Introduction

For the US electrical grid, the 21st century has been a time of change and opportunity. New technologies have expanded power providers’ abilities to engage electricity consumers in conserving energy, ease electricity demand during peak hours, and reduce the overall cost of providing electricity. Innovations like digital technology, the internet, and web-based applications are providing more information about how and when consumers use electricity. They also are changing the relationship between consumers and producers by giving customers more autonomous control over their power consumption.

Smart meters are one such innovation that promised to utilize new technology to provide two-way communication between customers and the utility. Smart meters provide several benefits, including improvements in grid stability and reduced costs of meter reading. Over the past decade, utilities have made a concerted effort to deploy smart meters in homes across the country in an effort to increase energy efficiency, among other goals. That effort received a major boost in 2009 with the Smart Grid Investment Grant (SGIG) program, the largest program funded by the US government’s American Recovery and Reinvestment Act (ARRA).1 US Department of Energy, “Recovery Act: Smart Grid Investment (SGIG) Program,” accessed March 29, 2019, https://www.energy.gov/oe/information-center/recovery-act-smart-grid-investment-grant-sgig-program.1 SGIG grants had five goals, including promoting measurable improvements in “electric power system costs and peak demand” and “consumer electricity costs, bills, and environmental impacts.”2US Department of Energy, “Smart Grid Investment Grant Program: Funding Opportunity Number: DE-FOA-0000058,” FedConnect, June 25, 2009,https://www.fedconnect.net/FedConnect/default.aspx?ReturnUrl=%2fFedConnect%2f%3fdoc%3dDE-FOA0000058%26agency%3dDOE&doc=DE-FOA-0000058&agency=DOE.2

Speaking on October 26, 2009, to announce $3.4 billion in federal funding for building elements of the “Smart Grid,” President Obama highlighted those goals, telling a Florida audience that smart meters would give consumers the ability to track their electricity usage and save money by finding ways to be more energy efficient. The president said, “Most of the projects that are receiving grants involve the installation of what are known as smart meters, devices that will have direct benefits for consumers who want to save money on their electric bills.”3President Barack Obama, “Remarks by the President on Recovery Act Funding for Smart Grid Technology,” October 26, 2009, https://obamawhitehouse.archives.gov/photos-and-video/video/president-obama-explains-smart-grid-and-economic-recovery#transcript.3 The president claimed that, “Smart meters will allow you to actually monitor how much energy your family is using by the month, by the week, by the day, or even by the hour. So, coupled with other technologies, this is going to help you manage your electricity use and your budget at the same time, allowing you to conserve electricity during times when prices are highest, like hot summer days.”

A decade after the federal government authorized a multi-billion dollar increase in funding for the deployment of smart meters, it is worth asking if the deployment is achieving the goal of providing consumers with more control over electricity use and their power bills. Additionally, as smart meters have been deployed, private innovations like smart thermostats have begun to offer an alternative route for more energy efficiency and consumer control. The emergence of those innovations paralleled the deployment of smart meters but did not initially receive financial support from utilities.

This paper compares smart meters and smart thermostats in order to understand the effectiveness of each technology in engaging consumers and reducing power demands at key periods during the day. First, the paper will look at the impetus for smart meter deployment and how smart meters might impact existing electricity rates and demand. Next, we will look at the rollout of smart meters during the past decade, their successes and failures, and why they have fallen short of expectations. We will examine the emergence of smart thermostats and ask why utilities have turned to private innovations to achieve demand-reduction goals. Finally, we will offer some policy options and key ideas for future efforts to promote electricity conservation. Although smart thermostats and other private innovations are in their early stages, these tools have done more than simply update the technologies used by consumers. They have begun to change the nature of the incentives and economics in the energy market. As utilities continue to roll out smart meters, they are being leapfrogged by private-sector innovations. Those private-sector innovations provide a model for how we can change energy markets in ways that benefit consumers, the economy, and the environment.

Upgrading the Grid for Consumer Engagement

For more than a century, the cost structure facing electricity consumers has largely remained the same. Electricity prices were mostly static, fixing rates in a simple structure that recognized consumers’ inability to access timely information about fluctuating prices and respond appropriately. As one expert noted, without specific information, “consumers of electricity ‘have a hard time estimating the costs and benefits of their actions.’”4Gretchen Bakke, The Grid: The Fraying Wires Between Americans and Our Energy Future (New York: Bloomsbury USA, 2016), xxiv.4 As a result, residential rates “face a pricing schedule that does not vary with time but may increase once consumption reaches certain thresholds.”5Christopher Guo, Craig A. Bond, and Anu Narayanan, The Adoption of New Smart-Grid Technologies: Incentives, Outcomes, and Opportunities (Santa Monica, CA: RAND Corporation, 2015).5 Static rates hide the true cost of electricity use because they don’t reflect real-world market conditions. During times of high electricity demand, the static prices typically will be less than the actual market value of electricity and vice-versa during periods of low demand. The flat rate schedule was created at a time when technology did not exist to provide consumers real-time price information as demand changed during the day. That tariff system remains in effect today, and only about 2 percent of ratepayers see time-of-use rates.6David Nemtzow (Director of the Building Technologies Office, US Department of Energy), telephone interview with the author, November 5, 2018.6

Such a simple system, however, provides no incentive for customers to reduce their electricity demands when supplying power is most expensive.7See Paul L. Joskow, “Creating a Smarter US Electricity Grid,” Journal of Economic Perspectives 26, no. 1 (2012): 29–48.7 Under that system, consumers end up paying more for electricity overall—paying below-cost prices during peak demand hours but above-cost prices during off-peak to make up the difference.8See, for example, Samuel Newell and Ahmad Faruqui, “Dynamic Pricing: Potential Wholesale Market Benefits in New York State” (white paper, New York Independent System Operator, October 27, 2009); and Jeff Zethmayr and David Kolata, “The Costs and Benefits of Real-time Pricing: An Empirical Investigation into Consumer Bills Using Hourly Energy Data and Prices,” Electricity Journal 31, no. 2 (March 2018): 50–57.8 That system, although sub-optimal, was justifiable when technological constraints made it impossible for consumers to respond to prices. Time-of-use pricing, on the other hand, would send immediate price signals to consumers, encouraging them to conserve when it is most valuable, making electricity production more efficient. As demand reaches its peak, usually in the late afternoon, the marginal cost of electricity production increases, often sharply. Reducing peak demand means that utilities, and therefore customers, can avoid buying electricity at high rates. Additionally, utilities tend to add generating capacity based on expected peak demand. Reducing peak demand means that utilities can postpone building expensive new generating plants or adding capacity to existing ones.

As technology improved during the late 20th century, utilities and the federal government attempted to address the shortcomings of static pricing. Initially, utilities promoted thermostats designed to reduce electricity demand. Programmable thermostats allow homeowners to set temperatures appropriately for when they are at home or away. The goal was to reduce energy use when people weren’t in their houses. The systems, however, failed to save money, and the Environmental Protection Agency (EPA) rescinded the ENERGY STAR ratings for all programmable thermostats in 2009.9Katherine Kaplan (US Environmental Protection Agency, ENERGY STAR Product Development), letter to “Programmable Thermostat Manufacturer or Other Interested Stakeholder,” May 4, 2009, https://www.energystar.gov/ia/partners/prod_development/revisions/downloads/thermostats/Spec_Suspension_Memo_May2009.pdf?ddc6-9ea1.9 In its announcement, the EPA noted, “Significant questions have been raised as to the net energy savings and environmental benefits being achieved with the current set of ENERGY STAR qualifying” thermostats. The difficulty of actually programming the thermostats meant that consumers often used more energy, not less. One utility testified, “Programmed thermostats resulted in 25 percent higher summer peak demand compared to homes with non-programmed thermostats.”10Oscar Gans (Florida Power and Light Co.), letter to Katherine Kaplan (Acting Branch Chief, ENERGY STAR Product Labeling), n.d., https://www.energystar.gov/ia/partners/prod_development/revisions/downloads/thermostats/Florida-Power-Light-Comments.pdf?a271-cf42.10

With the removal of ENERGY STAR ratings for programmable thermostats, utilities began to look for alternative technologies to reduce peak demand. Using funding from the Smart Grid Investment Grant program, the federal government, state regulators, and utilities chose smart meters, also known as Advanced Metering Infrastructure (AMI), as an option for engaging electricity customers. That program provided grants to dozens of projects that would install millions of the new AMI smart meters in US households. In 2013, SGIG’s progress report noted, “There are 65 SGIG AMI projects that plan to install a total of at least 15.5 million smart meters, which will more than double the number of smart meters that were installed nationwide before the establishment of the SGIG program.”11US Department of Energy, Smart Grid Investment Grant Program: Progress Report II, October 2013, 19.11 Since 2008, when just over 4.6 million such meters were installed, the number of AMI meters in place nationwide has risen considerably.12US Energy Information Administration, “Annual Electric Power Industry Report, Form EIA-861 detailed data files,” accessed December 16, 2019, https://www.eia.gov/electricity/data/eia861/archive/zip/f86108.zip.12 By the end of 2017, nearly 70 million residences had AMI meters.13US Energy Information Administration, “Table 10.10. Advanced Metering County by Technology Type,” accessed March 29, 2019, https://www.eia.gov/electricity/annual/html/epa_10_10.html.13 The new meters also allow changes in the rate structure, including demand-responsive prices that vary with the actual cost of electricity to the utility. Demand-response programs differ, but generally they provide incentives to customers, such as reductions in their electricity bills, as a means of encouraging them to reduce electricity use during high-demand periods.14US Energy Information Administration, Glossary, s.v. “Demand Response Programs,” accessed March 29, 2019, https://www.eia.gov/tools/glossary/index.php?id=D By providing two-way communication and more rapid feedback, AMI meters create opportunities for flexible rate structures and offer customers some incentive to reduce peak demand. As Connecticut utilities noted, “Dynamic pricing programs are enabled by the investment in, and installation of, smart meters or Advanced Metering Infrastructure.”15Eversource Energy, United Illuminating Company, Connecticut Natural Gas, and Southern Connecticut Gas, 2017 Annual Update of the 2016–2018 Conservation & Load Management Plan, March 1, 2017, https://www.ct.gov/deep/lib/deep/energy/conserloadmgmt/2017_Plan_Update.pdf.15

Research demonstrates that when combining dynamic pricing information with the ability to respond to prices, consumers will cut their power demands during peak hours. A study of electricity demand responses to time-of-use pricing in Japan examined “economic incentives for energy conservation” to test the effectiveness of pricing changes during peak demand periods.16Koichiro Ito, with Takanori Ida and Makoto Tanaka, “Moral Suasion and Economic Incentives: Field Experimental Evidence from Energy Demand,” American Economic Journal: Economic Policy 10, no. 1 (2018): 240–67.16 Smart meters that collected data at 30-minute intervals were installed in participating households. On chosen treatment days, during peak demand hours, prices were increased significantly. The researchers note, “the economic incentive group had a price increase of 40, 60, or 80 cents/kWh. Because the baseline price was approximately 25 cents/kWh, these price increases mean that the critical peak price was 65, 85, or 105 cents/kWh.” The results were statistically significant; researchers concluded that “The economic incentive treatment produced usage reductions of 14 percent for the lowest treatment price and usage reductions of 17 percent for the highest treatment price.” The price incentives were so effective, the study’s authors wrote that the prices “motivated customers to lower their usage in both the non-treatment hours and the treatment hours.”

The Japanese experiment found that economic rewards for conservation were quite effective in reducing electricity waste. The researchers noted that “customers in our experiment had access to salient information about their real-time marginal price via in-home displays and text messages.”17Ibid.17 In contrast, a 2014 study by the same author found that customers in California failed to respond to tiered pricing systems— wherein costs increase at specified electricity consumption levels—and instead responded only to the average price of their electricity.18Ito, Koichiro. 2014. “Do Consumers Respond to Marginal or Average Price? Evidence from Nonlinear Electricity Pricing.” American Economic Review, 104 (2): 537-63.18 Customers typically received information about their use in their monthly bills, which is enough of a delay to discourage time-of-use responses. The author attributes that lack of sensitivity to price changes to the consumer’s lack of relevant information.

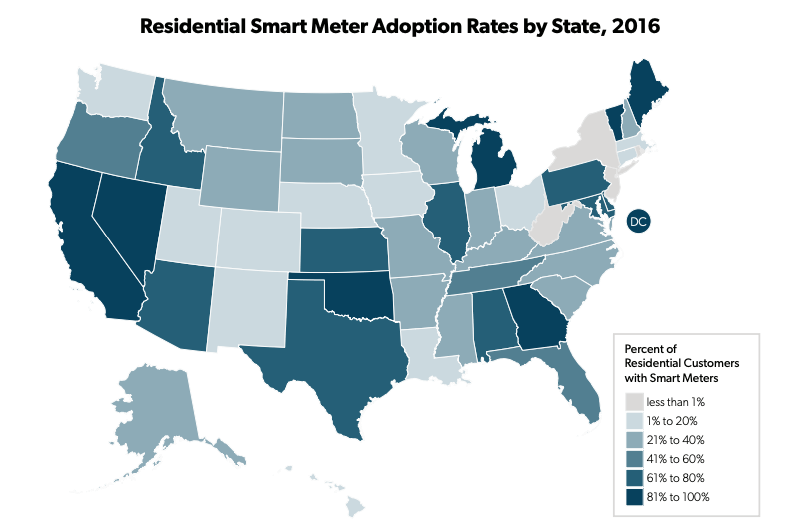

The deployment of smart meters, though intended to overcome such challenges, has not been without its difficulties. Implementation has varied widely from state to state. By the end of 2016, 96 percent of Nevada’s homes had AMI meters.19 US Energy Information Administration (EIA), “Nearly Half of All US Electricity Customers Have Smart Meters,” Today in Energy, December 6, 2017, https://www.eia.gov/todayinenergy/detail.php?id=34012 Six other states had adoption rates of more than 80 percent. Many other states, including New York, Washington, and Ohio, however, had smart meters installed in fewer than 20 percent of households. The wide range of adoption rates is partly a result of differences in state regulations. The Congressional Research Service points out that “In 2014, DOE [the Department of Energy] concluded that the adoption of Smart Grid technologies was accelerating but at varying rates depending largely on decision-making at utility, state, and local levels.”20Richard J. Campbell, The Smart Grid: Status and Outlook, Congressional Research Service Report, April 10, 2018, https://fas.org/sgp/crs/misc/R45156.pdf States have faced a range of challenges, and some have had success in realizing the goals set by SGIG. Many, however, have struggled to deploy smart meters in a timely way and have fallen short of achieving the hoped-for results. The reasons for those failures vary, but some basic lessons can be taken from the experiences of the past several years.

Lessons from the Smart Meter Rollout

An examination of instances of smart meter rollouts across the United States reveals some successes. A pattern of challenges faced by utilities and states, however, has slowed the installation of smart meters and made achievement of the initiative’s goals, including reducing demand during peak hours, elusive. Examining the challenges can help clarify whether they are inherent to the politically driven approach used and provide insights into how the problems can be addressed in the future to facilitate consumer technology deployments.

Institutional Barriers

Several states initially expressed concerns about the cost of installing smart meters and, in an effort to protect consumers, prevented utilities from recovering the installation costs. As regulated monopolies, utilities must justify expenditures for new equipment to a state public utilities commission. Utilities in a number of states have asked to pay for the cost of deploying the new meters by adding small surcharges to customers’ bills.21Installation costs may also be offset by lower costs of meter reading—utility companies can read smart meters remotely and forgo the expense of having to send workers around to manually read meters.21 Approval of pass-throughs to customers by utility commissions can increase energy bills, which is exactly what happened in Delaware. When smart meters were installed, consumers were told that they would not see a cost increase. Dave Stevenson, a Delaware ratepayer advocate, noted that although Delmarva Power and Light saved a small amount from reduced meter reading costs, the cost of the meters was added to bills, and consumers saw their monthly payments go up by about $1.22Dave Stevenson, telephone interview with the author, November 14, 2018; Public Service Commission of the State of Delaware, Order No. 8561, May 13, 2014.22 Not every state, however, is comfortable approving cost recovery options, and the uncertainty is a problem for some utilities. Chris McGuire of Washington’s Utilities and Transportation Commission notes that the amounts that can be passed along to consumers are determined only after the meters have been installed.23Chris McGuire (Washington State Utilities and Transportation Commission), telephone interview with the author, November 8, 2018.23 The combination of the uncertainty of cost recovery by utilities, along with regulators’ reluctance to approve rate increases, created barriers to deployment in several states. Below, we examine the experiences of four additional utilities that faced cost recovery challenges.

Baltimore General Electric

Baltimore General Electric (BGE) proposed a rollout of 1.2 million smart meters, with cost recovery coming from customer surcharges, an SGIG grant, and reductions in peak demand.24US Energy Information Administration (EIA), US Smart Grid Case Studies, September 2011, 58, https://www.eia.gov/analysis/studies/electricity/pdf/sg_case_studies.pdf. This was included as “Attachment B” in US Energy Information Administration, Smart Grid Legislative and Regulatory Policies and Case Studies, December 2011.24 The plan included a requirement to use time-of-use (TOU) pricing to encourage customers to reduce energy use during peak hours. The Maryland Public Service Commission (PSC) rejected the proposal, citing the high cost of the rollout and the risk to low-income customers. Examination of the plan found that “up to 40 percent of low-income customers would see a rise in summer energy bills and up to 15 percent would see a rise in annual energy bills overall.”25Ibid., 61.25 Additionally, the surcharge would amount to a monthly increase of 38 cents in 2010, rising to $3.78 per month in 2013. In ruling against the proposal, the PSC argued that “The Proposal asks BGE’s ratepayers to take significant financial and technological risks and adapt to categorical changes in rate design, all in exchange for savings that are largely indirect, highly contingent and a long way off. We are not persuaded that this bargain is cost-effective or serves the public interest, at least in its current form.”26Paula Carmody, “Dumb Policies and Smart Grids: A Consumer Perspective” (presentation to the Public Utility Research Center, University of Florida, Gainesville, FL, February 3, 2011), https://bear.warrington.ufl.edu/centers/purc/docs/PRESENTATIONS/events/2011_Annual_Conference/adddocs/P0211_Carmody_Dumb_Policies_and.pdf Ultimately, BGE revised the proposal, dropping the TOU pricing system and reducing the amount BGE had requested to cover the costs of deployment.

Connecticut Power and Light

Connecticut Power and Light proposed to deploy AMI smart meters covering 1.2 million customers beginning in 2012, to be paid for by a TOU pricing structure that could increase the price of a kilowatt hour (kWh) tenfold during peak hours. Although the proposal did not adopt surcharges, the Connecticut Public Utilities Commission expressed several concerns about the financial viability of the plan. The projected savings from customers reducing their peak demands were questioned, with the utility commission’s draft order noting “numerous instances of costs and benefits that cannot be quantified with actual data, but instead rel[y] on forecasts using many theoretical assumptions.”27 State of Connecticut Department of Energy and Environmental Protection, Public Utilities Regulatory Authority, Docket No. 05-10-03RE04: Application of the Connecticut Light and Power Company to Implement Time-of-Use, Interruptible Load Response, and Seasonal Rates – Review of Meter Study, Deployment Plan and Rate Pilot, August 29, 2011.27 The regulators also expressed concern that the new technology was not capable of producing the demand responses required (an issue we will examine further below). Finally, the state worried about such a significant expenditure so soon after meters recently had been upgraded to the Automatic Meter Reading (AMR) technology, which allows meters to be read wirelessly rather than manually on the meters they replaced.

Dayton Power and Light

In Ohio, Dayton Power and Light (DP&L) applied for an SGIG grant to cover deployment of AMI meters. DP&L asked the Public Utilities Commission of Ohio to approve a surcharge for the meters but later retracted that request because the federal grant had not been awarded.28Phil Carson, “Dayton Power & Light: An Exception Worth Considering,” Energy Central, March 25, 2012, https://www.energycentral.com/c/iu/dayton-power-light-exception-worth-considering As a result, it decided against deploying AMI meters because of cost concerns.29EIA, US Smart Grid, 76.29 The utility reported that during the economic downturn, customers objected to the potentially higher costs. Without adequate cost recovery, DP&L decided not to deploy AMI meters at all, and as of 2017, no new meters had been installed.30US Energy Information Administration (EIA), Form EIA-861M (formerly EIA-826) detailed data, accessed December 16, 2019, https://www.eia.gov/electricity/data/eia861m/ Some speculation arose that stopping deployment also allowed DP&L to determine if other utilities in Ohio and elsewhere had difficulties before they made the financial commitment to move to AMI meters. One analyst commented that “a go-slow approach may end up paying as many dividends as an immediate leap into the deep end of the pool.”31 Carson, Dayton Power.31

By way of contrast, other Ohio utilities did receive federal grants and went ahead with AMI deployment. In Ohio, Duke Energy eventually received approval to add 49 cents to its customers’ monthly bills to install new smart meters.32For other examples see EIA, US Smart Grid.32 The number of AMI meters deployed by Duke Energy Ohio increased from 108,843 in January of 2011, to 639,897 by the end of 2014, representing nearly 100 percent of their customers.33 EIA, Form EIA-861M.33 The key difference between the approaches of the two utilities appears to be the federal subsidy from the SGIG program.

State of Massachusetts

In Massachusetts, the state commission encouraged utilities to deploy smart meters, authoring a “straw plan” for deployment and cost recovery.34Massachusetts Department of Public Utilities, Investigation by the Department of Public Utilities on Its Own Motion into Modernization of the Electric Grid, D.P.U. 12-76, October 2, 2012.34 The plan actually required AMI deployment, to which the utilities objected. Two utilities, including Western Massachusetts Electric Company (WMECO), complained, noting that money recently had been spent upgrading meters to the AMR technology and worried that additional costs would be “borne by customers who may or may not be interested in interacting with the distribution system at the level implicated by AMI technology” [emphasis in original]. 35NSTAR Electric Company and Western Massachusetts Electric Company, letter to Mark Marini (Secretary of the MA Department of Public Utilities), January 17, 2014, https://fileservice.eea.comacloud.net/FileService.Api/file/FileRoom/9240858.35 In that case, it was the utilities who worried about their customers’ reactions to surcharges being imposed without consent.

Unlike the examples summarized above, utilities in other states were successful in recovering the costs of their meter rollouts. In Oklahoma, the state Corporation Commission approved a $3.11 surcharge for AMI meters for the Public Service Company of Oklahoma.36Corporation Commission of Oklahoma, “Application of Public Service Company of Oklahoma to Be in Compliance with Order No. 591185 Issued in Cause No. PUD 201100106,” Cause No. PUD 201300217, July 21, 2014, https://www.occeweb.com/ap/ReptRecomm/IHREPT/2014/13pud217.pdf

Examining a map of states with successful smart meter rollouts by 2016 shows an apparent correlation between smart meter deployment and cost recovery approval (figure 1).37EIA, Nearly Half.37

Figure 1.

Source: US Energy Information Administration, “Nearly half of all U.S. electricity customers have smart meters,” December 6, 2017, https://www.eia.gov/todayinenergy/detail.php?id=34012

Connecticut, Massachusetts, and Colorado all rejected rate plans and all lag behind in smart meter deployment.38 For the Colorado case, see Guo et al., Adoption.38 States that approved rate increases, including California, Delaware, and Oklahoma, have high rates of smart meter penetration. Ohio’s record is mixed—some utilities implemented rate increases while others withdrew requests after failing to receive federal support. That mixture left Ohio lagging behind other states. Maryland, on the other hand, has a high level of smart meter deployment, despite initially rejecting Baltimore General Electric’s application.

Smart Meters and Customer Engagement

Deployment, however, is only the first part of the process. Once smart meters are installed, they must improve customer engagement by providing opportunities to reduce peak power demands and power bills. If consumers don’t change their behavior to utilize the new technology, a large fraction of the benefit is lost. Although utilities’ experiences have been mixed, research demonstrates that customer engagement with smart meters has not met expectations.

Early pilot projects linking smart meters to TOU pricing showed potential. The District of Columbia’s PowerCentsDC program provided smart meters and smart thermostats to households with air conditioning.39eMeter Strategic Consulting, PowerCentsDC Program: Final Report, September 2010.39 During periods of high demand, customers saw either high prices (about 75 cents per kWh compared to the typical price of about 12 cents per kWh40US Energy Information Administration, “District of Columbia: State Profile and Energy Estimates,” accessed December 16, 2019, https://www.eia.gov/state/data.php?sid=DC#Prices.40) or were offered significant rebates (between 75 and 11 cents per kWh) for demand reductions. For households with air conditioning, the smart thermostat could reduce usage automatically during peak periods. Like the TOU pricing study in Japan, the PowerCentsDC pilot program demonstrated that consumers would respond to incentives when provided with information and assistance from automated systems. The study found a reduction in peak demand of between 13 and 34 percent, which translated into savings between 2 and 5 percent on customers’ monthly bills.

Several other case studies demonstrate that without such assistance, smart meters alone did not yield the hoped-for energy savings. An overview of smart grid efforts highlighted the high cost of acquiring information and taking action, making it difficult for consumers to respond effectively. Researchers at the RAND Corporation found that, “Because prices can change frequently, considerable cognitive or other informational burdens on consumers (i.e., transaction costs) might not translate into changed behavior.”41Guo et al., Adoption, 30.41 That was the experience of several utilities.

The Long Island Power Authority (LIPA) undertook a study to test the effectiveness of smart meters in allowing customers to track their energy usage on a web application and reduce their energy consumption.42Ming Mui, Long Island Smart Energy Corridor, final report for the Long Island Power Authority, April 27, 2015.42 Some participants also were enrolled in a TOU pricing system, with a guarantee that they would not end up paying more than they did under their normal tiered pricing system. Although the study found that customers participating in the Smart Time of Use Rate program were more likely to be engaged, the results were modest overall, with 49 percent of customers successful in shifting some demand off-peak, and 44 percent failing to change their use patterns. For customers without TOU rates, Long Island Power Authority found a lack of engagement, noting that individuals had even forgotten they had smart meters, despite a marketing effort identical to those participating in the TOU program. The LIPA study found that “frequent and creative reminders of the benefits to customers about smart meters and smart grid technologies along with specific recommendations on ways to save energy and money are necessary for customers to participate and remain engaged.”43 Ibid.43

As hypothesized by the RAND study, unless consumers repeatedly were prompted, they did not use the new information to change their electricity usage, likely because the costs of information and action were very high. That result was duplicated in a study completed by Portland General Electric (PGE). Like the LIPA study, PGE provided AMI smart meters to customers, along with increases in peak-load pricing.44Portland General Electric, letter to Public Utility Commission of Oregon regarding PGE’s application for deferral of expenses associated with two residential demand response pilots, October 3, 2014, https://edocs.puc.state.or.us/efdocs/HAA/um1708haa134559.pdf In its final report, PGE noted that the TOU rates were “complex and difficult to understand” for consumers, leading the utility to develop an alternative test of TOU rates. Finally, Georgia Power reached a similar conclusion in its research on smart meter deployment, noting that “TOU programs need thorough customer education and energy management advice to be successful.”45EIA, US Smart Grid, 29.45 In both cases, although smart meters provided the information necessary for utility customers to respond to TOU rates, users required repeated prompting to achieve meaningful reductions in power consumption. Even with such prompts, reductions often were minor. One recent study argued that users’ responses to TOU prices were based on a user’s perception of savings, not on the actual savings themselves.46Lee V. White and Nicole D. Sintov, “Inaccurate Consumer Perceptions of Monetary Savings in a Demand-Side Response Programme Predict Programme Acceptance,” Nature Energy 3 (December 2018): 1101–8, https://www.nature.com/articles/s41560-018-0285-y.epdf?no_publisher_ access=1&r3_referer=nature.46 Thus, consumers may not actually change their usage patterns significantly, even if they perceive benefits from TOU rates.

Innovation and Alternative Technologies

Another problem faced by smart meters is the rapid development of alternative technologies that serve a similar purpose. In an effort to improve the responsiveness of customers to price signals, some utilities looked at providing wall-mounted monitors that display transparent price signals. As part of its smart meter pilot program, the Hawaiian Electric Company proposed testing wall-mounted meters that provided information to consumers about household appliance energy use and alerted them when peak demand hours were occurring.47EIA, US Smart Grid, 81.47 Similarly, LIPA’s project included monitors, but that proposal ultimately was shelved because, according to LIPA, the fast pace of technological innovation had eliminated the benefits of in-home displays. They instead opted for a web-based app.48Mui, Long Island.48 The availability of newer technologies also underlies the objection of Western Massachusetts Electric Company to the state’s smart meter policy. Noting the rapid development of smart thermostats and appliances, they argued that AMI technology might be outdated quickly. They suggested that instead of forcing companies to use pre-determined technologies, Massachusetts should instead opt for a policy allowing more flexibility to meet consumer needs.49NSTAR letter.49

Other countries have faced a similar challenge. David Nemtzow of the US Department of Energy explained that in Australia, one utility “rolled out smart meters before there was adequate communication.”50Nemtzow interview.50 Subsequently, meters with two-way communication became available, meaning that the installed meters quickly were outdated.

Contributing to many of those challenges is the diversity of end users of smart meters. For example, the write-up of a test of TOU rates by South Dakota’s Sioux Valley Energy found a difference between customers who opted into TOU rates and those who were placed into a TOU-pricing system but did not opt out. The utility found that customers choosing to opt-in reduced peak-demand power consumption more than those who were placed in the program and chose not to opt out.51Guo et al., Adoption, 28.51 Regulators’ concerns about rate increases also reflected differences in customers’ incomes, which led to rejection of cost recovery proposals—similar to the case of Baltimore General Electric. Of course, smart meters are designed not only to engage customers but also to provide salient information to utilities, such as assistance in meter reading and identifying power outages. They increase energy providers’ accuracy and ease of determining the amount owed buy customers.

Given a choice between designing solutions around customers or solving problems faced by utility managers (e.g., collecting meter data), utilities are likely to emphasize solutions that prioritize their needs over customer service. Although AMI smart meters can provide a number of ancillary services, they do not meaningfully increase the amount of information available to consumers or their ability to respond to prices. Those incentives provide clues as to why smart meters have not been nearly as successful as expected in helping consumers save energy and money.

The Private Innovation Alternative

Facing regulatory roadblocks and the challenge of incentivizing meaningful energy conservation with diverse customer bases, utilities are starting to turn their attentions to technologies that emerged independently of the government-subsidized smart meter market. Smart thermostats from companies like Nest and Ecobee use artificial intelligence and two-way communication, enabling users to choose temperature parameters and let the thermostat decide how best to meet those targets. Unlike AMI smart meters, the thermostats make it easy for consumers to respond to changing power demands, reducing the overall lifestyle changes necessary to see improvements.

Fatima Crerar, the Director of Social Impact and Sustainability at smart thermostat company Ecobee says that artificial intelligence (AI) is a critical component of the effectiveness of the new smart ther mostats. “What made this possible,” says Crerar, “is the fact that the job gets done for you” using artificial intelligence. Both Nest and Ecobee use sensors to determine whether people are at home and can send notifications to users’ smartphones asking them if they would like to adjust the temperature setting.52Fatima Crerar, telephone interview with the author, February 28, 2018.52 Both companies argue that such communication has resulted in significant energy savings. Ecobee estimates that its users had saved 30 terawatt hours of energy by the beginning of 2018.53Ibid.53 Ecobee users, they say, are reporting savings of up to 23 percent. Nest boasted that its users avoided consuming more than 26 billion kilowatt hours between October 2011 and October 2018, “enough energy to cook a feast for all 7.6 billion people on Earth—twice.”54Nest, “October Home Report,” email to users, November 13, 2018.54 Although such claims have not been verified independently, several studies of the effectiveness of smart thermostats in reducing peak demand in response to incentives demonstrate that the functionality of smart thermostats is yielding better results than smart meters.

After completing its test of TOU rates using AMI smart meters, Portland General Electric (PGE) conducted a follow-up study to determine if smart thermostats would reduce peak demand. The study used Nest smart thermostats, along with a program called “Rush Hour Rewards” (RHR) to rebate homeowners who lowered their energy use during certain peak hours.55Nest, “Learn about Rush Hour Rewards,” accessed December 16, 2019, https://support.google.com/googlenest/answer/9244031?hl=en.55 In the Portland study, customers who opted to participate were notified of upcoming RHR events. During peak demand periods, PGE used “Direct Load Control,” which adjusts the temperature setting remotely on Nest thermostats to reduce demand. Users could override those adjustments but were given a “speed-bump” warning that Rush Hour Rewards were in effect.

Users relied on artificial intelligence to determine the best way to meet the program’s goals, which could include pre-conditioning a home. For houses that hold temperatures effectively, heating or cooling would occur prior to the period of peak demand, shifting demand outside the period of highest cost, and using the home’s insulation to keep the ambient temperature within a comfortable range. PGE compared the energy savings to a control group that did not receive the remote RHR adjustments. The study found that although homes with smart thermostats had similar use patterns outside RHR events, those in the RHR pilot project saw significant reductions during peak demand periods. PGE found that during the winter, the RHR pilot reduced average demand by 20 to 33 percent in the first hour. That dropped off slightly to 15 to 30 percent during the second hour. In the final hour, it fell a bit more to about 10 to 25 percent. Even in the final hour, however, these are significant reductions in demand at a time when prices are high.

Results in summer were better. The Rush Hour Rewards pilot “reduced demand by about 40 percent during the first RHR event hour, 30 percent during the second event hour, and 20 percent during the third event hour.”56 Scott Reeves and Jim Stewart (Cadmus), memorandum to Josh Keeling and Alex Reedin (Portland General Electric) regarding their PGE Rush Hour Rewards findings summary, December 27, 2016.56 Additionally, surveys of participants reported high satisfaction with the project. When the Public Utility Commission of Oregon subsequently evaluated PGE’s projects with smart meters and Nest thermostats, they approved cost recovery for both. However, the commission highlighted the success of the smart thermostats, encouraging PGE to allocate more resources to expanding their implementation.57Public Utility Commission of Oregon, Order No. 17-244, July 11, 2017.57 Comparing the results from smart meters and smart thermostats, PGE and the Oregon PUC found that the smart thermostats yielded better results. Other jurisdictions reported similar findings.

As part of a larger TOU rate study, Southern California Edison (SCE) tested the effectiveness of Nest thermostats in reducing peak demand. During the two-year study, users were provided with TOU price signals. During the second year, Nest users also used a program called “Time of Savings.”58Nest, “It’s Time for Time of Savings,” June 21, 2016, accessed December 16, 2019, https://web.archive.org/web/20170704051036/https://nest.com/blog/2016/06/21/its-time-for-time-of-savings/.58 Unlike the Rush Hour Rewards program, which provides a rebate for reducing power consumption, SCE used its Time of Savings program, wherein the thermostat calibrates energy use based on electricity rates provided by the utility. As Nest explains, “The Nest Thermostat can then use this rate information to learn and automatically adjust itself to help reduce electricity use during peak price periods. Nest never adjusts the temperature by more than a degree or two—just enough to keep customers comfortable while saving money.”59Nest, “Nest Introduces Time of Savings through Energy Partners,” June 21, 2016, accessed December 16, 2019, https://web.archive.org/web/20170328123044/https://nest.com/press/nest-introduces-time-of-savings-through-energy-partners/.59 Households with smart thermostats performed better than households receiving only the price signals. SCE reported that in 2017, households with smart thermostats reduced summer peak period usage almost twice as much as households without them when exposed to time-of-use rates.60Nexant, Inc. and Research Into Action, “California Statewide Op-in Time-of-Use Pricing Pilot,” final report prepared for the TOU Working Group, March 30, 2018.60 The following year, Nest also used rate data from SCE’s Time of Savings program, which “significantly increased the magnitude of peak load reductions relative to the first summer.” The researchers emphasize that because of weather variability and other factors, comparing one year to the next is difficult. Even without the additional Time of Savings effect, however, SCE’s pilot program saw a positive effect associated with Nest’s ability to respond automatically to peak pricing.

Finally, National Grid, an energy company in the Northeast United States, compared two approaches to reducing peak demand for customers using smart thermostats in Massachusetts, New York, and Rhode Island. The 2016 study compared Nest’s Rush Hour Rewards with a program called ConnectedSolutions that would provide incentives to cut demand during peak hours.61National Grid, “Receive Incentives for Decreasing Energy Use at the Right Times,” ConnectedSolutions, accessed March 29, 2019, https://www.nationalgridus.com/MA-Business/Energy-Saving-Programs/ConnectedSolutions.61 The ConnectedSolutions program used both Ecobee and Honeywell smart thermostats; both programs provided annual incentives for temperature changes of two or three degrees during peak demand periods. The study found meaningful reductions for all thermostats, with Nest’s thermostat showing the largest reductions but also the largest number of opt-outs among participants.62Steven Tobias, “Cutting Peak Demand: Two Competing Paths and Their Effectiveness” (presentation to the 2017 IEPEC Conference, Baltimore, MD, 2017), https://www.navigant.com/-/media/www/site/insights/energy/2017/iepec_ngrid-driepec2017.pdf?la=en.62 A study the following year found that incentives played an important role in the effectiveness of the peak-demand reduction program. The study reported that “more customers opt out when a participation incentive isn’t offered.”63Kathleen Ward, “The Human Dimension of BYOT Programs” (presentation to the 2018 BECC Conference, Washington, DC, October 9, 2018), https://beccconference.org/wp-content/uploads/2018/10/KWard_presentation2018.pdf.63 Both studies found positive effects from smart thermostats, noting that incentives increased participation.

The Advantages of Consumer Choice

The three studies, in Portland, Southern California, and the Northeast United States, demonstrate that smart thermostats can reduce peak power demands effectively in ways that simple AMI meters, even with TOU rates, generally have not achieved. Smart thermostats appear to overcome some of the challenges faced by smart meters. First, purchases of smart thermostats are voluntary, reducing the regulatory barriers to cost recovery that slowed down the deployment of smart meters. As a consumer product, smart thermostats must justify their purchase prices by providing enough value to make them worthwhile, catering primarily to the needs of the user. Smart meters, by way of contrast, are imposed on users and in many instances utility customers opted out or simply opposed deployment for a variety of reasons. In California, where smart meter deployment has been widespread, significant public opposition surfaced initially. In 2011, the Energy Information Administration reported that “Public opposition to PG&E’s smart meter program remains significant. One anti-smart meter organization reports that 10 counties and 36 cities or towns are opposed to mandatory wireless smart meters. Four counties and seven cities or towns have gone as far as passing ordinances making smart meter installations illegal within their jurisdictions.”64EIA, US Smart Grid.64 Voluntary purchases of smart thermostats avoid such conflict. To be sure, the goal of deploying tens of millions of smart meters may not be compatible with voluntary purchases, but a tradeoff exists: smart thermostats offer an alternative to government mandates by leaving the choice in the hands of consumers.

Smart thermostats also have demonstrated better results in engaging customers to reduce their peak power demands. Portland General Electric provides the clearest example of that difference, with Oregon’s PUC recommending expansion of smart thermostat programs while continuing to study the effects of such technology. Despite the hope that smart meters combined with TOU pricing can induce savings from electricity customers, experience and research demonstrate that customers lack the information and desire necessary to react effectively to price incentives. Smart thermostats with artificial intelligence, however, provide users with additional assistance in responding quickly and planning for peak demand periods, including pre-conditioning of household temperatures to shift demand outside peak hours. Not only do they make this process simpler for consumers than smart meters do, but because they are not mandated, only users wanting to learn and utilize the product effectively are likely to adopt them. That conclusion is confirmed by research indicating that customers who opt in to TOU pricing, where available, are more effective in reducing peak demand than customers who are put into the system without consent. That conclusion also means that customers who incur the additional cost of smart thermostats voluntarily are more likely to recover that cost in savings than those who have the costs of smart meter deployment imposed on them.

Many utilities already offer rebates for smart thermostats as part of their energy efficiency mandates. With the success of smart thermostats in reducing peak demand, utilities and utility commissioners should expand such programs. Utilities and utility commissioners also should increase the range of options available to customers and pursue policies that make regulations regarding cost recovery for utilities more flexible. The Southern California Edison pilot plan found differences in user patterns with different smart thermostats. Expanding options increases the likelihood that customers will find one that fits their unique preferences. By allowing cost recovery on a more incremental basis for smart thermostats, utility commissioners can alleviate the problems that plagued some smart meter deployments. The success of smart thermostats in recent pilot projects indicates that a more gradual approach—one that takes advantage of customer-focused innovations—can be successful in reducing peak power demands and saving consumers and utilities money.

Allowing Innovation to Work for Energy Consumers

It has now been a decade since the federal government began the smart grid rollout with promises that smart meters would change how consumers interact with electric utilities dramatically. Despite installing tens of millions of smart meters across the country at a high collective cost to consumers, that promise has not been fulfilled. Consumers today have begun to change the ways they interact with their electricity providers, but the best opportunities have come from outside the regulatory environment through innovators creating consumer-focused products.

Today’s modern thermostats eventually may be improved or displaced by other innovations. For example, a new technology called Sense allows consumers to track energy use and identify the appliances that are driving their household power consumption. Rather than measuring electricity every five or fifteen minutes, as with smart meters, Sense measures demand about one million times every second. Sense recently announced connectivity with smart electrical plugs to help the system identify power-consuming devices more rapidly and accurately, thereby providing additional device control.65Sense, “Sense Connects with Smart Plugs,” November 13, 2018, https://blog.sense.com/smart-plug-integration.65 Technologies like Sense could be used by utilities to provide consumers with an itemized bill showing their electricity consumption by source—something that is not possible with existing AMI technology. Nest’s Rush Hour Rewards program is adding new utility partners. Ecobee’s “Donate Your Data” program allows customers the option of providing access to their data for research purposes. That program is improving Ecobee’s understanding of how people use energy and opening new possibilities for conservation.66Ecobee, “Donate Your Data,” accessed November 16, 2018, https://www.ecobee.com/donateyourdata/.66 Such efforts will improve the technology, making innovation increasingly effective and powerful in the energy market. As such technologies improve and the number of consumers using them increases, utilities will find more ways to integrate them into their operations. Regulators should recognize and embrace those trends, allowing consumer preferences to drive efficiency gains rather than federal programs. An approach that engages consumers and embraces innovation in the electricity market is more likely to benefit consumers, utilities, and the environment.

Morning Consult

Morning Consult