“The Mexican immigrant is not good material for citizenship, and in some places Mexican colonies are decidedly objectionable.” — The Washington Post, Jan 25, 1930.

“Between 40 and 50 unemployed American laborers threatened a united disturbance this morning when they tried to prevent Mexican workmen to continue their work (…) demanding that the contractors employ white labor.” — The Los Angeles Times, Oct 17, 1931.

Introduction

Immigration has consistently been at the center of the political and economic controversies in history. The economic literature has shown that migration affects local economies through various channels, including labor markets, foreign direct investment, and innovation. A growing part of this literature has focused on the impacts of migration on housing. Studying housing remains vital for at least two reasons. First, housing is an essential component of most households’ wealth and expenditure. Second, since immigrants need a house to live in, intense immigration flows can significantly affect local housing quantities and prices, potentially impacting the local wealth distribution, the cost of living, and real wages. However, most of what we know about the effects of migration on housing comes from studies that focus on the inflows of immigrants (e.g., Saiz (2003), Ottaviano and Peri (2006), Saiz (2007), Akbari and Aydede (2012), Howard (2020)).

This paper sheds light on an understudied type of migration shock to housing markets: an out-migration shock. Making this distinction when studying housing markets is indispensable because housing investment is naturally irreversible. Once a dwelling unit is built, it is prohibitively expensive to convert it back to investable capital—a characteristic also known as the putty-clay nature of real estate investment.1The idea of putty-clay technology was introduced by Johansen (1959) and later emphasized in the context of housing investment by Cooke and Hamilton (1984) when modeling urban residential growth. The existing literature shows evidence that in-migration shocks to a city are likely to increase the demand for housing, inducing the construction of new house units (Howard (2020)). However, the empirical literature is silent on how an out-migration shock affects house prices, rents, and construction activity.

Because housing is durable, asymmetric effects on prices may arise, making us incapable of drawing precise conclusions about out-migration episodes from in-migration elasticities. Potentially, one would expect a larger impact on prices in the short run due to the inelastic downward nature of housing (Glaeser and Gyourko (2005)). Precisely gauging these impacts is one of our contributions.

This gap of out-migration studies in the housing literature has become more critical as we observe the invigoration of national-populism and immigration backlash across the globe. In recent years, influential leaders have voiced strong views against immigration in election campaigns and electoral mandates.22For example, Donald Trump (US), Matteo Salvini (Italy), Mette Frederiksen (Denmark), and Viktor Orbán (Hungary). Despite losing France’s presidential election in 2017, Marine Le Pen had more than one-third (33.9%) of the votes in a campaign mostly centered on anti-immigration views (Edo, Giesing, Öztunc and Poutvaara (2019)). Following this rhetoric, immigration policy has also been shifting towards stricter actions.33In the UK, the “hostile environment” policy for migrants gave rise to the Windrush scandal (See BBC News, “Windrush scandal: Home Office showed ignorance of race,” Mar 19, 2020). In Italy, asylum applications have reached record rejection rates, increasing the number of deportations (The Guardian, “Italy rejects record number of asylum applications,” Feb 14, 2019). In the United States, US Immigration and Customs Enforcement has increased enforcement actions (The New York Times, “More Than 2,000 Migrants Were Targeted in Raids,” Jul 23, 2019). While most immigration policies are designed to curb the inflow of immigrants (e.g., by limiting the entrance of immigrants from specific countries), more extreme actions involving the mass expulsion of immigrants through raids and deportations have also become frequent in politicians’ speeches.4For example, Donald Trump said on Twitter during his presidential campaign: “I have never liked the media term ‘mass deportation’—but we must enforce the laws of the land!” He also wrote on Twitter: “Because of the pressure put on by me, ICE to launch large scale deportation raids. It’s about time!” When the BBC’s 60 Minutes asked Marine Le Pen about undocumented immigrants during her presidential campaign, she told the interviewer, “Expulsion. It’s the French law.”

Our paper studies one of the largest ethnically motivated migration shocks in US history to study the impact of out-migration on local housing. Specifically, we study the United States’ Mexican repatriation of the 1930s—a negative, large-scale shock to the Mexican workforce in the US—to quantify its effects on housing prices and real estate outcomes of US cities. Between 1930 and 1936, organized labor movements, press, and local governments harassed, pressured, and forced Mexicans to leave the US (Hoffman (1974); Guerin-Gonzales (1994); Sánchez (1995); Balderrama and Rodríguez (2006); Enciso (2017); Lee, Peri and Yasenov (2022)).55In 2005, the State of California passed the Apology Act for the 1930s Mexican Repatriation Program, which officially recognized the “unconstitutional removal and coerced emigration of US citizens and legal residents of Mexican descent” and apologized to residents of California for violations of civil liberties and constitutional rights. The illegal expulsion of US citizens of Mexican descent has attracted the attention of legal scholars (See Johnson (2005)). We use data from the US Censuses of 1930 and 1940 to assess whether and how housing-market conditions in local economies were affected by the intensity of the repatriation.6Our sample ends in 1940 to avoid confounding factors of World War II and the Bracero Program. The broad presence of Mexicans in the US labor force and their dispersed geographical distribution across the US territory allows us to exploit the substantial variation in the repatriation of Mexicans across US cities.

There are key empirical challenges in estimating the housing effects of out-migration. The nature of the Mexican repatriation as an out-migration shock allows us to address at least two common challenges. First, most out-migration episodes occur in response to wars or natural disasters (e.g., Boustan, Kahn, Rhode and Yanguas (2020)). Obviously, these events destroy the existing supply of houses and affect real estate markets through channels other than just out-migration. As an ethnically motivated shock to out-migration rather than an armed conflict or natural catastrophe, the Mexican repatriation is less likely to induce the immediate destruction of housing units. Second, the business cycle conditions can directly affect the housing markets while also affecting immigrants’ decisions to move. The potential simultaneity between the migration flows and the local economic conditions can lead to biased estimates of the economic consequences of immigration. Because the Mexican repatriation involved harassing, pressuring, and forcing targeted individuals of a specific nationality to leave the country, it likely caused Mexicans to out-migrate for reasons beyond economic adversity. This helps to mitigate the usual confounding effects that are a common concern in the literature. We, therefore, approach the Mexican repatriation as a unique setting to evaluate the costs and benefits of out-migration for its ability to address these empirical challenges.

Nonetheless, the intensity of the repatriation efforts could be correlated with other city characteristics that might affect housing markets. To isolate the Mexican repatriation effects on real estate, we employ an instrumental variable (IV) approach. Our instrumental variable exploits patterns in the road infrastructure of 1930, combined with the historical presence of Mexican immigrants in the US at the turn of the century. More specifically, it combines a measure of exposure to the out-migration shock (the share of Mexican workers in 1900) with a measure of the cost of repatriating workers (travel distance based on the US road infrastructure in 1930). Our baseline specifications also include a series of control variables, including state fixed effects and sector employment shares to account for heterogeneous exposure to the Great Depression.7In other specifications, we include additional control variables to capture other important events that had profound economic effects in the period, such as the Dust Bowl and severe droughts discussed by Fishback, Horrace and Kantor (2005) and Hornbeck (2012).

Considering the nature of the Mexican repatriation as a local shock due to out-migration of a specific part of the population, we begin by investigating its effects on prices of Mexican-occupied houses. We develop a novel automated matching technique to link addresses across the 1930 and 1940 Censuses from the IPUMS Restricted Complete Count Data (Ruggles, Fitch, Goeken, Grover, Hacker, Nelson, Pacas, Roberts and Sobek (2020a)). The matched address sample allows us to track each housing unit’s value or rent evolution across the two censuses. Using this sample, our two-stage least squares (2SLS) estimates show that the Mexican repatriation had a strikingly large and persistent effect on houses where Mexicans lived in 1930. We find that the value of houses inhabited by Mexicans in 1930 devalued by an average of 8.2 percentage points between 1930 and 1940 for every percentage point drop in a city’s Mexican population. Rents on houses occupied by Mexicans in 1930 also fell by more than 2 percentage points for every percentage point of Mexican outflow. To illustrate the economic significance of this effect, we compare it to the median devaluation of Mexican-occupied houses in the period. The median house owned by Mexicans devalued by 41% between 1930 and 1940. This means that the partial negative effect of the repatriation on Mexican-owned houses is equivalent to one fifth (8.2/41 = 20%) of the decline observed in the median Mexican-occupied house value in our sample. The value of the median rent paid by Mexicans fell by 33% between 1930 and 1940. For rented units, the partial effect of the repatriation is equivalent to six percent (2/33 = 6%) of the decline observed in the median rent of Mexican-occupied houses in our sample. More importantly, despite the large devaluation of Mexican-occupied houses, we do not find evidence of strong effects on prices of US-born occupied housing in those cities.

Next, we study what happened to the resident composition of the Mexican-occupied houses in 1930. Using the matched address sample, we find that houses previously owned by Mexican immigrants decreased the number of Mexican residents in response to the repatriation. We do not find strong evidence supporting the inflow of US-born residents into these houses in response to the repatriation. The results of Mexican-rented houses are different. We find suggestive evidence that the repatriation increased the segregation between Mexican immigrants and US-born residents in the rented units. Our results suggest that Mexican-rented houses became less mixed with US-born residents during the period in response to the repatriation.

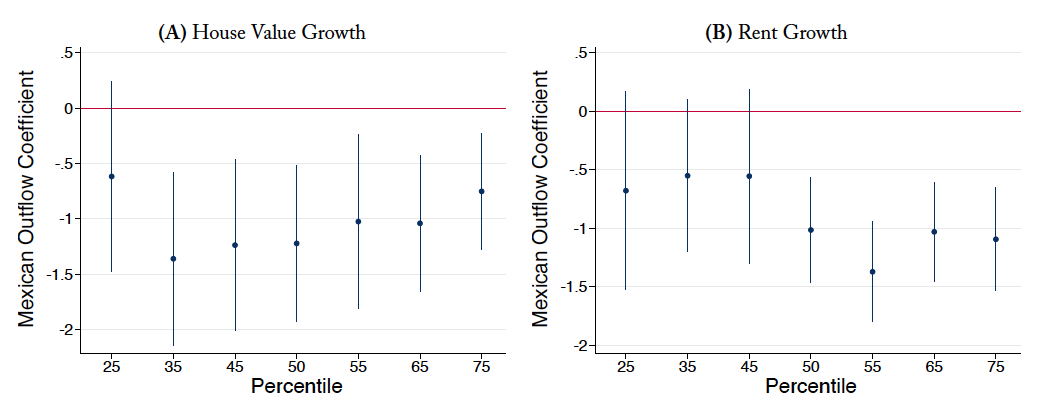

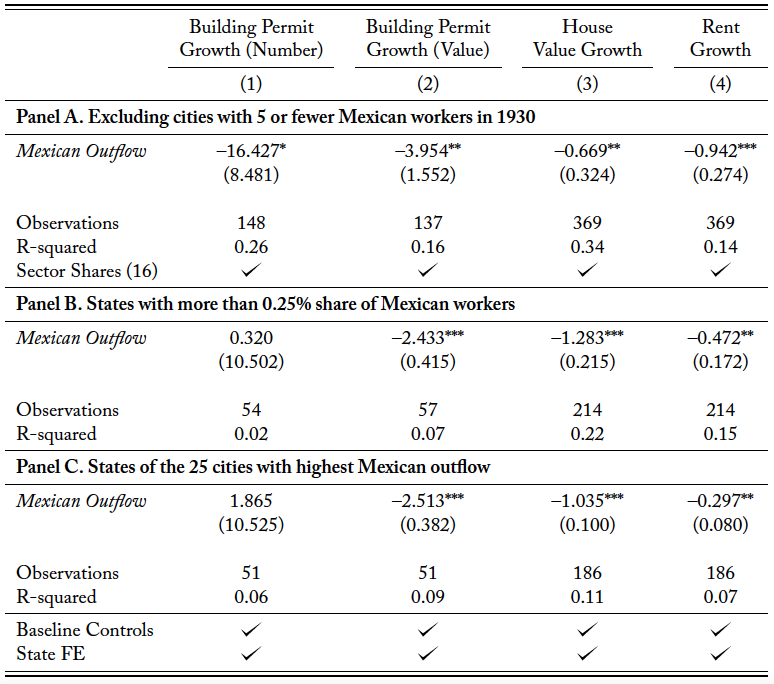

Given the large effects of the repatriation on Mexican-occupied housing, one natural question arises. To what extent the Mexican repatriation mattered to each city’s housing market? Using an instrumental variable approach, we turn to examine the effects of Mexican repatriation exposure on the growth rates of city-level housing market outcomes. In our baseline estimation, we find that cities with greater exposure to the Mexican repatriation faced reduced growth rates in all our housing outcome variables. Precisely, we find that a one standard deviation (1 percentage point) larger repatriation depressed the median house price growth rate (by –1.2 percentage points) and the median rent growth rate (by –1 percentage points).

We can compare these results to the observed growth rates of median house values and rents in the period to put these results into perspective. On average, median house values decreased 43.2% while median rents decreased 30.6% in the decade.

Therefore, a one standard deviation increase in exposure to the Mexican repatriation explains approximately 2.8% and 3.3% of the average decrease in house values and rents, respectively.

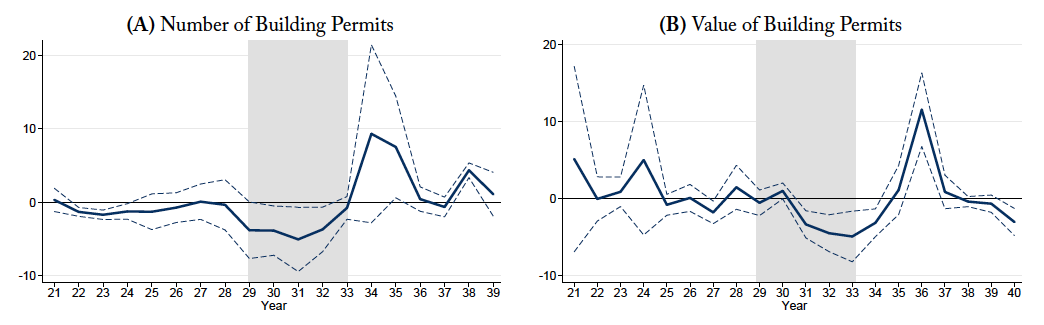

We also find that the repatriation depressed the growth rates of investment measures based on building permits. We find that a one standard deviation (1 percentage point) larger repatriation had lower growth rates for both the number (–13.3 percentage points) and the value (–3.7 percentage points) of building permits between 1930 and 1940. Slower growth in these outcomes suggests that the repatriation negatively impacted the expectations of future housing market conditions and local real estate activity, such as the construction of single-family homes and commercial buildings.

To illustrate our housing market findings, we compute a quasi-counterfactual exercise. We calculate the predicted growth rates for different housing-market outcomes in US cities in a hypothetical scenario where the Mexican repatriation never occurred. Assuming a simplified counterfactual outflow of Mexicans from our first stage regressions and ignoring general equilibrium effects, we predict that the growth rates would have increased substantially. For example, in Los Angeles, the value of building permits between 1930 and 1940 decreased 0.41%. Absent the repatriation, we predict that the value of building permits in Los Angeles would have fallen at a smaller rate, 0.25%. This difference was equivalent to over 100 thousand US dollars in 1930 terms.

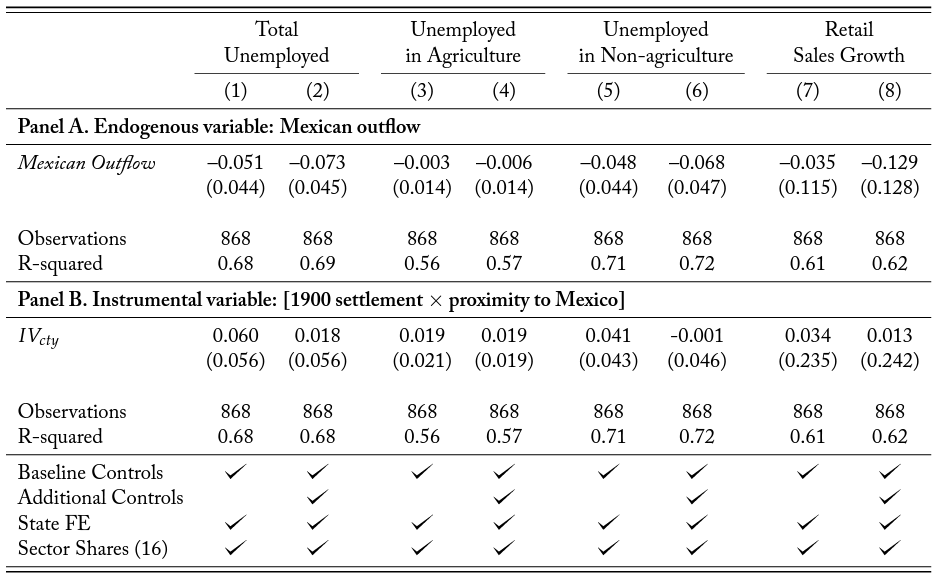

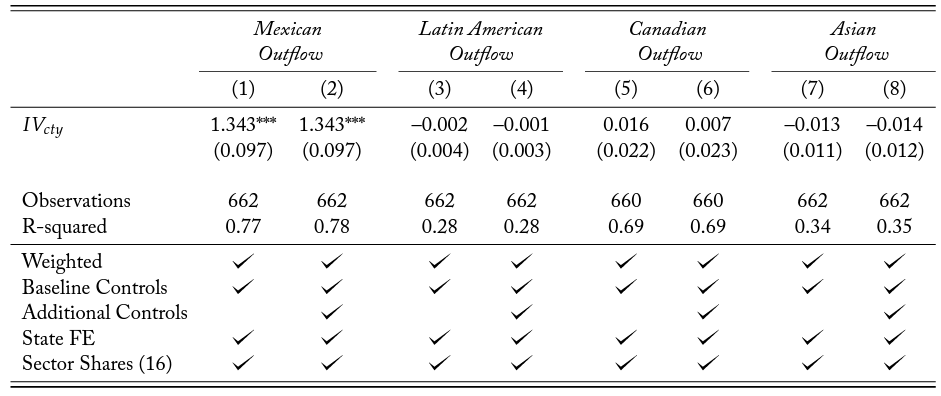

One of the main concerns of our analysis is whether our results reflect other shocks that US cities experienced at the time. To mitigate these concerns, we conduct a series of robustness and validation tests. First, we test for an association between the instrumental variable and different measures for the intensity of the Great Depression. We conclude that the instrumental variables are not linearly associated with the adverse economic conditions that defined the Great Depression, supporting the validity of the exclusion restrictions. Second, we test for the association between the instrument and the outflow of immigrants from other nations. We find no evidence of a linear association between the instrumental variables and other immigrants’ outflow rates. Using an event study specification, we find no evidence of pre-trends in housing-market outcomes associated with the share of Mexicans in 1930.

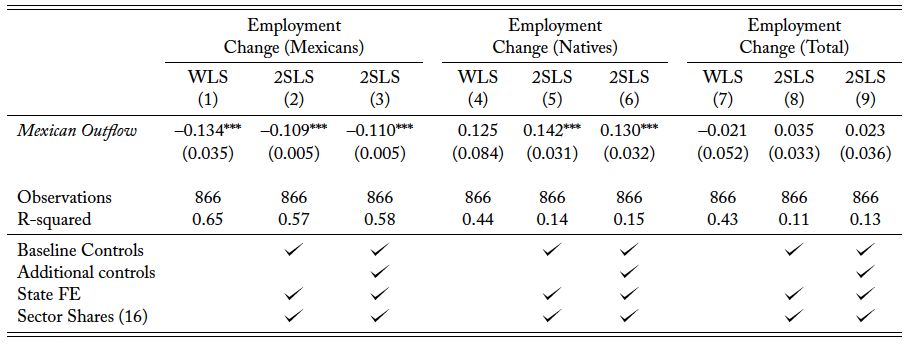

Another concern is whether the Mexican repatriation had a direct effect on the supply of housing. In 1930, approximately 12.7% of Mexican immigrants worked in the construction or construction-related, durable goods manufacturing sectors (See Table B.3 in Appendix B for details on the employment of Mexican workers by industry in 1930). We find that the Mexican repatriation reduced the employment of Mexicans in construction and that US-born increased their employment in construction proportionally. However, the repatriation did not have a significant effect on the overall employment in the construction sector. These results suggest that, while the repatriation induced substitution of Mexicans by US-born workers in the construction and construction-related sectors, the overall employment growth in these sectors stagnated.

Related Literature. Our paper contributes to several branches of the extensive literature on the economic consequences of immigration. Within this broad literature, this paper is related to the literature that studies the economic consequences of forced migration.8For a literature review on forced migration comprising historical and recent events, see Becker and Ferrara (2019). Most studies have focused on the assessment of the economic effects on receiving regions (Hornung (2014); Schumann (2014); Johnson and Koyama (2017)). In contrast, this paper provides evidence of the economic consequences of forced migrations to origin regions. This is closely related to Chaney and Hornbeck (2016); Testa (2020); Ferrara and Fishback (2020), who study politically or ethnically motivated expulsion events in history. While these papers show evidence of depressed regional growth or development from sending regions, our paper is the first to directly quantify the effects of an ethnically motivated out-migration shock on housing prices, one of the channels through which migration can affect economic growth.

Our paper relates to the recent literature that focuses on the economic effects of restrictions to immigration based on race or country of origin (e.g., Clemens, Lewis and Postel (2018); Abramitzky, Ager, Boustan, Cohen and Hansen (2020); Feigenberg (2020); Tabellini (2020); Lee, Peri and Yasenov (2022)). In studying the economic consequences of the 1930s Mexican repatriation, our analysis closely relates to Lee, Peri and Yasenov (2022), who study the labor market consequences from the repatriation. The authors find that in the regions more exposed to the repatriation, the US-born workers faced a smaller probability of having a job in 1940, and that this effect was larger to low-skilled workers. The authors also find that the repatriation did not cause internal migration of US-born workers to replace the repatriated immigrants.

Our analysis contributes to their findings by studying the effects of the Mexican repatriation to housing markets in the US. We use real estate conditions to gauge the costs to local economic growth because housing is a crucial channel through which immigration affects economic activity. Moreover, the recent Great Recession has drawn fresh attention from scholars to the housing sector and its responsiveness to immigration shocks.

A growing strand of the literature looks specifically at the effects of migration shocks on housing markets (Saiz (2003), Greulich et al. (2004), Ottaviano and Peri (2006), Saiz (2007), Akbari and Aydede (2012), Alix-Garcia, Bartlett and Saah (2012), Gonzalez and Ortega (2013), Mussa et al. (2017), Depetris-Chauvin and Santos (2018), Howard (2020)). In dealing with the challenge in identifying the causality of migration effects, the existing literature typically uses exogenous shocks of inflows of migrants to a region to study the effects on house prices and availability. Most studies find that immigration increases rents and house prices, suggesting that immigrants do not entirely displace natives. Few studies focus on the effects of forced migration on housing. For instance, Alix-Garcia, Bartlett and Saah (2012) and Balkan, Tok, Torun and Tumen (2018) study the economic effect of displaced populations on housing, focusing on the effects of receiving regions. Our paper contributes to this literature by assessing the effects of out-migration on the sending regions.

This paper also relates to the literature studying populism and nationalism, primarily focusing on 1930s America (Bennett (1969)). Recent work has focused on the direct consequences of exposure to populist radio hosts on political preferences (Wang (2021)) or the effects on uncertainty caused by populist politicians’ actions (Mathy and Ziebarth (2017)). As Tabellini (2020) shows, immigration can trigger strong political backlash resulting in more conservative, anti-immigrant policies. Therefore, our paper contributes to understanding the economic consequences of immigration backlash rooted in the ideals of national-populism. Our findings are particularly relevant to today’s ongoing debate on the economic effects of immigration backlash. Our results show that repatriations have large impacts on house values and rents of more exposed neighborhoods and that these effects matter to city-level housing in terms of coincident and leading housing indicators.

Mexican Immigration in the 1920s and the 1930s Repatriation

The US experienced a massive inflow of immigrants in the late 19th century and the early 20th century, especially from Europeans escaping adverse conditions in their home countries.9This period is known as the Age of Mass Migration from Europe. By 1910, 22% of the US workforce was foreign-born, compared to only 15% today (Abramitzky and Boustan (2017); Abramitzky, Boustan and Eriksson (2014)). Mexican immigration grew steadily throughout the early decades of the 20th century, but especially during the 1920s. This robust inflow was mainly driven by US employers recruiting Mexican workers in agriculture, railroad, meatpacking, and steel mill sectors. In the 1920s, the number of Mexican immigrants increased dramatically. The increased demand for cheap labor coincided with the 1924 Immigration Act, which imposed quotas on European immigration (Abramitzky, Ager, Boustan, Cohen and Hansen (2020)), which made many employers turn to Mexican labor to fill the job vacancies. The pressing economic conditions and armed conflicts in Mexico, such as the Mexican Revolution (1910–1920) and the Cristero War (1926–1929), also contributed to the inflow.

As the US economy entered the Great Depression, starting with the 1929 Crash, organized groups including labor unions, local authorities, and local media pressed for immigration quotas and repatriation of Mexicans.10Specifically, the panel C of Figure A.1 in the Internet Appendix A shows an article by The Washington Post on Jan 20, 1930, reporting an intense pressure from labor unions and “influential organizations opposed to adulteration of the ‘American blood stream”’ in discussing an immigration quota for Mexicans. As the Depression deepened, many Americans began to view Mexicans as unwelcome aliens who were a burden on their local community. The historiography argues that the Mexican community was an easier target for two main reasons. First, the number of Mexican immigrants had increased dramatically in the previous years, making them the largest group of newcomers in many cities in the US. Second, because of ethnic and cultural differences, some Americans often saw them as unassimilable, that is, unable to become a part of American culture and society (Simon (1974), Balderrama and Rodríguez (2006), Enciso (2017)).

The local and decentralized nature of the Mexican repatriation makes it challenging to determine the exact number of repatriated individuals. This uncertainty explains the variation among historians’ estimations of the total Mexican outflow in the 1930s.11The most intense period of Mexican deportations and repatriations was 1929–1934. Historical evidence shows that

deportations and repatriations continued until 1937 (Hoffman (1972)). The more conservative estimates by Hoffman (1974) and Gratton and Merchant (2013) suggest that nearly 400,000 Mexicans left the US between 1929 and 1937, while Balderrama and Rodríguez (2006) cite a much larger number—from 1 million to 2 million, based on estimates that attempt to include those undocumented immigrants omitted from official calculations.

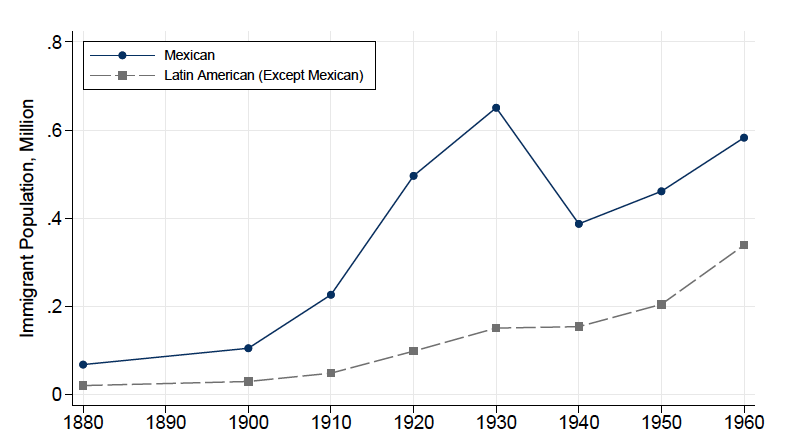

Using the Census, we calculate that there were 263,900 fewer Mexican immigrants in the US in 1940 than in 1930, which constituted 33.2% of the overall Mexican population present in the US as of 1930.12The observed decrease in the number of Mexican immigrants living in the US between 1930–1940 is likely to be an underestimate of the actual number of people affected by the repatriation for a couple of reasons. First, Balderrama and Rodríguez (2006) highlight that repatriation efforts also targeted a large number of US citizens with Mexican descent. Second, many Mexican immigrants were undocumented, making them more likely to avoid government surveys and census takers. Figure 1 depicts the surge of Mexican-born immigrants between 1900 and 1920, followed by a sharp decline between 1930 and 1940. Another interesting fact from Figure 1 is that the number of immigrants from other (non-Mexican) Latin American countries did not decline in the same period.

Figure 1. Total Latin American immigrant population in the United States by origin (1880–1960).

This figure shows the total number of Mexican and other Latin American immigrants in the United States from 1880 to 1960. Immigrants are defined according to the country of birth reported on each census. Latin American countries include Central America (Belize/British Honduras, Costa Rica, El Salvador, Guatemala, Honduras, Nicaragua, and Panama), the Caribbean (Cuba, Dominican Republic, Haiti, Jamaica, Antigua-Barbuda, Bahamas, Barbados, Dominica, Grenada, Montserrat, St. Kitts-Nevis, St. Lucia, St. Vincent, Trinidad and Tobago, Turks and Caicos, British Virgin Islands, Netherlands Antilles, Curacao, Guadeloupe, and St. Barthelemy), and South America (Argentina, Bolivia, Brazil, Chile, Colombia, Ecuador, Guyana/British Guiana, Paraguay, Peru, Suriname, Uruguay, and Venezuela).

While the existing historiography varies in their accounts of the period, there is a consensus that coercion, forced deportation, and various other fear-spreading tactics were used extensively against the Mexican population of the time. The historical accounts of this period documents that local authorities encouraged and enforced repatriation, even though it was officially categorized as voluntary migration (Valdés (1988); Balderrama and Rodríguez (2006)). Immigration officers and local police sometimes assisted welfare agencies and even staged raids to convince Mexicans to depart. They harassed Mexicans, provided free transportation in trains, and—at least partially—coerced them to leave their US homes.

In Internet Appendix Figure A.1, we present historical newspaper evidence of anti-Mexican sentiment and hostile acts targeted at Mexican immigrants. These acts involved the government (e.g., immigration officers), organized labor (e.g., unionized workers), and the press (e.g., local and national newspapers). As shown in Panel A, The New York Times reported in 1931 that 35,000 Mexican immigrants in California were “pressed by economic diversity, fearful over recently renewed activities of immigration authorities, and perplexed by what they regard as anti-Mexican sentiment.” This illustrates that economic distress (“idleness”) and tighter enforcement from government immigration officials played an essential role in Mexicans’ decision to leave the country.13One example is the intensity of the Immigration Service’s efforts in deporting Mexican immigrants. According to Balderrama and Rodríguez (2006), from 1930 to 1939, Mexicans constituted 46.3 percent of all the people deported from the United States. However, according to census data, Mexicans comprised less than 5 percent of the total immigrant population in the US in 1930. In Panel B, the Los Angeles Times reports a near-riot in 1930 in which some 50 unemployed American laborers “tried to prevent Mexican workmen (…) to continue their work by guarding their toolboxes and demanding that the contractors employ white labor.” The national and local press also contributed to the negative climate by publishing articles and opinions demeaning to Mexican immigrants. For example, as shown in Panel C, The Washington Post argued that “the Mexican immigrant is not good material for citizenship, and in some places Mexican colonies are decidedly objectionable,” even though it conceded that, given the economic importance of Mexican immigrants, “a sudden reversal of [immigration] policy would work great hardship to employers in the Southwest.”

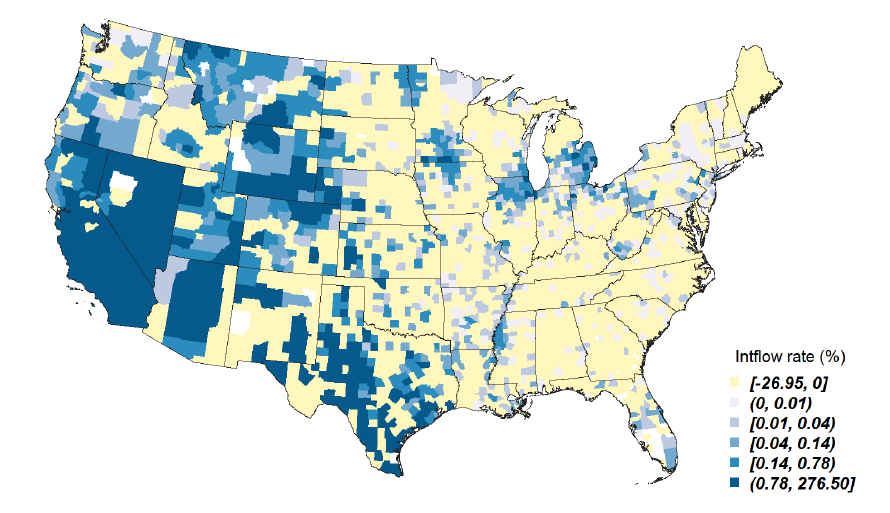

Figure 2. Geographical distribution of the inflow and outflow of Mexicans.

(A) Mexican Inflow (1920–1930)

(B) Mexican Outflow (1930–1940)

This figure shows, for each county, the 1920-30 inflow (Panel A) and the 1930–40 outflow (Panel B) of Mexicans as calculated from the full-count US Censuses of 1920, 1930, and 1940. The nationalities are defined based on the person’s place of birth from the US Census. The flows are measured by the Mexican working-age population’s county-level change relative to the local working-age population. For instance, a Mexican outflow of 10% means that the drop in the Mexican population of that county is equivalent to a 10% drop in the total working-age population. We define counties according to 1930 limits by IPUMS-NHGIS (Manson et al. (2020)).

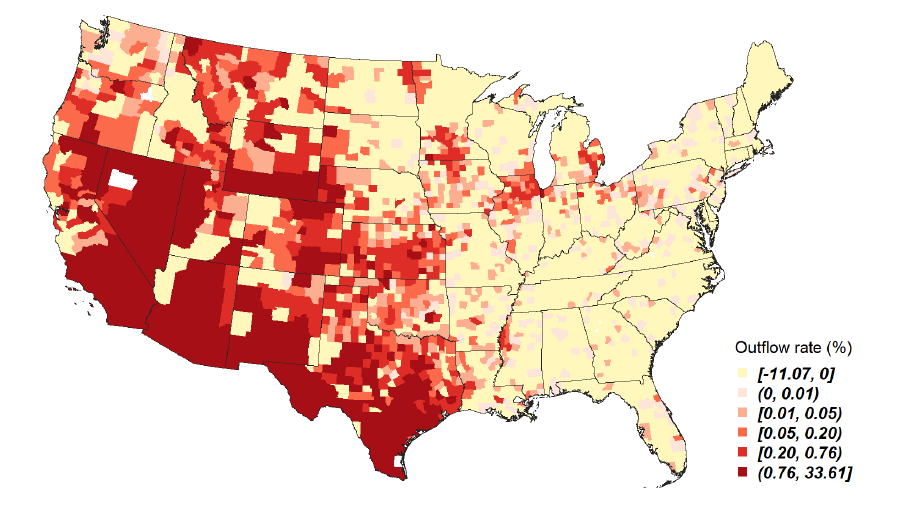

Figure 3. Positive correlation: repatriation intensity versus Mexican population shares from 1900.

This figure shows the positive correlation between Mexican Outflow (defined in Equation (2)) and the county level share of Mexicans in 1900, i.e., before the repatriation shock. Panel A presents the scatter plot for all cities in our sample, and Panel B repeats the scatter plot after excluding cities with more than 5% share of Mexicans in 1900.

The lack of granular data on the individual US-Mexico border crossings during that time makes it challenging to determine the exact importance of these repatriation efforts to the overall Mexican outflow. The available estimates in the literature suggest that the repatriation efforts involving harassment, coercion, pressures, and forced deportations were the primary determinant of the Mexican outflow of the 1930s. For instance, using the outflow of French-Canadian immigrants as a comparison group, Gratton and Merchant (2013) estimate that over 70% of the observed net Mexican outflow was not voluntary, due to excess repatriation.

We next document the geographic distribution across US counties of Mexican immigration before and after the repatriation. Panel A of Figure 2 presents the inflow as measured by the change in the total number of Mexicans between 1920 and 1930 as a share of each county’s total working-age population. Darker blue shades represent higher inflows. Conversely, Panel B of Figure 2 portrays counties with a greater outflow of Mexicans between 1930 and 1940 with darker shades of red.

Overall, counties with larger Mexican populations also experienced higher outflow rates in the 1930s. We present this correlation more clearly in Panel A of Figure 3, which shows a strong linear relationship between the 1900 Mexican population share and the 1930–1940 outflow of Mexicans. Although inflows and outflows were more substantial in counties near the border with Mexico, they were quite widespread. We observe counties with considerable migration flows in the West (Oregon, Nevada, Washington), the Midwest (Illinois, Indiana, Michigan, Ohio), and the East (Pennsylvania). If we exclude border cities and redo the scatter plot in Panel B of Figure 3, we see that the strong relationship remains for cities throughout the entire geographic span of the continental US, as documented by Balderrama and Rodríguez (2006).

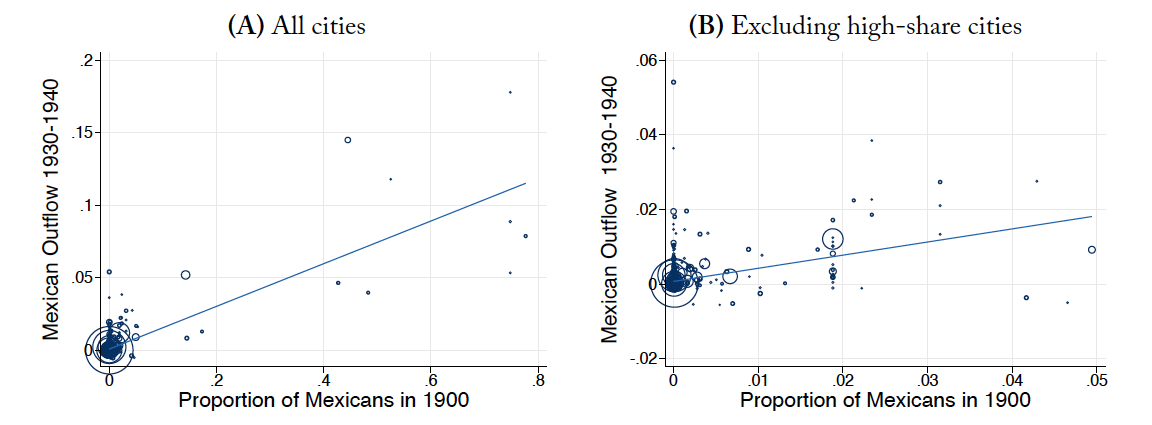

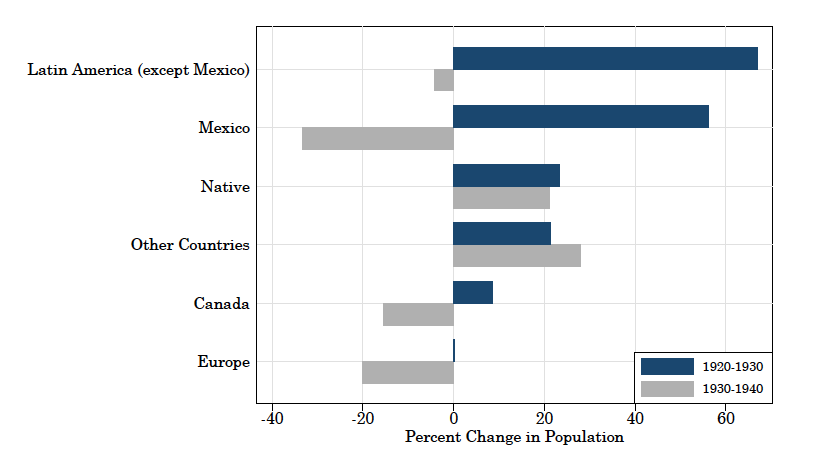

A helpful way to put the Mexican repatriation in perspective is to compare the outflow rates of Mexicans and immigrants from other ethnicities. Figure 4 examines the change in the US working-age population before (in dark blue) and after (in gray) the repatriation period for different ethnic groups. It shows that the massive Mexican outflow of almost 40% during the 1930–1940 period is unmatched by other groups. Their outflow is nearly twice that of the Europeans. Canadians—who also share a border with the US and could return more easily than other nationals—have half of the outflow rate. A final takeaway from Figure 4 is that non-Mexican Latin American immigrants experienced a substantially smaller outflow—even though the inflows of both Mexican and non-Mexican Latin immigrants had both grown at similar percentage rates in the previous decade.

Figure 4. Percent changes in working-age population by origin: 1920–30 versus 1930–40.

This figure shows the inflow (1920–30) and outflow (1930–40) of immigrants. The nationalities are defined based on the person’s place of birth from the US Census. For example, between 1920 and 1930 the Mexican population in the US increased by around 60%, whereas about 30% left the US in the following decade (1930–40). See notes on Figure 1 for a list of countries included under Latin America.

Empirical Strategy

Identifying the Effect of the Mexican Repatriation

The objective of our baseline empirical work is to study how the 1930s Mexican repatriation affected the evolution of housing prices in the United States. In doing so, our goal is to isolate the effect of the ethnically motivated out-migration shock from any other factor associated with housing markets. A naïve attempt to assess the relationship between the repatriation and housing price changes would be to estimate the following regression:

(1)

where is the percentage change of a housing market outcome between 1930 and 1940.

is the outflow of Mexican workers in city c in the same period. Following Lee, Peri and Yasenov (2022), we define the city-level measure of Mexican outflow from city c between 1930 and 1940,

:

(2)

where is the Mexican working-age population in city c in year t (1930 or 1940), and

is the total working age population in city c in 1930.14We define the working-age population as individuals aged between 18 and 65 years, not living in group quarters. Because the repatriation comprises a decline in the population of Mexican workers, we multiply the growth rate by minus one for a more straightforward interpretation. 15The measure

can be interpreted as the normalized drop in Mexican workers in city c over the decade. Therefore, higher values of the Mexican outflow measure are associated with greater declines of the Mexican working-age population in city c between 1930 and 1940.

The main drawback of estimating Equation (1) is that, even after controlling for observable characteristics, migration flows might be correlated with other local economic conditions. The main concern is that the intensity of the Mexican repatriation might have been correlated with other local economic conditions, such as the intensity of the Great Depression, that could have influenced the evolution of housing markets between 1930 and 1940. Therefore, our empirical strategy uses an instrumental variable (IV) approach to solve the potential endogeneity between the Mexican outflow and the housing market outcomes and produce causal estimates.

Our instrumental variable combines the infrastructure of the US road network and the historical presence of Mexican immigrants in a county at the turn of the century. The relevance condition of our IV is given by the historical evidence that the repatriation was more likely to happen in counties with larger pre-existing Mexican communities (see Figure 3). To avoid contemporaneous confounders, we opt to use the share of the Mexican population in a US county in 1900 as an ex-ante measure of exposure to the repatriation.16 Previous studies have relied on the ex-ante geographical variation in immigrant settlement to produce causal estimates of the effects of immigration. As argued by Jaeger, Ruist and Stuhler (2018), when studying migration inflows, the IVs based on the historical presence of immigrants in a region derive from the evidence that immigrants tend to choose locations of greater cultural proximity due to existing networks of fellow nationals living abroad. In the case of the Mexican repatriation, the IV borrows from the idea that in the regions with a larger Mexican population, the local nationalist groups were more likely to identify Mexican immigrants as a “problem” to the local economy, seeing them as rivals when competing for jobs and as a burden to the local welfare system, consequently resulting into more repatriation efforts. Tabellini (2020) shows that immigration can trigger strong political backlash via the election of more conservative, anti-immigrant members of Congress, who were in turn more likely to vote in favor of immigration restrictions. In the case of the Mexican repatriation, Balderrama and Rodríguez (2006) present historical evidence that local media, labor unions, and officials often overestimated the relief expenditures towards Mexicans. Alesina, Miano and Stantcheva (2018) show that these perceptions that immigrants take advantage of the welfare system are still common in many countries.

This has at least two advantages. First, it is less likely that the 1900s Mexican population share in a county is correlated with the economic fundamentals of the Great Depression in the 1930s. Second, for historical and cultural persistence reasons, the 1900 share is still sufficiently correlated with the size of the Mexican population in 1930, and therefore, with the population potentially exposed to the repatriation.

The transportation infrastructure also had an essential role in the repatriation. The historical evidence shows that the existing highways and railroad trackage governed the migration pathways between Mexico and the United States. As documented by Hoffman (1974), the infrastructure of the years before the Great Depression funneled travelers to the US-Mexico main border crossing stations in Texas (El Paso; Brownsville; Laredo), Arizona (Nogales; Douglas), and California (Calexico). We use novel data on county-to-county travel times in 1930, constructed by Morin and Swisher (2016) using the United States’ road network. Specifically, we define , where

is the travel time by roads between the county and the closest chief border crossing stations. The instrumental variable is defined as:

(3)

The first term, is negatively associated with the cost of repatriation to Mexico because it was easier and cheaper to encourage (or force) repatriation if people could reach one of the crossing stations more quickly.17One of the concerns with the measure of proximity to the Mexican border is that the origin of these border crossing stations

could be endogenous to housing markets changes between 1930 and 1940. The available historical evidence suggests that these cities were gateways of the Mexico-US migration decades before the repatriation. Escamilla-Guerrero (2020) describes in detail the importance of these entrance ports using data from the Mexican Border Crossing Records from the early years of the 20th century. According to the author, El Paso, Brownsville, Laredo, Nogales, and Douglas accounted for 81% of the registered crossings between 1906 and 1908. Although the information on the crossings in Calexico, CA, is limited for this period, the earlier accounts of its role as a port of entry also date from the beginning of the century (see, for instance, Romer (1922)). The second term captures the share of Mexicans workers in a county in 1900. It is positively related to the share of the Mexican population in 1930, given the persistence of migrant networks; hence this term is correlated with the size of population “at risk” of repatriation.

With this instrumental variable at hand, we conduct the analysis in two parts. In the first part, we investigate the effects of the Mexican repatriation on the house level, particularly focusing on Mexican-occupied housing, which are more exposed to the out-migration shock, and which we expect to observe the largest effects. This allows us to precisely estimate the repatriation effects on the most exposed neighborhoods within each city. The second part of the analysis focuses on the more aggregate effects of the repatriation. The goal is to assess to what extent the Mexican repatriation mattered to city-level housing markets. The following section describes the data employed in the paper, including the matched address sample used in the house level analysis and data used to measure migration flows, housing outcomes, and other city characteristics.

Data Sources and Descriptive Statistics

Linked Address Sample. A challenge to study the Mexican repatriation’s impact on housing is the lack of data measuring the evolution of house prices at the house level. In this paper, we develop a novel automated matching technique to link addresses across the 1930 and 1940 Censuses from the IPUMS Restricted Complete Count Data (Ruggles, Fitch, Goeken, Grover, Hacker, Nelson, Pacas, Roberts and Sobek (2020a)). The address-matched sample allows us to track the evolution of each housing unit’s house values, rents, and resident composition across the 1930 and 1940 censuses. Our goal is to create a sample of housing units that we can observe both in 1930 and 1940 to assess the effect of the Mexican repatriation on its prices and residents. We propose an automated matching technique to link identifiable addresses from the two censuses. Our matching procedure relies on matching addresses based on the state, city, street name, and house number, which is described in more detail in Appendix C.

Our full 1930–1940 matched address sample contains 4.03 million linked addresses spanning over 900 US cities.18To the best of our knowledge, the first study to match addresses across the 1930 and 1940 Censuses is Akbar, Li, Shertzer and Walsh (2019). They match addresses for ten cities in the US North (Baltimore, Boston, New York, Chicago, Cincinnati, Cleveland, Detroit, Philadelphia, Pittsburgh, and St. Louis) to study the erosion of African-American house value in pre-war urban areas. We perform a series of sample restrictions. In studying the effects on house values and rents, we exclude the addresses that report both an owner and a renter or changed ownership status from 1930 to 1940. We also exclude households with more than 10 members to avoid outliers and transcription errors. We obtain the percentage change in house value and rents from the self-reported values in the census between 1930 and 1940. In addresses with multiple households, we aggregate this information to the address level using the median house value and the median rent reported by the households living in the same address. Finally, we obtain a sub-sample by keeping only the addresses in states with a sufficiently large Mexican population. More specifically, we restrict the analysis to states that contained a share of Mexican workers greater than 0.25% of the total state workforce living in urban areas: Arizona, Texas, California, New Mexico, Kansas, Colorado, Wyoming, Utah, Idaho, Nebraska, Indiana.

We collect information about the percentage change in house values, percentage change in rents, the average age of residents, the total number of residents, and variables that contain the racial and ethnic composition of the residents: the share of Mexican, the share of US-born white, the share of US-born black, the share of foreign-born other than Mexican, and the share of US-born residents.

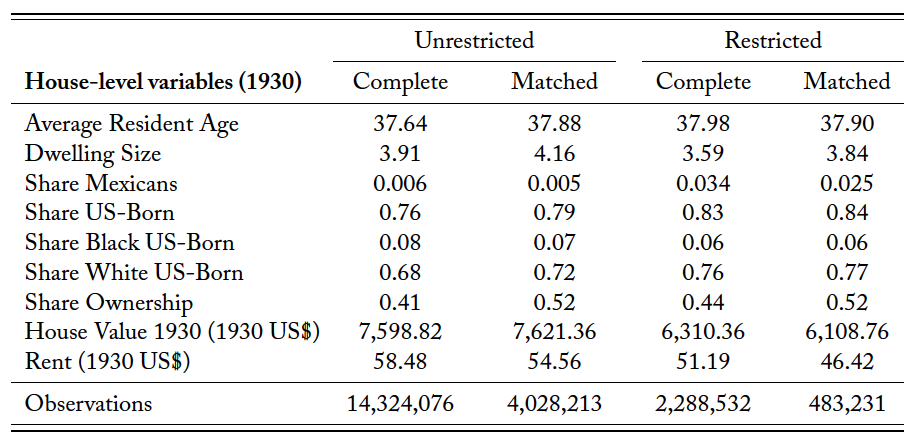

Table 1 presents the summary statistics of these variables and compares them across full-count 1930 Census data (column 1), the full address-matched sample (column 2), and the two sub-samples for states more affected by the Mexican repatriation (columns 3 and 4). When comparing the full data with our matched sample, we conclude that, on average, the dwelling characteristics are quantitatively similar across the two datasets. Our matching procedure seems to favor houses with larger shares of white or US-born residents, or houses owned in 1930. The variables on the average house value and rents are similar for the two samples. When comparing the state-restricted samples (columns 3 and 4), we observe larger shares of Mexican residents and smaller shares of US-born residents. We also observe smaller house values and rents due to the sample restrictions.

Table 1. House-level descriptive statistics.

This table presents the mean statistic for variables obtained at the house level. Average Resident Age is the average age for all working-age residents within the same address in the 1930 Census. Dwelling Size reports how many persons lived within the entire dwelling in 1930. Share Mexicans is the number of working-age Mexican immigrants in any given address as a share of the total number of working-age residents in that same address. Similarly, Share Black US-born, Share White US-born, and Share US-Born are the shares of black, white or total US-born residents in an address, respectively. These measures are constructed using the information of race and place of birth of each resident from the 1930 Census. Share Ownership indicates the share of residents that were house owners in any given address. In studying the changes in house values and rents, we exclude from the sample addresses that report both an owner and a renter or changed ownership status from 1930 to 1940. House Value and Rent are the self-reported house value and rent in 1930 US dollars, respectively. For addresses with multiple households, we aggregate this information using the median house value and the median rent reported by the households in the same address. The table below presents the summary statistics of these variables and compare them across complete-count 1930 Census data (column 1), the full address-matched sample (column 2), and the equivalent complete (column 3) and matched (column 4) samples when restricting to states that contained a share of Mexican workers greater than 0.25% of the total state workforce in the studied cities: Arizona, Texas, California, New Mexico, Kansas, Colorado, Wyoming, Utah, Idaho, Nebraska, Indiana.

City Demographics, Immigration, and Economic Activity. To obtain measures of cities’ economic and demographic characteristics, we use data from 868 US cities that we can consistently identify in the 1930 and 1940 full-count US Censuses (Ruggles, Flood, Goeken, Grover, Meyer, Pacas and Sobek (2020b)).19We use the CITY variable from IPUMS to identify the city of residence for individuals located in identifiable cities. The variable is comparable across 1930 and 1940, but not all cities are identified across the two censuses. In 1930, the city of residence was defined by any city with more than 25,000 inhabitants, and in 1940, a city could only be identified if it was the central city of a metropolitan area. The censuses provide the information used to construct our main variables to measure immigration flows.20We also use the 1900 Census to construct the share of Mexicans in each county as of 1900 in our instrumental variable. Finally, we use the censuses from 1880 to 1920 to construct Figures 1, 2, and 4. They also provide information on economic and demographic characteristics used as controls in our estimations. The baseline control variables include the Average Age, average School Attendance, share of Unemployed workers, which consists of the city-level averages of the worker’s age, school attendance status, and share of unemployed workers among the working-age population.

We refer to this set of control variables as baseline controls. Average Age and School Attendance are important to control for the characteristics of the working-age population in each city. The share of Unemployed workers and employment Sector Shares aim to capture the effects of the Depression on housing market outcomes across cities within each state. The unemployment share captures the economic conditions of cities in 1930, while sector shares account for heterogeneous effects of the Depression associated with the sector composition of cities.

As additional controls, we also use geographical and economic variables from the county-level dataset assembled by Fishback, Horrace and Kantor (2005), and Hornbeck (2012). In the 1930s, the Dust Bowl was a natural disaster that caused hardship in rural American states and induced migration out of the affected areas (Hornbeck (2012, 2021)). To measure and control for the exposure of a county to the Dust Bowl, we use the months of severe drought interacted with the share of farming land to measure the impact on a county of the Dust Bowl from Fishback, Horrace and Kantor (2005) and the fraction of each county exposed to medium and high permanent soil erosion from Hornbeck (2012). From Fishback, Horrace and Kantor (2005), we also use their county-level retail sales growth between 1929 and 1935 as a proxy for consumption and economic activity. We use the log of the median house value in 1930 as an additional control to capture for the contemporaneous conditions of the housing market.21Previous studies have argued that the real-estate boom of the mid-1920s has contributed to the severity of the Great Depression (Goetzmann and Newman (2010); Brocker and Hanes (2014); White (2014); Gjerstad and Smith (2014)). Therefore, we include the median house value in 1930 as an additional control variable to capture the across city heterogeneity in the housing market conditions.

City-level outcome variables. To study the consequences of the Mexican repatriation on city-level housing market outcomes, we use the information on house prices from the US Census and aggregate it to the city-level. The 1930 and 1940 Censuses include the self-reported values of housing units and rents in nominal US dollars. To reduce outlier influence when averaging out self-reported variables, we calculate the median house value and rent in each city from the working-age population not living in group quarters. In some specifications, we also consider alternative percentiles of the within-city house value and rent distributions. We convert nominal values to real 1920 US dollars using the Consumer Price Index from the Federal Reserve Bank Database (FRED) of the St. Louis Federal Reserve Bank.

We use the number and value of building permits as additional indicators of city-level housing and construction activity. Building permits must be filed with local authorities before any construction can take place. We consider two types of building permits.

The first is the total value of building permits, taken from issues of Dun & Bradstreet’s Review, a well-known business and financial publication in the 1920s and 1930s.22A detailed description of the building permit value data is in Cortes and Weidenmier (2019). The value of building permits represents the cost of new commercial and residential buildings for 215 cities across the US. The building permit figures represent estimated building costs under permits issued to prospective builders within the corporate limits of the cities. They include new residential and non-residential buildings, and additions, alterations, and repairs, excluding land costs. The data are compiled from reports furnished monthly to Dun & Bradstreet, Inc. by the building departments of the various cities.

The second series on building permits is the number of building permits collected by Snowden (2006) from issues of the Bulletin of the Bureau of Labor Statistics. These permits refer to single-family houses authorized for construction in 250 cities.

The building permit number series thus more closely reflects housing activity, whereas the building permits values are likely dominated by commercial and business construction. This fundamental difference in the construction of these series lets us consider both types of construction activity. However, it comes at the cost of precluding us from calculating a building permit-based price index (e.g., dividing the value by the number of building permits). We, therefore, rely on the Census’ median house value as our primary variable proxying house prices.

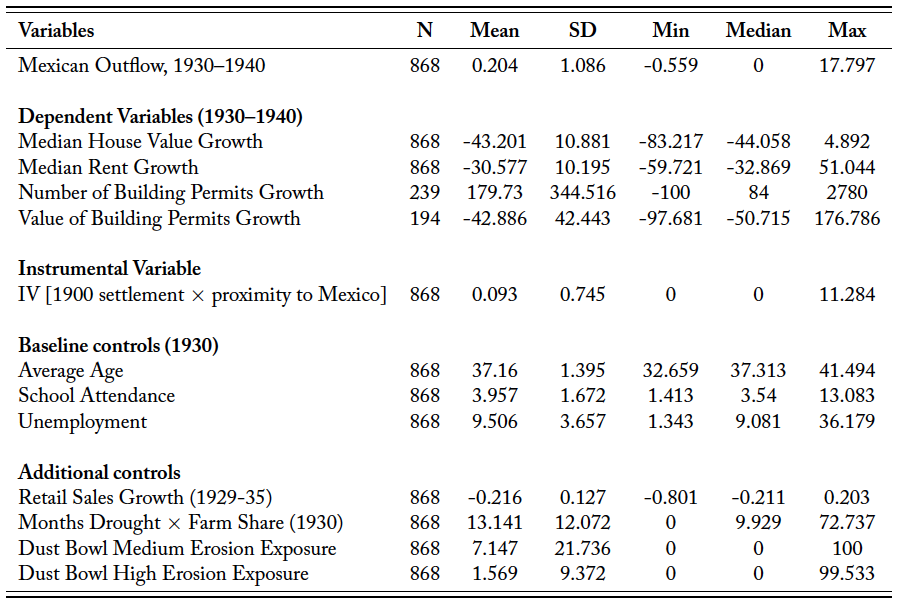

Descriptive Statistics. Table 2 presents sample summary statistics. All growth rates and share variables are presented in percentages. We can see that the average city experienced a decrease in the Mexican population equal to 0.2 percent of the city’s total population. There is substantial heterogeneity. San Benito and El Paso in Texas experienced the two greatest outflows. By 1940, they had lost Mexican population, equivalent to 17.8% (San Benito) and 14.5% (El Paso) of their total population. East Chicago, Indiana, part of Chicago’s commuting zone, was the seventh most affected city. As the East Chicago example shows, some cities distant from the Mexican border felt a measurable effect of the Mexican repatriation.23See Simon (1974) for a detailed account of the Mexican repatriation in East Chicago, Indiana. The author estimates that by 1932 over a third of the city’s Mexican population at the beginning of the decade had left the city. States on the list of top 10 of the most affected cities include Texas, California, Indiana, and Arizona.24Table B.1 in the Appendix shows the top 10 cities in terms of Mexican outflow between 1930 and 1940. Figures B.1, B.2, B.3, and B.4 in the Internet Appendix illustrate the geographic span of our housing variables with maps that show the series of building permits (number and value), median house values, and median rents for US cities. Despite the smaller number of cities shown in the building permits maps, our samples span a significant share of the US territory, accounting for the most populated and economically relevant cities in that period.

Table 2. City-level descriptive statistics.

This table presents summary statistics for variables used in our empirical analysis. Mexican Outflow is constructed in Equation (2) and is the city-level change in the Mexican labor force between 1930 and 1940 divided by the city’s total working-age population in 1930. The dependent variables (growth in the number of building permits, growth in the value of building permits, growth of the median house value, and growth of median rent are the main city-level real estate market outcomes studied in our regressions and are described in detail in Section 3.2. Section 3.1 describes the construction of our instrumental variable, which combines the proximity to the Mexican border (calculated using travel times in 1930 throughout the US road network to the nearest Mexican border crossing station) interacted with the historical Mexican settlements (share of Mexican immigrants in 1900). The baseline control variables are from the 1930 Census and consist of the city-level averages of the worker’s age, school attendance status, and share of unemployed workers. We use as an additional control variable the county level retail sales growth (a measure for the Great Depression intensity) from Fishback, Horrace and Kantor (2005). We also control for the intensity of the Dust Bowl environmental catastrophe using county-level measures for months of drought interacted with the county’s farm land share from Fishback, Horrace and Kantor (2005), and the fraction of each county exposed to medium and high permanent soil erosion during the 1930s from Hornbeck (2012). Our full sample contains 868 US cities.

The 1930s Mexican Repatriation and Housing

Effects of the Repatriation at the House Level

Considering the nature of the Mexican repatriation, a local shock due to out-migration of a specific part of the population, it is plausible to expect that regions within a city were differentially affected, depending on where Mexicans lived. Balderrama and Rodríguez (2006) argue that “small barrios virtually disappeared” and many homes were “abandoned by their owners” as a result of the Mexican repatriation. In this section, we describe the empirical strategy of our house level analysis. Our goal is to understand the effects of the Mexican repatriation on house values and rents at the house-level.

One may think that the ideal approach to study the within-city changes in rents and house values is to leverage the rich micro-level census data by focusing on the sample of matched individuals across censuses that other scholars have recently utilized (Abramitzky, Boustan and Eriksson (2012, 2014); Feigenbaum (2016); Abramitzky, Boustan, Eriksson, Feigenbaum and Pérez (2021); Price, Buckles, Leeuwen and Riley (2021)). However, the nature of the question we are interested in here is different. We are interested in the local effects of out-migration shocks, so using linked individual samples could raise various sample selection concerns. Because people are mobile, studying the changes in the house prices or rents of a given person may be contaminated by selection into different regions, neighborhoods, or houses. In studying housing, we can take advantage of the fact that houses are immobile to leverage the micro-level census data and avoid selection issues that can arise from the mobility of individuals.

We proceed by matching addresses from the IPUMS Restricted Complete Count Data (Ruggles, Fitch, Goeken, Grover, Hacker, Nelson, Pacas, Roberts and Sobek (2020a)). The address-matched sample allows us to track the evolution of house values and rents of each housing unit across the 1930 and 1940 Censuses. We propose a novel automated matching technique based on the state, city, street name, and house number. More details about our matching approach are in Appendix C.

Impacts on House Values and Rents

With the matched sample available, we estimate the following house level specification using two-stage least squares (2SLS) regression analysis with our instrumental variable :

(4)

where is a house’s 1930–1940 percentage change in its

or

.

is the Mexican outflow between 1930 and 1940 instrumented by

in the city c, where the house is located;

represents state fixed effects to capture state-specific, unobservable heterogeneity (e.g., differences in the intensity of the Great Depression between states); and

is the set of 1930 city-level baseline controls, which include the

, average

, share of

workers, and employment

; and

is the set of 1930 house level controls that include the

, the

and the level house value or rent in 1930. The specifications are unweighted and standard errors are clustered by state.

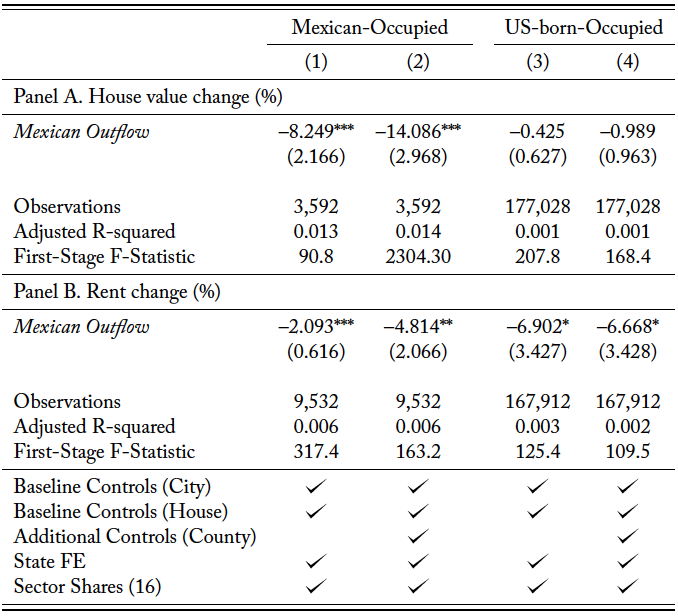

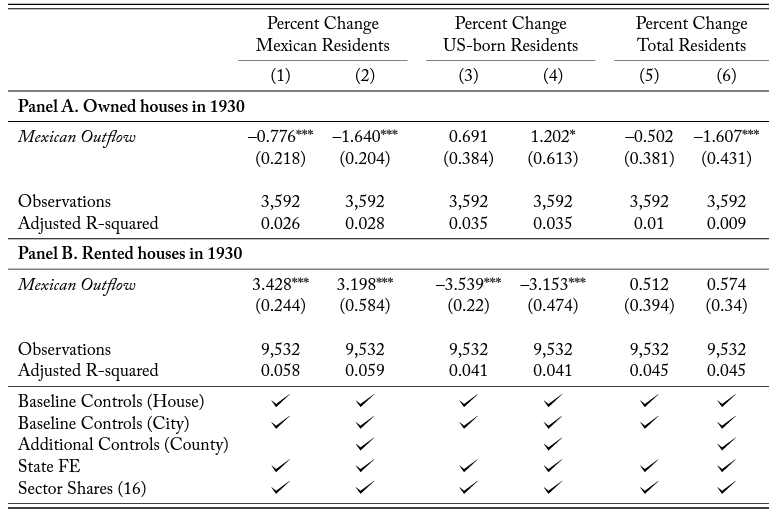

In studying the effects on individual house values and rents, we break down the sample into different types of houses. We define a Mexican-occupied house as an address with 50% or more of their residents in 1930 of Mexican origin. We define a US-born-occupied house as an address where all residents were US-born and not of Mexican descent. Table 3 presents the estimates of the effect of repatriation on the percent changes in house values or rents for Mexican-occupied and US-born-occupied houses. The table presents the estimates of the effect for Mexican-occupied houses (columns 1 and 2), US-born occupied houses (columns 3 and 4). We show the estimates using the percent change in the house value (Panel A) and percentage change in the rent (Panel B). In all regressions, we restrict the sample to the states with more than 0.25% Mexican population share (Arizona, Texas, California, New Mexico, Kansas, Colorado, Wyoming, Utah, Idaho, Nebraska, Indiana).

The results show that the Mexican repatriation had a large and persistent effect on houses where Mexicans lived in 1930. We find that houses inhabited by Mexicans in 1930 devalued 8.2 percentage points between 1930 and 1940 for every percentage point drop in the city’s Mexican population. Houses rented by Mexicans in 1930 also faced decreased rental rates of over 2 percentage points for every percentage point of Mexican outflow.

To illustrate the economic significance of this effect, we can compare it to the median devaluation of Mexican occupied houses in the period. The value of the median house owned by Mexicans fell by 41% between 1930 and 1940. This means that the partial negative effect of the repatriation on Mexican-owned houses is equivalent to one fifth (8.2/41 = 20%) of the decline observed in the median Mexican-occupied house value distribution in our sample. The value of the median rent paid by Mexicans fell by 33% between 1930 and 1940. For rented units, the partial effect of the repatriation is equivalent to six percent (2/33 = 6%) of the decline observed in the median rent of Mexican-occupied houses in our sample. Interestingly, we do not find a statistically significant coefficient on US-born occupied houses’ price change (rents or values).

Table 3. Effects on house-level prices.

This table presents our baseline estimates of the effect of the Mexican repatriation on house values and rents. We estimate the house-level regressions from Equation (4)

where is a house’s 1930–1940 percentage change in its

or

.

is the Mexican outflow between 1930 and 1940 in the city c where the house is located instrumented by

, as defined in Equation 3;

represents state fixed effects; and

is the set of 1930 city-level baseline controls, which include the

, average

the share of

workers, and employment

; and

is the set of 1930 house-level controls that include the

, the

and the house level or rent reported in 1930. We define a Mexican-occupied house as an address that had 50% or more of their residents in 1930 of Mexican origin. US-born-occupied houses are addresses that had only US-born and no Mexican descendent residents in 1930. The table presents the estimates of the effect for Mexican-occupied houses (columns 1 and 2) and US-born-occupied houses (columns 3 and 4). In Panel A, we restrict the sample to the houses that were owned in 1930. In Panel B, we restrict to houses that were rented in 1930. All regressions restrict the sample to states with more than 0.25% Mexican population living in urban areas (Arizona, Texas, California, New Mexico, Kansas, Colorado, Wyoming, Utah, Idaho, Nebraska, Indiana). Standard errors in parentheses are clustered by state. Statistical significance: ***p < 0.01, ** p < 0.05, * p < 0.10.

Impacts on Resident Composition

We find that the Mexican repatriation primarily affected Mexican-occupied house prices (values and rents). One natural question is whether this translated into a change in the types of residents in houses inhabited by Mexicans in 1930. We take advantage of the matched address sample and estimate the impact of the Mexican repatriation on the change of resident composition of Mexican-occupied houses. We estimate the following house level specification using two-stage least squares (2SLS) regression analysis:

(5)

where is one of our variables that measure the 1930–1940 changes in the resident composition in house h.

is the Mexican outflow between 1930 and 1940 in the city c where the house is located instrumented by

, which is the instrument defined in Equation 3;

represents state fixed effects; and

is the set of 1930 city-level baseline controls, which include the

, average

, share of

, and employment

; and

is the set of 1930 house level controls that include the

, the

. The specifications are unweighted, and standard errors are clustered by state. Table 4 presents the results. Using the two-stage least squares (2SLS) approach, we estimate the effect of the Mexican repatriation on the percent change in the house’s 1930–1940 resident composition: Mexican residents (columns 1–2); US-born residents (columns 3–4); and total residents (columns 5–6). In Panel A, we restrict the sample to the houses that were owned by Mexicans in 1930. In Panel B, we restrict it to houses that were rented by Mexicans in 1930.

We find that the Mexican repatriation decreased the number of Mexican residents in Mexican-occupied houses that were owned in 1930. We do not find a robust inflow of US-born residents into those houses in the subsequent decade. When looking at rented housing, the patterns are different. We find an increase in the number of Mexican residents and a decrease in the number of US-born residents. These results show that the houses previously rented by Mexican residents became increasingly less mixed with US-born residents, suggesting increased housing segregation during the period.

Table 4. Effects on house-level resident composition.

This table presents our house-level regressions from estimating Equation (5):

where is the percent change in the house’s 1930–1940 resident composition: Mexican residents (columns 1–2); US-born residents (columns 3–4); and total residents (columns 5–6).

is the Mexican outflow between 1930 and 1940 in the city c where the house is located instrumented by

, as defined in Equation 3;

represents state fixed effects; and

is the set of 1930 city-level baseline controls, which include the

, average

, share of

workers, and employment

; and

is the set of 1930 house-level controls that include the

, the

and the house level or rent reported in 1930. Columns 2, 4, and 6 include the additional county-level controls. In Panel A, we restrict the sample to the houses that were owned by Mexicans in 1930. In Panel B, we restrict it to houses that were rented by Mexicans in 1930. All regressions are restricted to states with more than 0.25% Mexican population share (Arizona, Texas, California, New Mexico, Kansas, Colorado, Wyoming, Utah, Idaho, Nebraska, Indiana). Standard errors in parentheses are clustered by state. Statistical significance: *** p < 0.01, ** p < 0.05, * p < 0.10.

Effects of the Repatriation at the City-Level

In the previous section, we show that the Mexican repatriation had larger effects in areas with Mexicans, more particularly in houses of Mexicans. A natural question follows: To what extent the Mexican repatriation mattered to city-level housing growth?

In this section, we study the effects of repatriation to the aggregate housing market. With the instrument available, we estimate the following baseline specification using two-stage least squares (2SLS) regression analysis:

(6)

where is a city’s 1930–1940 growth rate in percentage terms of the housing market outcomes: median reported

;

;

; and

;

is the Mexican outflow between 1930 and 1940 in city c instrumented by

which is the instrument defined in Equations 3;

represents state fixed effects to capture state-specific, unobservable heterogeneity (e.g., differences in the intensity of the Great Depression between states); and

is a set of 1930 city-level controls, which include the

, average

, share of

workers, and employment

. We refer to this set of control variables as baseline controls.

and

are important to control for the characteristics of the working-age population in each city. The share of

workers and

aim to capture the effects of the Depression on housing market outcomes across cities within each state. The unemployment share captures the economic conditions of cities in 1930, while sector shares account for heterogeneous effects of the Depression associated with the sector composition of cities. All regressions are weighted by the city’s working-age population in 1930,25We weight our specifications to correct for heteroskedasticity in the error term. In accordance with Solon, Haider and Wooldridge (2015), we perform a Breusch-Pagan test by first estimating Equation 6 using OLS or 2SLS, and then regressing the squared residuals on the inverse of the population in each city. The coefficients on the inverse of the population are positive and statistically significant when testing for outcome variables that span over the full sample of cities, indicating the presence of heteroskedasticity. Therefore, weighting the specifications by the city working-age population increases the efficiency of our estimates. and standard errors are clustered by state.

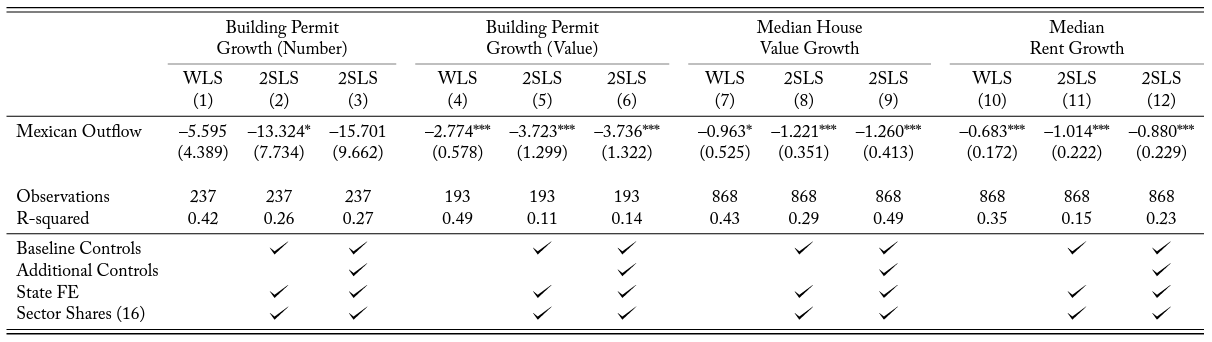

Table 5 presents the estimates of the effect of repatriation on the growth rate of the number of building permits (columns 1–3); the effect on the growth rate of the value of building permits (columns 4–6); the effect on the growth rate of cities’ median house value (columns 7–9); and the effect on the growth rate of cities’ median rent (columns 10–12). Within each real estate outcome in Table 5, the first-ordered columns (columns 1, 4, 7, and 10) show the weighted least squares (WLS) estimates. The second-ordered columns (columns 2, 5, 8, and 11) present 2SLS results using only the baseline controls. The third-ordered columns (columns 3, 6, 9, and 12) present the 2SLS results with the inclusion of the additional controls.

Table 5. Effects on city-level housing, 1930–1940.

This table presents our baseline regressions from estimating Equation (6):

where is a city’s 1930–40 growth rate in one of its housing market outcomes:

;

; median reported

; and median reported

;

is the Mexican outflow between 1930 and 1940 in city c instrumented by

, which is the instrument defined in Equation 3;

represents state fixed effects to capture state-specific, unobserved heterogeneity; and

is a set of 1930 city-level controls, which include the population

, average

, share of

workers, and employment

. The table presents the estimates of the effect of repatriation on the growth rates of the number of building permits (columns 1–3), the building permits value (columns 4–6), the cities median house value (columns 7–9), and cities median rent (columns 10–12). Columns 1, 4, 7, and 10 show

estimates of Equation 6 without any instrumental variable or control. Columns 2, 5, 8, and 11 present the 2SLS results with

as an instrument for the

and using the baseline controls. Columns 3, 6, 9, and 12 present the 2SLS results with the inclusion of the additional controls: (i) county level characteristics on the retail sales growth (a measure for the Great Depression intensity) from Fishback, Horrace and Kantor (2005); (ii) the intensity of the Dust Bowl environmental catastrophe using county-level measures for months of drought times the county’s farm share from Fishback, Horrace and Kantor (2005), and the fraction of land exposed to medium and high permanent soil erosion during the 1930s from Hornbeck (2012). All regressions are weighted by total working-age population in 1930. Standard errors in parentheses are clustered by state. Statistical significance: *** p < 0.01, ** p < 0.05, * p < 0.10.

The results reveal a negative and statistically significant relationship between the Mexican outflow and all the housing market outcomes. Specifically, a one standard deviation increase in exposure to the Mexican outflow (1 percentage point) leads to a 1.2 percentage points decrease in the average growth rate of the median house value and a one percentage point decrease in the median rent growth rate between 1930 and 1940. These are relatively large compared to the baseline growth rates of these variables in the period. On average, median house values decreased 43.2% while median rents decreased 30.6% in the period. In other words, a one standard deviation increase in exposure to the Mexican repatriation explains approximately 2.8% of the decrease in house values and 3.3% of rents.

We also find that the repatriation negatively affected the growth rate of forward-looking measures based on building permits. An increase of one standard deviation in the exposure to the Mexican outflow (1 percentage point) decreased the average growth rates of our leading indicator variables, the value of permits (–3.7 percentage points), and the number of building permits (–13 percentage points). To put these results in perspective, we can compare these values to the observed average growth rates in these indicators during 1930–40. The partial effect of one standard deviation increase in exposure to the Mexican outflow represents approximately 7.4%, and 8.7% of the building permit growth rates in terms of number and value, respectively. All results are robust to the inclusion of the additional control variables, except the effect on the number of building permits, which loses statistical significance. In the next section, we explore the geographical heterogeneity in the exposure to the Mexican repatriation to further illustrate the implications of our city-level results.

Quantifying the Effect of the Mexican Repatriation

In this section, we use a quasi-counterfactual exercise to illustrate the quantitative implications of our findings. This empirical exercise, similar to the one used by Burchardi, Chaney and Hassan (2018), is not meant to serve as a formal counterfactual, but rather to offer a different perspective to visualize the effects of the Mexican repatriation on housing market outcomes. In this quasi-counterfactual, we ask the question: How different would the growth rates of the housing market in US cities have been had the Mexican repatriation not happened?

To answer this question, we first assume that the general equilibrium effects from the repatriation are either negligible or non-existent. In this case, our reduced-form results could be used to estimate the predicted changes in the outcome variables under the scenario without the Mexican repatriation. We also require an estimate of the outflow of Mexican immigrants in the absence of the Mexican repatriation. We use the data and the estimated coefficients from the first stage to derive a rough estimate. We start by assuming that the repatriation effect is completely captured by our instrumental variables, conditional on the control variables. The underlying assumption is that, if the repatriation had not happened, we would not have observed any effect of the instrumental variables on the Mexican outflow. The results in Table 8 support this idea.

The results show that the instrumental variables are relevant to explaining Mexican immigrants’ outflow and that they do not have a statistically significant association with the outflow of immigrants from other nationalities. We use the estimates from Table 6 of the first stage regressions to obtain the hypothetical Mexican outflow in the absence of the repatriation. We calculate the hypothetical Mexican outflow in the case of no repatriation as , where

is the observed Mexican outflow and

is the estimated coefficient of the instrumental variable

in the first stage, i.e., Equation 7. We rearrange this expression to represent the predicted change in Mexican outflow as

.

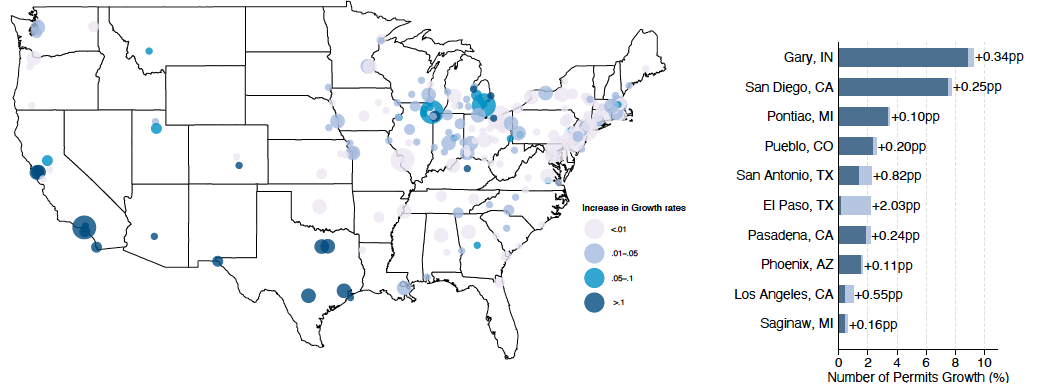

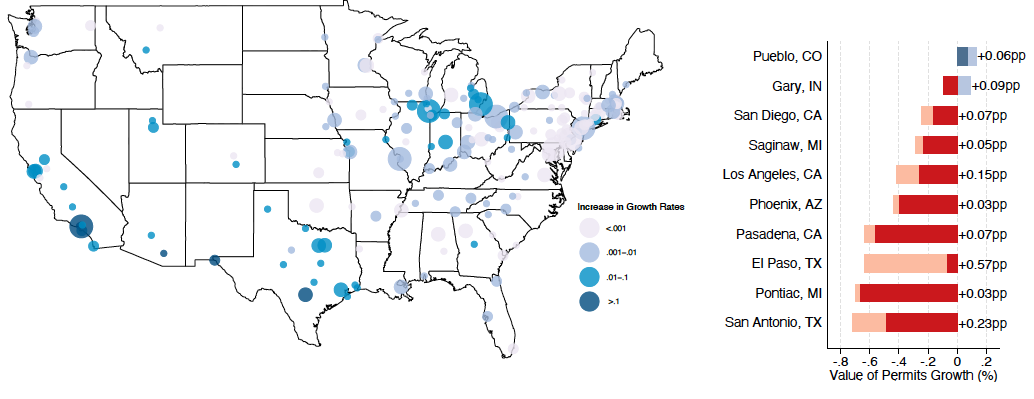

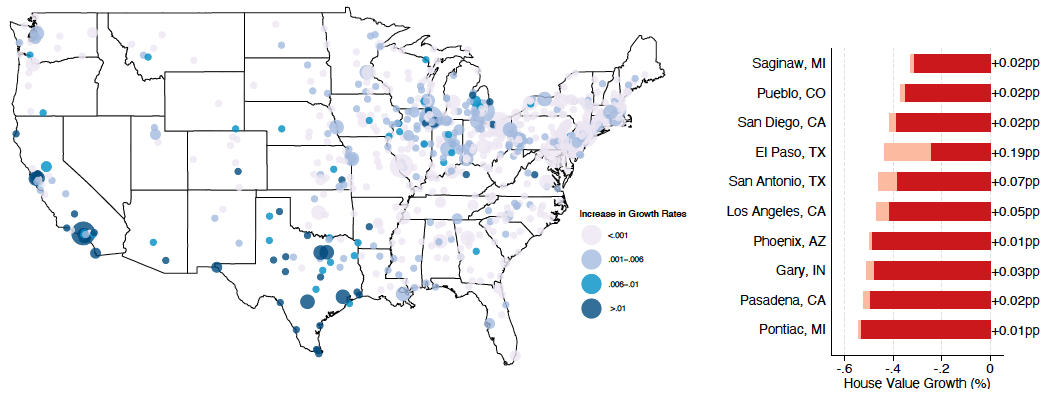

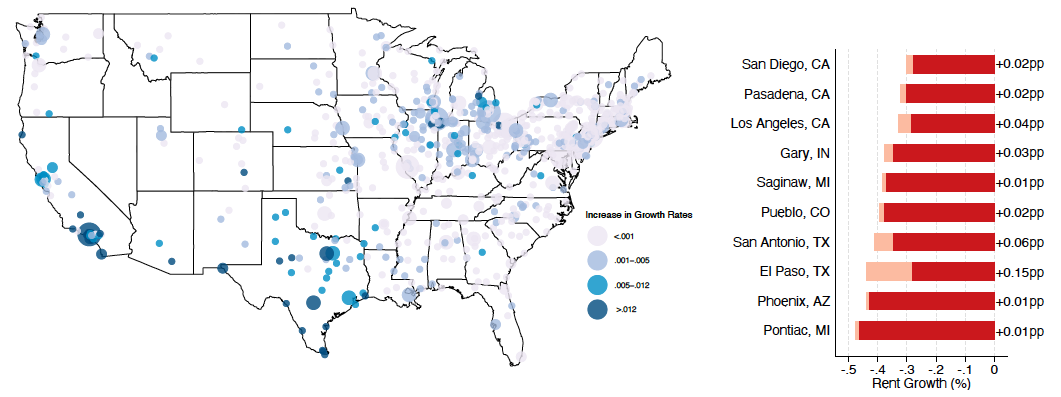

Figure 5. Real estate outcomes without the Mexican repatriation.

(A) Number of Building Permits

(B) Value of Building Permits

(C) House Value

(D) Rents

This figure summarizes the quasi-counterfactual for the housing market outcomes of interest: number of building permits (Panel A), value of building permits (Panel B), house value (Panel C), and rents (Panel D). The maps depict the predicted increase in the growth rates of the city’s respective real estate outcome as detailed in Section 4.3. The size of each bubble is proportional to the city’s working age population in 1930. Darker shades of blue represent greater predicted increases in percentage points. The bar graphs show the top 10 cities with highest Mexican outflow between 1930 and 1940 with non-missing information on all outcome variables. For cities with negative growth rates (red bars), the counterfactual (depicted in light red) cancels out the observed decline (depicted in dark red). For cities with positive growth rates (blue bars), the counterfactual (in light blue) increments the observed growth rate (in dark blue).

Given this predicted change in the Mexican outflow, we use the estimates from Table 5 to calculate the hypothetical change in the growth rates of our housing market outcome variables. The predicted change in the outcomes is specified by . FIgure 5 illustrates the predicted changes in the growth rates. The maps on the left depict the geographic distribution of the changes, while the bar graphs on the right show the predicted changes for the cities with the highest Mexican outflow between 1930 and 1940. For cities with negative growth rates, the counterfactual (depicted in light red) cancels out the observed decline (depicted in vivid red). For cities with positive growth rates, the counterfactual (in light blue) increments the observed growth rate (in vivid blue).26The only exception to this description is Gary, IN, depicted in Panel B. In this case, the observed growth rate is negative (red bar). In contrast, the counterfactual is represented in a blue bar, indicating that the 0.09 p.p. increment under this scenario is enough to cancel out the decline and make the overall growth rate positive.

The results in Figure 5 suggest that the predicted change in the Mexican outflow would have been highly heterogeneous across US cities, translating into heterogeneous changes in the growth rates of housing market outcomes. We find that the growth rates of the number and value of building permits, house values, and rents would have been significantly larger in the hypothetical scenario of no repatriation, especially for the cities closer to the US–Mexico border. For example, the growth in the number of building permits (Panel A) in El Paso would have been 2.03 p.p. higher in the counterfactual scenario, instead of stagnating around zero. Notably, the striking fall observed in El Paso’s growth rate in the value of building permits (Panel B) would have been almost fully canceled out in the counterfactual. Finally, the deep dive in the actual growth rate of El Paso’s median house value (Panel C) would be roughly cut in half in the counterfactual.

Identification Validity and Robustness

Instrument Validity

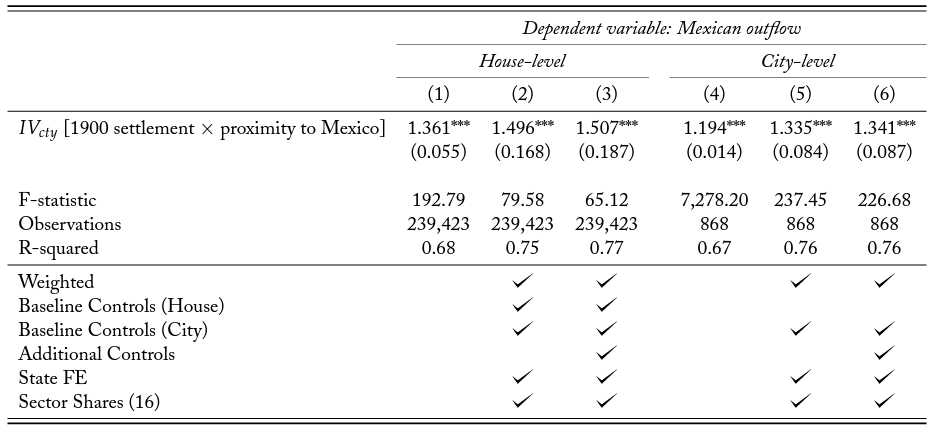

In this section, we present standard tests to validate our constructed instrument. Table 6 presents the results of estimating the following first stage regressions:

(7)

Columns 1–3 present the first stage estimates in the house-level sample, and columns 4–6 show them at the city-level. In columns 1 and 4, we estimate Equation (7) with no controls, fixed effects, and unweighted by city population. Columns 2 and 5 add our baseline controls, state level fixed effects, sector shares, and city population weights to the previous specifications. Columns 3 and 6 include the additional set of controls. The results show that the F-statistics are large and significant in all specifications, alleviating concerns that the instrument is weak.

Table 6. Instrument validation: first stage regressions.

This table presents results for the first-stage regressions of the instrumental variable approach and is one of the IV validation tests that we discuss in Section 5.1. The first-stage regressions are given by Equation 7:

(8)

where is the Mexican outflow between 1930 and 1940 in any given city c.

combines the proximity to the Mexican border interacted with the share of Mexican immigrants in 1900. Columns 1–3 show the first stage regression at the address level sample, while columns 4–6 show the estimates at the city level. In Columns 1 and 4, we estimate Equation 7. Columns 2 and 5 add city-level controls (1930 Census city-level

,

, and share of