Supply-side economics has a dirty reputation. Since the late 1970s, the term has been associated with “trickle-down” economics: the now-defunct theory that cuts in the highest tax brackets would boost economic productivity so much that government revenue would increase and all of society, even the poor, would benefit.

The trickle-down theory is all but dead, but there is more to the supply side of the economy than taxes. Thousands of government decisions affect real output and economic productivity. A new supply-side economics would recognize that productivity growth is the right target, but it would reject tax policy as the primary means of stimulating productivity. Instead, it would examine how everything government does — from permitting to procurement — could be improved to increase productivity.

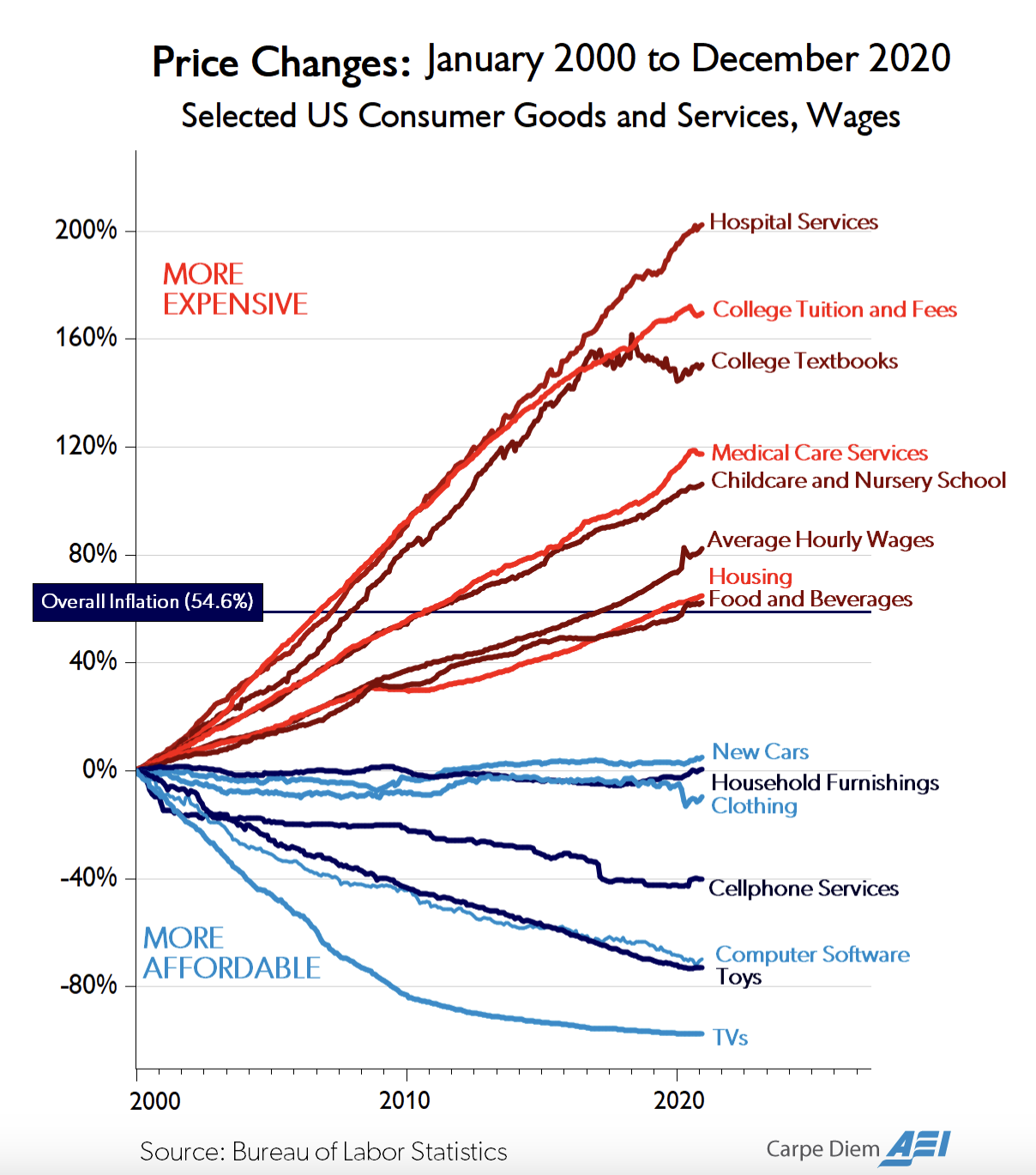

In contrast with the old supply-side economics, this approach could be progressive from the outset. Productivity growth has stagnated for decades, with a particularly sharp decline for the last 15 years. What little productivity growth we have experienced has been uneven — there have been many productivity improvements in television manufacturing and few in hospital services, as Mark Perry’s famous chart shows.

These productivity changes are not neutral with respect to the distribution of income. Some high-cost items impose an especially large burden on the budgets of the poor. If we could increase productivity growth in particular sectors, we would reduce real income inequality. Doing so would also unambiguously grow the size of the overall economy.

What are the sectors where productivity gains would have the biggest progressive effect? A look at the Bureau of Labor Statistics’s Consumer Expenditure Surveys, particularly its table on income deciles, can help us figure that out.

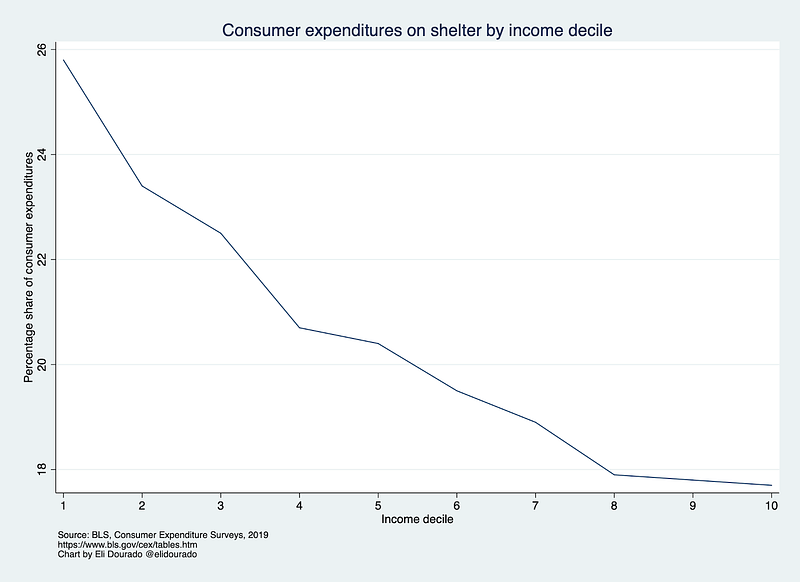

Shelter

By far, the biggest share of the lowest income decile’s consumer expenditures go to housing, and specifically shelter (as opposed to other household expenses such as household operations, housekeeping supplies, or furnishings that all fall under BLS’s housing category). Much has been made about NIMBYism, zoning reform, and the need to decrease housing costs. This emphasis is completely warranted from a progressive supply-side perspective. The lowest decile spends 25.8 percent of its budget on shelter, whereas the top decile spends 17.7 percent. A decrease in the cost of shelter would, therefore, disproportionately benefit the poorest in America.

Progressive supply-siders, therefore, must continue to unite against excessive zoning and NIMBYism. We need to build a lot more housing to drive down its cost. And we must support new and innovative building methods (like Cover’s LEGO-like building system) that leverage economies of scale in construction. A victory on housing productivity would result in hundreds of extra dollars a month in the pockets of the poor.

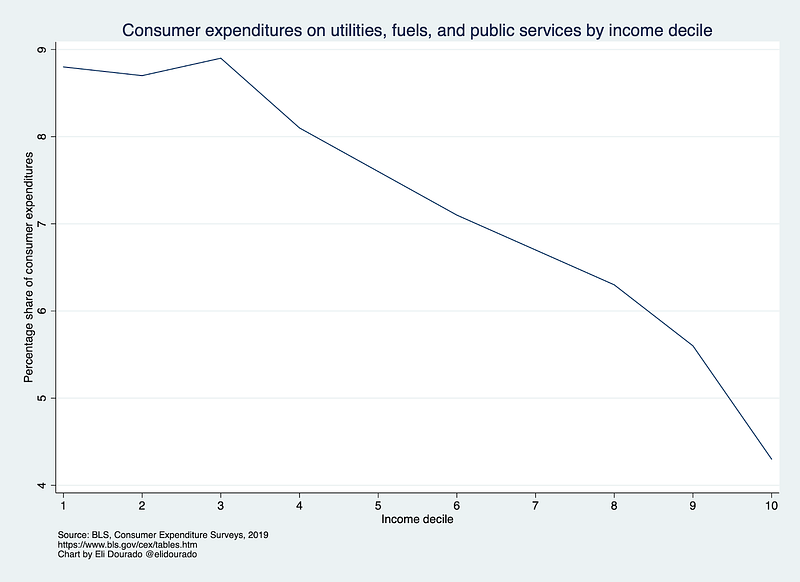

Energy

The three lowest income deciles spend between 8.7 and 8.9 percent of their budgets on what the BLS calls “utilities, fuels, and public services.” This category includes energy — natural gas, electricity, and heating oil — as well as telephone service and a catchall “water and other public services.” More than half of the category lies in the three energy items.

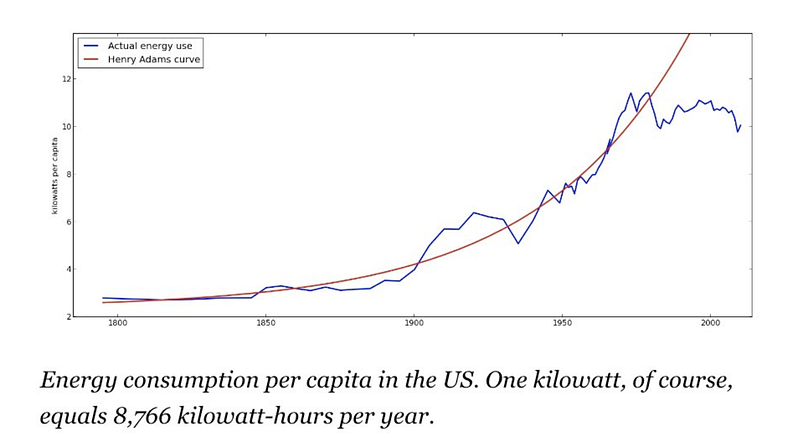

We are fortunate in the United States to have achieved energy independence through the shale oil boom. The boom has resulted in ultra-cheap natural gas, which is basically a waste product from the search for petroleum. US electricity prices are a fraction of what they are in Europe. But even so, we have not realized the 1950s-era goal of clean energy too cheap to meter. Instead, we have moderated our per-capita energy consumption, as shown in this chart from J. Storrs Hall’s book, Where’s My Flying Car?

The falling cost of wind and solar electricity combined with my favorite energy technology, advanced geothermal energy, could unlock significantly cheaper energy costs, as well as zero carbon dioxide emissions. The low cost of clean energy would have ramifications not only for the pocketbooks of the poor but also throughout the entire economy.

Food at home

Another major line item in the budgets of the lower income deciles is food. All deciles spend about the same percentage of their budget on food away from home — the numbers vary from 5.1 to 5.9 percent. Where the deciles differ is on food at home. The lowest deciles spend 9.7 percent of their total expenditures on food at home, whereas the top decile spends 5.2 percent.

Food and beverage inflation has increased in the past two decades nearly as much as housing inflation. As the data shows, this budget item hits the poorest the hardest. Through innovation in vertical farming, lab-grown meat, and the energy technologies mentioned in the previous section, we could reduce the cost of groceries and increase the level of nutrition available for any spending level. Cheaper healthy food options could reduce obesity, a condition disproportionally prevalent among the poor. This food innovation benefits everyone, but it benefits the poor the most.

Healthcare

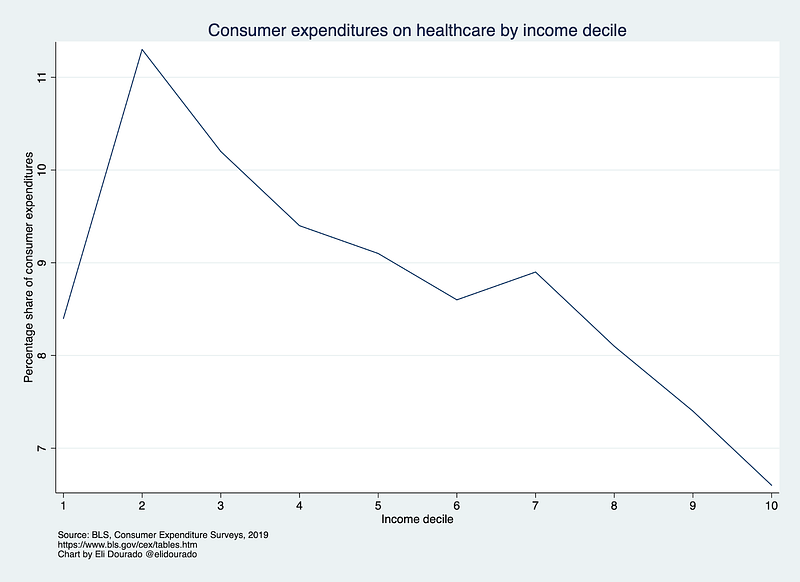

Healthcare is a tricky topic to evaluate from the Consumer Expenditure Surveys, as the surveys only capture costs borne by consumers — their personal portion of the cost of health insurance as well as out-of-pocket medical expenses. It doesn’t include the employer portion of health insurance or the contribution of programs like Medicaid, nor does it include services paid for by insurance. Total national health expenditures, if we include all of the above, would be 17.7 percent of GDP.

Yet even in personal and out-of-pocket medical expenditures, there is a clear trend suggesting that health innovation would benefit the poor the most. The second income decile spends 11.3 percent of its budget on these health expenses, while the top decile spends 6.6 percent. The first decile may spend less than the second because its household members are younger and healthier — people in the second decile are twice as likely to be elderly than those in the first.

We badly need health innovation to drive down costs. As I argued in Fortune, research on biological aging could lead to longer healthspans, compressed morbidity, reduced chronic disease prevalence, and lower medical expenditures. Additionally, consumer medical devices could lower the cost of high-quality medical monitoring, replacing the annual physical with continuous observation of health indicators. With better monitoring, serious conditions could be detected earlier, when they are cheaper to address. Other breakthroughs in biology, like mRNA vaccines and computer-simulated protein folding, could lead to quicker and less expensive cures for virtually every disease.

Putting it all together

Combining these four elements — shelter, utilities, food at home, and direct healthcare expenditures — adds up to a lot. Together, they make up 52.7 percent of the first decile’s total expenditures and 53.1 percent of the second decile’s. For the top decile they account for only 33.8 percent of expenditures. Innovation in these sectors, then, directly and disproportionately benefits the poorest in America.

A progressive supply-side agenda, therefore, would target productivity growth in the necessities that make up over half the budget of the poor. Through smarter regulation and entrepreneurial policy, we can drive down the cost of these goods and increase the real standard of living at the bottom of the income distribution.

To be sure, a supply-side approach is a complement, not a substitute, for many government transfer programs. Even so, the potential of progressive supply-side policy exceeds that of transfers over the long run. Total annual expenditures for the first income decile average $25,856. A 10 percent across-the-board increase in productivity — less than five years’ economic growth in the 1960s or the late 1990s — would be worth $2,586 per year to these households, twice the average value of direct public assistance as reported in the survey. A progressive approach that targeted productivity improvements specifically to necessities could do even better, as would productivity gains that compounded over a longer period of time. In addition, progressive supply-side policy could “trickle up” to provide gains in the rest of the income distribution, a benefit worth considering.

As necessary as government transfers are, the policy conversation has overrelied on them. Need to stimulate the economy? Write people checks. Have a poverty problem? People won’t be poor if we send them enough checks. Global pandemic? Checks. These demand-side policies have their virtues — they are simple to implement and they often at least partially achieve their goals.

But for true prosperity across the income distribution, we need a more creative supply-side approach. We policy wonks need to do the hard work of finding policies that increase productivity growth, particularly for those goods and services consumed disproportionately at the bottom of the income distribution.