Introduction

The publication of Thomas Piketty’s Capital in the 21st Century has focused considerable attention on the sharp increase in wealth and income inequality in the United States and across the world since the 1970s.1Thomas Piketty, Capital in the Twenty-First Century, trans. Arthur Goldhammer (Cambridge, MA: Belknap Press, 2014) Economists such as Atkinson and Stiglitz had previously focused most on the economic benefits to reducing inequality as measured by expected utility before the “veil” was lifted regarding where and how each of us was brought into the world.2Anthony Atkinson, Inequality: What Can Be Done? (Cambridge, MA: Harvard University Press, 2015); Joseph E. Stiglitz, The Great Divide: Unequal Societies and What We Can Do about Them (London: Penguin Books, 2015). Thanks to Piketty there is now also increasing alarm about the political implications of wealth disparity. History is, after all, replete with evidence that money can buy influence, making wealth inequality disruptive to liberal democracy.

Of course, there is an older tradition of criticism regarding the conflict between socioeconomic classes that can be traced back to Adam Smith and Karl Marx among others, which has, at times, caused major convulsions to the global order. Recent innovations in modeling have provided a more theoretical basis for some of Smith’s admonishments about the class of people that came to be known as capitalists. These are people who get most of their income from the capital they own (i.e., final goods used to produce other goods) rather than from the labor they exert.3Adam Smith, The Wealth of Nations, ed. C. J. Bullock (London: W. Strahan and T. Cadell, 1776; New York: Barnes & Noble, 2004), 181. Citations refer to the Barnes & Noble edition. While the attention of progressive politicians has historically been focused on discouraging the overaccumulation of wealth by the top 1 percent of the 1 percent, it is actually an underaccumulation of capital that yields market failure and may have contributed to the oft-cited stagnation of wages during the past few decades. In a world where the very wealthy own 20 to 30 percent or more of the capital stock, they can, by saving less, conspire to depress the overall capital stock and capture more profit.4How wealth inequality can lead to market failure is beyond the scope of this paper, but details can be found in James A. Feigenbaum, “Capital in a Segregated Economy” (working paper, Utah State University, Logan, UT, February 2019). While many Democratic candidates in the 2020 presidential election have identified wealth inequality as one of the two biggest threats, along with climate change, to America as we know it today, this nuance means, as Smith warned, we have to be exceedingly careful about how precisely we try to rein in capitalists.

The obvious political response to large concentrations of wealth is a progressive tax on wealth. This was propounded by Piketty, and proposals have been mooted that would tax the wealth of billionaires at rates that range from 2 percent to as high as 8 percent. However, such a wealth tax is a very blunt instrument; it is also controversial, even among Democrats. We will argue here that a more effective policy response would be to reduce the government’s debt, though the connection between debt and wealth inequality is, admittedly, highly counterintuitive.

While it seems unlikely, in the wake of this election cycle’s Super Tuesday, that a wealth tax will continue to be a major issue in the general election, the issues we raise here are highly relevant to the political decision of how to finance measures intended to mitigate the effects of COVID-19. Since interest rates are effectively zero now, the kneejerk reaction of many policymakers has, predictably, been to borrow our way out of the crisis, but a massive increase in the public debt could have significant long-term implications that economists have heretofore ignored.

The macroeconomics community has long been torn about the effects of the public debt. Some of the earliest economics writers, such as David Hume, believed that government borrowing was highly destructive.5David Hume, “Of Public Credit,” in Essays: Moral, Political, and Literary (Reprint, Overland Park, KS: Digireads Publishing, 2012). David Ricardo, on the other hand, posited that the debt is not so harmful as his predecessors feared.66 David Ricardo, Principles of Political Economy and Taxation (London: John Murray, 1817; New York: Barnes & Noble, 2005). Citations refer to the Barnes & Noble edition. Under some circumstances, which we will describe in more detail below, there is no difference in the economic impact between a government’s decision to pay for new spending by raising taxes now and a decision to borrow now and raise taxes later; this is known today as Ricardian equivalence. As implausible as this may sound, data on interest rates and the debt actually do support the contention, often ascribed to Dick Cheney, that deficits do not matter.

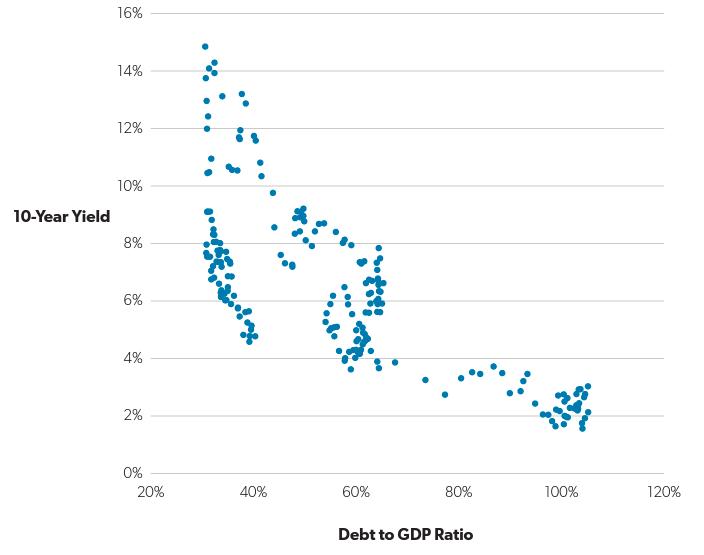

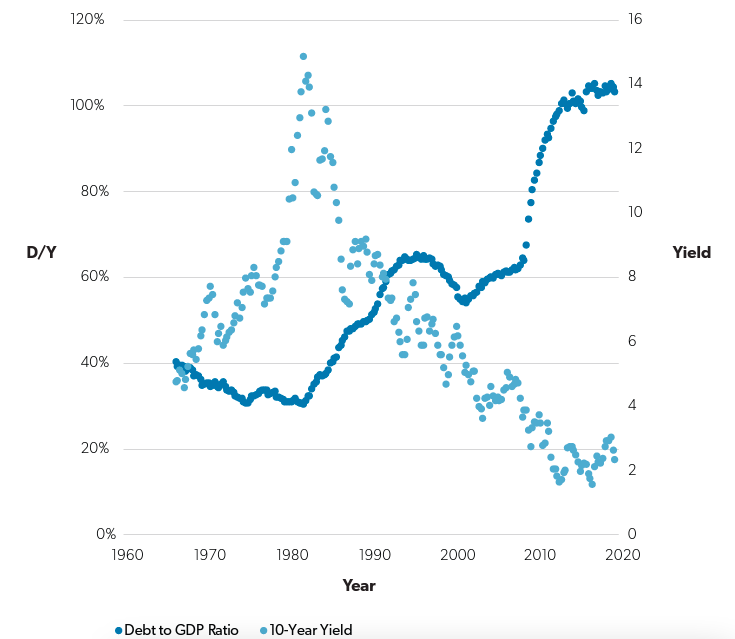

The main concern about a growing public debt has generally been that it will raise the government’s cost of borrowing. However, as shown in figure 1, between 1966 and 2019, the interest rate on 10-year Treasury bonds has generally moved in the opposite direction as the debt-to-GDP ratio. Figure 2 shows the corresponding time series for both of these variables. The positive correlation seen in figure 1 is mostly driven by the data following the so-called Volcker revolution in the early 1980s when interest rates peaked. Since then, interest rates have trended downward while the debt-to-GDP ratio has moved up in steps. One should not read too much into this decline of interest rates because it is likely the result of global factors. The growth of emerging economies has led to more households saving around the world. The United States has also been more reliable about paying its debts than many other countries. Accounting for these exogenous factors, though, we cannot reject the hypothesis of Ricardian equivalence based on interest rate data.

Figure 1. A scatter plot of the yield on 10-year Treasury bonds versus the debt-to-GDP ratio at quarterly intervals from 1966 to the second quarter of 2019.

Source: Federal Reserve Economic Database

Figure 2. Time series of the debt-to-GDP ratio (D/Y) and the 10-year yield on Treasury bonds at quarterly intervals from 1966 to the second quarter of 2019.

Source: Federal Reserve Economic Database

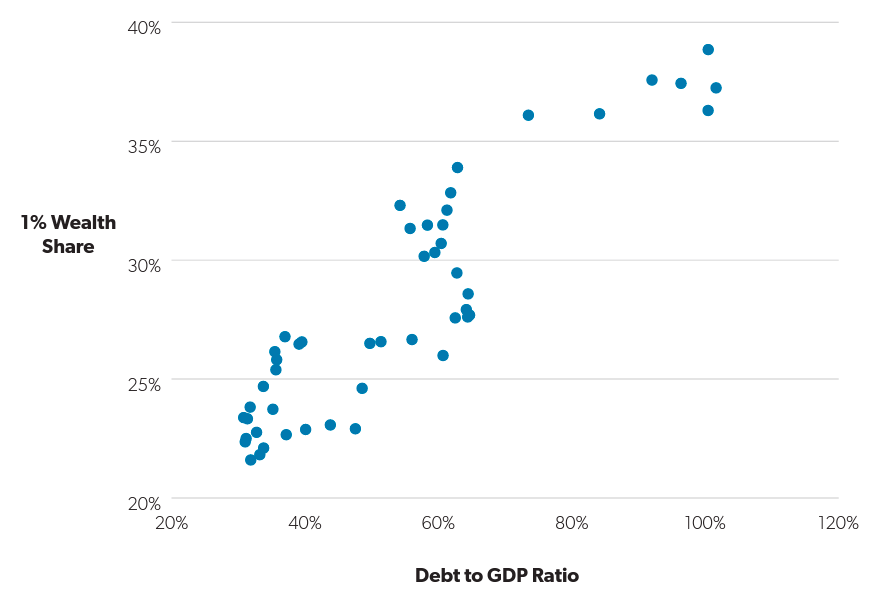

While it is fairly well known that the debt has not put upward pressure on interest rates, another correlation involving the public debt has virtually escaped attention, even among academic economists. Figure 3 is a scatter plot of the debt-to-income ratio versus the fraction of wealth owned by the top 1 percent as estimated by Saez and Zucman.7Emmanuel Saez and Gabriel Zucman, “Wealth Inequality in the United States since 1913: Evidence from Capitalized Income Tax Data,” Quarterly Journal of Economics 131, no. 2 (2016): 519–78. At the same time that the US government has extravagantly increased its borrowing, we have seen the rise in inequality documented by Piketty, resulting in a positive correlation between these variables.8Piketty, Capital. Our main thesis is that this correlation is not a historical coincidence.

Figure 3. A scatter plot of the share of wealth owned by the 1 percent versus the debt-to-GDP ratio at yearly intervals from 1966 to 2014.

Source: Emmanuel Saez and Gabriel Zucman, “Wealth Inequality in the United States since 1913: Evidence from Capitalized Income Tax Data,” Quarterly Journal of Economics 131, no. 2 (2016): 519–78.

Combining Two Macroeconomic Models

Scientific investigators are often in a situation like the mythical blind men who touched different parts of an elephant and drew entirely different conclusions about its constitution. The two leading classes of models in macroeconomics often make quite dissimilar predictions. One class will do a good job of explaining certain aspects of the data while the second model fares better with other aspects of the data. Historically, when some experiments favor one theory and other experiments favor a completely different theory, scientists usually find in the end that the truth is somewhere in between. Here too, if we combine these two classes of macroeconomic models, we can explain a larger subset of the data than either class can explain by itself. In addition, the hybrid model makes one new prediction consistent with figure 3: a positive correlation between the public debt and wealth inequality.

One of the primary components that distinguishes macroeconomics from microeconomics is that the former must address the dynamics of all inputs to production employed by the economy. The stock of physical capital is one such input.9Human capital (i.e., additional labor productivity that is acquired through education and other investments in oneself ) is another important input of production. The compensation for human capital behaves in part like the compensation for ordinary labor but also in part like the compensation for physical capital. Differences in human capital play a major role in explaining income and wealth inequality, but human capital cannot be accumulated without bound like physical capital, which is the key feature of physical capital here. Capital is accumulated by diverting final goods from consumption to the production of other goods. That only makes sense if there is a reward in the future, so accounting for this deferment of consumption requires a model in which the decision-making entities live for multiple periods. What separates the two classes of workhorse models is whether these entities are mortal or immortal.

The simpler case is actually to assume the decision makers never die since we can then assume everyone is the same age. So-called infinite-horizon models dominated early research in macroeconomics and, while there is an obvious unrealism to these models, much of our common intuition, especially among conservative politicians, derives from this pioneering work. Although the stock of physical capital is difficult to measure, physical capital is remarkable because it is one of the few macroeconomic variables that we fully understand, both in terms of how we modify it, via saving and investment, and in terms of how it affects the economic variables that matter most to us.10In contrast, while we know the processes by which we accumulate human capital, it is much more difficult to measure the stock of human capital or how exactly it contributes to production since we only have ordinal measures of how much education we have acquired. A high school senior, for example, does not have 12 times the knowledge of a first grader. In particular, wages increase with the capital-to-labor ratio. Ultimately, households determine the capital stock through their decisions about how much to consume and how much to save. If households value present consumption over future consumption, they must weigh the difference between the return on saving—how much their consumption will increase if they delay it—versus the loss in utility from delaying it. For households that live forever, this is the only consideration that comes into decisions about saving, so in equilibrium these two factors must balance out. The capital stock will adjust so the return on saving equals the rate at which the household discounts future consumption.

If true, this simple result would have enormous implications for tax policy. Today, the term supply-side economics is mostly associated with the Laffer curve and the now thoroughly debunked notion that any income tax cut will invariably lead to an increase in tax revenue.11The relationship between tax revenue and tax rates is known as the Laffer curve since it was popularized by economist Arthur Laffer. If tax rates are 0 percent, then tax revenues must too be zero; if tax rates are 100 percent, economic activity will cease, and tax revenues will again zero out. In between, the curve will be hump-shaped. A tax cut can indeed lead to higher revenue if tax rates are high enough, but the top rate for labor income taxes has not been that high since the 1970s. Indeed, Piketty attributes the rise of income inequality in the United States and Britain in part to the Reagan-Thatcher tax cuts. See Piketty, Capital. However, there is a germ of truth behind the concept of “trickle-down” economics. Assuming that all of these infinitely lived households invest in capital, Judd and Chamley have separately shown quite robustly that the optimal tax on capital should be zero.12Kenneth L. Judd, “Redistributive Taxation in a Simple Perfect Foresight Model,” Journal of Public Economics 28, no. 1 (October 1985): 59–83; Christophe Chamley, “Optimal Taxation of Capital Income in General Equilibrium with Infinite Lives,” Econometrica 54, no. 3 (1986): 607–22. Things are more complicated if some of these infinitely lived households do not save. See Ludwig Straub and Iván Werning, “Positive Long-Run Capital Taxation: Chamley-Judd Revisited,” American Economic Review 110, no. 1 ( January 2020): 86–119. If we ignore other forms of wealth such as land or artwork, this also implies the optimal tax on wealth should be zero.13 Most macroeconomic models treat capital and wealth as interchangeable, as we do here. Since the supply of land is, at least in the short run, fixed, taxes on land are much less distortionary than taxes on capital. When we argue that wealth should not be taxed, we are really arguing that capital, which makes up the bulk of wealth in most developed countries, should not be taxed.

A tax on capital reduces the return on saving. Due to diminishing returns to capital, the equality of the after-tax return on capital and the discount rate will yield a smaller capital stock and lower wages. Consequently, the optimal tax on capital with infinitely lived households is zero.14Subsidies of the capital stock are also inefficient since they result in too much capital. Ignoring the subsidy, the objective return on saving for society as a whole will be less than the discount rate. We would be better off consuming more now. This is the scientific basis for the belief that cutting the taxes of wealthy capitalists will ultimately benefit everyone by increasing salaries.

As mentioned earlier, economists have long debated what impact a large debt has on a macroeconomy. Ri- cardo argued that much of the consternation about debt expressed by his predecessors was overblown because, at first glance, it does not really matter whether a government finances its spending by taxing people now or by borrowing now and taxing them later.15Ricardo, Principles of Political Economy. If the government borrows against future tax revenue, an infinitely lived household will respond by saving more to pay the higher taxes later, and that additional saving will end up financing the government’s borrowing with no effect on the capital stock. Barro showed that this is a general property of infinite-horizon models, whether the people actually live forever or their families do, and he termed the result “Ricardian equivalence.”16Robert J. Barro, “Are Government Bonds Net Wealth?,” Journal of Political Economy 82, no. 6 (1974): 1095–117.

However, even Ricardo noted that his result depends on several caveats, most particularly that the same group of taxpayers should be responsible for repaying the debts their government incurs. An overlapping-generations model is a model in which households are mortal and households of different ages coexist or “overlap.” The first full-fledged neoclassical overlapping-generations model was introduced by Diamond to show rigorously that government debt indeed matters if cohorts do not internalize the welfare of other cohorts like the dynasties in Barro’s model.17Peter A. Diamond, “National Debt in a Neoclassical Growth Model,” American Economic Review 55, no. 5 (1965): 1126–50. In that case, government debt should “crowd out” private investment.

Households will be largely indifferent between saving by lending to the government or saving by investing in private enterprises, but their capacity to save will be limited by their labor income. The more the government borrows, the less the economy will be able to invest in itself. This will yield a smaller capital stock, and borrowers and entrepreneurs will bid up interest rates in search of scarce financing. When asked what cost a country incurs by borrowing at an ever increasing rate, the stock answer of economists has been to follow Diamond and say it will eventually push up interest rates. The continual failure of this prediction to bear out in the United States, as shown by figure 1, has lately generated such heterodoxy as Modern Monetary Theory.

Assuming households are mortal also yields a different result regarding taxes on capital. Taxing income from capital or from the value of capital or wealth can increase social welfare in an overlapping-generations model—the opposite result from what an infinite-horizon model delivers.18Juan Carlos Conesa, Sagiri Katao, and Dirk Krueger, “Taxing Capital? Not a Bad Idea After All!,” American Economic Review 99, no. 1 (March 2009): 25–48; Faith Guvenen, Gueorgui Kambourov, Burhan Kuruscu, Sergio Ocampo, and Daphne Chen, “Use It Or Lose It: Efficiency Gains from Wealth Taxation” (Working Paper 764, Federal Reserve Bank of Minneapolis, September 2019). The difference between these results is easiest to understand for the extreme case wherein households are modeled as living two periods of, typically, thirty years: a working period and a retirement period. Young households must allocate their labor income between current consumption and saving to finance their consumption while old. It is this saving for retirement that engenders the economy’s capital stock.19More complicated models with uncertainty would yield additional motives for saving, but these are not pertinent to the present discussion. In this stylized framework, saving must come out of wages alone rather than out of the total income of the economy, including the profits from capital. More precisely, saving must come out of after-tax wages.20This assumes that all saving is private. If the government also saves, since it is presumably infinite-lived, the capital stock will be determined by how much it discounts the future just as we would have with infinite-lived households. Arguments for taxing capital are then more nuanced. See Conesa, Katao, and Krueger, “Taxing Capital?” However, government saving would introduce other difficulties endemic to a socialist economy. Depending on the house- hold’s preferences, the return on capital may not even enter into the decision of how much to consume and how much to save. Thus, for some parameterizations of overlapping-generations models, it may be optimal to only tax capital and not tax labor income.

How do we reconcile these two diametrically opposed policy prescriptions? Scientifically, we have the problem that, empirically, some facts are easily reconciled with an infinite-horizon model but not an overlapping-generations model while the reverse is true for other facts. Obviously, real people are mortal, but as Barro argued, if the happiness or utility of parents depends directly on the happiness of their children,21This is termed pure altruism. In contrast, under “impure altruism,” epitomized by De Nardi, parents get utility from doing good things for their children or by observing signals that their children are doing well. See Mariacristina De Nardi, “Wealth Inequality and Intergenerational Links,” Review of Economic Studies 71, no. 3 (2004): 734–68. reproducing households will behave as though they live forever.22Barro, “Government Bonds.” The most basic overlapping-generations models.23For a review of the complexities of overlapping-generations models used in practice, see Martin Browning and Thomas F. Crossley, “The Life- Cycle Model of Consumption and Saving,” Journal of Economic Perspectives 15, no. 3 (2001): 3–22. assume that households start from nothing, which is consistent with the finding that most parents do not purposefully save just to leave something for their children.24Michael D. Hurd, “Savings of the Elderly and Desired Bequests,” American Economic Review 77, no. 3 (1987): 298–312. On the other hand, a large fraction of the capital stock is known empirically to derive from intergenerational transfers and bequests.25Laurence J. Kotlikoff and Lawrence H. Summers, “The Role of Intergenerational Transfers in Aggregate Capital Accumulation,” Journal of Political Economy 89, no. 4 (1981): 706–32.

The Segregated-Economy Model

Consider a hybrid model, which we will call a segregated-economy model,26Mankiw called this model a spenders-savers model. N. Gregory Mankiw, “The Savers-Spenders Theory of Fiscal Policy,” American Economic Association Papers and Proceedings 90, no. 2 (May 2000): 120–25. in which some households effectively live forever and other households do not.2727 We should clarify that the empirical deficiencies of overlapping-generations models highlighted in the above discussion can generally be remedied if they are made sufficiently sophisticated. The segregated-economy model is presented here as a simple way of bypassing the considerable work that must go into fine-tuning such models. For our purposes here, a segregated-economy model is sufficient, but many research questions can only be answered with complicated overlapping-generations models since, after all, real people are without exception mortal and that is likely true of dynasties as well. For simplicity, let us suppose that most members of the population do not have enough wealth to leave a significant bequest to their children, so they can best be modeled as finite-lived. The top 0.1 percent of the population28While much of the discussion of wealth and income inequality focuses on the distinction between the 1 percent and the 99 percent, according to Adam Smith, the legitimate class conflict is between those who earn most of their income from labor and those who earn most of their income from capital, for the interest of capitalists “has not the same [connection] with the general interest of the society as that of ” workers and landlords (Wealth of Nations, 181). Citations refer to the Barnes & Noble edition. “The rate of profit does not, like rent and wages, rise with the prosperity, and fall with the declension, of the society” (Smith, Wealth of Nations, 180). Piketty identifies the threshold quantile that separates people into these two groups to be roughly 0.1 percent. Those between the top 0.1 percent and 1 percent do earn more than the bottom 99 percent, but their wages generally move in the same direction as the 99 percent while the profits that maintain the 0.1 percent move in the opposite direction. However, qualitative results are not sensitive to the value of this threshold quantile. See Piketty, Capital. does have sufficient wealth to manage it through posterity, so they are modeled as infinite-lived.29Feigenbaum and Li show how this disparate behavior can arise naturally in a model where transfers between parents and children who care about each other’s utility are determined by intrafamily bargaining. James A. Feigenbaum and Geng Li, “Intergenerational Bargaining and Intravivos Transfers” (working paper, 2018). Following the language of Ricardo, we term these two groups the workers and the capitalists respectively since the former get most of their income from labor while the latter get their income from their capital.

The segregated-economy model was constructed specifically to study the political economy of financing government spending with taxes on labor income or capital since, a priori, workers should be most burdened by taxes on labor whereas capitalists should be most burdened by taxes on capital. We imagine that most policymakers who support a wealth tax are motivated by that expectation. Shockingly, the Judd-Chamley result carries over from a pure infinite-horizon model to a segregated economy regardless of what fraction of the population are laborers and what fraction are capitalists.30Mankiw first established this result. See Mankiw, “Savers-Spenders Theory.” Michel and Pestieau showed it is fairly robust. Philippe Michel and Pierre Pestieau, “Fiscal Policy with Agents Differing in Altruism and Ability,” Economica 72, no. 285 (February 2005): 121–35. As long as there are some infinite-lived capitalists, a tax on capital will burden laborers more than a tax on labor, so the optimal tax on capital for both groups is zero. 31Actually, while it is optimal for laborers not to tax capital, the relationship between the capital tax and the welfare of the capitalists can surprisingly be more complicated. James A. Feigenbaum, “Taxing Capitalists” (working paper, Utah State University, Logan, UT, August 2019).

Two variables determine the welfare of laborers: the after-tax wage and the after-tax return on capital. What distinguishes the political economy of the overlapping-generations model from the segregated-economy model is that, in the latter, the after-tax return on capital is determined in the steady state solely by the preferences of the infinite-lived capitalists.32This assumes the capitalists are price-takers. For the more general case, see Feigenbaum, “Segregated Economy.” Assuming those are fixed, the after-tax wage is really the only variable that affects laborers in the segregated-economy model.

If the government’s needs are held constant and taxes on capital are cut, presumably taxes on labor income must be increased, and vice versa. Thus one would intuitively expect a decrease in capital taxes to hurt laborers since they will be paying more of the country’s tax bill. However, this ignores the effect of capital taxes on the before-tax wage. Lower capital taxes should also yield more capital and higher wages. These conflicting effects make the overall effect of capital taxes on the welfare of laborers ambiguous, a priori. Surprisingly, if capitalists are price-takers and taxes on both labor and capital income are flat, the effect of capital taxes on wages always dominates the contrary effect of changes to the tax on labor income.33We can decompose the effect of a change in capital taxes on the after-tax wage into three pieces. The direct effect of a higher capital tax rate is that it should lower the tax rate on labor income, but it also reduces the capital stock, which serves to reduce overall revenue from the capital tax, undoing some of the decrease in the labor tax rate. The higher capital tax rate also reduces the before-tax wage. If factor markets are competitive so the before-tax wage is the marginal product of labor and the before-tax return on capital is the net marginal product of capital, the reduction of the before-tax wage will exactly cancel the direct effect of the higher capital tax rate on the after-tax wage. This leaves the effect of the smaller tax base for the capital tax, which unambiguously lowers the after-tax wage. We only need a handful of very wealthy people who manage their fortunes like infinite-lived dynasties for a tax on capital to have the deleterious effects predicted by the workhorse models of the 1970s and 1980s.

Although a wealth tax can generate efficiencies that a tax on capital income does not, the segregated-economy model demonstrates that a wealth tax of even 2 to 3 percent might have devastating effects.34Guvenen et al., “Use It Or Lose It.” Again, this comment does not apply to taxes on other forms of wealth besides capital. In order for capitalists to hold a significant amount of capital, as they do empirically, they must discount the utility from future consumption at a slower rate than workers.35It is simpler to assume capitalists hold more wealth because they are more patient. We could alternatively explain this in terms of capitalists having access to investments that earn higher returns, but the results would be qualitatively similar. A progressive wealth tax that applies only to capitalists would effectively increase their discount rate by the percentage rate of the tax. If the total capital stock consistent with both capitalists’ preferences and the wealth tax is smaller than what workers would save on their own, there will be no niche for capitalists to fill; they will quickly consume all of their wealth and disappear from the economy. Since we only need a difference in discount rates of about two percentage points per annum in order to get capitalists to accumulate the roughly 20 percent of the capital stock owned by the 0.1 percent, a wealth tax of 2 percent a year would be sufficient to wipe out the capitalists and eliminate their contribution to the aggregate capital stock. This would permanently reduce the capital stock by 20 percent, which would in turn reduce output and wages by roughly 7 percent.36More generally, if capitalists own a fraction k of the capital stock, elimination of the capitalists would reduce output and wages by ak, where a is the fraction of GDP that goes to compensate the owners of capital, gross of depreciation. For the United States, a is between 0.3 and 0.4. That is nearly twice the reduction in output that occurred, albeit only temporarily, during the Great Recession.

This is not to say that capital income or wealth should not be taxed under any circumstances. The preceding discussion pertained to the effects of a tax on capital or wealth in the long run. A one-time tax on capital or wealth may be a useful tool of public finance. Indeed, any attempt at a Pareto improving37 a Pareto improvement is a change that increases the welfare of at least one agent while reducing the welfare of no one. tax reform would have to be kick-started with a tax increase on the very wealthy. Because they optimize over a longer time horizon, the top 0.1 percent can accept a short-term sacrifice in exchange for long-term benefits and still come out better off. That is not possible for the rest of the population.

Is there a fiscal reform that can improve wealth inequality without hurting the income of the lower 99.9 percent? As Mankiw first observed, while the segregated-economy model, like the infinite-horizon model, does not exhibit crowding-out effects, it does starkly predict that wealth inequality should increase with the debt-to-income ratio.38Mankiw, “Savers-Spenders Theory.”

The reason for this is simple. Government borrowing does not crowd out private investment because the capital stock in the segregated-economy model is determined by the preferences of capitalists. The only policy variables that do affect the capital stock are taxes that affect the rate of return on capital, such as taxes on wealth or capital income.39This is only true in the segregated-economy model with price-taking capitalists. With price-setting capitalists, there would be some higher-order crowding out effects from government debt. However, initial results indicate the effects of debt would be qualitatively similar in these two regimes of the model. See Feigenbaum, “Taxing Capitalists.” Meanwhile, it is the capital stock that determines the factor prices, which direct household behavior.

An increase in government debt causes two things to happen. First, an increase in taxation must occur to pay the higher interest bill. As discussed earlier, a tax on capital hurts both capitalists and laborers40If we do pay the higher interest with higher capital taxes, the story is more complicated but essentially the same., so it is more reasonable to suppose instead that higher debt would lead to higher taxes on labor income. Before-tax wages will not change, so after-tax wages (i.e., the income of laborers) must fall.

Second, since there is no crowding out and the capital stock is unchanged, private wealth must expand to accommodate the increase in public debt. Effectively, the government is converting public wealth into private wealth by issuing the debt and securitizing the value of future tax revenue. Since the available income of the laborers has fallen due to the labor income tax, they cannot afford to finance the new debt. The capitalists, with their income left unchanged, must therefore be the ones to accumulate the wealth of the newly issued debt. Due to this dynamic, the more the government borrows, the more wealth will be owned by capitalists.

Policy Implications

Raising taxes on wealth or capital to reduce wealth inequality is like cutting off your nose to spite your face. It will reduce wealth inequality but at great cost to workers since it also reduces the capital stock, which in turn depresses wages. We can reduce wealth inequality much more efficiently if we reduce total private wealth without reducing the capital stock, which can be accomplished by paying down the government’s debt. That, of course, would require an increase in taxation. While a permanent wealth tax would be ill advised, a short-term wealth tax could ameliorate the pain that workers would otherwise bear from a course of debt reduction.

The two standard models of neoclassical macroeconomics have been found wanting in their predictions regarding the consequences of government debt. Overlapping-generations models with finite-lived households suggest that government debt should drive up interest rates when in fact the opposite has happened. At the other extreme, infinite-horizon models, however unreasonable their assumptions, can account for the observed behavior of interest rates but not the accompanying rise in wealth inequality. However, if we combine these two classes into a hybrid model where most households are finite-lived while only a few behave as infinitely lived dynasties, we can accommodate all of the stylized facts regarding debt, interest rates, and inequality. In such a segregated-economy model, wealth taxes are ultimately self-defeating, yet the model offers another policy prescription that would reduce wealth inequality without reducing GDP: pay off the public debt by utilizing wealth taxes with a short-term sunset provision.

Before we close, we should address the current fiscal crisis faced by the United States. The federal government has already authorized emergency expenditures of two trillion dollars in response to the COVID-19 pandemic. It is likely that additional stimulus packages will follow if the country is to get through this recession without unnecessary pain. How this aid should best be allocated is the subject for another article. What is relevant here is how these aid packages should be paid for. Obviously, the government cannot raise taxes when we already have record unemployment. It will have to finance these expenditures primarily through borrowing.41Some of this cost may end up getting defrayed via increases in the money supply, as happened during the Great Recession. This is the exact opposite of what we just recommended, but it cannot be avoided. What concerns us is the temptation to leave these expenses on the country’s tab indefinitely.

While the federal government responsibly paid down a large chunk of the debt incurred during World War II in the prosperous peacetime that followed, this has not happened after the last two recessions. If interest rates stay at current levels, we are likely to hear a similar refrain arguing that it is too expensive to pay down the debt while the cost of servicing it is so low. To echo Adam Smith, we should be cognizant that much of this advice “comes from an order of men, whose interest is never exactly the same with that of the public, who have generally an interest to deceive and even to oppress the public, and who accordingly have, upon many occasions, both deceived and oppressed it.”42Smith, Wealth of Nations, 181. To prevent further encroachments of inequality, we should begin to pay down this debt as soon as it is practicable. History suggests the wealthy will recover from the recession sooner than the rest of the population, so their taxes should go up first, though any taxes on their physical capital should be temporary.