uncertain cost only biases the model against the current results.

Another economically relevant aspect in which many immigrants differ from native-born citizens is their desire to send remittances (i.e., gifts of money) to friends and family members back in the home country. A common complaint about remittances is that they contribute to the current account deficit in the United States. This is closely related to the US trade balance and is the amount by which America’s net debt to the rest of the world increases in a year.5050 Alternatively, America’s net debt to the rest of the world would decrease if the nation runs a current account surplus, but that has not happened in many years. Before proceeding further, it is important to note that remittances do not have any mechanical impact on the current account, despite the fact that they appear as a negative term in the formula to calculate it. This negative term is included simply to cancel out the implicit appearance of remittances in the other terms, much as imports are subtracted from the calculation of GDP to correct for the fact that these imports would otherwise be included as part of consumption or investment, whichever they are used for. Put another way, all else being equal, if someone in America who earns a dollar by producing American goods chooses to send that dollar to someone in another country, that dollar must ultimately still be used to buy a dollar’s worth of American goods.51 The dollar may pass through many hands before this happens, though. Thus remittances improve the trade balance. However, since remittances do not change how much the United States owes to the rest of the world, their contribution to the trade balance has to be subtracted out.

Another concern about remittances is that they reduce aggregate saving, but this too is a misnomer. Remittances are a substitute for domestic consumption, not saving, and therefore have no effect on the domestic stock of productive capital.5252 We are assuming here that immigrants remain in the economy until they die. Some remittances are actually savings set aside by the immigrant for when they return home. These would reduce domestic aggregate saving and increase aggregate saving in the home country. Such remittances are outside the scope of this paper. Presumably, the temporary immigrants we disregard would have much less of an impact on American society than the permanent immigrants we consider. They do, however, provide households that view remittances as a necessity with an additional incentive to work.53 Feigenbaum, “Illegal Immigrants.” If, in contrast, native-born households view remittances to distant family as a luxury good rather than as a necessity, a population of legal residents that includes a group of former illegal immigrants will work slightly more on average than a population without any present or former illegal immigrants.5454 The leading model of gift giving among family members today, “warm glow altruism,” does treat such gifts as a luxury good. See Mariacristina De Nardi, “Wealth Inequality and Intergenerational Links,” Review of Economic Studies 71 (2004): 734–68. This theoretical result about immigrants’ greater willingness to work is confirmed empirically in a study done in North Carolina that had a government agency steer unemployed native-born workers towards farms that had become dependent on immigrant labor.55 NAE, “Immigrant Workers Vital to North Carolina’s Varied Crops, Says NC Farm Bureau President,” New American Economy, June 7, 2016, https://www.newamericaneconomy.org/feature/immigrant-workers-vital-to-north-carolinas-varied-crops-says-nc-farm-bureau-president/. In 2011, 268 workers were referred to this agricultural work, of which 245 were employed. However, only 163 ever showed up and only 7 remained on the job through the end of the season.56Dylan Matthews, “North Carolina Needed 6500 Farm Workers. Only 7 Americans Stuck It Out,” Washington Post, May 15, 2013, https://www.washingtonpost.com/news/wonk/wp/2013/05/15/north-carolina-needed-6500-farm-workers-only-7-americans-stuck-it-out/?noredirect=on&utm_term=.f3c809f522cf.

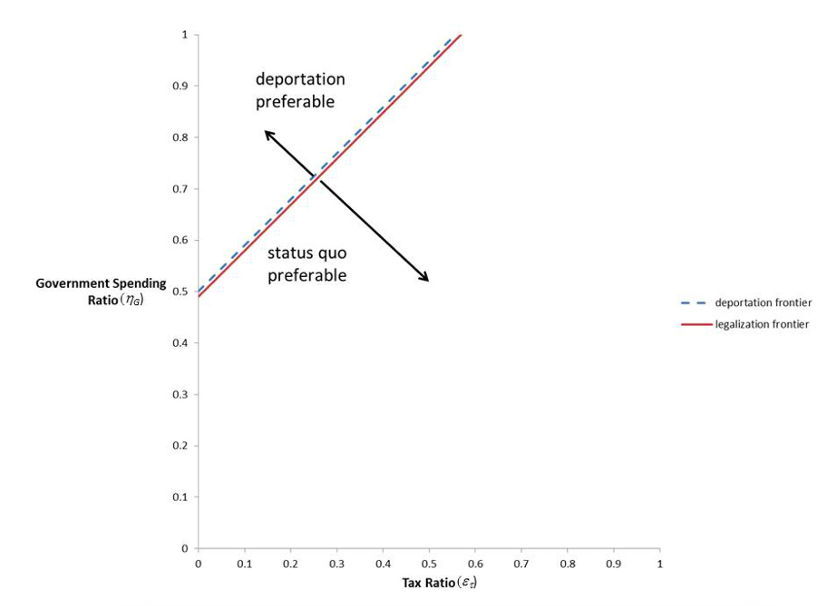

In figures 1 and 5, accounting for remittances causes an expansion in the region of the parameter space where natives prefer legalization over the status quo. In practical terms, what this shift means is that for any set of parameters for which deportation is preferable to the status quo, legalization is even more preferable. Although uncertainty about the parameters and

prevents a conclusive determination in this paper about whether either of the two policy options should be pursued relative to the status quo, the analysis conclusively finds that legalization would yield higher welfare for natives than engaging in a mass deportation of illegal immigrants.

5. Conclusion

Illegal immigrants who have no legal permission to live or work within the United States comprise 4 percent of the American population. No other rich country in the Western world has accumulated such a large stock of unauthorized laborers. This paper has considered two diametrically opposed deviations from current policy to address these works—remove them or legalize them—and reported the welfare consequences of these policy options for American citizens based on an assessment of their macroeconomic impact.

Although deportation is a popular option among some voters, the analysis in this paper shows that there is little long-run difference between legalization and deportation in terms of native individual welfare. However, implementing a deportation, especially a hard deportation, would be quite costly in the short run, which makes it difficult to justify on economic grounds. Moreover, legalization becomes strictly superior to deportation if immigrants have a stronger preference for sending remittances. Thus, the more relevant trade-off is between legalization or maintaining the status quo, in which natives benefit from illegal immigrants’ ineligibility for Social Security but are potentially made worse off if illegal immigrants consume disproportionate public services—something which the empirical literature is highly divided on. Other considerations not included in this paper—such as the potential of legalization to alleviate labor market search frictions faced by illegal immigrants but which adversely impact natives—could further tip the balance in favor of legalization.57See Sandra Orozco-Aleman and Heriberto Gonzalez-Lozano, “Labor Market Effects of Immigration Policies,” 2017. Mimeo and Andri Chassamboulli and Xiangbo Liu, “Immigration, Legal Status and Fiscal Impact, 2020., Mimeo. The latter in particular asks questions similar to what we ask here but in an infinite-horizon model with search frictions and obtain similar answers, demonstrating the robustness of our results.

Figure 1. Frontiers in the space of the tax ratio and the public goods spending ratio

where legal residents are indifferent between deportation and the status quo, and between legalization and the status quo, assuming illegal immigrants have no access to capital markets.

Figure 2. Response of labor market to a deportation with inelastic labor demand.

Figure 3. Response of labor market to mass deportation with elastic labor demand.

Figure 4. Frontiers in the space of the tax ratio and the public goods spending ratio

where legal residents are indifferent between deportation and the status quo, for the cases where illegal immigrants have full access to perfect capital markets and where they have limited access to imperfect capital markets.

Figure 5. Frontiers in the space of the tax ratio and the public goods spending ratio

where legal residents are indifferent between deportation and the status quo, and between legalization and the status quo, assuming illegal immigrants have full access to capital markets.