Introduction

States around the country are considering enacting or increasing renewable portfolio standards (RPS), which are policies meant to lower carbon emissions and encourage renewable energy use.1http://www.ncsl.org/research/energy/renewable-portfolio-standards.aspx RPS require that utilities provide some percentage or amount of their electricity from qualifying renewable sources. This mandate functionally taxes fossil fuel producers and provides a subsidy to producers of renewable energy.2For information on the formal development of this idea, see Antonio M. Bento, Teevrat Garg, and Daniel Kaffine, “Emissions Reductions or Green Booms? General Equilibrium Effects of a Renewable Portfolio Standard,” Journal of Environmental Economics and Management 90 (2018):78-100; and Carolyn Fischer, “Renewable Portfolio Standards: When Do They Lower Energy Prices?,” Energy Journal 31, no. 1 (2010): 101-19. Academic research, however, has yielded mixed results regarding how cost-effective RPS policies are relative to other policies aimed at reducing emissions and promoting renewables.

How an RPS Affects Electricity Prices

Perhaps unsurprisingly, many studies conclude that an RPS raises electricity prices by inducing utilities to use more expensive energy sources. As long as renewables are more expensive than the predominant nonrenewable resources, requiring utilities to use them will raise prices.

However, in theory, an RPS can either increase or decrease electricity prices. Carolyn Fischer, a senior fellow at the environmental think tank Resources for the Future, argues that price changes depend on the price sensitivity of renewable energy compared to nonrenewable energy and on the stringency of the RPS policy.3 Fischer, “Renewable Portfolio Standards,” 103. The stringency of the RPS determines whether it functions primarily as a tax on nonrenewable energy sources or as a subsidy for renewables. If the percentage requirement for renewable energy sources is low—that is, if the policy is less stringent—the subsidy effect may dominate and cause electricity prices to decrease. However, as the stringency of the RPS increases, “the implicit tax [on nonrenewable resources] quickly dominates.”4Fischer, 117. Several factors determine the breakeven point, but Fischer’s analysis suggests that prices start accelerating once RPS requirements reach 10 to 15 percent.5Fischer, 116. Importantly, few current state-level RPS are within the range at which an RPS is projected to lower electricity prices. Most RPS require well over 10 percent of energy to come from renewable sources.6 Database for State Incentives of Renewables and Efficiency, Renewable Portfolio Standard Policies, October 2018, http://www.dsireusa.org/resources/detailed-summary-maps/.

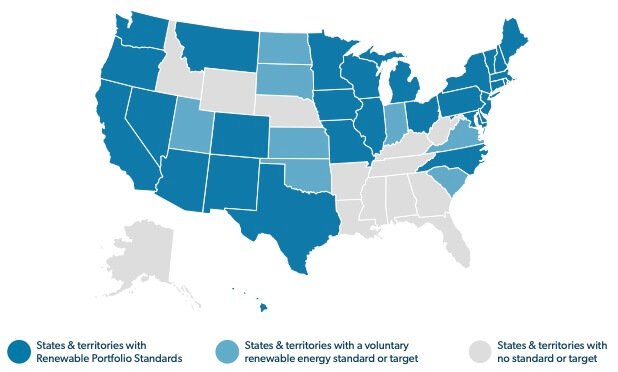

Figure 1. Renewable Portfolio Standard Requirements By State

Source: National Conference of State Legislature, State Renewable Portfolio Standards and Goals, February 1, 2019, http://www.ncsl.org/research/energy/renewable-portfolio-standards.aspx.

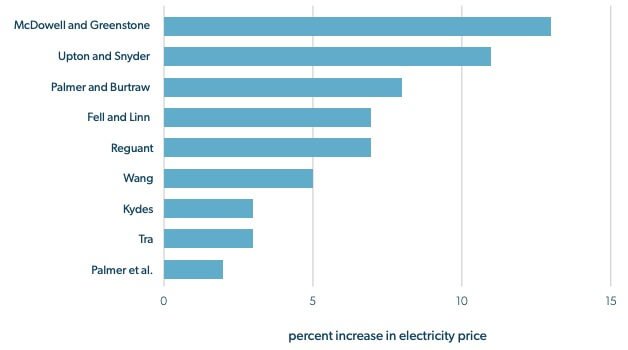

Many researchers other than Fischer also conclude that RPS lead to higher electricity prices.7Gregory B. Upton Jr. and Brian F. Snyder, “Funding Renewable Energy: An Analysis of Renewable Portfolio Standards,” Energy Economics 66 (2017): 205-16; Karen Palmer and Dallas Burtraw, “Cost-Effectiveness of Renewable Electricity Policies,” Energy Economics 27, no. 6 (2005): 873-894; CostEffectiveness of Renewable Electricity Policies,” Energy Economics 27, no. 6 (2005): 873–94; Constant I. Tra, “Have Renewable Portfolio Standards Raised Electricity Rates? Evidence from US Electric Utilities,” Contemporary Economic Policy 34, no. 1 (2016): 184–89; Hongbo Wang, “Do Mandatory US State Renewable Portfolio Standards Increase Electricity Prices?,” Growth and Change 47, no. 2 (2016): 157–74. Louisiana State University professors Gregory Upton and Brian Snyder estimate the price increase associated with enacting an RPS by comparing electricity prices from states that adopted an RPS to what the price would have been without an RPS. They find that RPS cause price increases of about 11 percent.8Upton and Snyder, “Funding Renewable Energy.” While this estimate is on the high end of the estimates presented in the academic literature, figure 2 shows that past research predicts price increases of between 2 and 13 percent. Different empirical methods and geographic variation in renewable resources among states help explain the breadth of this range. Figure 2 displays each study’s estimate of the electricity price increase associated with an RPS.

The consequences of these price increases are not evenly distributed across groups. As Mar Reguant, an environmental economics expert, points out, renewable producers are the “major beneficiaries…with all other technologies losing out.” Consumers, on the other hand, suffer welfare losses due to the price increases.9Mar Reguant, “The Efficiency and Sectoral Distributional Impacts of LargeScale Renewable Policies” (NBER Working Paper No. 24398, National Bureau of Economic Research, Cambridge, MA, 2018): 27, https://www.nber.org/papers/w24398

Figure 2. Estimated Electricity Price Increase Associated with a Renewable Portfolio Standard

Sources: Karen L. Palmer, Anthony C. Paul, Matt Woerman, and Daniel C. Steinberg10Sources: Karen L. Palmer, Anthony C. Paul, Matt Woerman, and Daniel C. Steinberg, “Federal Policies for Renewable Electricity: Impacts and Interactions,” Energy Policy 39, no. 7 ( 2011): 3975-991; Hongbo Wang, “Do Mandatory US State Renewable Portfolio Standards Increase Electricity Prices?,” Growth and Change 47, no. 2 (2016): 157–74; Andy S. Kydes, “Impacts of a Renewable Portfolio Generation Standard on US Energy Markets,” Energy Policy 35, no. 2 (2007): 809-14; Constant I. Tra, “Have Renewable Portfolio Standards Raised Electricity Rates? Evidence from US Electric Utilities,” Contemporary Economic Policy 34, no. 1 (2016): 184–89; Harrison Fell and Joshua Linn, “Renewable Electricity Policies, Heterogeneity, and Cost Effectiveness,” Journal of Environmental Economics and Management 66, no. 3 (November 2013): 703–4; Mar Reguant, “The Efficiency and Sectoral Distributional Impacts of Large-Scale Renewable Policies” (NBER Working Paper No. 24398, National Bureau of Economic Research, Cambridge, MA, 2018), https://www.nber.org/papers/w24398; Karen Palmer and Dallas Burtraw, “Cost-Effectiveness of Renewable Electricity Policies,” Energy Economics 27, no. 6 (2005): 873–94; Gregory B. Upton Jr. and Brian F. Snyder, “Funding Renewable Energy: An Analysis of Renewable Portfolio Standards,” Energy Economics 66 (2017): 205–16; Richard McDowell with Michael Greenstone (2016), “Essays on the Economics of Renewable Energy” PhD. diss., Massachusetts Institute of Technology, https://dspace.mit.edu/handle/1721.1/104487; Note: Each of these studies uses different methods and models different simulations, but this figure provides a range of estimates for the likely effects of RPS on electricity prices.

How Cost-Effective Are RPS Policies?

Research on renewable portfolio standards’ cost-effectiveness is inconclusive. Some researchers point out that, even though they aren’t the most cost-effective policy, RPS still create more benefits than costs.11 Ryan Wiser et al., “Assessing the Costs and Benefits of US Renewable Portfolio Standards,” Environmental Research Letters 12, no. 9 (2017): 094023. Nevertheless, research shows that if reducing carbon emissions is the goal of these standards, then there are likely more cost-effective policies—or the RPS could be adjusted to be more cost-effective.12 Harrison Fell and Joshua Linn, “Renewable Electricity Policies, Heterogeneity, and Cost Effectiveness,” Journal of Environmental Economics and Management 66, no. 3 (November 2013): 703–4; Palmer and Burtraw, “CostEffectiveness of Renewable Electricity Policies,” 874. The poor performance of RPS in reducing carbon emissions is generally attributed to two factors. First, RPS typically encourage the use of renewables at the expense of natural gas and not at the expense of coal. The energy provided by sources such as solar power and wind fluctuates in response to weather patterns, meaning these energy sources are more likely to replace the flexible energy generation of natural gas than the baseload capacity that coal provides. But natural gas is less carbon-intensive than coal. Consequently, the carbon emission reductions of RPS may be lower than policymakers expected.13Palmer and Burtraw, “Cost-Effectiveness of Renewable Electricity Policies,” 874.

Second, RPS promote the use of selected renewable sources, instead of creating incentives for broad-based technological improvement. For example, an RPS does not incentivize carbon sequestration or nuclear technology developments even though these could potentially provide carbon-neutral energy sources. Including a wider variety of permissible sources in an RPS would offer more opportunities for utilities to comply with the policy at a lower cost, ultimately making the policy more cost-effective. For lower carbon reduction goals, it is more expensive to require additional renewable energy instead of replacing coal with natural gas or other nonrenewables with lower emissions. Energy economists David Young and John Bistline estimate that, even with the hypothetical introduction of a 50 percent national RPS, pursuing the carbon-emission reduction through an RPS would be 2.5 times more expensive than achieving this goal through the cheapest possible methods to reduce emissions.14 David Young and John Bistline, “The Costs and Value of Renewable Portfolio Standards in Meeting Decarbonization Goals,” Energy Economics 73 (June 2018): 337–51. These cheaper methods include a greater variety of electricity sources, such as nuclear power, natural gas generation and carbon capture, in addition to the energy sources commonly considered in an RPS.

California, for example, recently altered its RPS to mandate 100 percent clean energy by 2045, but left requirements more open-ended to accept carbon-free sources of energy.15“SB-100 California Renewables Portfolio Standard Program: Emissions of Greenhouse Gases.” California Legislative Information. September 10, 2018. https://leginfo.legislature.ca.gov/faces/billNavClient.xhtml?bill_id=201720180SB100 This could allow utilities to meet the requirement using nuclear power plants, large hydroelectric plants, and even natural gas plants with carbon capture systems. These changes will likely make the state’s RPS more cost-effective than a similar policy that forces utilities to pick specific carbon-free sources at specified rates.

Conclusion and an Alternative to RPS Policies

A wide range of academic research finds that RPS raise electricity prices and are not the most cost-effective way to reduce carbon emissions. Research also shows that policies that offer more choices to energy consumers may be preferable to state mandates that require specific sources for energy. For example, an RPS that permits a wider variety of low-carbon sources, such as large hydropower and nuclear power, may have a lower economic cost than an RPS that limits the permissible energy sources to solar power and wind. Another possibility is to provide a green power option, which allows individuals who want to source their electricity from cleaner sources to pay a premium on their electricity bill to do so.16Magali A. Delmas and Maria J. Montes-Sancho, “U.S. State Policies for Renewable Energy: Context and Effectiveness,” Energy Policy 39, no. 5 (May 2011): 2274. Although utilities are sometimes required to provide these options, they also emerge naturally as electricity providers attempt to satisfy consumers’ demands for clean energy sources. For example, Texas’s competitive electricity market offers plans that consumers can choose from according to their own preferences, ranging from zero to 100 percent renewable energy.17 Public Utility Commission of Texas, “Plan Options,” accessed February 1, 2019, http://www.powertochoose.org/en-us/Content/Resource/PlanOptions.

As policymakers debate implementing and increasing RPS, they must not lose their focus on choosing policies that achieve desired environmental goals at the lowest cost to electricity consumers.