For decades, politicians have furiously debated the impact of immigration on domestic labor markets (Kerwin and Warren, 2017). In 1986, then US president Ronald Reagan signed into law the Immigration Reform and Control Act (IRCA), which established sanctions against companies knowingly employing undocumented immigrants, but legalized most undocumented immigrants already residing in US labor markets. The penalties were intended to curb the hiring and recruiting of unauthorized workers, while the legalization was meant to retain productive citizens. This legalization process of granting unauthorized immigrants permanent legal status remains under heavy debate. In fact, in January 2021, the Biden administration proposed a bill to Congress that would provide an “earned roadmap to citizenship for undocumented individuals.”1See the “Fact Sheet: President Biden Sends Immigration Bill to Congress as Part of His Commitment to Modernize our Immigration System” released by The White House on January 20, 2021 and available at: https://www.whitehouse.gov/briefing-room/statements-releases/2021/01/20/fact-sheet-president-biden-sends-immigration-bill-to-congress-as-part-of-his-commitment-to-modernize-our-immigration-system/. Since amnesty is being considered as a solution to immigration concerns, understanding the impact of such programs on firm-level outcomes is becoming increasingly important.

In this study, I examine the effect of immigration legalization on employee productivity of firms that rely heavily on unauthorized workers. Several economic models predict a strong link between labor productivity and the legalization of undocumented immigrants. In the multiperiod overlapping generations model of Benítez-Silva, Eren, and Carceles-Poveda (2011), the move of some undocumented immigrants to legal status leads to higher labor productivity. Edwards and Ortega (2017) allow for different industries and a heterogeneous labor market and show that the economic gains associated with the legalization of unauthorized workers primarily stem from a more productive labor market. Peri and Zaiour (2021) model a scenario in which all undocumented immigrants are granted a pathway to citizenship: they predict economic growth of $1.7 trillion and 438,800 new jobs. Thus, I hypothesize that a positive shock to immigration legalization will be associated with an increase labor productivity.

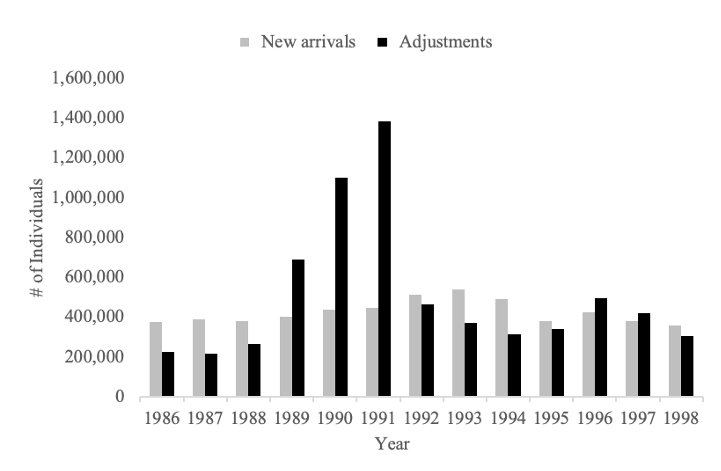

The identification strategy used in this analysis is a difference-in-differences. I examine the per-employee productivity of manufacturing firms vis-à-vis matched control firms around the time of IRCA’s implementation, which saw rapid growth in adjustments made to the legal status of unauthorized immigrants. As can be seen in Figure 1, the number of adjustments made to the status of individuals who were already in the US increased abruptly around the implementation of IRCA in 1986, while the number of new arrivals remained relatively flat. I select the manufacturing industry as my treatment sample mainly because Hill and Pearce (1990) estimate that manufacturing firms employed a large number of unauthorized workers around the time of IRCA’s passage. I bucket all publicly traded manufacturing firms into a treatment group and then use composite score matching to identify a similar control group.

Figure 1. US Immigrant Admissions and Adjustments

This figure plots the number of new immigrant arrivals and adjustments made to undocumented immigrants already residing in the US by year from 1986 to 1998.

In my first set of tests, I examine the effect of an increase in immigration legalization on the labor productivity of manufacturing treatment firms vis-à-vis matched nonmanufacturing control firms in a fixed-effects regression framework. I find that the average revenue per employee for treatment firms, relative to control firms, increases by 3.4 percentage points from the pre- to post-event periods. Similarly, the average earnings before interest and tax (EBIT) per employee for treatment firms compared to control firms increases by 6.7 percentage points from the pre- to post-event windows. Therefore, the results suggest that, holding other factors constant, a positive shock to immigration legalization increases the productivity of employees of manufacturing firms, which employ a substantial number of undocumented immigrants, relative to similar nonmanufacturing firms. These results are robust to the removal of other immigration-sensitive industries within the control group and falsification tests in the form of pseudo-event studies.

Next, I examine whether the results are amplified in a subsector within manufacturing that has been shown to employ a substantial number of undocumented immigrants per establishment – food and kindred products (Hill and Pearce, 1990). I find that the average revenue and EBIT per employee for firms in the food and kindred products subsector, relative to other manufacturing firms, increase by 2.7 and (11.3) percentage points around the time of IRCA’s passage, respectively. These results provide further support for the notion that immigration legalization can have a positive impact on labor productivity.

Most studies that examine immigration and firm-level outcomes focus on migration rather than amnesty (see, e.g., Teruel Carrizosa and Segarra Blasco, 2009; Olney, 2013; De Arcangelis, Di Porto, and Santoni, 2015; Mitaritonna, Orefice, and Peri, 2017; Altındağ, Bakış, and Rozo, 2020; Beerli, Ruffner, Siegenthaler, and Peri, 2021). There is also a fairly robust literature, both theoretical and empirical, that examines the effects of IRCA on labor markets (see, e.g., Cobb-Clark, Shiells, and Lowell, 1995; Phillips and Massey, 1999). I contribute to these two branches of research by providing empirical evidence that firm-level productivity in the industries that rely most heavily on unauthorized workers is directly affected by immigration legalization. My results are generally consistent with those of Ghosh, Mayda, and Ortega (2014), who show that if the cap on H-1B visas were relaxed (i.e., if there were an increase in temporary foreign workers), some US firms would exhibit an increase in productivity and profitability.

The results in this paper may also have important policy implications. There are currently more than 10 million undocumented immigrants, as of 2017, working in US labor markets (Lopez, Passel, and Cohn, 2021). My findings suggest that legislators must carefully consider the manufacturing industry when forming, or reforming, immigration policy. Haraguchi, Cheng, and Smeets (2017) argue that manufacturing continues to play an important role in economic development. In fact, as manufacturing activities concentrate in a lower number of countries, it may be more important than ever to ensure a robust manufacturing industry.

Literature Review

Immigration Reform and Control Act

My study complements the theoretical and empirical work on IRCA. The bill was first introduced in the Senate on May 23, 1985, and was eventually signed into law by President Ronald Reagan on November 6, 1986. Nearly 2.7 million unauthorized workers were ultimately approved for permanent residence as a result of IRCA (Rytina, 2002; Baker, 2010). There were two groups of immigrants eligible for legalization under IRCA. First, unauthorized immigrants residing in the US since before January 1, 1982, were legalized under section 245A. Immigrants in this first group were categorized as legally authorized workers (LAWs), and about 1.6 million were granted legal status as a result of IRCA. Second, agricultural workers who had been employed for a minimum of 90 days in the year before May 1986 were legalized under section 210A. Immigrants in this second group were categorized as special agricultural workers (SAWs), and about 1.1 million were given legal documentation as a result of IRCA.

Several studies examine the effect of IRCA on immigrant wages, but they arrive at different conclusions. Cobb-Clark, Shiells, and Lowell (1995) introduce a theoretical model that predicts that the legalization of immigrants may provide firms with greater access to human capital at a lower cost. The authors contend that the newly legalized workers become more mobile after legalization, creating competition with authorized US workers. The authors then empirically show that the employee wages of manufacturing firms increase as a result of the legalization portion of IRCA. Phillips and Massey (1999) show that the wages of Mexican immigrants deteriorated following IRCA, particularly for those without legal documentation, suggesting greater employer discrimination. The authors contend that previous studies that examined the legalization program at the aggregate level failed to control for many individual characteristics, such as legal status.

Other studies have focused on the migration of undocumented workers around the time IRCA was implemented. Although a large part of the bill was explicitly designed to reduce the volume of undocumented immigrants entering the US, several studies have found little evidence that IRCA deterred such migration (see, e.g., Cornelius, 1989; Bustamante, 1990; Gonzalez de la Rocha and Escobar Latapi, 1990; Donato, Durand, and Massey, 1992; Orrenius and Zavodny, 2003). Furthermore, Amuedo-Dorantes, Bansak, and Raphael (2007) provide empirical support for the notion that amnesty may improve labor markets through increased transparency, job mobility, and quality job matches.

Immigration and Firm Outcomes

I also contribute to a growing literature that debates the impact of immigration on firm-level outcomes. The empirical literature generally finds a positive association between various firm outcomes and an increase in immigrant labor supply. However, the focus has been primarily on migration of immigrants rather than on amnesty for immigrants already in the host country. Carrizosa and Blasco (2009) show that immigration flow has a positive impact on labor productivity and wages for a sample of manufacturing firms in Spanish cities. Olney (2013) shows that firms in the US respond to immigration by expanding their production activities (or number of establishments). De Arcangelis, Di Porto, and Santoni (2015) show that immigration into the manufacturing industry in Italy leads to better firm performance. Mitaritonna, Orefice, and Peri (2017) show that an increase in the supply of immigrant workers in French manufacturing firms increased total factor productivity. Altındağ, Bakış, and Rozo (2020) use the sudden inflow of Syrian refugees into Turkey beginning in 2012 to show that firm production increases following an increase in immigration. Beerli et al. (2021) show that the reform of the Agreement on the Free Movement of Persons signed between the European Union and Switzerland, which granted European cross-border workers access to the Swiss labor market, improved productivity and innovation and attracted new firms. In contrast to these aforementioned studies, Karamollaoglu and Trionfetti (2020) show that capital-intensive firms in Turkey experienced a decline in sales following the increase in Syrian refugees.

Data Description

Sample Selection and Matching Process

The data used in this analysis were obtained from Compustat Fundamentals Annual for the period 1986 to 1991, which surrounds the spike in immigration legalization associated with IRCA (see Figure 1).2As a means of robustness, I use the three-year period before the signing of IRCA, 1983–1985, as the pre-event period in all estimations, and the results are stronger. I use a continuous event window from 1986 through 1991 for the main tests. I use the period from 1986 to 1988 as the pre-event period because this is the time period before migrants were able to formally adjust their legal status, though IRCA became law in 1986. I gather firm-year financial statement information for all publicly traded companies. However, I retain only firm-year observations with positive values for the following variables in each of the six years: total assets, total liabilities, total current assets, total current liabilities, net income, fiscal year-end stock price, revenue, earnings before interest and tax, shares outstanding, and number of employees.

I then identify treatment firms as those that belong to the manufacturing industry or historical standard industrial classification (SICH) codes between 2000 and 3999.3If the SICH is missing for a firm-year observation, I use the SIC instead.The reasons to focus on manufacturing are twofold. First, Hill and Pearce (1990) use the census of 1980 to show that manufacturing firms employ a large proportion of unauthorized workers.4See Hill and Pearce’s table on p. 34. Second, Cobb-Clark, Shiells, and Lowell (1995) estimate that a sizeable number of undocumented workers in manufacturing applied for amnesty under IRCA’s general legalization program between 1987 and 1989. Therefore, I believe that the broad manufacturing industry experienced a shock to the supply of undocumented workers receiving legal status.

I then match treatment firms to control firms (all firms not in the manufacturing industry) on the basis of average characteristics between 1986 and 1988. In particular, I use composite match scores as follows:

(1)

where represents either a firm’s market value of equity (price times shares outstanding) or total revenue per employee. For each treatment stock, I select a control stock with the smallest composite match score.5To remove poor matches, I require that the composite match score be below 5. The process is iterated until each treatment stock is matched with a unique control stock. I am left with 430 treatment firms and 430 matched control firms. My empirical tests are estimated on a balanced panel of 5,160 firm-year observations.

Variable Definitions

The two measures of productivity used throughout the analysis are revenue per employee (Rev/Emp) and earnings before interest and tax per employee (EBIT/Emp). These two measures roughly capture how much money is generated by each employee. I also estimate several control variables used in the multivariate analysis. MCAP is the firm market capitalization, or fiscal year-end closing price times shares outstanding. CR is the current ratio, or total current assets divided by total current liabilities. P/E is the ratio of fiscal year-end closing price and earnings per share. D/E is the debt-to-equity ratio, measured as total liabilities divided by total stockholders’ equity (total assets minus total liabilities). TAT is total asset turnover, or total revenue divided by total assets. ROA is return on assets, or net income divided by total assets. To avoid the influence of extreme outliers, I winsorized all variables by year at the 1st and 99th percentile levels.6The distributions of the variables before winsorizing are available from the author upon request.

Descriptive Statistics

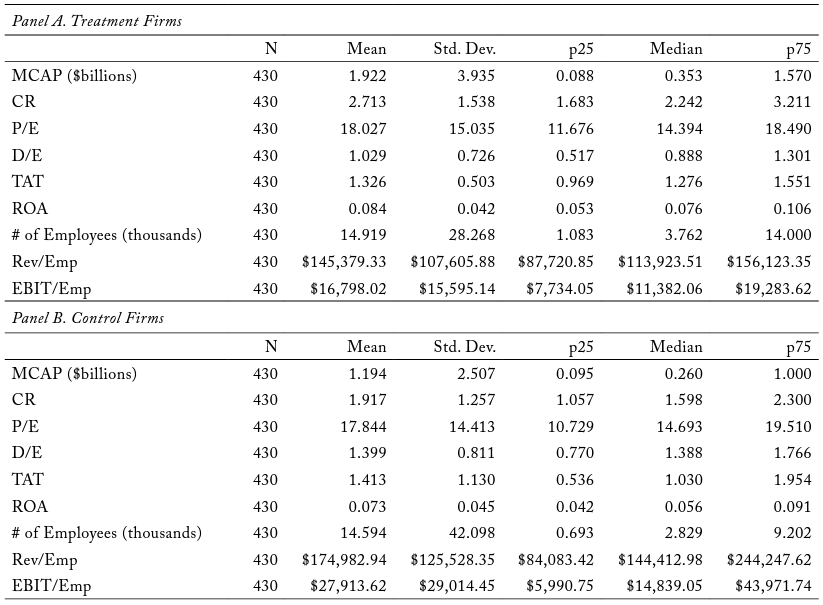

In Table 1, I provide descriptive statistics for the aforementioned variables during the pre-event period, 1986 to 1988, and separately for treatment firms (panel A) and control firms (panel B). All variables are first averaged by stock. I find that the average Rev/Emp is $145,379.33 for treatment firms and $174,982.94 for control firms. The median Rev/Emp is $113,923.51 for treatment firms and $144,412.98 for control firms. I also show that the average EBIT/Emp is $16,798.02 for treatment firms and $27,913.62 for control firms. The median EBIT/Emp is $11,382.06 for treatment firms compared to $14,839.05 for control firms. The average treatment firm has an MCAP of $1.922 billion, relative to $1.194 billion for the average control firm. Additionally, the average treatment firm has roughly $2.71 in current assets for every dollar in current liabilities, relative to $1.92 for control firms. Furthermore, the average treatment firm has an ROA of 8.4% compared to 7.3% for the average control firm. The average treatment firm and the average control firm are slightly leveraged, with debt-to-equity ratios of 1.029 and 1.399, respectively. Additionally, the average P/E ratio for treatment firms is 18.027; the average for control firms is 17.844.

Table 1. Summary Statistics

This table provides descriptive statistics for the variables used in the analysis. The data are obtained from annual Compustat filings for the pre-event period 1986 to 1988. The treatment group (panel A) consists of 430 firms in the manufacturing industry (SICH codes between 2000 and 3999). The control group (panel B) consists of 430 matched nonmanufacturing firms. MCAP is market capitalization, or fiscal year-end stock price multiplied by shares outstanding. CR is the current ratio, or total current assets divided by total current liabilities. P/E is the price-to-earnings ratio, or fiscal year-end stock price divided by earnings per share. D/E is the debt-to-equity ratio, measured as total liabilities divided by total stockholders’ equity (total assets minus total liabilities). TAT is total asset turnover, or total revenue divided by total assets. ROA is the return on assets, or net income divided by total assets. # of Employees is the number of employees per establishment. Rev/Emp is the ratio of revenue to the number of employees. EBIT/Emp is the ratio of earnings before interest and tax to the number of employees. All variables are first averaged by stock.

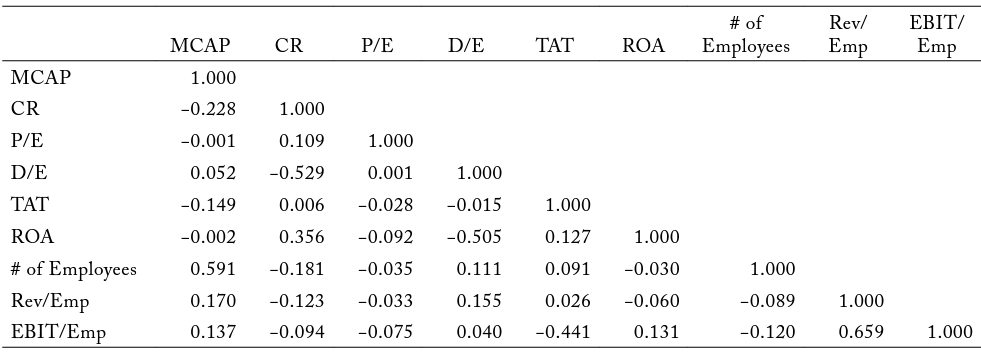

To further describe the sample, I estimate cross-sectional correlation coefficients between the variables. The results of this analysis are in Table 2. I highlight some of the stronger correlations here. As expected, the two employee productivity measures, Rev/Emp and EBIT/Emp, are highly positively correlated, with a coefficient of 0.659. Not surprisingly, the correlation coefficient between MCAP and # of Employees is 0.591, suggesting that larger firms have more employees on average. The correlation coefficient between CR and D/E is −0.529, indicating that short-term liquidity and long-term leverage are negatively related. Conversely, the correlation coefficient between CR and ROA is 0.356, meaning that the relation between short-term liquidity and asset profitability is positive. The correlation between D/E and ROA is negative, with a coefficient of −0.505. Lastly, the correlation coefficient between EBIT/Emp and TAT is −0.441.

Table 2. Cross-Sectional Correlation Matrix

This table reports cross-sectional correlation coefficients between the variables used in the analysis. The data are obtained from annual Compustat filings for the pre-event period 1986 to 1988. MCAP is market capitalization, or fiscal year-end stock price multiplied by shares outstanding. CR is the current ratio, or total current assets divided by total current liabilities. P/E is the price-to-earnings ratio, or fiscal year-end stock price divided by earnings per share. D/E is the debt-to-equity ratio, measured as total liabilities divided by total stockholders’ equity (total assets minus total liabilities). TAT is total asset turnover, or total revenue divided by total assets. ROA is the return on assets, or net income divided by total assets. # of Employees is the number of employees per establishment. Rev/Emp is the ratio of revenue to the number of employees. EBIT/Emp is the ratio of earnings before interest and tax to the number of employees. All variables are first averaged by stock.

Empirical Results

In this section, I present the empirical methods used in this study and discuss the estimated results. I examine the alternative hypothesis that a positive relation exists between immigration legalization and the productivity of employees of manufacturing firms. More specifically, I examine employee productivity of manufacturing firms, relative to control firms, around the sudden increase in immigration legalization associated with IRCA.

IRCA and Labor Productivity: Manufacturing vs. Control

I begin by examining the effects of an increase in immigration legalization on the productivity of employees for firms that rely heavily on the employment of immigrants (i.e., manufacturing firms) and for a group of control firms. Therefore, I estimate specifications of the following regression equation on a balanced panel of 5,160 firm-year observations between 1986 and 1991:

(2)

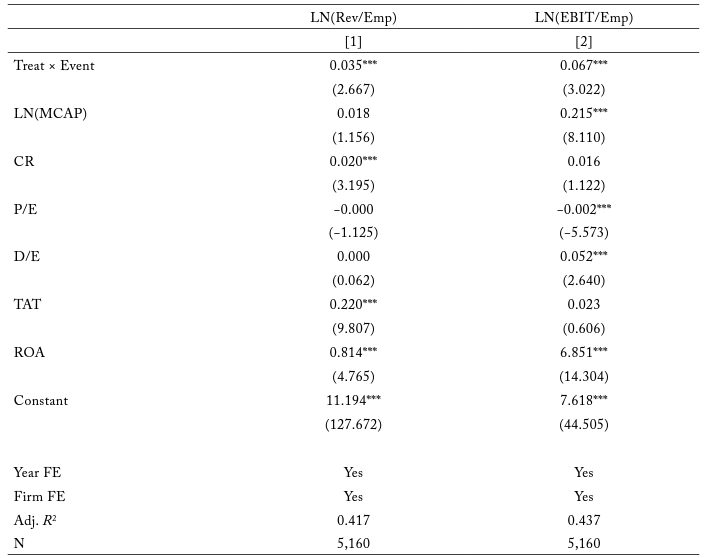

where the dependent variable is the natural log of one of two measures of employee productivity, Rev/Emp or EBIT/Emp. Treat is an indicator variable equal to one if the firm is in the manufacturing industry (SICH codes between 2000 and 3999) and zero for a matched control firm not in manufacturing. Event is a dummy variable equal to one if the firm-year observation is between 1989 and 1991 inclusive, zero otherwise. The independent variable of interest is the interaction term between Treat and Event, which is the difference-in-differences estimator. The remaining control variables have previously been defined. I also include firm fixed effects ( ) and year fixed effects ( ), but in doing so must exclude the individual Treat and Event indicator variables to avoid violating the full column rank assumption for consistent estimation. I report t‑statistics in parentheses obtained from robust standard errors clustered at the industry level (Bertrand, Duflo, and Mullainathan, 2004). The results of this analysis are found in Table 3.

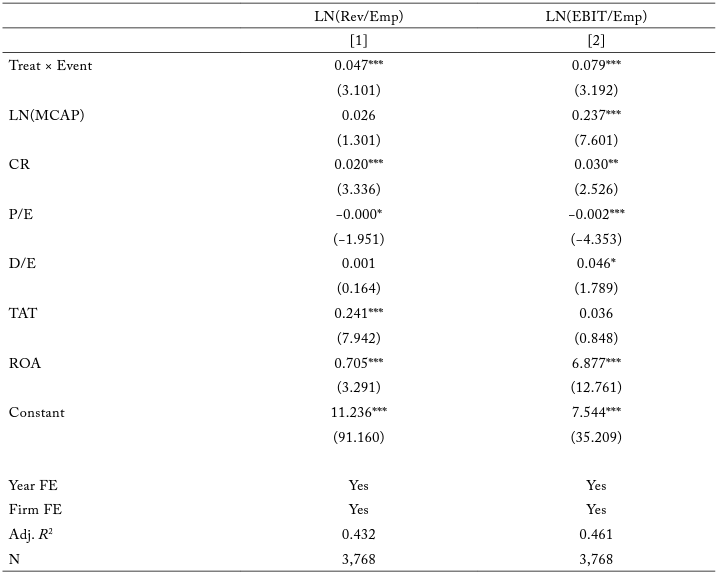

Table 3. IRCA and Labor Productivity in Manufacturing Firms vs. Nonmanufacturing Firms

This table reports the results from estimating equation (2) on a balanced panel of 5,160 firm-year observations between 1986 and 1991. The variables are consistent with the equation description in the text above. *, **, and *** denote statistical significance at the 0.01, 0.05, and 0.1 levels, respectively.

In column [1] of Table 3, I estimate equation (1) and insert the natural log of Rev/Emp as the dependent variable. The average annual revenue per employee for manufacturing firms, relative to that for matched control firms, increases by 3.5 percentage points around the time IRCA was implemented. In column [2] of Table 3, I reestimate equation (2) but insert the natural log of EBIT/Emp as the dependent variable. I find results similar to before: the average annual EBIT per employee for manufacturing firms compared to control firms increases by 6.7 percentage points around the effects of IRCA. My finding is consistent with the prediction of Benítez-Silva, Eren, and Carceles-Poveda (2011): an increase in immigration legalization is associated with a significant increase in employee productivity for manufacturing firms vis-à-vis matched control firms, holding constant other factors.

In the previous analysis, I include the entire population of publicly traded nonmanufacturing firms in the control group. Therefore, there might be other immigration-sensitive firms in the control group influencing the results. However, I believe that this would only introduce a downward bias on the difference-in-differences terms. Nevertheless, I reconstruct the matched sample using equation (1) but remove from the control group other immigration-sensitive industries, such as services (SICH codes between 7000 and 8999), agriculture (SICH codes between 0100 and 0999), administration (SICH codes between 5600 and 5699), and construction (SICH codes between 1500 and 1799). I then reestimate the fixed-effects regression equation (2) using this updated sample of 3,768 firm-year observations. The results of this analysis are reported in Table 4.

Table 4. IRCA and Labor Productivity in Manufacturing Firms vs. Non-Immigration-Sensitive Firms

This table reports the results from estimating equation (2) on a balanced panel of 3,768 firm-year observations between 1986 and 1991, where the dependent variable is the natural log of one of two measures of employee productivity, Rev/ Emp or EBIT/Emp. Treat is an indicator variable equal to one if the firm is in the manufacturing industry (SICH codes between 2000 and 3999) and zero for a matched control firm not in manufacturing, services (SICH codes between 7000 and 8999), agriculture (SICH codes between 0100 and 0999), administration (SICH codes between 5600 and 5699), or construction (SICH codes between 1500 and 1799). Event is a dummy variable equal to one if the firmyear observation is between 1989 and 1991 inclusive, zero otherwise. The independent variable of interest is the interaction term between Treat and Event, which is the difference-in-differences estimator. The remaining control variables have previously been defined (see Table 1). I also include firm fixed effects ( γ i ) and year fixed effects ( δ t ), but in doing so must exclude the individual Treat and Event indicator variables to avoid violating the full column rank assumption for consistent estimation. I report in parentheses tstatistics obtained from robust standard errors clustered at the industry level. *, **, and *** denote statistical significance at the 0.01, 0.05, and 0.1 levels, respectively.

In the first column of Table 4, I show that the estimated coefficient on the interaction term is positive and significant at the 0.01 level. In economic terms, this result implies that the average annual revenue per employee for treatment firms, relative to control firms, increases by 4.7 percentage points around the implementation of IRCA. In the second column of Table 4, I find that the result is robust to the use of after-cost revenue. In particular, the average annual EBIT per employee for treatment firms vis-à-vis control firms increases by 7.9 percentage points from the pre- to post-event periods. These results suggest that relative to employees of non-immigration-sensitive firms, those of manufacturing firms become more productive after IRCA.

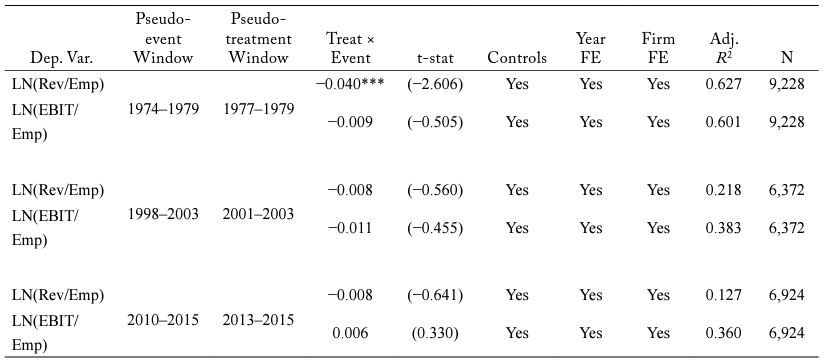

It is possible that I have just captured something happening in the manufacturing industry that is unrelated to immigration. To address this concern, I estimate falsification tests using pseudo-events. More specifically, I randomly selected three different six-year windows (1974–1979, 1998–2003, and 2010–2015) and reestimate my main fixed-effects model specification in equation (2) using the original balanced sample of 5,160 firm-year observations. The results of this analysis are found in Table 5.

Table 5. Pseudo-ICRA and Labor Productivity in Manufacturing Firms vs. Nonmanufacturing Firms

This table reports the results from estimating equation (2) on a balanced panel of firm-year observations around three separate six-year pseudo-event windows (1974–1979, 1998–2003, and 2010–2015), where the dependent variable is the natural log of one of two measures of employee productivity, Rev/Emp or EBIT/Emp. Treat is an indicator variable equal to one if the firm is in the manufacturing industry (SICH codes between 2000 and 3999) and zero for a matched control firm not in manufacturing. Event is a dummy variable equal to one if the firm-year observation is in the last three years of the sample periods and zero if it is in the first three years. The independent variable of interest is the interaction term between Treat and Event, which is the difference-in-differences estimator. The remaining control variables have previously been defined (see Table 1). I also include firm fixed effects ( γ i ) and year fixed effects ( δ t ), but in doing so must exclude the individual Treat and Event indicator variables to avoid violating the full column rank assumption for consistent estimation. I report in parentheses tstatistics obtained from robust standard errors clustered at the industry level. *, **, and *** denote statistical significance at the 0.01, 0.05, and 0.1 levels, respectively.

Importantly, of the six model specifications reported in Table 5, only one produces a significant difference-in-differences estimator. Furthermore, that significant coefficient is negative, which is the opposite of what I find in my analysis around IRCA. Therefore, these results indicate that the labor productivity of manufacturing firms, relative to control firms, remains the same or decreases around these pseudo-events. Thus, these falsification tests provide some validation of the results reported in the previous two tables.

Together, the results in this subsection provide strong support for the notion that amnesty programs, such as IRCA, have the ability to improve labor productivity. I find that the employees of manufacturing firms are more productive, relative to employees at other firms, after the passage of IRCA, but not around other pseudo-events.

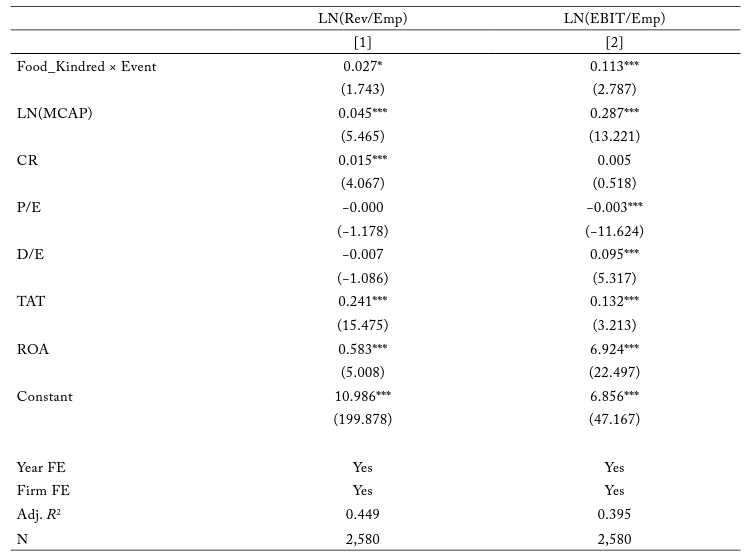

IRCA and Labor Productivity: Manufacturing Subsectors

In my final set of tests, I examine whether the results are driven by a particular subsector within manufacturing. Hill and Pearce (1990, p. 34) show that food and kindred products is the industry that employs the most undocumented immigrants per establishment. In fact, the authors use the census of 1980 to show that firms in the canned foods industry employ an average of 37.7 undocumented immigrants per establishment, firms in meat products employ 16.7, firms in grain and bakery products employ 13.6, and firms in beverages and miscellaneous foods employ 3.6. Therefore, in the following analysis, I use the food and kindred products subindustry (two-digit SICH code 20) as the treatment group and all other manufacturing firms as the control group. I then estimate the following fixed-effects regression equation on a balanced panel of 2,580 firm-year observations:

(3)

where the dependent variable is again the natural log of one of two measures of employee productivity, Rev/Emp or EBIT/Emp. Food_Kindred is an indicator variable equal to one if the firm is in the food and kindred products subsector of manufacturing (two-digit SICH code 20) and zero for all other manufacturing subsectors (two-digit SICH codes 21 through 39). Event is a dummy variable equal to one if the firm-year observation is between 1989 and 1991 inclusive, zero otherwise. The independent variable of interest is the interaction term between Treat and Event, which is the difference-in-differences estimator. The remaining control variables have previously been defined. I also include firm fixed effects ( ) and year fixed effects ( ), but in doing so must exclude the individual Treat and Event indicator variables to avoid violating the full column rank assumption for consistent estimation. I report t‑statistics in parentheses obtained from robust standard errors. The results of this analysis are reported in Table 6.

Table 6. IRCA and Labor Productivity in Food and Kindred Firms vs. Other Manufacturing Firms

This table reports the results from estimating equation (3) on a balanced panel of firm-year observations around three separate six-year pseudo-event windows (1974–1979, 1998–2003, and 2010–2015). The variables are consistent with the equation description in the text above. *, **, and *** denote statistical significance at the 0.01, 0.05, and 0.1 levels, respectively.

I find that the results are much stronger in the food and kindred products subindustry relative to all other manufacturing subindustries. For instance, in the first column of Table 6, I find that the average revenue per employee for food and kindred products firms, relative to other manufacturing firms, increases by 2.7 percentage points after IRCA. Similarly, in the second column of Table 6, I show that the average EBIT per employee for food and kindred products firms vis-à-vis other manufacturing firms increases by a staggering 11.3 percentage points after implementation of IRCA. Thus, my results suggest that the changes in immigration legalization associated with IRCA substantially impacted the productivity of the firms employing the most unauthorized workers.

Concluding Remarks

Few topics have demanded more attention from politicians than immigration law. The immigration bill proposed by President Biden “allows undocumented individuals to apply for temporary legal status, with the ability to apply for green cards after five years if they pass criminal and national security background checks and pay their taxes.”7See the “Fact Sheet: President Biden Sends Immigration Bill to Congress as Part of His Commitment to Modernize our Immigration System” released by The White House on January 20, 2021 and available at: https://www.whitehouse.gov/briefing-room/statements-releases/2021/01/20/fact-sheet-president-biden-sends-immigration-bill-to-congress-as-part-of-his-commitment-to-modernize-our-immigration-system/. Therefore, the approximately 10 million undocumented immigrants currently in the US might have a clear road map to citizenship. In this study, I examine the effect of immigration legalization on the labor productivity of firms that employ a substantial number of undocumented immigrants vis-à-vis a group of control firms. For productivity measures, I use revenue per employee and EBIT per employee. As an event, I use the rapid increase in the number of people given legal permanent residence surrounding the implementation of IRCA.

I find that the average annual revenue per employee for manufacturing firms, relative to nonmanufacturing control firms, increases by 3.5 percentage points after the implementation of IRCA. Furthermore, I find that, ceteris paribus, the average EBIT (after-cost revenue) per employee for manufacturing firms versus matched control firms increases by 6.7 percentage points from pre- to post-event periods. These results are robust to both year and firm fixed effects and the removal of other immigration-sensitive firms from the control group. I also perform falsification pseudo-event tests and do not find meaningful changes in labor productivity in manufacturing firms, relative to similar nonmanufacturing firms. In additional tests, I find that the results are magnified in a subsector within manufacturing that has been shown to employ a substantial number of undocumented immigrants per establishment—food and kindred products. I find that the average EBIT per employee for firms in the food and kindred products subsector, relative to other manufacturing firms, increases by 11.3 percentage points around IRCA.

Collectively, my results provide strong empirical support for a positive relation between labor productivity in manufacturing and the authorization of undocumented immigrants. Since manufacturing has long played an important role in economic growth (Kaldor, 1965; Kaldor, 1966; Pacheco-López and Thirlwall, 2013; Haraguchi, Cheng, and Smeets, 2017), my results may have important macroeconomic implications. Policymakers might consider the direct relation between immigration legalization and the production of manufacturing firms. Legislation that reduces immigration has the potential to impede the productivity of manufacturing firms, which may then lead to economic stagnation.

References

Altındağ, O., Bakış, O., and Rozo, S.V., 2020. Blessing or burden? Impacts of refugees on businesses and the informal economy. Journal of Development Economics, 146, p.102490.

Amuedo-Dorantes, C., Bansak, C. and Raphael, S., 2007. Gender differences in the labor market: Impact of IRCA. American Economic Review, 97(2), pp.412–416.

Baker, B.C., 2010. Naturalization rates among IRCA immigrants: A 2009 update. US Department of Homeland Security, Office of Immigration Statistics.

Beerli, A., Ruffner, J., Siegenthaler, M. and Peri, G., 2021. The abolition of immigration restrictions and the performance of firms and workers: Evidence from Switzerland. American Economic Review, 111(3), pp.976–1012.

Benítez-Silva, H., Eren, S. and Carceles-Poveda, E., 2011. Effects of Legal and Unauthorized Immigration on the US Social Security System. Michigan Retirement Research Center Research Paper No. WP, 250.

Bertrand, M., Duflo, E. and Mullainathan, S., 2004. How much should we trust differences-in-differences estimates? The Quarterly Journal of Economics, 119(1), pp.249–275.

Bustamante, J.A., 1990. Undocumented migration from Mexico to the United States: Preliminary findings of the Zapata Canyon project. Undocumented Migration to the United States—IRCA and the Experience of the 1980s, pp.211–226.

Cobb-Clark, D.A., Shiells, C.R. and Lowell, B.L., 1995. Immigration reform: The effects of employer sanctions and legalization on wages. Journal of Labor Economics, 13(3), pp.472–498.

Cornelius, W.A., 1989. Impacts of the 1986 US immigration law on emigration from rural Mexican sending communities. Population and Development Review, pp.689–705.

De Arcangelis, G., Di Porto, E. and Santoni, G., 2015. Immigration and manufacturing in Italy: Evidence from the 2000s. Economia e Politica Industriale, 42(2), pp.163–187.

Donato, K.M., Durand, J. and Massey, D.S., 1992. Changing conditions in the US labor market. Population Research and Policy Review, 11(2), pp.93–115.

Edwards, R. and Ortega, F., 2017. The economic contribution of unauthorized workers: An industry analysis. Regional Science and Urban Economics, 67, pp.119–134.

Ghosh, A., Mayda, A.M. and Ortega, F., 2014. The Impact of Skilled Foreign Workers on Firms: An Investigation of Publicly Traded U.S. Firms. IZA Discussion Papers, No. 8684, Institute for the Study of Labor (IZA), Bonn.

Gonzalez de la Rocha, M. and Escobar Latapi, A., 1990. The Impact of IRCA on the Migration Patterns of a Community in Los Altos, Jalisco, Mexico (Working Paper No. 41). Washington, DC: Commission for the Study of International Migration and Cooperative Economic Development.

Haraguchi, N., Cheng, C.F.C. and Smeets, E., 2017. The importance of manufacturing in economic development: Has this changed? World Development, 93, pp.293–315.

Hill, J.K. and Pearce, J.E., 1990. The incidence of sanctions against employers of illegal aliens. Journal of Political Economy, 98(1), pp.28–44.

Kaldor, N., 1965. The role of taxation in economic development. In Problems in Economic Development (pp. 170–195). Palgrave Macmillan, London.

Kaldor, N., 1966. Causes of the Slow Rate of Growth of the United Kingdom. An Inaugural Lecture. Cambridge.

Karamollaoglu, N. and Trionfetti, F., 2020. Immigration and firm performance: Evidence from Turkey. WP, MEF University.

Kerwin, D. and Warren, R., 2017. National interests and common ground in the US immigration debate: How to legalize the US immigration system and permanently reduce its undocumented population. Journal on Migration and Human Security, 5(2), pp.297–330.

Lopez, M.H., Passel, J.S. and Cohn, D.V., 2021. Key facts about the changing US unauthorized immigrant population.

Mitaritonna, C., Orefice, G. and Peri, G., 2017. Immigrants and firms’ outcomes: Evidence from France. European Economic Review, 96, pp.62–82.

Olney, W.W., 2013. Immigration and firm expansion. Journal of Regional Science, 53(1), pp.142–157.

Orrenius, P.M. and Zavodny, M., 2003. Do amnesty programs reduce undocumented immigration? Evidence from IRCA. Demography, 40(3), pp.437–450.

Pacheco-López, P. and Thirlwall, A.P., 2013. A New Interpretation of Kaldor’s First Growth Law for Open Developing Countries (No. 1312). School of Economics Discussion Papers.

Peri, G. and Zaiour, R., 2021. Citizenship for Undocumented Immigrants Would Boost US Economic Growth. Washington: Center for American Progress.

Phillips, J.A. and Massey, D.S., 1999. The new labor market: Immigrants and wages after IRCA. Demography, 36(2), pp.233–246.

Rytina, N.F., 2002. IRCA legalization effects: Lawful permanent residence and naturalization through 2001. WP, U.S. Immigration and Naturalization Service: Office of Policy and Planning Statistics Division.

Teruel Carrizosa, M. and Segarra Blasco, A., 2009. Immigration and firm performance: A city-level approach. Investigaciones Regionales, pp.111-137.