In a speech to Congress at the end of June, President Biden urged state and federal legislators to implement a three-month gas tax holiday. With inflation rates and gas prices continuing to climb towards historic levels, the President hoped this proposal would “bring down the price of gas, and give families just a little bit of relief.”

The proposal failed to gain much traction, but the administration stated that they haven’t entirely given up on the idea. It could make a comeback as soon as November when gas prices are expected to rise again as a new round of sanctions are set to be enacted against Russia.

President Biden is correct in saying that pausing the gas tax would lower the price consumers see at the pump. Unfortunately, this discount would only save drivers a meager $2 to $4 a month, while simultaneously causing a $6 billion reduction in our nation’s ability to conduct much-needed repairs on federal roads, highways, and bridges.

The gas tax was once an efficient and effective way to pay for national infrastructure. For decades, however, the gap between gas tax revenues and the cost of road maintenance has been growing. Rising inflation, increasing road construction costs, and growing numbers of fuel-efficient and electric vehicles are all reducing the revenues generated from the gas tax.

The gas tax has not only lost much of its usefulness, but it will continue to do so in the coming years. Perhaps it’s time to accept that the gas tax was never meant as a long term solution for infrastructure funding. We need a solution that better reflects the current and future reality of driving.

After all, the gas tax was designed for Ford’s Model T, not Tesla’s Model 3.

Many states are currently experimenting with a number of alternatives, such as a vehicle mileage tax (VMT), which taxes drivers based on the miles they drive rather than the fuel they consume. These alternatives should also serve as a roadmap for modern-day federal infrastructure funding.

America’s infrastructure needs some serious love

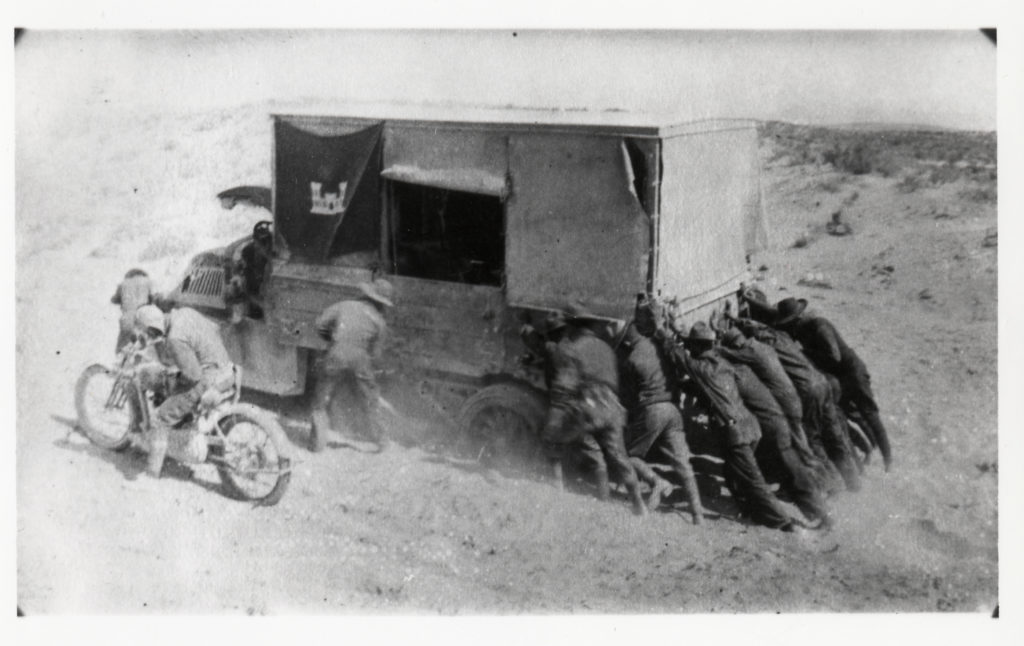

In 1919, the US Army commissioned a transcontinental expedition to test the country’s capacity to transport men and vehicles during times of war. The convoy consisted of 79 military vehicles and nearly 300 men and traveled 3,251 miles from Washington, DC, to San Francisco, CA. That trip, which can be made in 2-3 days by car today, took the expedition more than two months to complete at great cost: 21 men died, 9 vehicles were lost, and 88 bridges were damaged or destroyed.

The official report notes that over half the distance traveled was on dirt roads, wheel paths, mountain trails, desert sands and alkali flats. On three different occasions the convoy became stuck in quicksand in the deserts of Utah and Nevada. Of these three episodes in the sand, the report authors said they spent a total of 42 hours “in the most arduous and heroic effort in rescuing the entire convoy from impending disaster.”

Soldiers in the 1919 expedition attempting to free a military truck stuck in the sand – National Archives

One of the officers in charge of the expedition was Lieutenant Colonel Dwight D. Eisenhower. His experience on that convoy led him to be a major advocate for a national highway system after he became president, and under his leadership the Federal-Aid Highway Act of 1956 was signed into law. This act created the Highway Trust Fund—with revenues largely generated from the gas tax—to finance the construction and maintenance of public roadways.

Today, there are roughly 164,000 miles of federal highways connecting the over 4 million miles of public roads in the US. This public road network has made possible a trucking industry which is responsible for shipping over 70 percent of all goods in the US every year, not to mention the hundreds of millions of Americans who use them to get to and from work, to take their children to school, and to carry out many other aspects of daily life.

But this backbone of American commerce is crumbling.

In a report published last year, the American Society of Civil Engineers gave public roads a “D” rating and found that there is currently a $786 billion backlog for road and bridge capital needs. The poor condition of American roadways also causes unnecessary damage to vehicles, forcing drivers to spend an extra $130 billion a year on automobile repairs and maintenance.

The Highway Trust Fund, which receives nearly 90 percent of its revenues from the gas tax, is supposed to cover those costs. Since 2008, however, those revenues have not been enough to cover highway spending. As a result, nearly $155 billion in general Treasury funds have been used to cover the shortfall.

Still more is needed if we ever hope to do more than maintain the status quo.

What’s in a tax?

Every gallon of gas you buy includes an 18.4 cent federal gas tax. Each state adds its own gas tax as well, which ranges from 9 cents per gallon in Alaska to nearly 58 cents per gallon in Pennsylvania. This type of tax is referred to as a “use tax” because, in theory, the more you use the roads, the more gas you buy and the more money you contribute to repair those roads.

But as new vehicles become more fuel efficient and alternative-fuel vehicles like electric cars become more common, the use principle begins to fall apart. This is an issue for two major reasons. First, this increased efficiency causes budget shortfalls. By some estimates, the deficit in the Federal Highway Trust Fund will reach a cumulative shortfall of $188 billion in the next 8 years. This will leave American roads in a worse state of disrepair than they currently are, or force the government to spend tens of billions of dollars of general funds each year to make up the difference. Second, the gas tax is placing a larger burden on people who cannot afford newer, more fuel-efficient vehicles and are therefore paying more per mile to maintain roads.

Newer vehicles are also heavier and cause more wear and tear on roads. This is especially true for electric vehicles, which tend to weigh significantly more than their gasoline counterparts.

The federal gas tax was not built to adapt with changing technology. In fact, it was never intended as a long-term solution. When Congress instituted the first gas tax via the Revenue Act of 1932, it was set at one cent per gallon and was supposed to expire the following year. As roadways expanded and became a critical part of the nation’s economic and cultural health, the need for funding grew. But each increase required a prolonged political battle. The last increase happened under President Clinton in 1993, which raised the tax to its current rate of 18.4 cents.

In the thirty years since, rising inflation and the increasing cost of construction means that 18.4 cents doesn’t help nearly as much as it used to. Inflation has cut the purchasing power of a dollar in half, which is to say that if something cost you a dollar in 1993, it would cost you two dollars today.

A promising solution

Instead of trying to salvage this antiquated system, now might be a good time to consider supplementing or replacing it with a vehicle mileage tax (VMT). At its core, a VMT is simple. Drivers are charged a small fee for each mile they drive. This achieves the same goal that legislators had when implementing the gas tax a century ago, while leaving room for new driving technologies not tied to gasoline.

Over the last decade, several states have begun to conduct pilot programs to test the viability of VMTs and foster the development of technologies and methods needed to administer the program effectively. These pilot programs have largely proven the viability of a VMT, causing some states to move towards expanding their pilots to permanent programs. In addition to the pilots providing proof of concept, states have also identified a number of benefits provided by a VMT.

Because a VMT is dependent only on the distance a vehicle travels, it future-proofs roadway revenue for any number of innovations in not only gasoline vehicles, but electric, hydrogen, nuclear, or other fuel sources we haven’t even dreamt of yet.

In addition to future-proofing funding against technological change, a new tax system provides an opportunity to future-proof against inflation. The lack of flexibility in the current law forces lawmakers to either make the politically unpopular decision of periodically increasing the gas tax or abandon the practice and allow the highway trust fund to be eaten by inflation as it has for the past 30 years. If lawmakers choose to implement a VMT, it would be prudent to peg the tax to inflation from the beginning. This would help ensure the long term sustainability of the new system without a need for frequent legislative intervention.

It isn’t a perfect solution yet

As with any new idea, the benefits described above also come with a new set of problems and concerns.

Many of the strongest critics of switching to a VMT are quick to raise privacy concerns about the methods used to collect mileage data. This stems from the fact that many states have used GPS-enabled OBD-II devices in their pilot programs. These GPS-enabled devices offer many benefits, such as allowing states to only charge drivers for mileage driven within their states or allowing for variable rates based on where miles are driven within the state. However, the public perception of VMT programs being an invasion of privacy must be addressed fully and convincingly in order to remove this barrier to widespread adoption. In light of this issue, many states have taken privacy concerns seriously and are addressing it by offering alternative methods of mileage recording in their pilot programs.

Utah allows drivers to opt-out of OBD-II devices altogether by paying an alternative fee at registration each year. This fee can essentially be set at an amount equal to the per mile fee other drivers are paying multiplied by the miles an average driver travels per year. It could also be broken into monthly payments to reduce the financial burden of making a single, large lump-sum payment.

Oregon offers an alternative OBD-II device that doesn’t have GPS capabilities and only reads the vehicle’s odometer. Drivers who choose this option miss out on savings from out-of-state driving not being taxed, but gain the benefit of their privacy concerns being remedied. These devices could work well with a Federal VMT program because the majority of American drivers do not spend much time driving outside national borders, making the use of GPS uneccessary.

In Hawaii, drivers can opt to have their odometer read manually, with the mileage fee being charged retroactively. The administrative cost of this alternative is kept to a minimum by piggybacking on the annual vehicle safety check that Hawaii requires before vehicle registration (which already included an odometer reading).

In addition to these alternatives, Oregon will soon be experimenting with implementing its entire VMT system within the security of a blockchain to increase privacy protections for drivers. This development would not only protect driver privacy, but also increase Oregon’s ability to interface with the programs of other states and the federal government.

Even with these privacy concerns addressed, administrative costs for VMT programs are still much higher than for gas tax programs. The Federal Highway Trust Fund spends about 0.2 percent of its revenue on collecting funds. In contrast, the Oregon Department of Transportation projects that collection costs under its VMT program will approach 10 percent in the long term.

Currently the federal system collects the gas tax from gas distribution centers (of which there are 1,296 in the US), and the gas company raises the price of their product to recoup those costs. A VMT program would instead require almost 300 million vehicle accounts, with every driver in the country being directly charged for the miles they drive.

While this 10 percent estimate may seem steep, there are several ways to reduce these administrative costs through widespread implementation, increased scale, and state and federal integration. For example, if both states and the federal government adopt VMTs, it is possible to integrate all of their separate VMT programs into a single system. This would entail cost saving measures such as only needing a single OBD-II device to report mileage to multiple agencies.

State-level VMT programs can also reduce their reliance on GPS devices by integrating their programs with other states. This was done in a pilot program along the Interstate 95 corridor, where states from Florida to Maine collaborated to developed a system that accounts for the many drivers who cross state borders on a regular basis.

Instead of requiring GPS devices, this pilot program found success in only tracking miles added to a vehicle’s odometer and charging the driver for those miles based on a formula. This formula charged each driver the state tax rate for the majority of their miles traveled, with the remainder of the miles being charged at the rate of neighboring states.

Conclusion

Regulation needs to evolve with technology, and in no place is this more apparent than in the modern state of our transportation system. Over the last decade, states have demonstrated that a VMT is more intuitive, more equitable, and a more viable source of infrastructure funding in a future that is increasingly gasoline free. But that doesn’t mean there aren’t challenges still left to solve. Rather than advocating for gas tax holidays while our national infrastructure decays, the federal government should be actively exploring meaningful alternatives for funding that can future-proof one of our nation’s greatest economic assets.

Popular Mechanics

Popular Mechanics