Introduction

Amidst a global chip shortage and concerns that China has too much control of critical parts of global chip production, Congress passed the 2022 CHIPS and Science Act, 64–33 in the Senate and 243–187 in the House. The Act committed $280 billion over a decade, including $52.7 billion that is headed to the semiconductor economy.1John F. Sargent Jr., Manpreet Singh, and Karen M. Sutter, Frequently Asked Questions: CHIPS Act of 2022 Provisions and Implementation, Congressional Research Service, April 25, 2023, https://crsreports.congress.gov/product/pdf/R/R47523. While $200 billion is headed to R&D commercialization, workforce, and other economic development programs, $52.7 billion is being directed to the semiconductor industry to help with manufacturing, R&D, and workforce development. The bill also includes another $24 billion worth of tax credits for chip production was part of the bill. In other words, the bulk of the funds will go towards “building, expanding, and equipping domestic fabrication facilities and companies in the semiconductor supply chain”2Karen M. Sutter, Manpreet Singh, and John F. Sargent Jr., Semiconductors and the CHIPS Act: The Global Context, Congressional Research Service, May 18, 2023, https://sgp.fas.org/crs/misc/R47558.pdf.

This primer is designed to bridge a void in the existing literature by examining the semiconductor industry from a political economy perspective. Chips go into everything from cars to computers to dishwashers. They are fundamental to our modern world. However, chip fabrication faces unique economic conditions that tend to push out supply lines to Taiwan, South Korea, and China. When COVID hit, the reliance on Chinese and East Asian production became clear as supply chain issues arose, creating the crucible for the CHIPS and Science Act.

The Act was designed to push back against long-term trends in the industry. The unique economic nature of semiconductor fabrication has led to the foundry model where one company designs and uses chips, while another manufactures them.3Mark Liu, “Taiwan and the Foundry Model,” Nature Electronics 4 (2021): 316–320, https://doi.org/10.1038/s41928-021-00576-y. For years the industry has been outsourcing the end fabrication process while focusing on higher-margin products.

The first section of this paper explains the economic forces that have given rise to the current chip manufacturing industry and supply chains. The second and third sections explain how COVID created a perfect storm for a chip shortage to arise and brought attention to the fragilities of supply chains and US reliance on Chinese production. The fourth section explains the passage of the CHIPS and Science Act and what is included in the program language.

Congress is spending significant sums with the intention of bringing back semiconductor supply chains, especially companies engaged at the final stages of production, which include the manufacturing of chips (commonly known as fabrication), as well as packaging and testing. A bipartisan coalition for big spending became possible when the bill was framed as necessary for countering China.4Noah Smith, “Industrial Policy Starts with Semiconductors: The CHIPS Act Should Be Just the Beginning,” Noahpinion, August 2, 2022, https://www.noahpinion.blog/p/industrial-policy-starts-with-semiconductors?utm_source=%2Fsearch%2FCHIPS&utm_medium=reader2.

This primer leaves it to future research to discuss broader industrial policy concerns and needed policy changes. The aim here, however, is not to propose solutions, but to foster a deeper comprehension of the politics and economics that gave rise to the CHIPS and Science Act.

Section 1. The technology and the market behind chips

A microchip, also called a chip, a computer chip, or an integrated circuit, is a set of electronic circuits that are made on a small flat piece of silicon. Silicon is a semiconductor in that it can conduct electricity or act as an insulator. Silicon atoms are nonconductive at room temperature, but if boron or phosphorus are carefully added, the impurities can be used to make circuits.5“Doping: N- and p-Semiconductors – Fundamentals – Semiconductor Technology from A to Z,” Halbleiter.Org, https://www.halbleiter.org/en/fundamentals/doping/. The more precise the process to add these small impurities the more complex that the chips can become.

Advanced logic chips, “logics,” are the most advanced chips currently manufactured. They demand the most precision. These are the chips that power laptops, cellphones, and graphical processing units (GPUs). But there are also other key segments of the chip market. Memory chips provide computers with the memory they need to operate. A third category of chips, broadly called legacy chips, is more diffuse and includes analog chips like sensors that convert visual or audio signals into digital data, radio frequency chips that communicate with cell phone networks, and semiconductors that manage how devices use electricity.6Chris Miller, Chip War: The Fight for the World’s Most Critical Technology (New York City: Scribner, 2022).

Semiconductor manufacturing is the most technologically demanding production process that exists. It demands incredible precision to deliver its revolutionary results. Fabs are the factory floors where chips are made. Here, photolithography machines and wafers come together to produce large batches of chips. Each individual chip begins its life as part of a larger silicon wafer that has patterned films deposited on it via a process called photolithography. Like printers layer color on paper, photolithography machines use a combination of advanced chemicals and light to layer patterns on the silicon wafer.7“The Basics of Microchips,” ASML, accessed August 1, 2023, https://www.asml.com/en/technology/all-about-microchips/microchip-basics.

Photolithography powers a diverse range of goods that earned the industry $574 billion dollars in 2021.8Semiconductor Market Size, Share & COVID-19 Impact Analysis, By Component (Memory Devices, Logic Devices, Analog IC, MPU, Discrete Power Devices, MCU, Sensors, and Others), By Application (Networking & Communications, Data Processing, Industrial, Consumer Electronics, Automotive, and Government), and Regional Forecast, 2022–2029, Fortune Business Insights, published April 2022, https://www.fortunebusinessinsights.com/semiconductor-market-102365. Cobble together a bunch of advanced logic chips, and you essentially have the latest iPhone or laptop. Or, the pattern and design can be tweaked resulting in NVIDIA’s latest graphical processing units (GPUs), which are powering the AI future. Slightly older standards are still in use and provide the basis for the chips going into cars, kitchen appliances, and other durable goods. All of it is powered by the same principle.

Investments in photolithography shrank the scale at which machines could operate. The smaller the patterns, the more the chip can do. But as the sizes shrink, problems compound. At around 10 nanometers (nm), which is a billionth of a meter, traditional processes of lithography start to encounter quantum effects.9Ed Sperling, “Quantum Effects at 7/5nm and Beyond,” Semiconductor Engineering, May 23, 2018, https://semiengineering.com/quantum-effects-at-7-5nm/. For some comparison, a single strand of human DNA is 2.5 nanometers in diameter and a single gold atom is about a third of a nanometer in diameter.10“Size of the Nanoscale,” National Nanotechnology Initiative, accessed August 2, 2023, https://www.nano.gov/nanotech-101/what/nano-size.

While multiple toolmakers exist, only one company in the world has been able to create the photolithography systems that work at such small scales, the Netherlands-based Advanced Semiconductor Materials Lithography or ASML.11“ASML Holding,” Wikipedia, last modified August 1, 2023, https://en.wikipedia.org/wiki/ASML_Holding. ASML is the sole toolmaker that can create photolithography systems in the 7nm, 5nm, and 3nm range. These machines cost around $320 million each and can make the most advanced chips, which are used in phones, computers, and GPUs.12Toby Sterling, “Intel Orders ASML System for Well Over $340 mln in Quest for Chipmaking Edge,” Reuters, January 19, 2022, https://www.reuters.com/technology/intel-orders-asml-machine-still-drawing-board-chipmakers-look-an-edge-2022-01-19/.

Photolithography machines must be run in large clean rooms to avoid microscopic impurities. A clean room is a specialized indoor setting where the level of air pollutants, temperature, humidity, and pressure are all maintained within precise, predefined boundaries.13“Ultimate Guide to Sterile vs. Clean Rooms,” KleanLabs, March 25, 2021, https://kleanlabs.com/blog/ultimate-guide-to-sterile-vs-clean-rooms/. The clean room must also keep steady against vibration to ensure the nanometer-scale alignment of machines.

Construction of these facilities is similar in complexity and materials to building a skyscraper. Building foundations need to be specially constructed to deal with the demands. Intel’s two new fabs in Ohio, for example, will need enough structural steel to build eight Eiffel Towers and enough concrete to build the world’s tallest skyscraper, the Burj Khalifa, twice.14James Leggate, “Intel Ohio Fab Breaks Ground, Leading Chip Plant Project Wave,” ENR Midwest, September 12, 2022, https://www.enr.com/articles/54776-intel-ohio-fab-breaks-ground-leading-chip-plant-project-wave. Put a bunch of these manufacturing fabs together at one site, and you have a foundry.

Because of the precision that is required, the size that is demanded, and the tools that are needed, a single advanced logic fab can cost $20 billion to $40 billion to start up. Even less advanced fabs, especially those making legacy chips, are still pricey. Setting up a new fab today using 1990s tech costs about $700 million to $1.3 billion.15Mark Lapedus, “200mm Shortages May Persist for Years,” Semiconductor Engineering, January 20th, 2022, https://semiengineering.com/200mm-shortages-may-persist-for-years/. These price tags ensure that very few players are able to enter the market.16Miller, Chip War, 234.

Production takes time as well. The most advanced chips may take up to 26 weeks from start to finish to get to market, while legacy chips can take 18 weeks.17Wassen Mohammad, Adel Elomri, and Laoucine Kerbache, “The Global Semiconductor Chip Shortage: Causes, Implications, and Potential Remedies,” IFAC Papers Online 55, no. 10 (2022): 476–483, https://www.sciencedirect.com/science/article/pii/S2405896322017293. Production may take anywhere from 12 to 20 weeks depending on the complexity while testing and packaging takes another 6 weeks.

Because fabs are so costly to start up and photolithography machines work best when they run all the time, fabs shoot for little downtime.18Jon Trossbach, “Closed Source Intellectual Property & the Chip Shortage,” Safety Critical Computer Security, April 9, 2023, https://trossbach.substack.com/p/closed-source-intellectual-property. Additionally, there is a large component of learning by doing, so foundries typically co-locate fab facilities.19Nile W. Hatch and David C. Mowery, “Process Innovation and Learning by Doing in Semiconductor Manufacturing,” Management Science 44, no. 11 (1998): 1461–1477, https://www.jstor.org/stable/2634893; Douglas A. Irwin and Peter J. Klenow, “Learning-by-Doing Spillovers in the Semiconductor Industry,” Journal of Political Economy 102, no. 6 (December 1994): 1200–1227, https://www.jstor.org/stable/2138784. TSMC, for example, is putting all of its most advanced processes at Fab 18 right next to its older fabs in Taiwan.20“TSMC Holds 3nm ‘Volume Production and Capacity Expansion Ceremony’ at Fab 18 Construction Site,” VideoCardz, December 29, 2022, https://videocardz.com/press-release/tsmc-holds-3nm-volume-production-and-capacity-expansion-ceremony-at-fab-18-construction-site. Samsung is also putting its newest fabs next to its older fabs.21Arjun Kharpal and Jihye Lee, “Samsung to Spend $228 Billion on the World’s Largest Chip Facility as Part of South Korea Tech Plan,” CNBC, March 15, 2023, https://www.cnbc.com/2023/03/15/samsung-to-spend-228-billion-on-the-worlds-largest-chip-facility.html. Significant cost and know-how is needed to produce chips, so currently Samsung and TSMC are the only two foundries capable of running ASML machines to produce chips at 7nm and below.

Semiconductor production has traditionally moved in sync with global GDP, experiencing alternating periods of highs and lows. Surges in consumer demand for products like PCs in the 1980s, mobiles in the 2000s, and smartphones in the 2010s motivated manufacturers to bolster their production capabilities. However, supply periodically surpasses demand due either to excessive production or economic slumps, causing a decrease in prices and revenue. This boom-and-bust cycle would restart with the advent of a new consumer product or an economic upturn. Because of this, semiconductor stocks have typically garnered lower earnings multiples by equity investors.22Geraldine Sundstrom, Tania Bachmann, and John Mullins, “Semiconductors: A Less Cyclical Future,” Pimco, June 10, 2022, https://www.pimco.com/gbl/en/insights/semiconductors-a-less-cyclical-future.

This volatility and risk pressed early manufacturers to jettison the fabrication part of the process, starting in the early 1960s.23Miller, Chip War, 54. But by the early 1990s, the entire industry began to shift when TSMC became a large player. TSMC pioneered the foundry model.24Liu, “Taiwan and the Foundry Model.” TSMC focused on just manufacturing, leaving the design of the chip to another firm.

Today those design firms are referred to as “fabless.” Foundry companies in turn are typically known as “pureplay foundries.” Apple, NVIDIA, and Broadcom are all fabless firms that outsource manufacturing to pureplay foundries like TSMC or GlobalFoundries.

Given the investment needed in the end part of the production process, the foundry model follows what economic theory predicts. Firms have two options, they can either vertically integrate, or they can outsource their production. Because firms tend to be inefficient in their labor investments under integration and labor investment is relatively important to production, it makes sense to outsource labor to a specialist firm. In other words, under one of the most common outsourcing models, outsourcing occurs when the investment in labor is relatively important to production.25Pol Antràs, “Firms, Contracts, and Trade Structure,” The Quarterly Journal of Economics 118, no. 4 (2003): 375–1418, https://doi.org/10.1162/003355303322552829.

The fabless-foundry model stands in contrast to the integrated firm. Typically called “integrated device manufacturers” (IDMs), these firms must manage complex vertical value chains across both design and manufacturing. Intel, Samsung, and Texas Instruments are the biggest IDMs. Doing it all is tough. Even traditionally well-managed companies like Intel and Samsung have stumbled trying to keep up with the latest waves of technology.

The unique economic nature of chip fabrication and use has resulted in a complex market.26“The Foundry Model,” Wikipedia, last modified June 30, 2023, https://en.wikipedia.org/wiki/Foundry_model. Fabless enterprises like Apple, Broadcom, NVIDIA, and Qualcomm are paired to foundries like TSMC and GlobalFoundries as well as producers of memory like Micron and Western Digital to make their products. IDMs like Intel and Samsung partly compete with standalone foundries, but also compete with other integrated device manufacturers like Texas Instruments. All the while, every firm relies upon the tools provided by ASML and other manufacturers of capital equipment.

Over time, the semiconductor market has settled into five major groups of firms. These include: producers of memory chips, fabless enterprises, chip manufacturers, tool makers, foundries, and diversified integrated device manufacturers.

While the chip industry started in the US, companies began moving fabrication to Hong Kong by the early 1960s.27Miller, Chip War, 54. Then fabrication shifted toward Japan, South Korea, and Taiwan throughout the 1980s. Fabrication was brought back to the States in the 1990s, reaching a peak of 37% of global production in 1990.28Antonio Varas, Raj Varadarajan, Jimmy Goodrich, and Falan Yinug, Government Incentives and US Competitiveness in Semiconductor Manufacturing, Semiconductor Industry Association, September 2020, https://www.semiconductors.org/wp-content/uploads/2020/09/Government-Incentives-and-US-Competitiveness-in-Semiconductor-Manufacturing-Sep-2020.pdf. But the share of US-based fabrication has been on a steady decline since then as the fabless-foundry model took over. US companies might account for 48% of the world’s chip sales, but US-located fabs only account for 12% of the world’s production.29Varas, et al., Government Incentives. That includes none of the advanced chip fabs, which are all currently made in South Korea and Taiwan.

Building a new fab in the United States presents its own challenges. Specialty construction firms must build the fabs, the fab has to get the needed permits, and educated workers have to be hired.30Katy Bartlett, Ondrej Burkacky, Loraine Li, Rutger Vrijen, and Bill Wiseman, “Semiconductor Fabs: Construction Challenges in the United States,” McKinsey & Company, January 27, 2023, https://www.mckinsey.com/industries/industrials-and-electronics/our-insights/semiconductor-fabs-construction-challenges-in-the-united-states#/. All of these costs add up, meaning that the “ten-year total cost of ownership of a new fab located in the US is approximately 30 percent higher than in Taiwan, South Korea, or Singapore, and 37 percent to 50 percent higher than in China.”31Varas, et al., Government Incentives.

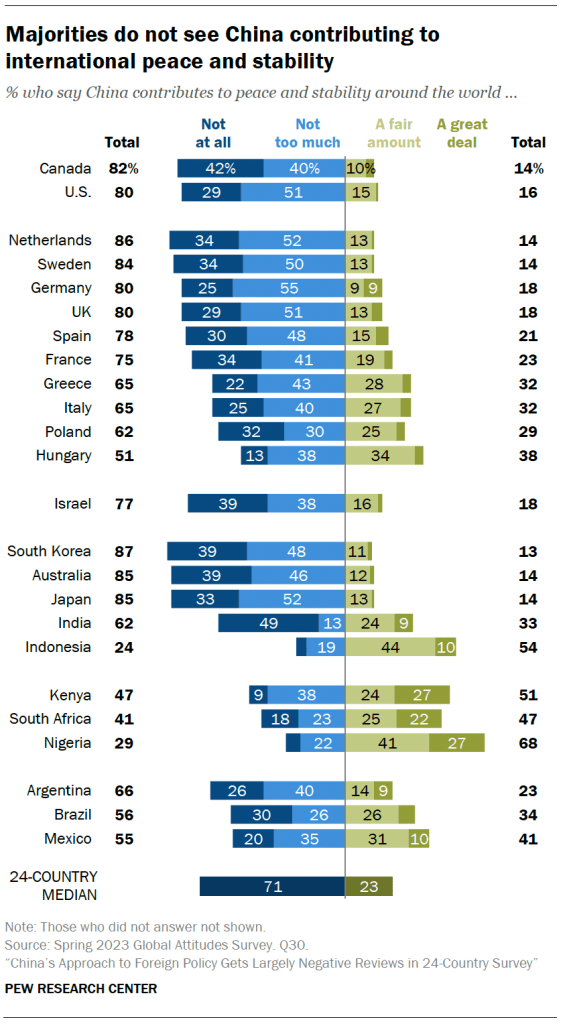

As fabs moved to East Asia, the design firms and fabless enterprises that build tech off the newest chip designs stayed in the United States. This is the throughline between Apple, NVIDIA, and Broadcom.32Ondrej Burkacky, Marc de Jong, Ankit Mittal, and Nakul Verma, “Value Creation: How Can the Semiconductor Industry Keep Outperforming,” McKinsey & Company, October 15, 2021, https://www.mckinsey.com/industries/semiconductors/our-insights/value-creation-how-can-the-semiconductor-industry-keep-outperforming. They design the chips and then outsource production to TSMC, GlobalFoundries, or other foundries. Older chip production technologies and memory production also stayed in the United States. The US lacks production capabilities for advanced technologies that make logic chips possible. The table below helps to illuminate.

Figure 1: Installed worldwide capacity, by node size, December 2020, %

Source: Katy Bartlett, Ondrej Burkacky, Loraine Li, Rutger Vrijen, and Bill Wiseman, “Semiconductor Fabs: Construction Challenges in the United States,” McKinsey & Company, January 27, 2023, https://www.mckinsey.com/industries/industrials-and-electronics/our-insights/semiconductor-fabs-construction-challenges-in-the-united-states#/.

Altogether, semiconductors are among the most expensive and complicated manufacturing processes currently in use. Fabs are extremely expensive to build. Production times can vary from four to six months. Machines need to be run constantly to retain their precision, and they need to be maintained by an educated workforce. Additionally, there is a large component of learning by doing in the fab. Combined, these pressures have made the foundry model attractive. Heading into 2020, the semiconductor market seemed poised for another bust.33Marc de Jong and Anurag Srivastava, “What’s Next for Semiconductor Profits and Value Creation?” McKinsey & Company, October 9, 2019, https://www.mckinsey.com/industries/semiconductors/our-insights/whats-next-for-semiconductor-profits-and-value-creation. Phone and computer sales were slipping. TSMC and other foundries were reporting dropping revenue, and everyone in the industry expected a downturn.34Kathrin Hille, “Taiwan Chipmaker TSMC Suffers Biggest Earnings Fall in 7 Years,” Financial Times, April 18, 2019, https://www.ft.com/content/904f34e6-61b3-11e9-b285-3acd5d43599e. Then COVID hit.

Section 2. COVID and the chips shortage

The first year of COVID, 2020, created the perfect storm for a chip shortage. Social distancing norms and nationwide lockdowns shifted consumption patterns. People stayed at home, reduced travel, cut back on eating at restaurants, and exercised at home instead of the gym. All the while, households were flush with cash as stimulus checks came out in quick succession, beginning in March 2020 and ending in March 2021.

These forces pushed consumers toward kitchen appliances, TVs, electronics, computers and countless other durable goods.35Demetrio Scopelliti, “COVID-19 Causes a Spike in Spending on Durable Goods,” Monthly Labor Review, US Bureau of Labor Statistics, November 2021, https://www.bls.gov/opub/mlr/2021/beyond-bls/covid-19-causes-a-spike-in-spending-on-durable-goods.htm. Later on, these forces would drive up demand for electric vehicles and cars as well.36David Ferris, “Chip Shortage Threatens Biden’s Electric Vehicle Plans, Commerce Secretary Says,” E&E News, November 30, 2021, https://www.scientificamerican.com/article/chip-shortage-threatens-bidens-electric-vehicle-plans-commerce-secretary-says/.

There were other factors driving up demand. Increases in video calling, streaming, and gaming put pressure on services to upgrade their backend infrastructure. Microsoft and Sony launched new video game consoles, requiring large orders with big chipmakers. And with the soaring price of cryptocurrencies, crypto miners drove demand for GPUs.37“Why Is There a Shortage of Semiconductors,” The Economist, February 25, 2021, https://www.economist.com/the-economist-explains/2021/02/25/why-is-there-a-shortage-of-semiconductors.; Raevenlord, “GPU Market Pricing Back in Uptrend, Shattering Expectations of Price Normalization,” TechPowerUp, August 30, 2021, https://www.techpowerup.com/286150/gpu-market-pricing-back-in-uptrend-shattering-expectations-of-price-normalization.

However, companies expected the COVID quarantines to cause an economic downturn, so many of them did the logical thing and slashed orders. Seeing soft demand, TSMC decommissioned their legacy machines that used 250nm node technology. Then larger than expected orders came in, so chip suppliers, particularly auto chipmakers, were left scrambling to retrofit their designs to newer 140nm node tech.38Trossbach, “Closed Source Intellectual Property.”

The shortage of semiconductors left auto manufacturers unable to install the electronics that control entertainment systems, safety features, and driving aids in vehicles. The car industry, which was “used to working with flexible ‘just-in-time supply chains,’” lacked inventory, so the entire production process ground to a halt.39“Why Is There a Shortage of Semiconductors,” The Economist. Auto assembly line shifts were cut, and some car companies even temporarily closed factories. One estimate suggests that nearly 20 million cars were cut out of production schedules because of chip shortages between 2021 and 2023.40David Straughan, “The Semiconductor Shortage Explained: The Auto Industry’s Big Challenge,” Automoblog, March 24, 2023, https://www.automoblog.net/research/news/semiconductor-shortage-explained/.

COVID shook up the legacy chip market. The automobile industry was an extreme case, but it wasn’t the only industry connected to legacy chips that were held back by the chip shortage. Makers of fridges, microwaves, gas ranges, toasters, slow cookers, blenders, and other kitchen appliances found it difficult to get the needed silicon.41Josh Horwitz, “Fridges, Microwaves Fall Prey to Global Chip Shortage,” Reuters, March 29, 2021, https://www.reuters.com/world/china/fridges-microwaves-fall-prey-global-chip-shortage-2021-03-29/. These chips are still based in tech from the 1990s. Since product manufacturers haven’t been under pressure to continuously pursue smaller transistor dimensions every few years, the chips have been notably less expensive.

By January 2021, it was clear that a chip shortage existed.42“Chip Shortage January 1, 2020 to July 25, 2023,” Google Trends, accessed August 9, 2023, https://trends.google.com/trends/explore?date=2020-01-01%202023-07-25&geo=US&q=%2Fm%2F09v2m48&hl=en. But it was not just one industry that was affected. Multiple markets were under the strain of increased demand at the same time. Logics were in demand, as were memory and large segments of the legacy market.43“Results from Semiconductor Supply Chain Request for Information,” US Department of Commerce, January 25, 2022, https://www.commerce.gov/news/blog/2022/01/results-semiconductor-supply-chain-request-information.

On top of the dramatic increase in demand, the Renesas fab in Japan caught fire in March 2021, taking the fab’s automotive chip production offline for three months.44“Update 9 – Notice Regarding the Semiconductor Manufacturing Factory (Naka Factory) Fire: Production Capacity Recovery Status,” Renesas, June 1, 2021, https://www.renesas.com/us/en/about/press-room/update-9-notice-regarding-semiconductor-manufacturing-factory-naka-factory-fire-production-capacity. An ice storm in Texas in February 2022 took NXP, Samsung, and Infineon fabs offline as well.45“Samsung, Infineon, and NXP Halt Production in Texas Due to Winter Storm,” Sourcengine, February 18, 2021, https://www.sourcengine.com/blog/samsung-infineon-nxp-halt-production-texas-winter-storm-2021-02-18. Fires in Ukraine in early 2019 and then the Russian invasion disrupted production of critical materials used in packaging and manufacturing of semiconductors.46Alexander Bor, “Fire Hits Ukraine’s Ethylene, Polyethylene Producing Facilities,” S&P Global Commodity Insights, January 14, 2019, https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/petrochemicals/011419-fire-hits-ukraines-ethylene-polyethylene-producing-facilities. On top of all of this, shipping into the US was backed up in October 2021 at the ports in Los Angeles and Long Beach due to staffing shortages.47Jeff Cox, “Economists Expect Shipping Problems to Linger Well Into 2022,” CNBC, October 25, 2021, https://www.cnbc.com/2021/10/25/economists-expect-shipping-problems-to-linger-well-into-2022.html.

Section 3. COVID, China and Chips

The shortages also brought attention to the critical role that China plays in the semiconductor supply chain. Though China’s production of chips is mainly limited to low-end legacy chips, all forms of chips are commonly packaged and tested there. Semiconductors form the backbone of all key US defense systems and platforms, and any decline in US microelectronics competencies poses a severe risk to the nation’s self-defense and protection of its allies.48Sujai Shivakumar and Charles Wessner, “Semiconductors and National Defense: What Are the Stakes,” Center for Strategic and International Studies, June 8, 2022, https://www.csis.org/analysis/semiconductors-and-national-defense-what-are-stakes. Semiconductors are also a rare industry in that the Chinese economy is dependent on others, rather than being the primary exporter.49Christopher A. Thomas, “Lagging but Motivated: The State of China’s Semiconductor Industry,” Brookings Institution, January 7, 2021, https://www.brookings.edu/articles/lagging-but-motivated-the-state-of-chinas-semiconductor-industry/.

In 2015, the Chinese government announced the “Made in China 2025” strategic plan, a series of investments that were meant to reduce China’s dependence on foreign technology and promote Chinese technological manufacturers in the global marketplace. Since the beginning of this plan, semiconductors have been at the top of the priority list to receive funding. To implement the plan, China put $150 billion in state funding toward supporting domestic industry, state-directed overseas acquisitions, and the purchase of foreign semiconductor equipment.50Karen M. Sutter, China’s New Semiconductor Policies: Issues for Congress, Congressional Research Service, April 20, 2021, https://crsreports.congress.gov/product/pdf/R/R46767.

By 2017, China’s desire to have a completely homegrown semiconductor industry had registered as a strategic problem for the United States. In one of the last reports that came from the Obama administration, the President’s Council of Advisors on Science and Technology (PCAST) warned that “Chinese industrial policies in this sector, as they are unfolding in practice, pose real threats to semiconductor innovation and US national security.”51President’s Council of Advisors on Science and Technology (PCAST), Report to the President: Ensuring Long-Term U.S. Leadership in Semiconductors, Executive Office of the President, January 2017, https://obamawhitehouse.archives.gov/sites/default/files/microsites/ostp/PCAST/pcast_ensuring_long-term_us_leadership_in_semiconductors.pdf.

By the time COVID shut the world down, China had made itself a critical part of the global semiconductor industry, particularly in the manufacturing of legacy chips and the final stage of testing and packaging. The country is still so indispensable to the process that even the new plants in the US, spurred by the government’s investment, will likely send their chips to China for testing and packaging. But it is worth noting that during COVID lockdowns, China didn’t (and still doesn’t) have a foothold in advanced logics. Just months before COVID hit, China announced another $29 billion to be directed to the creation of advanced fabs to close this gap.52Yoko Kubota, “China Sets Up New $29 Billion Semiconductor Fund,” The Wall Street Journal, October 25, 2019, https://www.wsj.com/articles/china-sets-up-new-29-billion-semiconductor-fund-11572034480.

The shortages that occurred during the COVID crisis made evident the national security threats presented by China. When China locked down due to COVID, American and European companies were impacted almost immediately.53Frank Pisch, “Just-in-Time Supply Chains After the Covid-19 Crisis,” The Centre for Economic Policy Research (CEPR), VoxEU, June 30, 2020, https://cepr.org/voxeu/columns/just-time-supply-chains-after-covid-19-crisis. Outbound trade to the US plummeted quickly.54Henry Byers, “US Import Demand Is Dropping off a Cliff,” FreightWaves, June 7, 2022, https://www.freightwaves.com/news/us-import-demand-drops-off-a-cliff. Subsequent research has found that a drop in Chinese exports in 2020 impacted both Japan and the United States substantially.55Mary Everett Hancock and Jesse Mora, “The Impact of COVID-19 on Chinese Trade and Production: An Empirical Analysis of Processing Trade with Japan and the US,” Journal of Asian Economics 86 (June 2023), https://doi.org/10.1016/j.asieco.2023.101596. But China was not hit as hard, as their imports largely didn’t change.

China’s draconian lockdowns of 2020 were coupled with crackdowns on democratic protests in Hong Kong and continued suppression of the Uyghurs. All the while, China has made increasingly aggressive overtures toward Taiwan, threatening military action to bring the island nation under control of Beijing. As the biggest producer of chips, an invasion of Taiwan would be catastrophic for the supply chain, much worse than the disruptions seen in the last two years.

COVID was a collective realization about the counterparty risk with China. Counterparty risk is the risk that another party to a trade doesn’t fulfill their end of the bargain. With the lockdowns and the emphasis on China 2025, trading partners began to reassess their dependencies and explore diversifying supply chains to mitigate potential disruptions in the future. In the United States, COVID marked a turning point with China. In 2020, around one in five people were concerned about China as a national rival to the US. Now over half see China as a rival, as Gallup’s polling illustrates below.

Figure 2: China, Russia, North Korea, and Iran: Greatest Enemy to the US

Source: “Americans Continue to View China as the U.S.’s Greatest Enemy,” Gallup.com, March 6, 2023, https://news.gallup.com/poll/471494/americans-continue-view-china-greatest-enemy.aspx.

But it isn’t just the United States that has turned from China. South Korea has also embarked on an unmistakable pivot away from the Chinese economy in the wake of COVID.56Christian Davies, “Tech Cold War: South Korea Pivots from China to US,” Financial Times, August 1, 2023, https://www.ft.com/content/c164c880-a832-422f-8fb4-29b2185d4982. Japan’s business leaders are also turning away from China.57“Risky China Business: Japan Inc. Wary Over Taiwan, Zero-COVID,” Nikkei Asia, July 8, 2022, https://asia.nikkei.com/Spotlight/Supply-Chain/Risky-China-business-Japan-Inc.-wary-over-Taiwan-zero-COVID. COVID unmasked the Chinese government, leading to global opinion shifting decidedly against the country.

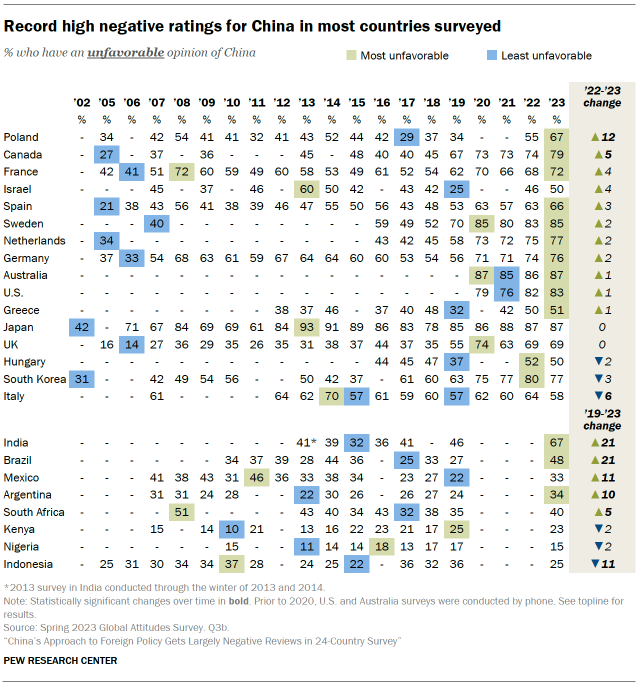

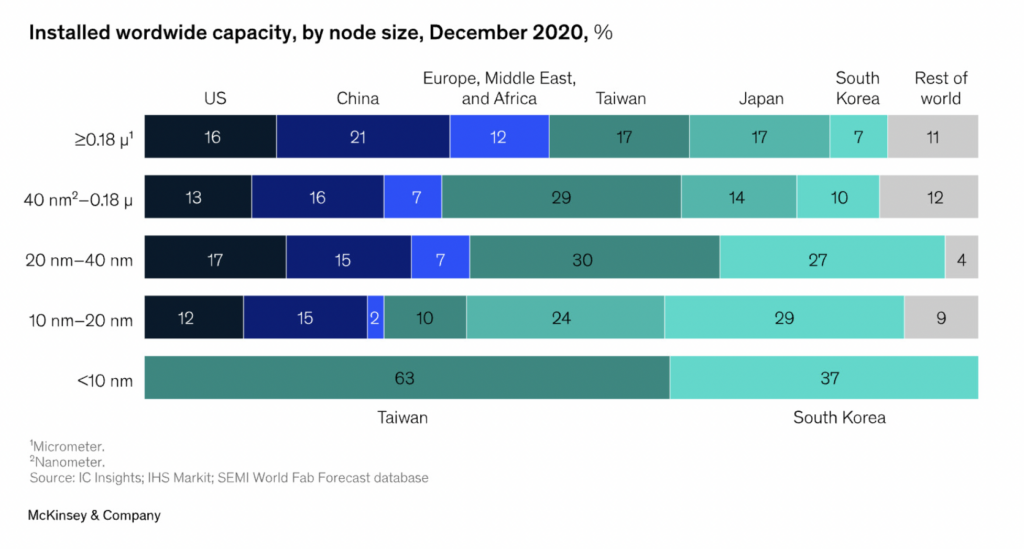

Pew polling captures this worldwide shift:

Pew reported record-high negative opinion towards China in most countries they surveyed in 2023. For many of these nations, the rise of negative opinion began in 2019 or 2020. Further, when asked if China contributes to international peace and stability, citizens of most countries surveyed responded “not at all” or “not too much.”

Figure 3: Pew Polling Shows Majorities Do Not See China Contributing to International Peace and Stability

Source: “Majorities Do Not See China Contributing to International Peace and Stability,” Pew Research Center’s Global Attitudes Project, July 26, 2023, https://www.pewresearch.org/global/2023/07/27/chinas-international-behavior/pg_2023-07-27_views-of-china_2-03/.

Figure 4: Record high negative ratings for China in Most Countries Surveyed

Source: “Record High Negative Ratings for China in Most Countries Surveyed,” Pew Research Center’s Global Attitudes Project, July 26, 2023, https://www.pewresearch.org/global/2023/07/27/chinas-approach-to-foreign-policy-gets-largely-negative-reviews-in-24-countrysurvey/pg_2023-07-27_views-of-china_0-03/.

The buildup in tension has been a slow boil. The world watched as the COVID crisis unfolded in China, and skepticism about the country’s handling of the situation steadily grew. Unease quietly seeped into the international arena, gradually influencing the actions of nations. The pivot away from China has now become an unmistakable global trend, signaling a significant shift in the world’s economic and political dynamics.

Section 4. The CHIPS and Science Act

As the tension boiled, US policymakers began working on legislation to aid in the pivot away from China. The semiconductor industry became a focal point, and legislative efforts eventually yielded the CHIPS and Science Act. Though it ultimately became law, this large bill, totaling more than $280 billion over 10 years, did not pass seamlessly.

Similar to other programs, CHIPS needed two things to get up and running, an authorization and an appropriation.58Saturno, James V. “Authorizations and the Appropriations Process.” Congressional Research Service, May 16, 2023. An authorization defines the authority of the government to act, while an appropriation provides the budget authority.

The National Defense Authorization Act for Fiscal Year 2021 (2021 NDAA) included the language that authorized the CHIPS for America fund. It passed Congress in late 2020 and was the result of work by Senators John Cornyn, Mark Warner, Tom Cotton, and their respective staffs to get the program inked into law.59David Shepardson and Michael Martina, “Exclusive: U.S. Senators Close to Announcing $52 billion Chips Funding Deal,” Reuters, May 14, 2021, https://www.reuters.com/article/us-usa-semiconductors-congress-exclusive-idCAKBN2CV1I3. While funding was left to the future, the language in the NDAA laid out the incentives to support semiconductors.

Legislative passage of the 2021 NDAA with CHIPS is significant. Its inclusion indicates a lack of opposition within congressional defense committees. It also shows that broad acceptance developed earlier in the defense community than it did in other political communities. Though, this is unsurprising given the national security elements of chip production.

Within the next year, the broader political environment became much friendlier to the passage of a semiconductor manufacturing incentive bill to fund the program created by the NDAA. The elections of 2020 brought in a new Congress and a new White House that was decidedly more tilted to the Democrats. All the while, the chip shortage ramped up in early 2021, driving interest in countering China somehow.

Still, there were a spat of failures to get a funding bill passed. The Endless Frontiers Act60United States Innovation and Competition Act (USICA) of 2021, S. 1260, 117th Cong., 1st sess., https://www.congress.gov/bill/117th-congress/senate-bill/1260/text. and the Creating Helpful Incentives to Produce Semiconductors (CHIPS) for America Act61USICA. both died in committee.

It took another two years for CHIPS to get funding.

The lull in action picked back up during the summer of 2022 as negotiations over a large reconciliation bill were breaking down. Republicans threatened to block the semiconductor funding bill, called the United States Innovation and Competition Act (USICA), as long as Democrats were attempting to pass the large reconciliation bill.62Mitch McConnell (@LeaderMcConnell), “Let me be perfectly clear: there will be no bipartisan USICA as long as Democrats are pursuing a partisan reconciliation bill.” June 30, 2022, https://twitter.com/LeaderMcConnell/status/1542600738823618564?s=20&t=nm39gsyWGumxgQEP7IKvDw. At this point, Senator Schumer, spurred into action by the threat of Micron and other chipmakers to abandon US expansion plans if the bill was not passed by August, began what he described as, “one of the most intense lobbying campaigns in his 24 years as a senator.”63Mark Weiner, “Behind the Micron Deal: Schumer Used Briefing, CEOs to Pressure GOP Senators,” Syracuse.com, October 18, 2022, https://www.syracuse.com/politics/2022/10/behind-the-micron-deal-schumer-used-classified-briefing-ceos-to-pressure-gop-senators.html&subscribed=google-oauth2%7C102785747955818665406. This lobbying campaign, alongside the large reconciliation bill seemingly falling apart, allowed a narrowed version of USICA, known as the CHIPS and Science Act, to pass through the Senate 64–33.

Passing the bill through the House proved to be more difficult, as it was revealed hours after the Senate passed the bill that Senators Schumer and Manchin had negotiated a deal that allowed the large reconciliation bill to pass. As a result, Kevin McCarthy, the House minority leader and a Republican, vowed to block the bill. Despite his vow, 24 House Republicans broke rank to vote in favor of the CHIPS and Science Act. This was enough to pass the bill through the House, 243–187, and on August 8, 2022 President Biden signed the CHIPS and Science Act into law.

As passed, the CHIPS and Science Act is intended to play a crucial role in the shift away from China by addressing some of the main challenges to increasing domestic semiconductor production. A large portion of the bill is focused on addressing the significant cost gap between building and operating a manufacturing facility in the US versus abroad.64CHIPS for America: A Strategy for the CHIPS for America Fund, US Department of Commerce, National Institute of Standards and Technology, September 6, 2022, https://www.nist.gov/system/files/documents/2022/09/13/CHIPS-for-America-Strategy%20%28Sept%206%2C%202022%29.pdf.

This cost gap has been attributed to a number of factors including subsidies from foreign governments and extended construction timelines in the US.65CHIPS for America. In order to address these factors, the CHIPS and Science Act injects $52.7 billion of new money into the semiconductor industry through four funds: the CHIPS for America Fund, the CHIPS for Defense Fund, the CHIPS for America International Technology Security and Innovation Fund, and the CHIPS for America Workforce and Education Fund.66Sargent, et al., Frequently Asked Questions: CHIPS Act of 2022, 7–8.

The biggest program in the bill is the $39 billion CHIPS for America Fund. It is aimed at bolstering semiconductor manufacturing capacity in the United States by providing financial incentives for building, expanding, and equipping domestic fabrication facilities.67Sargent, et al., Frequently Asked Questions: CHIPS Act of 2022. Of the $39 billion, $2 billion is allotted for mature semiconductor nodes and up to $6 billion can be used to cover the cost of direct loans and loan guarantees.68CHIPS and Science Act of 2022, vanhollen.senate.gov, accessed October 17, 2023, https://www.vanhollen.senate.gov/imo/media/doc/CHIPS%20and%20Science%20Act%20of%202022%20Summary.pdf. The ultimate goal of these incentives is to make the US a more attractive place to build and operate semiconductor manufacturing facilities by reducing, or ideally eliminating, the cost gap associated with operating in the US versus abroad.

In addition to grant funds, the CHIPS and Science Act established an advanced manufacturing investment tax credit (AMIC). Proponents of including the AMIC in the CHIPS and Science Act noted that the CHIPS grants, while substantial, would not be enough to overcome the 25 to 40 percent cost advantage for overseas semiconductor production.69CHIPS and Science Act of 2022, vanhollen.senate.gov. The AMIC is intended to sweeten the pot by providing a 25 percent tax credit for investments in semiconductor manufacturing.70Facilitating American Built Semiconductors (FABS) Act, S. 2107, 117th Cong., 1st sess., https://www.congress.gov/bill/117th-congress/senate-bill/2107/text; 26 U.S.C. 48D.

Other challenges identified, such as the decline in capital investments in domestic manufacturing capability and lack of an appropriately trained workforce, are addressed by the other three funds.71Sargent, et al., Frequently Asked Questions: CHIPS Act of 2022. These funds will pay for a variety of semiconductor R&D activities, including new projects at the National Institute of Standards and Technology, a new National Semiconductor Technology Center, a National Advanced Packaging Manufacturing Program, and other programs.

Thus far, the incentives offered by the CHIPS and Science Act seem to be drawing investment. Within a week of the CHIPS and Science Act’s passage, companies had announced close to $50 billion in private investments in American semiconductor manufacturing.72“Fact Sheet: CHIPS and Science Act Will Lower Costs, Create Jobs, Strengthen Supply Chains, and Counter China,” The White House: President Joseph Biden, August 9, 2022, https://www.whitehouse.gov/briefing-room/statements-releases/2022/08/09/fact-sheet-chips-and-science-act-will-lower-costs-create-jobs-strengthen-supply-chains-and-counter-china/. Among them were Micron, TSMC, and Texas Instruments. Notably, TSMC, which leads the world in advanced semiconductor production, raised its investment at its Arizona plant from $12 billion to $40 billion. The company also announced that it would be “producing more technically advanced chips than originally proposed.”73Emma Kinery, “TSMC to up Arizona Investments to $40 Billion with Second Semiconductor Chip Plant,” CNBC, December 6, 2022, https://www.cnbc.com/2022/12/06/tsmc-to-up-arizona-investment-to-40-billion-with-second-semiconductor-chip-plant.html. Apple also announced that it would be buying hardware produced in Arizona by TSMC.74Mark Gurman, “Apple Prepares to Get Made-in-US Chips in Pivot From Asia,” Bloomberg, November 15, 2022, https://www.bloomberg.com/news/articles/2022-11-15/apple-prepares-to-get-made-in-us-chips-in-pivot-from-asia-supply?in_source=embedded-checkout-banner.

While the bill has successfully attracted private investment in the domestic semiconductor manufacturing industry, the long-term success of the CHIPS and Science Act is not guaranteed. Policymakers should now focus on addressing some of the underlying issues that make it more expensive to operate in the US.

The grants and tax incentives offered by the CHIPS and Science Act were designed to overcome the cost differential of constructing a plant in the US. However, delays caused by permitting and workforce shortages could quickly drive-up costs and undermine the investments made in the Act. Determining whether the incentives offered are sufficient to overcome these will be the first hurdle to clear if the US is to succeed in reshoring the semiconductor manufacturing industry. Even if the projects are not abandoned by companies due to these increased costs, they will make it more difficult for the fabs to be cost competitive, thus decreasing their chances of long-term viability in the absence of continued federal subsidies.

Relying on continued federal subsidies is hardly a secure course of action. As noted above, passing the CHIPS and Science Act was a years-long process that, save for heavy campaigning on the part of proponents, could have fallen apart at the last minute. Policymakers should not rely on the ability to pass similar legislation to increase these funds in the future. It is better to avoid this situation by addressing one of the root causes of potential cost overruns: permitting delays. Policymakers should turn their attention to permitting reform. There has already been some action on this front. Senator Kelly has introduced legislation seeking to streamline the federal permitting process for projects funded by the CHIPS and Science Act.75Building Chips in America Act of 2023, 118th Cong., 1st sess., https://www.kelly.senate.gov/wp-content/uploads/2023/07/Building-Chips-in-America-Act-Bill-Text.pdf. This bill, the Building Chips in America Act, would be an important first step in ensuring the long-term success of the CHIPS and Science Act by maximizing the value of the funds that are soon to be dispersed to incentivize companies.

Conclusion

The semiconductor industry of today looks quite different than it did in its early days. Initially, it was based entirely in the US, which is unsurprising since the semiconductor was invented here as well.76Miller, Chip War, 11. However, over time, the unique nature of semiconductor fabrication has pushed the semiconductor industry to outsource the end fabrication and focus on higher-margin products.77Antràs (2023). Additionally, as fabrication was outsourced, supply lines moved to East Asia, predominantly Taiwan, South Korea, and China. This move is not new. As early as the 1960s, companies began moving fabrication to Hong Kong.78Miller, Chip War, 54. What is new is the political drive to bring them back.

This drive began as early as 2018 but came into force as COVID highlighted the precarious position that the US was in concerning chips. China’s push into the semiconductor industry combined with its increasingly aggressive actions towards Taiwan and strict zero-COVID policy underlined the potential for counterparty risk to both the semiconductor industry and, due to the national security implications of chips, the US government itself.

What emerged from this realization was a concerted effort to bring the semiconductor manufacturing industry back to the US, which culminated in the passage of the CHIPS and Science Act on August 9, 2022.79CHIPS and Science Act, Pub. L. No. 117–167, 136 Stat. 1366 (2022). Whether this effort will be successful remains to be seen. Its goals are lofty, given that prevailing forces since the 1960s have seen the industry move out of the US and into East Asia, but not impossible. As grants are dispersed by the Department of Commerce, policymakers must focus on making the changes necessary for the US semiconductor industry to be self-sufficient and thriving.