1 Introduction

Americans are growing increasingly concerned about the size and influence of large corporations. Between 2001 and 2016, the percentage of Americans dissatisfied with the influence of major corporations increased from 48 to 63 percent Gallup (2023). Further, the last 20 years have seen a simultaneous easing of restrictions that govern corporate money in politics and a stark increase in the quantity of corporate money in politics. From 2000 to 2016, the average non-individual contribution to state politics increased by nearly 200 percent, while that for the average individual decreased by 2 percent. Electric utilities in particular are large contributors to state-level campaigns, donating $115 million to state-level candidates and political parties in the 2018 election cycle. Why do electric utilities disperse such large sums on the political process?

One possibility is that utilities are attempting to influence their regulatory environment. Electric utility profits are strongly tethered to the decisions of state regulators, known as public utility commissions (PUCs). This reliance on favorable regulations provides an incentive for utilities to attempt to “capture” regulators to shape regulatory policy in their favor. For example, in Ohio, FirstEnergy was criminally charged with bribing state politicians to plant an industry-friendly lobbyist as the head of the Ohio Public Utilities Commission and pass legislation that bailed out its nuclear power plants (Zuckerman, 2022; Bischoff, 2021). This example highlights an explicit bribe perpetrated by an electric utility to favorably influence its regulatory environment, but utilities may achieve similar results without such brazen behavior.

Specifically, inducements in the form of campaign contributions may enable a utility increased influence over state politicians. Because politicians exert significant control over regulatory agencies, these implicit bribes provide a strong incentive for politicians to exercise this control in service of the utility. What effect, if any, do utility campaign contributions have on state regulatory policy?

Critics argue that firms leverage political contributions to influence governmental policies in their favor (Stratmann, 2005; Gordon and Hafer, 2005; de Figueiredo Jr and Edwards, 2007; Stratmann and Monaghan, 2017), but skeptics contend that firms do not benefit from their campaign contributions (Ansolabehere et al., 2003, 2004; Fowler et al., 2020; Fouirnaies and Fowler, 2021). This debate in the literature has persisted for decades without emergence of a clear understanding of the influence of campaign contributions on the legislative and regulatory processes. Two reasons for this lacuna in the literature are the inherent problem of endogeneity and the lack of natural experiments to aid identification.

Addressing this gap, in this paper I exploit a natural experiment to study the regulatory effects of legalizing electric utility campaign contributions at the state level. I identify the causal effect of legalizing electric utility campaign contributions on regulatory outcomes by exploiting the 2005 repeal of the Public Utility Holding Company Act of 1935 (PUHCA), which legalized direct electric utility campaign contributions in 30 states. While the PUHCA’s primary purpose was to curb the monopoly power of electric utilities, a lesser-known provision prohibited them from contributing company funds to local, state, and federal political campaigns. Throughout the PUHCA’s 70–year tenure, regulated holding companies and their subsidiaries were prohibited from using treasury funds to contribute to politicians and political parties at the state level regardless of a state’s campaign finance regulations.

The PUHCA was repealed in 2005, thereby returning authority over campaign finance regulations governing regulated holding companies and their subsidiaries to the states. Starting in 2006, regulated holding companies and their subsidiaries operating in the 30 treated states that permit corporate contributions to either politicians or political parties could legally contribute directly from corporate treasury funds in addition to their political action committees (PACs). In contrast, due to a prohibition on direct corporate contributions, utilities operating in 20 control states continued to be barred from this practice. Exploiting this natural experiment, I estimate the effect of legalizing electric utility campaign contributions on regulatory outcomes using a difference-in-differences (DiD) identification strategy.

The primary regulatory outcome in this analysis is the utility’s authorized return on equity (ROE) permitted by state PUCs. Electric utility rates are established during a process known as a rate case, with the authorized ROE being the most important regulatory outcome to come out of this process due to its crucial role in determining utility profits. Consequently, ROE is a key outcome of interest in several papers analyzing electric utility regulation (Hagerman and Ratchford, 1978; Bonardi et al., 2006; Fremeth et al., 2014; Lim and Yurukoglu, 2018). Generally, utilities petition for a high ROE to increase profits, and consumers lobby for a low ROE to keep prices down. Although PUCs seek to establish an ROE sufficiently high to compensate shareholders for risk and to encourage capital investment, there is no correct method for determining this rate. As a result, the determination of an appropriate ROE is highly subjective to commission judgment.

My preferred DiD specification indicates that PUCs in treated states respond to the legalization of utility campaign contributions by authorizing ROEs 0.4 percentage points above the ROEs authorized in control states, translating to roughly $4 million in additional authorized profits per utility annually. This finding is robust to a battery of time-varying economic and political controls. Further, the PUHCA’s repeal leads to a wave of merger and acquisition (M&A) activity in the utility sector such that several operating companies are subject to new holding company ownership during this period. The results are robust to including holding company fixed effects such that I compare treated and control operating companies owned by the same holding company, suggesting that increased financing requirements or differential exposure to risk due to M&A activity does not contaminate these results.

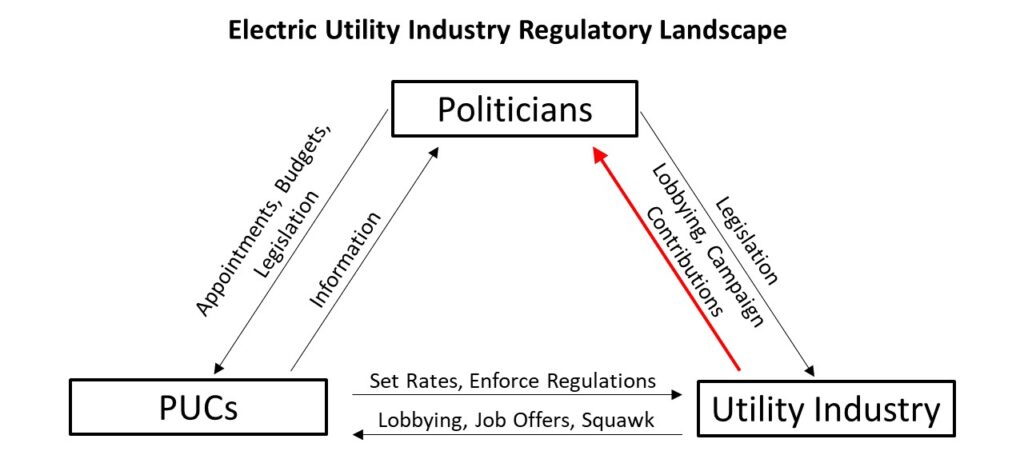

To interpret this finding, I develop a conceptual framework that outlines the channels of influence between a PUC, politicians, and a utility. The framework demonstrates that while the utility can attempt to influence the PUC directly through lobbying and inducements (e.g., future job prospects), it can also attempt to capture the PUC by exploiting the influence that politicians wield over the PUC (Weingast and Moran, 1983). By providing politicians with campaign resources, the utility can exploit this political control to its advantage.

To test this hypothesis, I estimate the average effect of the PUHCA’s repeal on utility campaign contributions. I find that treated utilities increase total political donations by $46,000 annually compared to control utilities. This treatment effect suggests that treated utilities more than double their campaign contributions when the prohibition on direct contributions is lifted. Further, this effect is strongest during years new rates are established, suggesting that utilities target contributions to candidates to facilitate this quid pro quo relationship.

The conceptual framework suggests three key mechanisms through which legalizing campaign contributions can engender regulatory capture. First, a state’s institutional characteristics can play a pivotal role in facilitating regulatory capture. State campaign finance regulations are heterogeneous and can be categorized into three groups: (1) states that ban corporate contributions, (2) states that cap corporate contributions, and (3) states that allow unlimited corporate contributions. The framework indicates that politicians in states that allow unlimited contributions face the most industry pressure to influence PUCs, while contribution caps should limit this pressure and reduce the extent of capture. I find support for this hypothesis. Specifically, states that allow unlimited corporate contributions experience significant increases in both campaign contributions and authorized ROEs, while this effect is muted in states that cap contributions.

Second, the framework indicates that political control over the appointment process of PUC commissioners affords politicians increased influence over the PUC. PUC commissioners in the majority of states are appointed by the governor and approved by the legislature, but in 11 states, commissioners are elected by voters. This institutional feature provides the opportunity to test the role of the appointment process contributing to regulatory capture. I find that broad political control over the appointment process of PUC commissioners can exacerbate the political influence over regulatory decisions. States where the legislature is involved in the commissioner selection process experience significantly higher political donations and authorize significantly higher ROEs than states where the legislature is uninvolved.

Last, heterogeneous preferences of politicians may either insulate or facilitate PUCs from regulatory capture. While utilities may prefer when industry-friendly politicians are in office, utilities may benefit more by contributing to marginally hostile politicians, albeit at an increased cost. I find that utilities strategically target campaign contributions for Democratic governors, who I assume are marginally more hostile to utility interests than Republicans. Further, I find strong heterogeneous treatment effects by governor party affiliation. Treated PUCs under Democratic governors authorize significantly higher returns than under Republican governors. These findings provide empirical evidence for the work of Denzau and Munger (1986), who argue that the cost to influence hostile politicians is greater than friendly politicians, and Snyder Jr (1991), who theorizes that firms benefit by targeting marginally hostile politicians. This evidence suggests that firms may find it too costly to influence politicians with strong preferences for advancing the public good.

This paper contributes to the broad literature on money in politics. There is considerable debate regarding corporations’ motivations in contributing to political campaigns, with some scholars arguing that political contributions should be viewed as a consumption good, motivated by ideology and a desire to participate in the political process, rather than as a political investment (Ansolabehere et al., 2003). The preponderance of this literature analyzes the influence of campaign contributions on roll call votes (Stratmann, 1995; Bronars and Lott, 1997; Stratmann, 2002; Ansolabehere et al., 2003; Stratmann, 2005; Mian et al., 2010). Likely a consequence of endogeneity bias and weak identification strategies, this literature ranges from conclusions of significant influence (Stratmann, 2005; Roscoe and Jenkins, 2005) to no influence (Ansolabehere et al., 2003). To quantify plausible returns to shareholders, recent scholarship has employed regression discontinuity designs to estimate a causal effect of contributing to a narrowly elected politician on abnormal stock returns, but this research has also produced varying conclusions (Akey, 2015; Fowler et al., 2020). Accordingly, it is not entirely clear that corporations secure significant benefits from their campaign contributions.

Recently, a growing body of empirical research estimates the effect of campaign contributions on regulatory outcomes. Using an instrumental variable approach, de Figueiredo Jr and Edwards (2007) and Stratmann and Monaghan (2017) find that an increase in campaign contributions is associated with favorable regulatory outcomes in the telecommunications and healthcare industries, respectively. Gordon and Hafer (2005) provide evidence that nuclear power companies can influence their amount of regulatory monitoring by using large political donations to signal their willingness to fight in the political arena. In contrast, Fouirnaies and Fowler (2021) exploit within-state variation in campaign finance law and find that regulated insurance firms do not benefit from more favorable regulatory outcomes as a result of relaxed campaign finance restrictions. I contribute to this literature by exploiting a natural experiment that exogenously legalized electric utility campaign contributions, finding strong support for pervasive regulatory capture in the electric utility industry.

This paper provides empirical support for the theory of regulatory capture, which proposes that an industry can acquire regulation as an asset (Stigler, 1971; Posner, 1974; Priest, 1993). One mechanism of capture explored in the literature is the firm’s ability to explicitly bribe regulators to secure favorable regulatory outcomes (Tirole, 1986; Spiller, 1990). Political influence over the agency, however, may also play a pivotal role in shaping regulatory policy. Specifically, politicians have many tools to affect regulatory policy, including appointing agency heads (Wood and Waterman, 1991; Spiller and Urbiztondo, 1994; Berry and Gersen, 2017), controlling agency budgets (Pasachoff, 2016; Thomas, 2019), performing public hearings before the legislature (Kriner and Schwartz, 2008; Parker and Dull, 2009), and legislating the authority of the agency (McCubbins, 1985; McCubbins et al., 1987; Calvert et al., 1989; Ferejohn and Shipan, 1990). The conceptual framework developed in this paper combines these related literatures and suggests that firms can exploit politicians’ influence over the regulatory process by bribing politicians, rather than regulators, to influence the regulatory agency.

Further, this paper contributes to the literature analyzing firms’ nonmarket strategies, which attempt to maximize profits by engaging in public policy arenas (Bonardi et al., 2006). The most closely related papers are those by Fremeth et al. (2016) and Holburn and Vanden Bergh (2014), who find that electric utilities leverage campaign contributions to gain political support during contentious rate case proceedings and M&A requests, respectively. Importantly, this literature contends that regulatory agencies are not entirely independent but rather shape policies to strategically appease their political principals (Bonardi et al., 2006; Holburn and Vanden Bergh, 2004, 2008). Aware of this political influence, firms strategically target pivotal political actors and rivalrous legislatures to shape policy for their benefit (Snyder Jr, 1991; Fremeth et al., 2016; Holburn and Vanden Bergh, 2014, 2004, 2008; Bonardi et al., 2006). This paper contributes to this literature by demonstrating that utilities strategically contribute to marginally hostile politicians and legislators who control the commissioner appointment process.

Finally, this paper contributes to the literature analyzing the electric utility rate case process. Several studies analyze the regulatory effects of the commissioner selection process and find that elected regulators are more responsive to the public interest than appointed regulators (Kwoka, 2002; Besley and Coate, 2003; Holburn and Spiller, 2002). In addition, some studies find that participation by a consumer advocate during rate case proceedings is associated with lower authorized ROEs, indicating that PUCs are more receptive of consumer interests when formalized into a consolidated lobby (Holburn and Spiller, 2002; Fremeth et al., 2014). Last, researchers seek to understand the growing discrepancy between the ROE authorized by PUCs and the predicted ROE produced by the asset pricing models that PUCs purportedly use, resulting in excess industry returns (Azgad-Tromer and Talley, 2017; Rode and Fischbeck, 2019; Werner and Jarvis, 2022). This research suggests that this divergence from theoretical underpinnings may be due to a lack of expertise among regulators and a reluctance to reduce authorized ROE as interest rates decrease.

The rest of the paper proceeds as follows. Section 2 provides a conceptual framework for analyzing the regulatory dynamics of electric utility regulation. It discusses the incentive structures of politicians, utilities, and the PUC and develops hypotheses about the effects of legalizing utility campaign contributions. Section 3 provides background information on the PUHCA, campaign finance regulation, and the PUC rate-making process. Section 4 describes the data used in this analysis, and Section 5 discusses the empirical strategy. Section 6 presents the main results of this analysis, including the effects of legalizing campaign contributions on authorized ROE and campaign contribution amounts. Section 7 probes the mechanisms that facilitate capture, and Section 8 concludes.

2 Conceptual Framework

Regulatory capture theory posits that an industry can influence regulatory policy in its favor, but the process of regulatory capture remains opaque. I present a conceptual framework, adapted from Igan and Lambert (2019), to illustrate the mechanisms that facilitate capture. Consider three players: (1) the PUC (regulatory commissioners), which value industry information, their reputation, and career prospects; (2) politicians, who value industry information and reelection prospects; and (3) the utility industry, which values economic rents. Aware of these objective functions, each player attempts to influence the others to maximize their respective utility. Figure 1 presents the attributes of this regulatory landscape, where the arrows represent the direction and mechanisms of influence between the three players.

Figure 1. Regulatory Landscape of the Electric Utility Industry

Arrows represent directions of influence.

Critically, the industry’s economic rents are constrained by the PUC, which establishes an authorized rate of return for the industry. The public interest is served by a low authorized rate of return sufficient to encourage capital investments in grid resiliency and to keep prices down. Conversely, the industry’s interest is served by a high authorized rate of return that maximizes economic rents. Of note, the regulatory landscape contains asymmetric information such that only the industry knows the specific rates of return required to serve the public interest and the industry’s interest, while the PUC must exert effort to learn the required rates of return.

To maximize profits, the utility’s objective is to secure high authorized returns from the PUC. In pursuit of this objective, the utility can spend resources on expert witnesses during its rate case hearings to persuade the regulator that a higher authorized rate is necessary. Further, the industry may offer regulators bribes, such as monetary transfers and future employment, in an attempt to induce a favorable policy shift (Spiller, 1990; Che, 1995). Another possibility is that regulators offer firms generous regulatory outcomes to avoid potential complaints or backlash from the industry for mistakes (Leaver, 2009). These direct channels of influence have received considerable attention in the literature (Dal Bó, 2006), but the industry may also employ more subtle and indirect nonmarket strategies to achieve higher authorized rates.

If politicians can exert considerable influence over regulators, the industry has a strong incentive to shape politicians’ preferences. Although regulatory agencies are purportedly independent, a robust literature identifies some of the mechanisms through which politicians can influence regulators (Weingast and Moran, 1983; Weingast, 1984; McCubbins and Schwartz, 1984; McCubbins, 1985; Calvert et al., 1989; McCubbins et al., 1989; Fiorina and Fiorina, 1989; Spiller and Urbiztondo, 1994; Clinton et al., 2014; Selin, 2015; Berry and Gersen, 2017; Breig and Downey, 2021). The preponderance of these studies model a principal-agent problem, in which political principals maximize reelection prospects by affecting regulatory policy in return for campaign resources from special interests. Politicians effectuate this quid pro quo relationship using various mechanisms, including appointing agency heads (Wood and Waterman, 1991; Spiller and Urbiztondo, 1994; Berry and Gersen, 2017), controlling agency budgets (Pasachoff, 2016; Thomas, 2019), performing disciplinary hearings (Kriner and Schwartz, 2008; Parker and Dull, 2009), and legislating the procedural rules of the game (McCubbins, 1985; McCubbins et al., 1987; Calvert et al., 1989; Ferejohn and Shipan, 1990). Of note, merely the existence of these mechanisms may be sufficient to steer the regulator toward implementing the politicians’ preferred policies (Weingast and Moran, 1983). As Weingast (1984) explains, “It makes no sense to let bureaucrats capture all the political rewards when an agency’s policy could reasonably be used to enhance electoral prospects” (p. 154).

Cognizant of the power politicians wield over the PUC, the industry uses both lobbying and campaign contributions to shape legislation governing the regulatory process itself. For example, the Florida legislature, which receives millions in political contributions from utilities, amended the procedural rules to oust consumer advocate J.R. Kelly, who led the Office of Public Council, which advocates on behalf of consumers during rate negotiations (Klas, 2020; Garcia, 2022; Editorial Board, 2021). By instituting a cap on the tenure of this role and requiring a renomination, the legislature was able to replace Kelly with a former business lobbyist, who helped settle Florida Power & Light’s largest rate increase in the state’s history Klas (2021); Garcia (2022). In Ohio, Governor Mike DeWine worked cojointly with FirstEnergy to secure the appointment of Sam Randazzo, an industry lobbyist, to the state’s PUC (Zuckerman, 2022). After donating $1 million to DeWine’s election, FirstEnergy executives dined with DeWine to encourage Randazzo’s appointment, which DeWine pushed through contentious legislative confirmation (Zuckerman, 2022; Bischoff, 2021).

These examples illustrate how utilities employ lobbying and campaign contributions to exploit the mechanisms of control that politicians exert over PUCs to achieve higher profits. Importantly, although empirical evidence is limited, several empirical analyses have demonstrated that campaign contributions can shift regulatory policy in the industry’s favor, substantiating these watchdog reports (Gordon and Hafer, 2005; de Figueiredo Jr and Edwards, 2007; Stratmann and Monaghan, 2017). Several studies also find that firms strategically contribute to politicians to influence regulatory policy (Holburn and Vanden Bergh, 2008, 2014; de Figueiredo Jr and Edwards, 2016; Fremeth et al., 2016). The sum of this evidence suggests that utilities employ indirect methods, such as contributing to politicians, to capture the PUC and secure high rates of return. Next, I relate this conceptual framework to my empirical setting and develop four hypotheses to test empirically.

2.1 Hypothesis Development

I begin by presenting a framework, developed by Carpenter and Moss (2013), that provides a rigorous standard for detecting regulatory capture. To detect capture, Carpenter and Moss argue that one must (1) “provide a defeasible model of the public interest,” (2) “show a policy shift away from the public interest and toward industry interest,” and (3) “show action and intent by the industry in pursuit of the policy shift sufficiently effective to have plausibly caused an appreciable part of the shift” (Carpenter and Moss, 2013, p. 15). I use these criteria to analyze regulatory capture within the conceptual framework described earlier.

First, consider a regulatory environment similar to the environment depicted in Figure 1 but modified such that extant legislation restricts utility campaign contributions to politicians. Utilities can attempt to influence PUCs directly, but restrictions on indirect influence through politicians allows PUCs to adjudicate regulatory outcomes without industry-serving political influence. Politicians require public support for reelection, which can be acquired by implementing public-serving policies and spending campaign funds on advertisements. Lacking the ability to provide politicians campaign resources, the industry’s ability to influence PUCs is blunted. Consequently, when campaign contributions are prohibited, politicians will encourage the PUC to serve the public interest.

Because regulatory capture exists on a spectrum between regulation that serves the industry’s interest and the public interest, it is unreasonable to expect that PUCs in this setting authorize low rates of return in sole service of the public interest. PUCs in this environment are still susceptible to both political and industry influence. This restriction on utility influence over politicians, however, alters PUCs objective function toward serving the public interest. Consequently, PUCs in this environment authorize rates of return relatively closer to the lower-bound rate of return serving the public interest.

Next, consider a second regulatory environment where there are no legislative restrictions on utility campaign contributions. In this environment, utilities maximize profits without constraints on their influence over politicians. Opening this floodgate affords them the opportunity to appreciably increase their influence over politicians, which increases the industry’s ability to capture the PUC. In pursuit of higher profits, utilities will exercise this influence by increasing campaign contributions to politicians. If regulatory policy has low salience for voters, this implicit bribe provides an incentive for politicians, who value campaign resources, to exert political pressure over PUCs in service of the industry’s interest (Besley and Coate, 2003). Consequently, a PUC in this environment will authorize a higher rate of return closer to the utility’s profit-maximizing rate.

Hypothesis 1a: Lifting legislative restrictions on campaign contributions will lead to an increase in campaign contributions.

Hypothesis 1b: Lifting legislative restrictions on campaign contributions will lead to an increase in the authorized rate of return.

Of course, in reality each state offers a unique regulatory environment, which provides an opportunity to test for the mechanisms of political influence that limit or facilitate regulatory capture. One mechanism of policy interest is whether legislative limits on campaign contributions can effectively limit capture. Consider a third regulatory environment with caps on campaign contributions. This regulatory environment permits utilities to contribute to politicians but limits the amount that can be contributed. In this environment, utility influence over politicians is reduced, thereby increasing PUC resilience to capture.

Hypothesis 2a: Capping utility campaign contributions will effectively reduce campaign contributions.

Hypothesis 2b: Capping utility contributions will result in more consumer-friendly rates of return.

Another mechanism of policy importance is the selection process of PUC regulators. A key mechanism of control that politicians exert over the PUC is the ability to replace commissioners through the appointment process. As regulators value career prospects, this legislative tool allows politicians to influence regulators through job offers or threats of replacement. Alternatively, if PUC regulators are elected by the public, politicians’ influence over PUCs is reduced. Utilities may contribute to politicians to shape legislation, but opportunities for indirect influence over the authorized rate of return are dampened. Consequently, elected regulators will be more insulated from regulatory capture (Besley and Coate, 2003).

Hypothesis 3a: Utilities will contribute more to politicians in environments where politicians appoint regulators when legislative restrictions on campaign contributions are lifted.

Hypothesis 3b: Appointed regulators will approve higher rates of return than elected regulators when legislative restrictions on campaign contributions are lifted.

Last, regulatory environments may also differ by the regulatory preferences of politicians. Consider an environment where politicians hold heterogeneous preferences regarding the authorized rate of return such that consumer-friendly politicians prefer a low rate of return, while industry-friendly politicians prefer a high rate of return. Utilities, aware of these preferences, strategically contribute to each group to exert indirect influence. Because consumer-friendly politicians are averse to utility interests, utilities’ cost to influence these politicians will be greater than the cost to influence friendly politicians (Denzau and Munger, 1986; Snyder Jr, 1991). Further, utilities have more to gain from influencing consumer-friendly politicians, as industry-friendly politicians already influence the PUC in the utility’s interest.

Hypothesis 4a: Utilities will contribute more to marginally hostile politicians than to friendly politicians when legislative restrictions on campaign contributions are lifted.

Hypothesis 4b: Marginally hostile politicians will further deviate from their preferred policy than friendly politicians when legislative restrictions on campaign contributions are lifted.

3 Background

3.1 The PUHCA

The PUHCA was enacted during the second wave of New Deal reforms to curb the abuses of the 19 holding companies that owned 90 percent of the electric utility industry at that time (Fund et al., 1948). Its primary purpose was to break up large gas and electric utility monopolies by requiring holding companies to either limit their operations to a single state or contiguous geographic region (“exempt companies”) or continue operations across noncontiguous geographic regions (“regulated companies”) but subject themselves to additional regulations enforced by the Securities and Exchange Commission (SEC) (Feldman, 2021). Accordingly, companies that elected to be regulated by the PUHCA could operate across multiple states or noncontiguous geographic regions but at the expense of compliance costs associated with the PUHCA’s regulations.

By the 1950s, every holding company had completed this reorganization (Kent and Kent, 1993). The focus of this study is on the regulated companies subject to further SEC regulation, while exempt companies serve as a placebo group. Feldman (2021) identifies four key regulations in the PUHCA that restricted regulated holding companies from engaging in several standard business practices. First, regulated holding companies required SEC approval before acquiring other utilities or non-utility businesses. Second, regulated holding companies were prohibited from transferring funds with their subsidiaries in the form of loans or dividends. Third, regulated holding companies were barred from providing centralized services for their subsidiaries. Fourth, regulated holding companies required SEC approval to sell new securities or exercise rights in current securities (Feldman, 2021).

A lesser-known provision of the PUHCA prohibited regulated holding companies and their operating companies from using corporate funds to contribute to any local, state, or federal campaign. Specifically, the PUHCA rendered it “unlawful for any registered holding company, or any subsidiary company thereof” to contribute to the following: (1) “the candidacy, nomination, election or appointment of any person for or to any office or position in the Government of the United States, a State, or any political subdivision of a state” and “any political party or any committee or agency thereof.”1Public Utility Holding Company Act of 1935 § 12 (h), 15 U.S.C. § 79l(h) (1935) (repealed 2005).

Contending that the PUHCA succeeded in reorganizing the industry and continued regulation hampered growth, electric utilities lobbied for 70 years for the PUHCA’s repeal, gaining the SEC’s support for deregulation in 1981 (Bowsher, 1983; Thakar, 2008). The US General Accounting Office produced a report in 1983 analyzing the SEC’s recommendation and identifying potential regulatory gaps that would occur with the PUHCA’s repeal, but it overlooked the potential political power that repeal would award utilities (Bowsher, 1983). Further, analysis from the Congressional Research Service and articles from both the New York Times and the Wall Street Journal in 2005 emphasizes the potential market consolidation that could result from the PUHCA’s repeal but similarly overlooks the implications of legalizing utility political contributions (Stoffer, 2005; Smith, 2005; Vann, 2006). The PUHCA was ultimately repealed with the enactment of the Energy Policy Act of 2005. With public discourse focused on the looming wave of M&As, the impact of the PUHCA’s repeal on utility campaign contributions never surfaced prominently in public debate.

3.2 Campaign Finance Regulation

The federal intervention in state campaign finance laws that the PUHCA imposed was unprecedented. While the Tillman Act of 1907 prohibited corporations from contributing corporate treasury funds to federal campaigns, it allowed states to retain regulatory authority over state elections (Mutch, 2014). Between 1907 and 1917, 36 states enacted legislation prohibiting corporations from contributing to state political campaigns (Sikes, 1928). Although the majority of these states still maintain this prohibition, 17 subsequently legalized corporate campaign contributions, with the majority of legalization occurring in the 1960s and 1970s La Raja and Schaffner (2015). These regulations notably do not prohibit corporations from using treasury funds to administer corporate PACs, which consolidate individual donations from employees and shareholders to contribute to preferred political candidates.

During the 70 years that the PUHCA was in effect, regulated holding companies and their subsidiaries could not use treasury funds to contribute to politicians and political parties at the state level regardless of a state’s campaign finance regulations. When the PUHCA was repealed in 2005, regulated holding companies and their subsidiaries operating in the 30 treated states that allow corporate contributions to either politicians or political parties could legally contribute directly from the corporate treasury funds. In contrast, in the remaining 20 control states, regulated holding companies and their subsidiaries continued to be barred from the practice. Notably, the PUHCA’s repeal had no effect on the industry’s ability to contribute using corporate PACs, which is legal in every state throughout this period of study.

3.3 State PUCs

Electric utility companies are regulated at the state level by PUCs, which are regulatory agencies mandated to ensure reliable service at reasonable rates. PUCs set electric utility rates using a hybrid system of rate of return regulation and price-cap regulation in a quasi-judicial process known as a “rate case.” During a rate case, utilities petition PUCs for reimbursement of costs incurred providing service, along with a fair rate of return on capital assets deemed used and useful. Electricity rates are then capped until the utility’s next rate case proceeding, which occurs every four years, on average.

Electric utilities finance their capital-intensive production processes through long-term debt and common equity. While the cost of debt is contractually known, the ROE must be estimated using a variety of financial models and assumptions. Two Supreme Court cases provide the foundation for the subjective regulatory standards used by PUCs across the United States to estimate ROE. First, the Court found that a “just and reasonable” return on shareholders’ investments should be “sufficient to assure confidence in the financial soundness of the utility, and should be adequate, under efficient and economical management, to maintain and support its credit and enable it to raise the money necessary for the proper discharge of its public duties” (Bluefield Co. v. Pub. Serv. Comm., 1923, p. 693). Second, the Court determined that “the return on equity owner should be commensurate with returns on investments in other enterprises having corresponding risks,” and PUCs should not be “bound to the use of any single formula or combination of formulas in determining rates” (Accord FPC v. Hope Natural Gas Company, 1944, p. 602–603). The Court’s decisions engendered a subjective regulatory framework for state PUCs. The level of subjectivity involved in its determination, combined with its significant influence on firm profitability and consumer surplus, makes ROE arguably the most contentious and scrutinized component of a rate case.

PUC regulators cite expert testimony and asset pricing model results when establishing an authorized ROE in a rate case order,2See Application 19-04-014, where Pacific Gas and Electric lobbied California’s PUC for a 12 percent ROE, while California’s consumer advocacy group, Cal Advocates, lobbied for a 8.49 percent ROE, both citing results from financial models. The PUC split the difference, authorizing a 10.25 percent ROE. but empirical evidence indicates that PUCs establish ROEs significantly higher than what finance models predict (Rode and Fischbeck, 2019; Azgad-Tromer and Talley, 2017; Werner and Jarvis, 2022). Political influence over PUCs may explain this discrepancy. For example, Lim and Yurukoglu (2018) find a positive correlation between Republican regulators and authorized ROEs. Further, in the vast majority of states, the governor nominates, and the state legislature confirms, each PUC regulator, a structure that may leave PUC regulators vulnerable to politicians’ influence. However, the extent of political influence over the rate case process has not been thoroughly investigated empirically.

4 Data

4.1 Political Contributions and Campaign Finance Law

I develop a novel data set of electric utility campaign contributions using the National Institute on Money in Politics’s followthemoney.org, which compiles state campaign finance reports. The data set identifies electric utility campaign contributions to state-level candidates and political parties for each state for the years 2000–2015. Because operating companies and their holding companies may separately contribute, I aggregate all contributions to the holding company level by year and state, resulting in a holding company by year of contribution panel structure within each state.

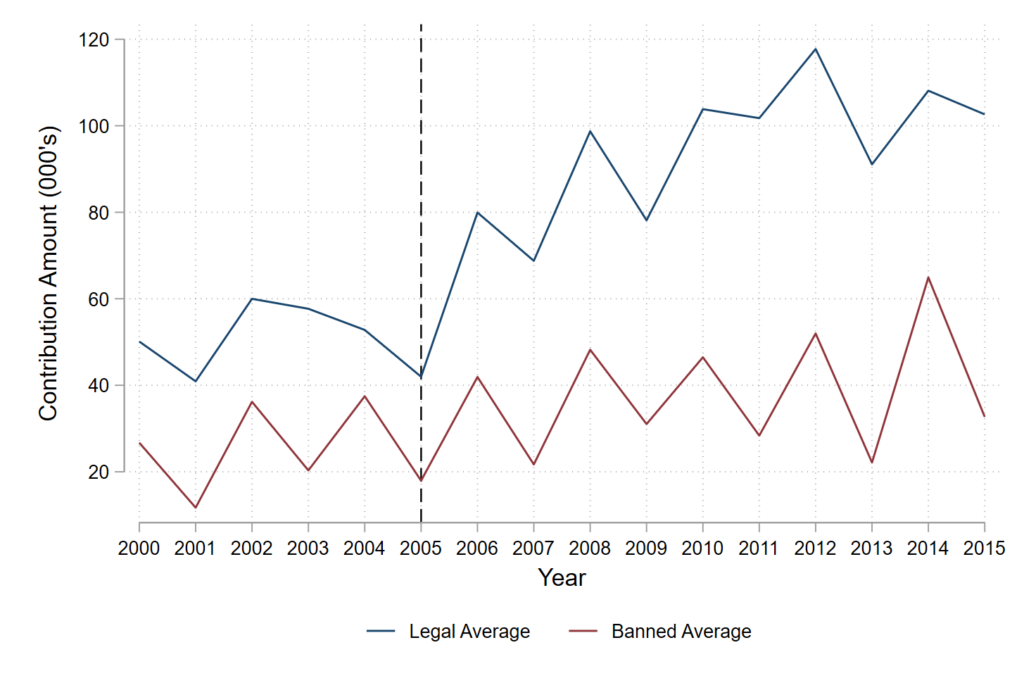

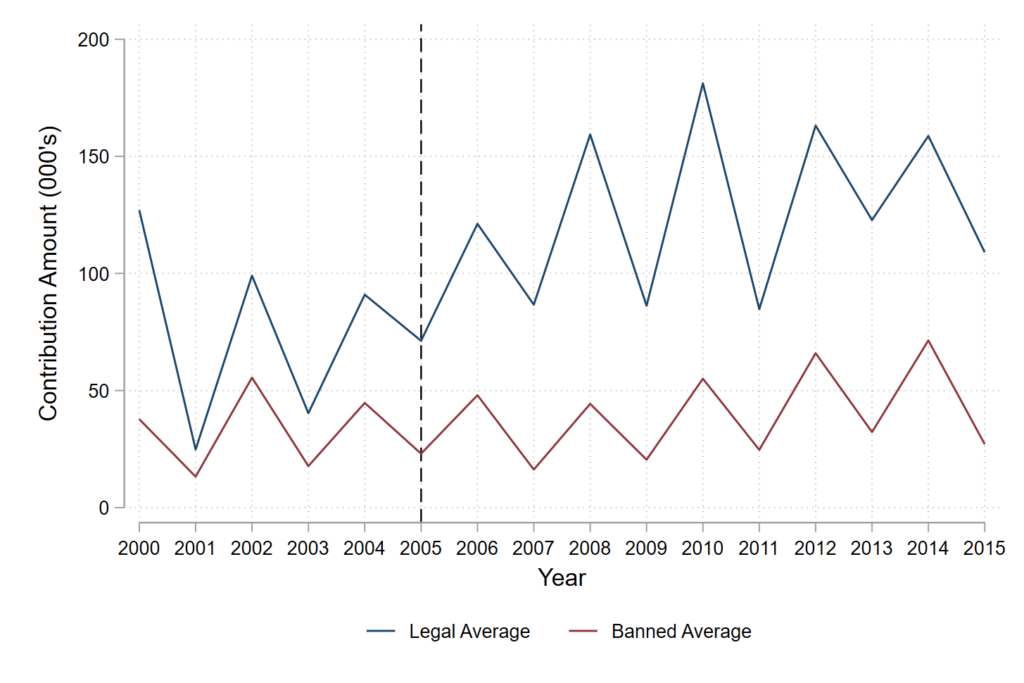

The data do not distinguish between contributions from a utility’s treasury and contributions from a utility’s corporate PAC. Notably, the PUHCA’s repeal only legalized direct contributions from a utility’s treasury. While I use aggregate contributions in my analysis, I attribute the relative increase in contributions by treated utilities to contributions from the corporate treasury. To illustrate, consider Figure 2, which depicts average campaign contributions within a state per holding company in treatment and control groups. In the pre-treatment period, 2000–2005, contributions in both groups solely originate from corporate PACs. In the post-treatment period, 2006–2015, contributions in the control group remains solely from corporate PACs, while in the treatment group contributions may flow from both PACs and treasury funds.

Figure 2. Average Regulated Electric Utility Campaign Contributions, 2000–2015

Average electric utility campaign contributions from regulated holding companies and their subsidiaries to state-level politicians and political parties per state, 2000–2015. The vertical dotted line in 2005 represents the PUHCA’s repeal. The legal group includes treated states where corporate contributions from the treasury are legal. The banned group includes control states where corporate contributions from the treasury are prohibited.

While it is likely that treated utilities reallocate political funding sources in response to the PUHCA’s repeal, data limitations restrict analysis to aggregate contributions from both sources. However, it is unlikely that treated utilities increase contributions from corporate PACs upon the legalization of direct contributions from treasury funds. It is far more likely that utilities substitute funding sources away from their PACs and toward their treasury in response to the repeal. I therefore interpret the relative increase in aggregate contributions from treated utilities as a lower-bound estimate of contributions from treasury funds.

These data do distinguish between contributions to political parties (party contributions) and to political candidates (candidate contributions). Within each category, I identify contributions by political party. For candidate contributions, I identify contributions to candidates for governor, house, and senate and sum these totals for an aggregate measure of candidate contributions. Last, these data identify whether a candidate wins or loses, allowing me to create an aggregate measure of contributions to winning candidates and losing candidates.

To define treatment and control groups, I use state campaign finance regulation data from the National Institute on Money in Politics’s Campaign Finance Institute, which provides the limitations on corporate spending in state elections from 1996 to 2018. Specifically, these data identify states that prohibit corporate contributions, states that allow unlimited corporate contributions, states that limit corporate contributions, and the value of these limitations.

There are two categories of treatment groups relevant to my analysis, as state laws governing corporate contributions distinguish between contributions to candidates and contributions to political parties. Although treatment assignment is invariant for the majority of states between 2000 and 2015, four states pass campaign finance regulation during this period, altering their treatment statuses. To minimize concerns of endogenous selection into treatment, I drop observations for each of these states such that treatment assignment is invariant.3I drop observations before 2004 for Alaska and Colorado and after 2011 for Tennessee and Wyoming.

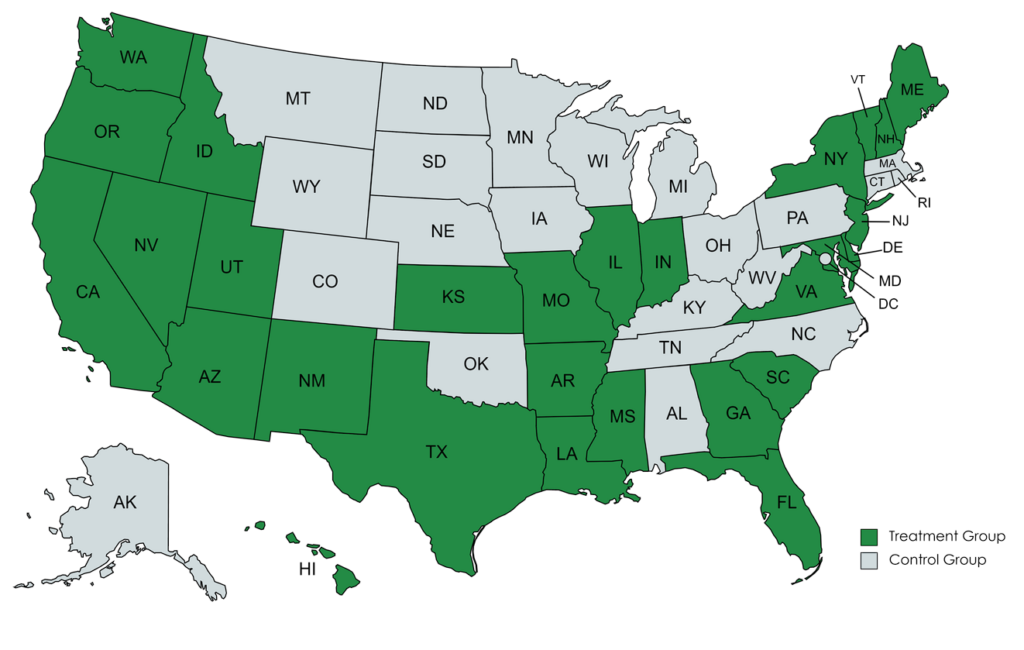

Figure 3 presents a map of the United States indicating each state’s treatment group. Treated states and control states are depicted in green and gray, respectively. Although there is some spatial clustering of treatment status, there is significant variation in treatment assignment within US census regions. There is also significant variation in treatment assignment between conservative and liberal states. I demonstrate in the Appendix that a state’s political preference is uncorrelated with its treatment assignment.

Figure 3. State Laws Regulating Corporate Campaign Contributions, 2000–2015

The treatment group includes states that allow direct corporate contributions to either candidates or political parties. The control group prohibits all direct corporate contributions.

Last, to control for years where an election occurs, I use Carl Karner’s state legislative election returns data set and governors data set (Klarner, 2013, 2018). I measure contribution data annually and input zeros for the years when no sums were contributed. When the data are aggregated (e.g., total candidate contributions), I control for the election year using a binary variable equal to one if either a house, senate, or gubernatorial election occurred. When the data are segmented by contributions to house, senate, and governor, I control for the election years associated with each specific seat category.

4.2 Electric Utilities and Regulatory Outcomes

Electric utility holding companies were either subject to the PUHCA’s regulations and regulated by the SEC (“regulated”) or exempt from their regulations (“exempt”). I restrict my analysis to regulated holding companies as identified by the SEC (Secuirty and Exchange Commission, 2004).4The SEC list, compiled in 2004, is available at “Holding Companies Registered Under the Public Utility Holding Company Act of 1935,” https://www.sec.gov/divisions/investment/opur/regpucacompanies.htm. Exempt holding companies serve as a placebo group. I corroborate this information with the annual filings that regulated holding companies were required to submit to the SEC via Form U5A. Holding companies sorted into exempt and regulated groups after the PUHCA’s implementation in the 1950s and have remained stable in these groups since (Feldman, 2021).5Two holding companies, Black Hills Corp. and PNM Resources, registered with the SEC only days before the SEC’s online list was compiled, and they never filed an annual report demonstrating compliance with the PUHCA’s regulations. As the PUHCA was repealed in 2005, the latest annual reports showing compliance covered the year 2004, before Black Hills Corp. and PNM Resources were registered. Accordingly, I define these utilities as exempt. See Appendix Table 1 for a list of regulated and exempt holding companies.

Because an operating company within a state may experience several changes in parent holding companies throughout the sample period, I track holding company ownership by researching corporate histories on each utility’s website. I assign an operating company a new holding company if the operating company was acquired by a new holding company or if its holding company merged with another holding company to create a new company. As one of the PUHCA’s primary mandates was to restrict utility size and prevent M&As, its repeal opened the door to industry consolidation for both regulated and exempt holding companies. As a result, an operating company owned by an exempt holding company in 2005 may be owned by a regulated holding company in 2008 and therefore was never subject to the PUHCA’s campaign finance restrictions. I therefore define an operating company as regulated if it was owned by a regulated holding company in 2004. The resulting number of regulated and exempt operating companies is 85 and 72, respectively.

The regulatory outcome of interest is the ROEs authorized by state PUCs during rate case proceedings. These data come from Regulatory Research Associates, a group within S&P Global. A utility files a rate case every four years, on average, resulting in an unbalanced panel of authorized ROE observations. To control for the time-varying economic conditions specific to holding companies, I obtain each company’s beta coefficient, a measure of firm risk and a key determinant of ROE,6The beta coefficient is a component of the capital asset pricing model (CAPM), a financial model PUCs typically employ to determine ROE. from Wharton Research Data Service’s Beta Suite. I consider several time-varying economic and political controls in this analysis. First, I control for citizen and government ideology in each state over time using measures developed by Berry et al. (1998) and updated by Richard C. Fording (Fording, 2018). These measures range from a value of 0, the most conservative value, to 100, the most liberal one. Second, I control for political party affiliation of a state’s house, senate, and governor (Klarner, 2013, 2018). I obtain data on commissioner party affiliation and number of commissioners from Michigan State’s Institute of Public Utilities to calculate the party in majority control of a PUC for each state and year (Institute of Public Utilities, 2020).

Last, I control for time-varying economic characteristics for each state. The percentage of manufacturing jobs in a state proxies for industry pressure, as manufacturers are high energy consumers and therefore have a significant interest in lobbying for lower rates. The percentage of utility jobs in a state proxies for utility influence in a state and is expected to increase with authorized ROE. I obtain both variables from the Bureau of Labor Statistics (BLS). I also control for a state’s unemployment rate, obtained from the BLS, and the annual percentage change in per capita income in each state, obtained from the St. Louis Federal Reserve, to proxy for consumer pressure for lower utility rates. Table 1 provides descriptive statistics for each variable in this analysis.

5 Empirical Strategy

5.1 Empirical Setting

I employ a DiD identification strategy to compare regulatory policy in states with varying degrees of restrictions on the industry’s ability to influence politicians. My identification strategy exploits the PUHCA’s repeal, a shock that legalized direct electric utility campaign contributions in a plausibly random subset of states. For 70 years, the PUHCA prohibited regulated electric utility holding companies and their subsidiaries from contributing to political parties and candidates from their corporate treasuries. As previously mentioned, this repeal in 2005 opened the door for campaign contributions in 30 treated states where state campaign finance regulations already allowed such contributions. This advantageous empirical setting provides an opportunity to test for the relationship between utility campaign contributions and regulatory capture.

Because regulatory capture exists on a spectrum between regulation that serves either the industry’s interest or the public interest, I do not claim that PUCs operate solely in the public interest. Further, provided the range of ROE estimates that various financial models produce, I do not argue for a particular ROE that serves the public’s interest. Instead, I argue that PUCs in treatment and control groups operated on similar points in this spectrum before the repeal. I provide support for this criterion by demonstrating that PUCs in treatment and control groups authorized similar ROEs in the years before the repeal. This finding also supports the DiD assumption of parallel trends.

I next provide evidence that the regulatory policy of treated PUCs shifted away from the public interest and toward the industry’s interest upon campaign contributions being legalized. This claim requires a clear definition of authorized ROE that serves the public and the industry’s interest. ROE is typically bounded within a floor. Authorized ROEs lower than the floor harm the public interest by inducing low capital investments and poor service quality. Conversely, a ceiling is set such that authorized ROEs exceeding the ceiling harm the industry’s interest by reducing profits. Within these bounds, it is reasonable to assume that lower ROEs serve the public interest and higher ROEs serve the industry’s interest. This assumption is supported by the lower ROEs recommended by consumer advocates during rate cases and the moderating impact of consumer advocates on authorized ROEs (Holburn and Spiller, 2002; Holburn and Bergh, 2006; Fremeth et al., 2014). An increase in authorized ROE in treated states after the PUHCA’s repeal indicates a shift in regulatory policy away from the public interest and toward the industry’s interests. A positive average treatment effect on the treated (ATT) supports my contention that campaign contribution legalization contributes to regulatory capture.

5.2 Estimating Equation

I employ the following DiD identification strategy:

(1)

where denotes the outcome of interest for company

in state

and year

.

is an indicator variable equal to one if year

is greater than 2005, the year the PUHCA was repealed.

is an indicator variable equal to one if utility

operates in a state

that allows direct corporate contributions to candidates or parties. The parameter of interest,

, is the coefficient of the interaction term

. This coefficient captures the ATT, the average impact of legalizing campaign contributions on authorized ROE.

I control for the time-varying economic and political conditions of each state, designated by the variable . Controls include senate, house, PUC and governor party control, citizen and institution ideology, state-level unemployment rates, change in per capita income, share of manufacturing and utility jobs in the state, and the holding company's CAPM beta. Year fixed effects,

, allow me to control for the economic and political characteristics common to all states and companies in year

. State fixed effects,

, allow me to control for each state's time-invariant characteristics, such as institutional quality of the PUC and the state's political and business culture. I cluster these standard errors by state to address correlations caused by treatment at the state level (Abadie et al., 2017).

Critically, identification requires random assignment of the treatment. If states pass legislation to either legalize or prohibit corporate campaign contributions, ATT estimates may be biased due to endogenous selection into or out of treatment. The institutional characteristics of campaign finance regulation provide credible evidence that this form of endogeneity is minimal. Specifically, states first sorted into treatment and control groups during the Progressive Era and have remained relatively stable in these groups since the 1970s (La Raja and Schaffner, 2015). Four states switch between treatment and control groups between 2000 and 2015, the sample period of the analysis. I drop observations before 2004 for Alaska and Colorado and after 2011 for Tennessee and Wyoming such that the composition of treatment groups remains invariant.

Random assignment of the treatment is further supported by the plausibly exogenous effect of the PUHCA’s repeal on state-level electric utility campaign finance regulation. Notably, the PUHCA’s primary mandate was to restrict utility monopoly power by increasing barriers for M&A activity. The campaign finance regulations became an overlooked aspect of the repeal. In their reports analyzing potential consequences of the repeal, both the General Accounting Office and the Congressional Research Service overlooked the implications for utility campaign contributions (Bowsher, 1983; Vann, 2006). As the primary debate surrounding the merits of the PUHCA and the consequences of the repeal centered around industry consolidation, the legalization of electric utility campaign contributions in 30 states was largely an unintended consequence.

This identification strategy also relies on the assumption that selection into the sample is uncorrelated with the treatment. This is a strong assumption since rate cases are nonrandom events that occur at the PUC’s or utility’s discretion. The timing of a rate case depends on several factors, including the change in the costs of operations since the company last filed a rate case, and the state’s current political climate (Fremeth et al., 2014). For each company , I only observe a new value for ROE when a rate case is authorized in year

, resulting in an unbalanced panel with nonrandom selection. Therefore, selection into the sample could bias results if treated utilities are more likely to file a rate case after legalization. I demonstrate that selection into the sample is uncorrelated with the treatment in Appendix Table 3.

Last, credible DiD estimates require that utilities in treatment and control groups are comparable such that authorized ROE in treatment and control groups would continue to trend similarly in absence of treatment. I provide evidence that the parallel trends condition is satisfied in Section 6.1.1.

6 Main Results

I begin this analysis by estimating the effect of legalizing direct electric utility campaign contributions on authorized ROE. This reduced-form analysis provides evidence that lifting restrictions to utility influence over politicians contributes to pro-industry regulatory outcomes, but it is insufficient to prove that affected PUCs are captured by industry. To demonstrate that utilities exercised their newfound prerogative to influence politicians, I next estimate the effect of legalization on the total campaign contributions employed. Last, to probe whether campaign contributions are targeted to influence the rate case process, I test if utilities increase contributions in the years PUCs establish new rates. Together, the results presented in this section suggest that granting utilities an increased ability to influence politicians can contribute to PUC capture.

6.1 Return on Equity

To understand how easing restrictions on utilities’ political contributions may contribute to regulatory capture, I first establish the relationship between legalization and authorized ROE, the key regulatory outcome for electric utilities. I begin with an event study to demonstrate parallel trends in authorized ROEs between treatment and control groups in the pre-treatment period and dynamic effects of legalization in the post-treatment period. I then provide summary measures of the treatment effect from estimating equation 1 and demonstrate that these results are robust to a variety of alternate specifications.

6.1.1 Event Study

In this section, I test for parallel trends and explore dynamic treatment effects. I estimate an event study modification of equation (1), which estimates coefficients for the average difference in authorized ROEs between treatment and control groups for the years 2000–2015, each relative to 2005. Specifically, I estimate the following equation:

(2)

is an indicator for each year

(other than 2005). The omitted year in this estimation is 2005, the year before the legalization of campaign contributions in treated states.

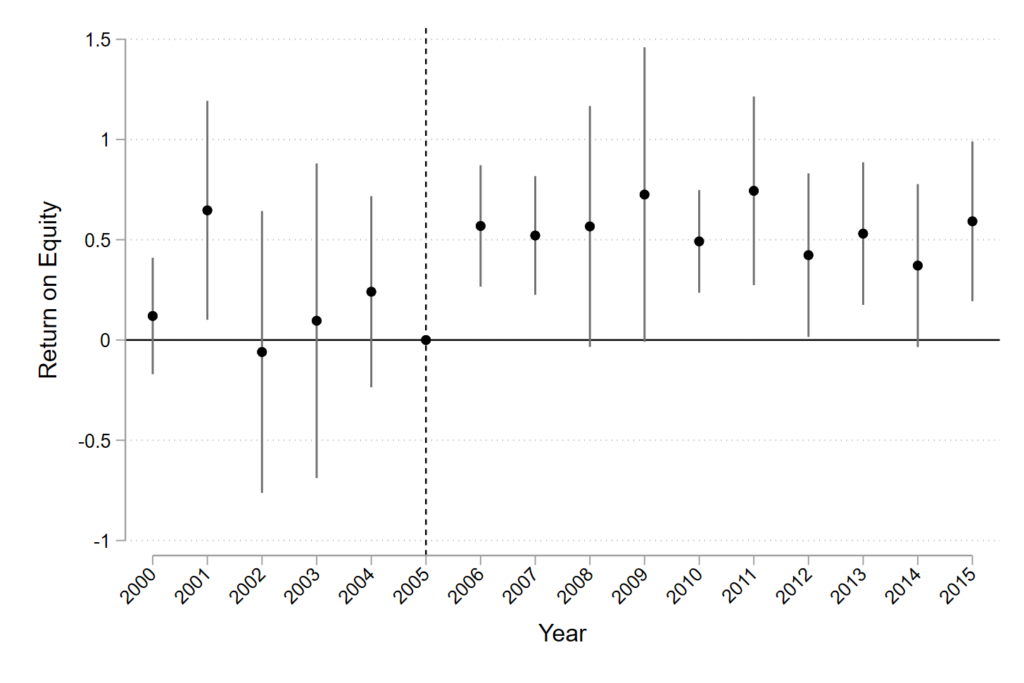

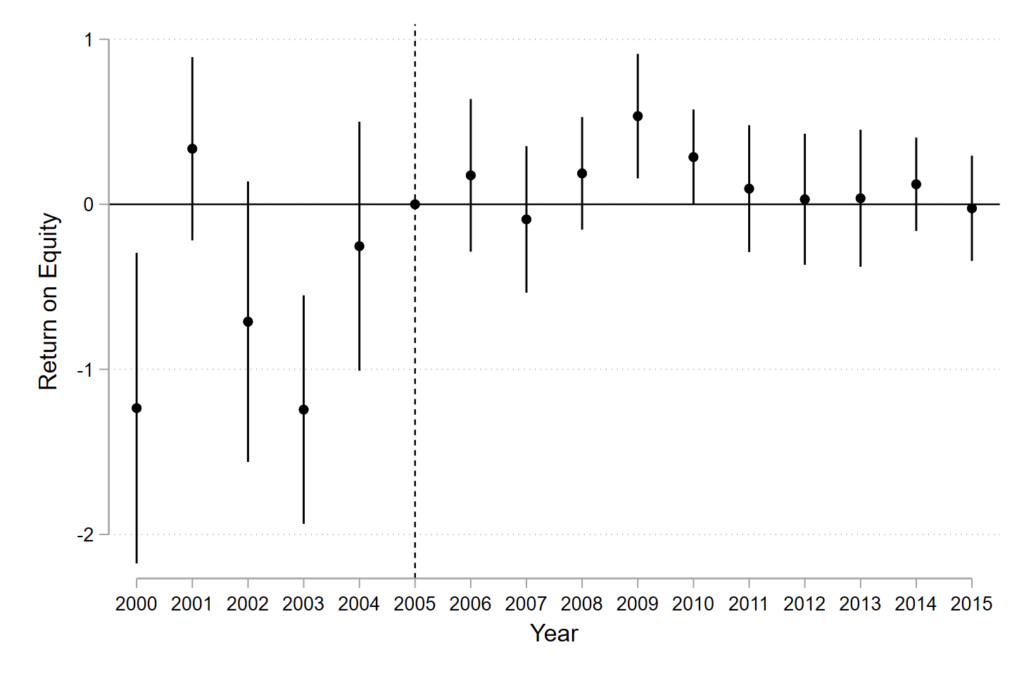

Figure 3 plots coefficient estimates for the difference in authorized ROE between treatment and control groups, along with 95 percent confidence intervals. The vertical dotted line represents the PUHCA’s repeal in 2005. The figure indicates that average authorized ROE in treatment and control groups trend similarly before the PUHCA’s repeal, providing support for parallel trends. Of five years in the pre-treatment period, only the coefficient for the year 2001 is statistically significant. This result likely reflects the small sample size for this year, as indicated in Appendix Figure 3.

Figure 4. ROE Event Study

Event study coefficients and 95 percent confidence intervals from estimating equation 2. Each coefficient estimates the average difference in authorized ROEs between treatment and control groups, relative to 2005, the year before treatment. Standard errors are clustered by state and year.

In contrast, there is a noticeable increase in authorized ROEs in the treatment group, relative to the control group, starting in 2006, the first year after treatment. Every coefficient estimate in the post-treatment period is positive, and the majority are statistically significantly different from zero. With such a stark discontinuity after 2005, these estimates suggest that easing restrictions to utility political influence significantly strengthens utilities’ ability to capture regulators and secure favorable regulatory outcomes.

To further probe the pre-treatment balance of observables between treatment and control groups, Appendix Table 2 provides mean values for each outcome and control variable for treatment and control groups for the period 2000–2005. The results indicate that treatment and control groups were remarkably similar in the pre-treatment period, only differing slightly on the political alignment of the PUC and manufacturing intensity in the state. This evidence strengthens the contention that treatment and control groups are comparable in the pre-treatment period and further supports the assumption that the two groups would have trended similarly absent the PUHCA’s repeal.

6.1.2 Difference-in-Differences

I now provide summary estimates of the effect of legalizing utility campaign contributions on authorized ROE. Table 2 reports the results from estimating equation 1 as well as several robustness checks. I report standard errors clustered by state and by state and year to account for probable correlation between residuals across time and states, as is commonly done in the finance literature (Thompson, 2011).

Model 1 controls for state and year fixed effects and indicates an ATT of 0.4 percentage points. Model 2 includes a battery of political controls, including party affiliations of the PUC and its state government principals, citizen ideological leanings, and time-varying economic controls. The economic controls include state-level unemployment rates, change in per capita income, and the holding company's CAPM beta. The controls serve to increase the precision of the ATT estimate and demonstrate that my parameter of interest, , is not biased due to endogenous correlation with relevant observables.

Models 3 and 4 replicate Models 1 and 2, respectively, but further control for time-invariant differences between holding companies, such as stable risk profiles and access to capital markets. The main results are robust to this important consideration. The primary objective of utility lobbying for the PUHCA’s repeal was not to legalize campaign contributions for a subset of utilities but rather to allow all utilities to engage in M&A activity. Consequently, ownership over operating companies varies within states over this sample period. This change in ownership raises the possibility that PUCs in legal states authorize relatively higher ROEs due to the new and riskier holding company ownership of operating companies within the state rather than as a result of increased political pressure. The robustness of the ATT to including holding company fixed effects in Models 3 and 4 suggests that the increased M&A activity resulting from the PUHCA’s repeal cannot explain the pro-industry ROEs authorized in legal states.

I provide three additional robustness checks in the Appendix. First, to further probe the potential that M&A activity is biasing these results, I test whether operating companies in treated states are more likely to receive a new parent than in control states. To execute this test, I estimate a linear probability model by replacing the dependent variable in equation (1) with a binary indicator equal to one in the years when an operating company receives new ownership. The results, presented in Table 4, suggest that operating companies in legal states are no more likely to receive new ownership than in control states.

Second, rate cases are nonrandom events typically instigated by the utility (Fremeth and Holburn, 2012). ATT estimates in Table 2 are biased if selection into the rate case process is correlated with campaign contribution legalization. To demonstrate that selection bias does not contaminate these findings, I replace the dependent variable in equation (1) with a binary indicator for selection into the sample. The results, presented in Table 3, show that utilities in legal states are not significantly more likely to initiate a rate case proceeding. Although this finding may be counterintuitive, there are numerous considerations that determine a utility’s decision to file a rate case. Further, utilities may delay rate negotiations to preserve existing high rates, as demonstrated in the recent Ohio bribery scandal in which FirstEnergy sought to delay a rate review (United States District Court, Southern District of Ohio, Western Division, 2021).7United State of America, Plaintiff, vs. FirstEnergy Corp., Defendant. (2021, July 20) https://www.sec.gov/Archives/edgar/data/1031296/000103129621000071/ex101-8k7x22x21.htm.

Last, I conduct a placebo test using the group of utilities that the SEC exempted from the PUHCA’s regulations. Exempt utilities operating in legal states could make direct political contributions throughout this period of analysis. As a result, the PUHCA’s repeal has no effect on exempt utilities’ ability to influence politicians. On average, exempt utilities are smaller than regulated utilities and, as such, may not be directly comparable. Further, exempt utilities operating in the same treated state as regulated utilities may benefit from positive spillover effects of regulated utilities’ increased political influence. Nevertheless, I conduct an event study restricted to exempt utilities to compare them operating in treated states with those operating in control states. The results, presented in Figure 2, indicate that exempt utilities in treated states do not systematically benefit from higher authorized ROEs after the repeal.

These findings suggest that utilities can exercise increased political influence to achieve higher authorized rates of return, providing support for Hypothesis 1b. Further, these results stand in stark contrast with Lim and Yurukoglu (2018), who do not consider the campaign finance restrictions that the PUHCA imposed and find no correlation between a state’s campaign finance laws and authorized ROE. These results also differ from previous work finding no effect of relaxed campaign finance laws on regulatory outcomes in the insurance industry (Fouirnaies and Fowler, 2021). Last, the treatment effect estimates are economically meaningful. Assuming an average utility rate base of $2 billion, an increase in ROE of 0.4 percentage points increases authorized returns by approximately $4 million annually.8The estimate assumes financing with 50 percent debt, 50 percent equity. Increased return . Next, I demonstrate that utilities exercised this increased opportunity for political influence in an attempt to achieve higher rates of return.

6.2 Campaign Contributions

Following the criteria developed by Carpenter and Moss (2013) for detecting regulatory capture, evidence of a shift in regulatory policy toward the industry’s interest alone is insufficient to credibly claim that the regulatory agency is captured. This policy shift must coincide with industry efforts to shape regulatory policy in its favor. In this section, I demonstrate that treated utilities increase their campaign contributions in an attempt to influence regulatory policy in their favor.

Table 3 presents the results from estimating equation 1 with electric utility campaign contributions

as the outcome of interest. The dependent variable in Models 1 and 2 is total contributions to parties and candidates combined, while Models 3–4 and Models 5–6 analyze contributions to political parties and individual candidates, respectively. All models control for state, holding company, and year fixed effects as well as election year dummies. Models 2, 4, and 6 further control for the economic and political variables previously discussed. I present standard errors clustered by either state or holding company.

Models 1 and 2 indicate that annual total utility campaign contributions increase by approximately

$46,000, on average, as a result of legalization. Models 3–6 demonstrate that this significant increase is driven by contributions to both political party PACs and individual candidates. These results provide support for Hypothesis 1a, which states that utilities will increase efforts to influence politicians provided the additional legal opportunity to do so. To correctly interpret these findings, it is important to acknowledge that I cannot distinguish between contributions from utility PACs and those from the treasury in the dependent variables of this analysis. While legalization may prompt utilities to reallocate the source of their contributions, I find a strong causal effect of legalizing direct corporate campaign contributions on the total level of campaign contributions from corporate PACs and treasuries. This finding suggests that utilities operating in control states are constrained by their sole reliance on corporate PACs and would contribute more if these restrictions were relaxed.

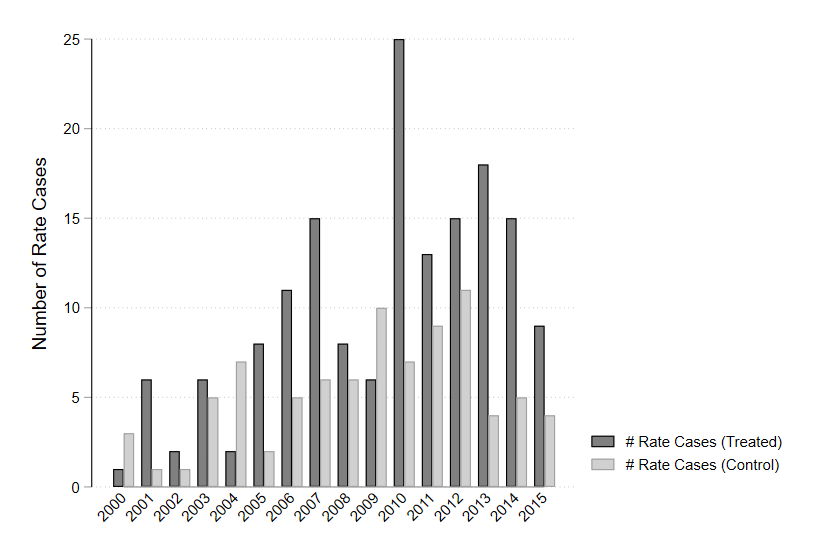

Utilities may increase campaign contribution expenditures to achieve a number of goals, including shaping legislation and implicitly bribing politicians to apply increased regulatory pressure in the utility’s favor. If contributions are intended to influence rate case outcomes, one would expect utilities to increase contributions in the years when new rates are authorized. To test this, I fully interact , a binary variable equal to one in the years when an ROE is authorized, with the parameter of interest

. The results, shown in Table 4, indicates that utilities prefer to target specific candidates, rather than political parties, during ROE authorization years. Specifically, treated utilities increase contributions to gubernatorial, house, and senate candidates during rate case years compared to control utilities.

Further, treated utilities contribute significantly more to senate candidates during rate case years compared to other years. These findings emphasize the importance of having a political ally during the rate case process and suggest a quid pro quo relationship between politicians and the utility. Utilities are likely better able to effectuate this relationship by donating directly to candidates rather than indirectly influencing them through party PACs. These findings are consistent with Holburn and Vanden Bergh (2014), who find that utilities increase contributions in the year before an M&A is proposed for PUC consideration and approval.

Last, I present two robustness checks in the Appendix. I first test if exempt utilities in treated states significantly increased campaign contributions compared to exempt utilities in control states. Throughout this period of analysis, exempt utilities in treated states were legally allowed to contribute from both their corporate PACs and directly from their treasury funds. Consequently, the PUHCA’s repeal did not affect exempt utilities’ ability to contribute directly from their treasury. Figure 1 graphs average contributions in treatment and control groups for exempt utilities, the placebo group. The results suggest that exempt utilities in treated states increased contributions in the post-treatment period compared to control states. This finding may indicate that utility contributions increase in treated states due to a shifting political or regulatory climate in the state rather than solely due to the repeal. Alternatively, this result could suggest that exempt utilities respond to the increased political influence of their competitors in the state (regulated utilities) by increasing their own campaign contributions. Politicians may exploit this competition between competing utilities to increase the total contributions that they can extract from the industry (Fremeth et al., 2016; de Figueiredo Jr and Edwards, 2016).

I then test if the recipients of utility campaign contributions won their elections and could therefore exercise control over the PUC to influence their regulatory decisions in the utility’s favor. Appendix Table 5 estimates the effect of legalization on contributions to politicians who won their campaigns and politicians who lost their campaigns. The results indicate that treated utilities significantly increased contributions to political winners as a result of the PUHCA’s repeal but did not increase contributions to political losers. These findings show that utilities targeted contributions toward politicians who could effectively influence the PUC on the utility’s behalf.

7 Mechanisms

The results thus far suggest that utilities can bribe politicians to exercise considerable control over PUCs and shape regulatory policy in the industry’s interest. In this section, I probe the mechanisms of control that politicians wield over PUCs. Specifically, I test the role of campaign contribution caps, the PUC appointment process, and the regulatory preferences of the executive branch in the facilitation of regulatory capture. The results further inform the public policy debate regarding effective legislation to limit regulatory capture.

7.1 Campaign Contribution Caps

Critically, states vary drastically in the amount of money corporations that are permitted to contribute in politics. In 2006, the year the PUHCA’s repeal was effective, 20 states banned direct corporate contribution altogether, 14 capped the amount of contributions, and 16 permitted either unlimited contributions to candidates or political parties. How do caps on campaign contributions affect corporate influence over politicians? I address this by examining whether caps on contributions limit a utility’s influence over the regulatory process. I split the treatment group into two sub groups: (1) states that cap corporate contributions and (2) states that allow unlimited corporate contributions. Table 5 presents the results.

Models 1 and 2 estimate the average effect of legalization on utility campaign contributions in unlimited states and capped states. The results strongly indicate that the caps do meaningfully restrict utility campaign contributions. Utilities in unlimited states increase annual campaign contributions by approximately $64,000 per year, on average, compared to only $16,000 in capped states. The difference in these amounts, $48,000, is statistically meaningful, providing support for Hypothesis 2a.

Models 3–4 estimate the average effects of legalization on authorized ROE in unlimited states and capped states. Their results indicate that PUCs in unlimited states authorize significantly higher ROEs than PUCs in control states where direct utility contributions remain banned. The results do not suggest a significant effect of legalization on authorized ROE for states that cap campaign contributions, although the standard errors are too noisy to make a definitive conclusion. Further, tests of equality between treatment effects for unlimited states and for capped states suggest that the treatment effects do not significantly differ between unlimited and capped states. Consequently, I find tepid support for Hypothesis 2b.

The results of Table 5 suggest that the legislature’s ability to shape campaign finance law can have powerful effects on the resiliency of its regulatory institutions. In particular, prohibiting or restricting utility campaign contributions may reduce the prevalence of politicians exerting undue influence over PUCs to the industry’s benefit.

7.2 Appointment Process

Next, I test whether the appointment process affords politicians a useful mechanism of control over PUCs. PUCs that are less susceptible to political influence should be more resilient to capture. Previous research has demonstrated that elected PUCs respond to voter preferences to increase chances of reelection and, as such, may be more insulated from industry and political pressure than their appointed counterparts (Joskow et al., 1996; Besley and Coate, 2003; Kwoka, 2002; Holburn and Spiller, 2002). My proposed path of influence is therefore distorted when commissioners are elected as they do not rely on appeasing politicians to obtain or maintain their positions.

Ideally, I would test this hypothesis by comparing the effects of legalization in states that elect commissioners9Elected states include Georgia, Louisiana, Mississippi, New Mexico, North Dakota, Oklahoma, Montana, Nebraska, Alabama, Arizona, and South Dakota. and states that appoint commissioners. Unfortunately, due to sample restrictions (i.e., I do not observe authorized ROE by appointed and elected PUCs both before and after legalization in both treatment and control groups), I cannot compare differential treatment effects of legalization on authorized ROEs between elected and appointed states.

Instead, I compare states where the legislature is involved in the commissioner approval process with states where the legislature has no authority in the approval process.10The legislature is involved in the appointment process in 31 states. The governor is the sole politician in charge of the appointment process in 7 states. This analysis compares PUCs with differing degrees of political influence. Due to the senate’s increased veto power, commissioners approved by the legislature must appease more politicians to secure and maintain their positions, and therefore they may be more susceptible to political influence than PUCs that are elected by voters or appointed solely by the governor. Further, the legislature holds considerable control over the approval process and can shape the executive’s choice of nominee (Calvert et al., 1989; Chang, 2001; Bertelli and Grose, 2009). Last, when legislature approval is required, the utility will need to contribute to a coalition of politicians, increasing its costs to influence (Denzau and Munger, 1986). Table 6 presents the results of this analysis.

To execute this test, I fully interact , a binary variable equal to one in states where the legislature is involved in the PUC appointment process, with the parameter of interest,

. Models 1 and 2 estimate differential effects of legalization for states with different values of

. Model 1 suggests that the effects of legalization on total campaign contributions in states where the legislature is not involved in the appointment process is not statistically different from zero. The effect for states where the legislature is involved is statistically significant, suggesting that utilities annually contribute approximately $64,000 more as a result of legalization. The difference between these effects, estimated by the variable

, is estimated with noise and is insignificant.

Models 2 and 3 suggest that this treatment effect is relatively evenly split between contributions to political parties and individual candidates, respectively. Further, Model 2 indicates that treated utilities contribute significantly more to political parties in states where the legislature participates in the approval process than states where the legislature is uninvolved. Finally, Model 4 tests if utilities target senate candidates more in states that require legislative approval for commissioner confirmation. Although the coefficients are estimated with uncertainty, the positive coefficient and large difference between contributions in states where the legislature is and is not involved in the appointment process suggests that utilities target contributions to senators in the former group.

Model 5 tests if PUCs appointed by the legislature respond to legalization differently than PUCs that do not require legislature approval. The results suggest a significant and large effect of campaign contribution legalization on the former group and no effect on the latter group. Specifically, PUCs appointed by the legislature in treated states authorize ROEs 0.5 percentage points higher than in control states after the PUHCA’s repeal. Further, the difference in treatment effect estimates between states where legislature approval is required and states where it is not is large and statistically significant.